What about the latest updates on each? And which ones we believe take off first?

Well, today's your lucky day! We're about to unpack an all-encompassing timeline of our crypto investments dating back to 2020 - you remember 2020 right? Pretty quiet, not much going on in the world. Well, we’re still here making more bets and we’re in it for the long-haul.

Like every parent though we have our favourite kids, even if we don’t admit it and it’s the same here - we think some of our assets are going to outshine the others in the short-term, and we’re about to share an all-inclusive rundown of our crypto bets. Everything. Right here, right now.

TLDR 📃

- We are bullish on every asset mentioned in this piece but we do know that some will perform better than others in the upcoming bull run. The others will need more time.

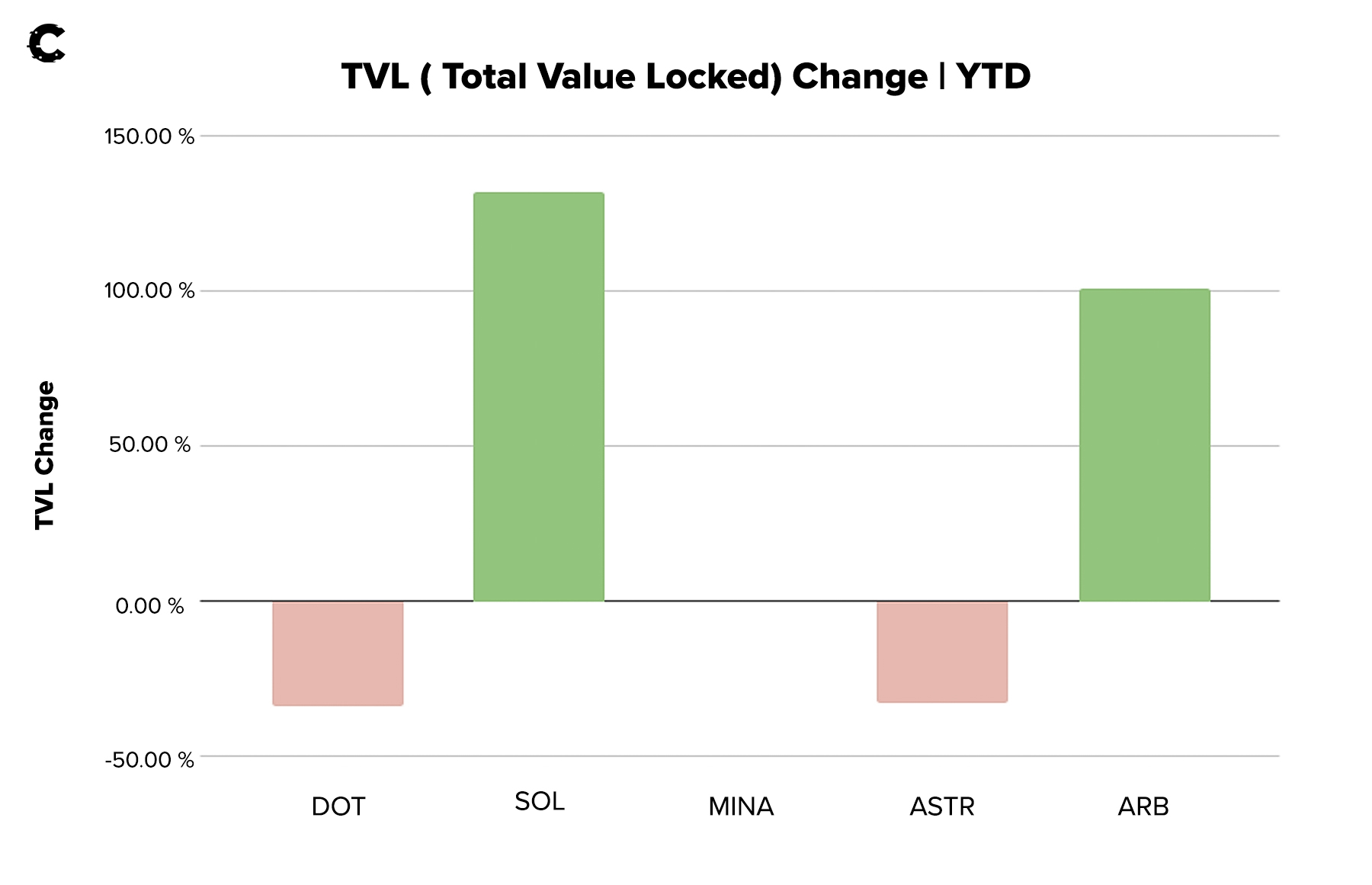

- Base layers have a lot of attention but only ARB and SOL are interesting today. DOT, MINA and ASTR will have their time but that time isn’t today.

