Can this project merge Bitcoin's liquidity with Solana's speed?

The Bitcoin ecosystem welcomed a myriad of events in Q2, 2024. It started with the news of Bitcoin spot ETFs in Hong Kong, then the fourth halving, and the launch of the Runes protocol, which brought memecoins to Bitcoin. However, as you already know, BTC has also had a strong correction after hitting a new ATH.

But with BTC's recovery in sight (see today's market update), a newly launched protocol wants to unlock Bitcoin's bottomless liquidity on Solana.

Sounds too good to be true?

But there might be some substance here; this project was the inaugural winner of Jupiter's LFG launchpad.

This project has found a gap in the market, but is there a market (and opportunity) in the gap?

Let's find out!

TDLR

- A new protocol aims to unlock Bitcoin's liquidity on the Solana blockchain

- It creates a bridge between Bitcoin and Solana, combining Bitcoin's liquidity with Solana's speed and scalability

- The protocol's flagship dApp will issue a 1:1 pegged zBTC token to access Bitcoin's liquidity on Solana

- Tokenomics allocate 40% for ecosystem growth, with measured unlocks to avoid inflation

- The 2024 roadmap outlines enabling BTC staking, enhancing token utility, and building for developers

- Backed by prominent investors, the protocol is valued at $100M and positions itself for cross-chain opportunities

- Short-term price action remains speculative, but we see an exciting 15x potential here.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Introducing the Zeus Network

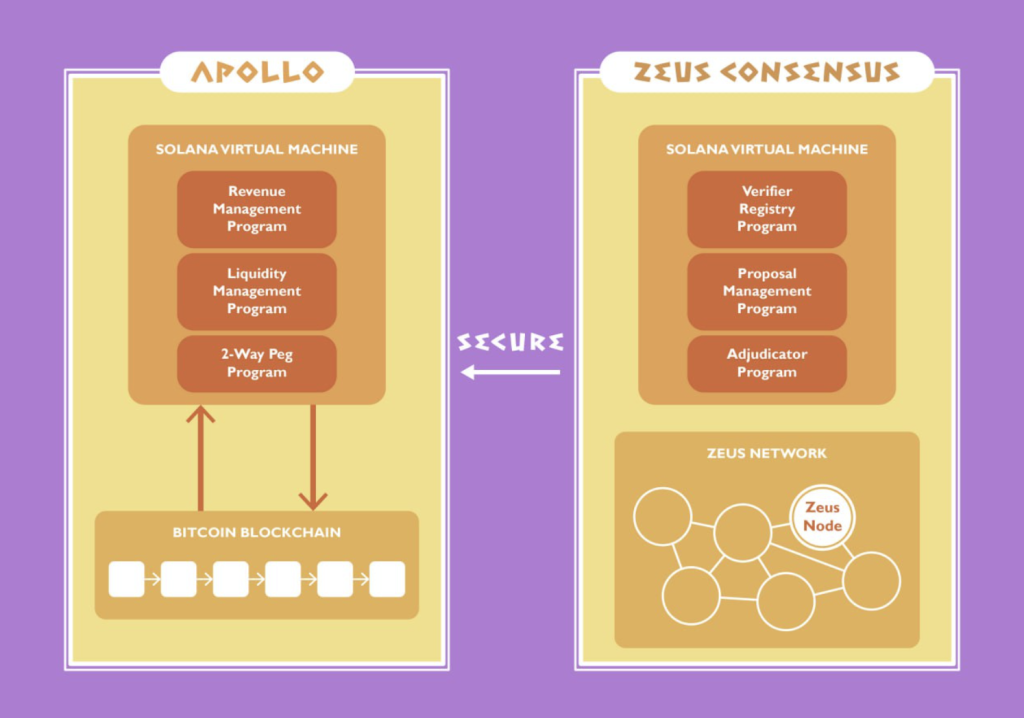

The Zeus network is positioning itself as a native, cross-chain communication layer on Solana. Its objective is to bring integration between Bitcoin and Solana, where the protocol wants to combine the strengths of both networks.The network is built on the Solana Virtual Machine (SVM). Its primary objective is to unlock interoperability between the Bitcoin and Solana networks and, most importantly, create a liquidity channel access from BTC to SOL. That is their main selling point, and the project's success depends on it!

