CPRO Macro Outlook

The macro picture is currently one of the most precarious we have seen since the recession in 2008, and in some respects, decades. Inflation in most developed countries in the West is at unacceptable levels, and central banks are taking steps to correct this.

CPRO Macro Outlook

The global macro situation never stops changing. There is always something going on, central banks making statements, inflation figures, GDP figures, labour figures, geopolitical developments – you get the jist.However, the damage to the global economy that these measures will most likely have is concerning. Recession is on the horizon for many economies. The real question is – can inflation be tackled whilst avoiding prolonged damage?

In the finale of our macro series, we will outline the main recent developments and present our views on what we expect for the rest of the year going forward into 2023!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Can Powell tame inflation?

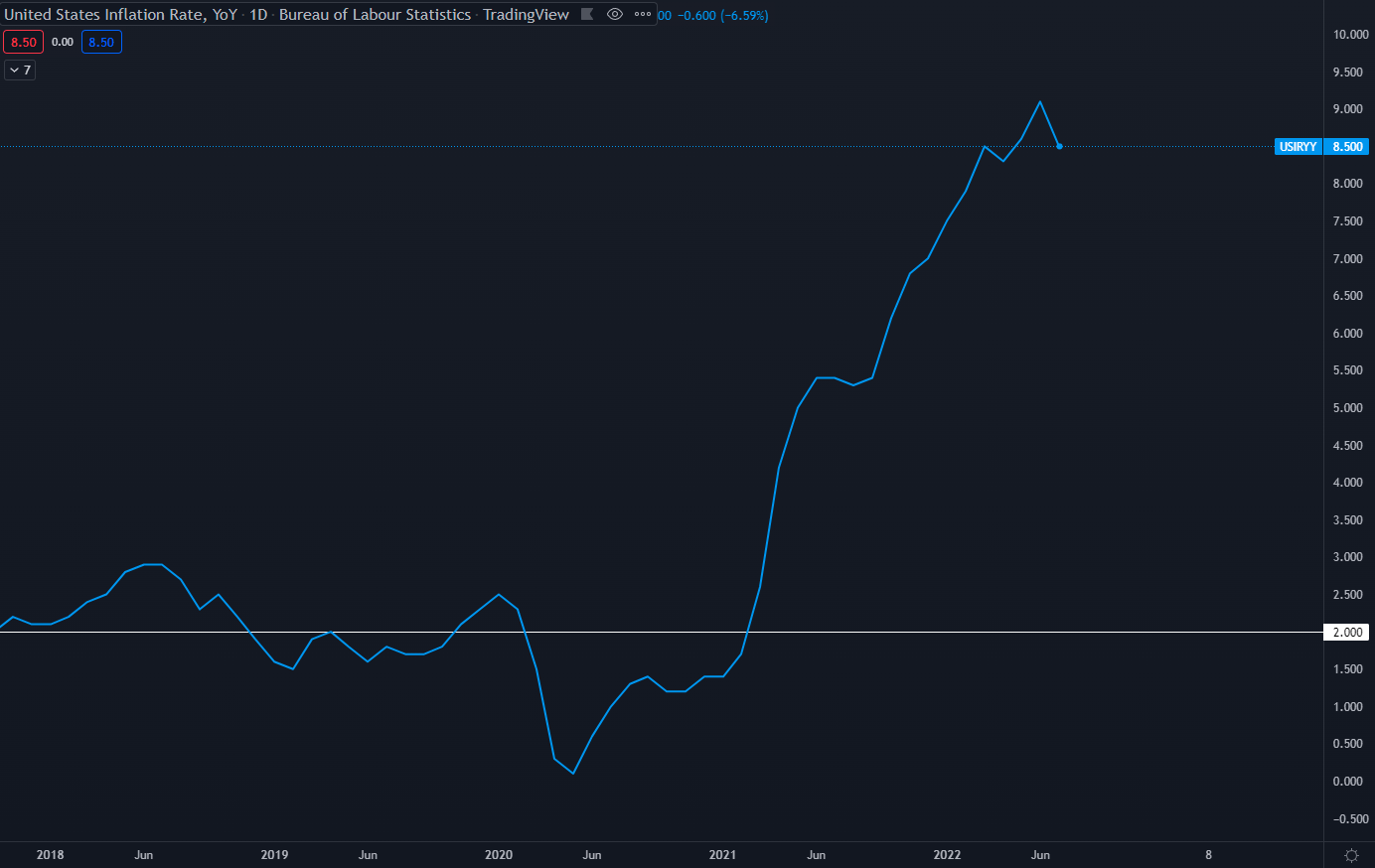

As expected, and explained in previous journals in this series, many of the core causes of inflation (supply chains, energy, food) are returning to pre-pandemic levels in the US. This has been confirmed with the latest CPI print on the 10th of August. The previous print in July was 9.1%, exceeding expectations and sparking fear that inflation was getting worse. However, the latest print was lower than expected coming in at 8.5%. It should be noted that a single lower print is likely not enough to confirm that inflation will continue down; another couple of prints will be necessary before the markets and the Fed can come to that conclusion.

As can be seen in the chart, inflation is still well above the target of 2% and it will be a long process before this target is met. Although the recent print provides a viable argument that the Fed’s quantitative tightening is working to reduce inflation, it is the potential for collateral damage to the economy that is concerning.

