Why you should read this report

- When the going gets tough, the tough cut their losses. We're parting ways with nine assets that have failed to live up to expectations.

- You'll see how even the best-laid plans can go awry when protocols don’t adopt retail-friendly tokenomics.

- Explore how, despite their innovative potential, two promising projects became unlikely casualties of tepid market reception.

- Sometimes, the hardest decision is letting go to free up capital for the next big thing.

- Discover the challenges of cutting underperforming assets and why emotional attachment can hinder your portfolio's agility. Are you ready to let go when it's time to sell?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

NOM

The original thesis for the Onomy protocol was that it could bring the FOREX market on-chain by implementing a reserve system that would back a basket of on-chain fiat derivatives.Why are we removing NOM?

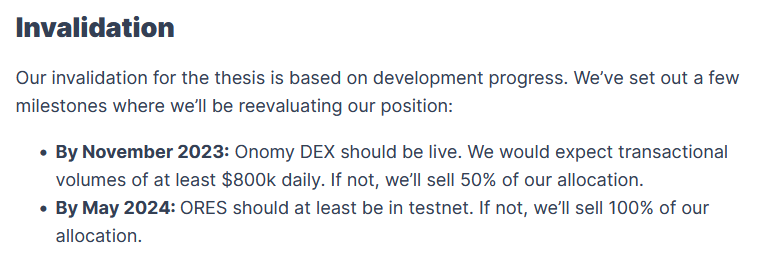

Simply put, they’re taking far too long to implement what they set out to do. Additionally, when not backed by a working product, the bonding curve token release schedule has been detrimental to price action.

This is a clear-cut invalidation we outlined in the initial report.

GH0ST

GH0ST was always going to be a wildcard. The launch of SPL-22 on Solana earlier this year did not give us many options in terms of how we could capitalise on the new token standard, mostly because in March, very few projects were using the standard. GH0ST was one of the first to launch as a showcase.Unfortunately, the collection and the token have not received the attention we had expected. The chart is dead and unlikely to recover. Between the lack of underlying value accrual mechanisms and a dead chart, GH0ST is out.

DYDX

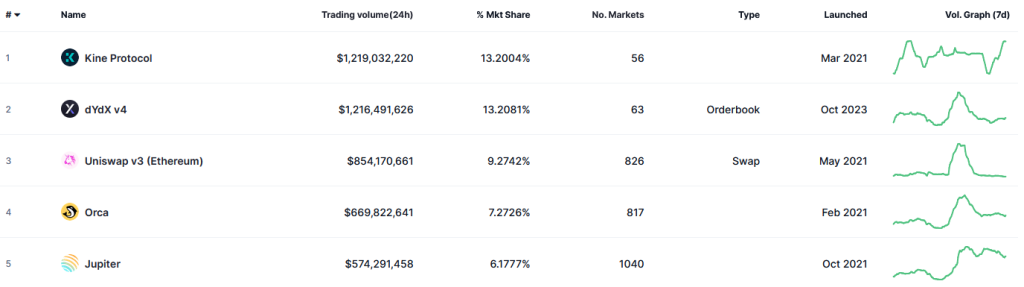

dYdX is a premium decentralised derivatives exchange and a successful one at that.

It has consistently topped the top DEXs by volume since its launch.

However, its token DYDX has not lived up to the same expectations. After a headline-grabbing airdrop launch in October 2021, holders have been disappointed by poor tokenomics and relentless unlocks.

Again, the situation is unlikely to improve, and scores of DYDX hit the market every minute. Since the second the airdrop went live, it has been down only for DYDX.

We have given the token more than enough time to recover some ground. Ultimately, we got DYDX for free as part of the airdrop, so we’re happy to drop it here in favour of newer protocols with more solid tokenomics.

DITH

DITH was one of those assets that could have gone extremely well or stagnated and been forgotten. In other words, a moonshot. Unfortunately, in this case, the latter occurred.The goal was to capitalise on the AI narrative being pushed across crypto, more specifically Solana.

- AI: Since Dither focuses on developing AI models for trading, it fits an AI narrative

- Memecoins: The platform also focuses on developing AI models to trade memecoins. Hence, if memecoins start getting crazy again, DITH will most certainly catch some of the momentum.

- Telegram bots: Dither's Telegram bot enables users to access a wide range of trading features and functionalities. Additionally, bots like BONKbot and UniBot are integrating it as a backend.

- Prediction markets: Dither focuses mainly on predicting certain outcomes based on historical data. This places Dither to benefit from the prediction markets narrative if, for example, Polymarket and other prediction markets get traction.