The network is the first to provably deliver a connection between Bitcoin and Solana, so there is a legitimate first-mover advantage and innovation here.

Developers will also be able to build applications and services on the network, taking advantage of Solana's fast transactions and scalability and Bitcoin's liquidity and security to build new dApps supercharged to compete with incumbents.

Which brings us to…

Zeus Network's flagship dApp: Apollo

The protocol has wasted no time unveiling Apollo, the network's first decentralised application. Apollo will access Bitcoin liquidity to Solana by issuing a 1:1 pegged zBTC.The idea behind Apollo is to implement an on-chain BTC multiple-sig wallet on SVM, which a community of verifiers will control. It is important to note that Apollo does not act as a bridge, where the liquidity provider on Bitcoin gets its liquidity on Solana. The protocol will lock and protect the assets.

As illustrated above, Apollo uses the Zeus Consensus to ensure honesty and community involvement. This system helps run programs like Two-Way Peg, Liquidity Management, and Revenue Management on Solana's platform.

It's not just about linking blockchains; it's about creating a smart DeFi system where Bitcoin's value flows smoothly within the Zeus Network's active community. (Please refer to the whitepaper for a detailed technical overview of the project.)

What do we like about Zeus?

Tokenomics

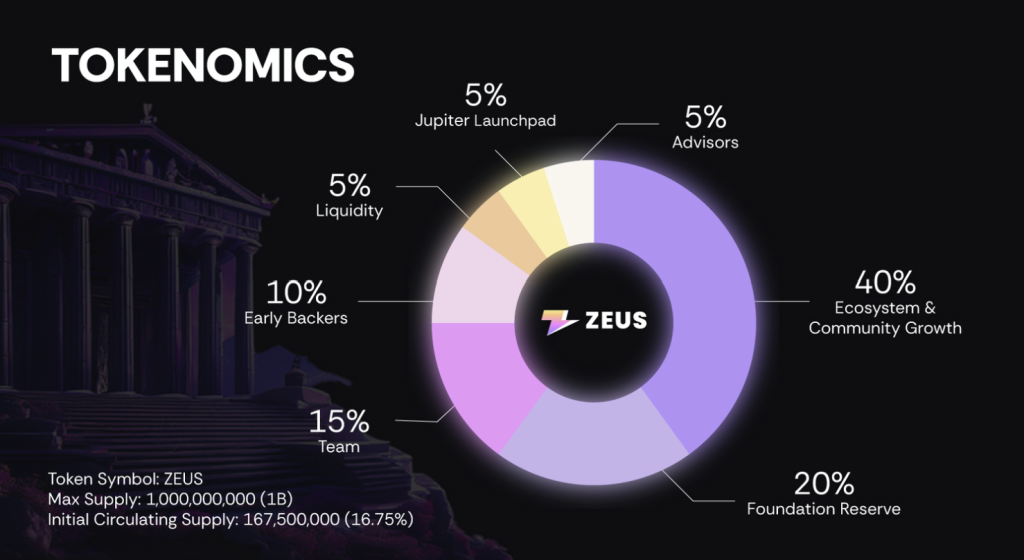

On April 4th, the protocol released its $ZEUS token.The project announced a maximum supply of 1 billion tokens; the initial circulating supply was capped at 16.75%.

