Can Optimism outgrow its underdog status to vie for the L2 throne?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

In 2022, we published a deep dive into the world of Optimism (OP).

In the report, we made a case for Optimism, stating that “Optimism was the underdog for a long time, and it has proved its competence to compete for the throne. We know that the team has great potential...” We didn’t include price targets in that report but promised to monitor the project.

Fifteen months later, we are revisiting the project.

The L2 sector is becoming increasingly competitive, with the likes of Arbitrum and Polygon also vying to be top dog.

Has Optimism delivered on its promise, is the project still competitive, and what sort of upside can the OP offer investors from here on?

Let’s dive in.

TDLR

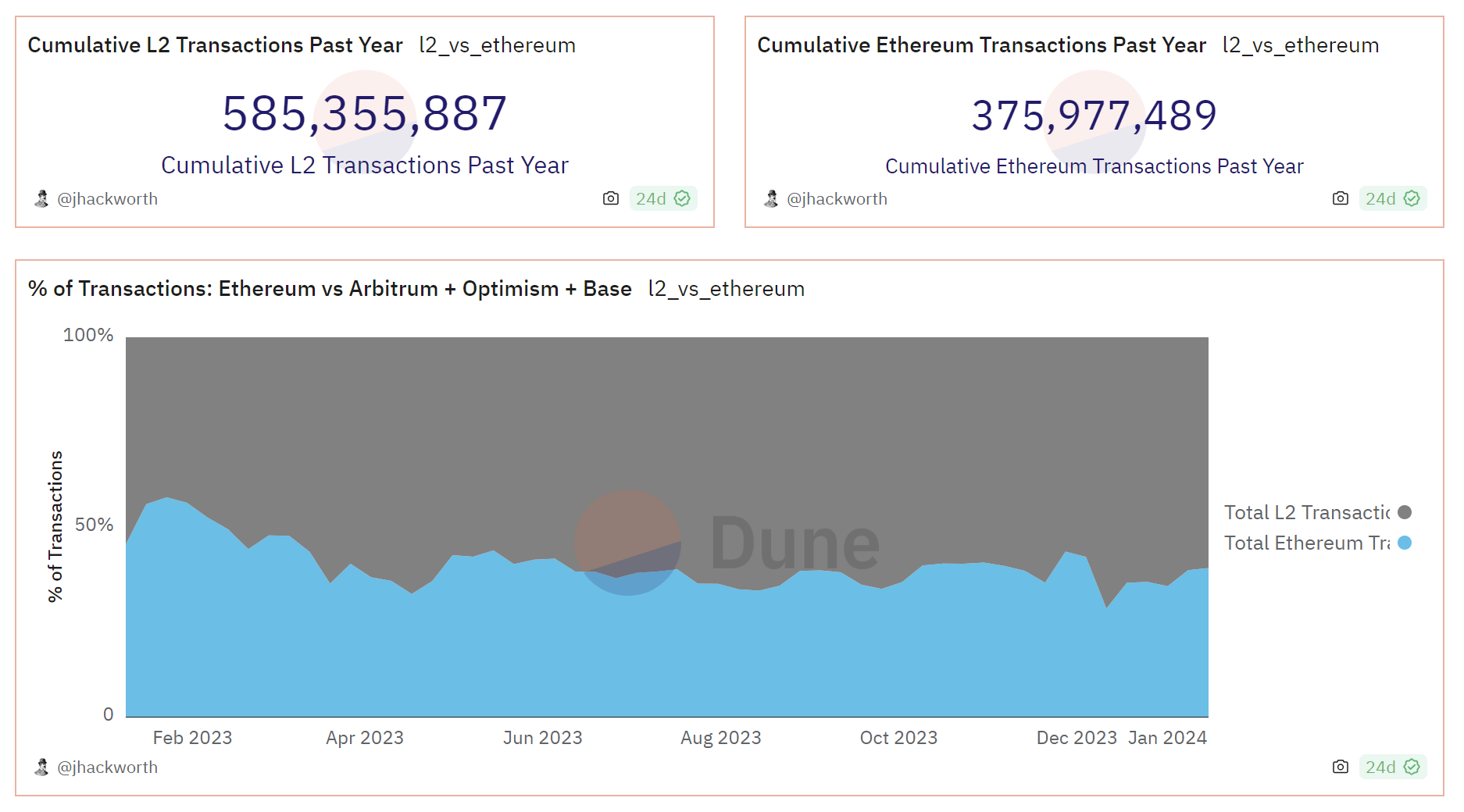

- L2 networks have processed a combined 585 million transactions over the past year.

