While other narratives, such as memecoins and airdrops, bring attention to Solana, lending protocols are also gaining momentum. Deservingly so; after all, these protocols are part of the reason Solana has such a huge TVL.

But while two of Solana's top lending protocols are engaged in dirty mudslinging, a new entrant is quietly building the momentum to outpace both.

Could there be an opportunity for investors here?

This report will explore the infighting between Solana's top lending projects, spotlight the potential winner emerging from the chaos, and provide guidance on how to best position to capitalise on the opportunity.

The race is on - let's dive into the world of Solana's lending protocols.

TDLR

- Solana's DeFi lending space is booming with over $3.5B TVL; while not as exciting as memecoins, lending is a leading sector in the Solana ecosystem.

- While Solend and marginfi have been distracted by infighting, Kamino, an up-and-comer, has quietly built momentum.

- Kamino's innovative products, like unified liquidity pooling and risk dashboards, give it an edge.

- The project is well-positioned for its upcoming token launch after a 535% TVL increase in 2024

- There's an opportunity to back the new "lending king" emerging from Solana's chaotic landscape.

- Pre-market trading already values KMNO tokens around $0.15-$0.2.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A brief introduction to lending protocols

Decentralised lending protocols emerged as one of the foundational utilities of the DeFi ecosystem to replace traditional lending systems. In decentralised lending, users lend and borrow directly through smart contracts.

Lenders deposit their tokens into smart contracts, which are then available for borrowing by others. In return, lenders receive interest tokens that can be redeemed later. This arrangement not only generates income for lenders but also enhances platform liquidity.

Borrowers must provide collateral in other cryptocurrencies, ensuring the loan's security through over-collateralization. While this may seem excessive, it's a necessary precaution to mitigate default risks. The amount borrowers can access is determined by platform liquidity and collateral factors.

This system's interest rates are variable and governed by supply and demand, ensuring a balance between lenders and borrowers. It can also vary between different protocols.

Solana's lending ecosystem

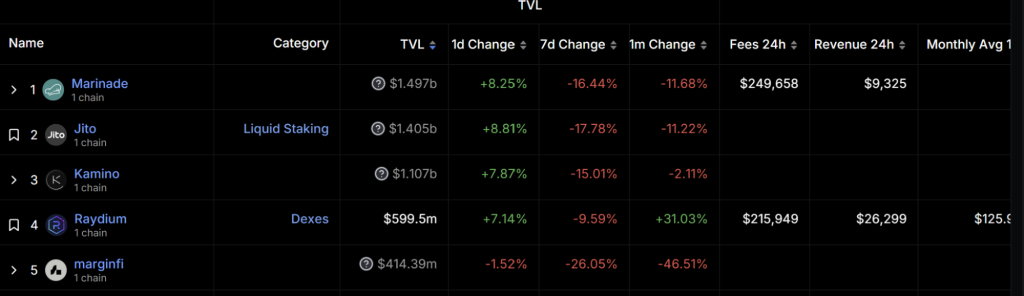

There are three major entities in the Solana lending ecosystem: Solend. marginfi , and Kamino. Over the past few weeks, they have significantly increased the TVL value on Solana. All three currently rank in the top 10 protocols on Solana DeFi. They form a major chunk of the TVL on Solana, so there is a lot of capital in these protocols.

These three money market makers use a peer-to-pool model, offering variable rates and parallel interest rate mechanisms. Solend already has the SLND in the market, while marginfi and Kamino will soon have token generation events (TGE).

Solend vs marginfi vs Kamino: Quick update on the drama

Over the past few months, there has been public hostility between the members of each protocol. Their core devs have criticised one another for their approach to risk mitigation, airdrop events, and past reputation.Solend's past

Let us begin with the original lending protocol on Solana, Solend, which currently boasts a TVL of $237 million. It is based on the spl-token lending program and offers a yield-bearing deposit receipt for every deposit, known as 'cTokens'.Let's face it: despite its first-mover advantage, this project has too much baggage.

Solend is a decent lending protocol, but using it is less intuitive than using Marginfi or Kamino. The user interface makes it tricky to figure out what pool you should deposit your funds in or where to locate your deposited assets.

In terms of price action, the SLND token is currently down 94.3% from its all-time high price of $16.65.

However, the major issue is that its credibility took a major hit in 2022 when the unfortunate SOL whale incident happened.

In June 2022, Solend created a governance vote to gain 'emergency powers' over a whale wallet dangerously close to liquidation. The wallet in question had deposited 95% of Solend's entire SOL pool, representing 88% of the USDC borrowed.

The team was worried that if the wallet gets liquidated at $22.30 SOL, it would lead to bad debt for the lending platform and cripple the Solana ecosystem. They then initiated a governance vote titled "SLND1: Mitigate Risk From Whale", which was approved within 24 hours.

However, there was severe backlash from the crypto community. This move was deemed "the complete opposite of DeFi", and under pressure, the Solend team initiated a second governance proposal vote to invalidate the previously approved proposal.

The proposal ended in favour of disregarding the SLND1 proposal.

However, the damage was done, trust was broken, and the community didn't fully trust the team from that point. By the way, the whale eventually got liquidated in November 2022.

marginfi's turbulence

Shifting our focus to marginfi, this lending platform has a strong TVL of $411 million, but at the beginning of April, it was as high as $881 million.It was Solana's leading protocol in the category until the tides began to change last week. Edgar Pavlovsky, then marginfi CEO, resigned, stating an internal dispute. The abrupt exit instantly caused turmoil, with over $100 million in capital outflows.

Solend and Kamino benefited from this incident; they recorded $17 million and $81 million in deposits.