After analysing the above allocation, $ZEUS tokenomics looks investor-friendly. The distribution model is:

- Ecosystem and community growth: 40%

- Foundation reserve: 20%

- Team: 15%

- Early backers: 10%

- Liquidity: 5%

- Jupiter launchpad: 5%

- Advisors: 5%

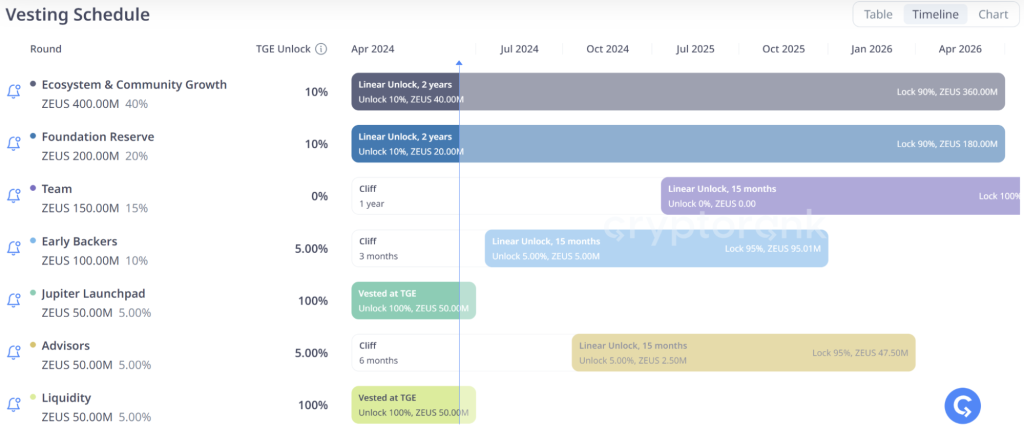

Now, although the circulating supply is projected to reach up to 50% by the end of 12 months, the unlocks are mostly for growth and reserves.

The planned unlocks that could increase selling pressure have a spread-out cliff. Five percent of early backers were released at TGE, and the remaining five percent will be linearly released across 15 months, starting in July. The 15 percent team allocations do not unlock until July 2025, so it is safe to say there isn't any inflationary concern in the short term.

Roadmap 2024

When a protocol is building a category-defining service or product, it is often difficult to evaluate its progress since there isn't a benchmark. Keeping that in mind, it is admirable that the Zeus network has an established technical roadmap for 2024. The roadmap focuses on three fundamental areas: development of the Zeus layer (Node), the $ZEUS token utility, and enabling native $BTC staking.The roadmap is categorised into these phases:

- Q2 2024: Muses Upgrade

- Q3 2024: Gaia Upgrade

- Q4 2024: Athena Upgrade

Gaia Upgrade in Q3 will focus primarily on improving the $ZEUS token utility and introducing native $BTC staking for users to earn yields on Solana. It will be followed by Athena Upgrade in Q4 2024, which will release the Zeus Programming Library (ZPL) for protocol development and innovations.

Notably, the protocol releases bi-weekly/monthly updates on their quarterly upgrade. A technical report for the ongoing Muses upgrade was released recently, highlighting key milestones. It involved:

- 77,000 Apollo testers in three weeks

- 100,000 holders of $ZEUS token at peak

- 15+ exchange listings

Additionally, the Zeus protocol's May 9th report highlighted recent key updates, including the completion of various parts of the product. It included:

- Leak UI mock-up

The new Apollo UI is nearing completion. In early February, Alpha Testers will access features like viewing the APY for liquidity provision and a new personal dashboard to monitor their total liquidity supply and earned interest.

- Two-way peg program

Apollo is developing a robust two-way peg (2WP) mechanism to ensure $zBTC maintains a 1:1 peg with Bitcoin, facilitating its integration within the Solana ecosystem. Utilising the Zeus Program Library (ZPL), APOLLO's decentralised framework leverages Simple Payment Verification (SPV) and the Zeus Network's consensus to secure seamless value transfers between Bitcoin and $zBTC on Solana.

- Liquidity management program

Apollo is in the early stages of enhancing its Liquidity Management Program, aiming to maximise yield generation for $zBTC. Utilising the Zeus layer and the two-way peg mechanisms, Apollo ensures the security and verification of $BTC deposits while focusing on operational efficiency and optimal asset management within the ecosystem.

