In this report:

- How will the new pro-crypto administration and Congress impact the future of cryptocurrency regulation in the U.S.?

- What specific policies and promises has President Trump made regarding the crypto industry?

- What potential shifts and opportunities can be expected in the crypto market and DeFi sector under this new leadership?

- Cryptonary’s take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

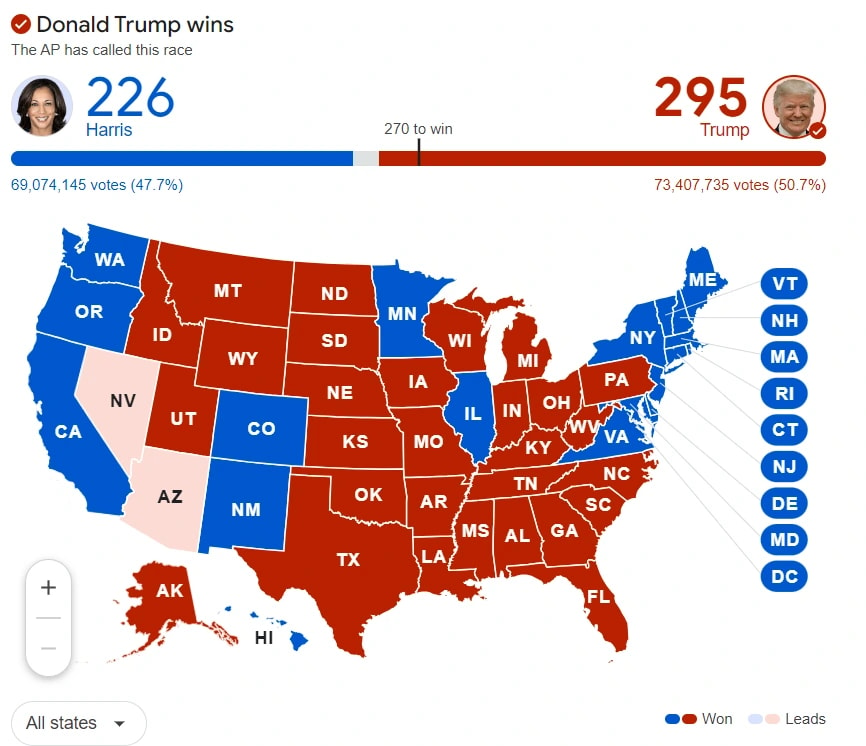

2024 US elections results

Over the past few weeks, all eyes have been on the 2024 U.S. elections, capturing the attention of the world in a spectacle that has been nothing short of unpredictable and dramatic. After weeks of suspense and anticipation, the results are finally in.This election season has seen twists and turns that few could have foreseen, including a dramatic change in the Democratic ticket from President Biden to Vice President Harris midway through the campaign, as well as two assassination attempts on Donald Trump that shocked the nation. Adding to the intensity, the race remained fiercely contested, with no clear winner emerging until the final days, keeping the entire nation and global observers on edge.

After a tumultuous and closely contested race, former President Donald Trump has been elected as the 47th President of the United States, defeating Vice President Kamala Harris in the 2024 presidential election.