- Polygon, Optimism and Arbitrum have periodically dominated the L2 ecosystem.

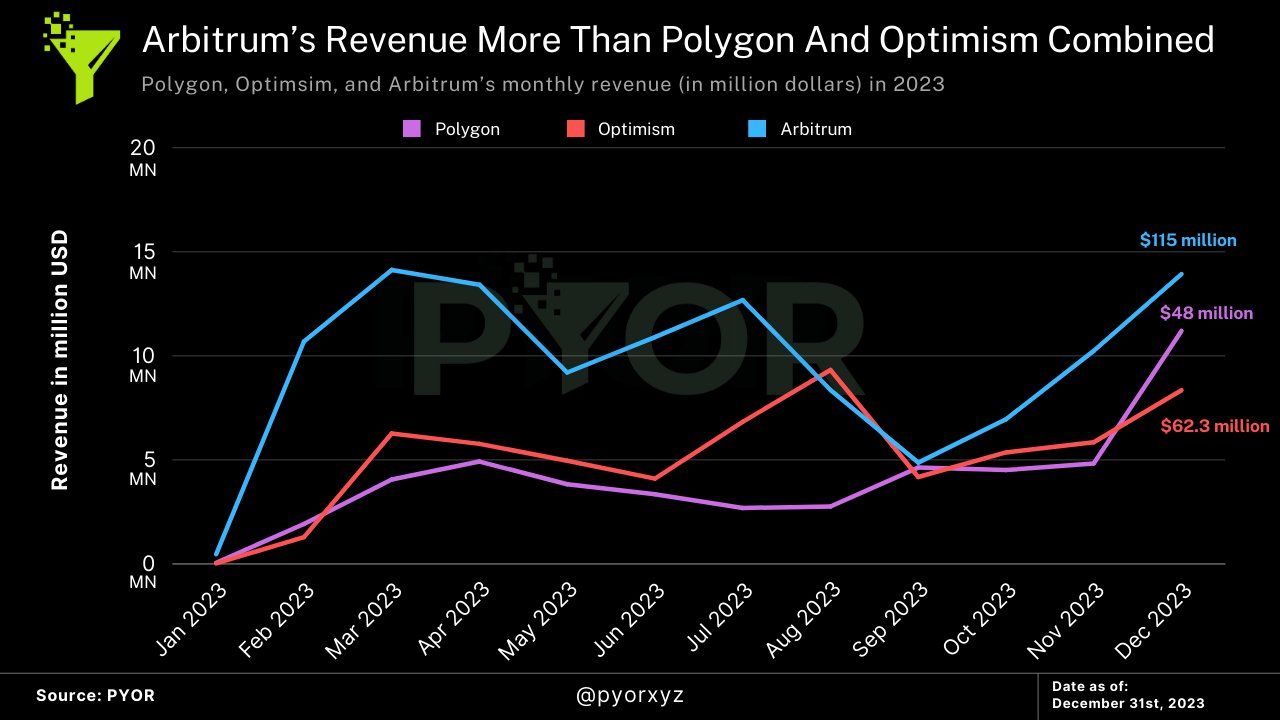

- Arbitrum recorded more revenue than Polygon and Optimism combined in 2023.

- Optimism can rise another 9.5x in this upcoming bull run

- OP investors can DCA into three price targets below $3.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

A quick primer on L2s and Optimism

Let us briefly revisit the relationship between an L1 and an L2 network.A blockchain can operate on multiple layers, each responsible for a different purpose. The base layer, or Layer 1, is the foundational layer where transactions are stored, processed, and recorded.

