This popular phrase that has been trending on crypto Twitter for a while highlights the rise of “modular blockchains”.

It is rapidly becoming a category-defining narrative for the upcoming bull run, and Celestia network is currently absorbing all the early accolades.

Since Celestia’s mainnet launch, its native asset is up by 600%, defying many naysayers who deemed the asset overvalued at the beginning of the rally.

Now, despite its rally, the doubts remain whether the asset can realise its potential in the long term or not.

In this deep dive, we analyse a short-term opportunity and how its “first-mover advantage” can play a role in the project’s long-term vision.

The most enticing speculation on Celestia is this: “Is it a $100B project”?

Let us find out!

TLDR

- Celestia optimises only one part of the blockchain, i.e., Data Availability.

- 53.2% of the total supply is allocated to early investors.

- TIA stakers have generated massive payouts from airdrops.

- The generated revenue is around $8M annually at the moment.

- Investors can build a strong position at $10-$12.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Modular blockchains vs monolithic blockchains

In our Dymension report, we briefly discussed the difference between Modular and Monolithic blockchain networks. However, we didn’t essentially explain how one approach solves the issues of another, i.e., scalability.A blockchain’s scalability stems from its ability to verify more transactions while keeping requirements for verification very low. This is termed as throughput. In monolithic design, throughput can be increased by increasing block size. This is an issue, as an increase in throughput is correlated to the rise in cost to verify the chain, leading to a centralised network.

Modular architecture solves this issue by the segregation of activity, where a different network can handle each core component. This means different core components do not have to fight for blockspace on the same Layer 1, which invariably improves the throughput.

Celestia is responsible for one of the key components in this modular design: the data availability layer.