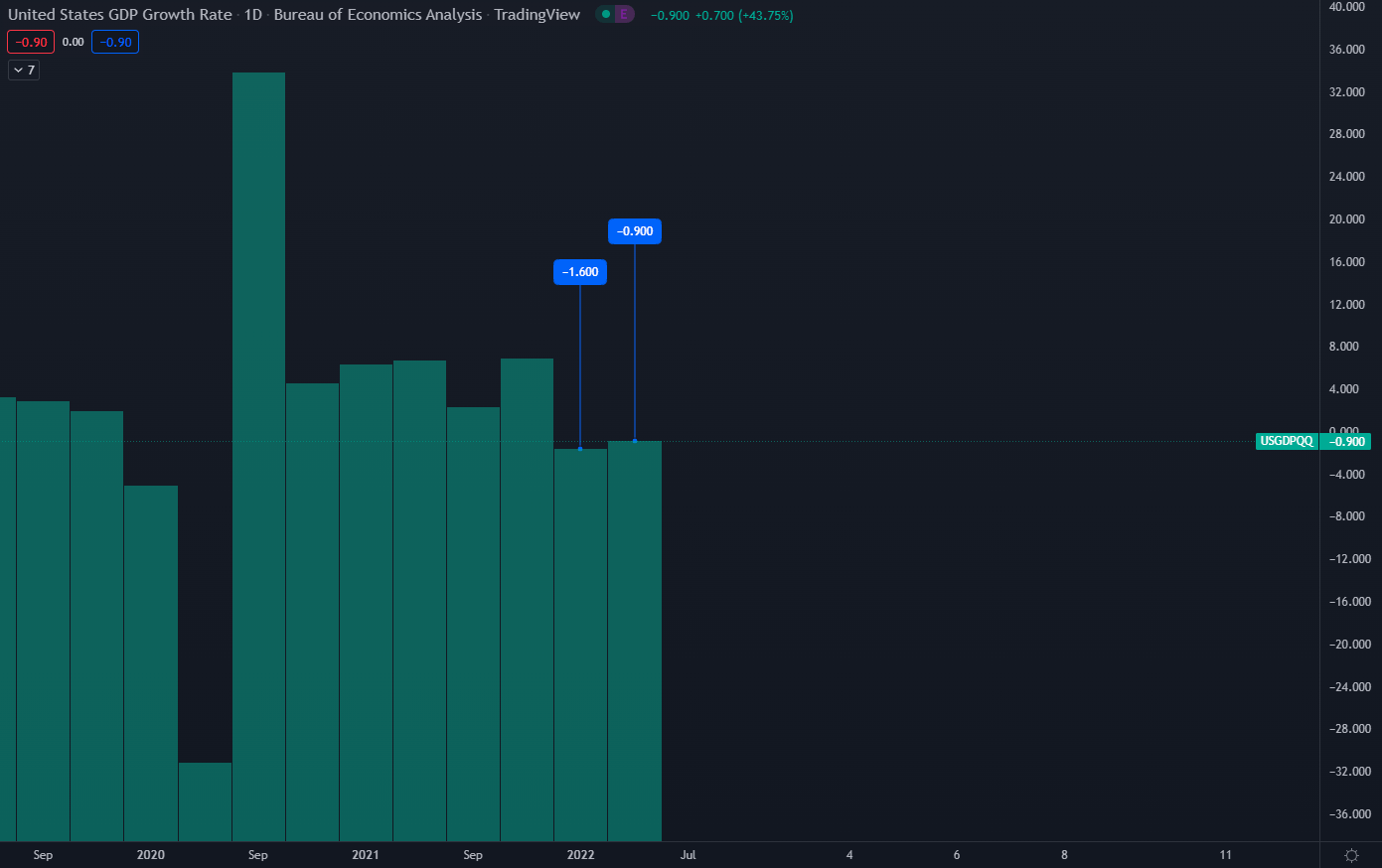

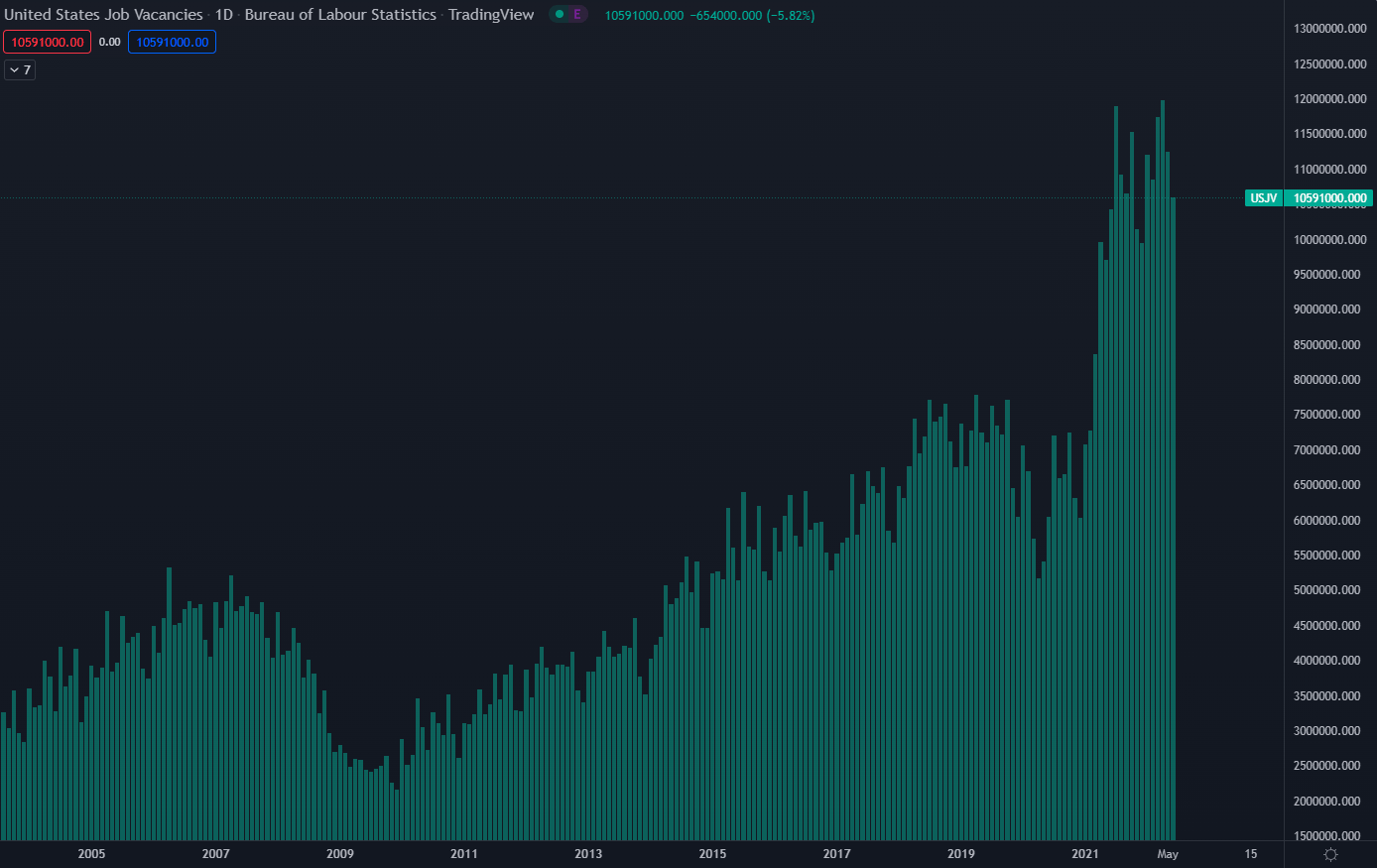

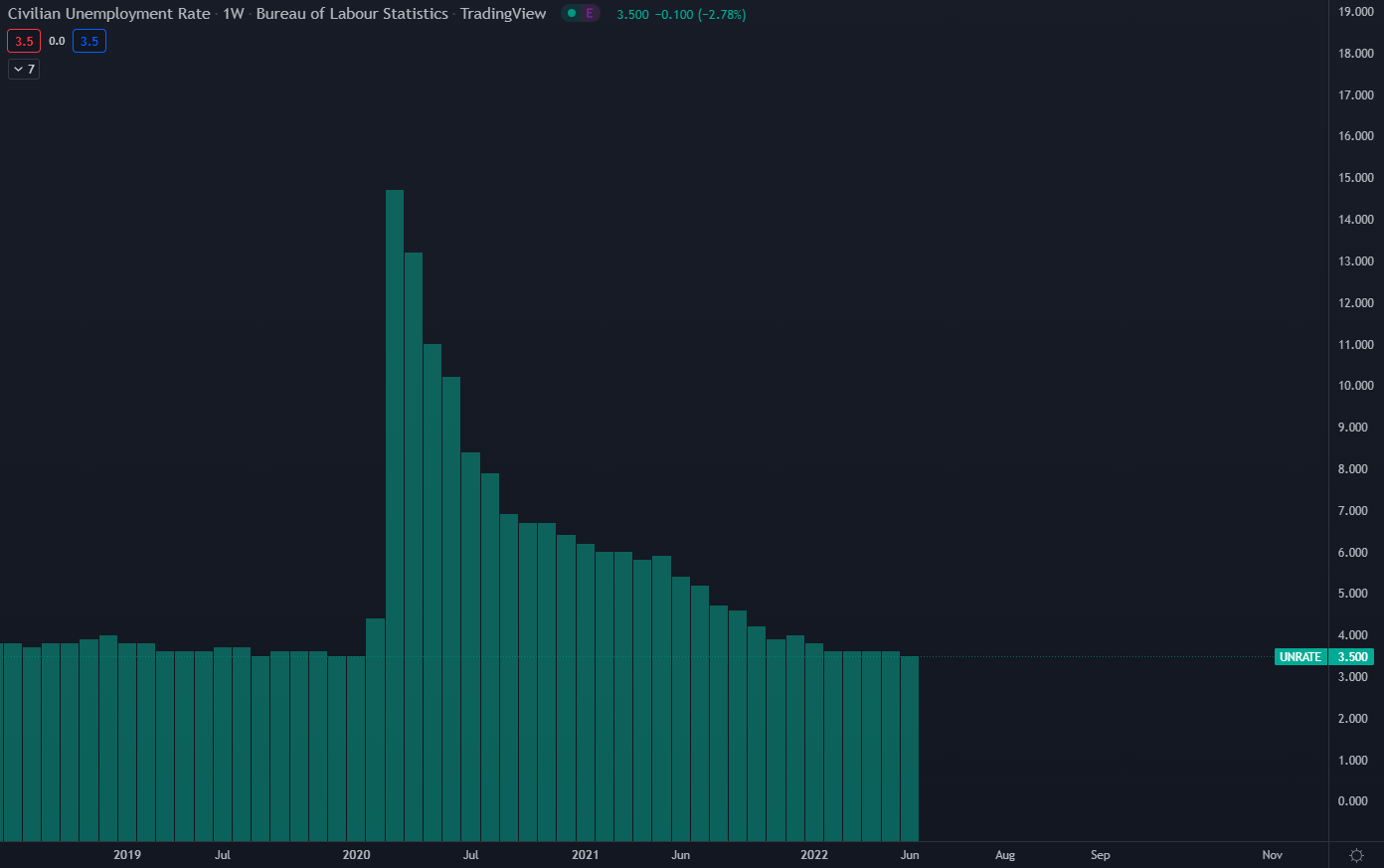

United States GDP has already printed 2 negative growth figures for Q1 and Q2, which some market participants believe is indicative of a recession. However, the Fed and the US Government has hammered home the idea that this isn’t a recession since the job market is still strong. We believe that there is some truth in this, and we tend to agree that the negative GDP prints are not necessarily a recession. Why?

Looking at the employment market in the US we can clearly see that there are still significant vacancies – around 10.6 million in the most recent print. This