Let's go back to the beginning!

The Sei Network launched in 2023 with great fanfare as an innovative solution to the exchange trilemma.

But then, it stumbled straight out of the gate. Despite strong technical fundamentals, adoption lagged due to teething challenges.

With Sei V2 on the horizon and the promise of EVM compatibility and key upgrades, could Sei flip the narrative from under-delivery to overwhelming success?

Is Sei on the mend, and is there an opportunity here?

Let's dive in.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Why do DEXs lag behind CEXs? Exchange trilemma

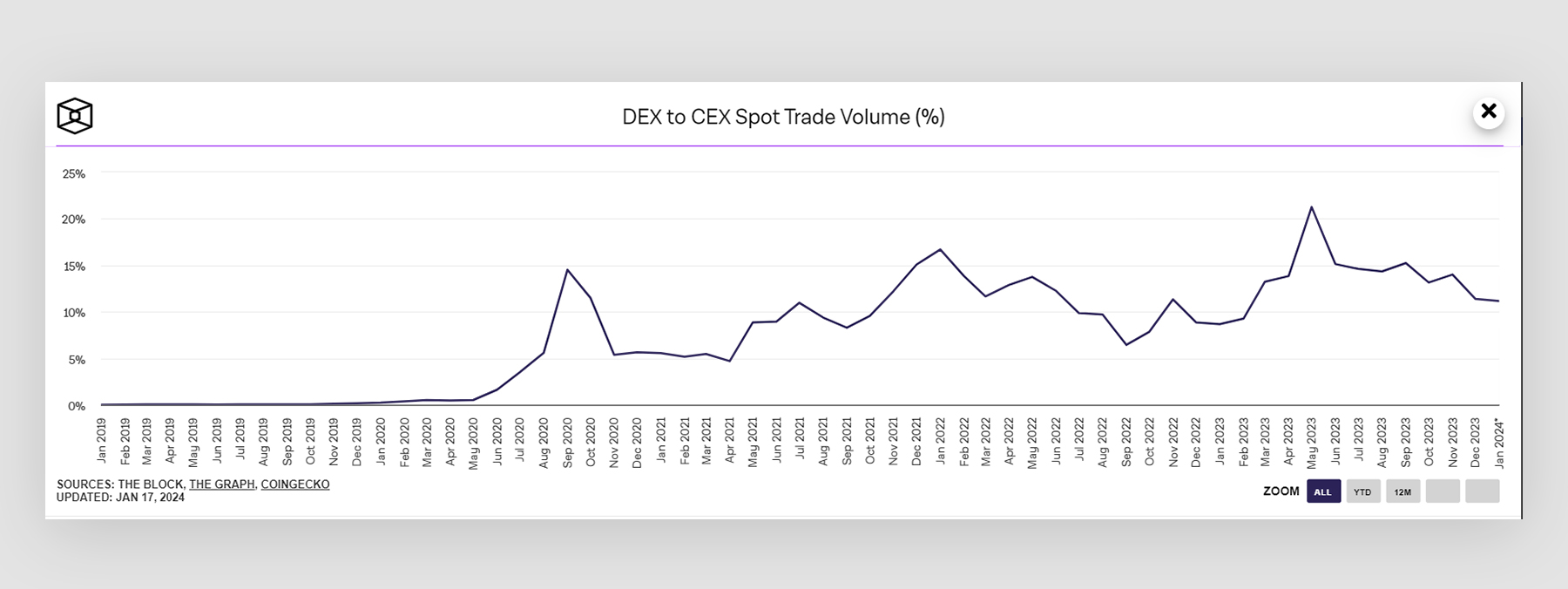

A core crypto ethos is decentralisation, but a large portion of crypto trading happens in centralised exchanges (CEXs) even though there are decentralised exchanges (DEXs).In the spot market, DEXs have grown from a 0.5% market share in 2020 to 11%, thanks to more users moving funds on-chain and the increasing appeal of DEXs. However, centralised exchanges still lead, with about 90% of trading volume.

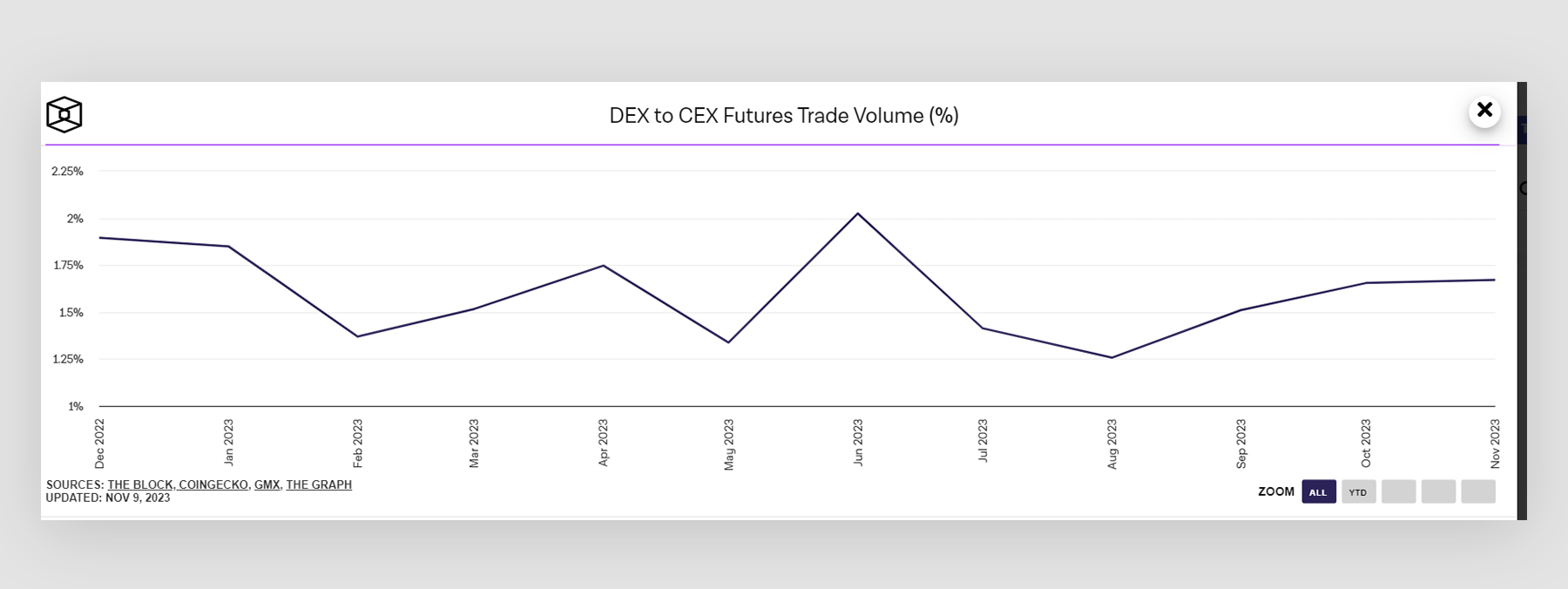

The derivatives market shows an even greater disparity between CEXs and DEXs. DEXs handle only about 1.6% of crypto derivatives trading volume, starkly contrasting their centralised counterparts.

This huge disparity in spot and derivatives volumes indicates significant potential for growth projects in the decentralised trading space.

But why do users still prefer centralised exchanges despite many DEX options?