Ethereum is an L1. Now, while security and decentralisation are the key strengths of L1, scalability and speed are not, this is where L2 networks come into play.

Layer 2 networks are the secondary layer on top of L1. They handle transactions off-chain before settling them on the L1. Projects like Polygon, Optimism, and Arbitrum compete as Layer 2s to Ethereum.

One key classification between different L2 networks is their scaling method, which includes Optimistic Rollup, Zero-Knowledge Rollup, and State Channels. Optimism utilises optimistic rollup, which allows it to execute transactions off the main chain.

The OP token is the governance token on Optimism.

We’ve written about Optimism and what differentiates it from the competition here.

L2s are gaining ground

There is a lot of development activity around Ethereum L2 solutions, and adoption is accelerating.Evaluating the number of transactions processed by Ethereum and L2s over the last year confirms the growth trajectory of L2s.

Over the past year, the cumulative number of transactions processed on Ethereum has been around 376 million.

Over the same period, Arbitrum, Optimism, and Base processed over 585 million transactions.

If you pay close attention to the percentage shift, you’ll observe that Ethereum handled close to 60% in early 2023. However, by January 15, 2024, L2 networks accounted for 60.8% of the total.

Hence, we can argue that L2 networks are increasingly utilised, and their importance is growing.

But how is Optimism, in particular, faring among L2s?

Optimism vs Arbitrum vs Polygon

(Note: There are other emerging L2s like Metis and Manta Pacific, but we are only comparing the protocols with an established user base for this analysis.)Optimism offers a unique approach to scaling Ethereum, but to be fair, Arbitrum and Polygon offer equally competent alternatives.

Polygon was the industry leader back in 2017, followed by Optimism in 2019, and then Arbitrum entered the fray in 2021.

Since the end of 2022, the performance and adoption of these L2 networks have varied.

Now, let us break down some key statistics.