- Infrastructure is the hottest sector with three outperformers: LDO, FXS and RPL.

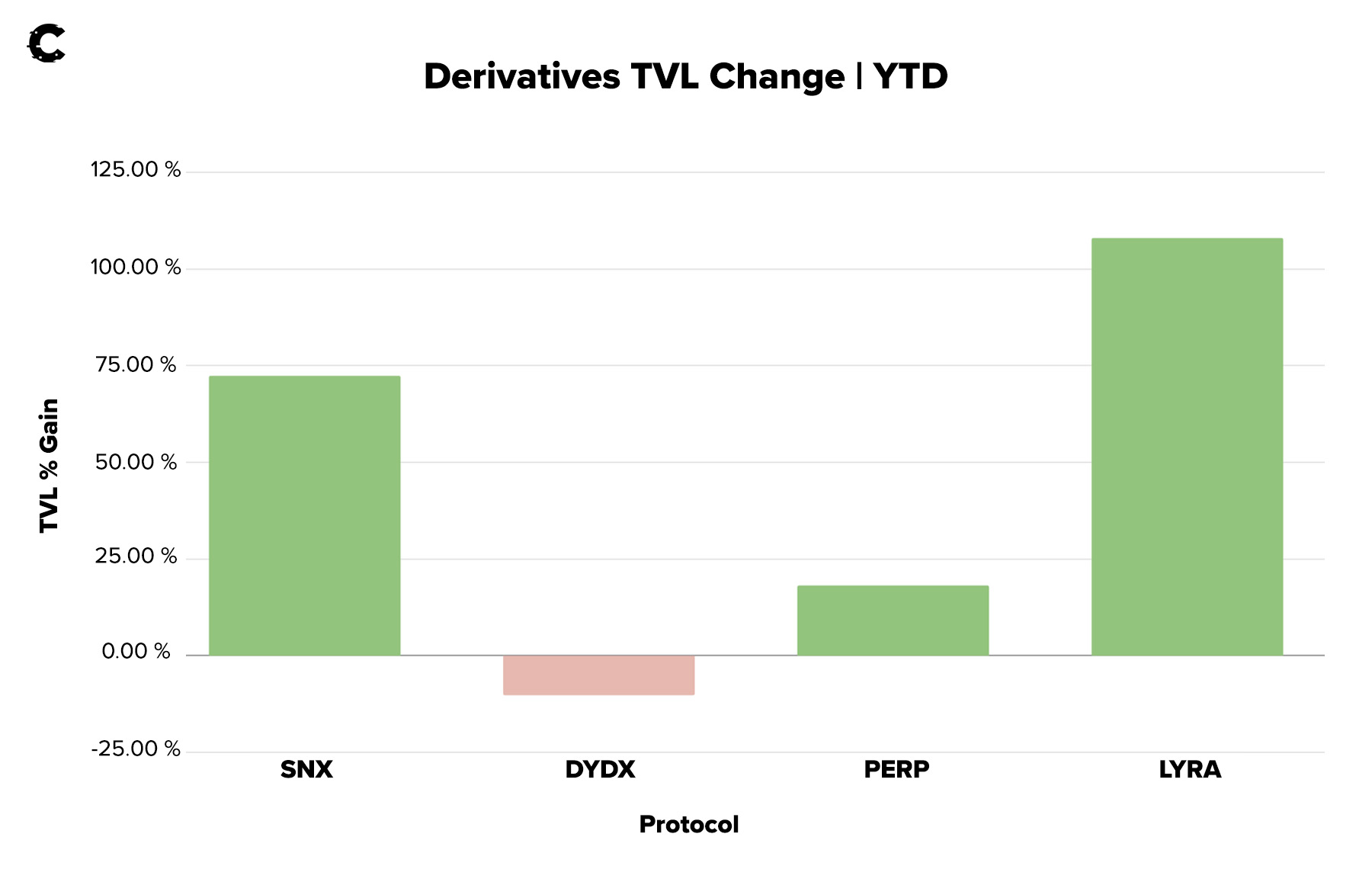

- Derivatives are third in line after ARB/SOL and Infrastructure, specifically SNX, DYDX and PERP. LYRA will need more time.

