As those of us who have experienced the gruelling, desperate depths of a bear market are only too aware, drawdowns are a normal part of the crypto experience.

But sometimes, adding a bit of perspective based on experience can do good for those new to the market (or anyone looking to cope).

Let's get started with the copium!

Key questions

- Just how bad is this downturn really? You might be surprised when we put it in perspective.

- Are memecoins taking a beating? Find out why their volatility could be a double-edged sword.

- Remember the COVID-19 crypto apocalypse? Discover how today's market compares to past crashes.

- Could your expectations be sabotaging your success? Uncover the psychology behind market disappointment.

- Is your portfolio prepared for the next upswing? We reveal a simple strategy that could dramatically improve your position.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Current market conditions

Majors

Since the peak in March, BTC has been in limbo, hanging precariously.

Still, the drop from the peak to the local low at the end of April was "only" ~24%.

The recent dump over the previous 20 days was more volatile but not as significant. Volatility is key here.

A faster pace to the downside instils much more panic than a more significant loss spread out over a couple more weeks. Waking up five days in a row to BTC, recording a 3% drawdown, is much less jarring than waking up to a 15% overnight drop in BTC. It is still the same nominal 15% drop, but when BTC dumps quickly, altcoins get battered much more than they would otherwise as everyone heads to the exits to avoid further losses.

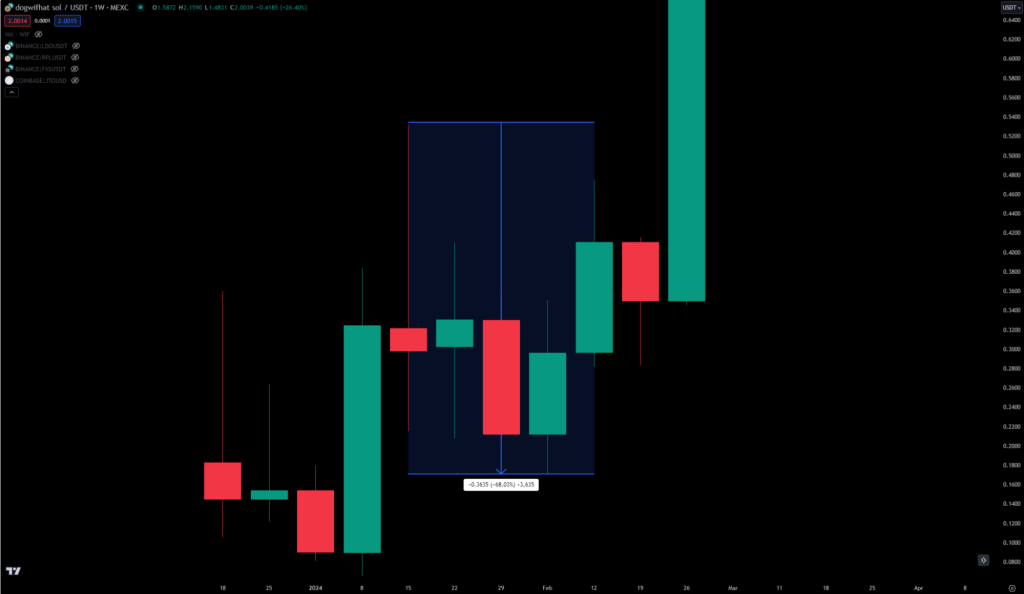

Memecoins

When you look at Cpro Picks for this cycle, the best-performing coins have been memecoins. Unsurprisingly, the greater volatility on the upside (which gets us those gains) also inevitably gives us an outsized downside.

When BTC dropped ~24%, as earlier discussed, WIF, over the same period, dropped ~70%. Compared to the BTC drops above, WIFs were almost 3x worse.

But depending on when you got into Bitcoin and WIF, what isn't usually taken into consideration are the gains that the WIF holder has made compared to holding BTC—and it's not the first time that WIF has had a significant drawdown.

Are we saying that we're expecting a WIF god candle in a couple of weeks? Probably no. But if you remember early 2024, when we wrote about WIF after a big drawdown, we had the same takeaway, and the patience paid off three months later by setting a $4.83 high.