Celestia’s approach to scalability

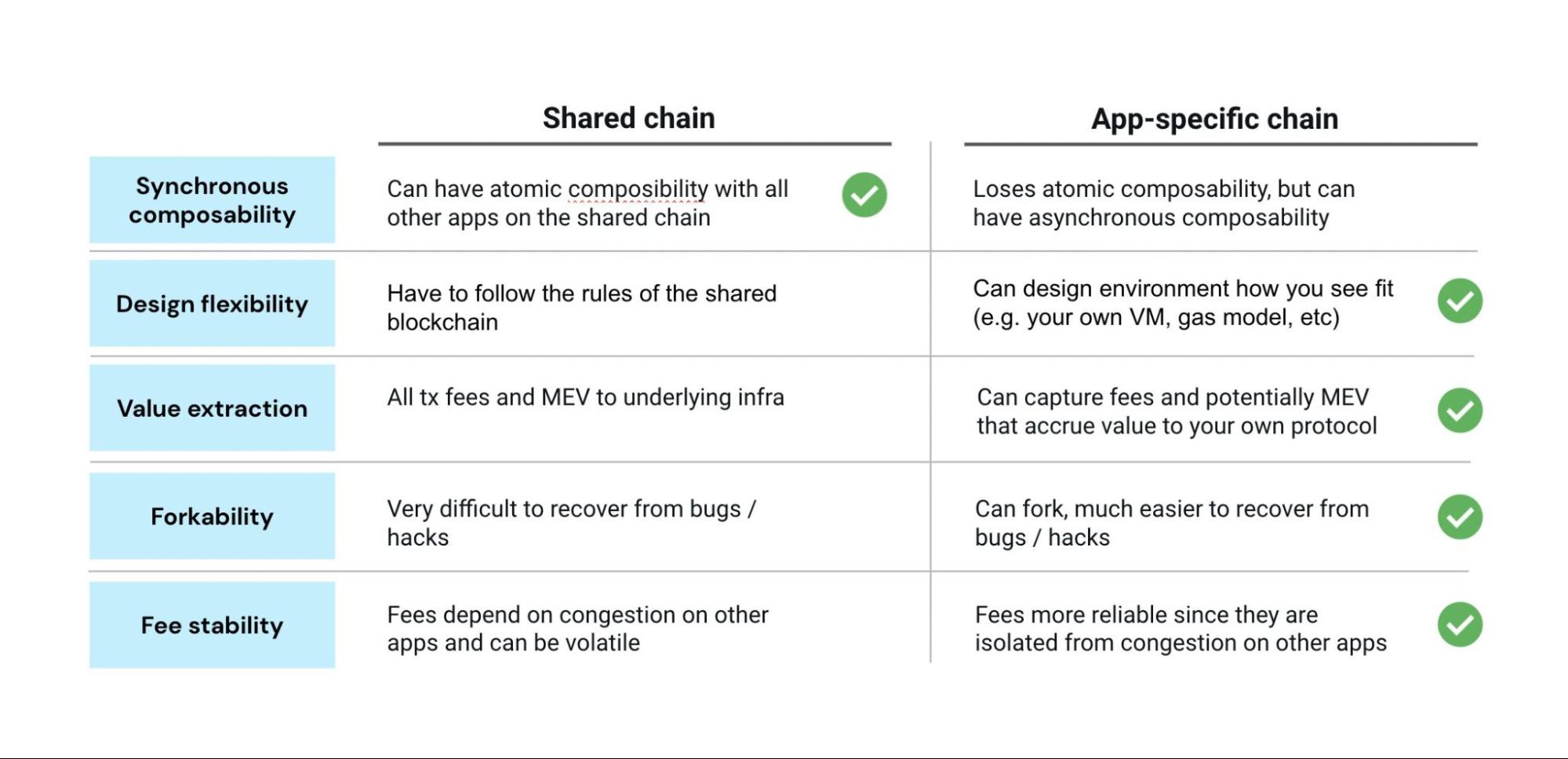

Celestia provides data availability that allows app-specific rollups to post data without being responsible for any verification, i.e., it doesn’t provide an execution layer. Since these rollups are not governed by the base layer(like in Ethereum), they can be built and customised specifically by the developers.Let us understand this from a comparison model with Ethereum.

Both Ethereum and Celestia are base layers, but with the former, all rollups are on a shared chain. With a shared chain like Ethereum, everything depends on the Layer 1 ecosystem, which limits its ability to scale with blockspace congestion.

With Celestia, there is an ability to borrow the best of each model for app-chains due to its modular nature. This means the app-specific rollups can borrow security from Ethereum, governance from Cosmos, and use Celestia to handle consensus. There is no blockspace congestion, leading to a scalable network.

Now, there are obvious trade-offs in this structure. Ethereum rollups can rely on ETH’s consensus, whereas rollups must trust Celestia’s consensus and staking on-chain attestation.

Yet, from an innovation perspective, Celestia is a first-of-its-kind, and a part of the community is rightly excited.

