Sounds crazy! But if you've seen the trending threads and tweets about Runes on crypto Twitter, you probably know where they are going with this.

According to Google Trends, last week's halving event was the most-searched 'halving' event. Also, block 840,000 was the most expensive block ever mined on Bitcoin, with users spending a whopping $2.6 million in fees.

There are many different reasons why users may care about the halving or be willing to pay that much in transaction fees during the period. However, once you peel back the layers, the main reason is the idea of Runes. Casey Rodamor, the brain behind the Ordinals Protocol, has effectively developed a way to create memecoins on Bitcoin.

We always argued that this bull run is the cycle of 'shiny new things'. Are Runes part of the shiny new things that will make you money during this bull run?

Let's find out.

TDLR

- Runes is a new protocol that allows the creation of fungible tokens on the Bitcoin network.

- The bullish case argues Runes could unleash Bitcoin's latent capital, attract more builders/users to its ecosystem, generate fees for miners, and spark a memecoin frenzy.

- The bearish case states Runes is still unproven, may struggle to gain critical mass, risks high fees clogging the network, and previous "Bitcoin building" efforts have fizzled out.

- While promising in theory, Runes has not yet produced any major breakout memecoin winners or captured widespread imagination.

- We recommend patience - letting the initial hype fade to see if quality, sustainable Runes projects emerge over time.

- For now, the DeFi and memecoin narratives remain stronger on Ethereum and Solana, but Runes represents an intriguing opportunity for Bitcoin in the long term.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Understanding Runes protocol on Bitcoin

Memecoins are a big part of this bull run. Many people who turned up their noses against memecoin in previous years have slowly accepted them as a valid sector in crypto. Solana is the home of memes in this cycle; Ethereum memes aren't pushovers, and Avalanche is actively pushing its memecoin ecosystem.The Runes protocol is a new token standard on Bitcoin that allows users to create fungible tokens and, by extension, meme coins on Bitcoin.

But before we get into all that, we need to do a quick primer on how it works.

When most people hear Bitcoin, the first thing that comes to mind is Bitcoin (BTC), the currency. And while that is valid, there is also the Bitcoin network, the blockchain on which you send and receive BTC. Think of it like ETH and the Ethereum network or SOL and the Solana network.

Now, you know that beyond SOL on the Solana network, there are tons of other tokens – NOS, JUP, and SHDW, to name a few. The fact that you can create other tokens on Solana is why you've seen the explosion of memecoins on Solana. Check out Pump.fun; for less than a cent, you can create your own Solana memecoin in minutes.

But can you name any other token on the Bitcoin network? Nah!

Feature not a bug

The main reason there aren't other tokens on the Bitcoin network is that Bitcoin has a limited scripting capability and doesn't support smart contracts—this is a feature, not a bug. Anyway, Stacks and a few other projects are working on developing Bitcoin Smart Contracts.Beyond Stacks, with the advent of Ordinals theory, we've seen the emergence of BRC-20 tokens. These are essentially token data inscribed on individual Satoshis to be processed off-chain. ELI5: they are Bitcoin tokens that don't need to be fully managed on the Bitcoin network.

On the surface, this approach works, but it also has many challenges—you can only transfer one token per time, you'll need multiple transactions to mint, claim, or transfer, and probably the biggest concern for Bitcoin maxis is that it outputs junk UTXOs, thereby clogging up the Bitcoin network.

So, for all intents and purposes, creating "fundamentally sound" tokens on the Bitcoin network remains unsolved, and meme coins were even out of the question.

Until now!

The development of Runes meant that creating fungible tokens—and, by implication, memecoins—on the Bitcoin network had fewer technical challenges.

How do Runes differ from BRC-20?

The major difference between Runes and BRC-20 is the reduction of the on-chain data footprint.BRC-20 uses Ordinal theory, which requires technical knowledge and off-chain data. As mentioned above, Runes has a simplified UTXO system that doesn't require additional infrastructure, allowing a better user experience.

Runes protocol messages are stored in the "OP_RETURN" area of a Bitcoin transaction, whereas BRC-20 data is inscribed in the witness section, which is larger than OP_RETURN and less efficient. However, in both cases, data is not stored in a UTXO.