is important because as companies try to fill these jobs, they increase the wages they’re willing to pay to stay competitive. Who pays for the increased wages? Consumers through increased prices for goods and services, contributing to inflation. Increasing interest rates should bring this number down as the economy cools off, and the job market should become less competitive and we’re already seeing signs of that happening.

Generally, when businesses see less revenue the first action they’ll take is to cut hiring – less competitive jobs market. If the situation gets worse, or doesn’t improve after a period, they’ll begin redundancies and fire people. The evidence suggests that the job market is cooling off, but workers are not yet losing their jobs.

The large number of vacancies and the fact that unemployment rates have been grinding lower, despite the Fed tightening up monetary policy, will likely give Powell a green light to continue raising rates aggressively. Although the US may not be in a recession now – there is a very real chance that a recession is on the horizon. As stated in the last journal, when the Fed implements an actively restrictive policy, they tend to break something.

Inflation becomes a problem when total spending (the demand side) overwhelms the ability of the economy to produce enough goods and services (the supply side). The Fed cannot influence the supply side – they cannot force companies to produce more goods/services. All they can do is curb the demand side by increasing the cost of borrowing, which has the net effect of reducing spending (demand).

As can be seen from the information above, the Fed believes that overall, the US economy will be able to weather quantitative tightening. However, it is a balancing act – go too far and they could jeopardise future growth and current stability. We believe that although it’s true that the Fed does have some room to manoeuvre in terms of raising rates further, it is highly unlikely they will be able to deliver the “soft-landing” that they believe they can at the pace they would like to.

