Solana is not just surviving; it's thriving, thanks, in part, to the innovative projects that it hosts.

In this report, we take a closer look at a pivotal piece of the Solana ecosystem. It is hard to be bullish on Solana without being bullish on this project.

This project is the heart and soul of Solana, and if Solana lives up to expectations in the 2024/2025 bull run, this project will be one of the top performers in this season.

Let's dive in!

TLDR

- Jupiter is a decentralised swap aggregator and an important infrastructure for the Solana ecosystem.

- Volumes are very impressive and have tripled since we last covered it.

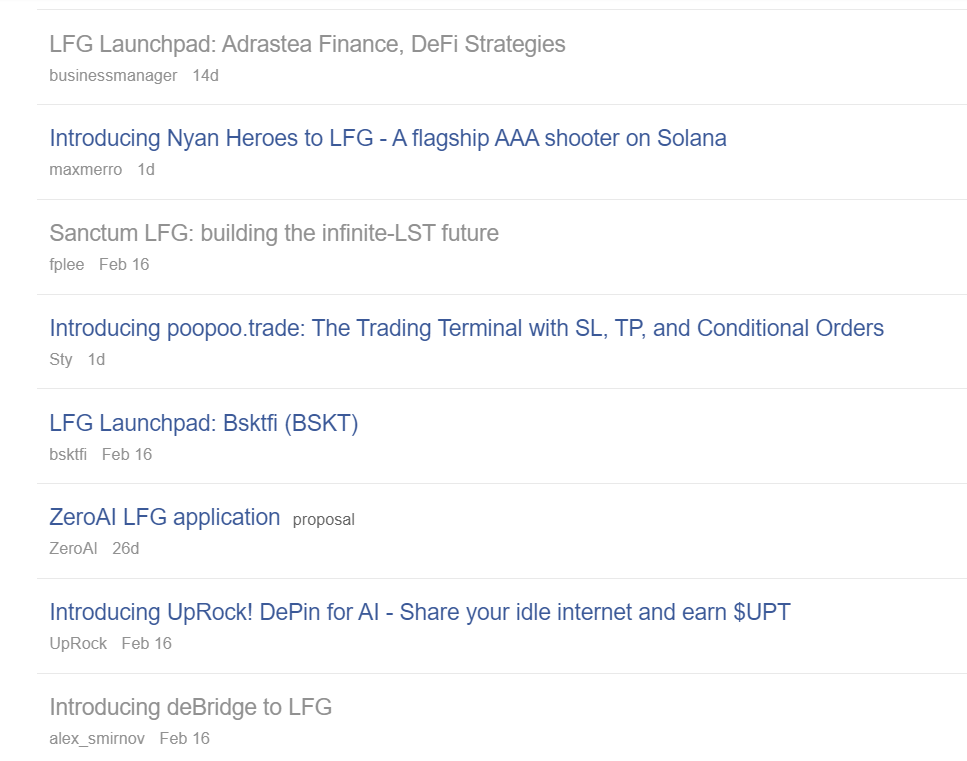

- It has a launchpad with over 20 projects wanting to be listed.

- We remain bullish on JUP and expect it to perform well in line with SOL.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Reintroducing Jupiter

For most of our community members, Jupiter probably doesn't need an introduction. We all know and love using Jupiter when interacting with the Solana ecosystem.

For people new to Solana, Jupiter is a decentralised swap aggregator and an important piece of infrastructure for the Solana ecosystem. It aims to provide the best price, token selection, and user experience for all users and developers.

It serves as a key liquidity aggregator, offering the widest range of tokens and the best route discovery between any token pair on the Solana network.

We've previously covered Jupiter extensively here and provided an update just before its token launch.

Let's recap what Jupiter offers as a key infrastructure layer for Solana.

DEX aggregator (Swaps)

The core of the Jupiter platform is the DEX aggregator. It focuses on providing the best trading experience for Solana users. The primary function is aggregating liquidity from various DEXs and automated market makers (AMMs) such as Raydium, Serum, Orca, Saber, and others to offer users the best token swap prices and routes.Using Jupiter's DEX aggregator for normal swaps is free of charge and probably one of the best spot trading experiences in the DeFi.

Limit orders

Jupiter's limit orders allow you to buy or sell any token pair according to your specified price limit. They provide the easiest way to place limit orders on Solana, offering the widest selection of token pairs and leveraging all the available liquidity across the entire Solana ecosystem.Jupiter charges 0.2% fees on all limit orders.

Dollar-cost-averaging (DCA)

The DCA feature on Jupiter allows you to set a fixed interval and period for your investments, automatically buying your tokens for you. This is a great option for those without time to watch the charts all day. This is a great feature for onboarding many new users on-chain. Before Jupiter, there wasn't a DEX with a DCA feature that could mimic the CEX-like experience.Jupiter charges 0.1% on DCA order completion.