Perspective is key. You cannot account for what will happen in the next candle; we can only make an educated guess. If we need to revisit our thesis on any asset, we will.

However, to give up and not learn from these experiences is like losing a life once in a video game and never picking up the pad again because "it's too hard".

Does this mean to continue risking-on without caution? No! If you are unprepared to weather the downside, consider reducing exposure until you are comfortable with the risk.

Crypto apocalypse - we've seen worse

The sharpest market drop in recent memory was the March 2020 COVID-19 giga-dump.

If it happened today at these prices, the same drop would take BTC from ~$74k to $27k in three weeks.

Now THAT is a dump.

There is really no describing what seeing that happen in real time was like.

Yet, even DOGE, basically the only memecoin at the time, didn't fall all the way to zero.

So, when considered from a zoomed-out perspective, this current drawdown is minuscule in the grand scheme of things.

This, too, shall pass.

Learning lessons

One of the major learning curves in the crypto market is just losing money. Assuming you haven't put yourself in a position to be completely wiped out, losing money is sometimes part of the game.Think about what your portfolio is worth now and what it was worth around the time of Bitcoin's local high a couple of months ago. That pain you feel now? It's a lesson.

As we proceed in this bull market, that pain will be instructive in making it easier for you to take profit and start scaling out as we reach the euphoric phase of this cycle.

Losing money is one of the only aspects of investing that simply cannot be taught. You must experience the loss at some point.

Coming to terms with and making decisions based on the fact that you can lose money, you aren't invincible, or you aren't a genius is as sobering as it is enlightening.

Manage expectations

If you've gone from $10K to $100K and are now back to $50K, you are still profitable and $40k richer than you were six months ago. Nobody likes losing money, but take a moment to reflect on why you are really gutted.It is probably because of a failed expectation.

OMFG, I've 20x'd in 2 months. In another two months, think where I'll be!

So, why are you?

Instead of wallowing and making emotionally charged decisions, we should accept that drawdowns are a normal part of the market.

As outlined above, the market will only continue to offer up-only mode for so long.

Always keep some stablecoins aside

Inevitably, there are cool-off stages in a bull run. 20x'ing is excellent, but having cash set aside to dip into and top up is even better. By staying all in, 100% in whatever assets you hold, you've only given yourself essentially two options:- Sell: Sure, you could argue that selling half or 1/3rd is more than one option. But if you haven't sold anything at all through the run, are you likely to sell any amount in the future?

- Hold: A valid option, but only for the right reasons. Why are you holding? Is it because you're down so bad that you feel you can't sell now or because you still have a strong conviction in the asset?

- Buy: By having excess capital on standby, you increase your options by a whopping 50%. Aside from having more options, the psychological aspect of having cash on the side cannot be overstated. Decisions are easier to make since you're not feeling like you are "always in".

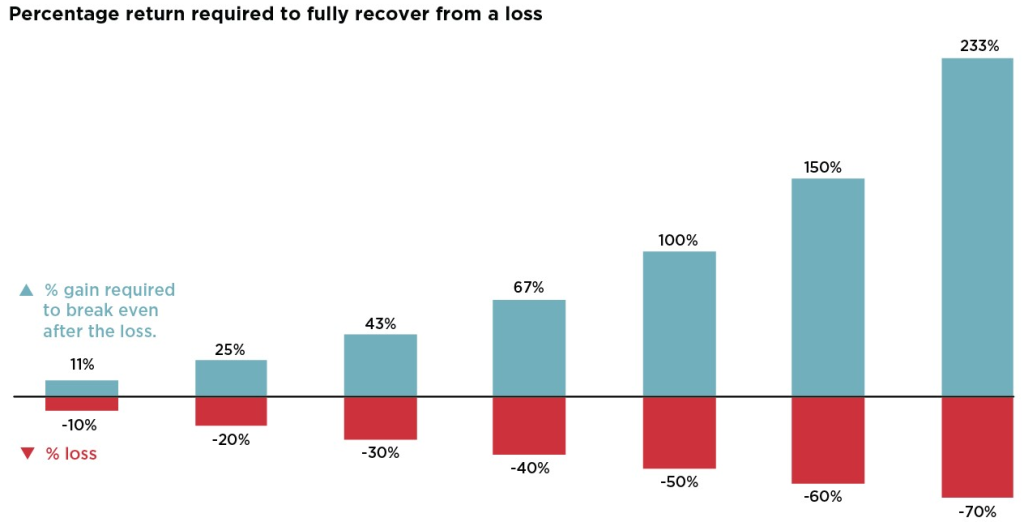

If a coin is down 10%, you need it to make an 11% gain to break even. And if it is down 70%, you need it to make a 233% gain to break even.