Protocol value and TVL

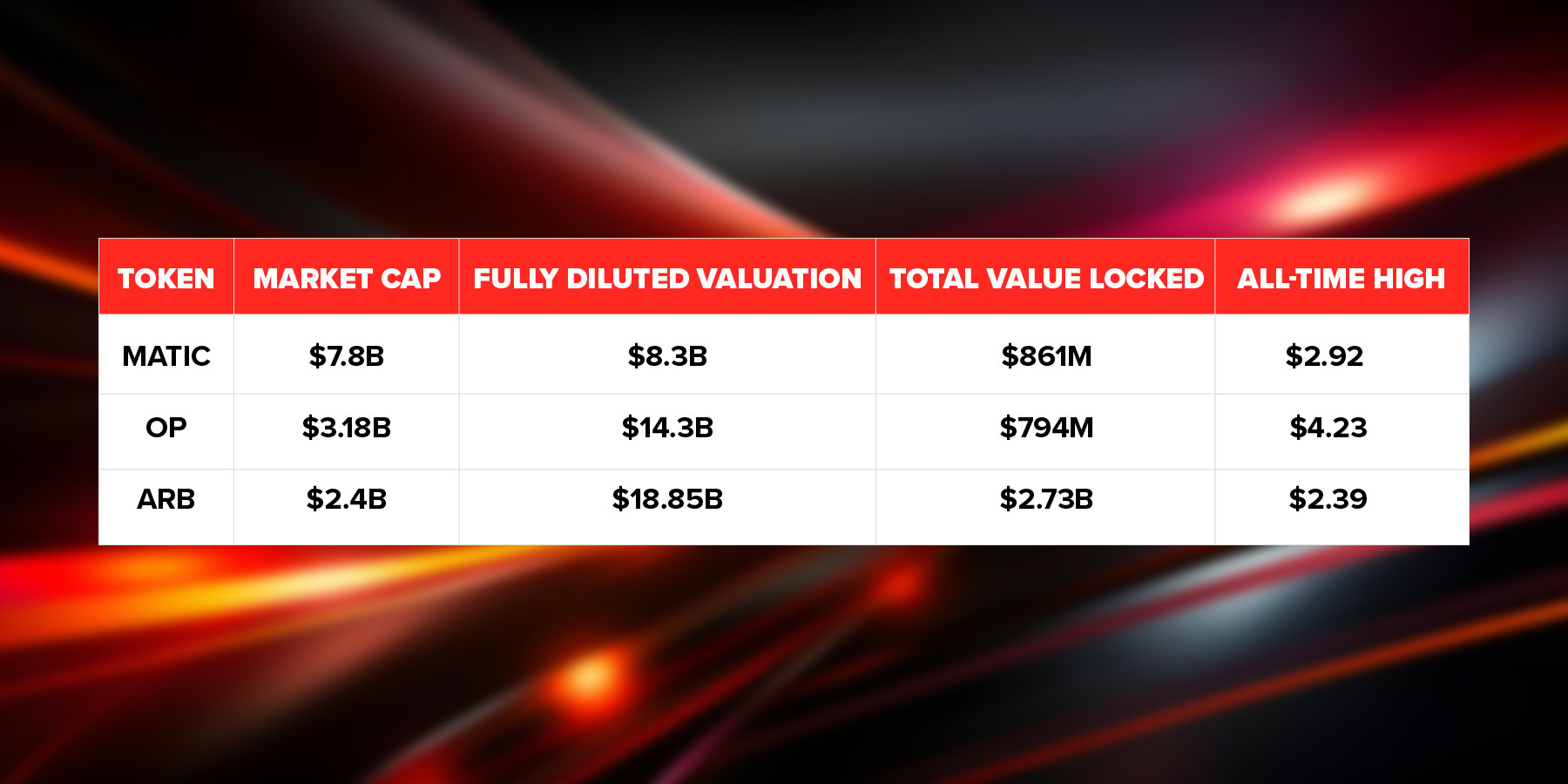

Polygon is the current leader in the L2 category with respect to market cap. Optimism is right behind, and then Arbitrum takes the third slot.

However, when it comes to Total Value Locked (TVL), Arbitrum is the clear winner, with over double the net worth of both the other protocols.

Meanwhile, Arbitrum also highlights the largest FDV value, which means it has a very low float in the market, signalling a relative overvaluation compared to the other two networks.

Yet, Optimism is the project with the highest token emission rate, at 28.6% over the next four years. Arbitrum reflected a 16.77% rate over the next four years, whereas it was a flat 2% rate for Polygon over the next decade.

Lastly, MATIC is also furthest away from its all-time high value. It peaked at $2.92 in 2021 but is currently priced at $0.83.

OP and ARB recorded their ATH last month, so recency bias has favoured the latter pair.

