Can MINA reach its potential? It boils down to one question

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Mina is not building for you!

They are too focused on impressing professors at Harvard.

While theory can be the compass, it is not much use unless it interacts with reality.

And this is where Mina falls short – much of its innovation has stayed too long as theories.

This leads us to question whether MINA can compete with other layer 2 solutions on Ethereum.

Is the network getting caught in a perfectionist trap? Or is it simply a matter of innovation requiring time?

In this report, we answer the question of whether Mina is the real deal.

And, more importantly, whether we would consider investing in MINA under the current circumstances.

Let’s dive in

TLDR 📃

- Mina faces the challenge of bridging the gap between innovative concepts and practical implementation.

- This challenge is worsened by the network's absence of functional dApps and a delayed roadmap, resulting in declining interest.

- Also, Mina's initial advantage in zero-knowledge technology is threatened by the competition, notably zkSync.

- Amidst these challenges, positive strides are evident as Mina allocates funds to initiatives for its network launch, signalling an approaching hard fork and ecosystem expansion.

- For Mina to succeed, it must focus on users’ needs and practical benefits. Consequently, we've adjusted the MINA target to $26.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

State of MINA 💡

We’ve not seen much movement as far as Mina’s development is concerned. The Mina ecosystem is practically non-existent, with projects only stating their intention to launch on Mina.And it’s impossible for projects that have expressed such intentions to launch.

Why?

