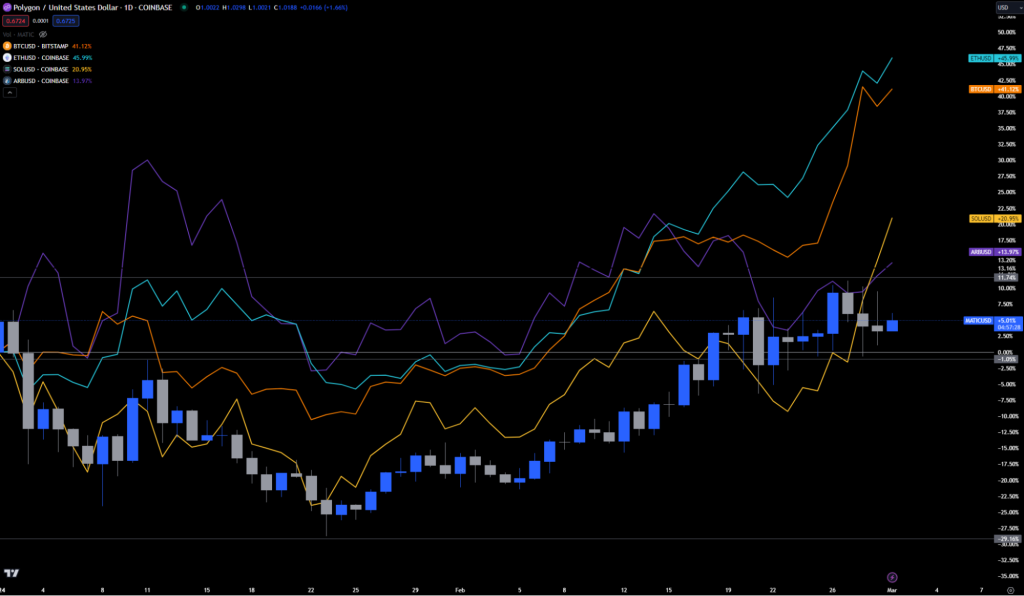

Its performance over the last two years has been lacklustre, to say the least.

But why? It’s had all the same opportunities as other assets in the market.

Where do we stand on Polygon?

TLDR

- Polygon, a once-promising layer 2 scaling solution has struggled to keep pace with competitors.

- Despite being an early mover, the lack of innovation has allowed rivals to surpass it in total value locked (TVL) and token price performance.

- Its TVL increased only ~20% this year compared to ~63% for the overall DeFi market.

- While a key competitor recovered impressively from a major setback, MATIC has stagnated.

- The opportunity cost of holding MATIC in hopes it will pick up means you are leaving money on the table.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Recap of Polygon

Polygon is a Layer 2 Ethereum sidechain with a PoS consensus mechanism secured by the MATIC token.Polygon began as a pure L2, like Arbitrum and Optimism, but now functions as a hybrid sidechain that should be evaluated as a standalone chain/ecosystem. Its key link to Ethereum is the interoperability component. For example, a wallet address is as unique and valid on Ethereum as on Polygon and vice versa.

However, with Polygon being closely related to Ethereum, one would have thought it would perform well in this market.

That's the logical thought, but this project has had us scratching our heads and questioning our reasoning for covering it.

The current state of Polygon

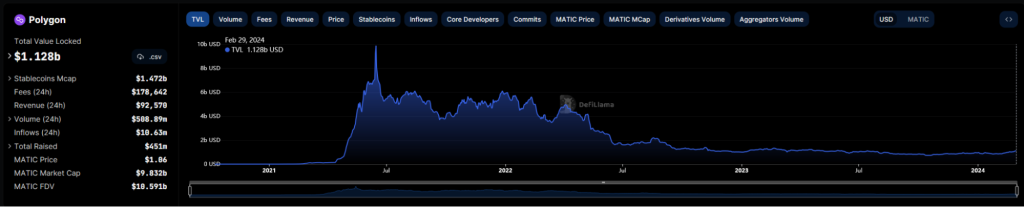

We have covered and monitored Polygon consistently for a couple of years now.Overall, Polygon’s performance has been hugely underwhelming by most metrics, considering the wider market moves this year.

The ecosystem’s TVL increased ~20% this year, compared to ~63% for the DeFi market.

The key concern here is that Polygon is simply not attracting usage and liquidity at a rate that would warrant significant price action for MATIC.

Now, here’s the question: “Why is this happening?”

There's no simple answer, but we know this project is not meeting expectations.

But don't take our word for it; look at the data.

Polygon is lagging behind its peers

Let's start with the chief competitors: Optimism, Arbitrum, and Solana.They all launched after Polygon, but they’ve been able to accumulate value, and quite frankly, the numbers don’t lie.