Jupiter Perps

Jupiter also offers perp contracts on popular cryptocurrencies such as BTC, ETH, and SOL, with a maximum leverage of 100x. It closely mimics GMX's popular model, where the counterparty for perp traders is liquidity providers. Despite being more user-friendly than Zeta or Drift, only three assets are available to trade, which limits the perp trading experience. However, perps are still in the Beta phase, so we can expect that there will be more assets to trade in the future.Jupiter Launchpad

Jupiter LFG Launchpad is a platform designed to facilitate the launch of new projects and tokens in the crypto ecosystem. It aims to provide a fair and transparent environment for project teams and investors while protecting users from scams and rug-pulls.It is innovative and aims to improve the crypto project launch experience for project teams and investors. By leveraging the power of the Solana blockchain and the Meteora DLMM technology, the platform offers a fair, transparent, and efficient way to launch new projects.

Until now, only two tokens have been launched on Jupiter's Launchpad: Jupiter's token, $JUP itself and the memecoin, $WEN. Both launches were successful and proved that Jupiter's innovative concept works. Therefore, over 20 tokenless projects (including deBridge and Sanctum) are currently making introductions in Jupiter's forum to get a chance to launch their tokens on Jupiter.

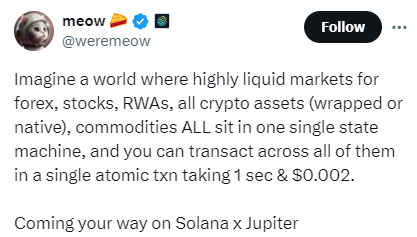

With all these excellent features, Jupiter aims to compete not only with DEXs but also with CEXs. It is becoming a go-to place for all crypto interactions.

Jupiter by the numbers

As discussed above, features are undoubtedly important, but are they being used?Let's talk numbers.

Transactional volume

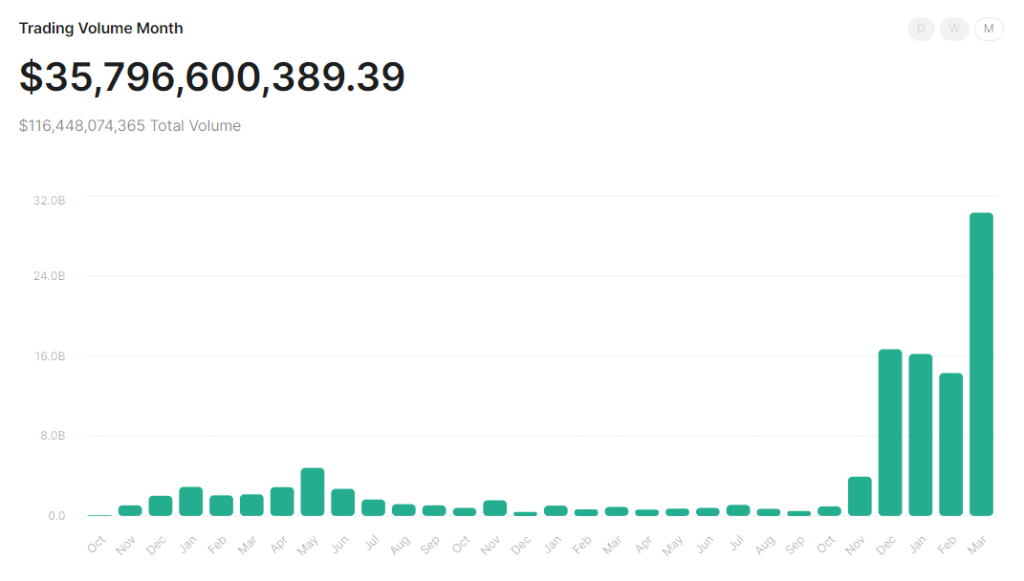

Since our last deep dive into Jupiter, the volumes have skyrocketed and more than tripled in 3 months.

Both the number of swaps and total volume have exploded starting October 2023

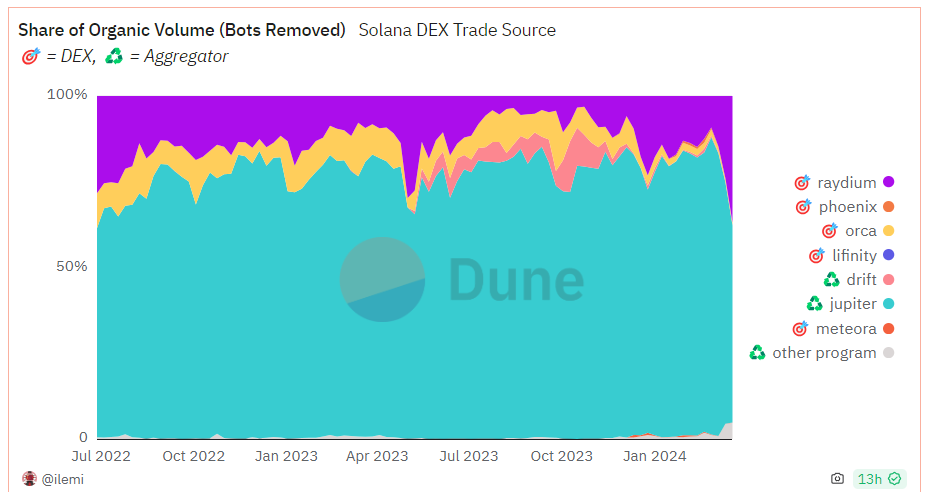

Currently, over 70% of organic volume on Solana goes through Jupiter; there's unquestionable dominance here.