With DITH, it is more a case of opportunity cost than something the team or protocol has done wrong. DITH will still be on our radar for future thesis, but in terms of focusing investments, it is not worth covering regularly at the moment.

DITH tokenomics are relatively weak and rely on sign-ups to the SeerBot. Those signups haven’t come through. So, although the case could be made that we were too early, it's not worth counting pennies over in the short to mid-term.

KUJI

The Kujira network is an L1 blockchain based on the Cosmos ecosystem. It offers a host of DeFi applications for its users.One of the most attractive attributes of KUJI was the tokenomics.

Kujira’s economic model is based on generating revenue from products to ensure long-term adoption. The aim is to create a circular economy where participants accrue value from the platform’s success, which in turn may attract more users.

$KUJI is the native token of the Kujira network, and it has excellent tokenomics.

The network has a total supply of 122.4 million tokens, which was originally 150 million. Currently, the entire total supply is in circulation, meaning KUJI carries zero inflation pressure. The emission schedule was concluded in November 2023, which was one of the catalysts for its previous price action.

Now, with the latest news that the team has “fumbled the bag” and caused a mass-liquidation event involving KUJI, this has been invalidated.

It goes to show that even supposedly professional protocols are not safe from treasury mismanagement. Quite frankly, the ordeal has been a total and irrecoverable disaster.

Our latest update on Kujira laid out a couple of options for managing any KUJI positions.

“We continue to be confident in the KUJI token, as we need to give it a chance to perform during a bullish leg environment.”

We have now had that second leg, and KUJI has done nothing but dump; it is time to go.

“However, hope is not a strategy, and the bullish strategy on KUJI is a high-risk bet that may lead to more losses. Since KUJI is at the cusp of key support, the bearish strategy also provides a chance to exit with a reduced loss, and you can reallocate the funds to other trending narratives.”

Again, it was a pretty cut-and-dry exit from KUJI.

MINA

We’ve not seen much movement as far as Mina’s development is concerned. The Mina ecosystem is practically non-existent, with projects only stating their intention to launch on Mina.And it’s impossible for projects that have expressed such intentions to launch.

Why?