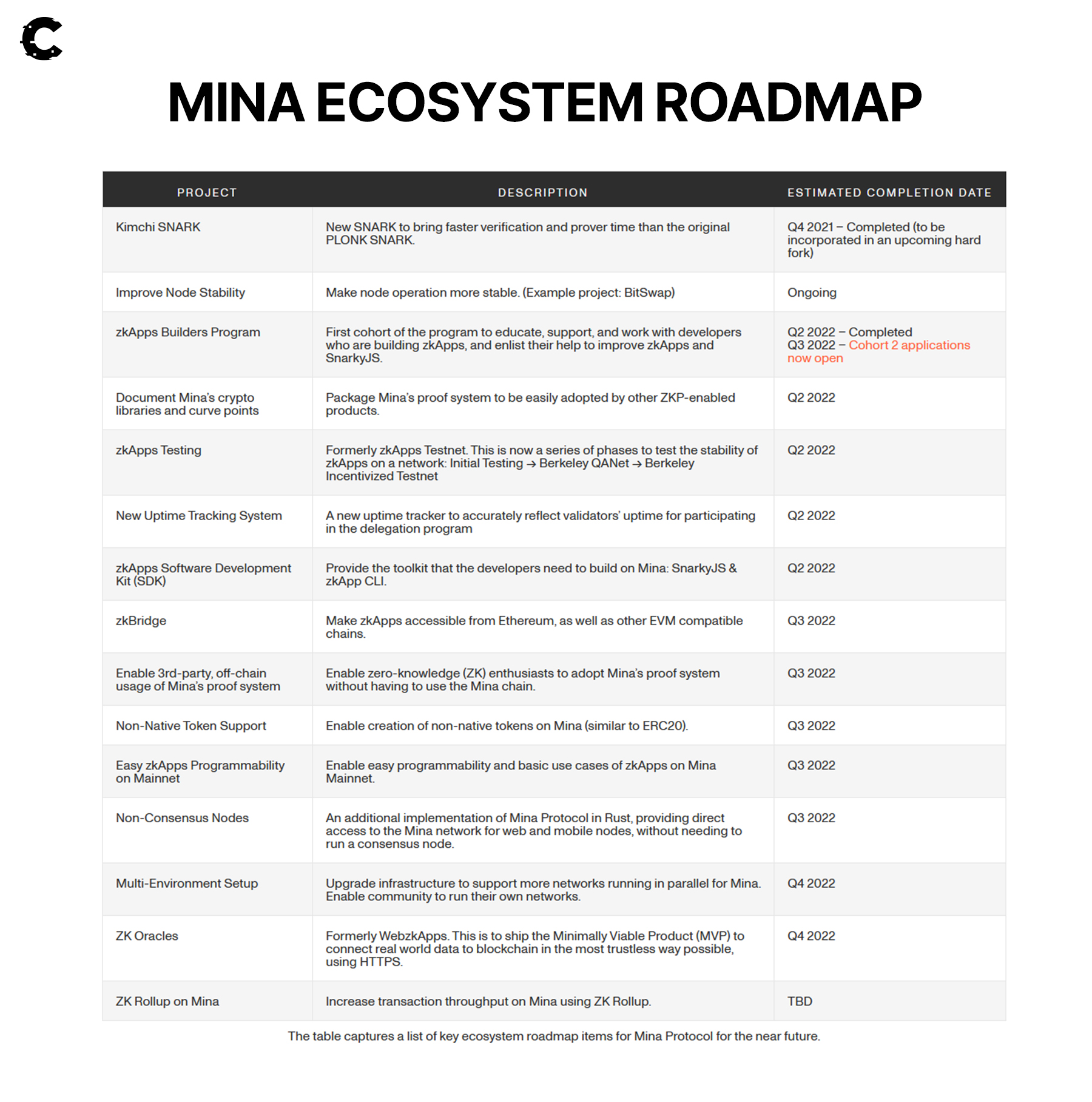

The original roadmap (below), which went up to the end of 2022, is far behind schedule.

The hard fork, an essential milestone for any on-chain improvements, is yet to happen. No dApps are running on the MINA blockchain after all this time.

