CPro picks update: Diversifying with major asset + trade setup

You can debate decentralisation, you can question regulation, but you can't ignore performance. This asset has quietly become one of crypto's most efficient, profitable, and battle-tested ecosystems. The numbers speak louder than opinions and here's why we are adding this asset to our picks...

This asset has moved beyond the noise. What began as a simple exchange token is now one of crypto's most complete ecosystems, a network that has survived regulatory pressure, rebuilt its brand, and edged closer to institutional credibility. Its deflationary model, low fees, and vertical design give it a clear advantage in a market defined by speed and efficiency.

In 2025, BNB functions like an economy of its own. It processes millions of transactions daily, burns over $1 billion in tokens each quarter, and expands through initiatives like YZi Lab's $1 billion Builder Fund, momentum is rooted in both fundamentals and flywheel design.

This report is Cryptonary's master thesis on BNB, exploring the mechanisms, leadership, and ecosystem driving its strength, along with our ecosystem alpha and the key price targets for BNB we're tracking for the months ahead.

So let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The thesis

At the heart of this thesis is a simple observation: BNB is now a battle-tested asset and infrastructure, and no longer a speculation. It processes over 13 million daily transactions, maintains 2.9 million active users, and burns over $1 billion in supply every quarter, all without a single network halt in 2025.These are industrial-scale throughput numbers. The chain has matured into a high-frequency settlement layer for DeFi, memes, AI projects, and tokenised assets, connecting retail flows (Asian markets) with institutional liquidity rails.

The structural edge comes from its flywheel design:

- Low fees → more users → more transactions → higher fees collected → larger burns → reduced supply → higher price → renewed builder and investor confidence.

The thesis extends beyond the token. YZi Labs' $1 billion Builder Fund and Giggle Academy's educational push illustrate a shift from speculative growth to mission-based expansion. BNB is building social legitimacy while still generating hard cash flows, a balance rarely achieved in crypto.

For the 2025-2026 cycle, the core of our call is this: BNB represents a battle-tested infrastructure, a self-contained economy where velocity, burn, and brand converge into sustainable value for tokenholders.

In Cryptonary's framework, this earns BNB its Institutional Chain and a diversification play, not because it's flawless, but because it's functional at scale, and has repeatedly proven itself over time.

That's the thesis we'll unpack in the sections ahead.

Historical Context & Evolution

BNB's story mirrors the evolution of crypto itself, from speculative tokenisation to industrial utility. Launched in 2017 as a simple exchange discount token on Ethereum, BNB was never meant to carry an ecosystem. Yet within two years, it became the backbone of one. The 2019 migration to Binance Chain and later Binance Smart Chain (BSC) marked the first step toward vertical integration, a strategy few other networks have executed at this scale.By blending exchange liquidity, smart contracts, and user acquisition, Binance effectively bootstrapped an economy overnight. The early model rewarded traders through fee discounts and used BNB as gas for the new chain. When DeFi Summer of 2020-21 exploded on Ethereum, BNB captured the overflow with lower fees and faster confirmations, positioning itself as the "retail chain" of that era. PancakeSwap's rise cemented this identity, playful, fast, and open, but still anchored to Binance's liquidity network.

However, 2022–2023 reshaped BNB's trajectory. The regulatory crackdown that dismantled many centralised exchanges could have crippled it, yet BNB survived. The turning point came with the U.S. Department of Justice settlement in 2023 ($4.3B) and CZ's (Binance's founder and ex-CEO) exit from operational leadership. Rather than implode, the ecosystem restructured under Richard Teng, transforming from a personality-driven entity to a compliance-first infrastructure. This pivot restored institutional confidence and allowed BNB Chain to grow quietly while sentiment elsewhere cooled.