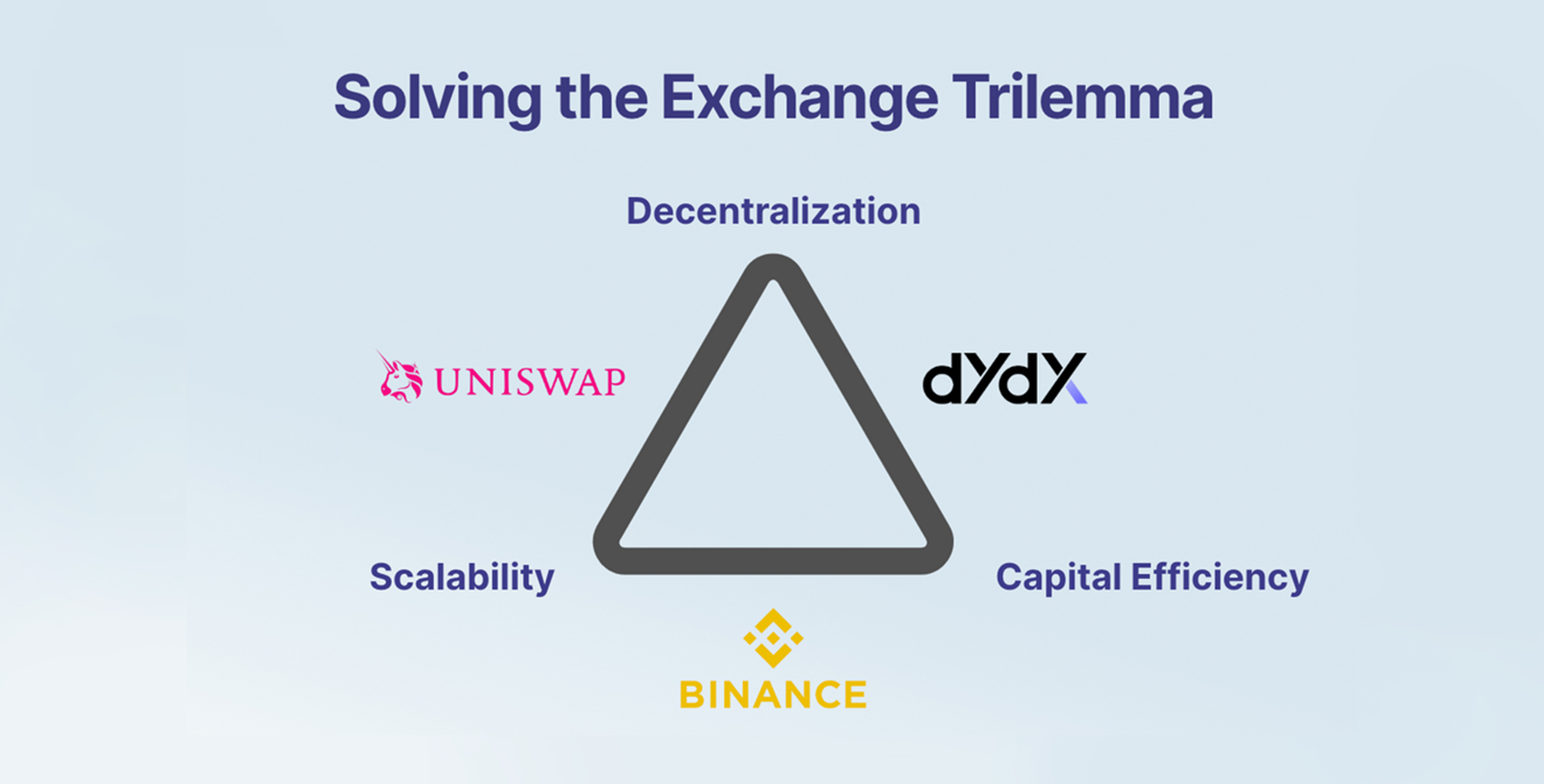

This comes down to the "exchange trilemma," which involves balancing decentralisation, scalability, and capital efficiency.

AMMs like Uniswap offer decentralisation and scalability in spot markets, but they need more capital efficiency. Central Limit Order Books (CLOBs), favoured for derivatives, provide some decentralisation and high capital efficiency but can't match the scale of centralised exchanges.

Consequently, users, especially in the derivatives market, often choose centralised exchanges for their capital efficiency, scalability, ample liquidity, and lower costs.

This issue represents a major opportunity.

A platform that matches and surpasses the experience of centralised exchanges while delivering the core decentralisation ethos of crypto could attract a vast majority of crypto users.

This opportunity is what Sei is trying to capitalise on.

And considering that Binance was rumoured to be worth about $300 billion, the potential here, if SEI can solve the exchange trilemma, is huge.

Sei Network's attempt to tackle the exchange trilemma

In 2018, software engineer Jay Jog joined Robinhood. However, he became disillusioned with its lack of transparency during the 2021 GameStop incident. This prompted him to shift his focus to crypto.Initially, Jay Jog wanted to create a "decentralised Robinhood." However, exploring existing options made him realise the need for suitable infrastructure to build a DEX. This birthed the idea of the Sei Network.

Sei Network is an open-source Layer 1 blockchain using the Cosmos SDK. It focuses on addressing the scalability challenges prevalent in exchanges.

Sei's design targets specific use cases like:

- Decentralised exchanges (DEXs) - Sei's performance, efficiency, and order matching facilitate scaling DEXs while preserving decentralisation.

- NFT marketplaces - Sei's performance enables smooth NFT trading, like minting and bidding, with reliable pricing from native oracles.

- In-game token economies - Sei's transaction capacity supports in-game marketplaces and exchanges, enabling seamless trading of in-game assets.

- Traditional finance apps - Sei's order book and matching engine enable decentralised iterations of traditional platforms like stock exchanges.

Building an order book into the base layer

Many blockchains, like Solana, rely on apps like Open Book to offer order books and unify liquidity across DEXs.Sei takes a different approach to supply the order book within the blockchain. This approach allows DEXs on Sei to share a unified order book. This gives SEI a liquidity advantage over networks like Ethereum with fragmented order books.

Optimistic block production

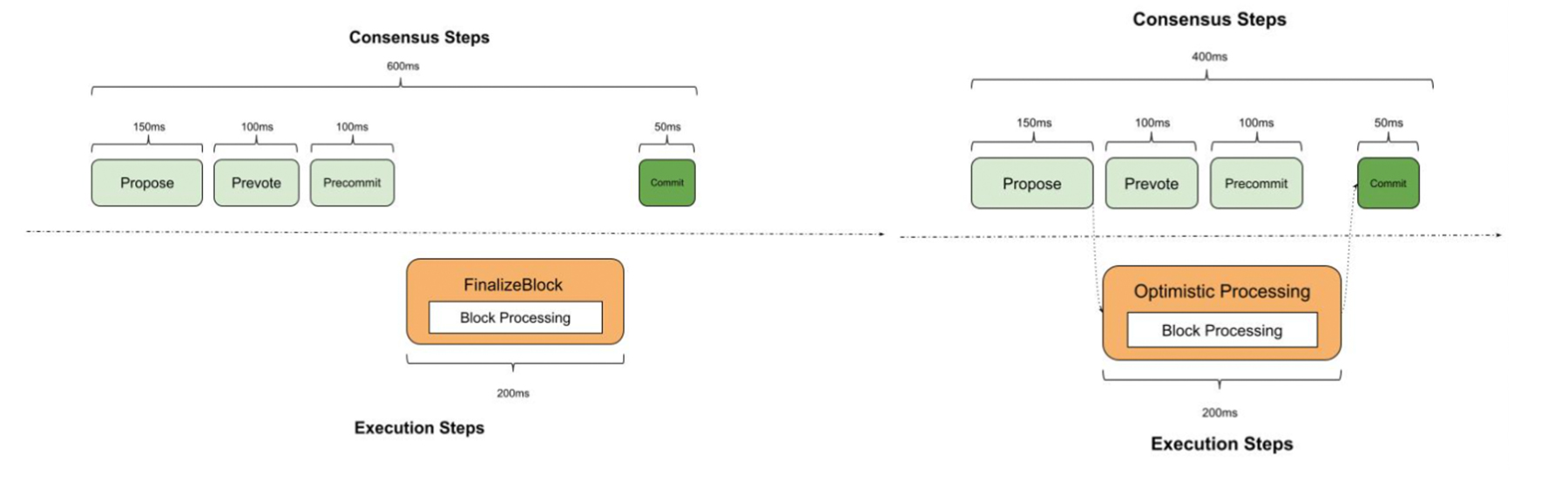

Sei speeds up block creation to just 400ms using "optimistic block production." This modified Tendermint consensus greatly boosts processing speed and reduces delays. Traditional Tendermint consensus works by proposing, voting on, and committing blocks step-by-step (diagram on the left). Sei optimistically starts execution after the proposal stage - this optimistic block production shortens block times and increases TPS with lower latency.

Traditional Tendermint consensus works by proposing, voting on, and committing blocks step-by-step (diagram on the left). Sei optimistically starts execution after the proposal stage - this optimistic block production shortens block times and increases TPS with lower latency.