One key benefit of the Runes Protocol is that it allows users to store multiple Rune balances on a single UTXO, whereas BRC-20 only provides for a single token declaration. Hence, fewer UTXOs are required for Runes, and running a Bitcoin node is technically cheaper.

Runes Protocol is also lightning compatible, whereas BRC-20 tokens are not.

The bull case for Runes

As mentioned earlier, the Runes protocol is expected to introduce ERC20-like fungible tokens, allowing projects to issue different types of tokens, such as meme coins, stablecoins, governance tokens, etc.Putting BTC capital to work

The main reason for being bullish on Runes is that this standard now creates an opportunity to put the latent capital in the Bitcoin ecosystem to work beyond hodling BTC. If the standard gains momentum, jumping on the train early enough gives you the early-adopter advantage.For a long time, Bitcoin has been widely considered a store of value. The Bitcoin network (not to be confused with Bitcoin, the currency) does not receive much attention because there isn't much you can do with it beyond sending and receiving Bitcoin.

The Bitcoin narrative changes slightly with Runes because it presents a new wave of opportunity for Bitcoin builders.

Making it easier to build on Bitcoin

This protocol brings a level of responsibility for the builders to build on top of the BTC network and at scale.The Bitcoin community is huge, and most of it is extremely loyal. They almost feel pride for being loyal to Bitcoin. For developers within this community, Runes offers them a way to build within their beloved Bitcoin ecosystem.

Recent data from Franklin Templeton highlighted that the current opportunity for fungible tokens on Bitcoin is quite huge. As illustrated in the chart, Ethereum has a fungible token market cap, which is higher than ETH's actual market cap, and Solana has $37 billion in fungible tokens' value.

Before the release of Runes, only $600 million worth of fungible tokens, largely represented by BRC-20 tokens, carried value in Bitcoin's ecosystem.

Now, with the release of Runes, a more efficient fungible token standard, fungible tokens may close the gap and potentially capture a portion of Bitcoin's market cap if Ethereum and Solana are examples to follow.

Suppose the market cap for fungible tokens on the Bitcoin network increases as Runes gain prominence on Bitcoin. In that case, it will gradually lead to more users interacting with the BTC network.

Making Bitcoin more sustainable

Runes could also help generate more revenue for Bitcoin miners, ensuring the sustainability of the Bitcoin network as mining rewards reduce over time. For instance, during block 840,000, a total of 40.7 BTC worth $2.6 million was paid to miners for producing the halving block. It is important to note that this stark rise in fees was due to users rushing to inscribe and create rare sats on the halving block after the Runes protocol launch.Since then, block fees for miners have declined. However, a consistent narrative where more users interact with Runes could raise the average value of miner rewards and keep miners motivated on the Bitcoin network. For context, block rewards have now been down to 3.125 BTC since the recent halving.

Memecoins on Bitcoin

The bullish case that probably interests you the most is a meme coin mania on Bitcoin.Memecoins are undoubtedly the top-performing assets of this bull run, with coins like WIF and POPCAT making incredible gains in 2024.

The idea of introducing fungible tokens on Bitcoin is fuelling the optimistic expectation that a meme coin frenzy will also pick up on Bitcoin.

The $PUPS token has gained the attention of initial investors after crypto influencer Ansem compared it to a WIF equivalent. It would be interesting to see how that plays out.

Beyond $PUPS, other Bitcoin memecoins to check out include $WZRD, $ZBIT, and $PIZA.

The bear case for Runes

The last section highlights the bull case for Runes on Bitcoin, but it is theoretical and based on assumptions. We haven't seen credible growth yet, so it is only fair to highlight Runes' bear case.Yes, the Runes protocol is a revolutionary update to the Bitcoin ecosystem, but it is currently completely unproven and untested – and that is probably the biggest risk.

Reality doesn't seem to support the hype

Right now, the idealistic bet is that 'fungible tokens on Bitcoin' are bound for success. However, the critical success factor is getting a minimum viable population of Bitcoin users to adopt Runes. Based on the technical and operational realities, there's a decent chance that Runes will struggle to get that critical mass of users.First, if you consider the initial hype that followed Runes protocol before the halving, multiple influencers wrote threads/alphas on "how to position yourself" before the launch. Yet, there haven't been any jaw-dropping returns on any token.