- Cross-chain comms, DEXs and Web3 VCs are all sectors we’re very bullish on but they’re unlikely to be the outperformers - we still hold some though!

- If we had to choose a small list today, it’d be ARB, LDO, FXS and RPL.

- Mark June 3rd! We're dissecting all these assets in a chart analysis on our Discord. Don’t miss it!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility.

Base layers 🌃

DOT, SOL, MINA, ASTR, ARB

Imagine "Base Layers" as the foundational soil for futuristic cities, shaping their blueprint, capacity, and unique allure.Just as betting on real estate in popular cities can yield high returns, investing in the right base layers could result in similar windfalls. Ethereum has already emerged as the Manhattan of crypto, but what's next? What will be the Dubai, London, Hong Kong, or Monaco of this digital realm?

That's what we're striving to figure out and we've placed our bets on Polkadot, Solana, Mina, Astar, and Arbitrum. So, let's dive into how they're faring and whether we still have faith in them.

We gauge a city's potential by the capital flowing into it – just like Dubai wouldn't be its dazzling self without investment. That's why we're observing the capital influx (% change) into these blockchain 'cities'. The leading performers are Arbitrum and Solana.

While Solana may boast superior performance, it's crucial to remember its price rebound after the FTX debacle, catapulting its TVL. Without this bumpy ride, Solana would be behind Arbitrum.

Right now, Arbitrum is the city everyone's talking about. It's buzzing! Solana is playing catch-up, post-crisis, rebuilding to attract both tourists (retail players) and corporations (institutions) gradually.

As for Polkadot, Astar and Mina, they're still being built. We believe in their potential, but it's crucial to remember, not all cities rise at the same pace. Patience, their time will come.

- Arbitrum: The Arbitrum universe is expanding, with Circle revealing their native USDC launch. For a recent deep dive on ARB, click here.

- Solana: Solana is betting big on AI! The integration with ChatGPT has made quite a splash. For the latest intel on Solana, visit our freshest report here.

- Astar: Dubbed the Asian gem of the Polkadot kingdom, Astar keeps impressing. A proposal to amplify ASTR's already robust tokenomics is on the table - learn more here.

- Polkadot: Though battling rivals like Cosmos and emerging cross-comm protocols like LayerZero, Polkadot remains a cornerstone in our base-layer roster, thanks to hosting an array of utility-rich chains (including Astar).

- Mina: Progress on Mina has been slower than expected. However, zkSNARK tech is complicated to build (and key) - once Mina shifts from incentivised testnets to full functionality, we anticipate it will be a hotspot for cutting-edge developments in this field.

Betting on the right infrastructure 🪜

LDO, FXS, RPL

Think of each city's token as your ticket to bolster its security - a process we lovingly refer to as staking. The best part? You get paid to secure your own city.

But let's be real, for most people, staking isn't a walk in the park. That's where a third-party solution comes to the rescue. All these 'cities' offer or are soon to offer staking services. But let's focus on the Big Apple of the bunch - Manhattan (a.k.a Ethereum) - where most of the capital lies.

These staking facilitators take a small cut for doing the heavy lifting, allowing you to earn passively. It's no wonder they're among the top revenue-earning applications in the crypto world.

We're backing three potential powerhouses here: Lido, Frax Finance, and Rocketpool. When sizing up these contenders, our yardstick is the number of Manhattan's keys (ETH tokens) people have entrusted them with and the growth in that number since the year kicked off.

Don't be misled by the numbered list below. Each of these businesses is currently highly relevant, and we believe they're poised to outperform in the forthcoming bull market (hopefully happens soon).

- Lido: Lido continues to reign supreme in the liquid staking market, proudly holding 32% of the total ETH staked on Ethereum. The latest proposal includes a method of adding more utility to LDO - staking, with the yield coming from protocol revenue.