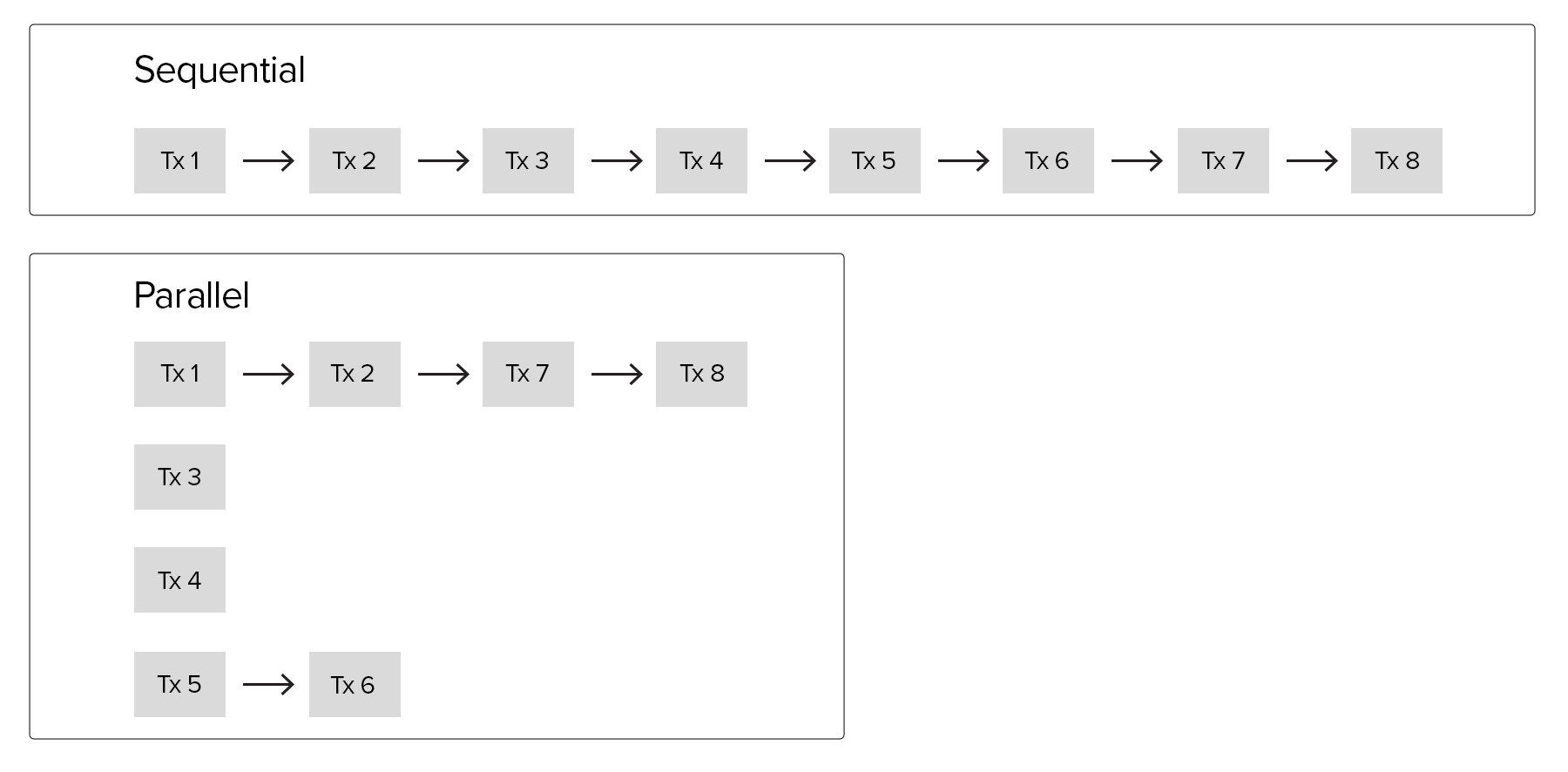

Parallel order execution

Newer blockchains like Solana, Aptos, and Sui embrace parallel transaction processing to increase throughput. Sei shares this approach, processing unrelated transactions from different markets concurrently to theoretically match Solana's TPS given similar demand.

While these represent the core innovations within Sei Network, there are additional noteworthy features:

- Native price oracle: Sei has an integrated oracle at the foundational level that mandates validator agreement on prices before block confirmation. This ensures dependable on-chain market prices accessible to various modules.

- Frequent batch auctioning: This feature allows the consolidation of market orders at the block's conclusion, streamlining execution at a single price to minimise frontrunning.

- Order bundling: Market makers can efficiently update prices across multiple markets within a single transaction, streamlining their operations and enhancing flexibility.

Sei's progress in solving the exchange trilemma

With strong tech and $30M in funding, Sei launched its mainnet in 2023 with high expectations.But months after launch, has it delivered on its promises?

Let's evaluate Sei's performance metrics and adoption rate so far.

Performance metrics

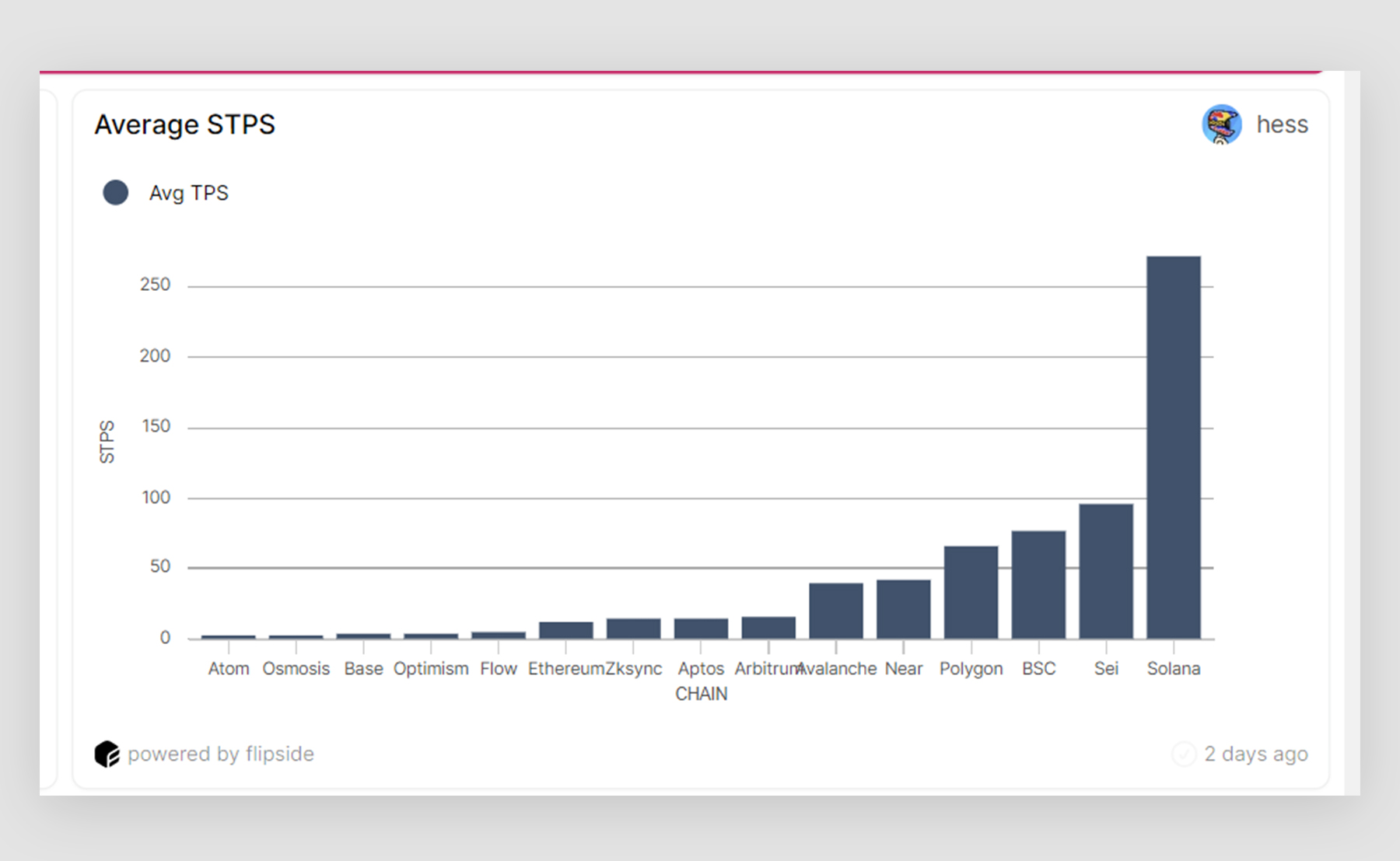

Sei’s Successful Transactions per Second (STPS) is a standout metric that underscores its efficiency by only counting successful transactions. Sei excels at 47 STPS, second only to Solana's 197.