Market activity

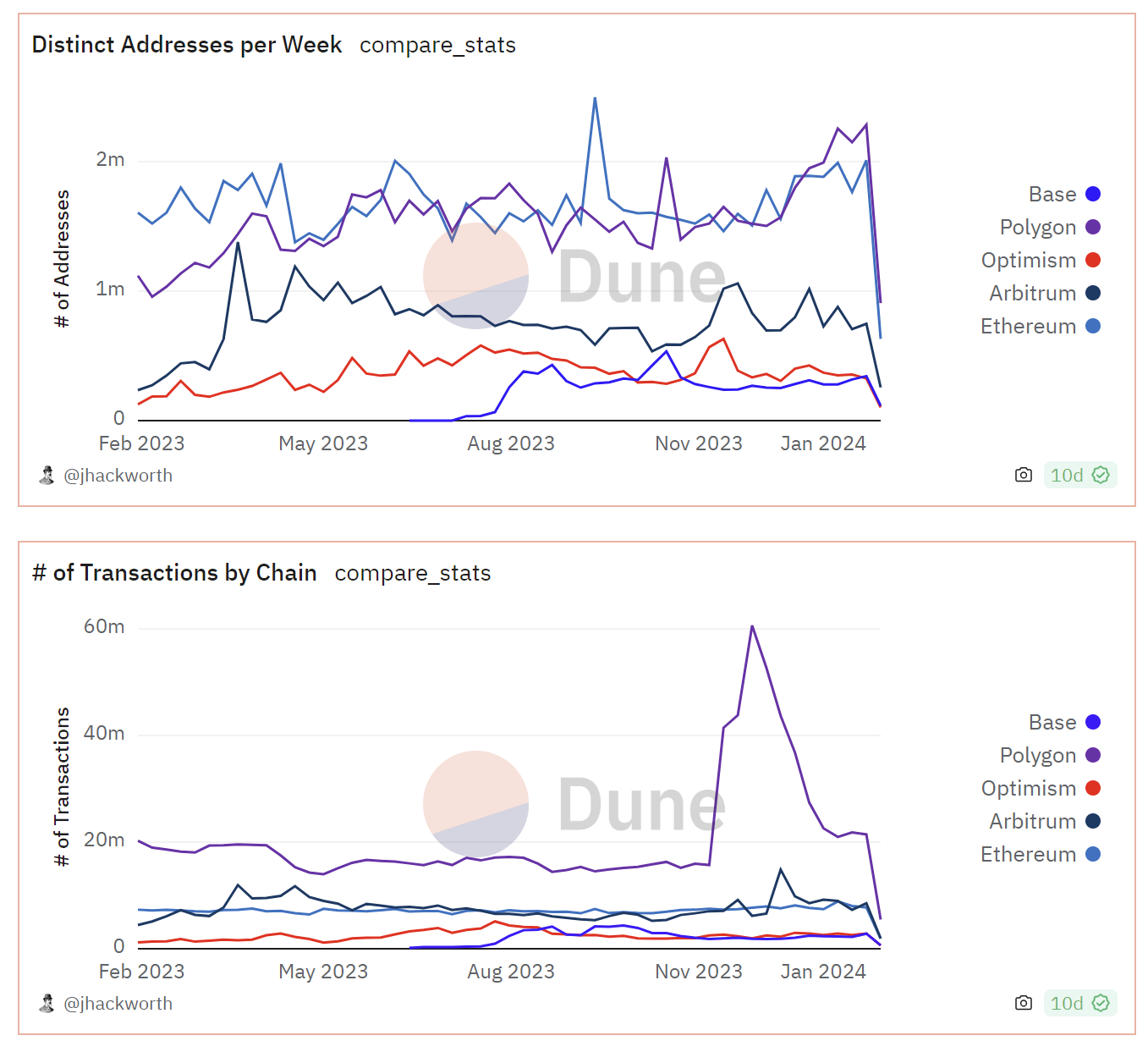

After analysing transactional data, we noticed that Polygon has dominated a fair share of activity.

