Everyone who can find their way around code is launching a memecoin to capitalise on this interest. Platforms like pump.fun are not helping matters. Hedge funds, TradFi, and people who didn't like memecoins before now cannot resist it and are getting in.

But buyer beware - not all memecoins are created equal. In this modern-day gold rush, two distinct camps are battling for control: the corporate cash-grab coins backed by deep-pocketed VCs looking to exploit retail and the true community-powered coins formed by the people, for the people.

Here's the twist!

VCs hate the fact that no one wants to buy their useless governance tokens with low-float greedy tokenomics, which they got in early. Therefore, VCs and sideliners devised an ugly way of taking a piece of the people's memecoin supercycle.

In this no-holds-barred exposé, we'll rip away the slick veneers of corporate memecoin con artists to reveal the harsh reality of their predatory tactics.

You'll learn how to identify and avoid becoming mere exit liquidity for their rug-pulling ploys.

But fear not, for we'll also equip you with the tools to separate the signal from the noise and latch onto the next great organic memecoin.

Sounds exciting?

Let's dive in!

TLDR

- Memecoin mania is reaching new heights, with a surge of corporate/VC-backed "cash grab" coins looking to exploit retail investors.

- Two camps have emerged: Predatory corporate memecoins vs authentic community-driven organic memecoins

- Corporate coins use tactics like influencer pumping, predatory tokenomics, and hiding insider wallets to dump on retail as exit liquidity.

- Organic memecoins are built from the ground up by passionate communities, with wide distribution and the ability to survive major drawdowns.

- Identifying promising organic gems requires vetting factors like the number of holders, commitment after dev rug pulls, and compelling narratives.

- We present two exciting new memes, community-led and "organic", with huge upside potential.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Camp 1: Organic memecoins powered by a community