Sei also matches Solana's capacity in this area but doesn’t have the demand to demonstrate this fully.

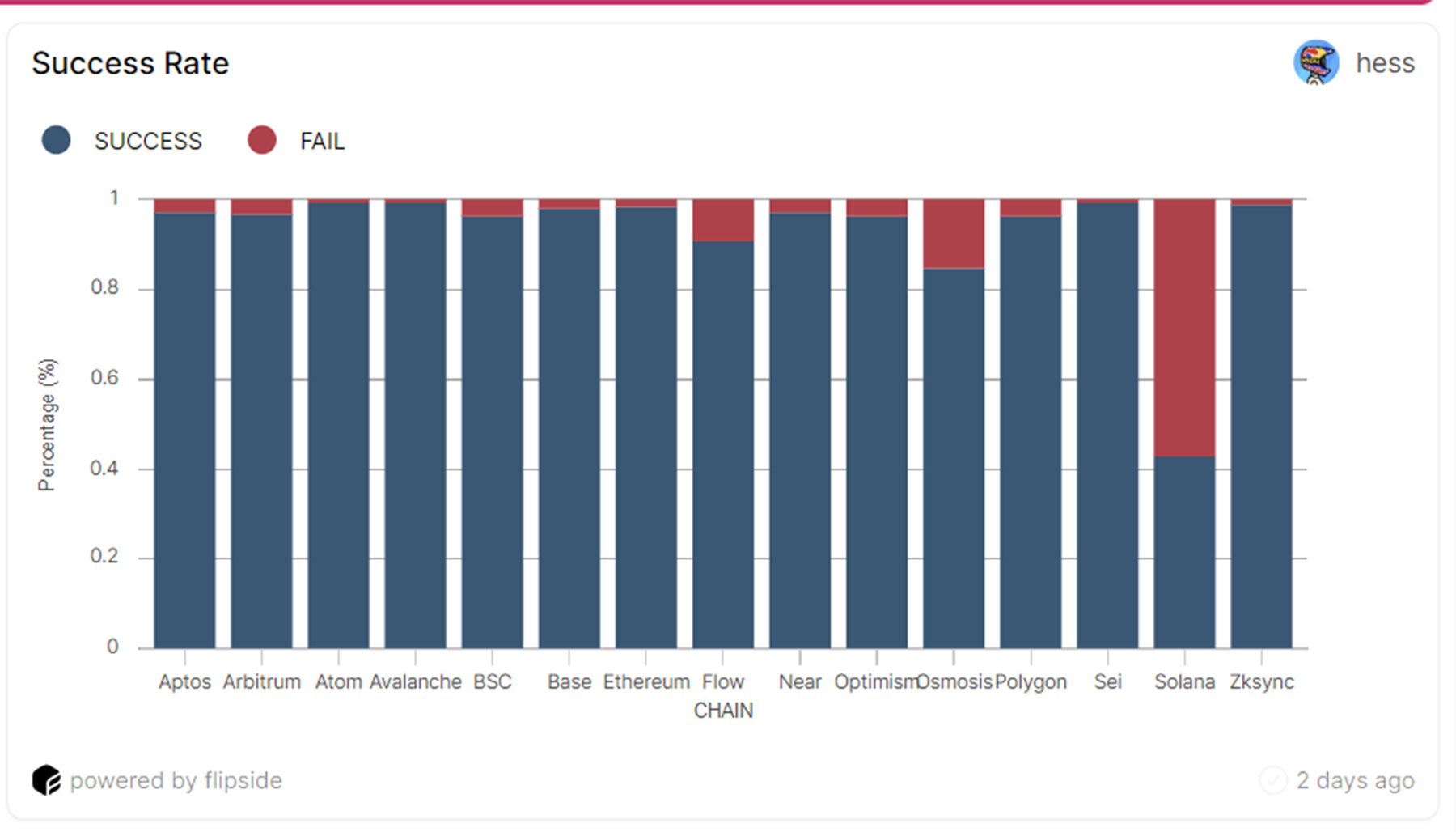

However, Sei surpasses Solana in transaction success rate, demonstrating superior reliability for trading execution.

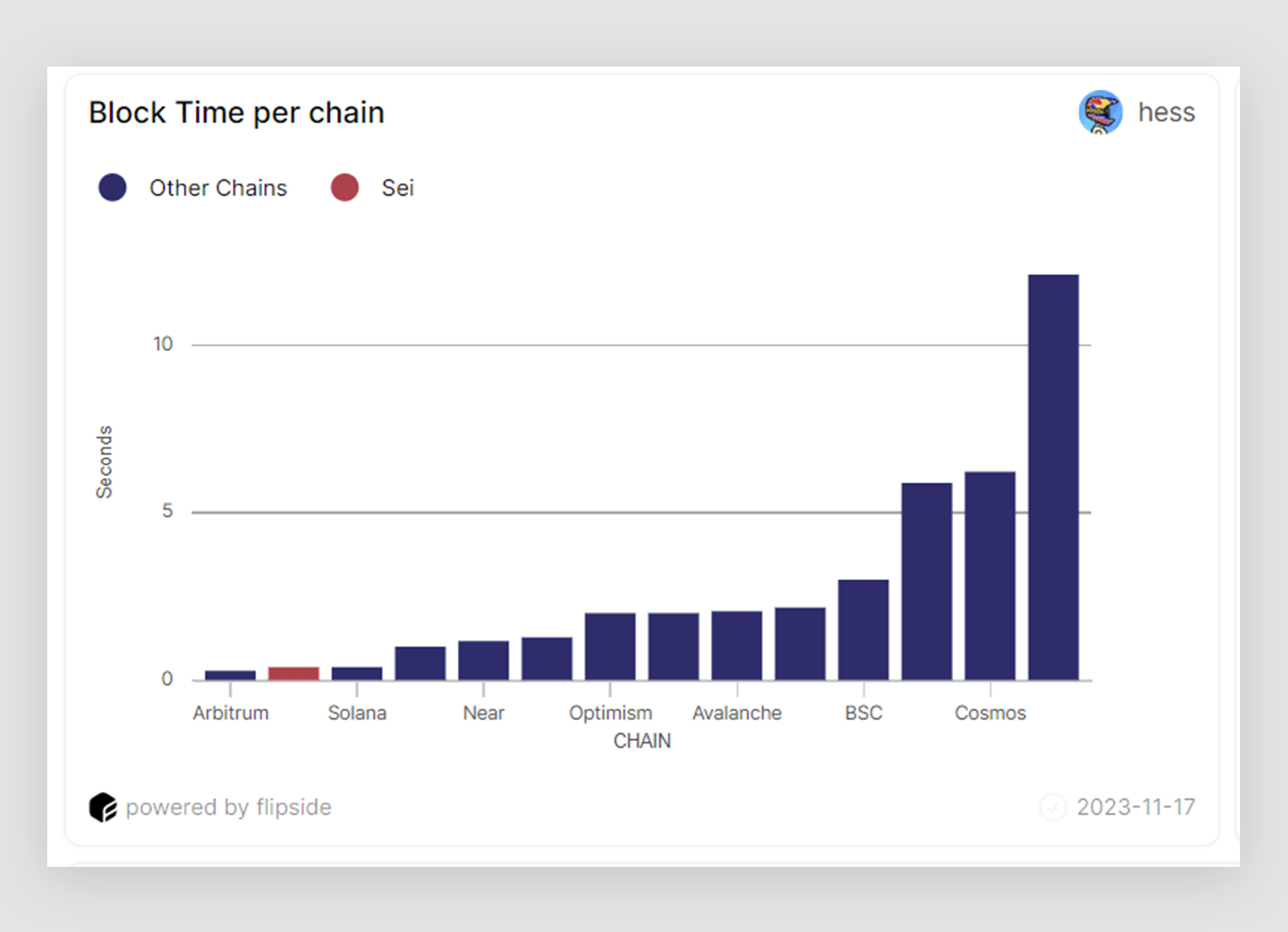

In terms of block time, Sei again demonstrates its prowess, achieving lower block times since launch compared to Solana.

While Arbitrum outperforms Sei in block time, it lags in TPS, highlighting Sei's balanced strengths in both areas.