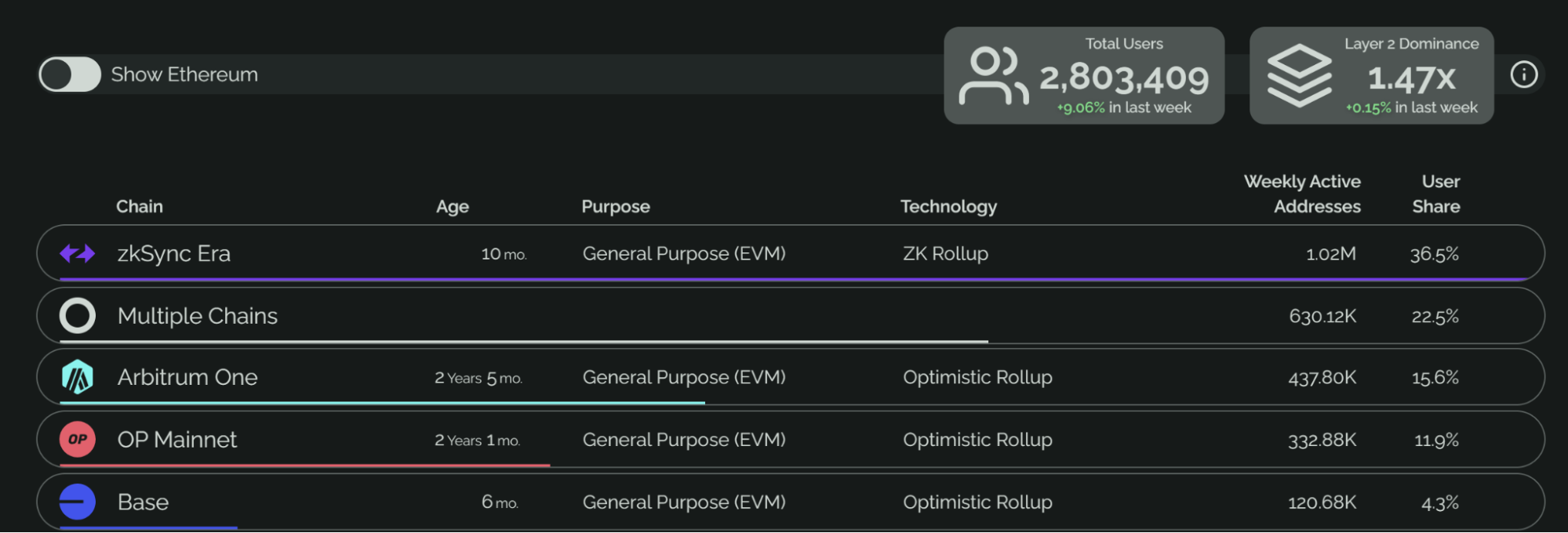

Since February 2023, Polygon has averaged between 1.3 and 1.7 million distinct addresses per week on its network. Arbitrum has maintained a volume above 500,000 on average, whereas Optimism's distinct addresses have largely remained under 500,000.

The number of transactions on the chain facilitated a similar picture, with Polygon leading Arbitrum by at least twice the volume and Arbitrum leading Optimism by over 100%.

During the last week of January 2024, this is how the L2 compared with each other on active users and transactions.

- Active users:

- Transactions:

Multiple other factors could be included here, but the general idea was the same: Optimism has either lagged behind Arbitrum or Polygon.

One striking piece of data suggested that only two Optimism addresses have been active each day in 2023. For Polygon, it was 545, and for Arbitrum, it was 12. It does not really convey anything significantly critical, but it is certainly interesting.

Now, does Optimism have any edge at all in this competition?

OP Stack and Superchains

From the foregoing, it doesn’t seem that Optimism has been able to shed its underdog tag from 2022. However, Optimism still has an edge in the form of the OP Stack.The OP Stack represents a modular, multi-chain layered approach from Optimism.

It is an open-sourced development framework and a compilation of software components designed for constructing L2 ecosystems.

The idea of building multiple rollups, data availability, settlement layers, sequencing, etc., in a decentralised manner is the key vision, or ‘Superchain’ of the protocol.

Over the past year, the idea has reverberated across the industry, and popular organisations such as Coinbase and Binance have launched their OP stack rollups. In fact, Coinbase's L2 network, Base, is also built within the OP Stack ecosystem, a key example of its mainstream adoption.

Now, one of the main reasons why the OP stack has been popular is that anyone can utilise the software components without splitting revenue with the Optimism collective.

It is important to note that Coinbase volunteered and stated that they will be sharing sequencer revenues, but not all entities are likely to follow the same path.

So, while the OP Stack gives Optimism a technical advantage, Optimism's generous structure might limit the upside of financial profitability.