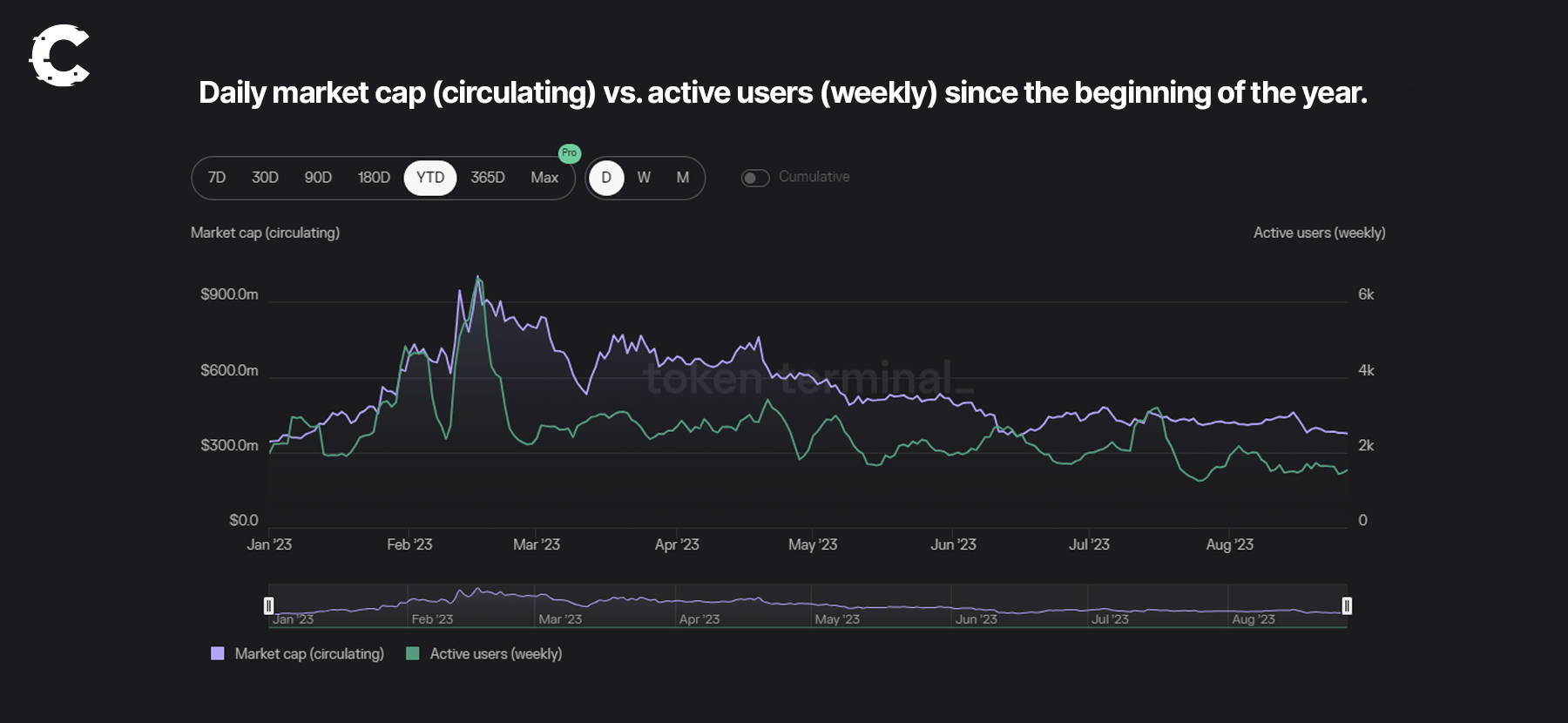

This development delay has eroded investor confidence in the project, causing MINA to underperform.

There’s often a correlation between the number of users and the overall market cap. This correlation may become irrelevant in a bull market, but the steady decline in active wallets indicates a loss of interest in Mina.

Signs of developmental progress, such as the incentivised testnet, launched in May, suggested that zkApps would be coming to mainnet soon. However, there have been few further updates regarding the crucial hard fork that will make this possible.

There is no timeline for the hard fork yet; it’s essentially just a case of “soon”. The new roadmap simply laid out “progress” meters for each activity. After failing to keep to the original roadmap, it now feels like the project has moved away from timelines to a “we’ll get to it eventually” outlook.

As investors, this is not great to see - it leaves the roadmap open to interpretation.

Mina's vision for building an ecosystem 🏗️

However, it’s not all doom and gloom.Mina is actually making progress, albeit slowly, in some areas.👇

After considerable time, the project has started the long-anticipated preparations for its upcoming hard fork. Projects launching on Mina are emerging from stealth mode, and there appears to be a concerted effort to develop and expand its ecosystem.

One standout from all these preparatory events is the incubator program initiated by the Mina Foundation. The program aims to fund the initial wave of projects launching on Mina. Additionally, we’ve seen some privately funded projects supported by venture capital.

