Bullish on MINA? Here are our revised price targets for this bull run

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

The world’s lightest blockchain, the Mina protocol, is in a crucial development period.

We released our original thesis on Mina when it traded around its all-time lows between $0.34 and $0.38.

Since then, the token has already gone up 3x.

In that report, we delivered a long-term prediction that indicated a massive 68x return.

While taking a longer-term view of the market is great, relatively shorter timeframes are also crucial to helping you properly calibrate your portfolio.

In this report, we reevaluate the $26 target to see if Mina can achieve it during the 2024-2025 bull market.

So, is Mina finally breaking out of its perfectionist trap, or is it still on the sidelines of greatness? Let's find out!

TDLR

- The Mina Protocol completed its UMT (Upgrade Mechanism Testing) program on March 13, a crucial step before the Devnet launch and eventual mainnet hard fork upgrade.

- On-chain activity shows increasing active users (138% rise in 6 months), but the average block times are longer than last year's.

- Although Mina is making progress, it still lags behind established L1 blockchains in technology and adoption.

- We have revised our shorter-term price targets for the 2024-2025 bull market with conservative, base, and bullish cases.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick recap on the Mina protocol

The Mina Protocol brands itself as the lightest blockchain in the world, with a micro size of 22 KB.The protocol emphasizes privacy control of users’ data via Mina’s zkApps, i.e., smart contracts powered by zero-knowledge proofs.

In our last analysis of the project, our concerns were based on a lack of practical implementation. We mentioned that Mina faced the substantial challenge of bridging the gap between innovation and implementation.

Since August 2023, the development side of things on Mina has continued to build towards a potential mainnet launch.

Now, the delays have led to a decline in users, leading to many investors losing interest in the project as well.

However, in 2024, things seem to be moving fast in the right direction.

Recent Mina updates

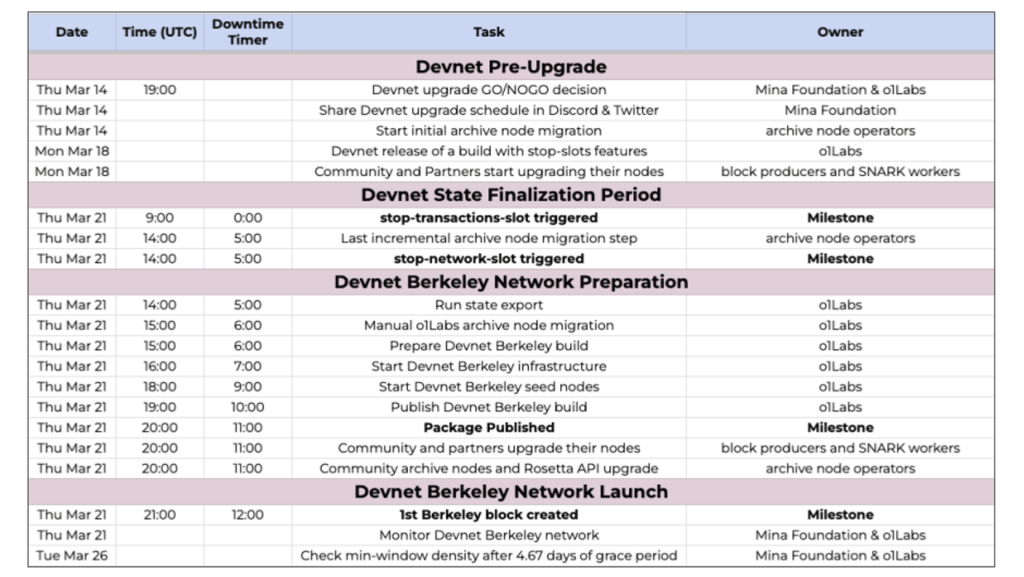

Mina’s Testnet Mission 2.0 is at the final stages before the mainnet upgrade or hard fork. The Upgrade Mechanism Testing or UMT program was launched at the beginning of this month and was managed by o1labs and the Mina Foundation.The UMT program focused on validating end-to-end and dry-running upgrade mechanisms and tools integral to the DevNet or Berkeley Upgrade. This stage is crucial to ensure the mainnet upgrade is seamless upon launch. The monitoring period did not raise any critical issues or bugs.

The UMT program was concluded this week, and the Cpro research team attended Mina’s monthly UMT program call on March 13.

The development team highlighted that on March 14, the initial pre-upgrade for Devnet will commence with Archive node migration, which requires 75% of the active stakers to be upgraded. This is supposed to run for another seven days before the Berkeley Upgrade on March 21, 9 a.m. UTC.

Considering things run smoothly, the Devnet network launch will conclude positively by the end of the month. It is important to note that the Berkeley Launch is the last key stage before the hard fork, for which the community has been waiting for over a year.

While these updates are relatively positive, the team remained tight-lipped about a tentative timeline for the hard fork. When pressed on the timeline, whether it will be weeks, months or quarters before the mainnet launch, one of the developers suggested they are only weeks away from the mainnet launch.

On-chain health

Mina's on-chain health is currently a mixed bag.While the protocol has a loyal community, its recent on-chain activity has yet to ignite an impressive uptrend.