By 2024-2025, the transformation was visible in data:

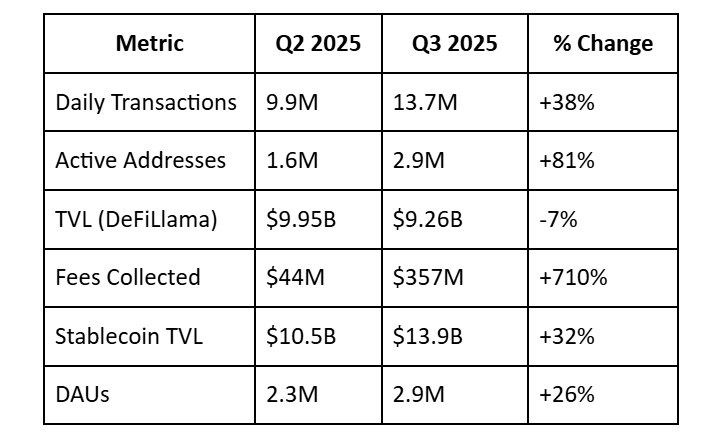

- Transactions per day: rose from 9.9M (Q2 2024) → 13.7M (Q3 2025).

- Active addresses: grew from 1.6M → 2.9M DAUs.

- Fees: jumped 710% QoQ to $357M in Q3 2025.

- TVL: stabilized near $9.2B even through market rotations.