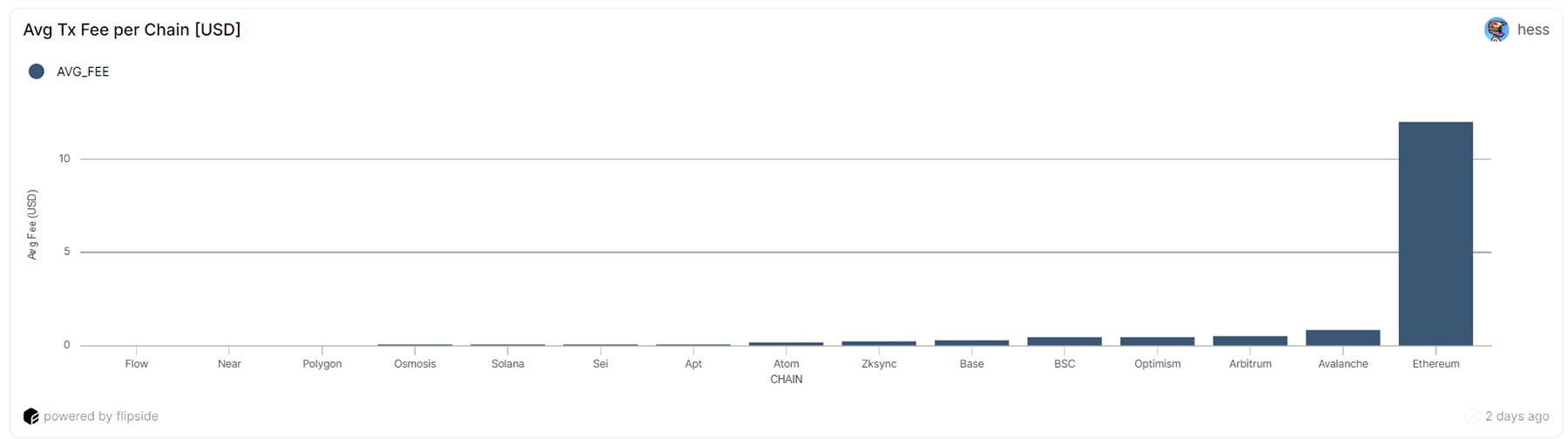

Regarding average transaction fees, Sei manages to remain cheap to use.

While not the cheapest, its average transaction fee has been $0.07, which is negligible.

Although it trails behind Solana in this aspect, these fees are likely low enough for the specific use cases that Sei focuses on.

Adoption rate

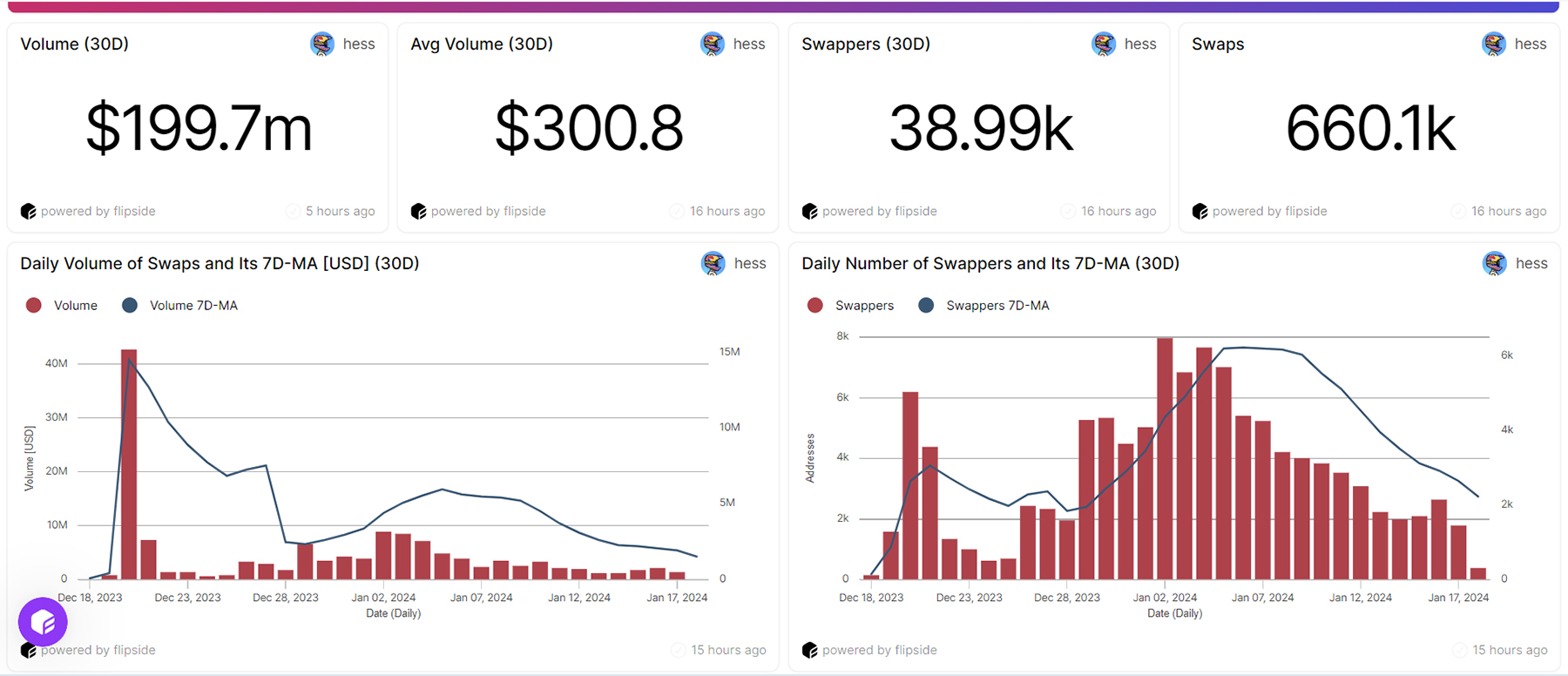

Despite its strong technical performance, Sei Network faces significant challenges in adoption. As a relatively new player, its trading volume over the last 30 days stands at $199 million.This figure is modest compared to larger decentralised trading venues like dYdX, which recorded $491.43 million in volume in just 24 hours, and Solana, which recorded $823.33 million in the same period.

