Cosmos | Deep Dive

We have covered Cosmos in the past; however, that coverage has never been fully in-depth. There were a few aspects that put us off – especially throughout our coverage of the cross-chain comms sector, where we were looking for value accrual. Yes, we did mention Cosmos, but it was not one of our top picks.

Why?

The ATOM tokenomics - pure and simple. Chains built using Cosmos infrastructure generally have their own validators and their own native asset securing the network – not ideal for ATOM value accrual.

However, in the last few weeks, new developments have meant that we will now be re-evaluating our thesis on Cosmos; here are our findings!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

What exactly is Cosmos?

Most other blockchains and ecosystems are quite clear-cut; they have a base layer on which DApps are built, and that base layer handles security and execution. However, the Cosmos ecosystem is not as cut and dried as this. There are many components that make up Cosmos - many moving parts. Before we get into details, let’s try and summarise Cosmos at the most basic level.

Cosmos is more of a network than a single blockchain, for example, Solana or Ethereum. Self-described as a network of decentralised, independent, scalable, and interoperable blockchains enabled by the Cosmos Software Development Kit (Cosmos SDK). Each blockchain created using the Cosmos infrastructure is completely customisable for specific use cases and connected to all other chains on the network through the Cosmos Inter-blockchain Communications Protocol (IBC). In this sense, Cosmos is an “Internet of Blockchains”.

Created with the purpose of solving the interoperability problem (the largest issue in crypto right now!), Cosmos, along with Polkadot, were among the first projects to seriously consider solutions to the lack of communication between chains – the Cosmos whitepaper was published in 2016. The solution that was implemented is quite arguably one of the most robust and extensive solutions out there. The Cosmos network consists of three main components:

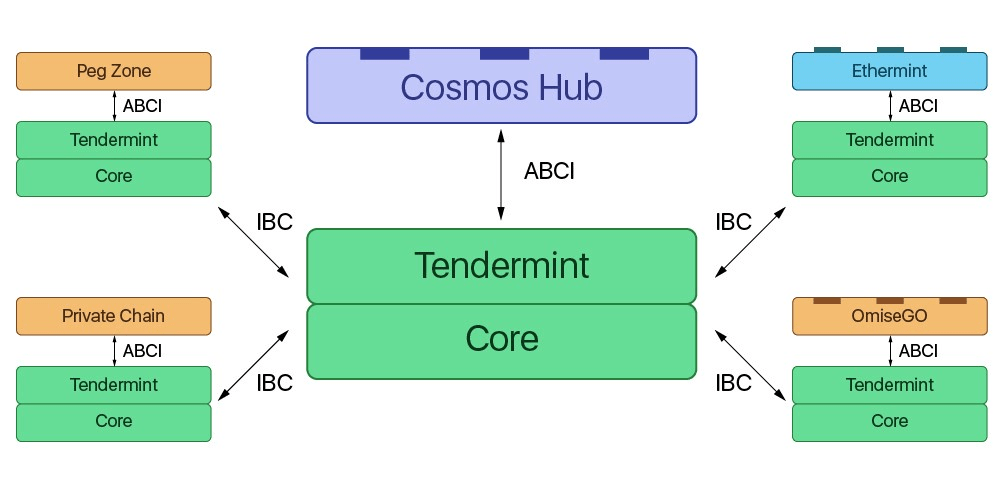

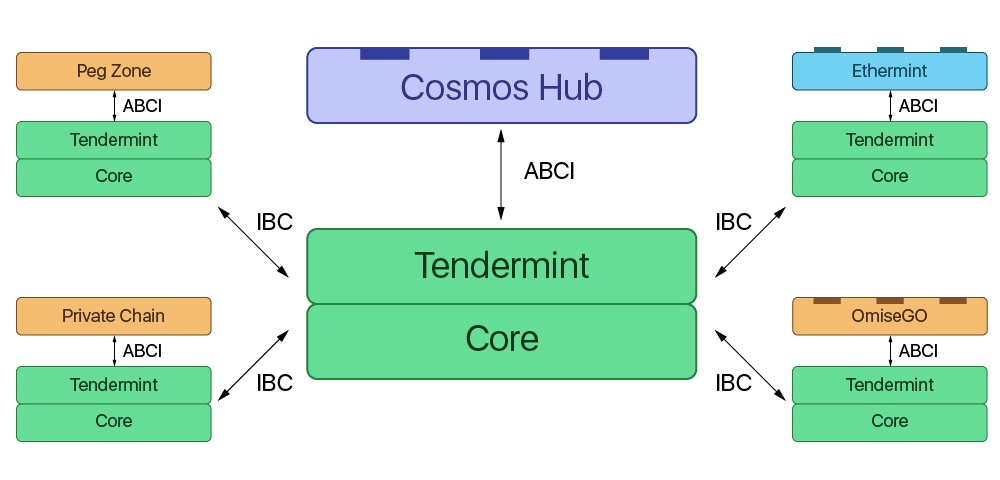

- Tendermint Core – essentially connects the network to the consensus layer (Cosmos Hub).

- Application Blockchain Interface (ABCI) – this allows developers to program part of their custom blockchain in basically any programming language. ABCI connects the Tendermint Core with the Cosmos SDK.

- Cosmos SDK – a Software Development Kit for reducing the complexity of creating blockchains and DApps on the Cosmos network allowing developers to focus on the actual application rather than infrastructure design.

Chains maintain their own sovereignty and can effectively operate independently of other chains on the network (validating their own transactions), which means that there is not a heavy load on any individual consensus layer. In this way, Cosmos also solves the scalability issues inherent in other congested blockchains.

Cosmos Zones & Hubs

With the potential for hundreds or even thousands of blockchains to be built using the Cosmos infrastructure in the future, there must be a way to separate the workload so that there is no single point for the load to accumulate and slow everything down. Cosmos utilises a modular construction whereby the work is spread out amongst Hubs and Zones:- Zones are regular blockchains/protocols built on the Cosmos infrastructure.

- Hubs (there can be more than one) are blockchains specifically designed to connect Zones together.

This is an overview of the Cosmos network. As you can see, the Zones (second and third tiers of the circle) have only a few connections to the inner parts of the network. The utility or purpose of each Zone essentially dictates what connections, to what other zones, and which Hubs, are necessary. This adds a level of efficiency to the network – network capacity is never really wasted because resources are diverted exactly where they need to be.

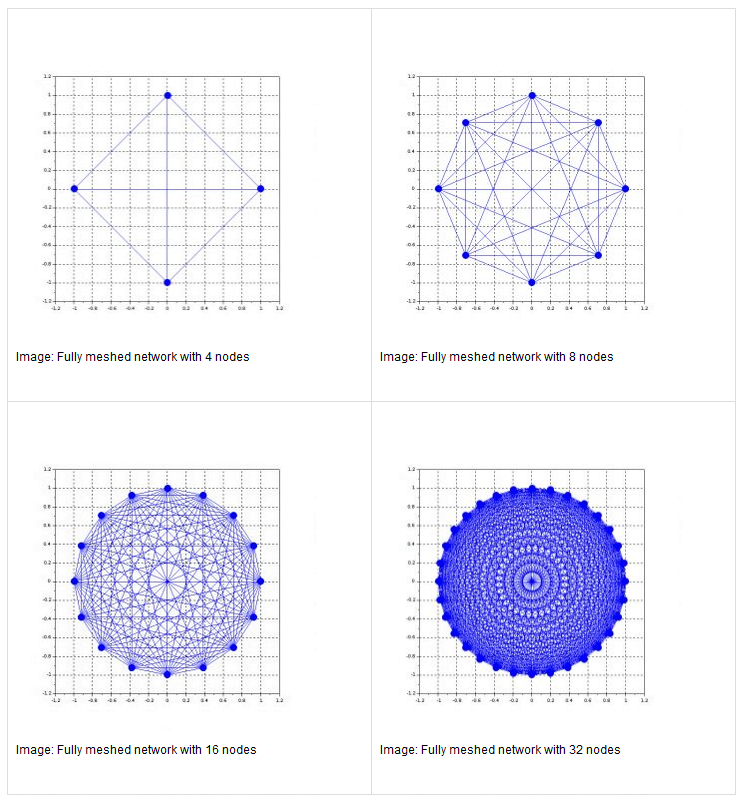

However, when we highlight the Cosmos Hub, we can see that all the “core” infrastructures, or blockchains, of the Cosmos network, are connected to the Cosmos Hub, with everything else indirectly connected through the Hubs. If each Zone had to establish a connection to every other Zone, there would be an exponentially growing number of connections with every Zone added to the network.

