While the total market cap of the L2 category peaks at $32 billion, the Arbitrum network is currently worth $3.7 billion.

We initially published a $30 long-term price target on ARB – that's more than 20X return on its current price. But this is crypto, and it is often better to think in terms of market cycles.

This report evaluates whether ARB is on track to reach the $30 target in the 2024-2025 bull market.

Let us dig in!

TLDR

- Arbitrum's recent price action has been dismal, with a 28% drop since the March 16th token unlock.

- However, the network has several catalysts that could reignite its bullish run.

- The upcoming launch of Arbitrum Orbit is a major development that could drive adoption and innovation on the network.

- The Ethereum Dencun upgrade has significantly reduced Arbitrum's transaction fees and set the stage for increased activity.

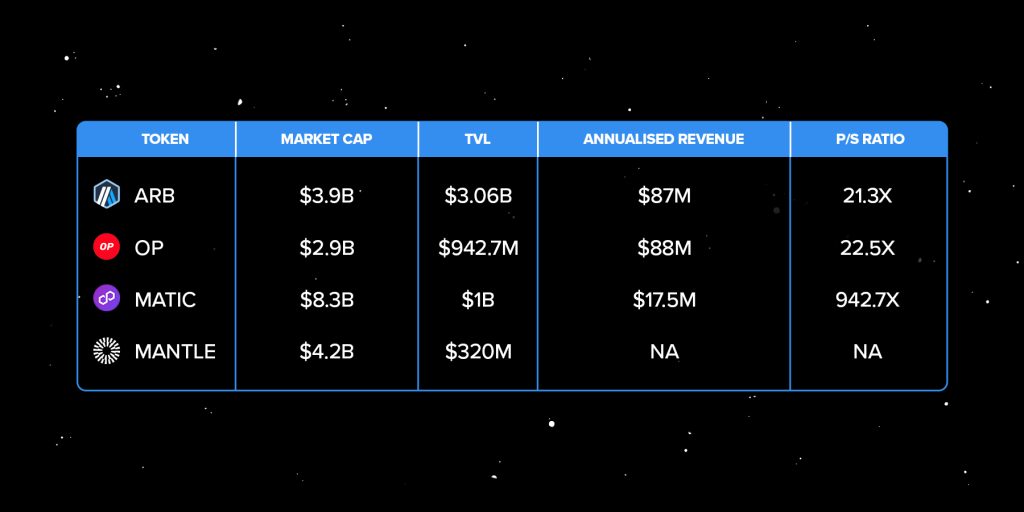

- Arbitrum's fundamental metrics, including its dominant $3.06B TVL and $87M in annualised revenue, position it favourably compared to competitors like Optimism, Polygon, and Mantle.

- But does all of these mean ARB can deliver a 20x upside during this bull run?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Why is Arbitrum underperforming?

For context, ARB has recently seen some FUD, so it is time to examine it and determine whether it is still a viable investment going forward.Let us quickly address the elephant in the room.

Arbitrum's recent price action has been terrible – almost terrifying.

Since its massive unlock on March 16, which increased the circulating supply by 87%, the asset has decreased by 28% over the past 20 days. Based on a historical study, we expected a minor price impact when we released its token unlock evaluation. Yet Arbitrum has registered a massive drawdown since then, and its long-term bullish structure is becoming bearish.

Does this mean it is time to sell your ARB bags? Well, not quite.

Key narratives for ARB in 2024

We have observed that Arbitrum still has multiple catalysts in 2024, which can re-engage its bullish run over the next few months. Let us take a look at them.-

Arbitrum Orbit

If the priority is making sure call-data gets posted to Ethereum, developers can choose to deploy their Orbit chain onto Arbitrum One. For running higher-volume dApps, Orbit chains can be deployed onto Arbitrum Nova with a tradeoff of minimal trust assumption.

Celestia has partnered with Arbitrum to allow Orbit chains to publish data on the TIA network. At the moment, 50+ Orbit chains are in development.