Solana

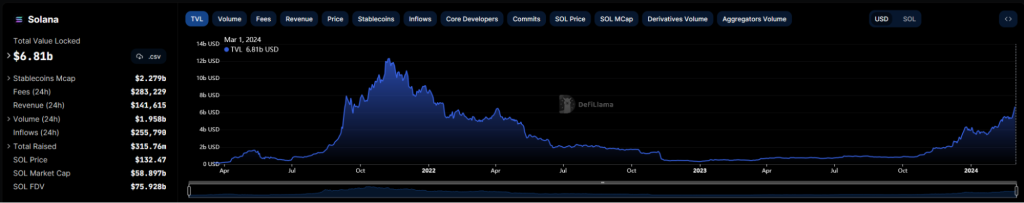

Clearly, Solana is the big winner here in terms of TVL, general hype, and blockchain capability.Despite the issues with FTX and SBF being deeply enmeshed in the Solana ecosystem, SOL has largely come out ahead and defied all expectations, reinforcing its position as “the people’s chain.”

This merit is based mostly on transaction speed and cost, but Solana’s ecosystem has also been on a rip in line with the bullish trends of the general market.

Solana is the outlier here - essentially back from the dead.

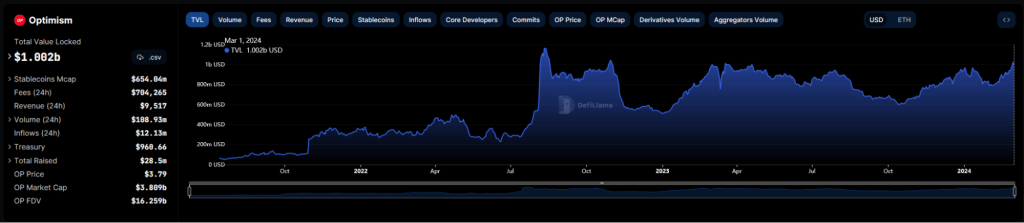

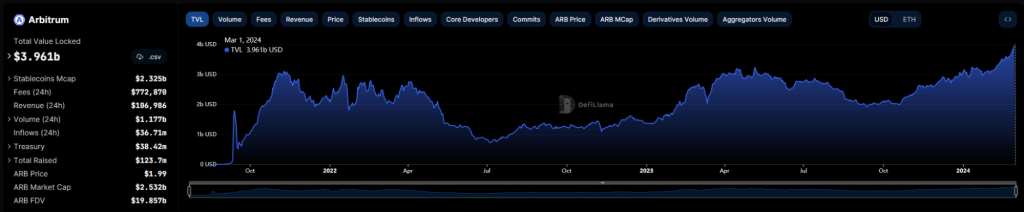

For Optimism and Arbitrum, we don’t even have to write anything because the charts are enough.

Optimism

The note for optimism is that OP has also been underwhelming, but equally, its TVL has not changed much.

Arbitrum

MATIC is out

Polygon has been underperforming because innovation has not happened. The chain has had a first-mover advantage for a while—Optimism, Arbitrum, and even Solana came after. Innovation is key in any market, but even more so in the crypto market, where things move so quickly that those unwilling to innovate are left behind.You can have the best protocol or chain on the planet - but if you’re not willing to fund innovation, eventually, someone else will.

From a purely technical perspective, Polygon wasn’t even the best solution for scaling Ethereum. Couple that with a lack of innovation, and you’re left with a “mid” chain with “mid” performance and “mid” numbers to back that up.

To be completely honest, we think Polygon has taken its position for granted for too long, to the point that it will be extremely difficult to catch up.

TVL on a flatline, MATIC on a flatline (compared to the rest of the market).

By every metric imaginable, MATIC is not worthy of a Cryptonary’s pick title - not even close.

For these reasons, we’re removing it from coverage.

Polygon’s only advantage is its position on the crypto market cap rankings. Given the newer, shinier alternatives, we feel MATIC is overvalued.

MATIC price action

MATIC's price action struggled to break the key psychological level of $1.After breaking out above that level, we saw some strength, but we still haven't seen price break the 2023 highs just yet, which is unique for assets at this point in the cycle.

There are some headwinds at 1.25000.

From a technical standpoint, considering market conditions and BTC’s recent price action, this level should have been broken already.

The 2023 highs will form the next key resistance if this level breaks.

Cryptonary’s take

Polygon has struggled to recover even 20% of its TVL since the peak in 2021.This is indicative of a lack of interest, especially when considering that Polygon’s competitors like Solana, have managed to bounce back from what was a catastrophic event.

Sam Bankman-Fried getting cooked should have buried SOL, but it didn’t.

Solana’s recovery ahead of Polygon to surpass all expectations speaks volumes about Polygon’s lacklustre performance.

We would have loved to give MATIC another chance, but at this point, there are simply better opportunities out there, and there's no point in being married to this specific bag.

So, where else should you look?

OP, ARB, and METIS are great starting points.

Cryptonary, OUT!

The Future of Crypto: Don’t Miss Out

The crypto market moves fast—projects that don’t innovate get left behind. But for those who know where to look, massive opportunities still exist. That’s why 230,000 investors trust Cryptonary for expert research, market insights, and top crypto picks.🚀 We called WIF at $0.004—now up 54,769.11% 🔥 Get real-time analysis, winning strategies, and exclusive insights.

Try Cryptonary 100% risk-free for 7 days!