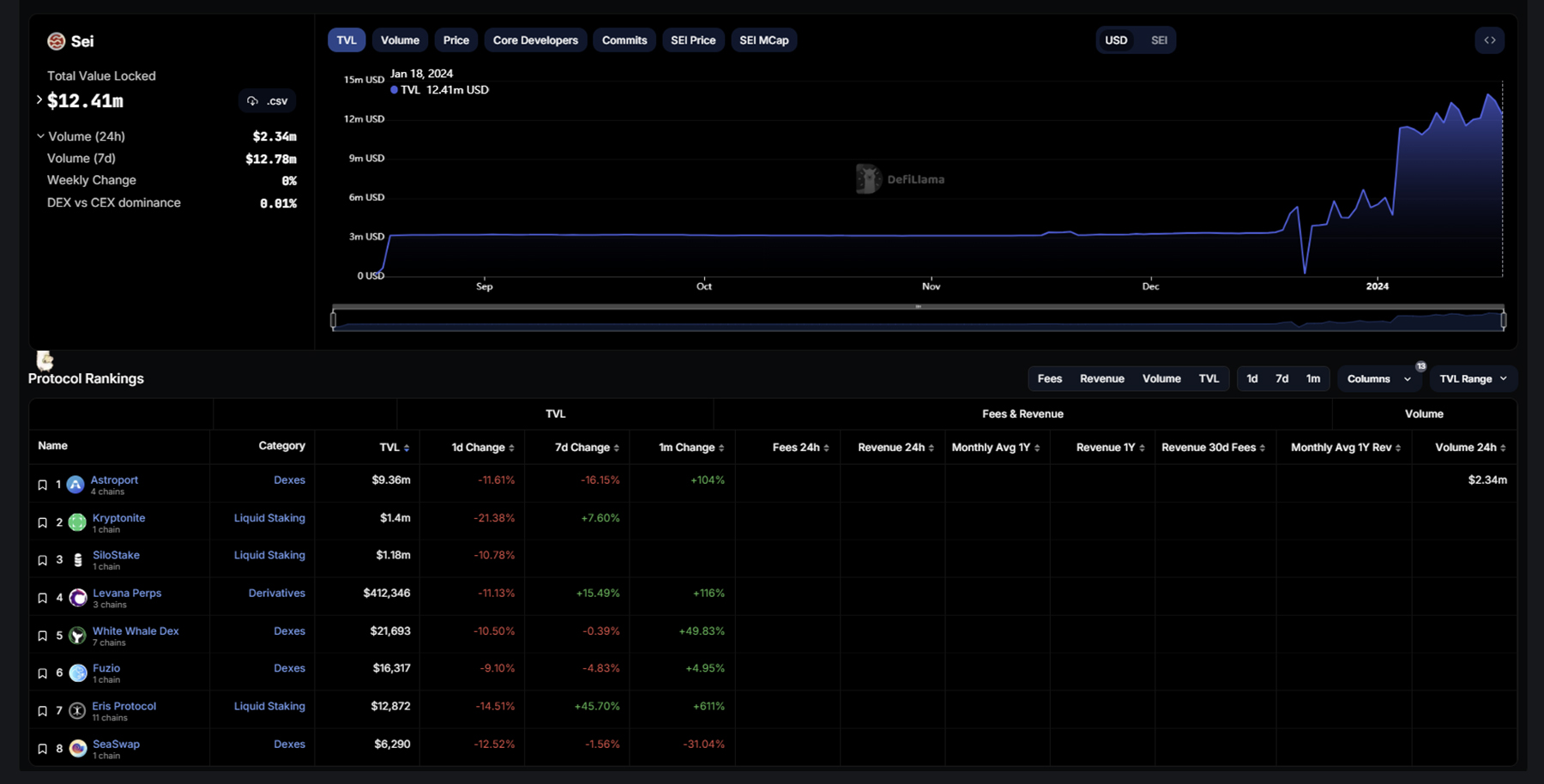

Sei's 24-hour volume of $2.34 million places it in a similar range to other emerging chains like Aptos, ranking it 31st among all blockchains.

The Total Value Locked (TVL) in Sei's DeFi ecosystem and the number of applications launched on the platform also reflect its nascent stage.

With only $12.4 million locked in DeFi and eight live applications, it's evident that Sei has yet to capitalise on its technological capabilities fully.

Given the increasing number of Layer 1 blockchains launching each year since 2021, it has become more challenging for new blockchains to stand out. This trend has turned the quest for recognition into an uphill battle.

Despite this, Sei Network distinguishes itself with impressive performance metrics and the introduction of intriguing technologies.

What is the reason behind its low adoption rate? We have some insights.

Understanding Sei's low adoption despite strong performance metrics

To understand why Sei hasn't experienced the adoption rates of many other Layer 1 blockchains, it's essential to revisit its launch and gain a deeper understanding of the Sei Network.Launches are crucial for adoption, especially in today's context, where the difference between a successful and a lacklustre launch can significantly impact a blockchain's trajectory.

Before Sei launched, it teased a $50 million ecosystem fund to support developers building on the blockchain. This fund was later increased to $120 million. This appeared to be a very strong start for the Sei Network in attracting builders.

On top of the ecosystem fund, Sei also introduced the "Sei Liquidity Alliance," a large set of reputable market makers like Flow Traders that seemed to be lining up to provide liquidity on Sei markets. Having market makers onboard is always challenging when launching decentralised exchanges, so this also looked very promising.

On top of the ecosystem fund, Sei also introduced the "Sei Liquidity Alliance," a large set of reputable market makers like Flow Traders that seemed to be lining up to provide liquidity on Sei markets. Having market makers onboard is always challenging when launching decentralised exchanges, so this also looked very promising.

With its setup, Sei Network announced that around 50-60 projects were lined up to build on its network after the mainnet launch, which seemed impressive initially.

However, this spectacular launch appears to have been a textbook case of overpromising and underdelivering.

According to a developer looking to build on Sei at launch, they were promised funding from the outset and strong liquidity.

But as the launch approached, Sei could not fulfil these commitments, leading many of the 50 projects that had initially signed on to leave the network.

On top of unfulfilled promises, there was a significant barrier to entry, as Sei Network was not EVM compatible, meaning users had to use Kepler Wallet instead of more popular options like MetaMask or Phantom. The UI/UX also still needed more development at launch.

Furthermore, the developer experience on Sei was more complex than on EVM chains, where most activity occurs. It offered an experience similar to Cosmos, which has a smaller developer community. Without substantial incentives to build on Sei over other chains, this contributed to a relatively weak launch with hurdles for user and developer adoption.

At first glance, the situation for Sei Network may be challenging.

However, with its robust technology that demonstrates strong performance, a substantial ecosystem fund and additional funding raised, there is potential for a turnaround.

Sei V2: A second chance to get it right

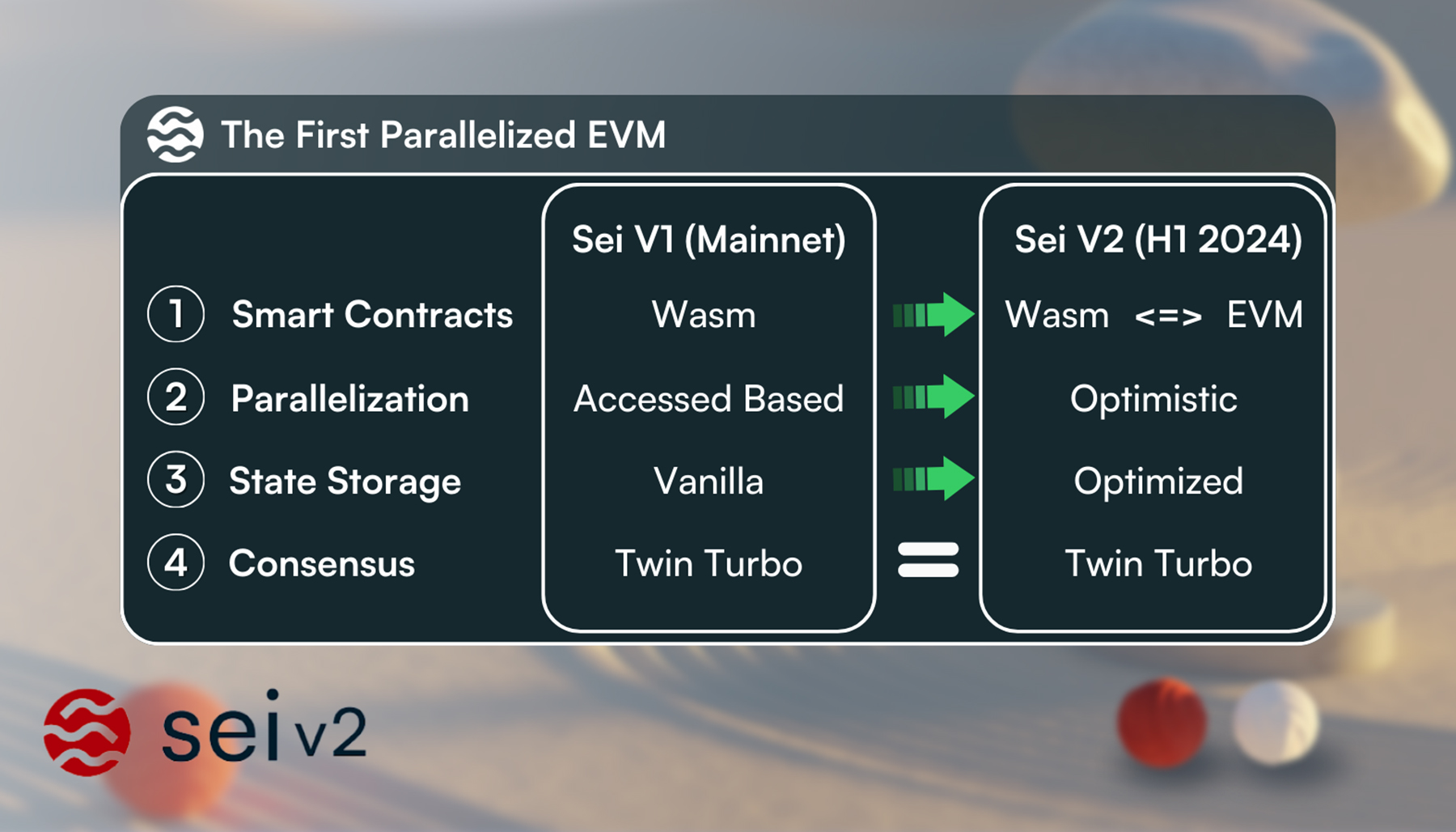

Sei is addressing its initial challenges, starting with this year's announcement of Sei V2. This update tackles Sei’s launch problems and introduces novel technology that will distinguish Sei from its peers.The major innovation Sei aims to introduce with Sei V2 is the integration of the EVM within Sei, creating the first EVM chain to utilise parallel execution.