Projects funded through Mina's incubator

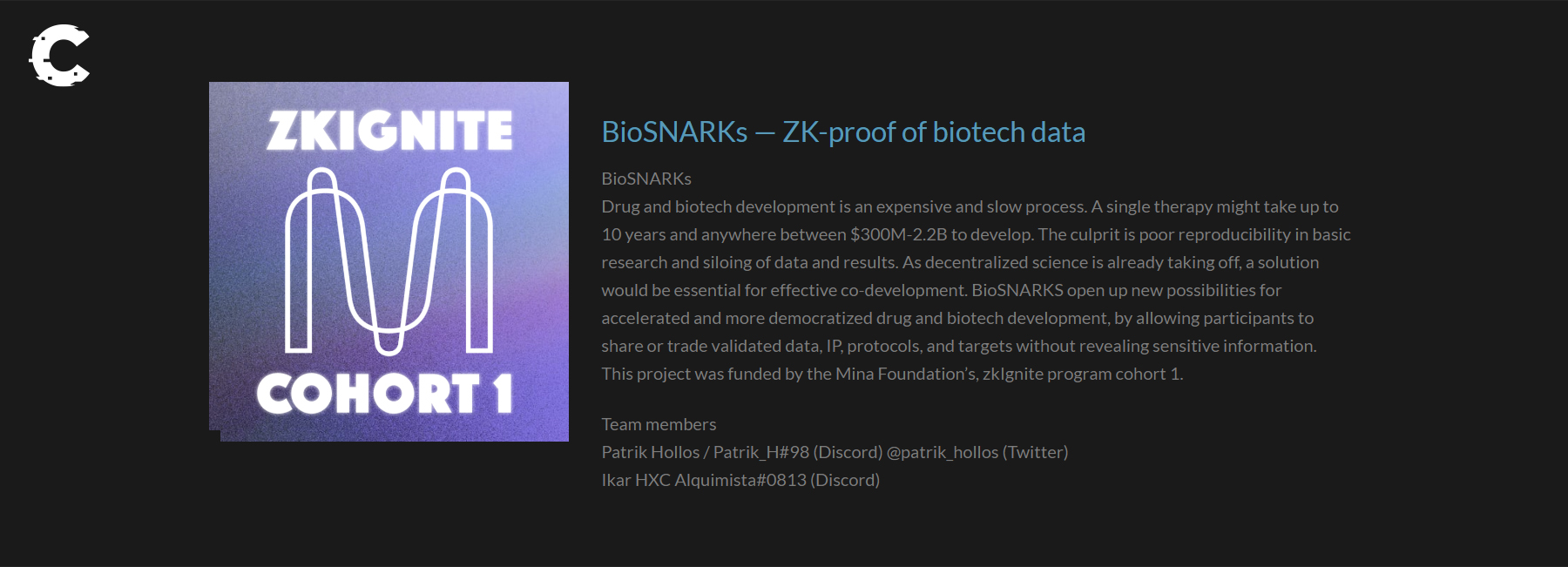

Mina launched the inaugural ZkIgnite incubator cohort, in which 26 projects undergo a rigorous process designed to prevent overpromising and underdelivering. The Mina Foundation confirmed that 20 projects met their milestones – meaning that the funding delivered positive outcomes.Yet, reviewing these projects, we noticed many weren't the consumer-focused apps vital for Mina’s ecosystem growth. Instead, most projects targeted niche areas with future potential but not immediate user needs. Examples are advertising or biotech protocols, relevant later but not now.

While the initial cohort didn't fully captivate our interest, the two wallet projects stood out. These wallets play a crucial role, especially with Mina Protocol's zero-knowledge technology enhancing privacy and user-friendliness.

For post-mainnet launch, consider these wallet options:

ZK Keyless Wallet: Emphasizing security and usability, it sidesteps private keys for features like Social Recovery and biometrics. Privacy remains intact through zero-knowledge technology.

Airgap: An innovative multi-chain wallet, AirGap Vault transforms idle smartphones into hardware wallets. It operates securely without the internet, akin to a hardware wallet.

We didn’t find many exciting projects in the first cohort of the incubation, but now 88 projects are vying for grants in the second cohort – hopefully, there’ll be some winners in the new lot.

Privately funded projects

Apart from grant-funded projects, which are often treated as "public goods" rather than investments, private investors also participate in the Mina ecosystem.These investors prioritise applications with tangible demand and strong investment returns. In this context, a decentralised exchange, Lumina DEX, has garnered significant interest among investors.

Backed by major investors like Jump and the MINA Foundation, Lumina DEX positions itself as an "enterprise-ready DEX and DeFi platform built on the Mina Protocol." Its goal is to address challenges faced by conventional decentralised exchanges.

Unlike the typical permissionless DEXs we're accustomed to, Lumina DEX operates differently. It aims to comply with regulations, diverging from the norm by requiring KYC for user access. It focuses on permitting trading exclusively for users meeting KYC and regulatory prerequisites.

From a business standpoint, it could make sense due to stricter regulations and new crypto tax rules in the US. Being one the few decentralised exchanges playing by these rules could give Lumima DEX a competitive edge.

However, will users favour it over permissionless options? If launched as the first decentralised exchange on Mina, we don't view it as the primary attraction; KYC and regulations raise the entry barrier, impacting its appeal.

In essence, the project’s pro-regulation stance is controversial; there’ll be debates on whether or not it goes against the fundamental ethos of crypto – all of which detracts from the goal of having a project that could help Mina grow its user base.

Meanwhile, competitors appear to be moving much faster than Mina 👇

Did zkSync strip Mina of its first-mover advantage? 💭

When Mina was conceived in June 2017 to become the inaugural blockchain utilising zero-knowledge technology –, doubts lingered about the scalability of blockchains with zero-knowledge.Even Vitalik foresaw optimistic rollups taking the lead – and the tacit understanding was that ZK technology would likely require a decade to materialise. Mina forged ahead, unfazed, as a trailblazer in this new domain.