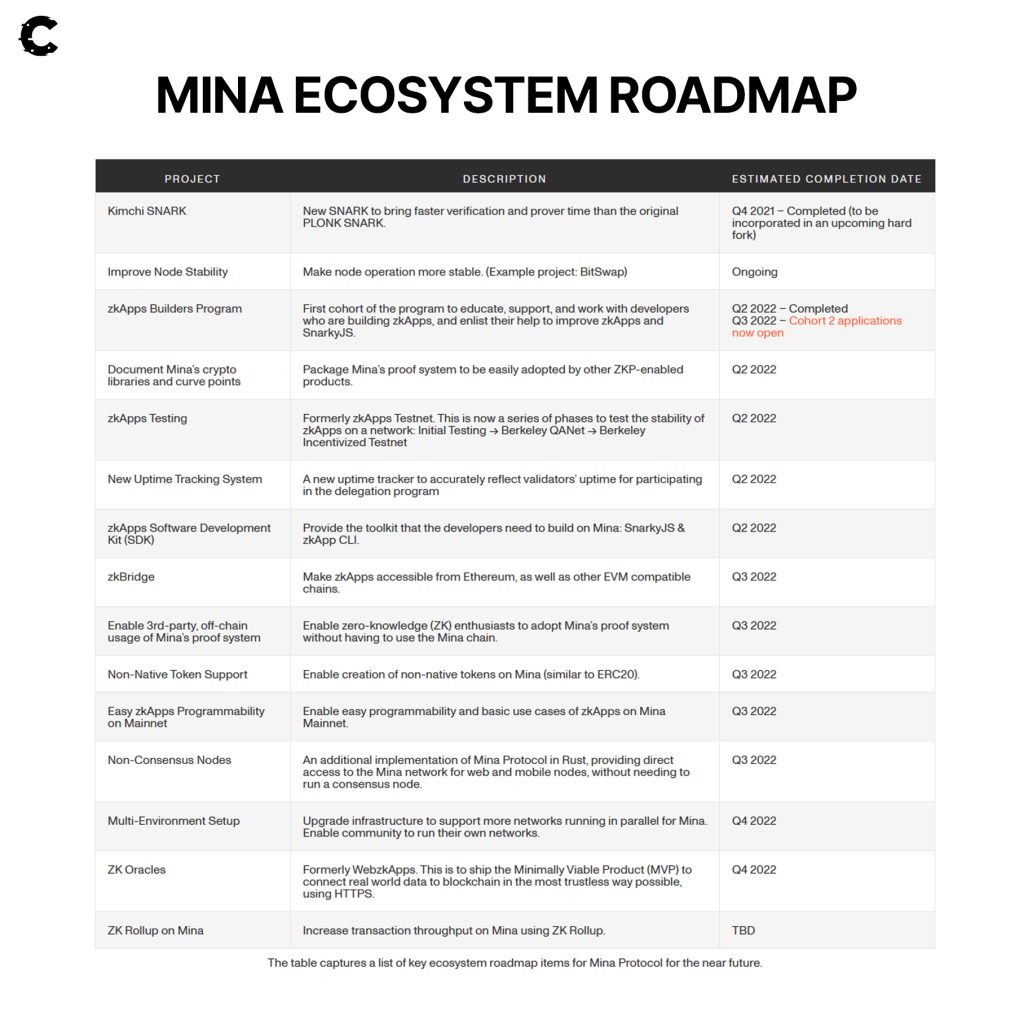

The original roadmap (below), which went up to the end of 2022, is far behind schedule.

When it comes down to the technicalities, Mina is essentially a blueprint, impressive whitepaper, beautiful website, and many promises – but certainly nothing you can use today.

The chart portrays the same story. Inflation has been detrimental to MINA's price action. Ultimately, the goal of creating a super-light blockchain that can be validated using a smartphone has not been met. The chain works, but only at a very basic level.

