Can Astar get back to being a shining star in 2024/2025?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Going back to 2021, when Polkadot parachains were being launched, we put our DOT into five projects that we believed had the best chance of capturing users and value.

Astar Network (ASTR) was one of those projects.

Now, Polkadot itself has not lived up to expectations by any means.

But does this mean we're writing off the entire ecosystem?

Let's find out!

TLDR

- Polkadot's parachain ecosystem has failed to live up to expectations, with minimal user and developer participation in new parachain launches.

- Astar Network, one of the original Polkadot parachains, has recognised Polkadot's stagnation and is pivoting away to focus on a multi-chain strategy.

- The launch of Astar's zkEVM on the Polygon network provides a new avenue for growth, connecting Astar to the broader Ethereum L2 ecosystem.

- Astar has revamped its dApp staking mechanism and token economics to address previous inflation and reward distribution issues.

- Despite Polkadot's struggles, Astar remains active in building partnerships and onboarding new crypto projects and companies, particularly in the GameFi space.

- What kind of performance can you now expect from ASTR in the 2024/2025 bull run?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The state of Polkadot

At the time, Polkadot promised to revolutionise cross-chain interoperability by creating a network of application-specific chains. They achieved this, but no one is using it.

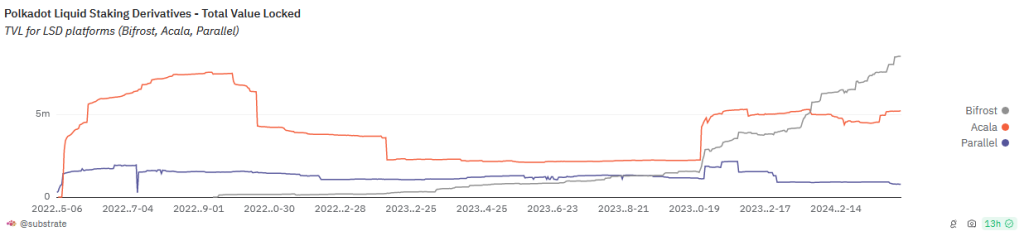

Liquid staking, one of the key sectors where Polkadot should have been performing well (because of parachain auctions), has essentially been flatlined for the last two years. This means minimal participation in new parachain launches, which is poor for two reasons:

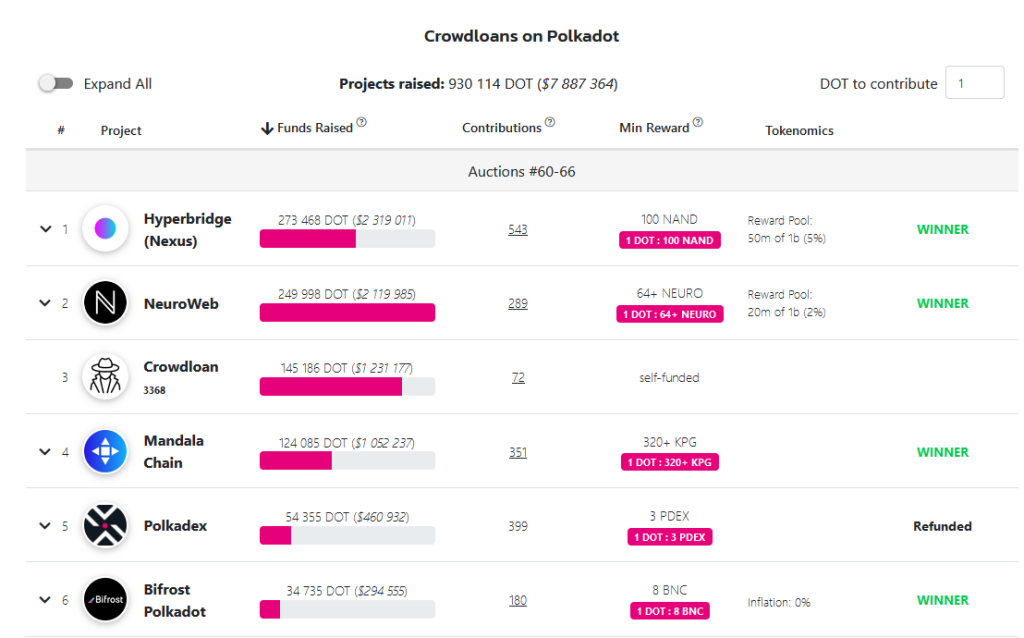

- No exciting parachains have been launched that would attract users, showing the lack of interest from developers in launching on Polkadot.

- There is no competition for slots - anyone can launch a parachain for just a few thousand DOT (that they aren't even spending, just locking up.

Compared to the hundreds of millions/billions of dollars raised in the first couple of auctions, Polkadot's fortunes have fallen off.