-

Revenue

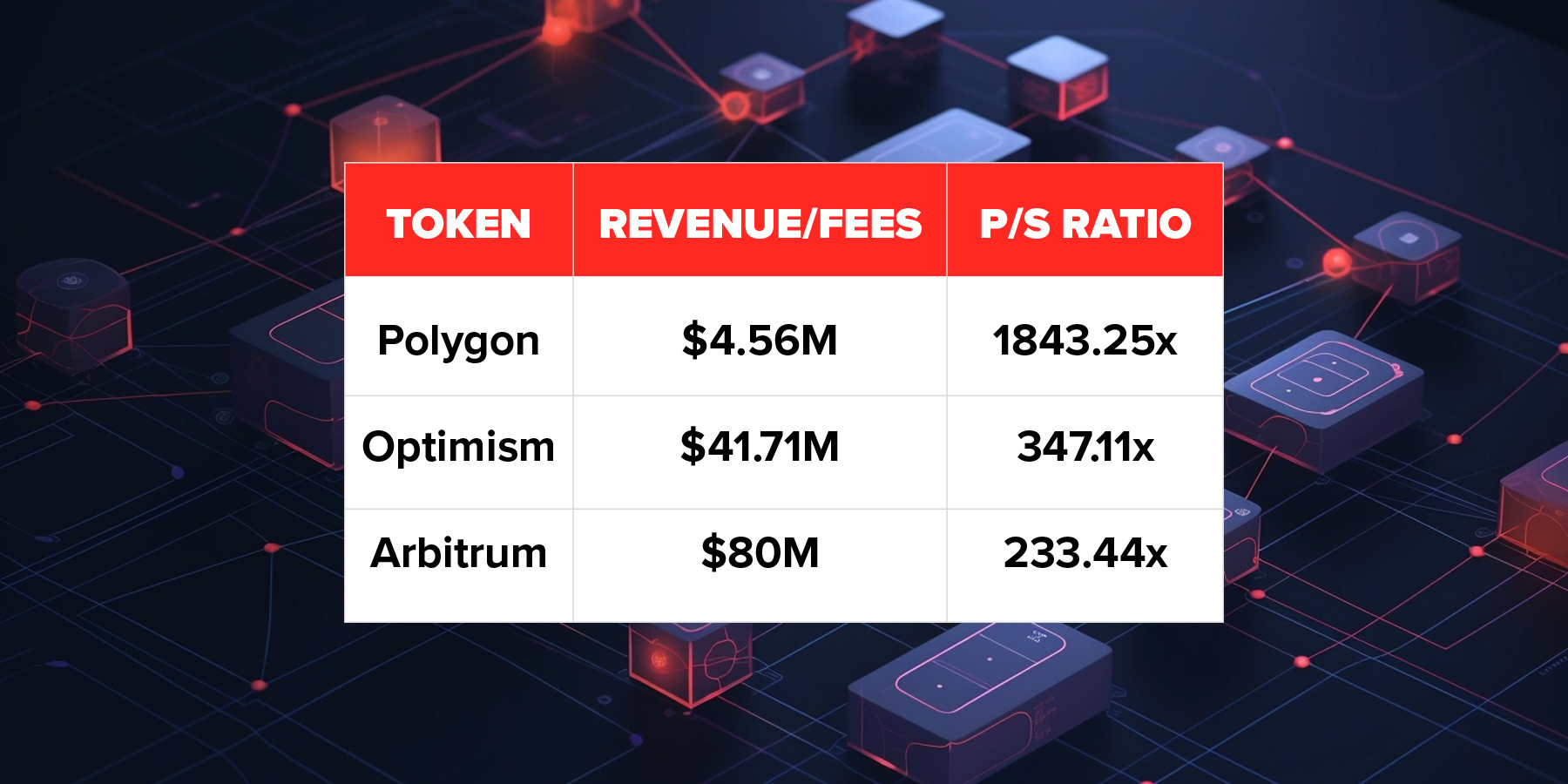

Let us compare the revenue data of other L2 tokens with Optimism.

Both Arbitrum and Optimism have a revenue model that has worked decently for them.

The current Matic token has accrued value solely from the Polygon PoS chain. It is not a governance token or used in any form to pay transaction fees. Hence, Polygon has generated the least revenue.

Although Optimism had a user base and market activity ¼ or less of the size of Polygon’s ecosystem, it generated ten times more revenue on its network.

However, the annualised revenue of Artbitrum topped both Optimism and Polygon at $80 million.

How do we value Optimism?

From a technical point of view, both Arbitrum and Optimism are trying to do the same thing, with a slightly different approach.Both utilise Optimistic Rollup, but both have another unique layer of functionality. Optimism has its OP stack and superchain, and Arbitrum has its Orbit.