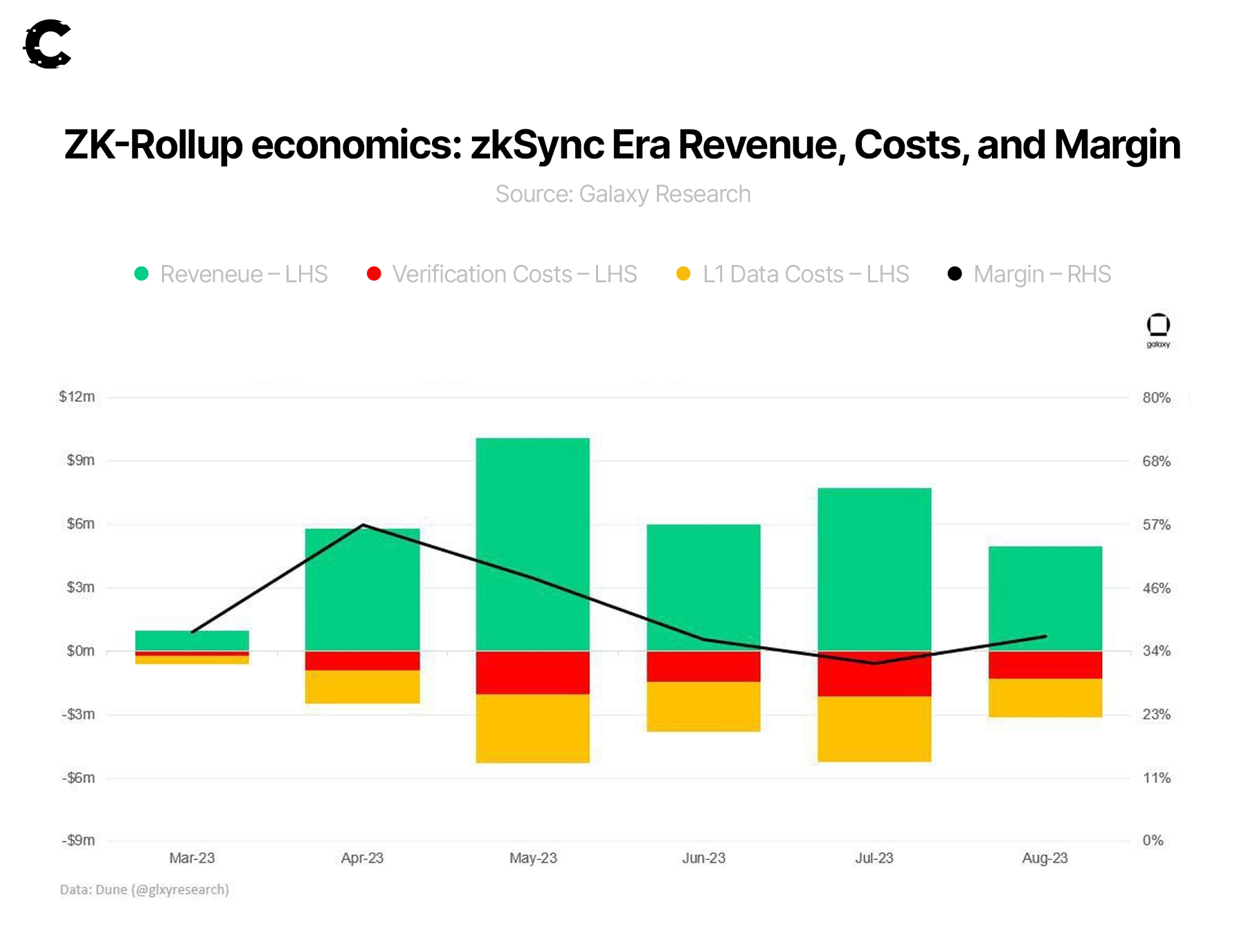

However, delays in Mina's development let competitors in. Swiftly, other zk-rollups projects emerged, and the technology is now proven with zkSync Era's launch this year. Mina, the trailblazer, is still in development, but a competitor has rolled out the first zkEVM live on mainnet.