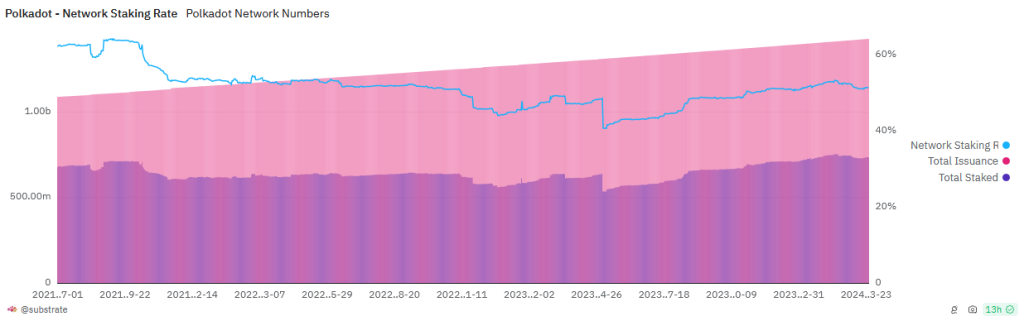

The staking rate has remained relatively unchanged as well.

When combined with the lack of DOT locked up in auctions, DOT tokens have essentially just been printed through staking and sold on the market. The original thesis for DOT was that many tokens would be locked up in parachain slots, which has just not happened.

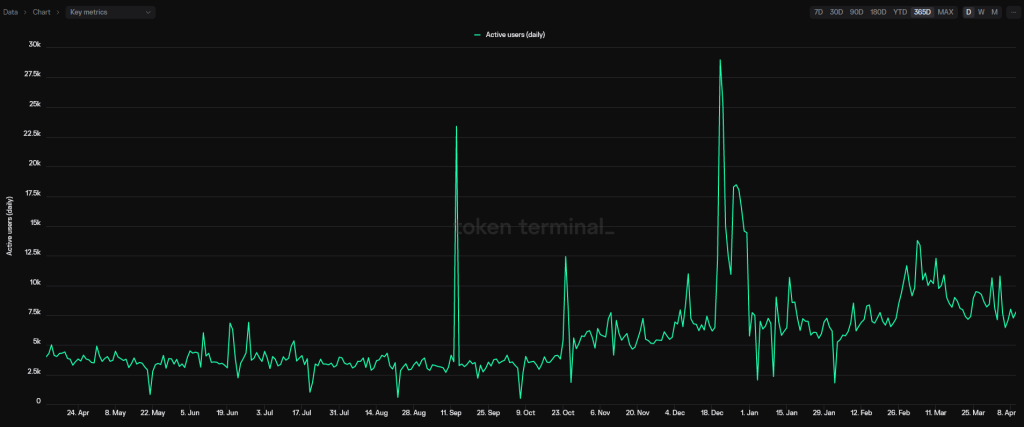

Finally, while most other chains have seen a large uptick in users over the last year…, the figures below speak for themselves.

So, with developers and users showing little interest in the Polkadot ecosystem, where does that leave Astar?

After all, they were one of the five OG parachains. Let's dive in!

Astar 2.0

The Astar team has recognised that Polkadot is no longer a viable strategy for them. As a relatively un-marketable chain nowadays (see above for reasons), Astar has decided to take a different direction and "go their own way", so to speak.

They'll still be working with and on Polkadot, but they've expanded their horizons in several different directions.

The most important of these developments is launching a zero-knowledge protocol based on the Polygon network.

Astar zkEVM

The launch of Astar zkEVM further connects the ecosystem to the expansive Ethereum L2 ecosystem.

In this case, the tech doesn't really matter; it's not the key development. This pivot away from Polygon allows Astar to connect with a larger target market and more liquidity while retaining the same level of control over its blockchain.

Astar has always been multi-chain. However, to "grease the gears" and provide a smooth connection to the Astar zkEVM, they will be using the LayerZero infrastructure. Stargate Finance is one of the cheapest and most effective methods of moving between Ethereum L2s and is readily integrated with multiple destinations outside of the Ethereum ecosystem as well. This provides a great avenue for further expansion.

New initiatives

Astar is still highly active on social media, particularly Twitter/X.Gaming is one area we expect to perform well later in the cycle, and they're being proactive about pushing GameFi on Astar zkEVM.

They are continuing to push partnerships left, right, and centre. In addition to the partnerships with Sony and Toyota we've already mentioned, they clearly still have strong connections in the crypto and TradFi worlds.

Overall, Astar is essentially incubating and working to onboard crypto users, projects, and companies, as well as some of the largest companies in Japan/Asia. And they are succeeding.