In fact, the floor prices of the top trending pre-rune projects have dropped a bit after the launch, indicating decreasing demand. For example, Runestone and Rune Pups NFTs were priced at $5.3K and $7.4K, respectively, on April 18th. At present, the floor prices have dropped down to $1.8K and $5.6K.

Another factor that lends to the bearish case is that Runes will become a victim of its success. Bitcoin transaction fees skyrocketed during the period when Runes became a trending topic on crypto Twitter. The average fee per transaction reached $128, almost three times higher than its last ATH in 2021. So, it is unsurprising that the fees stopped other degens from getting too involved—especially when considering Solana's negligible fees.

The Bitcoin ecosystem doesn't love shiny new things

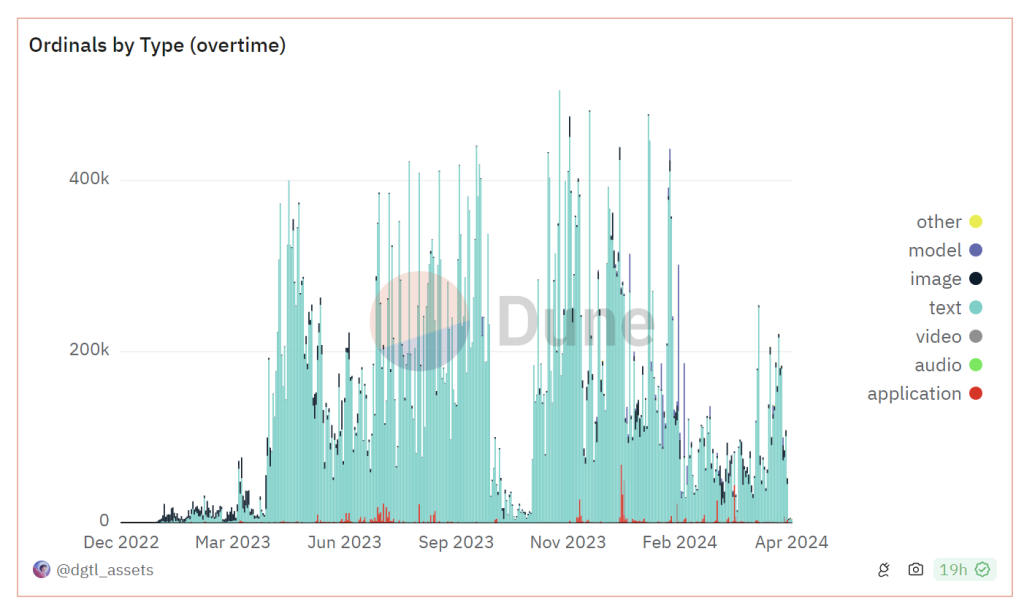

Let us look at a past example of when Ordinals were initiated and built on Bitcoin. As illustrated in the charts below, Ordinals by inscriptions and type did not sustain a consistent demand in 2024 after its initial hype in Q3-Q4 2023.It recently registered a minor uptick in activity, possibly due to the Runes hype, but it is not engaging enough to suggest prolonged demand.

This has been a common theme for building on Bitcoin, where, in theory, influencers and BTC maxis hype it up online, but devs and users do not interact with them for a prolonged period.