- Bitcoin wallet integration

Apollo is also working on integrating Bitcoin Wallet connectivity, which will allow for native $BTC deposits. Expected integrations include popular wallets like UniSat, Xverse, and Leather, which will be part of the upcoming Muses Upgrade. This integration aims to streamline user interactions and enhance overall platform accessibility.

Now, such technical updates can seem monotonous, but for a new project, such regular updates indicate intent and a defined product vision.

Backing from prominent angels

The investment proposition for a protocol can often improve if reputed venture capital funds or angel investors back it up. In that regard, Zeus Network has received support from a few prominent individuals from the industry. Zeus Network's angel investors include:- Anatoly Yakovenko, Co-founder of Solana Labs

- Muneeb Ali, Co-Creator of Stacks

- Andrew Kang, Founder of Mechanism Capital

Additionally, the protocol has raised $8 million from investment firms such as Animoca Ventures, OKX Ventures, and the Spartan Group. Based on the capital raised, the project is currently valued at $100 million.

Potential in cross-chain narratives

This is a subjective take, but it holds quite a bit of weight.We have observed the rise of interoperability in 2024, where cross-chain communication is slowly being inculcated into solitary ecosystems. There are currently a 'n' number of L1 blockchains, each functioning in isolation, making it harder to develop a universal standard. Therefore, the fluid exchange of data and information is still inconsistent, which brings us to the advent of cross-chain communication layers.

We recently covered Wormhole, a cross-chain bridge. Then, we have the case of Cosmos Hub, which introduces the idea of shared validators. Then, we have L2 solutions and oracles.

The intent is clear with the Zeus network, and Bitcoin and Solana are possibly the most important L1s in the ecosystem right now. Hence, an inevitable rise in cross-chain demand should directly impact the rise of such protocols, considering they can produce an adequate service in the long term.