As the image above illustrates, this involves significant changes to the blockchain's operation.

Here are the implications of these changes.

- Backward compatibility with EVM smart contracts: This feature enables developers to deploy audited smart contracts from EVM-compatible blockchains without code modifications. It simplifies the transition to Sei for developers and preserves the integrity of existing contracts.

- Reusability of familiar tools and applications: Developers and users can continue using well-known applications and tools like MetaMask. This reduces the learning curve and facilitates a smoother integration with the Sei ecosystem.

- Optimistic parallelisation: Sei V2 supports parallelisation without requiring developers to specify dependencies. This enhances the chain's efficiency and scalability, allowing for more complex and high-performing applications.

- SeiDB enhancements: The storage layer has been improved to prevent state bloat and enhance state read/write performance. This makes it easier for new nodes to synchronise and catch up, ensuring a more robust and efficient network.

- Interoperability with existing chains: The update allows seamless composability between EVM and other execution environments supported on Sei. This interoperability fosters a more versatile and inclusive ecosystem, enabling a wider range of applications and use cases. This new design addresses the two main adoption challenges: the need for users to adapt to a new interface and for developers to learn a new programming language.

What about funding?

Sei has taken lessons from its earlier challenges with its ecosystem fund.After the Sei V2 announcement, it introduced the Sei Accelerator, a new initiative designed to support emerging projects on Sei. The Sei Accelerator is now active.

Unlike the previous program, which was somewhat vague and primarily featured a form without a clear purpose, the Sei Accelerator is accompanied by a detailed blog post, a well-defined list of criteria, and a timeline on how long it will work together with projects that participate.

While specific details on the number of participating projects are still sparse, there is an expectation of a decent number of projects launching with Sei V2, provided the team successfully executes the program this time.

We have identified a fair number of projects that have launched or are planning to launch on Sei.

However, many of these projects have tokens with very low market caps, and due to our inability to conduct quality control, we will refrain from sharing them at this stage.

Once the ecosystem is more developed, we might consider creating an ecosystem watchlist. In the meantime, you can effectively track tokens launching on Sei Network using an alternative to Dexscreener called Coinhall, which keeps you updated on new launches.

So, how does the SEI token fit into all this?

Let's delve into the SEI token.Its functions are quite similar to those of most tokens in Layer 1 blockchains, but it bears the closest resemblance to SOL in design.

Here are the key functions of the SEI token:

- Network fees: SEI is used to pay for transaction fees on the Sei blockchain.

- DPoS validator staking: SEI holders can delegate their holdings to validators or stake SEI to run their validator node, contributing to the network’s security.

- Governance: Holders of SEI can participate in the protocol’s governance, influencing its future direction.

- Fee markets: Users can pay a tip to validators to prioritise their transactions. These tips can be shared with users who delegate to that validator, creating an incentive mechanism.

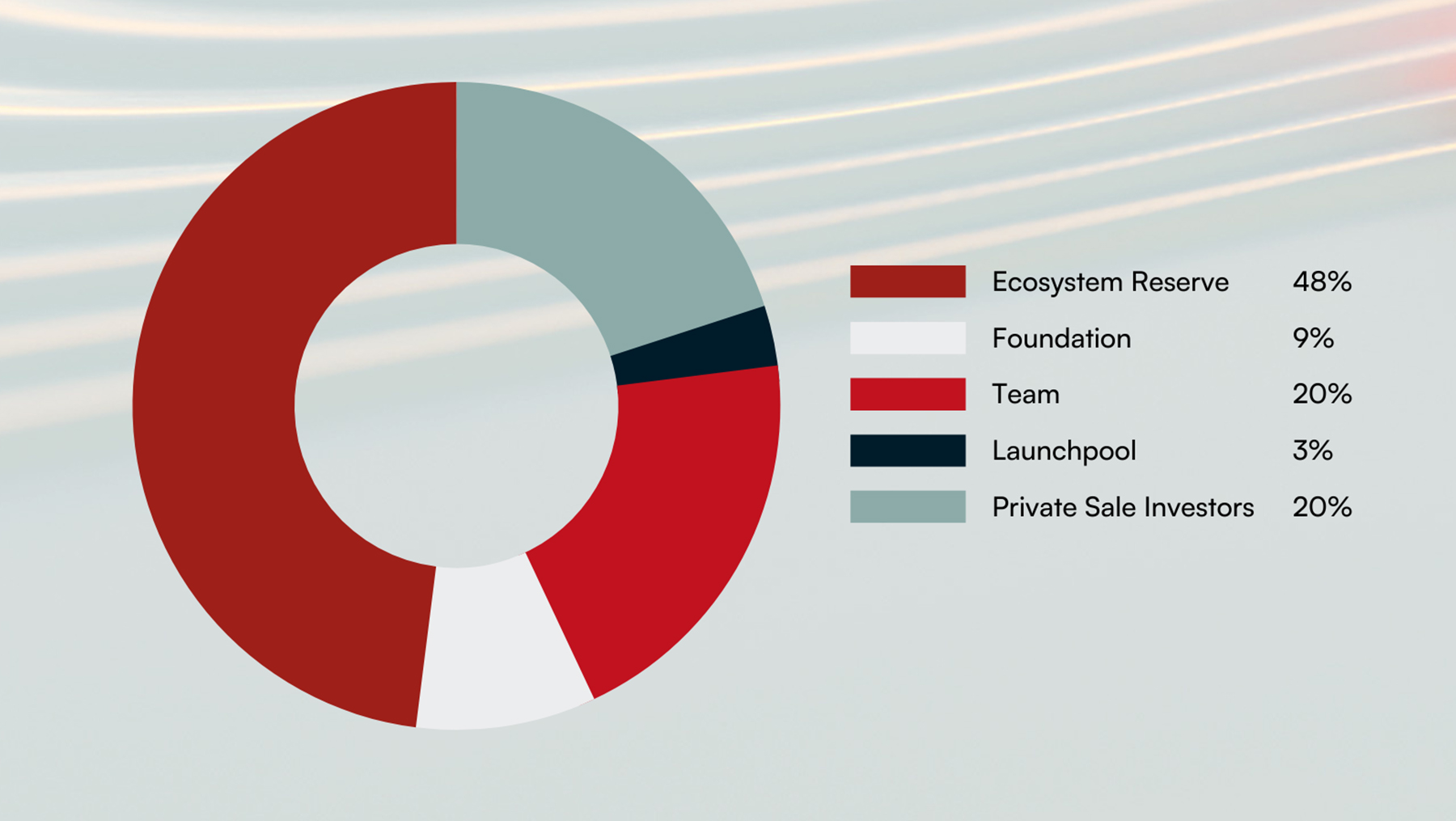

In the chart below, you’ll notice that most of the tokens, accounting for 48%, are allocated to the ecosystem reserve, which we will discuss in more detail later.

Additionally, the initial launch pool comprised 3% of the total supply, bringing the total distribution to 51%, which is not going to insiders.

The remaining 49% is divided among private investors, the team, and the foundation.

Since the token launch, the private sale investors have been subject to a lock-up period of 1 year, followed by a gradual release over three years.

The team's tokens are locked up for one year and then released over five years. As for the foundation, 2% of the maximum supply was unlocked at the Token Generation Event (TGE), with the rest being released over two years.

You might be curious about its purpose because the ecosystem reserve constitutes a significant portion of the SEI token supply.

Here is a detailed breakdown of what it is allocated towards.

- Staking rewards: Users can stake their Sei to validators and receive staking rewards, while validators themselves can set a fee to be compensated for their important role.

- Ecosystem initiatives: SEI tokens will be distributed via grants and incentives to contributors, builders, validators, and other network participants contributing to or building on Sei

- Sei airdrops and incentives: A portion of the supply is allocated to airdrops and incentive programs designed to distribute SEI to users.

In the case of SEI, there have been no signs of heavy usage of these tokens, except for staking rewards.

There is potential for future use in the SEI Accelerator Program once more details are available.