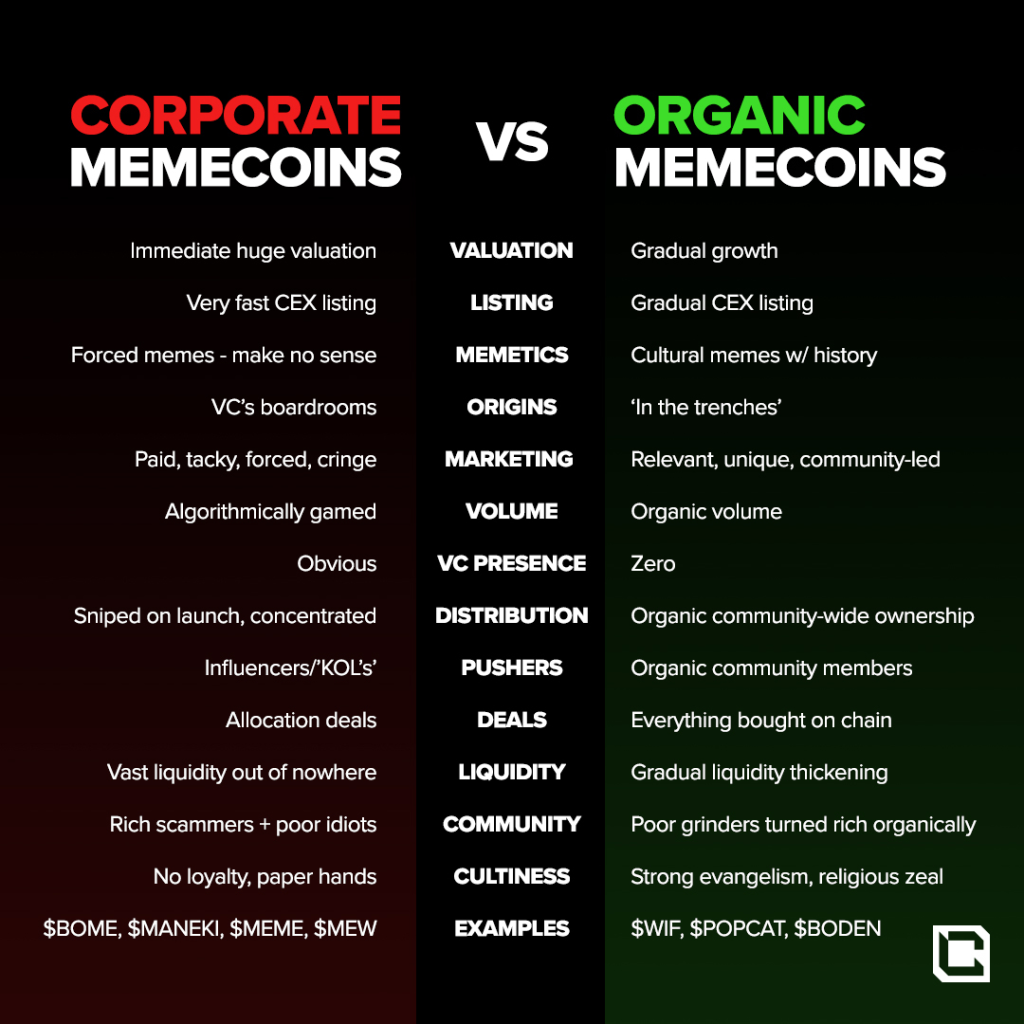

Organic memecoins are those built from the ground up by a community without significant backing from greedy VCs or other corporate entities.

These coins often rely on organic growth through community efforts and word-of-mouth marketing. They experience multiple 90% drawdowns but always recover to show their commitment and devotion to the community. The distribution of organic memecoins is as wide as possible and has minimum concentration.

Camp 2: Corporate memecoins powered by a team

On the other hand, corporate memecoins are backed by VCs, corporate entities, or influential individuals.These coins are launched with significant resources and marketing efforts, aiming to leverage meme culture and hype for quick gains at the expense of retail. They often have predatory tokenomics and distribution, with insiders having a large "hidden" allocation.

Additionally, the growth isn't organic but rather forced by influencers and teams to make a quick gain at the expense of the community.

We don't like them for attempting to manipulate the market and for misleading investors.

For further distinctions, look at the table below.

Organic vs corporate memecoins

We found a great example of why you shouldn't invest in corporate memecoins.

Case study: GUMMY

Let's look at the price action first

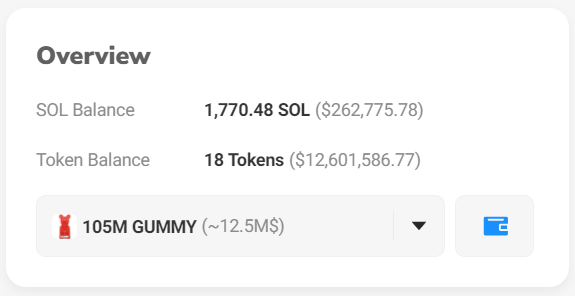

Instant $200+m market cap, little liquidity, instant CEX listing, top 10 holders control over 50% of the supply, backed by scammy influencers