Tokenomics

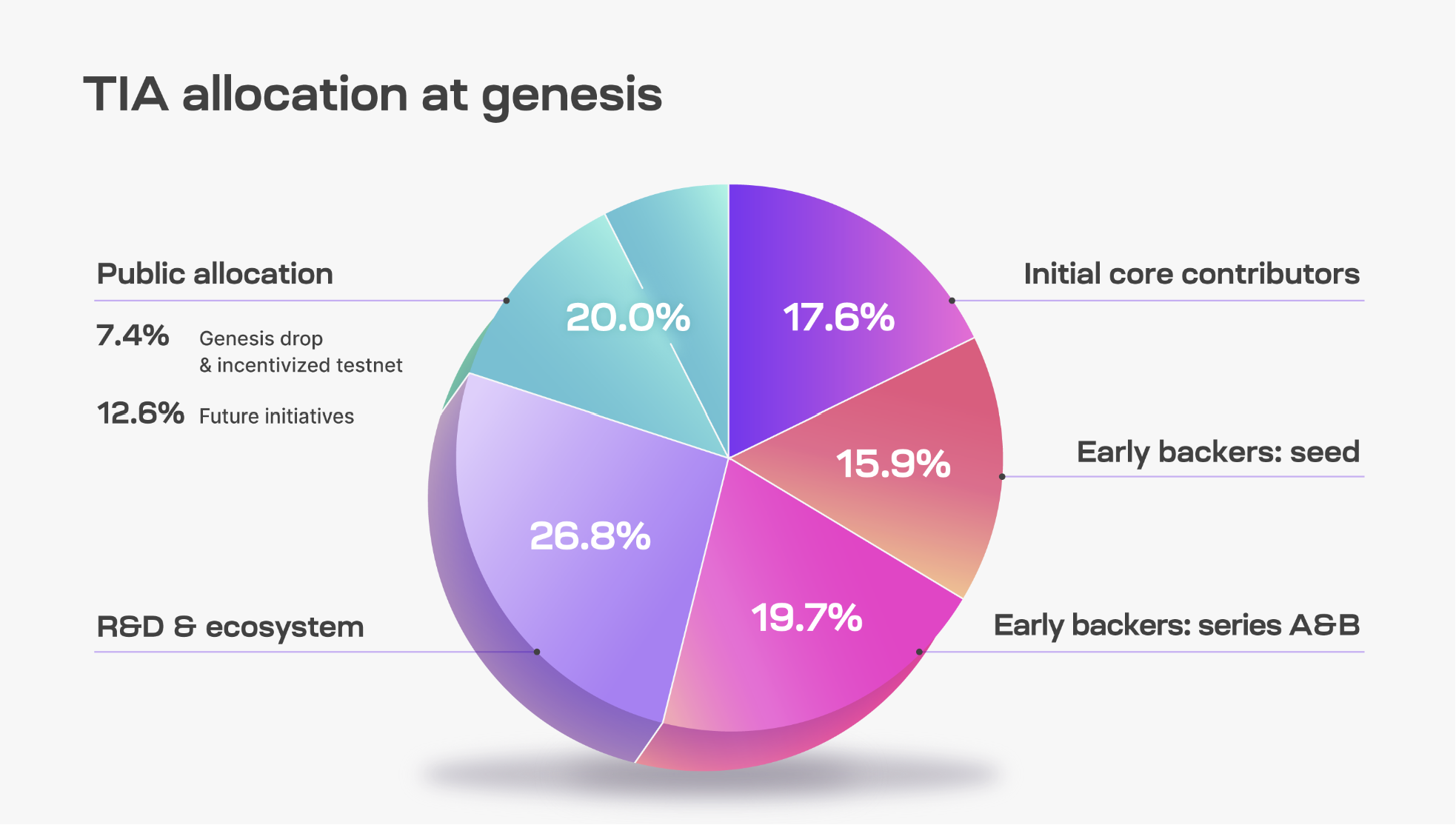

Celestia’s native token TIA was pre-mined at 1 billion supply at genesis. The chart above illustrates the token division into five categories.26.7% of the supply was unlocked at genesis. i.e., 267 million tokens. The protocol airdropped 7.6% of the total supply to 576,653 on-chain addresses and 7529 developed during its token generation event.