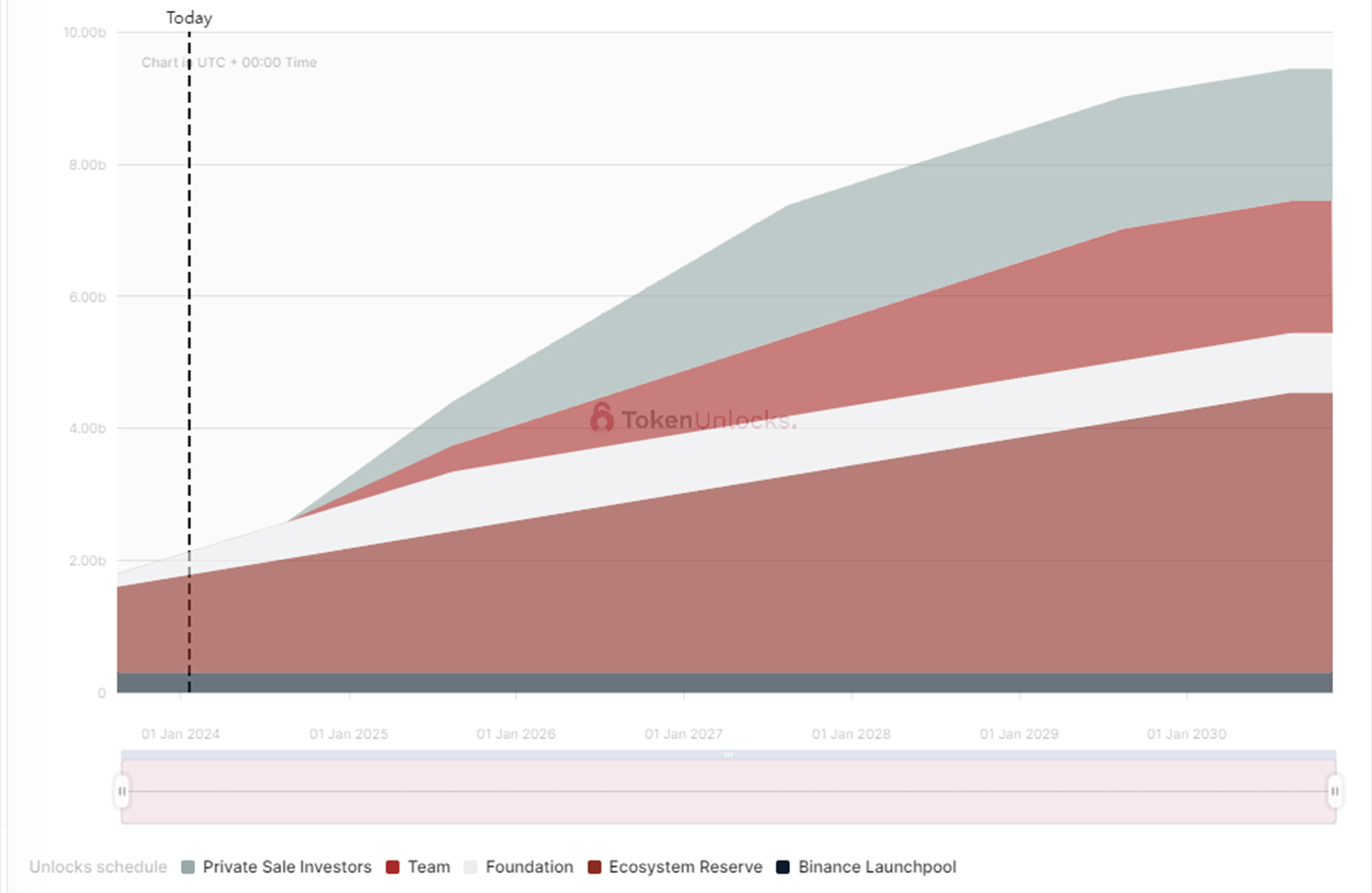

Moving on to the emissions.

As of now, 2,425,000,000.00 tokens have been unlocked.

This figure is anticipated to rise to 3,353,063,091.00 from January 19, 2024, to January 19, 2025, representing an increase in supply to 38.26%

This increase includes about 500 million tokens from the ecosystem reserve, 285 million from private investor unlocks starting on August 16 and continuing gradually throughout 2024, and 171 million from the team's allocation, also commencing on August 16.

As of this writing, SEI is trading with a market valuation of $1.7 billion and a Fully Diluted Valuation (FDV) of $7.12 billion. This sets the market cap to FDV ratio at 0.24.

While this may seem like a significant gap, it's common to observe such large discrepancies between market cap and FDV in newer blockchains.

For instance, Arbitrum, which launched its token in the same year, has a market cap to FDV ratio of 0.13, and SUI, another Layer 1 blockchain from the same generation, is at 0.11.

Valuation

The Sei Network's current $1.7 billion valuation may seem lofty compared to its present adoption and performance metrics.However, crypto valuations often look to future potential rather than current circumstances.

In Sei's case, the upcoming Sei V2 upgrade represents a pivotal moment that could catalyse substantial ecosystem growth if executed successfully. By integrating EVM compatibility while maintaining speeds comparable to Solana, Sei V2 aims to establish a uniquely positioned blockchain capable of attracting developers and users.

The rationale for investing in SEI now centres on the probability of Sei overcoming past stumbles to realise its ambitious vision.

The market may assign a lower valuation if major dApps and user adoption do not materialise post-V2.

Our valuation approach involves analysing scenarios based on Sei's ability to deliver on its trilemma-solving potential.

We will construct an ecosystem stagnation and an ecosystem growth scenario to illustrate a reasonable range for SEI's future valuation, given different adoption outcomes after the V2 launch.

Ultimately, Sei's success will depend on delivering its lofty promises.

Scenario 1 - Ecosystem stagnation

If, after the launch of Sei V2, the Sei network fails to achieve trading volumes and TVL comparable to major decentralised exchanges or layer 1 blockchains with similar valuations, the market may punish SEI as it would underperform expectations.For example, six months post-launch, if Sei only reaches metrics similar to Injective Protocol (another Cosmos-based DeFi chain):

- TVL: $40 million

- 24 hr Volume: $14.27 million

At Injective's market cap with Sei's circulating supply of 3.35 billion tokens, SEI would be valued at $0.93 per token.

This represents a 28.5% upside from today's price, which the market may deem overvalued if adoption is stagnant.

Scenario 2 - Ecosystem growth

If Sei V2 catalyses ecosystem growth through technological innovation and onboarding users, Sei could see meaningful adoption.It might not reach Solana or Avalanche's peak TVL but could attain their levels in slower markets like 2022 and 2023.

For example, reaching Avalanche's current metrics would be strong growth:

- TVL: $1 billion

- Volume: $100 million

With Sei's circulating supply, SEI would be $3.67 per token, a 407% upside from today's price.

Technical analysis

SEI is up 7x to 8x from early November 2023 and since mid-December.We've seen it experience a large uptrend, which has recently been broken - price has now fallen beneath the uptrend line.

There is currently a local horizontal support at $0.69 that price would need to hold and bounce from for SEI to see higher prices.

As mentioned, SEI has been up significantly over the past few months, and the RSI on the 3D and weekly timeframes is overbought, particularly on the weekly.

Considering SEI has broken below its uptrend line, we would wait to buy in.

The area of interest for us would be the two yellow box areas.

The buying range for SEI is essentially between $0.39 and $0.51.

Our strategy would be to layer buy orders at price intervals with heavier USD-valued orders at lower price levels.

If we can get into SEI at the lower end of our preferred entry range of $0.39, we would be looking at a 138% upside in the base case and an 841% upside in the best-case scenario.

Therefore, we strongly recommend waiting for price retrace to the target buy zones to increase your upside potential.

Cryptonary’s take

The Sei Network shows immense potential with its innovative technology that delivers excellent performance metrics exceeding many recently launched blockchains.However, it has yet to translate this into significant user and developer adoption.

The upcoming Sei V2 upgrade represents a pivotal moment that could catalyze ecosystem growth if it successfully tackles previous hurdles.

By adding EVM compatibility and enhancements, Sei V2 removes key barriers to adoption.

Yet, with a current valuation of $1.7 billion, SEI seems priced based on optimistic assumptions before Sei V2 has proven itself. This appears overvalued relative to current network activity and metrics.

Based on fundamentals, we believe Sei justifies a much lower valuation today.

However, if Sei V2 lives up to its promises, growth in adoption and activity could potentially support a valuation on par with the likes of Avalanche at $10-12 billion in time.

Therefore, while we are bullish on Sei's technology and future outlook, we would ideally recommend accumulating SEI at lower prices than today's elevated levels. In the more conservative approach, buying after the launch of V2 poses less downside risk and greater upside potential.

We believe patience could be rewarded with a lower and more attractive entry point, especially if the market sees a downturn before the initial rally to new all-time highs for BTC begins.

Cryptonary OUT!