Looks ridiculous, doesn’t it? That is what Zones and Hubs are for – to avoid this huge inefficiency. Have a play around with this tool here and see which Zones are connected to what!

IBC

At the core of the communications between these chains is the Cosmos IBC. The IBC allows blockchains that may have different validators and different applications to be interoperable with each other. There really isn’t any other blockchain infrastructure that allows this kind of interoperability.

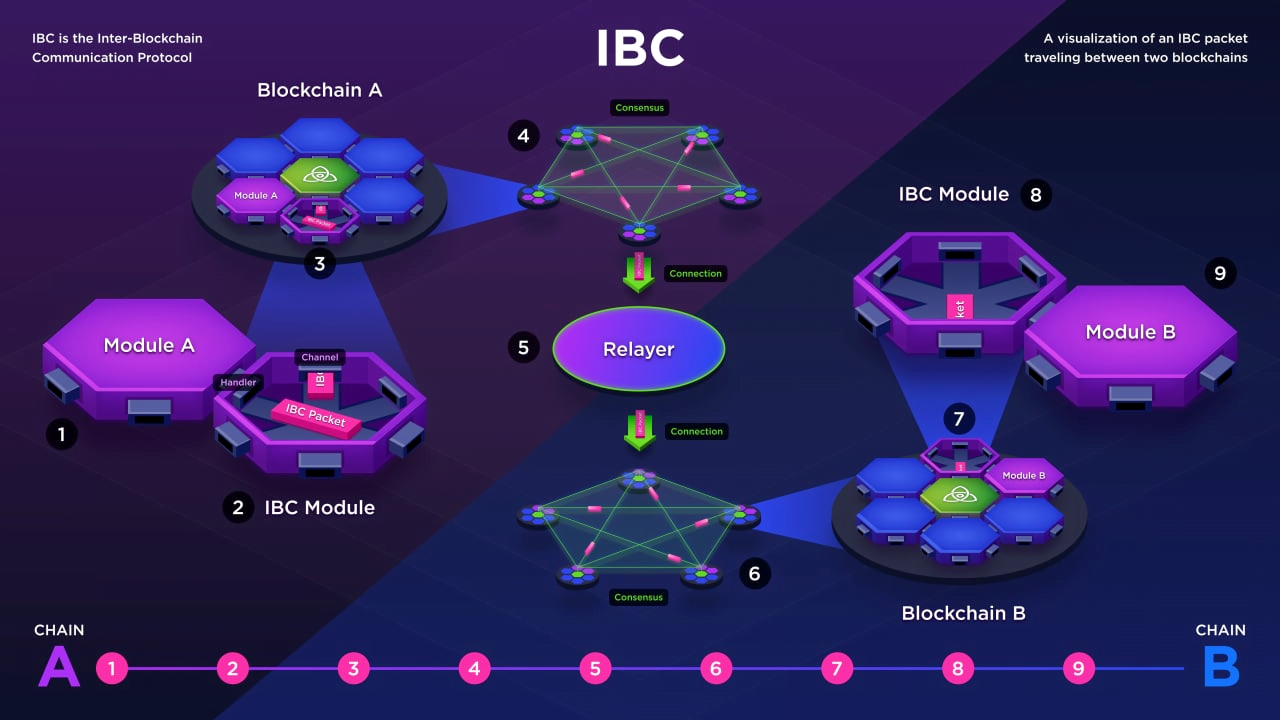

Going back to the image, the IBC protocol is possible because of the instant finality of Tendermint consensus (which is the core for any Cosmos SDK developed chain). Every chain connected through the IBC basically runs a light-client (not a full node) of every other chain, which allows them to track each other’s transactions. We’ll do a simplified example of a transfer of 5 ATOM tokens to illustrate how this works:

- Bonding - IBC transfer initiated, with the 5 ATOM locked on the sending chain.