Early signs of growth

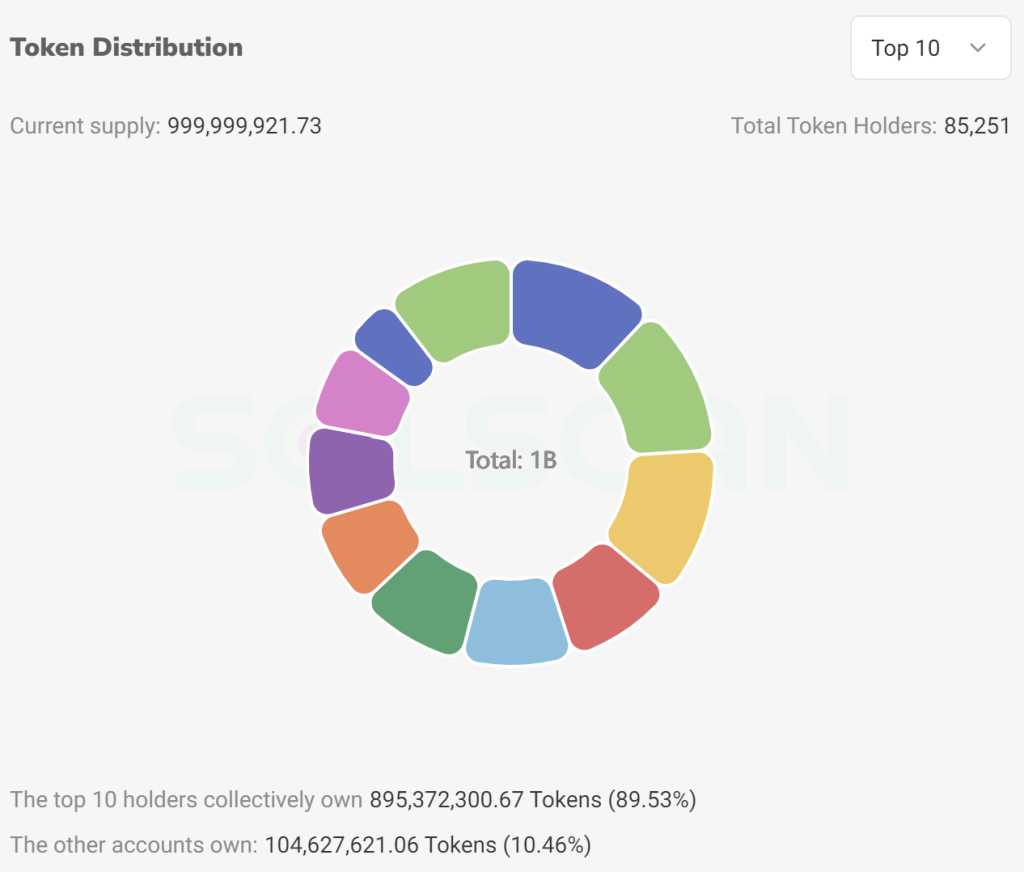

The $ZEUS token currently has 85,251 holders, which is impressive considering the protocol was launched on April 4th. Token ownership has also been renounced, and the contract creator wallet currently holds 0% of the total circulating supply.

Yet, we observed that the top 10 holders collectively hold 89.53% of the tokens. At first glance, this might raise centralisation concerns, but it isn't so. We investigated each wallet in the top 10 and identified that nine wallets are vested accounts controlled by the dev team. The allocations in these wallets also coincide with the tokenomics, further validating the vested argument.

Valuation exercise

The current price of a $ZEUS token is $0.43, and the market cap is just $70 million.Now, estimating a valuation exercise is tricky for $ZEUS due to nascency and a lack of utility for now. The $ZEUS token is expected to be involved deeply in the ecosystem as a part of the following:

- Security: $ZEUS tokens enable users to enhance security measures in the Zeus Network, protecting transactions and interactions through additional layers like encryption and authentication.

- Governance Right: Token holders can vote on decisions regarding the platform's development and direction, including upgrades and protocol changes, leveraging their $ZEUS holdings to influence decisions.

- Gas fees: Users will be able to use $ZEUS tokens to pay for transaction fees, power smart contracts, and unlock specific features within the Zeus Network ecosystem

- $ZEUS staking: Participants receive $ZEUS tokens for contributing to the network's growth, including providing liquidity, staking tokens, or engaging in community initiatives, fostering an active and collaborative ecosystem.

However, for a narrative and early momentum argument, it is fair to state that $ZEUS may rally in accord with Bitcoin and Solana, and narratives often front-run the initial rallies for most new projects.

Keep these factors in mind; we believe the price targets for $ZEUS in 2024/2025 are:

- Base target: $500M market cap, delivering a 7.4x upside from current prices

- Bullish target: $1B market cap, providing a 15x upside from current prices

Technical analysis

The $ZEUS token has been undergoing a strong correction since its TGE on April 4th. The token followed the collective bearish sentiment, but during the last weeks of May, it registered a sideways movement.

This range may be acting as an accumulation range for buyers. During this time, the asset also breached its descending trendline (yellow line).

Another positive development at the moment is that $ZEUS is building a position above its 50-day Exponential Moving Average. This could indicate that a trend shift is slowly taking place.

Right now, the first key range that needs to be flipped is the $0.50 range, which will imply a break of structure. Overtaking $0.57-$0.62 over the long term would trigger the beginning of an uptrend.

Cryptonary's take

The Zeus network is still in the nascent stage of development. The protocol has much to unveil over the next few months, but these last few weeks can be considered optimistic.They have taken the right steps forward. The roadmap is transparent and clear, tokenomics looks good, and there's a decent possibility for finding product-market-fit.

Although a long-term and concrete market valuation is not available right now, building a position with a $ZEUS token in the initial stages can prove fruitful. However, this is a mid-risk to high-risk bet, so we suggest taking a minor position with the asset since the network doesn't really fall under any trending narratives for now. It is a project for the long term, and short-term returns might not manifest immediately.

Combining Solana's scalability and Bitcoin's liquidity for dApp development sounds enticing on paper. Apollo's imminent testnet will give either confirm or disprove whether there's value in bringing Bitcoin to Solana.

We are still early; exciting times ahead!

Until next time,

Cryptonary Out!