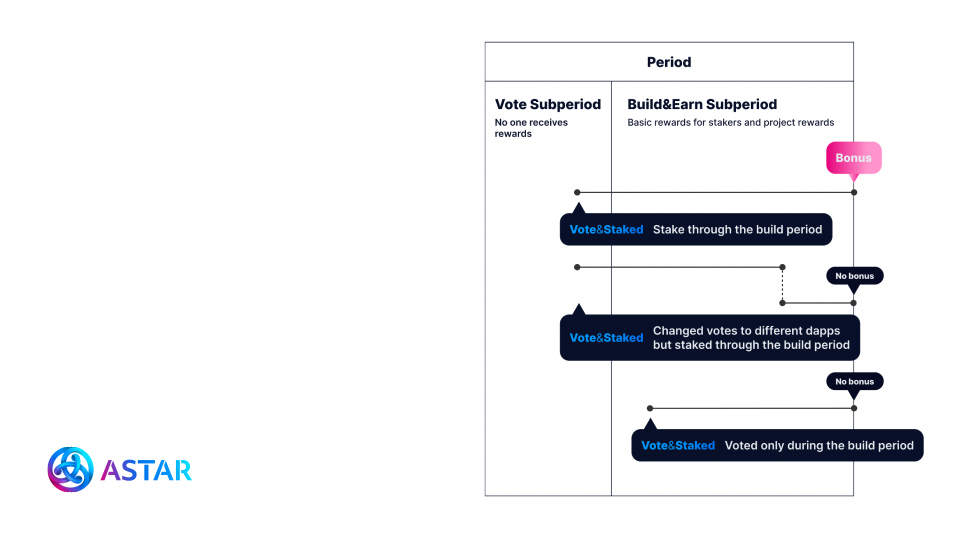

dApp staking V2

Beyond partnerships, Astar has also expanded the core infrastructure and revamped its tokenomics. dApp staking was a key component of Astar's value proposition—the more projects launched on Astar, the more ASTR tokens locked up.This didn't really play out on Polkadot (see reasons above). However, the actual dApp staking mechanism is still a major selling point. The update includes the following changes:

- Scalable rewards & rewards cap: Rather than having a million projects launch, all offering 10% ASTR rewards per year, the number of "spaces" available for new projects on Astar is now impacted by the number of projects already launched. This reduces ASTR inflation and sell pressure.

- New project bonus: newer Astar launches have boosted rewards rather than competing with well-established projects.

This reshuffle of the dApp staking mechanism makes it much more attractive for underfunded teams to consider building on Astar in confluence with all the wider changes to the protocol.

ASTR tokenomics

Although the above changes to dApp staking alleviate some of the inflation pressure on ASTR, there were other pain points around the tokenomics.Basically, the rewards being emitted were already too high overall, never mind the rewards for each individual project.

The key changes for ASTR tokenomics include:

- A soft cap on inflation for each cycle (year).

- The soft cap limit is recalculated for each new cycle based on the previous year's data.

Updated targets

Our previous target was $6.30, based on a $10 billion market cap.The inflation rate is much higher than anticipated, which means that at a ~$ $750 million market cap currently, ASTR is only worth $0.13. If ASTR hit $6.30 right now, it would have a market cap of $35 billion—way off our original thesis.

However, as previously discussed, there have been some changes. Many of them have been quite recent, and some are ongoing.

With the inflation situation partially resolved and Astar actively transforming its infrastructure away from a Polkadot-centric posture, we think a $10 billion market cap target is still reasonable.

However, this would place ASTR at $1.77.

The original target market cap was between $10-15 billion.

Therefore, we will revise the initial target down to $2 per ASTR.

Technical analysis

ASTR has been an asset we have been monitoring closely due to the high request and attractive price action.

We have had steady corrective price action into the level of interest of around 0.126 on ASTR, which has held up nicely and has historically had multiple validations.

Since then, we have had a pop-out breaking out of the short-term bearish corrective trend, and now it appears we are coming back to test the bearish diagonal level as support.

This is a strong bullish pattern and attractive price action.

Cryptonary's take

Although the Polkadot ecosystem is becoming the Cardano of the multi-chain world, Astar is branching away from that stagnation and has consistently built partnerships throughout the bear.For those looking to capitalise on ASTR, we highly recommend participating in governance. Or, at the very least, staking ASTR. This will avoid the scenario earlier holders find themselves in - being inflation to oblivion.

Ultimately, though, Astar is still a pretty niche selling point and has a few of the characteristics we are looking to avoid at this stage of the market:

- Salty bag holders.

- A long previous history (albeit with no major issues).

- There is no clear winning narrative.

Final verdict: ASTR is not a poor investment, but it is just not optimal for the current market conditions.

Cryptonary, Out!