- Proof Relay - Proof is sent from the sending chain to the receiving chain that the 5 ATOM tokens are locked.

- Validation – The proof is verified against the data from the sending chain, and 5 ATOM “vouchers” are created on the receiving chain.

The same process is true for messages or data – if the information or data is valid on one chain, it is valid on all other IBC-connected chains.

But can Cosmos connect to non-Tendermint chains? It certainly can!

Communications for All

As stated above, the fast-finality feature of Tendermint chains is what makes IBC possible for Cosmos SDK-implemented blockchains. However, before we go any further, we should probably define what fast-finality means.Simply put, finality means that once a transaction has been validated and added to a ledger, it can’t be changed. It is final; it cannot be reversed – that transaction is on the blockchain forever and cannot be undone.

Have you ever wondered why, for example, when you are withdrawing crypto from an exchange, there are a certain number of confirmations that have to be registered before the withdrawal is accepted? That’s finality.

Fast-finality means that these confirmations happen quickly. IBC is good at connecting such blockchains together – hence the preference for Tendermint chains. However, for blockchains that have slower finality, another layer must be added for IBC to make the connection.

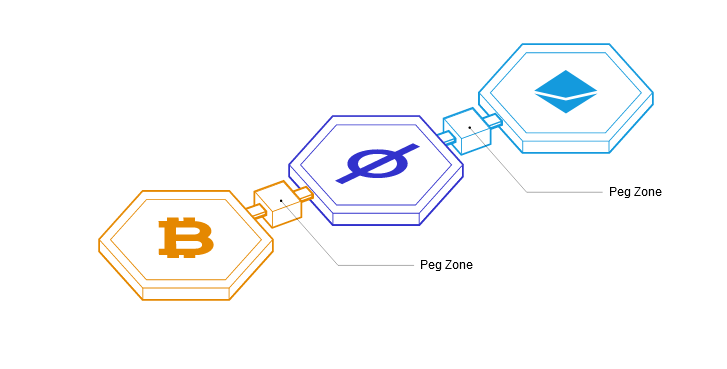

For connecting to Proof-of-Work chains like Bitcoin (that have slower finality), that intermediate chain is called a Peg-Zone, and has fast-finality and is therefore compatible with IBC. The Peg-Zone tracks the state of another, slower blockchain and establishes a “finality threshold”. This is essentially a certain number of blocks from the slower finality chain – it monitors blocks produced and determines when the transaction can be considered “final”.

Once a certain number of blocks have been produced on the PoW chain, the transactions are considered final and can be processed by the IBC in the same way outlined in the previous section. In this sense, IBC and the Peg-Zone chain act much the same as any other bridge. The easiest way to wrap your head around this is to picture the Peg-Zone as a buffer!

ATOM 2.0

The ATOM token is the native token for the Cosmos Hub (CH), used for securing the CH through a Proof-of-Stake consensus, paying transaction fees, and network governance. A few weeks ago, this would be where the utility stops, and there wouldn’t be much to mention other than the market cap ($3.7 billion), circulating supply (286.3 million), max supply (uncapped), and emissions (varies 7-20%).However, the tokenomics are set to change with the introduction of ATOM 2.0, so we’ll jump right into that. This is one of the main reasons for the deep dive, and we believe warrants a change in our perspective of ATOM and the wider ecosystem.

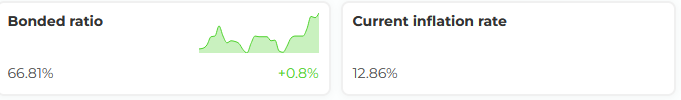

The most obvious, direct effect that ATOM 2.0 will have is on ATOM emissions. At present, ATOM has yearly emissions of anywhere between 7% and 20% depending on the quantity of ATOM staked securing the network.

Now, obviously, the long-term effect of this is significant inflation of the supply over time which inevitably caps any price growth, if not outright pushes the price down. Also, this number is exponential because the 7-20% variable doesn’t change. What we mean by this is that the minimum emissions for ATOM at present are 7% if most of the tokens were staked.

