We've always said there are two main ways to make money in crypto:

There are two types of investments in crypto:

- Retail Hype Trains - Intrinsic-Value BasedThe former cannot have sustainable growth, the latter can.

2017 ICOs all belonged to the first category, there was never value trickling down into the token from product usage.

3/

— Cryptonary🚀 (@cryptonary) January 18, 2021

While "Retail Hype Trains" may not have sustainable growth, it is often the case that they do rise rapidly.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

"Ethereum Killers"

Every now and then the "Ethereum Killer" narrative shows up in the market, while it's very rarely true or real, profits can be generated by it.At the start of February 2021, BNB began rising parabolically as can be seen on the chart below.

The reason behind the price increase? Hype.

The reason behind the hype? "Cheap DeFi"

Decentralised Finance has been the talk of the town and honestly the most innovative sector to date within crypto. The issue is that 99% of DeFi protocols live and function on the Ethereum blockchain. When overloaded, the latter becomes excessively expensive due to gas fees. $50-$100 per transaction leaves out a lot of people.

Binance, offered DeFi on "Binance Smart Chain" or BSC for short, where transactions are cheap and fast. This pushed many people to go and try out the BSC DeFi ecosystem, which helped boost the price of BNB due to positive sentiment and people buying it to get on BSC.

Where is the next hype?

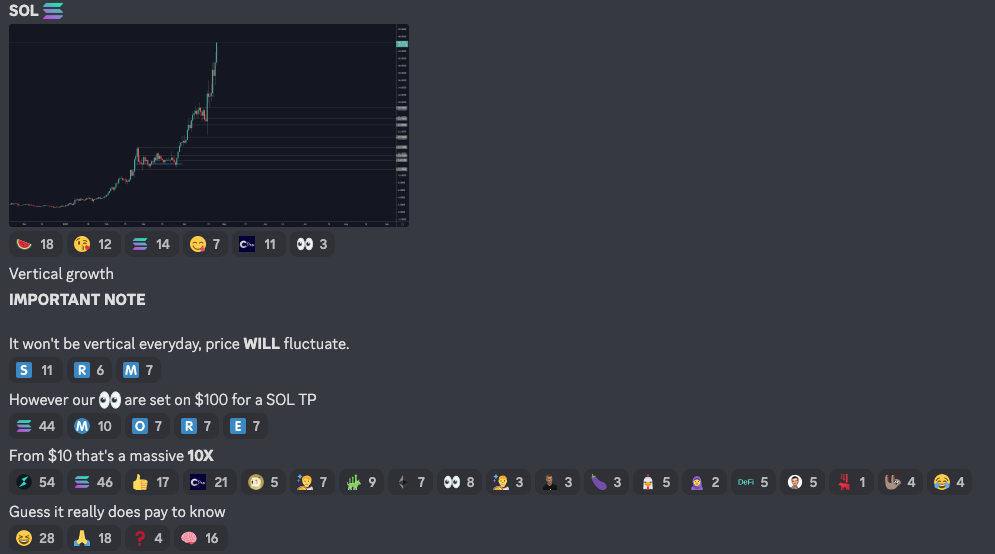

This "Ethereum is slow and expensive" narrative is still out there and Solana is the next beneficiary.With Serum and Raydium, Solana is building a DeFi ecosystem where transactions are even cheaper and faster than BSC. For that reason, on the day of the dip (22 Feb 2021) we decided to invest into SOL and buy the dip at $10. Fast forward to a couple days later and SOL is trading at $16+ already.

Update: SOL is trading above $65 now (+550%).

Ethereum?