-

The impact of EIP-4844

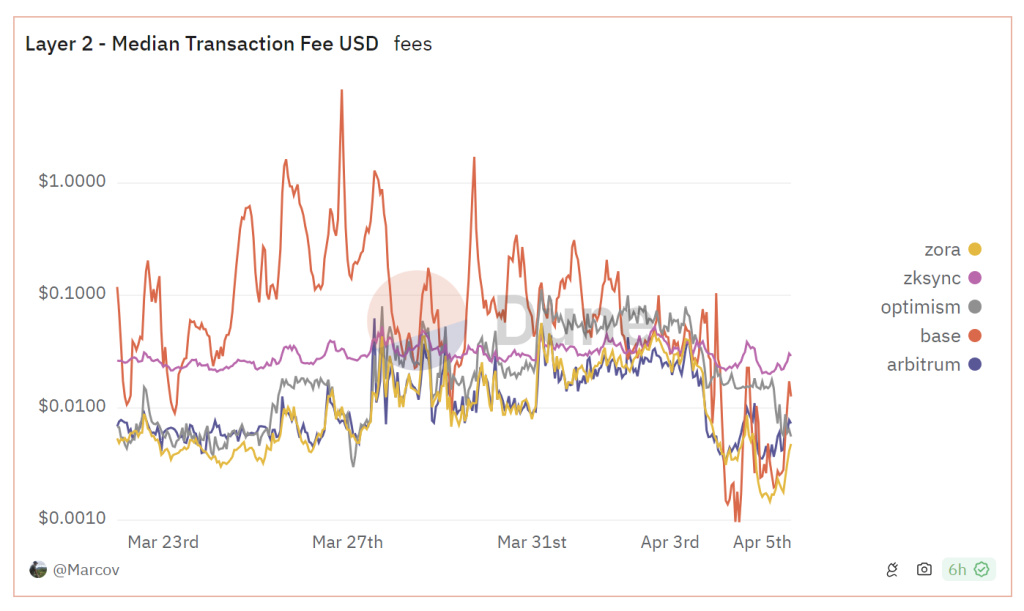

The chart shows that the median transaction fee in USD has dropped massively. For ARB, the average transaction fee currently stands at $0.006. Now, this particular upgrade helps every L2 network's cause, but coupled with Orbit, Arbitrum is positioned to benefit more.

-

Active Arbitrum DAO

Last year, the DAO approved additional funding for its STIP proposals, with the budget increased to $23.4 million, to support emerging projects.

In January 2024, 50M ARB tokens valued at $54 million were released, and protocols could use this round of ARB rewards to incentivise users through fee rebates, LP rewards, and trading rewards.

-

ARB staking

The circulating supply is expected to increase by 48% by April 2025. ARB's circulating supply will be around 4 billion tokens by then. Staking should offset ARB's increasing circulating supply and counter the selling pressure for the token.

On-chain comparison across L2s after Ethereum's Dencun Upgrade

For most L2 networks, total value locked (TVL) and revenue generation are key on-chain determinants. After the EIP-4844 launch, transaction fees on most L2 dropped significantly, and there was a change in on-chain statistics as well.We have tabulated the key data for Arbitrum, Optimism, Polygon, and Mantle. (Note: The Base Network has recently emerged as a main competitor, but we haven't included it since it does not have a native token.)

As observed, Arbitrum continues to boast the largest TVL among all L2 networks. Its annualised revenue is also competitively high, with a good Price-to-Sales ratio.

Polygon, which has a larger market cap, does not have the strongest revenue statistics. Now, remember that these factors are not perfect indicators that one network is better than the other, but they enable us to understand the rate of activity.

With Arbitrum, despite its current drawdown, the network has continued to gain traction, which should factor into its valuation over the long term.

Price targets for 2024/2025

Fundamentals are important, but most of the market is looking to capitalise on the current bull market with ARB. Therefore, we need to be objective with our price target.If ARB met our long-term target of $30, its current market cap would jump to $70 billion.

That is a huge number, considering the current market map of all L2 currently sits under that target.

Therefore, we posit that $30 is still a longer-term target, and there's a need for a more immediate target for the current 2024/2025 bull run.

Base target: $25 billion market cap, i.e. $6.25 based on a circulating supply of 4 billion.

Bullish target: $35 billion market cap, i.e. $8.75 based on a circulating supply of 4 billion.

Technical analysis

Chart-wise, ARB looks really clean here.

ARB has trended lower and filled a major Yellow Buy Box between $1.39 and $1.50, which has been positioned for a long while and has finally been filled. Price is now attempting to move higher, having broken out of the local red downtrend line, whilst price also formed a bullish divergence just slightly above oversold territory.

As a trading opportunity, this looks great to go higher in the short term. There is a relatively meaningful horizontal resistance at $1.69, just above the current price. However, if price can clear above this level, this would open the door for a move higher to $2.00.

However, in the short term, ARB looks like it could go higher from here, particularly if BTC breaks out of the all-time highs. ARB is an attractive trading opportunity here.

Cryptonary's take

Narratives are a powerful catalyst in bull markets, and right now, we have to be honest: L2s are lagging behind other categories. They started the year on a front foot, and there was major anticipation behind the EIP-4844 launch. However, the momentum has faded slightly since then, and ARB has been hit hard during this correction period.Yet, its on-chain prowess and active community should not be disregarded, and the L2 token is poised to make another bullish run in the market soon. Based on our current information, the above targets are appropriate.

If you already have ARB in your portfolio, a $6.25 to $8.75 price could be a decent performance, depending on when you got in. ARB is a mid-risk play that could help keep your portfolio diversified if you are heavily in the SOL ecosystem.

If you don't have exposure to ARB yet, the upside from here, 4.4x to 6.2x, isn't exactly exciting, and there are better opportunities elsewhere.

We remain bullish on ARB for now, but you most likely won't get a 20x from ARB during this bull run.

Until next time,

Cryptonary Out!