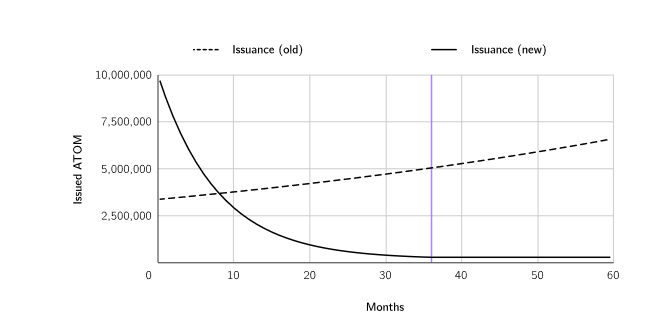

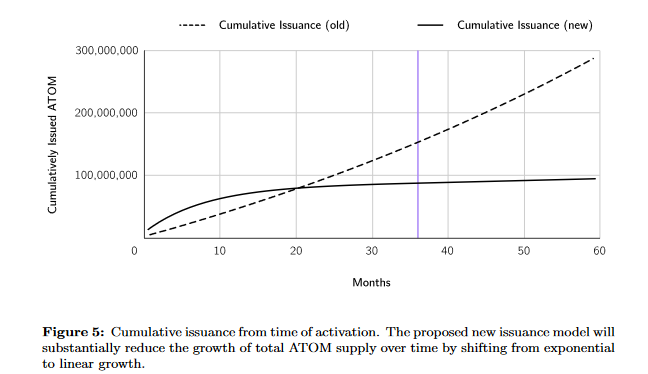

Looking at the new model:

We can see that over time, the newly issued ATOM (i.e. base emissions) would trend down to a fixed 0.1% per year after 36 months. Obviously, this is a huge improvement on the current model. As the chart below shows, the emissions would move away from the exponential model in place now to a linear model:

With the huge drop in emissions, there must be something in place to incentivise validators to continue processing transactions – right?!

Interchain Security

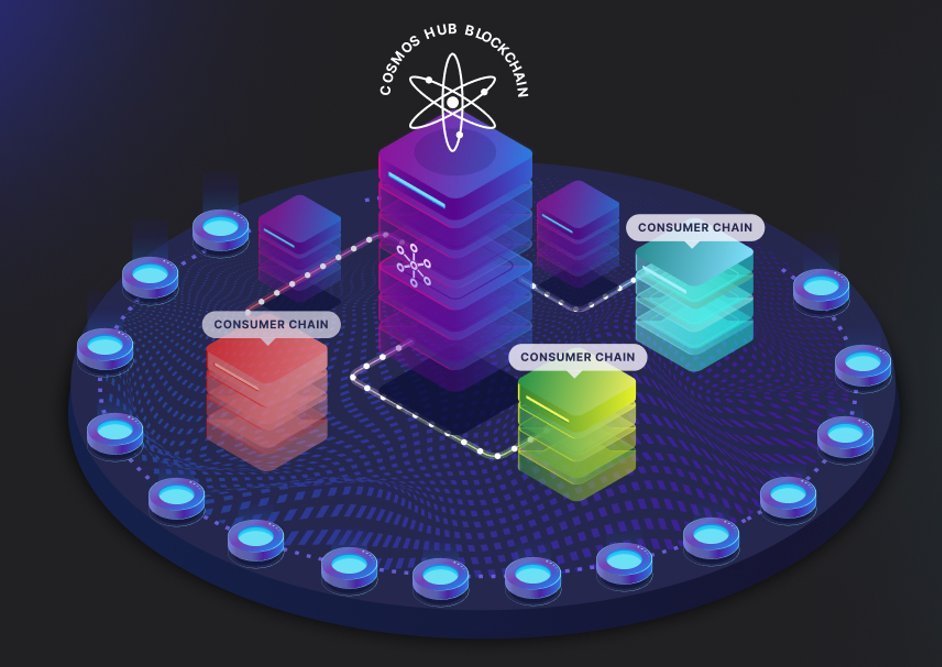

With this upgrade, the Cosmos Hub will be able to produce blocks for other blockchains in the Cosmos ecosystem.