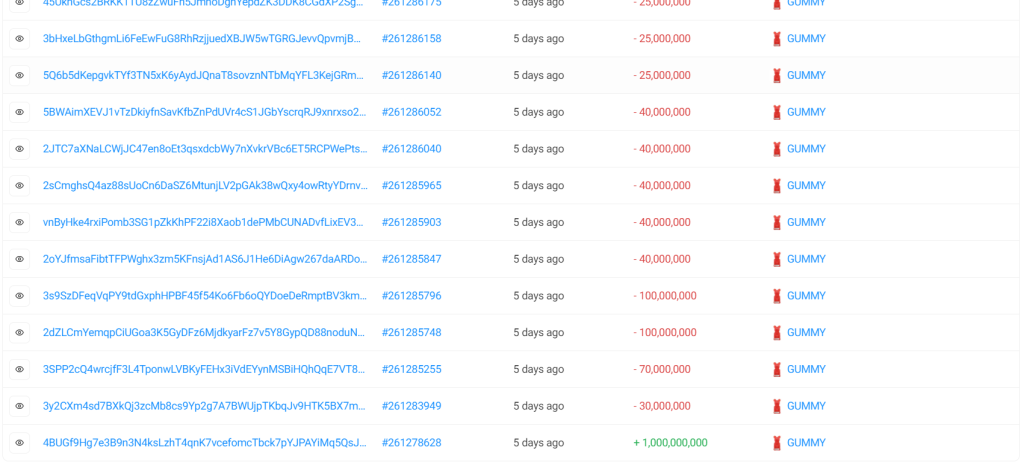

Further, we tracked down the token's creating wallet. The wallet minted 1b tokens and spread them into many different wallets to hide that he still has them to mislead investors.

We tracked one of them, and here is what we found:

This wallet alone holds over $12m of tokens that inevitably will be dumped on innocent retail. We believe if we keep tracking further, we will find more hidden wallets with a massive allocation that will cost not-informed retail a lot of money

The allure of corporate memecoins

But why are people attracted to corporate memecoins?It is a mix of two reasons. On the one hand, it is becoming increasingly hard to find winners within the organic meme category because of the vast number of memes launching daily. On the other hand, corporate memecoins are socially engineered to trade as if they will be successful memes.

Here's why winning memecoins are scarce

- Fragmented liquidity: with so many memecoins in the market and thousands created every single day, the liquidity becomes fragmented, and it is challenging for any single of them to have sufficient liquidity to facilitate multi-billion market caps sustainably

- Minimum viable holders: Based on our experience as memecoin hunters, we have observed that the majority of memecoins that have less than 3k holders die out and never reach their full potential

- Fragmented community: similarly, communities are fragmented as well, with most of them struggling to cross 3k organic holders and thus never take off

- Greedy devs: Devs are becoming increasingly greedy as well with no LP lockups, spreading minted tokens across many wallets to obfuscate and later slowly dump on retail.

That is the selling point of corporate memes. They seem legit and easy winners. However, most retail participants will end up becoming exit liquidity for a small subset of suits because VC memes are much worse than organic memes because they sell pipe dreams while quietly taking advantage of retail users.

Finding a solid memecoin opportunity takes time and research

For example, it took us roughly three months to find Tremp and Boden after we covered WIF and Popcat. However, this difficulty in finding winning organic memecoins makes it easy to fall into the trap of corporate memes because there is a socio-engineered effort to mimic momentum.For example, they'll airdrop the coins to people to reach the critical mass of 3k holders. 3k holders who invest their own money have more skin in the game than 10k holders who got airdropped.

It's a similar story with liquidity as well. For a young coin to reach $10m of liquidity, it needs to remain relevant for a long time, gradually thickening liquidity due to volume. Meanwhile, corporate memes can reach that liquidity overnight without going through the test of time and markets.

So, in summary, it can be tempting to want to jump abroad corporate memecoins that seem to have momentum – but that momentum is fake; you are playing a game of hot potatoes, and the team behind the coin has all the advantage. Their ownership, allocations, and intentions are opaque, and you'll most likely be exit liquidity for the shady team behind such projects.

Key takeaway: Don't fall into the trap of corporate memecoins; you'll be positioning yourself as exit liquidity for people who don't have your best interests at heart. In most cases, the result is something like this:

Here's how to win with organic memecoins

Now that we've told you to avoid corporate memecoins and said it is hard to find winning organic memecoins, how can you participate in memecoins profitably?Previously, we published a memecoin masterclass; if you haven't read it, take a look here. We bet you won't regret it. In the meantime, here are the key takeaways:

- It needs to pass our rug pull test

- Survive 3/7/21 days. The longer, the better

- Have a hot narrative or catalyst

- Community-owned

- 80% drawdown and recovery. It would be even better if the community survived the dev's soft rug

- At least 3k holders if the meme coin is still small, at least 10k if the market cap is bigger than $10m

The most-promising memecoin narratives

Dog-themed coins are the OG and the most popular sector of memecoins. They have been a significant part of the cryptocurrency market since the early days, capturing the attention and investment of both the crypto community and the general public. We caught one of the biggest multi-billion dollar dog-themed coins: WIF (up almost 10,000%).Cat-themed coins—The second and less established category is cat-themed coins. There hasn't been a cat memecoin that crosses a billion-dollar valuation. Some might argue that cat lovers are less risky and are unlikely to invest in memes. But we believe a cat meme will reach the billion-dollar mark, and we bet it will be our POPCAT, which has been up more than 1200 per cent since we published the report.