Jupiter also leads among aggregators with almost 80% market share, surpassing 1inch and CowSwap.

When it comes to perps, Jupiter is ranked 5th (above Drift and Zeta). However, it is still quite impressive, given that it is still in the Beta stage.

As a platform, we can see that Jupiter's numbers look impressive from all angles.

But is it a viable investment?

Tokenomics

Let's look at Jupiter's tokenomics…- Circulating supply:1,350,000,000 JUP (13.5%)

- Max supply: 10,000,000,000 JUP

- Market cap: $1.5b

- Fully-diluted market cap: $11.2b

The token distribution is pretty straightforward. There are no VCs or early investors. 50% is allocated to the community and 50% to the team. Currently, only 1 round of airdrops has been distributed. Every year, on January 31, JUP distributes another round of airdrops to the community.

One thing that has been disturbing is that the team sold over 250m tokens on the launch day.

Even though Jupiter didn't have any VCs, many criticised Jupiter's team for acting worse than VCs because VCs' tokens are usually vested for at least one year after token generation (see Optimism or Arbitrum). This gave the impression that the community was an exit liquidity for the team.

Nevertheless, the Jupiter community seems to be forgiving, and the price has recovered well.

So, what is the purpose of the JUP token?

JUP's value accrual

JUP is a governance token used for governance. Users can stake JUP and have the right to vote on DAO's decisions.It sounds like a useless governance token, right?

However, this is not the case.

As mentioned earlier, Jupiter has its launchpad, allowing projects to launch their own tokens. JUP stakes vote on which projects will get listed, and in exchange, they will receive 75% of fees from launchpad fees.

There are currently many promising and tokenless projects in the Solana ecosystem. As mentioned earlier, over 20 projects are currently interested in launching their tokens on Jupiter.

We speculate that apart from launchpad fees, similar to Binance's launchpad, JUP stakers/voters may get airdrops to vote for specific tokens as a sign of goodwill from projects launching on Jupiter's launchpad.

So, how high can JUP go, and what is our investment thesis?

Investment thesis and price targets

Jupiter is a key piece of the infrastructure for the Solana ecosystem.It dominates in terms of volume both among dexes and aggregators. Additionally, it is developing its own perps market and has its launchpad. There aren't many projects that are as promising as Jupiter. The ultimate vision for Jupiter is very exciting, and we believe it will remain a key part of the Solana ecosystem.

Quantitative valuation

It is hard to value $JUP quantitatively because Jupiter doesn't charge fees for DEX aggregator swaps, so using volumes as variables is somewhat problematic. Additionally, using fees from the launchpad is also problematic cause there isn't enough data at this point. Therefore, we will use its price relationship with SOL to derive a relative valuation for JUP.Our quantitative analysis shows that $JUP is starting to act like $ SOL's beta asset. In other words, JUP moves in the same direction as SOL but with a bigger magnitude.

Our analysis revealed a beta coefficient of 1.003 and a p-value of 0.0002 (very strong evidence; the lower the p-value, the stronger the proof of the relationship).

Since JUP launched just two months ago, we believe over time, the beta coefficient can grow to 2-3

Price targets

In that scenario, based on our SOL price predictions, we have the following targets:- Conservative case: $5b mcap (almost 5x from here)

- Base case: $10b mcap (roughly 10x from here)

- Bullish case: $21b (Uniswap's ATH; 20x from here)

Technical analysis

JUP reached a new all-time high of $1.61 on March 18, after which the token faced a 34% drop to $1.06. The asset has bounced back to $1.30 but is currently consolidating under its ATH range.

One particular pattern to note is the supply zone formed after the ATH value. This usually indicates a trend reversal, so we might see a prolonged correction down to $1.03-$0.89, where a strong order block has been formed.

The long-term structure is still extremely bullish for JUP, with higher highs formed for 2024.

Cryptonary's take

Jupiter has seen impressive growth in the number of users and volume generated. The product is outstanding and can compete head-to-head with centralised exchanges.Despite some concerns during the initial token generation, the price has bounced back and shows signs of strength

$ JUP's value accrual isn't straightforward. However, seeing Jupiter give $JUP use cases beyond governance is good.

We remain bullish on JUP and expect it to continue to perform well in line with SOL.

Cryptonary, OUT!