Beyond the CEO's exit, marginfi has faced several other issues. Last month, marginfi's price data sourcing "oracle" infrastructure caused some users' withdrawal requests to fail when Solana's network congestion was still rising.

The airdrop points program has also been criticised. The development team has yet to announce a TGE, so many users feel they are being used to grow the TVL without any plan for a potential airdrop.

Lastly, it doesn't help that marginfi and Solend's core devs have been publicly attacking each other for a while. It started with Solend being criticised for its risk management. Then Solend's anonymous developer, @0xrooter, hit back with claims that marginfi was using stETH oracle instead of wstETH for its wstETH listing. The former's CEO later clarified this.

Such spats do not help anyone, and with the current market sentiment for Solend and marginfi, it was possibly a loss-loss situation.

But amidst the chaos, Kamino gets a chance to shine.

Kamino's sweet spot

Out of all three lending protocols, Kamino has the least drama.Yes, the community criticised the team when it announced an airdrop snapshot on March 31st. The concern was that with a linear airdrop after the points system, early adopters might not get much from their potential airdrop because now whales will farm out a chunk of the TVL. To be fair, that has been the case over the past few weeks.

However, the airdrop has yet to happen, so the jury is still out on whether this was a smart move.

There are no points for guessing that Kamino is the current winner in the category, and the fact speaks for itself. Beyond being drama-free, Kamino is currently a solid product, and here's why:

Why Kamino Finance?

Kamino is a DeFi lending/borrowing protocol which combines lending, liquidity, and leverage under one umbrella of different products. Kamino has become popular because of its ease of use and competitive yield/lower borrow rates.

Kamino's TVL rose 535% in 2024, reaching a peak of $1.43 billion on March 31. Based on TVL, it is currently the third largest DeFi protocol on Solana.

While the TVL battle rages on, what really sets Kamino apart from the rest is Kamino Lend.

What is Kamino Lend?

Until recently, Kamino's main product was its concentrated liquidity vaults. However, now, with Kamino Lend, the platform has introduced the ability for users to borrow against their LP positions as well.Kamino Lend streamlines borrowing and lending for both parties. One of its key aspects is its unified liquidity market.

This feature would allow users to use one big pool for all lending and borrowing, increasing efficiency. Competitors like marginfi and Solend lack this design mechanism for a unified market with eMode. It is one of the key unique selling points for market leaders AAVE, so this would be a game-changer for Kamino.

Additionally, Kamino has developed products like Multiply and Long/Short, which are one-click vault products designed for leveraged yields through looping. Kamino features a comprehensive risk dashboard for examining all types of risks alongside various scenario analyses. This feature is also exclusively available on Kamino and not other competitors.

We are particularly impressed by this dashboard because it indicates Kamino's effort to inform users, who sometimes focus on money/APY rather than the risks associated with these systems.

The platform has also implemented auto-deleveraging, where borrowers can deleverage (i.e., partial unwinding of positions) in response to market conditions to prevent bad debt, taking note of Solend's whale incident.

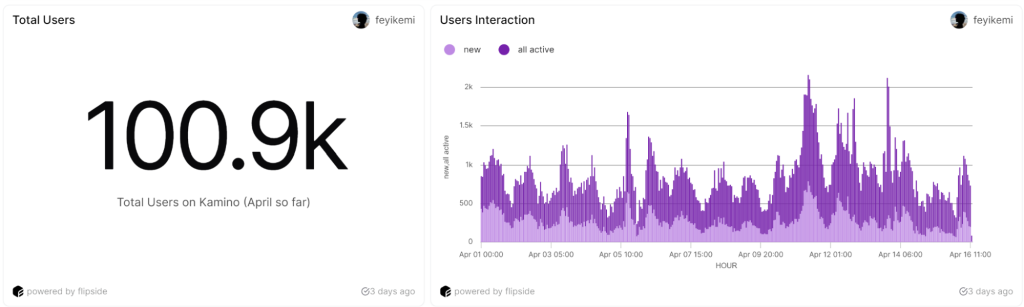

It is important to consider that Kamino has managed to stay afloat despite the recent market volatility. The protocol's total number of active users is above 100,000, and healthy activity is spread across the month.

Kamino's price prediction at TGE

Kamino announced that its token generation event would take place in April. However, we are already in the second half of the month, and there are no updates on the TGE. The current market correction may have contributed to the delay.Here is the potential layout for the tokenomics as indicated by Kamino:

- Total supply: 10 billion tokens

- Airdrop: 7% of the supply

- Distribution: Linear based on points, 35% of airdrop tokens to first 100 wallets

Therefore, Kamino's initial market cap could be around $1.5 billion to $2 billion, and each KMNO token will be worth around $0.15-$0.2. Pre-market trading on the secondary market also seems to agree with this assumption.

(Note: The above estimate is based on an assumption it is not a verified projection)

Cryptonary's take

Kamino deserves its current spot as the top lending protocol. While it is creating a very competitive environment for high yields and liquidity farming, the product has also made it easy for users to explore a range of strategies.If you are already farming Kamino airdrops, you should continue interacting with the platform to accumulate more points—we think it will be worth it. While the linear distribution of KMNO tokens favours whales more than small wallets, it does not diminish Kamino's future potential as a DeFi protocol.

If you aren't interested in airdrops, prepare for Kamino's TGE. But instead of buying immediately at TGE, you may want to wait for the post-TGE sell-off to buy.

The most important thing will be to have some money on the side so that you can jump in at the right time. Like the Parcl alpha we shared last week, if you bought PRCL after the initial post-TGE selloff, you'd already be up about 40% today, less than one week later.

We will be back to provide an initial valuation and estimate potential price targets after the TGE event.

Stay tuned!