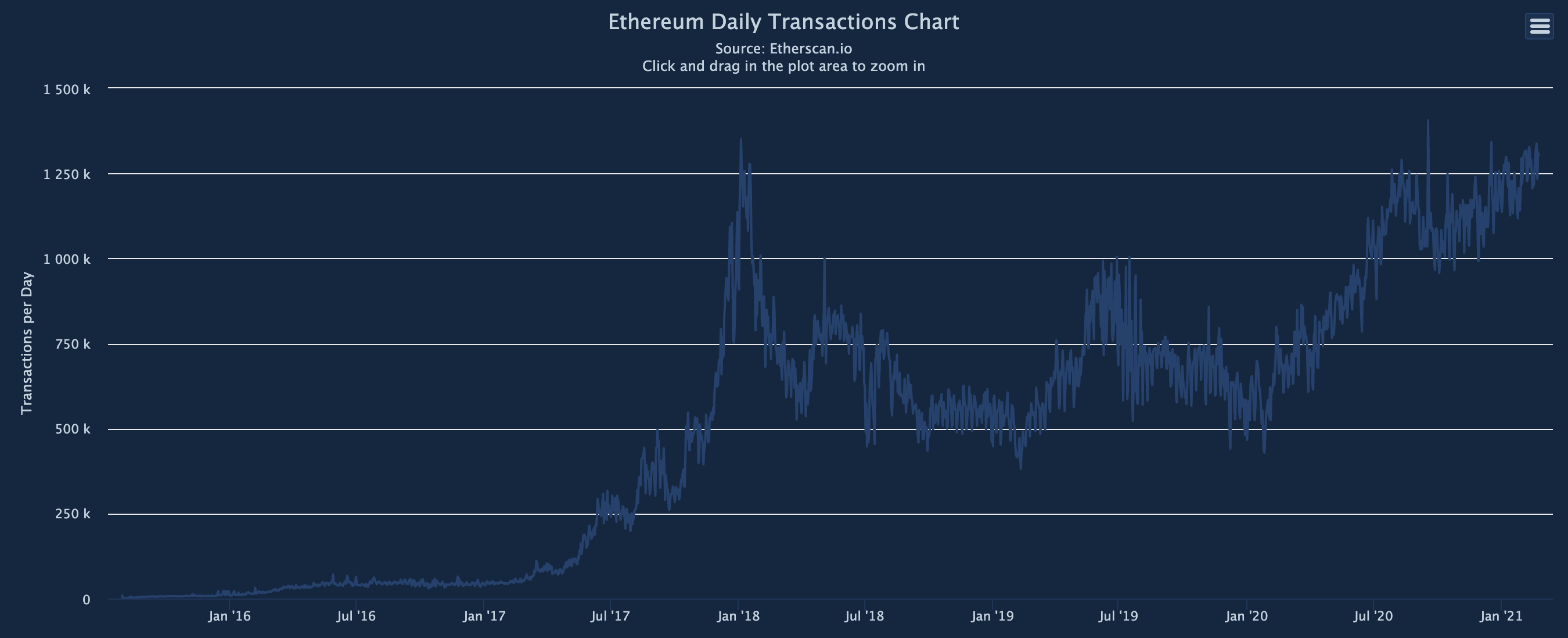

The number of projects that came out trying to replace Ethereum is extremely high, all of which failed "till now." Where are the users and the incredible transactional volume? Ethereum. Over 1,250,000 million transactions take place every day, and over $1,000,000,000 (BILLION) was generated in mining revenue in February 2021 ALONE.

Fundamentally, ETH is more valuable than any other Layer-1 native token. Narratives and hype, however, do drive some volume and crowds to purchase the "killers." These hype trains eventually die down.

While we are invested in DOT, even Polkadot has to prove itself because, up until this point, can we say we've used Polkadot for anything? No, we cannot. But one of those days a network will come and take a market share from DeFi and we believe Polkadot may be it—speculation.

In the long run, BSC will not replace Ethereum, that chain is centralised. 21 nodes process transactions on BSC, all of which are elected by BNB holders. Who's the single largest BB holder that can skew results? Binance.

Vitalik once said:

"When a chain claims to have a 1,000,000 TPS throughout, what they're not telling you is that it's a centralised piece of sh*t"Even though he was talking about EOS back then, this resonates with us to this day. Solana "may" be a candidate, Alameda research is smarter than the Binance Team and their activities in DeFi are extensive, so they would not back a "fake" horse, but it still needs to prove itself by taking a reasonable percentage of DeFi volume and TVL onto it. Solana is a retail play for now.

We are not saying Solana is not a good project or chain by any means. It's user experience is amazing, we've tried it multiple times. However, for it to become highly valuable, it needs to attract DeFi TVL, capital locked in DeFi protocols. Raydium may cause that to happen with Pools, but we cannot presume so before it does happen.

Until proven otherwise, ETHEREUM will remain the DeFi Mothership.

Our "Take-Profit"

Despite running hard, it is clear that nothing goes up forever. Given our $10 entry, it's wise for us to take at least some profit out at $100.

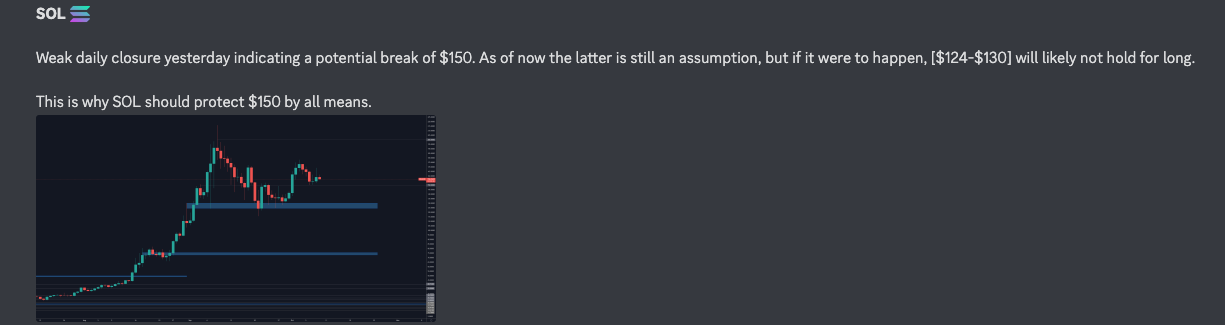

SOL Update: October 2021

SOL has a chance to survive if it's able to claim back $150. If it does not, further pain is likely on the way.