If you're down, and the pain hasn't hit you yet, consider it from the above angle. The bigger the loss, the higher the gain needed to pull it back - it gets exponentially worse the higher the loss.

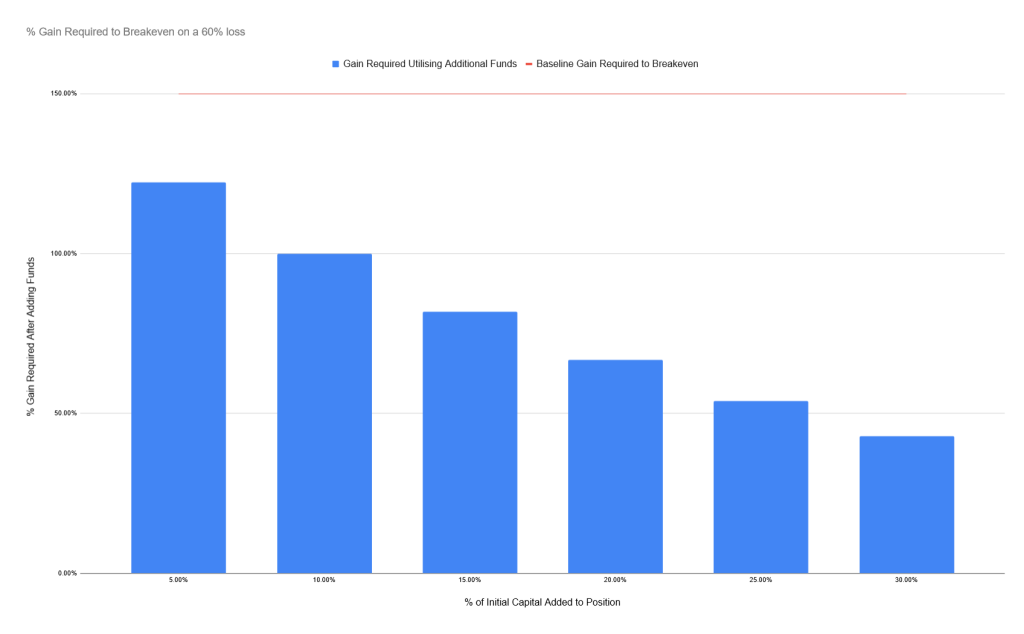

However, if you still have some cash on the side, (provided the other bullish factors that made you buy in the first place are still intact), buying more can significantly reduce how much gains the coin needs to make before you break even.

Now, we don't just say, "DCA to get the most from the market." Unless you're extremely lucky and win the first time, we can mathematically prove that having cash on the side will smooth out your portfolio over time.

Take this example - a 60% loss requires a 150% gain to break even. If you have capital to the side, here's how adding that capital to the position could influence your breakeven gains required:

Essentially, by adding just 10% of your initial capital to the position, you can reduce the percentage gain that the coin needs to make for you to break even to 100% rather than 150%. Invest 20% more; all you need to break even is a 66% gain.

Unless you are 100% certain, we are never 100% allocated. And since absolute certainty requires all-encompassing knowledge about everything - it's unlikely any of us will ever be that certain.

Finding the happy medium between risk and reward is all part of the fun!

Cryptonary's take

Crypto is often considered one of the most unforgiving spaces in which you can be involved.But we think that's bullshit - why?

Yes, we'll concede that it's easier to lose money faster than most other markets.

But you'll have a hell of a much better chance of making life-changing money in this market than any other.

Not losing money is 90% of the battle, but that 10% of the battle, if you win, can change your life.

And really, it only takes a few individual wins played smartly.

Cryptonary, OUT!