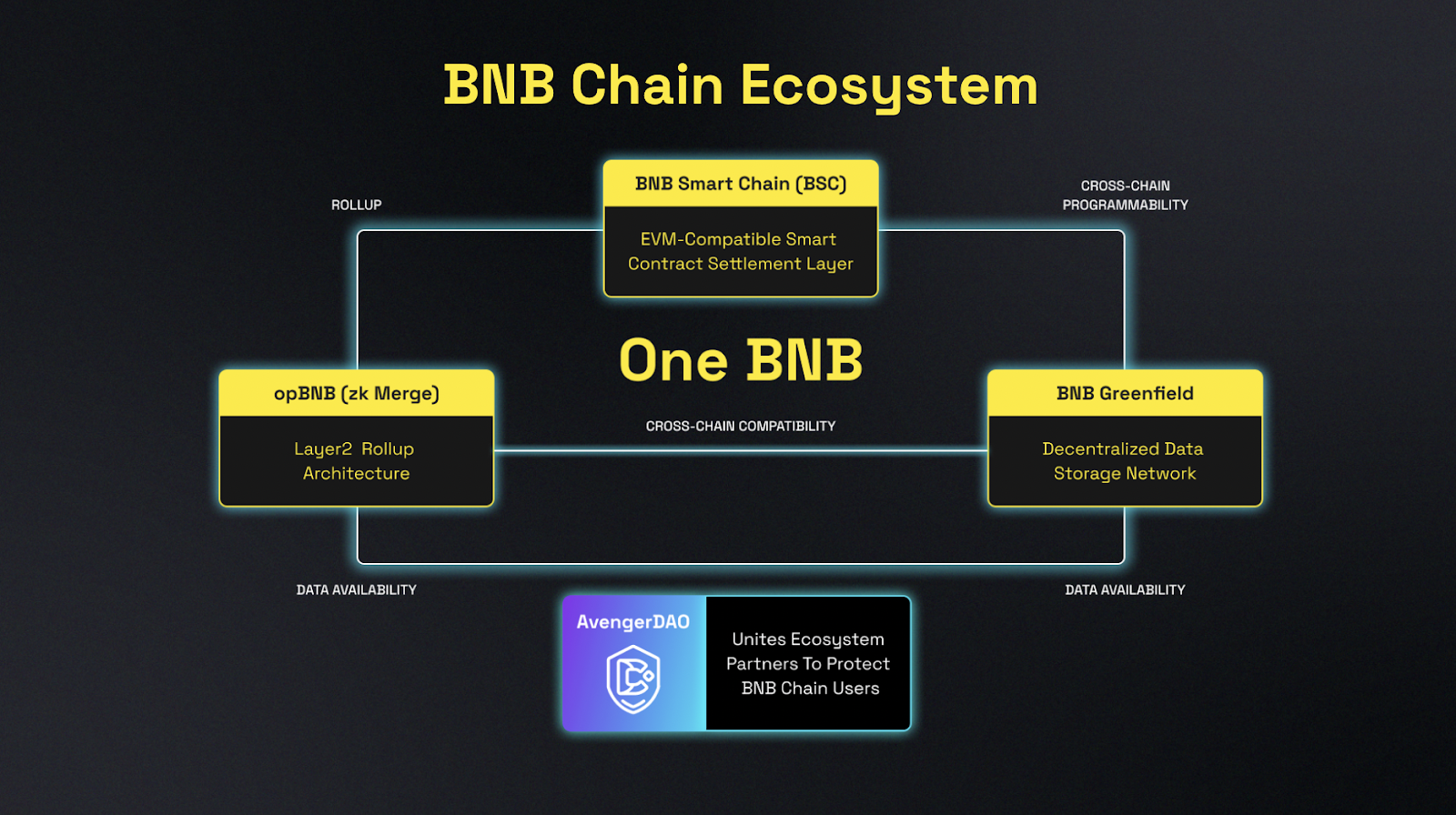

BNB Chain now runs three core layers:

- BNB Smart Chain (BSC) – EVM-compatible layer for DeFi and NFTs.

- opBNB – Layer-2 scaling with sub-second blocks and $0.005 fees.

- BNB Greenfield – Decentralised storage infrastructure for data-rich dApps.

This modular approach turned BNB into a self-sufficient ecosystem that can host high-frequency retail flows and institutional applications simultaneously.

The market narrative has evolved in parallel. From "the Binance token" to "a deflationary blue-chip," and now to "the institutional chain," BNB has transcended its origins. It is building its own economic operating system, one that prioritises functionality over philosophy.

BNB's evolution shows that longevity in crypto is about sustained relevance. And eight years in, BNB's relevance is only compounding.

Having traced BNB's journey from an exchange token to a multi-chain powerhouse, it's time to dive into what keeps that machine running, the tokenomics and monetary design that fuel its deflationary growth and long-term value.

Tokenomics & Monetary Design

BNB's tokenomics remain one of the most refined deflationary models in the market, not because of marketing slogans, but because the mechanics actually translate network activity into supply contraction. Where most ecosystems rely on inflationary emissions to sustain growth, BNB operates on the opposite principle: activity fuels scarcity.The Core Engine: Auto-Burn + Real Burn

The BNB Auto-Burn mechanism ties supply reduction directly to on-chain activity and price performance. Every quarter, a portion of BNB is permanently destroyed based on two variables, transaction volume and market price. The formula adjusts automatically, ensuring that when usage rises or volatility spikes, burns accelerate.In parallel, the Real Burn system destroys the portion of gas fees paid in BNB, directly linking user demand to deflation.

Together, these create a closed monetary loop:

More transactions → more fees → more BNB burned → lower supply → higher perceived scarcity → sustained demand.

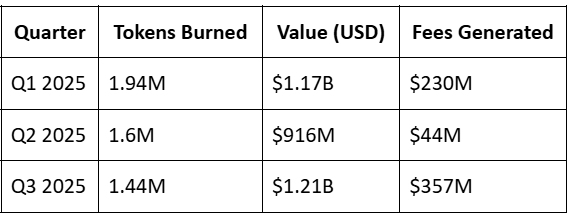

Since inception, roughly 31% of BNB's total supply has been burned, shrinking circulating tokens from 200M → 139.18M as of October 2025. The Q3 2025 burn alone removed 1.44 million BNB (≈ $1.21B in value), one of the largest in its history.

Annualised, BNB maintains a 4.5% effective deflation rate, far higher than Bitcoin's post-halving emission rate (0.9%) and unmatched among large-cap networks.

Value Distribution and Effective Inflation

While the burn dominates attention, effective inflation still exists through ecosystem incentives. Around 38% of historical supply was allocated to community rewards, grants, and liquidity programs. Though many of these tokens are already in circulation, future airdrops, rewards, or staking incentives create a "soft inflation" effect by redistributing supply.Still, because BNB's utility is integrated across trading, gas, staking, and governance, much of that released supply is reabsorbed by activity rather than diluting long-term holders. Team and early allocations, roughly 23.8%, remain vested through 2028, but the absence of external VC overhang gives BNB a cleaner token structure than most of its peers. No major cliff unlocks threaten short-term price stability, and most large holders are ecosystem-aligned.

Tokenomics: Utility-Driven Demand

BNB's demand pillars span across:- Exchange Utility: Fee discounts, launchpad allocations, and collateralization.

- Network Gas: Payments for transactions across BSC, opBNB, and Greenfield.