Optimism is taking the modular future ahead, which means “doing few things perfectly and outsourcing the rest.” The advantage of this approach is that they are looking at limitless possibilities with inter-chain connections.

On the other hand, Arbitrum is trying to unlock the power of decentralisation and leverage its governance token. Rather than interconnectivity, it is trying to deploy layer 3s on top of the Arbitrum mainnet.

Revenue

The ARB token will be at the centre of it all in a revenue-sharing model. This can also be considered a modular approach, but the revenue model is better for ARB than OP, and the market seems to agree.The generated fees have clearly highlighted this. In 2023, Arbitrum generated twice the revenue of OP – $115 million vs. $62.3 million.

Another factor that suggests Arbitrum has an advantage is the P/S ratio.

Despite earning more revenue, its price-to-sales ratio is 233x, but Optimism has a price-to-sales ratio of 347x.

It means that Arbitrum is relatively undervalued compared to Optimism.

Valuation exercise

Our bullish target for ARB is $30 per token, a 15.6x jump from the current price of $1.92.This would push the market cap to $35.8 billion. Factoring in the inflation emission rate of 16.77% by the end of 2024, the market cap rises to $41.8 billion.

Let us consider that as a base and evaluate Optimism valuation.

Based on the current trend performance, Arbitrum is on track to outperform Optimism. Its statistics, on average, are 2x–3x of Optimism’s across addresses, transactions, and revenue. So, the increment rate in valuation should logically favour Arbitrum as well.

A smaller market cap and preferable P/S ratio indicate the same. Now, let us look at market share.

Arbitrum currently occupies 15.6% of the market compared to 11.9% of the unique user share. We will add 22.5% to both networks since those user bases are operating across multiple blockchains.

So competitively, if both L2 solutions continue to grow equally, the market share division would look like 38.1% for Arbitrum and 34.4% for Optimism, i.e., around an 11% difference.

How high can OP go?

Based on the foregoing, if a similar difference is witnessed from a valuation standpoint, the Optimism peak bullish market cap would be around $37 billion.The current circulating supply of OP is 957,378,568. By the end of 2024, with a token emission rate of 28.6%, it will be around 1,231,188,838.

Now, with a market cap of $37 billion for 1.23 billion tokens, the price per token for OP also coincidentally comes around $30.

Therefore, at the current price of $3.36, we are looking at a 9.2x-9.5x increment for OP.

Price analysis

OP registered a strong bullish rally in Q4 2023, as the token rose almost 270%.

Over the past month, the asset has undergone a correction, but the current price action is very bullish.

If investors are looking to enter a position in OP, there are three key price ranges where they can set their buy orders. The range between $2.72 and $2.34 illustrates the Fibonacci level between 0.5 and 0.618.

This level also coincides with an order block, which has been formed between $2.50 and $1.95.

Hence, investors can DCA into these levels, i.e., $2.72, $2.34, and $1.95, if they want to build a position in Optimism.

Cryptonary’s take

If you’ve been paying close attention to our reports, you would have observed that we are bullish on the future of L2s.We have covered an outlook for Arbitrum, Metis, Manta Pacific, and now, Optimism.

Arbitrum leads the pack with its narrative of generating consistent yield. Just looking at the metrics today, you’ll probably get a better ROI on ARB than OP. However, during a bull market, other factors could be combined with pure fundamentals to drive outperformance.

So, while OP doesn’t offer the same amount of upside as ARB, it is not a bad bet. Interestingly, some developers may prefer Optimism over Arbitrum from a purely technical standpoint. After all, some major organisations, including Coinbase and Binance, have pitched tents in the Op Stack camp.

So, it is worth paying attention to how the momentum grows in Optimism’s favour and how the project reacts to the factors limiting the upside potential of the OP token.

If you want to diversify into L2 with a low-risk bet, both Arbitrum and Optimism are viable options.

ARB is the clear leader, OP retains its underdog status – and sometimes, the underdog can spring a pleasant surprise.