Case study: The rate of technological adoption

Voice-based virtual assistants, UAVs, Internet of Things (IoT), AI and Space Colonisation are concepts that ten years ago you would not have imagined would exist. Those terms are now a part of our everyday vocabulary, and points to that the speed of technology adoption increasing exponentially in the past few years.

Both diffusion and adoption are rising faster than expected. They are both needed to create an impact on societies and economies. Diffusion occurs when innovation spreads around a large number of individuals, while adoption is the decision to acquire and use the invention. Some notorious reasons sustain the progress named before. Elements such as communication networks, advanced software architectures and unlimited connectivity are levering technology substantially. Nowadays, startups and large enterprises have better infrastructure while households, governments and markets are more interconnected.

At the very beginning, the pace of adoption was affected by the number of resources needed to develop new inventions. The old methods of training workers, the few marketing tools and the scarcity of investors believing in disruption were significant challenges, with only the most powerful firms able to give the first steps to penetrate the market. Fortunately, things have changed. Faster adoption comes with a lower cost of development and more tools available to facilitate creation processes. Ecosystems are being filled with more skilled and knowledgeable professionals as well as successful mechanisms for the transmission of information. Felton,N from the Harvard Business Review, analysed the rate of adoption of more than 16 products during a century. From 1900 to 1960 the speed of adoption was extremely slow, technologies like the telephone and the radio needed more than 75 years to be fully adopted by American households. From 1960 to 1990, the pace increased significantly, with many categories of products such as the microwave, air conditioning and washing machine, being adopted in less than 30 years. If we continue analysing the timeline, the growth becomes more evident. From 1990 to 2005, technological progress was embraced easier, with elements such as cellphones and the internet disrupting the world we know.

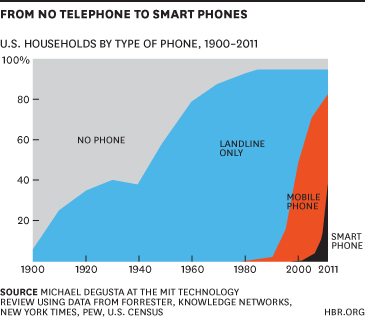

Another study from Michael Degusta (MIT’s Technology Review) also demonstrates the variation in the adoption rate. Smartphones needed 10 years to be absorbed by 40% of the US population while mobile phones needed more than 40 years to be adopted by the majority of American society.

From both of the studies presented above, we can conclude that each year that passes, the adoption rate increases exponentially. The hypothesis studied by many is now a reality: the most recent technologies are being applied with greater ease.

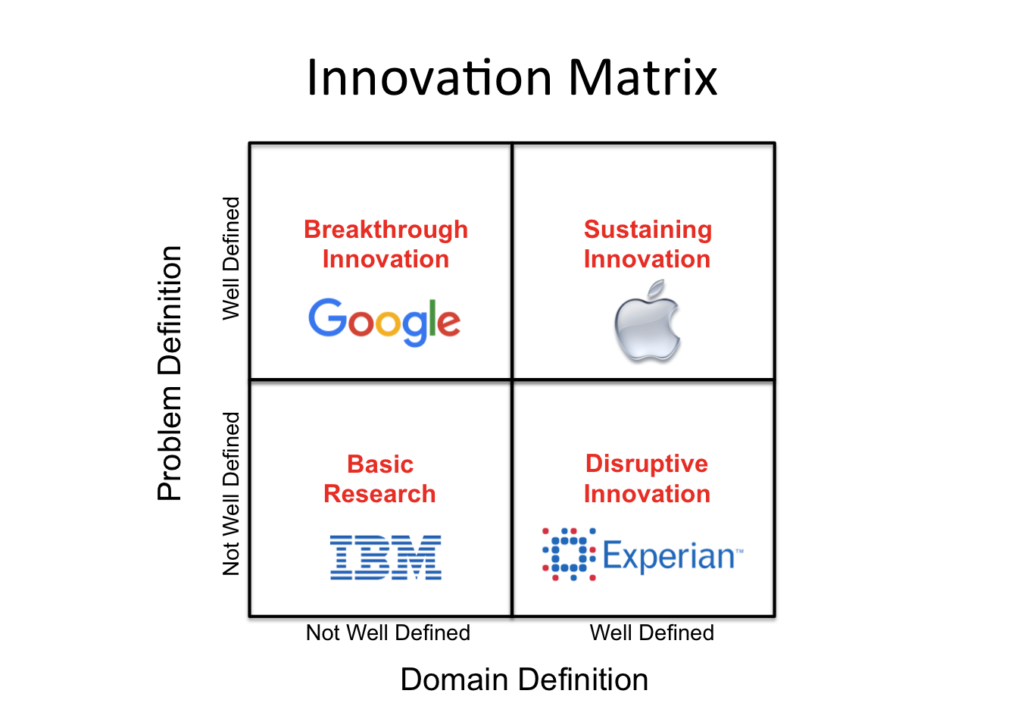

The scientist Greg Satell built a theory to locate the different types of innovations. The chart is divided into 4 sections: Basic Research, Breakthrough, Sustaining and Disruptive innovations. Now, if we want to know why technology adoption is rising non-stop, then attention must be focused on disruptive tech, with Blockchain and AI being the ones who take most of the credit.

From the various types of innovation in existence, technology is the most powerful. The exponential factor in the curve of global change derives from the technological advancements in the last decade, with disruptive technologies taking the lead. The web 3.0, digital twins, edge computing, AI and automation, quantum computing and commercial drones are just some of the creations that have set the tone. If we compared blockchain adoption with several advances in the past, the rate difference is quite shocking. Currently, ¼ of the biggest companies in the world are adapting chain of blocks in their corporate structures (with many experts forecasting that by 2020 half of the market giants will make full use). On the other hand, AI is being adopted even faster than cryptocurrencies, with financial services representing the biggest percentage of adopters. All in all, companies have accepted a harsh reality: if they do not adapt, they will be out of the game, thus losing their competitive advantage. They know that they will gain a competitive edge in productivity if they are up to date with tech trends.

As Charles Darwin stated:

“It is not the strongest of the species that survives, nor the most intelligent; it is the one most adaptable to change”.

Image licensed via Shutterstock