- Governance: Validator selection and BEP proposal voting.

- Yield and Collateral: Used across DeFi platforms like Venus, Aster, and PancakeSwap.

- Payments and Remittances: Fiat ramps in Asia and Africa use BNB as settlement.

This structure, refined over eight years, has evolved into what can be described as "monetised throughput", every on-chain action generates value for holders. That feedback loop is why BNB remains one of the few large-cap tokens where tokenomics are directly tied to ecosystem fundamentals.

With the mechanics of BNB's token design laid out, the next step is to see how that theory translates into real activity, on-chain metrics and network health reveal how the ecosystem is actually performing under the hood.

On-Chain Metrics & Network Health

BNB Chain's on-chain data paints the picture of an ecosystem that has shifted to sustained network utility. The metrics no longer show artificial volume spikes or bot-dominated flows, they show an infrastructure being used at scale.Core Activity Metrics

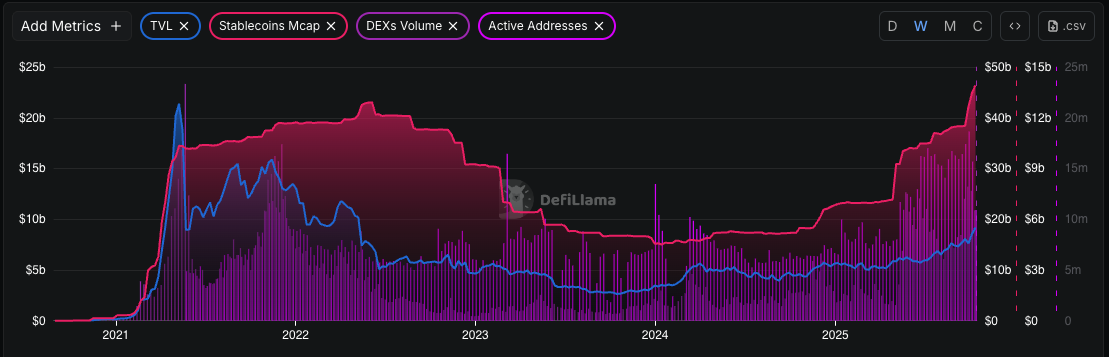

Across 2025, BNB Chain maintained exceptional consistency in both retail and institutional on-chain activity. The network processes 13–14 million daily transactions, a 38% increase QoQ from mid-2024. Active addresses have grown from 1.6 million to 2.9 million DAUs, with total monthly active addresses now surpassing 52.5 million, a level that places it ahead of Ethereum and nearly parallel with Solana.

BNB Chain's retail participation remains organic, stemming from the meme, DeFi, and AI sectors that have migrated to it due to low fees and fast confirmations.

Fee Revenue and Burns

Fee-based revenue is now BNB's strongest on-chain indicator. In Q3 2025, the network generated $357 million in fees, a sevenfold increase from Q2's $44 million. This surge came from a combination of DEX activity, stablecoin transfers, and meme-related volumes on platforms like four.meme and Aster.The translation of these fees into the auto-burn mechanism directly reduced BNB's supply by 1.44 million tokens (≈ $1.21 billion), tightening token velocity. This structure differentiates BNB from inflationary ecosystems, turning network throughput into measurable holder value.

Developer and Ecosystem Growth

Development remains another pillar of BNB's network health. Over the last 30 days, there have been 1,471 recorded developer events, second only to Ethereum. The chain now supports 4,800+ hackathons annually and incubates 232 new projects per year under YZi Labs' oversight. Recent proposals like BEP-593 (ultra-efficient consensus) and Lorenz upgrade (reducing block time to 0.75s) further demonstrate continuous optimisation.BNB's Maxwell upgrade also advanced AI integration and sub-0.5s transaction goals, with Greenfield storage expansion providing scalable infrastructure for decentralised data projects, an early signal that BNB is evolving from financial chain to computational chain.

Liquidity and Capital Flows

Stablecoin inflows are the clearest proxy for institutional participation. BNB Chain holds $13.9 billion in stablecoins, reflecting $11.2B+ inflows in Q3 alone, the largest since 2021's bull phase. These inflows underpin liquidity depth on DEXs like PancakeSwap and Aster.Additionally, $18.7 billion in daily trading volume across BNB-linked platforms underscores the network's role as a liquidity hub for Asia-based market makers.