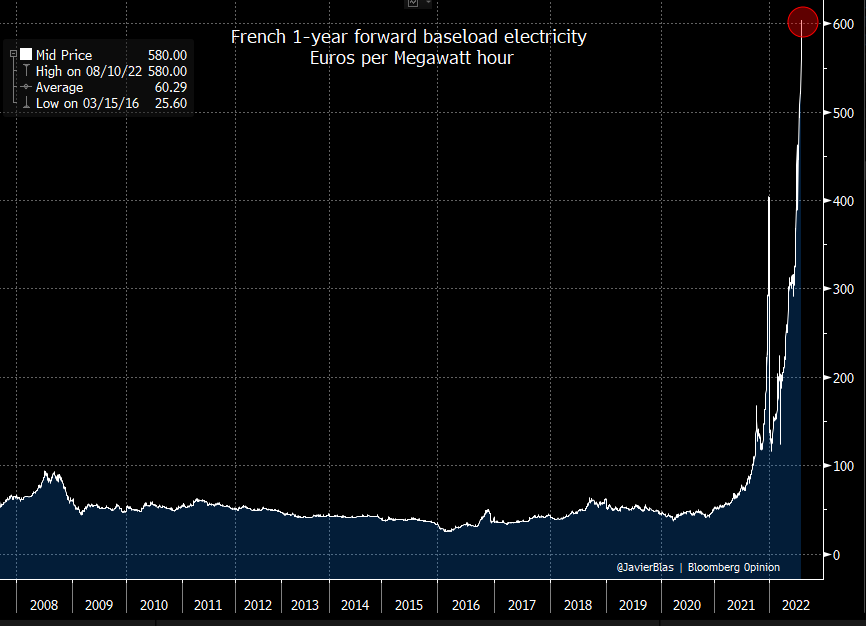

Europe in Crisis

The situation in Europe is much the same as in the US, apart from one major factor – the Ukraine conflict. Sanctions from both sides have severely disrupted energy supplies to Europe and this is compounded by widespread inflation (but we’ve already covered this here). Here’s what that looks like in France (warning, NSFW):

The rest of Europe is not much better off – energy costs for the average household in the UK, for example, is set to reach £4200+ over the next year. Compare this to the ~£1100-1200 consumers were paying before the pandemic, and you can see the scale of the problem. It is expected that going forward into Winter, Europe is going to have serious energy supply issues that could lead to rationing unless some sort of agreement can be made between both parties to restore gas supplies (unlikely).

What’s the Outlook?

Overall, we believe that inflation in the US has peaked. We may see some more inflation Month on Month (MoM) since energy demand trends higher in wintertime. Its important to note that the drop in shipping costs/energy and such is likely a product of reduced demand due to the economy cooling, just as much as it is from increased production. But since CPI is a lagging indicator, we would be looking for further declines in Year on Year (YoY) inflation to confirm the trend down.The dates below are the main data points we’ll be using to monitor the macro situation:

- FOMC Meetings (Rate Hikes): Sept 20-21st, November 1-2nd, December 13-14th.

- CPI Figures: September 13th, October 13th, November 10th, December 13th.

- US GDP Figures: August 25th (Q2 Second Estimate), October 27th (Q3 First Estimate).

- European Central Bank (Rate Hikes): September 9th, October 28th, December 16th.

We generally expect the US jobs market to cool off which will impact employment figures and open vacancies, reducing wage inflation. This is effective in fighting inflation; however, we believe that the Fed will most likely go too far potentially instigating a recession starting in Q1 2023. The market is currently pricing in the first rate cut around June 2023 – the beginning of a looser economic policy.

We believe the second half of 2023 should be relatively bullish in all markets; unless a 2008 type scenario happens, in which case we’re looking at years of uncertainty. However, this is the worst-case scenario, and we don’t believe this to be a likely outcome. The threat of recession is likely to cause a Fed pivot – the main concern is that the Fed is not reactive enough to prevent it from happening.

For the rest of 2022, Winter is the main concern here – especially for Europe. There is a real risk of a general recession in Europe through a combination of inflation and energy shortages. The US is in a much better position in terms of energy self-sufficiency, so we don’t expect that to be as big a factor there.

From now until the next CPI print and up to the FOMC meeting there will likely be a period of optimism after the lower print in August. We believe that this will be temporary, however, as overall there is still a huge hill to climb in combating inflation and so we believe that any significant upside is a bear market rally unless the data says otherwise.

As much as we hate to say it, the market is heavily dependent on Fed policy for now. The correlation between traditional finance markets and crypto can’t be ignored. All eyes will be on FOMC meetings and the words of Jerome Powell during his conferences. Updates will be provided in Discord as they happen, and we will update on macro in a journal later in the year!