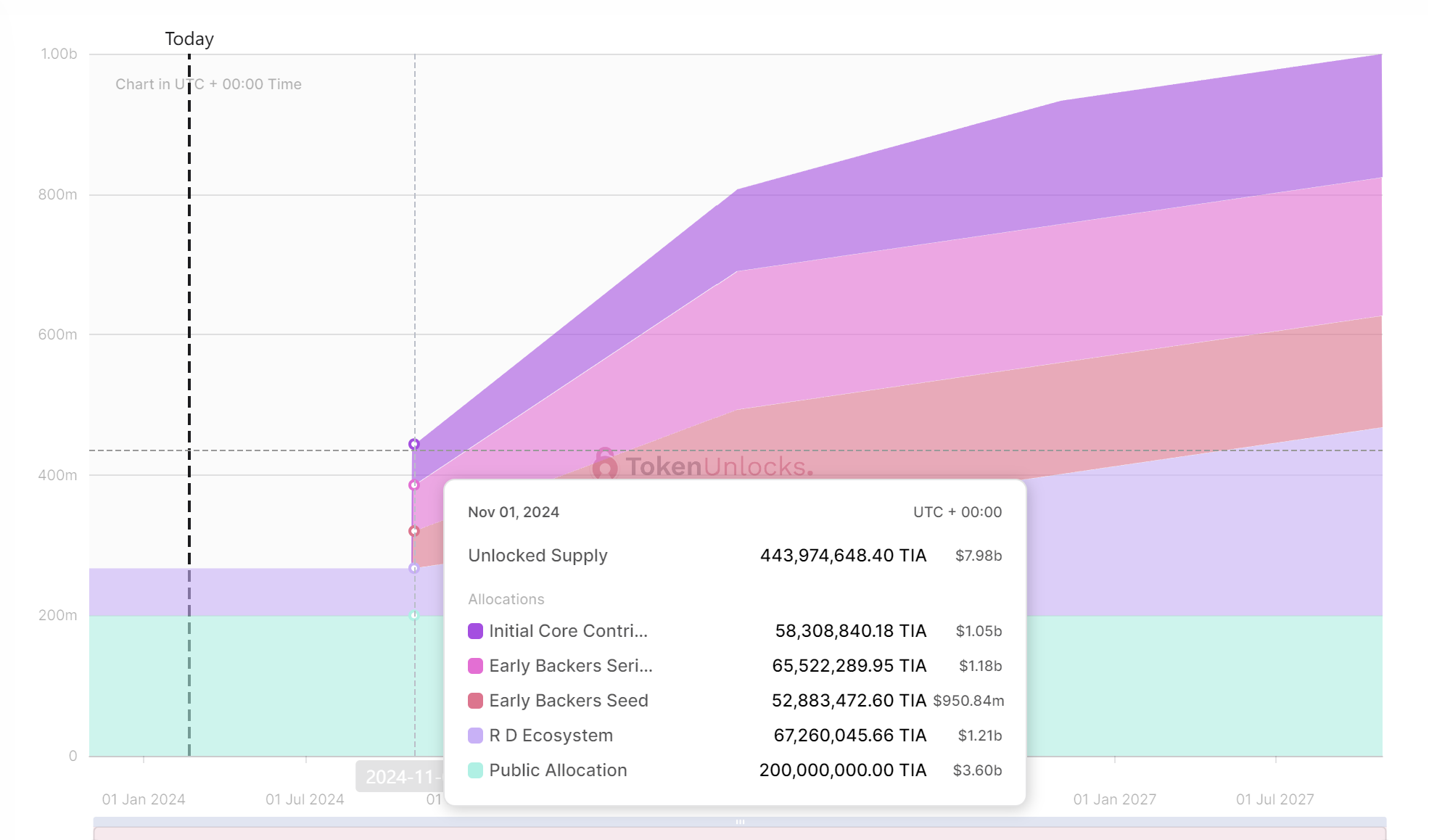

A massive 53.2% of the supply is allocated to the team and investors. The first token unlocked is scheduled for Oct. 31, 2024. After that, the tokens will be unlocked over 2-3 years.

The native token will have an annual inflation rate of 8% for the first year, dropping by 10% every year going forward.

Valuing Celestia as a token

Celestia’s price action post-mainnet launch has been significantly bullish.Its current market cap is $3 billion, while its FDV is a whopping $18 billion. “FDV is a meme” is another popular phrase circulating to justify Celestia’s hype. However, we need to analyse how it accrues value from a logical and possibly a visionary point of view.

Let us tackle the logical aspect first.