- Frax: Starting from virtually nothing, Frax has surged to the third spot in the decentralised staking market cap. The ETH staked in Frax has nearly 10x'd since the year's beginning. Given its top-notch yield on staked ETH, we expect Frax to keep gaining market share at an impressive pace.

- Rocketpool: RocketPool is living up to its explosive name, luring a significant chunk of new ETH staking participants. As the ETH liquid staking market broadens, RocketPool is strategically positioned to draw in new validators, thanks to its lower entry requirements (8 ETH compared to the hefty 32 ETH).

Cross-chain communications 🛣️

RUNE, THOR, SYN, STG

So, you have your cities (base layers), right? But without proper routes to connect them, they're like isolated islands. This is where cross-chain communications come into play, acting as the vital interconnecting highways and roads of the crypto universe.

Now, these highways aren't free to roam. Imagine every cross-chain transaction as a road trip - each trip comes with a toll fee, much like Salik in the UAE or EZPass in New York. These fees serve as a form of revenue for those who maintain the infrastructure.

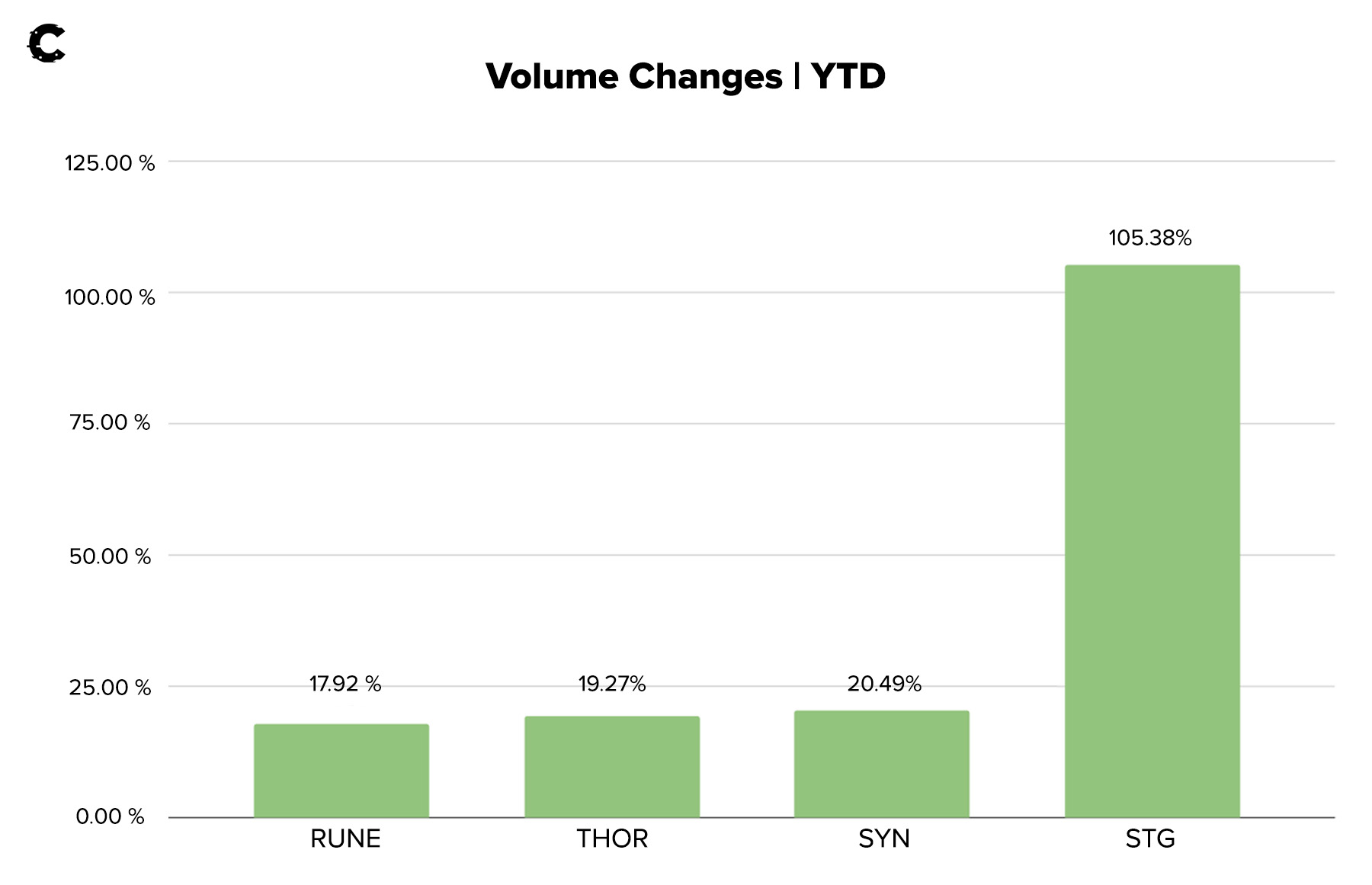

With the rise of new cities, these will become relevant very soon. Let’s analyse how each performed by seeing how much value has passed through these roads.

Now, here’s our ranking and the updates for each:

- RUNE: THORChain has had a slow start following a tumultuous 2022. Given that cross-chain solutions aren't the talk of the town right now, swap volumes have dipped. However, with lending on the cards, RUNE is set to gain more utility - THORChain is rapidly morphing into a cross-chain bank.

- THOR: Tied to the fate of THORChain, THORSwap has seen a notable drop in token inflation. THOR stakers directly reap benefits from protocol revenue, so as volumes on the THORChain ecosystem bounce back, THOR is well-positioned to profit.

- SYN: The eagerly-awaited Synapse chain is just around the corner, as developers announced they're on the home stretch of implementing the Synapse cross-chain messaging system.

- STG: Stargate volumes have witnessed a substantial surge as users aim to qualify for the LayerZero airdrop. Beyond that, Stargate has secured its spot as a top pick for cross-border asset transfers between ecosystems.

Decentralised exchanges 🏪

VELO, LIT, NOM

Picture this: every city has its bustling markets - supermarkets, farmers' markets, and so on. Now, what if a single place handled the lion's share of transactions? In the crypto world, we have these hubs, and we call them decentralised exchanges (DEXs).

While the heavy hitters like Uniswap or Sushiswap might be the go-to names, we're not looking to play it safe. We're after the trailblazers. That's why our money is on Velodrome, Bunni, and Onomy.