Interchain Security implements a security model similar to that used by Polkadot and its Parachains. Developers will be able to launch a chain (consumer chain) that is secured by the validators already present in the Cosmos Hub, saving them time and engineering resources that would otherwise be used to maintain their own validator set and make development on the Cosmos Network even simpler.

This should provide not only significantly more traffic on the Cosmos Hub (meaning more fees for validators and their delegators, paid in both ATOM and the native token of the tx) but also allow new chains and DApps to expedite their launch without having to worry about decentralizing validators and boosting their token value to outpace TVL (something necessary to prevent a 51% attack from becoming profitable in early-stage development).

The original ATOM emissions schedule would be reinstated if the revenue generated by Interchain Security was not enough to incentivize validators. You’ll notice in the new emissions schedule for ATOM 2.0 the 36-month period is more than enough time to tweak and modify before the changes become significant. This process would be reversed if it proved dangerous to the integrity of the network.

There are another couple of features outlined in the ATOM 2.0 Whitepaper:

- Interchain Scheduler – essentially an MEV solution that aims to decentralise the MEV process and create a marketplace for blockspace, issuing NFTs as a representation. MEV (Maximal Extractable Value) is beyond the scope of this report. TLDR; MEV is profits that can be made by validators by re-ordering transactions within a block whilst it is being produced.

- Interchain Allocator – creating economic coordination and alignment across the Cosmos network through agreements between IBC blockchains and entities, such as mutual stakeholding, reserve rebalancing, participating in each other’s governance, etc. The key point here is that ATOM would become the Cosmos Network’s “reserve” currency, similar to the place the US Dollar has in TradFi.

- Governance Stack – a governance superstructure for the Cosmos Network that would have much the same function as the allocator (cooperation), except would be more like the United Nations in TradFi than the USD - a council of DAOs.

This is essentially a sudden supply shock which will most likely wreck the price short term. However, would likely provide a decent entry opportunity as inflation rapidly decreases thereafter. The proposal is still under discussion, and certain variables, such as how much consumer chains would be charged in fees, are still to be clarified etc.

Voting is set for the 26th of October 2022 – we will keep members updated with any further developments or important points. For those who wish to follow the conversation, please check the forum here.