Open interest in BNB futures has climbed to $2.58 billion, while liquidations remain minimal, a sign of conviction over leverage. This composition, combined with stable fee growth, marks a structural shift: BNB's capital base is no longer purely speculative; it's recurring usage, demand and adoption.

Infrastructure Integrity

A major evolution in 2025 is operational reliability. Unlike Solana's recurrent outages, BNB Chain has maintained 100% uptime throughout the year.Validator sync issues that plagued 2023 (Erigon node failures) have been resolved through Rust-based clients and infrastructure upgrades. Reorgs are now rare, and block propagation sits under 1.2 seconds.

However, centralization remains the technical weak spot, 45 validators, many Binance-aligned, create governance dependence. But as validator-driven proposals rise (e.g., 2025 fee-halving and privacy upgrade), slow decentralization is underway.

BNB Chain's on-chain metrics reveal a mature, cash-generating network with institutional-grade stability. The activity is real, the burns are real, and the revenue loop is functioning, making BNB one of the few ecosystems where fundamentals drive throughput.

Now that we've seen BNB's network strength in numbers, it's time to look at the people steering it, the leadership and governance shaping how this ecosystem evolves beyond code and into culture.

Leadership & Governance

BNB's trajectory is inseparable from the individuals steering it. The duality between Changpeng "CZ" Zhao and Richard Teng defines the chain's cultural and structural evolution, one a visionary builder, the other a regulator's diplomat.

Together, they've reshaped Binance's identity from a controversial exchange empire to an institutionally credible ecosystem operator.

Changpeng Zhao (CZ)

CZ's influence on BNB extends far beyond his time as CEO. After stepping down in late 2023 following the U.S. Department of Justice settlement, he pivoted from day-to-day management to long-horizon initiatives, notably Giggle Academy and YZi Labs. These projects embody CZ's post-exchange phase: using blockchain to scale education, philanthropy, and capital allocation, while keeping Binance culturally relevant.Through YZi Labs, his family office managing over $10 billion AUM, CZ has quietly become the ecosystem's strategic investor rather than its operator. The firm's recent $1 billion Builder Fund (October 2025) to back DeFi, AI, and RWA projects on BNB Chain signaled a clear message, BNB isn't dependent on Binance's exchange anymore, it's standing on its own economic legs.

Meanwhile, his Giggle Academy initiative, a free, blockchain-powered education platform, merged philanthropy with memecoin culture, demonstrating that CZ still understands how to merge narrative and product. In the community's eyes, his role has evolved from CEO to patron of the ecosystem. He may not manage Binance, but he still defines its momentum.

Richard Teng: The Regulator's CEO

Appointed after CZ's resignation, Richard Teng brought a credibility reset to Binance. A former Monetary Authority of Singapore (MAS) regulator and Abu Dhabi Global Market CEO, Teng's reputation as a compliance expert helped rebuild trust among institutions. His leadership style is structured, cautious, and regulation-oriented, the opposite of CZ's high-speed execution model.Under Teng, Binance has settled most outstanding cases, expanded dialogue with financial regulators, and tightened internal compliance. On-chain, his impact shows through upgrades like fee halving, sub-second blocks, and validator-driven governance proposals. The market perceives him as the "stabilizer" who legitimized Binance without diluting its innovation.

The contrast between the two leaders works symbiotically:

CZ fuels culture and narrative, Teng anchors legitimacy and sustainability.

This duality is rare in crypto, one founder's exit usually ends an ecosystem's story. For BNB, it created a new phase of maturity.

Technical Analysis

BNB/USDT

BNB has been in a parabolic uptrend for weeks, extending significantly on the weekly timeframe. The RSI is currently at 80, firmly in the overbought zone, with the average around 68, confirming stretched momentum. A cooldown or consolidation phase from here would be healthy before the next leg higher.Key weekly support levels stand at $1,190, $1,050, and $900. The $1,050 zone remains the most balanced area for a potential retest, while a move toward $900 would likely signal a deeper correction. On the upside, immediate resistance lies at the recent all-time high of $1,347, beyond which price discovery continues.