PolitiFi coins are a new class of memes based on prominent political figures. We highlighted Tremp and Boden as potential winners.

You are probably aware that the US presidential elections will be held in November this year. That means lots of headlines, tweets, posts, and attention. The easiest way to bet on elections is through Tremp and Boden.

You might ask, "What about Kenidy?". We noticed many of our community members hold Kenidy bags.

But truth be told, we don't see an independent candidate having a chance in US elections. The real battle will be between Democrats (Boden) and Republicans (Tremp).

Besides the lack of narratives, we don't see numbers quite adding up as well. Kenidy has only 500 Telegram members and 1.9k holders. For us to consider a memecoin, it should cross at least 3k organic holders.

Emerging memecoin narratives

Macro memecoins

Macro moves every capital market. Whether it is stocks, bonds or crypto, everyone's bags are in the hands of Jerome Powell, the head of the money printer.Over the last few years, interest rates have been rising and remain high. We believe this year, we will finally see rate cuts, which can literally send our bags higher.

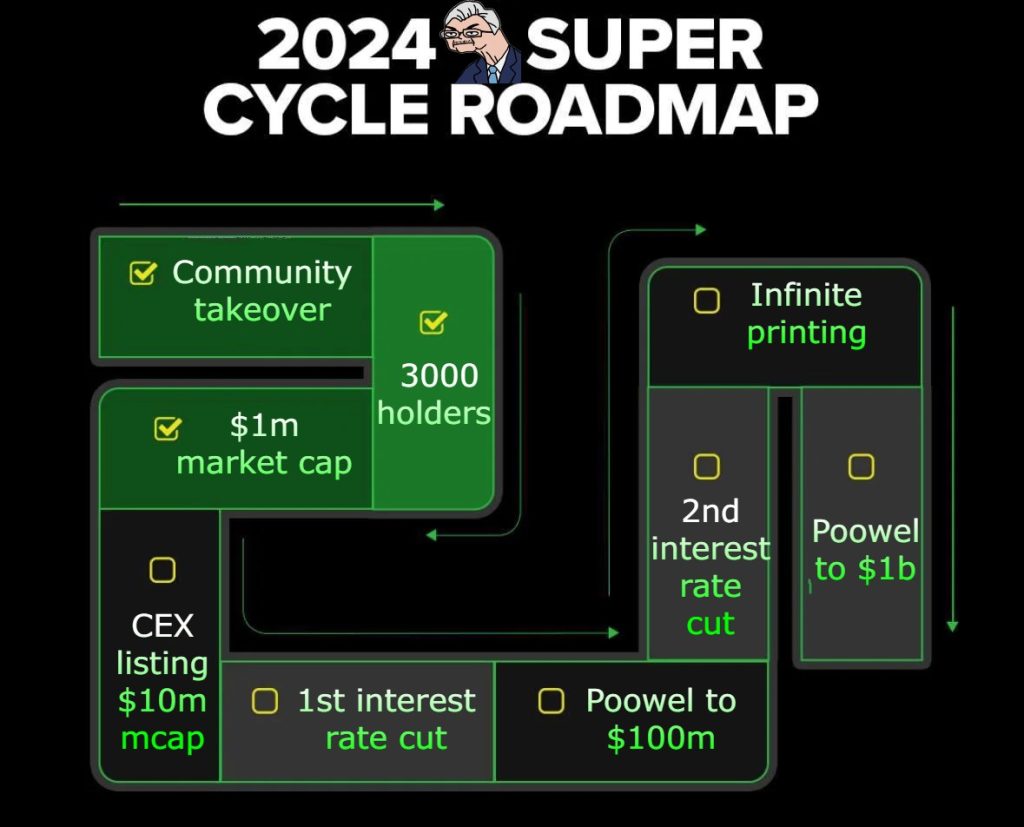

Therefore, narrative-wise, we believe Poowel ticks all the boxes.