Conclusions

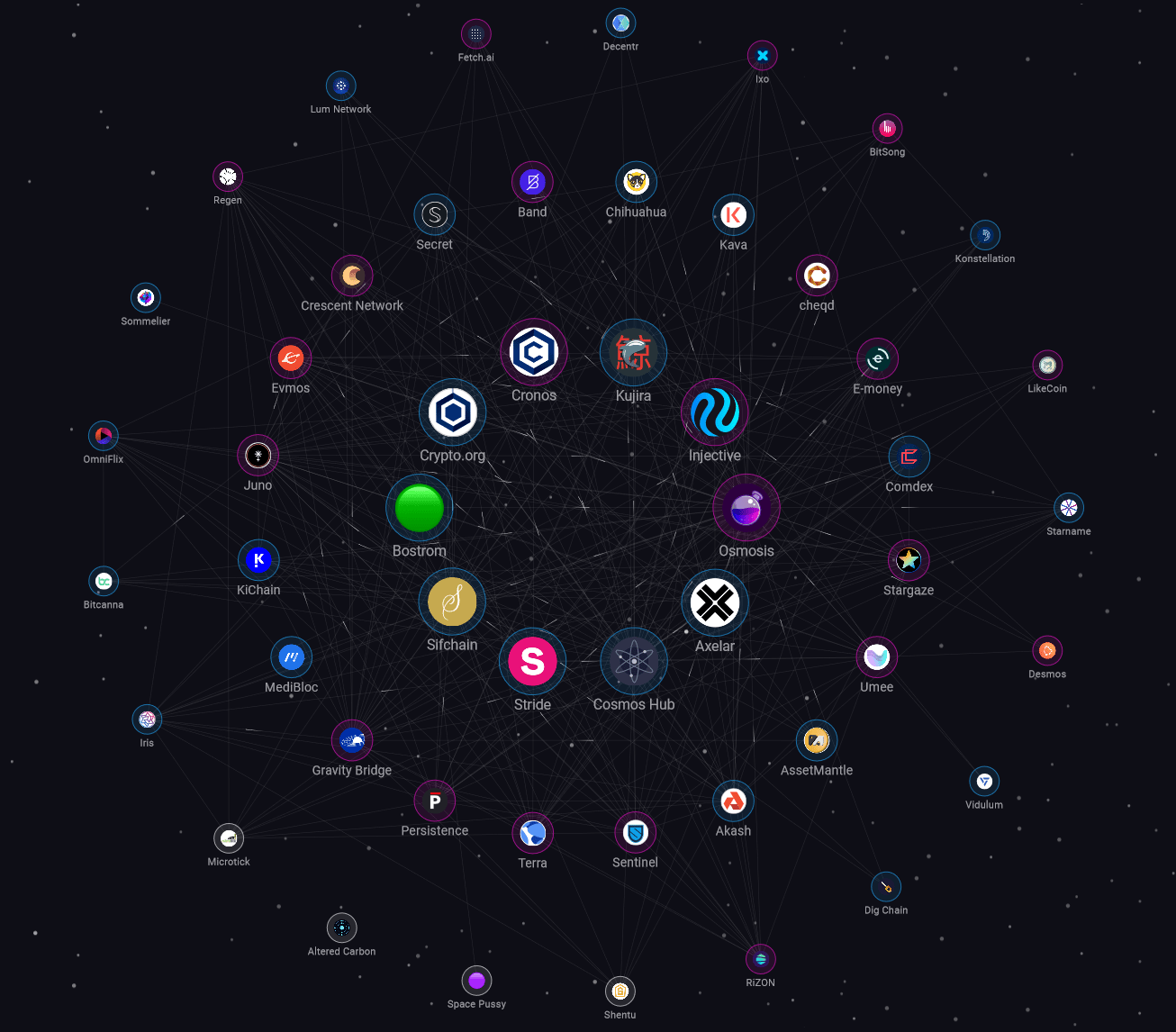

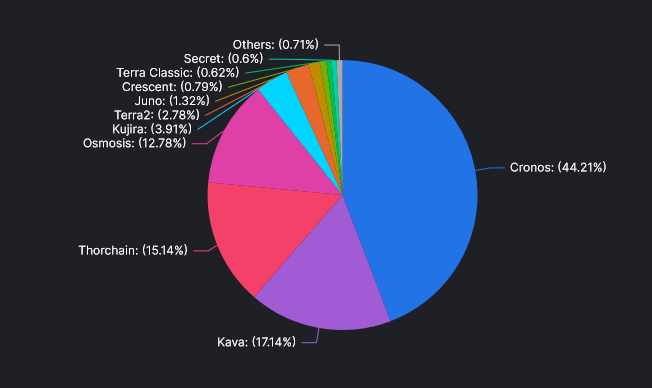

The Cosmos Network has a huge reach, and there are many projects that most would not know were part of the Cosmos Ecosystem without diving a bit deeper – THORChain, for example!

Boasting a TVL of well over $17 billion at peak, the Cosmos Network is hugely underrecognized due to the decentralised distribution of the projects that are built using the Cosmos SDK. In terms of the outlook, we believe that if the ATOM 2.0 upgrades pass voting and are implemented, there is significant future upside for the ATOM token itself when full bull mode returns.

In the mid-term, the protocols built using the Cosmos infrastructure have higher upside potential owing to significantly lower market capitalisations. However, we cannot ignore the potential for Cosmos Hub (and the ATOM token) to become another ecosystem within an ecosystem.