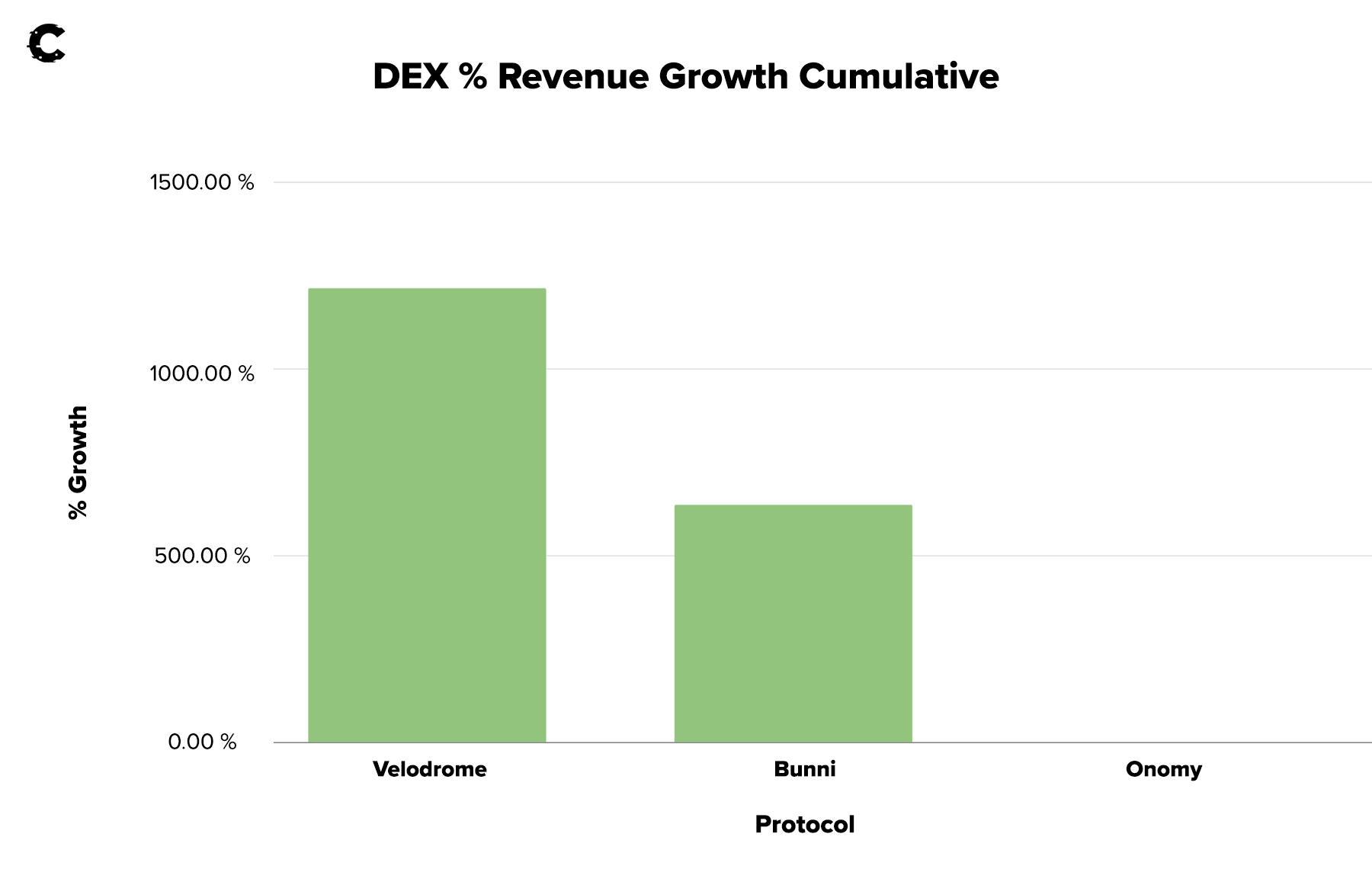

Since FTX's downfall and the subsequent wavering trust in centralised exchanges, DEXs have seen a spike in volumes. It's a trend that's just starting and is set to gain momentum over time.

The best way to judge those marketplaces is to see their revenue growth since the start of the year.

Here's the latest news on each, ranked in the order we anticipate they'll take off:

- Velodrome: Brace yourselves - Velodrome V2 is launching on June 15th. Expect a slew of updates spanning a major part of the protocol. The changes to VELO's tokenomics are huge and should bolster the token's performance in the months ahead.

- Bunni: Timeless is going cross-chain - a work in progress, any cross-chain upgrade for a protocol expands the potential target market.

- Onomy: No product yet so token price has suffered post-listing on exchanges. But the finish line is near - we're gearing up for the launch of Onomy DEX. This launch should cast a positive spell on the token over the next few months.

Derivatives 🎰

SNX, DYDX, PERP, LYRA

Here's the exciting bit: welcome to the casinos and gambling underworld of every city. While futures and options do serve important roles, let's be frank, they're mostly used for that thrill of the gamble. It's clear as day why the most successful product in crypto so far is perpetual futures with that electrifying "100x" option.

We're staring at a part of DeFi that's on the brink of takeoff - and we're massively bullish about it. Our bets are clear, they’re on Synthetix, dYdX, Perpetual Protocol, and Lyra.

Synthetix is more of a derivatives backbone (offering a platform to build both futures and options), whereas dYdX and Perp focus mainly on futures and Lyra zeroes in on options. Although options may take a few years to really catch on, we believe they're the most asymmetrical bet currently available in the entire crypto landscape.

The best way to keep tabs on their progress? Track how much capital they’ve attracted since the start of the year.

Here's a rundown of the latest updates for each, in the order we predict they'll ascend:

- Synthetix: Late last year Synthetix upgraded to v2, adding a huge number of updates across almost all aspects of the protocol - with a massive increase in TVL too.

- dYdX: DYDX unlocks have been a pain point for token price; however, many of these have been pushed back to later in the year. dYdX recently updated their progress on dYdX v4, which fully decentralises the protocol on its chain. This is a much-awaited update.