Unlike Mina's academic focus on perfecting tech, zkSync pushed products early, gaining users despite unfinished features.

This strategy enabled zkSync to attract users and achieve product-market fit rapidly, resulting in a significant monthly revenue of $5.9 million since the launch of zkSync Era.

Meanwhile, the Mina Protocol, possibly justifying its extended timeline to develop a stronger product, currently operates at a loss. It rewards stakers with MINA tokens for network security but hasn't attracted users due to the necessity of a hard fork for application launch.

Our concern is that, frequently, superior technology isn't sufficient. New tech ventures might fall into the academic trap, as evidenced by Mina Protocol adding Harvard Business School (HBS) Finance Professor Di Maggio to its board.

While valuable, this expertise exposes the project to the risk of becoming overly self-focused on academic pursuits rather than user-oriented outcomes. Development can prioritise intellectual choices over practical business operations.

Unless Mina shifts focus to cater to user preferences and adopts a business mindset focused on delivering real benefits, it will lose out completely to theoretically-less-advanced competitors.

So where does that leave MINA?

MINA price targets🤔

The previous targets set for MINA were under the assumption of:- The market being in a super-cycle. This was not the case. The market is still heading for double-digit trillions, but we did not anticipate this stage of the cycle going so low.

- The original roadmap. MINA should have a working product by now. Again, this is not the case, and they’ve lost their first-mover advantage as other zk-powered protocols enter the mix.

Additionally, as we’ve seen with Polkadot, the ecosystem can launch, but it can become a ghost town. There are no guarantees that the Mina ecosystem will outperform Polkadot in that sense.

We believe a fair valuation for Mina once an ecosystem is in action is around $25 billion.

This would set our MINA target to $26.

How did we arrive at $26?

Start by looking at other comparable L1s in terms of technological advantages. Take Solana, for example; it reached a $75 billion market cap during the bull market whilst not completely functional (despite outages and other tech issues). Avalanche, another “tech-heavy” chain, reached a market cap of $28 billion. Mina is comparable to these chains but significantly earlier in its development.

Mina price analysis📈

So, where does MINA stand now?

Since March, MINA's price has been taking a tumble to the lows. It recently reached a major accumulation area between $0.465 - $0.425, but there was not enough demand for its price to stay afloat.

As a result, the asset is now part of the "downside price discovery" club after registering a new all-time low on August 18th.

From a technical standpoint, we are now waiting for psychological levels to act as support, such as $0.35, $0.30, $0.25, and so on. Of course, reclaiming the previously lost support between $0.465 - $0.425 will invalidate the downside price discovery and put MINA back on its feet.

A cheap asset always intrigues the average buyer, but we recommend waiting until a clear bottom is formed. Even so, MINA's fundamentals will play a major role in whether the $26 price target will see the light of day - staying updated on their developments will give you an upper hand.

So, with all this in mind, here are our closing thoughts:

Cryptonary’s take 🧠

Mina is essentially a blueprint, impressive whitepaper, beautiful website, and many promises – but certainly nothing you can use today.So, on paper, they get a lot of things right, but in practice, there is no way for us to try out the product because there are no dApps.

It boils down to planning vs. execution: What do you think is most important?

We love great planning and want to see flawless execution – projects that can pull off both concurrently are where we want to put our money.

At the very least, Mina is already behind the competition – now it needs more than a usable product; it has lost the disruptor tag and needs to deliver a product that is demonstrably better than competitors like zkSync.

So, we have to ask ourselves - why would we hold MINA?

In its current form, MINA does not warrant the valuation we initially set for it in 2021.

If things work out in a reasonable timeframe, Mina is still an attractive investment for the longer term. Unreasonable would be Vitalik’s outlook for a decade.

We’re talking about opportunity cost here.

MINA is more of a moonshot and should be allocated as such - even with the reduced target.

The key point is that the market has more immediate opportunities today.

And that’s it on Mina.

As always, thank you for reading. 🙏

Cryptonary, out!