For now, we want to see RSI reset slightly to restore buying power and create a better risk-reward setup for fresh entries.

Our targets for the medium-long term stand at:

- $2,000: Conservative scenario

- $2,500: Base case

- $3,000: Bullish extension

BNB/BTC

The BNB/BTC pair has been showing strong relative strength. A double bottom pattern formed between 0.005 and 0.006, with the two legs developing between November 2023 and February-June 2025. Since July, BNB has outperformed Bitcoin by nearly 80%, breaking above the neckline at 0.0101, a key structural breakout.If this breakout sustains, the next resistances lie at 0.012, followed by 0.016, which represents a potential 35–40% outperformance versus Bitcoin. The final resistance for this structure is around 0.0197.

That said, RSI on the weekly chart is also overheated at 79–80, with an average near 61, suggesting that some cooling is likely before another sustained move.

Support levels to monitor are

- 0.0088

- 0.0079 (200 EMA)

- 0.0075

Ecosystem Alpha: PancakeSwap (CAKE)

Within the BNB ecosystem, PancakeSwap (CAKE) remains one of the most strategically important plays, both structurally and fundamentally. While the broader market has focused on BNB's rally past $1,000, CAKE has been quietly preparing its own breakout after nearly three years of accumulation.

This is one of those setups where structure, fundamentals, and timing align.

CAKE Trade Setup

Weekly Structure

CAKE has been quietly forming one of the cleanest long-term bases across major DeFi tokens. Since May/June 2022, it's been building a rounding bottom, a 1,200-day accumulation structure that signals exhaustion of sellers and preparation for a new cycle.In 2025, price action tightened further into an ascending accumulation wedge, compressing volatility until it finally broke out on the weekly timeframe, a classic signal of an early-stage expansion phase.

The timing couldn't be better, the entire BNB ecosystem is heating up, and PancakeSwap is its backbone.

Trade Plan (as shared with the community)

We first spotted CAKE around the $3.38 zone and shared the alpha on October 3rd in the traders-field channel. It was then officially shared as a trade setup on October 7th, right as the structure confirmed strength.Since then, CAKE has already moved nearly +20-30% from our initial call, yet the real breakout remains ahead.

Breakout Confirmation

- Main Breakout Zone: $4.82

- Weekly 200 EMA: $4.70

- Trigger: Weekly close above $4.82 confirms structural breakout and trend shift

Entry Plan

- Accumulation Zone: $3.38 – $4.82

- Build 15–20% position size within this range

- DCA Strategy: Add 5–10% on each 5–10% dip

- Retest Setup: A clean retest near $3.38 offers a discounted re-entry

Targets

- Target 1 (Main Scaling Zone): $8.80 – $10.40 100% upside from breakout confirmation, plan to scale out 80% of position in this range.

- Moonbag Zone: $17 – $20 300% upside potential, keep 10–20% as a long-term hold in case of extended expansion.

Invalidation

- Structural Stop: Below $2.30 (clean failure level on higher timeframes)

Our Take

CAKE's multi-year base, combined with strong Q3 fundamentals and structural breakout conditions, gives this setup real asymmetric potential.The fundamentals confirm the trend:

- BNB's ecosystem expansion → more users → more fees → more burns.

- Technical breakout → more liquidity inflow → higher protocol revenue.

Now that the opportunity is laid out, it's time to flip the lens. Every strong ecosystem has its cracks, and for BNB, understanding the risks and constraints is just as crucial as spotting the upside.

Cryptonary's Take

BNB is one of the most battle tested assets in crypto alongside BTC and ETH. It has matured beyond its origins, now commanding attention across DeFi, AI, gaming, and even meme markets. It's a great diversification play and a bet on CZ (one of the richest men on Earth). It has been on our radar for quite some time, and we've been continuously covering the asset via our Market Direction tool.From a technical standpoint, BNB looks extended and overbought in the short term. We're not adding it to our portfolios just yet but it is officially added to our Cryptonary Picks. We'll be waiting for a cleaner entry before positioning.

With BNB breaking out against BTC, we expect it to outperform in the next 3–9 months, and we see potential for it to trade north of $2,000-$3,000 in the medium to long term.

Cryptonary, OUT!