Airdrop season and staking demand

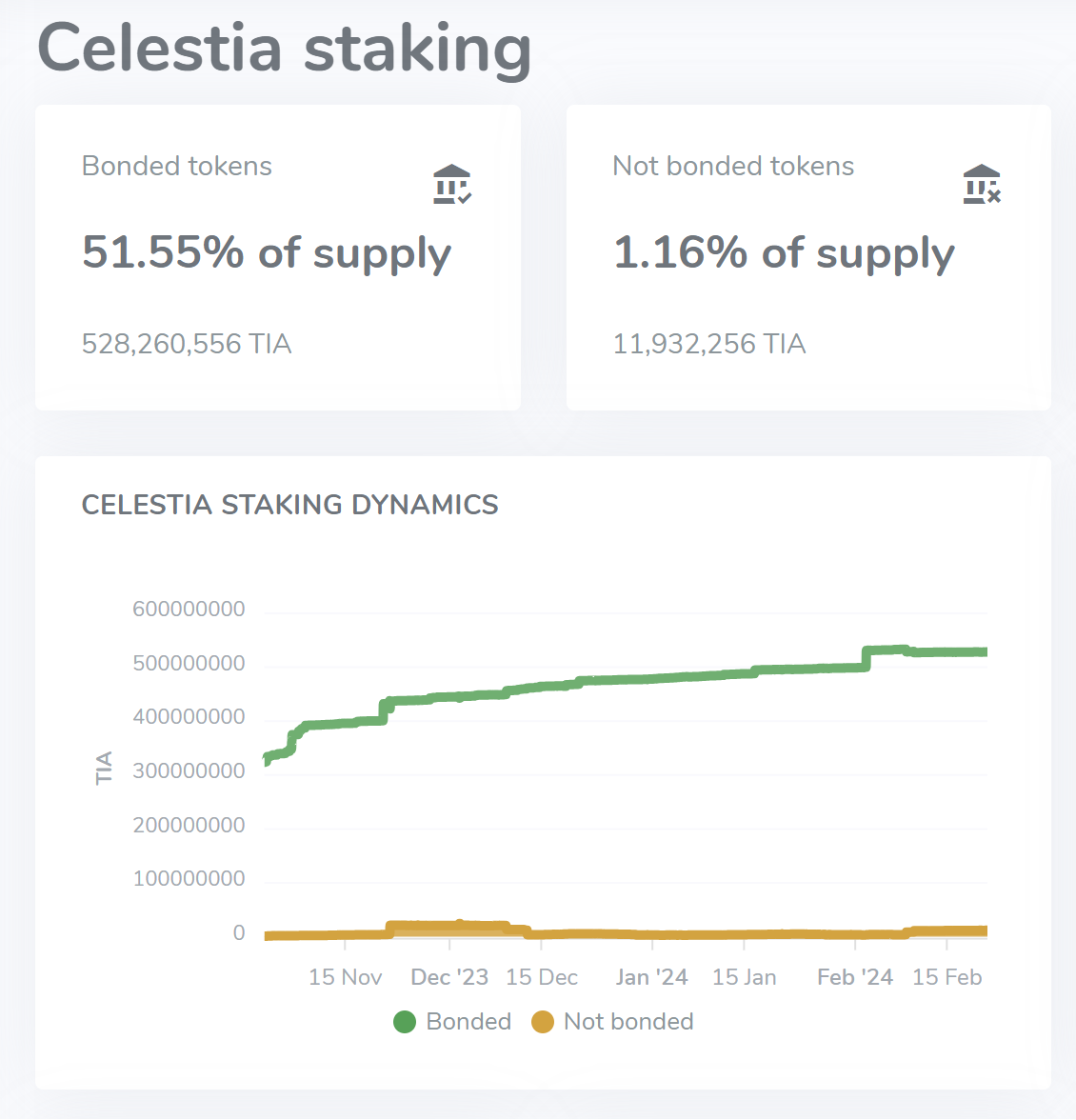

There is no doubt Celestia has been a major benefactor of airdrop farming. While it began with farming on the Solana chain, it has translated effortlessly into the Cosmos ecosystem.Staking TIA allows validators to be eligible for multiple airdrops, leading to massive payouts, with Dymension being a recent example. Additionally, TIA stakers are generating 15% APR in yield; hence, TIA holders are getting free money from multiple avenues.

These catalysts have led to high TIA demand; the staking statistics highlight the same.

At the moment, 540,192,812 TIA tokens are in the Celestia Staking Pool. 51.55% of the total supply are bonded tokens, with the Celestia staking dynamics gradually increasing over the past few months.

With the supply side locked for the next 254 days (until Oct. 31), the demand side for TIA can only increase as long as staking and airdrop farming is still lucrative. Along with the bull market, these factors are a recipe for bullish price action.

Generated revenue

TIA is Celestia’s utility token, and people use it to pay rollups to publish data on Celestia. A major reason Celestia has gained popularity is its affordable fees. Most of the transactions are at a flat rate per transaction.Such a revenue model has raised questions about long-term profitability for the network and whether it is sustainable. To approach this narrative on a data-centric level, we calculated the fees Celestia generated since its mainnet launch.

Available data suggests that the mainnet has generated 209,000 TIA tokens in fees over the past 113 days, with over 12.1 million transactions processed.

Now, 209,000 TIA is worth $3.76 million at $18 per token. However, these generated token fees have been spread around its entire price rally since Nov. 1, 2023. So, for an average range, we calculated the fee between the low median and higher median, i.e. $6-12$.

So, the fees generated by TIA are somewhere between $1.25M to $2.5M.

The range is definitely very large, but we will give Celestia the benefit of the doubt and assume that $2.5 million in revenue was generated from 112 days.

Therefore, based on this range, its annualised revenue will be around $8.17 million. This is fairly decent for a new protocol, but considering its market cap, it paints a different picture.

With the current market cap of $3 billion, its Price-to-Sales ratio comes to around 367x.

It means there is definitely a case of overvaluation around the token.

How do we value Celestia?

But before writing Celestia off, let us bring our attention back to how it works and functions.Celestia is a Layer 1 protocol; therefore, evaluating its potential based only on recent demand and generated revenue is not ideal.

