Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

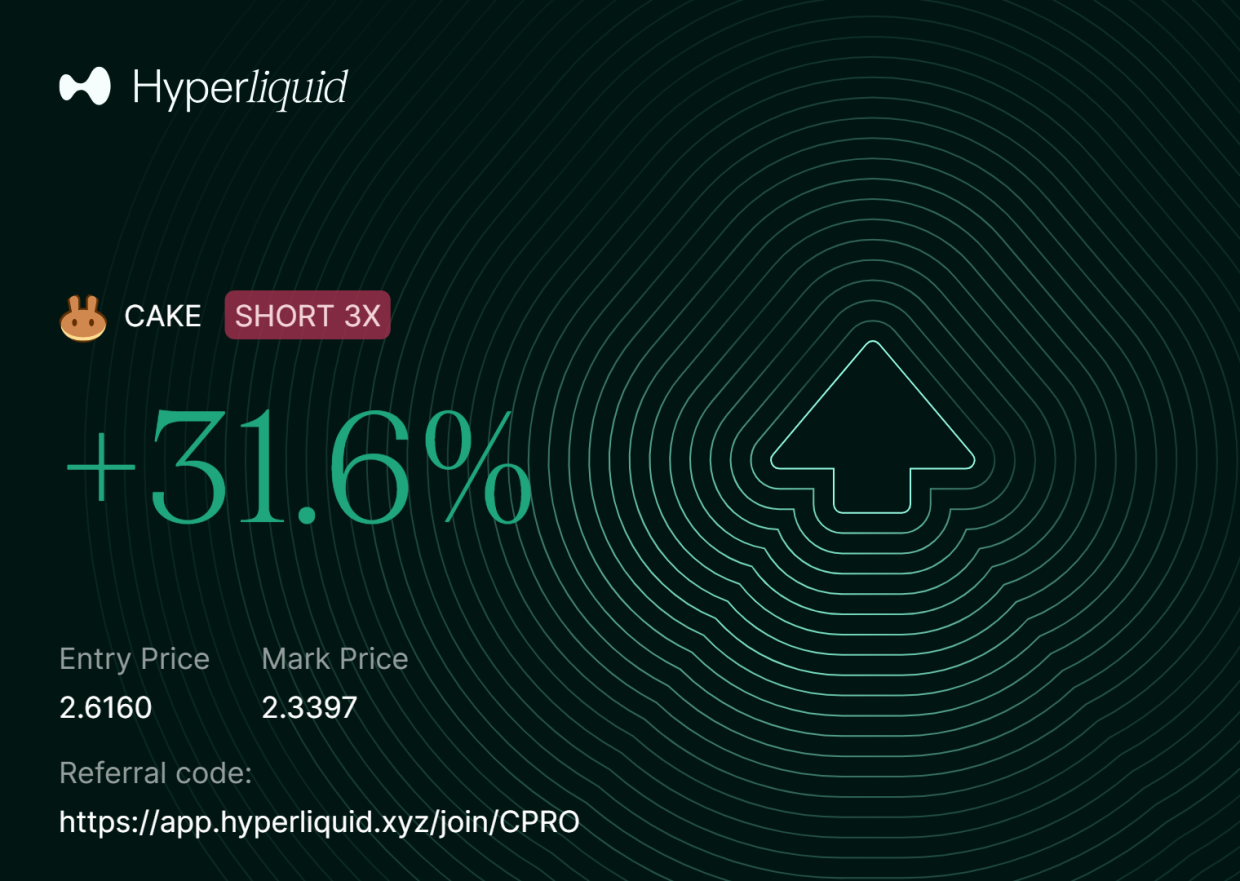

CAKE trade review

Let’s start with why we decided to enter the CAKE trade. First, despite the broader risk-off environment, CAKE was rallying and has given over 100% in a few days. However, it was pressing against its downtrend.Looking for potential reasons for this rally, we found that CZ (the founder of Binance) was pushing memes on Binance Smart Chain (BSC). So activity was picking up there, and CAKE being the main DEX there, some traders were betting on it as a proxy.

However, we were sceptical about memes running sustainably due to a broader risk-off environment and the underlying tech of BSC, which is still expensive and slower relative to Solana or Base.

UX was still bad compared to other protocols, so fundamentals-wise, it was hard to be bullish on CAKE mid to long-term. The zoomed-out chart confirmed our thesis:

Hyperliquid is where our trade was running, and we didn’t want to have exposure to the protocol just in case the situation escalated, and we lost money somehow. For us, capital preservation is the key.

However, the Hyperliquid incident has been solved, and we have started reentering the trade at slightly higher prices than the closure price, with the aim of building shorts all the way to $2.8.

Cryptonary’s take

One of the lessons we learned from it, despite being right in the direction and closing the trade in profit, we were oversized in this position, which caused some emotional discomfort.However, profit is profit, and we move on to the next one. We will gradually reenter this trade, averaging down to $2.8. We also have some more quality setups coming in the future. Stay tuned!

Peace!

Cryptonary, OUT!