Moreover, the meme is fully owned by the community. The dev soft-rugged already, but the community didn't die and took its destiny into its own hands. It became stronger with lots of activity on Twitter and Telegram.

- Name: Joram Powell

- Mcap: $1.2m

- Number of holders: 3,185

- TG and Twitter following: over 2k

- Contract address: BHcPVARUJEV3rCAmbLgRm7QPmZotsCcHcKWwzvCSAHJi

- Targets: Initial targets are $10m-$30m

The unofficial roadmap for Poowel by Cryptonary.

Technical analysis

Powell is currently bouncing back from a support range of $0.0008-$0.0013, which has historically been strong for the meme coin. While the token continues to deflect under the descending trendline, the asset might be close to a trend reversal at the moment.

A bullish divergence can be observed between the RSI and the price action, which may indicate a potential rally in the future. A daily close above $0.0021 will establish a break of structure, which may trigger price recovery in the coming weeks.

How to buy:

- Go to Jupiter

- Insert contact address in the "To receive" section: BHcPVARUJEV3rCAmbLgRm7QPmZotsCcHcKWwzvCSAHJi

- Execute the swap

- Have fun

Nationalist memecoins

We have identified nationalist memecoins as an emerging memecoin narrative because of their potential to bring people together across national lines.First, while we won't get involved in the politics of it all, populist ideas have been gaining prominence in recent years – it is what is it, and nationalist memecoins offer a chance to profit from the momentum.

Second, the threat of war has become a constant in geopolitics. Russia-Ukraine and Israel-Palestine-Iran situation are making people speculate about the possibility of World War 3 – hopefully, cooler heads prevail.

Lastly, this summer, we will have the Olympic Games, during which people all around the world will cheer for their countries.

Therefore, we see some national narratives emerging. We looked at the market, and we see the USA as a potential candidate to win in this category (at least as a meme…)

- Name: American Coin

- Mcap: $16m

- Number of holders: almost 10k

- TG and Twitter following: 1.5k and 3k

- Contract address: 69kdRLyP5DTRkpHraaSZAQbWmAwzF9guKjZfzMXzcbAs

- Targets: Initial targets are $100m

Technical analysis

American coin is currently finding support in a range, but there are a few concerns underlying its movement. First, the price action is extremely weak following a massive 60% correction. Now, while the USA token should find recovery at its current range, the long-term order block right below the support range can also be tested.

The token needs to display bullish strength in order for buying pressure to come in, and with the volatility surrounding such assets, it can happen within a few hours.

How to buy:

- Go to Jupiter

- Insert contact address in the "To receive" section: 69kdRLyP5DTRkpHraaSZAQbWmAwzF9guKjZfzMXzcbAs

- Execute the swap

- Have fun

Cryptonary's take

Many VCs and influencers are jumping into the meme wagon to launch sketchy coins. They are using many covert and overt to take advantage of communities. But remember: this is the people's memecoin supercycle, not the VCs.Therefore, we recommend that you stay in the organic camp where memes compete for attention fairly and transparently. If you aren't in any of the established coins by now, WIF, POPCAT, TREMP, and BODEN – you are probably late to the party.

However, the emerging categories may provide you with an opportunity to catch the last flight. We believe that Poowel and USA still have a decent shot of catching a bid and delivering outstanding returns, and your odds with them are much better than what you'll get from any of the corporate memecoins. But keep in mind that these are still memecoins and can go to 0. Invest only what you can afford to lose.

If you already spot positions in the established coins, the most important thing is that you don't yield to the VCs.

This is the people's memecoin supercycle; don't play into the hands of VCs.

Cryptonary, OUT