Unlike other types of protocols, such as L2 networks or DEXs, Celestia is a Layer 1 network. The network will also be valued on the demand for security, which it will provide as a data availability layer to rollup networks.

Right now, only a few major rollups and rollups-as services have been launched on the protocol. Manta Network, with a market cap of around $800 billion, and Dymension, with a $1 billion valuation, are generating security demand for Celestia.

The industry’s long-term vision is that dApps will operate their blockchains, where developers can design their virtual machines, gas models, staking protocols, etc. Paired with the capabilities of IBC or interconnected blockchains, most rollups will not have to rely on the native blockchain.

Celestia is then uniquely positioned to allow next-generation L2s to be more efficient, and on paper, the possibilities are limitless. Revenue generation would be much higher since rollups are the primary drivers.

Yet, in the short term, Celestia has an upcoming headwind that should be considered before making a long-term bet.

A potential sell-off event

One major drawback of Celestia is its tokenomics. Earlier, we highlighted how 53.2% of the total supply is allocated to early investors and the team. On Oct. 31, 2024, 176 million of these tokens will be unlocked, which will more than double the current circulating supply at 165 million.Now, there is another layer to this token unlock event.

Early backers: Seed Round investors have an allocation of 15.9%, which is 159 million tokens. 33% of the supply will be unlocked in October 2024, and these investors bought TIA at $0.0094. Hence, at the current valuation, these holders are sitting at around 2000x returns, which they are most likely to cash out.

Early backers: Series A & B investors have an allocation of 19.7%, 197 million tokens, and a similar unlock of 33%. These investors received TIA at $1. This means a minimum of 10x gain from them even if TIA is $10 at the end of the year.

While exiting at those price points may be pragmatic for the investors, such a supply increase can create a significant correction for the token.

Valuation targets

A long-term price target for Celestia depends on multiple factors.Earlier, we spoke about a $100 billion market cap, which ideally isn’t out of reach if Celestia goes on to host thousands of rollups in the future.

From an innovation perspective, Celestia is possibly right up there with Ethereum as a Layer 1. It will compete with Ethereum as a Layer 1 to provide data availability solutions, and the upcoming Ethereum upgrade also opens doors for the modular blockchain.

After the Cancun upgrade, third-party solutions will also invade L2s on the Ethereum ecosystem. The rise of other DA layers, such as EigenLayer, suggests that DA services are also increasing in demand and will be a thriving sector. Here, Celestia has a first-mover advantage.

So, a hyperbole prediction of a $50-$100 billion market cap may pan out sometime over the next decade, where

- Each TIA token can be valued around $100-$200

Right now, we have to look at Celestia from a short-term perspective.

Earlier, we established that Celestia has a P/S ratio of 367x, which is relatively overvalued, so a massive rise of 10x from this point might be difficult.Coupled with the fact that a massive token unlock is still 254 days away, TIA should continue its temporary bullish market, which investors could take advantage of.

Until Oct. 30, 2024, TIA should continue to rally forward, as the demand side will be higher, and airdrop farming will lead to more staking activity.

Therefore, considering narratives triumph over fundamentals in a bull market, Celesita may reach somewhere between $15-$20 billion over the next few months.

- At a $15 billion market cap, each TIA token will be worth $91, i.e. 5.39x.