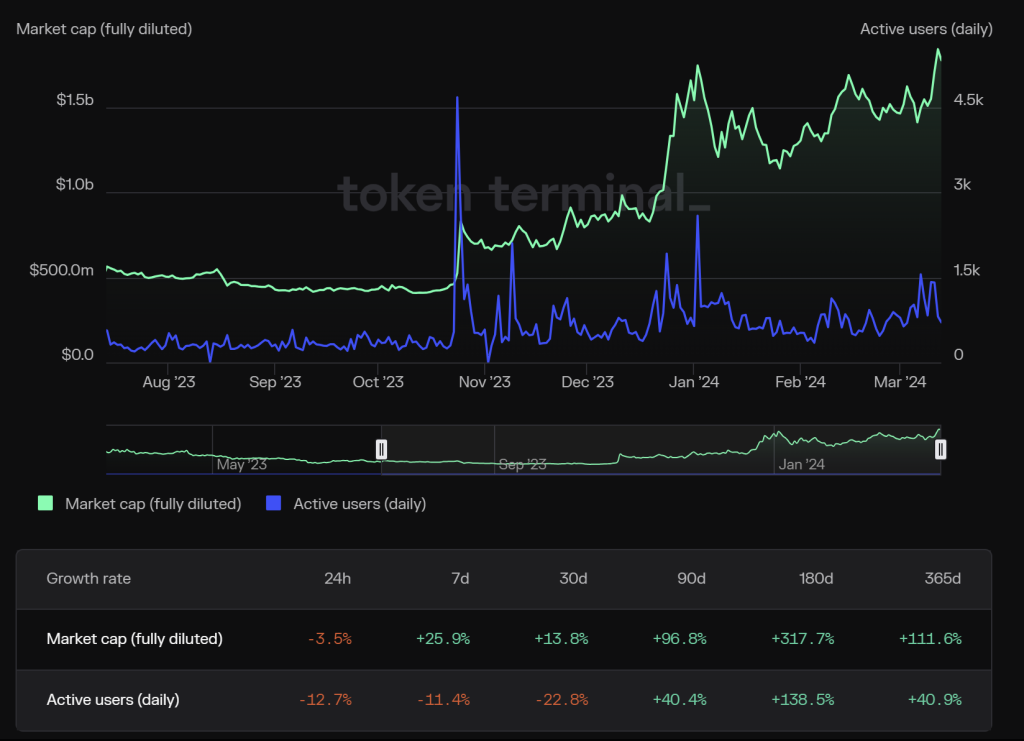

The Mina Protocol’s market cap is $1.59 billion, and its circulating supply is currently $1.06 billion.

In light of that, there are currently 216,431 accounts on the MINA network, including validators, snarkers, and regular token holders.

That is a decent haul, but it is important to note that most of those accounts currently hold 0 MINA tokens.

Over the past 30 days, the total number of transactions has reached 244,964, with a 41% rise. That is an average of 8,165 daily transactions, which is pretty good.

From a revenue perspective, the Mina protocol hasn’t generated significant fees as an L1 blockchain.

Its projected annualised fees are around $133.37k, an 18% decline over the same period last year.

Yet, over the past six months since our last report, the number of active users has increased by 138.5%, which is a good sign.

It might be a relative reaction to the increase in market cap, but it is positive indeed.

We would like to point out that the average block time is currently 6m 39s. In August 2023, this figure was around 5m 25s, which means it is taking longer - this is not great for transaction speed.

Considering that Mina is supposed to be the lightest blockchain, this is a contradictory statistic – again, it is not ideal for mass adoption and utility.

Revised price targets for 2024-2025

MINA spent most of the last two years between $0.34 and $1.15, an accumulation zone for the token.

Towards the end of December, MINA finally breached this threshold, and since February, it has maintained a position above the $1.15 mark.

The immediate resistance zone for MINA lies between $3.30 and $3.88. After this, the token should break down and retest its previous all-time high at $6.65.

Considering its recent market update, on-chain fundamentals, and technical analysis, we have estimated a new price target for MINA for the 2024-2024 bull run.

Here's how high MINA could fly during this bull run.

- Conservative: $3.50

- Base Case: $6.50-$6.80 (previous ATH range)

- Bull Case: $15, i.e. 10x from current market price

Cryptonary’s take

Our long-term target for MINA remains $26, but we believe that target may be unattainable over the next bull market.While the hard fork is heading towards a launch, it has been delayed for quite some time.

Most of Mina’s ambitions are under the ‘very soon’ timeframe. For instance, ZK-powered dApps will be developed on the chain in the future. Establishing access from other chains using Mina’s off-chain smart contract computation is still underway. A bridge between Ethereum and Mina is in progress.

To be fair, it is a project that emerged from the tail of the last bull market and is still waiting for a catalyst that will push it towards industry-wide utilisation.

But, considering that Mina competes with established L1 projects in the ecosystem, it is still miles behind in technology and adaptability.

If you’ve gotten in at $0.38 when we published the first report, you can still expect a 38x return at the peak of this bull run.

And if you are new to MINA, you can look forward to a 9.5x from current prices.

Our long-term target of $26 for MINA still stands, but the probability has decreased in terms of its achievability in 2024-2025.

Cryptonary, out!