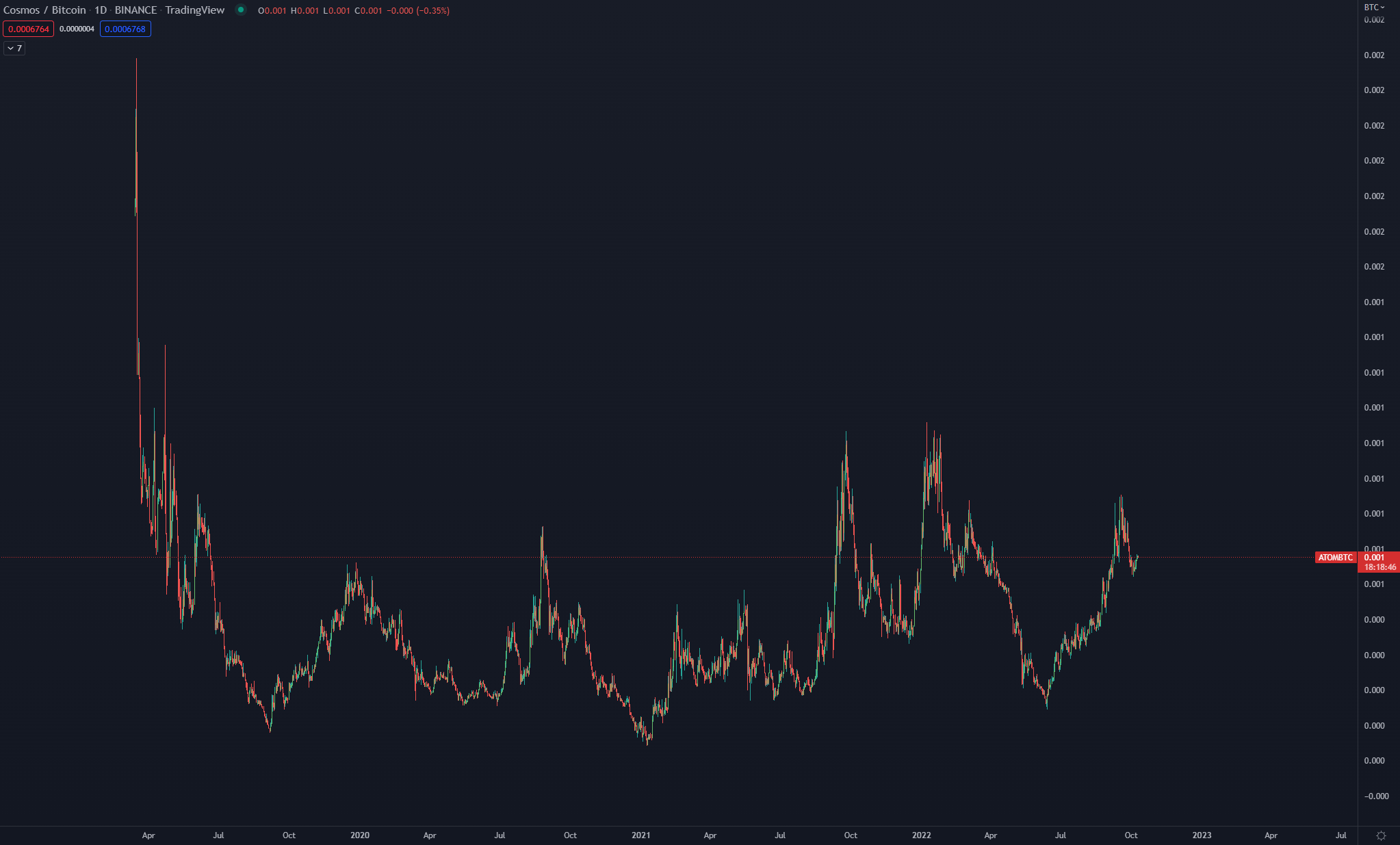

If we look at the ATOM/BTC chart, we can see just how damaging the current tokenomics have been on the price action of ATOM over the previous 2-3 years. Where most other altcoins pulled 5-10x on the BTC chart, ATOM has remained relatively steady. This is a combination of excessive inflation and, quite frankly, zero utility outside of securing the relatively low-traffic Cosmos Hub.

Obviously, tokenomics are a sticking point here, and with a solution in sight, we are of the opinion that ATOM will no longer be “lagging” other assets in growth. Ideally, we would like to see more ATOM usage throughout the ecosystem, even if the ATOM 2.0 proposal doesn’t pass or a revised version passes with less emphasis on emissions. With the number of projects built using Cosmos infrastructure, there is huge potential for ATOM if some form of utility over and above network security can be implemented.

We look forward to following the ATOM 2.0 votes, and we will keep members updated with any further developments going forward!