- At a $20 billion market cap, each TIA token will be worth $121, i.e., 7.1x

Price analysis

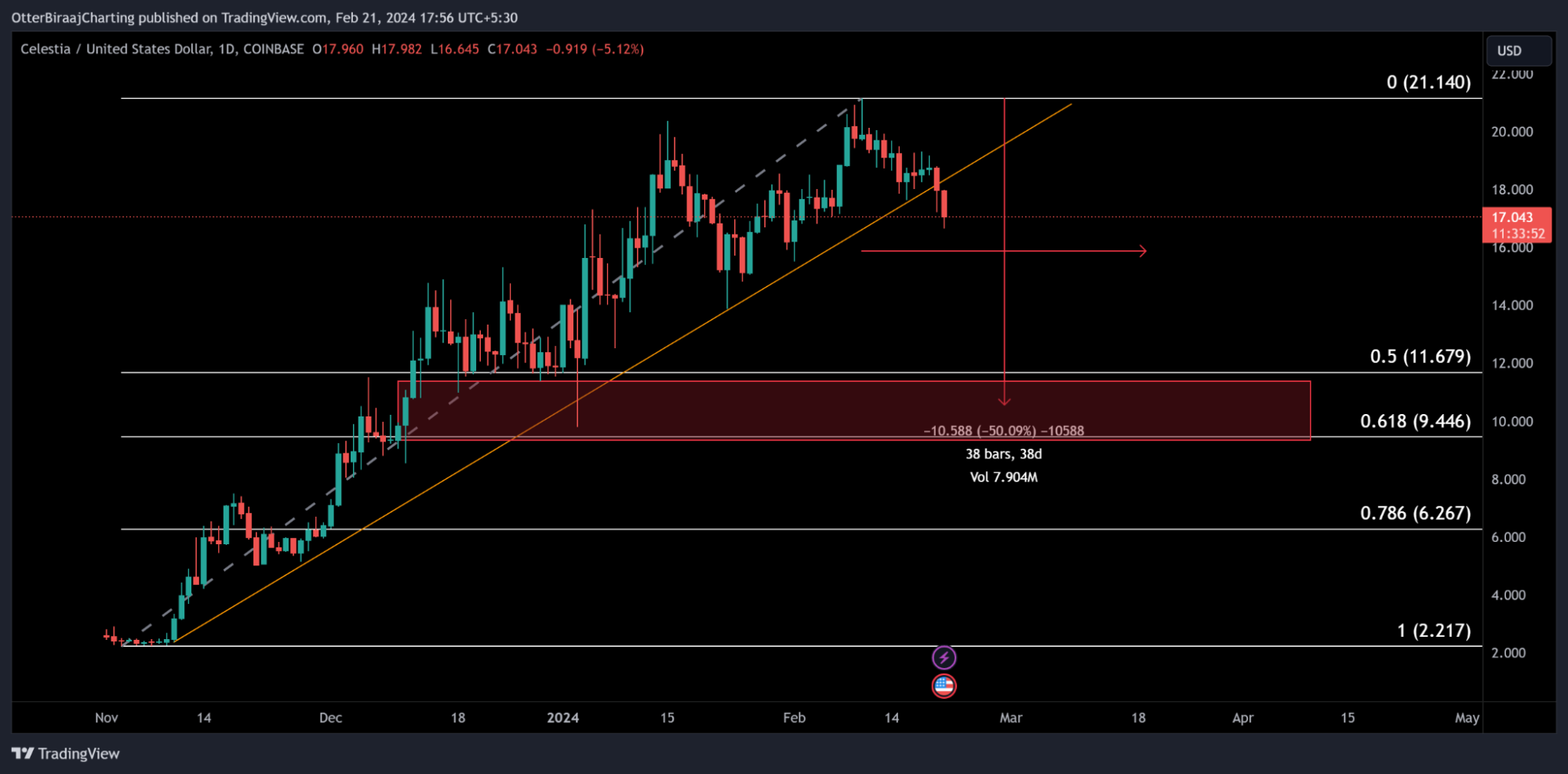

Celestia’s value peaked at $21.14 on Feb. 10, and now the asset is undergoing a market-wide correction. If TIA closes its daily candle under the incline resistance trendline, then we might be looking at a potential trend shift.

This is an ideal situation for investors as they can position themselves at a better price point for the bull market in the coming months.

Based on the Fibonacci retracement levels, investors can set their buy orders around $12, which would be at 0.5 Fib line. A 50% decline is around $10.55, and a retracement down to 0.618 is $9.44.

Therefore, the ideal DCA levels are $12.00, $10.55, and $9.44.

Cryptonary’s take

The long-term success of Celestia is an intriguing proposition. While the interest in the modular approach is high, it is still unproven in terms of growth and adoption.Right now, a lot of the shortcomings will be disregarded by early market participants, as they would eye Celestia as the new flashy solution for solving scalability.

At the root of the protocol is an untapped market, which leads us to believe that Celestia should be able to develop its intrinsic value in the future.

Celestia’s seems like a good bet as an investment, but only in the short term. The token unlock event is a huge red flag, and allocating 53% to early investors was not the right distribution strategy.

Bottom line, Celestia may have a bright future, but you should probably be out by October 2024

We will keep an eye on the project to see if any more curve balls are thrown moving forward.

Until then,

Cryptonary out!