ARB

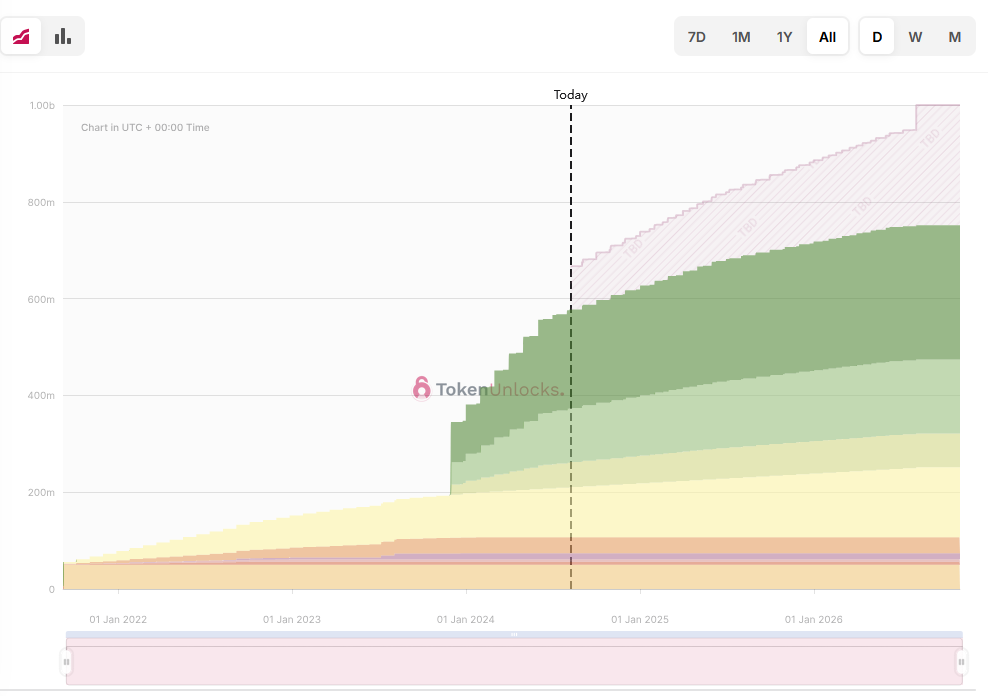

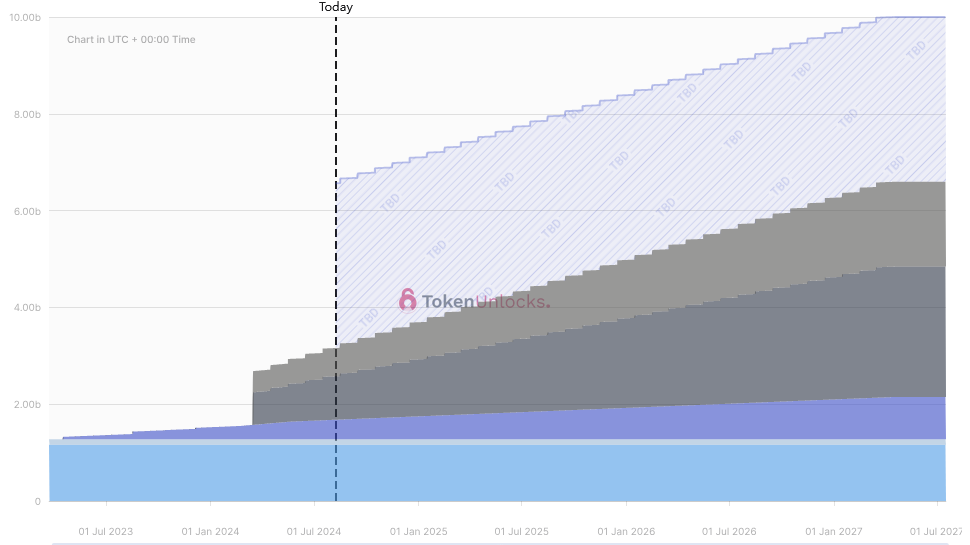

Arbitrum is an Ethereum Layer-2 protocol that we have been covering for a while.ARB has been stagnant for a while. Our reasons for removing it are not so much that it’s necessarily a poor project—that’s not what we’re saying—but that the tokenomics are not in a good place.

With a market cap of $1.7 billion and an FDV of $5.1 billion, ARB still has a lot of inflation ahead of it. Additionally, for a protocol of that size, the expected upside simply does not warrant holding on to it.

When the risks outweigh the rewards, it's time to let go of the asset. We believe that situation applies to ARB.

The unlock schedule is gruesome, and the cliff unlock earlier this year has caused havoc on price action. It is unlikely this will get better.

THOR

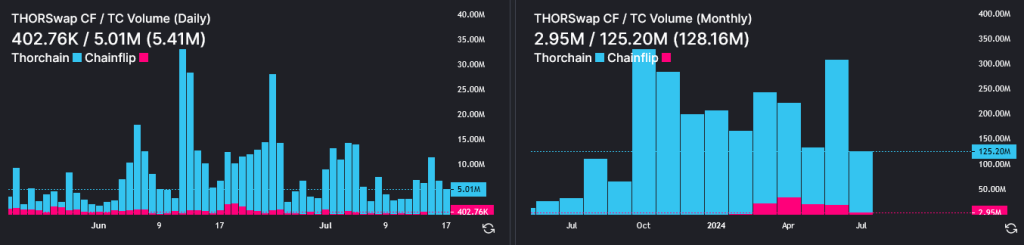

When we first backed THORSwap, the THORChain ecosystem was small. Since then, there have been many additions—new front-ends, wallets, and direct connections to the THORChain infrastructure. One of the most successful additions has been Chainflip, a cross-chain messaging/wallet protocol that uses THORChain to facilitate swapping.Although the difference is minor compared to using THORSwap, the numbers speak volumes (literally).

The fact that THORYield, the key data aggregator for the THORChain ecosystem, is now tracking THORSwap (TS)/Chainflip (CF) volume is telling. Although the ratio is small, the fact that there is now a direct competitor to THORSwap handling swaps more efficiently is cause for a revision of the THOR thesis.

Although more is needed to warrant a complete exit, we'll reduce our exposure to THOR and focus mainly on RUNE as our bet on the THORChain ecosystem.

BONK

The memecoin market on Solana has consolidated behind three major tokens - WIF, BONK and POPCAT.We called all three memes and supported them even before the rest of the crypto market embraced memes.

However, we recently labelled BONK as a corporate memecoin.WIF and POPCAT, so we feel we are obliged to make it official and drop BONK from the assets we’re watching.

We stand on the side of organic memecoins. The market cap of organic vs. corporate memes will be heavily skewed towards organic memes as we believe it is a people's market, and VC coins will fail.

Looking at our picks, WIF is the strongest chart in crypto.

Popcat has broken the billy curse to hit a billion-dollar market cap and it is on track to establish itself as a top cat coin in the market for many years.

Cryptonary’s take

As a team, we’re constantly considering and reconsidering all the assets we’ve covered to date.

It’s just as important to keep our thesis up-to-date and relevant as it is to find new assets to bring to your attention. Staying nimble, cutting losers, and ensuring the reason you bought the asset is still valid are part of everyday portfolio management as an investor.

To be clear, you won't necessarily lose money by holding on to any of these assets. But there’s an opportunity cost that’s just as expensive as holding on to a dumping asset.

We’ll continue to monitor these assets, and if a new opportunity arises, we won’t hesitate to create a new thesis.

For now, though, we’ll stop covering these assets in the foreseeable future to focus on the assets that are performing well/on track to perform.