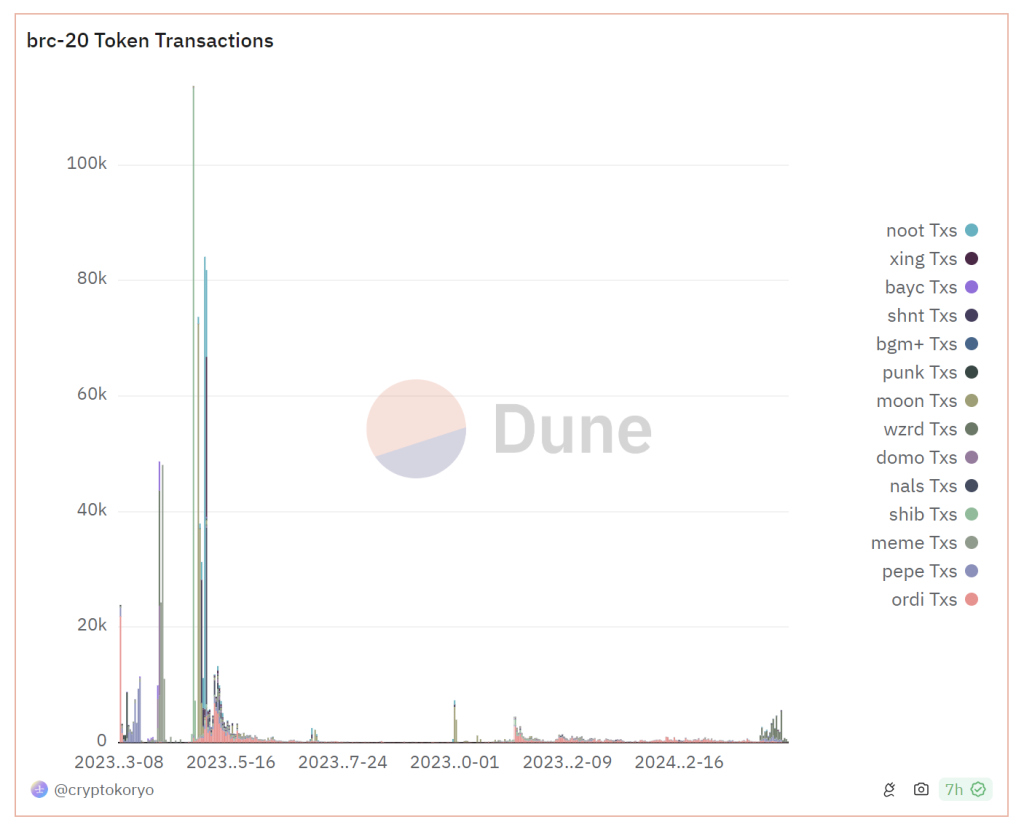

Similarly, BRC-20 token transactions have been significantly negligible since the beginning of 2023, which further solidifies our argument that building something new on Bitcoin doesn't mean immediate success.

The Runes hype is losing momentum

The number of Runes deployed over the past 24 hours has dropped compared to the 20th when the Runes protocol was launched. Demand is already beginning to fade in the short term.

Fundamentally, Runes hasn't yet improved the user experience or defined clear utility. Some say it is still trading like BRC-20s, as Unisat and Ordinal Wallet Rune UIs are similar to BRC-20s.

So, Runes is not providing a better swap mechanism, and users are still worried about the underlying issues.

How would we engage with Runes?

Patience.Sometimes, the best thing to do is "nothing".

Based on available information, we think the correct way forward is to let the initial hype subside. The current wave of euphoria is filled with newness and excitement, which will falter with the test of time.

There is a level of degeneracy in Runes right now, but this will fade. Once the dust settles, better-quality projects should rise.

While we aren't excited about Runes right now, do we believe a bullish market is ahead? Yes.

Credit has to be given where it is due, as Runes is trying to unify the Bitcoin-DeFi industry with this new token standard.

With the Bitcoin network as the base, Runes will be launched with the inherited characteristics of decentralisation and security. The capital in Bitcoin's network is enough for hardcore BTC devs to get involved and get their hands dirty.

If Runes and Ordinals capture 10% of the top BTC market cap, that is currently 2x Solana's market cap.

Yet, this is a long-term view. At present, Runes protocol hasn't tangibly captured the imagination of the masses.

Cryptonary's take

We are currently on the sidelines with Runes, and the DeFi narrative will remain strong with Ethereum and Solana. The meme coin frenzy is also rightly positioned in Solana because of its user experience and ease of functionality.Runes protocol is a start to change the tide towards Bitcoin, but quality projects must emerge from the ecosystem to capture widespread interest.

Over the next few weeks, we will be monitoring projects on Runes protocol to identify potential, but this narrative needs time to unfold naturally.

Until then, Cryptonary Out!