- Perpetual Protocol: Perp’s hot tub protocol, which allows users to deposit to an arbitrage pool, has seen huge success, with the ETH and USDC pools seeing close to 100% participation.

- Lyra: utilising the Synthetix infrastructure, Lyra is implementing an update on Optimism to make the protocol more efficient by leveraging the SNX V2 perpetual futures protocol.

Web3 VCs 💹

NEWO, BTRFLY

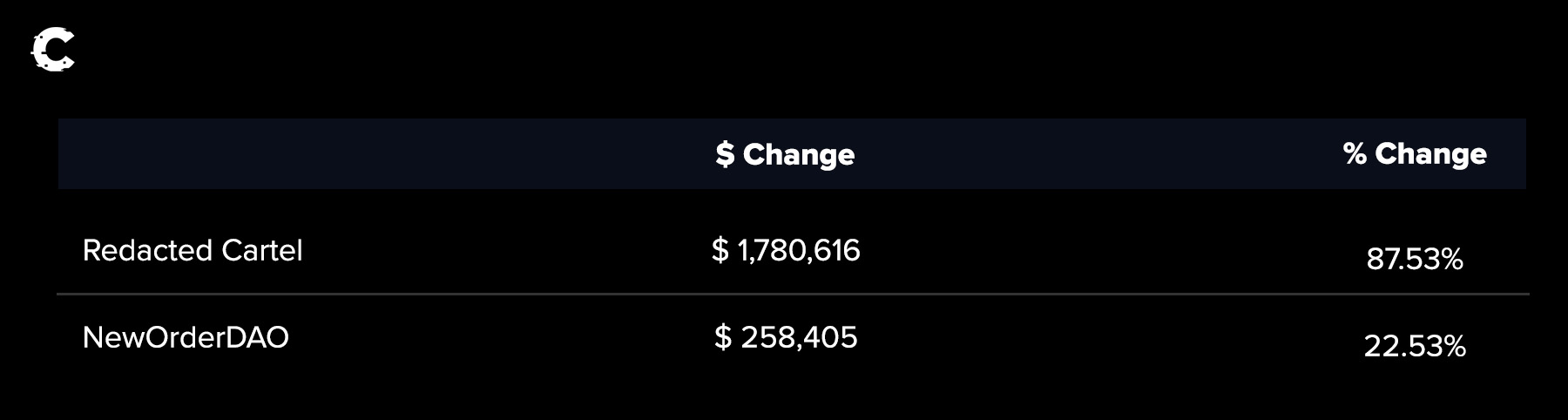

Wrapping up our bets, we've put our money on the savvy minds navigating this realm. A new breed of fund, a fresh kind of venture capitalist, born and bred in the decentralised universe: Web3 VCs. We're rooting especially for two players: Redacted Cartel and NewOrderDAO.

The most effective way to gauge their strides? Scrutinise their numbers and track how the value of their treasuries has evolved since the year began.

Here's the scoop on the latest happenings for each, in the sequence we believe they'll take flight:

- Redacted Cartel: the protocol has outlined their new stablecoin, Dinero. Overcollateralised, Dinero will capitalise on a previously under-utilised part of Ethereum - its block space.

- NewOrderDAO: the recent DeFi Basecamp Cohort 3 acceleration program was a success, adding eight more protocols to the DAOs retinue.

Cryptonary’s take 🧠

Clearly, our team is placing bets across multiple crypto sectors - each one slated to make headlines at some point. But let's be candid about the sectors and assets we reckon will skyrocket first.If we had to narrow it down to a shortlist of top runners - the ones with the most compelling narratives and poised for outsized gains in the upcoming bull market - we'd spotlight: ARB, LDO, FXS, and RPL.

Don't misinterpret us; we're super bullish on everything in the list above. However, we must keep our feet on the ground regarding timelines. The early birds in this race will be those solving the most significant issues - and today, those are the layer-2s and staking solutions.

Action points 📝

- Our thesis on the market's evolution is a must-read to fully grasp our viewpoint. Don't miss it!

- Want to stay ahead of the game? Dive into our latest Alpha reports right here for a brain boost 🧠

- Check out the #ta-charts channel in Discord for all of the price charts 📈

- Got questions? Fire away in our Discord chat 💬