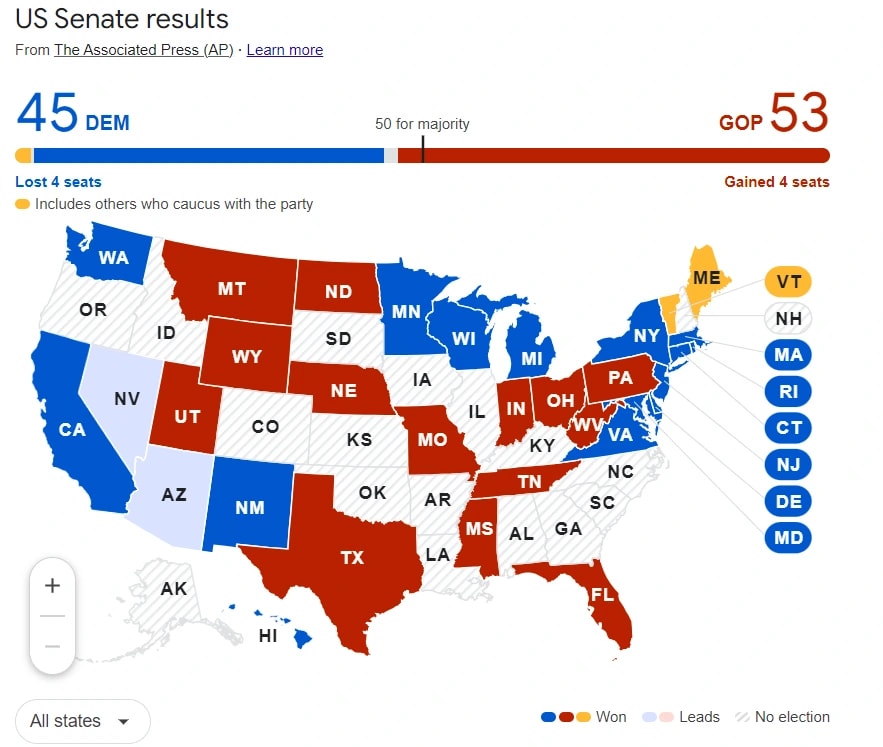

The U.S. Senate elections have also delivered significant shifts in the political landscape. The Republicans have secured a majority in the Senate, marking a pivotal change in the chamber's control. This unexpected turn has been attributed to several key races (e.g in Ohio, Pennsylvania, Nevada) where Republican candidates managed to flip seats traditionally held by Democrats.

These victories have provided the Republican Party with at least 53 Senate seats, ensuring their control over the upper chamber.

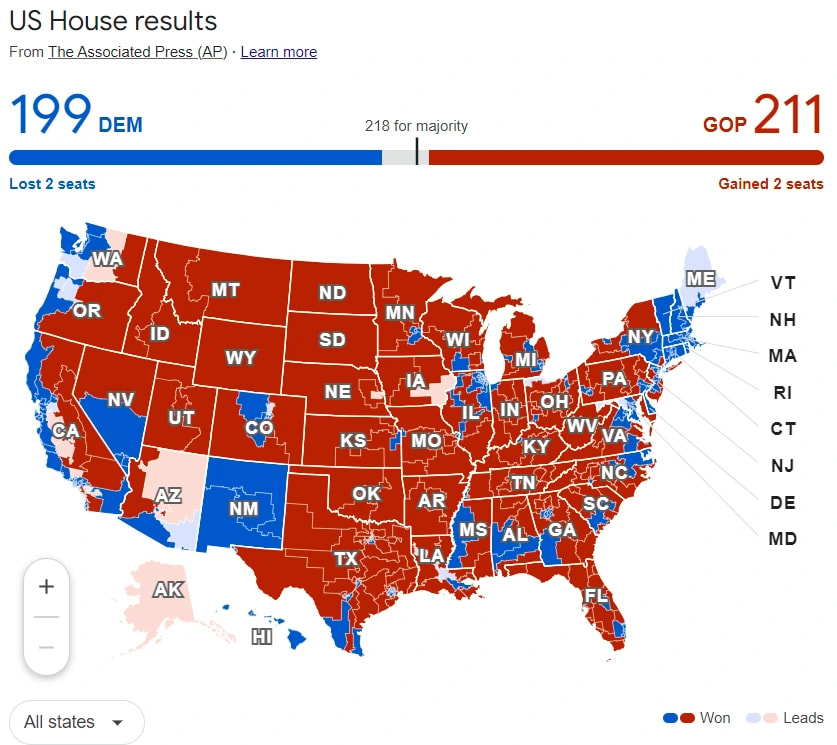

The results for the U.S. House of Representatives in the 2024 election, based on the latest available data, indicate that:

- Republicans have secured 216 seats and are leading in an additional 6 seats, which would bring their projected total to 222.

- Democrats have won 204 seats and are leading in 9 more, projecting a total of 213 seats.

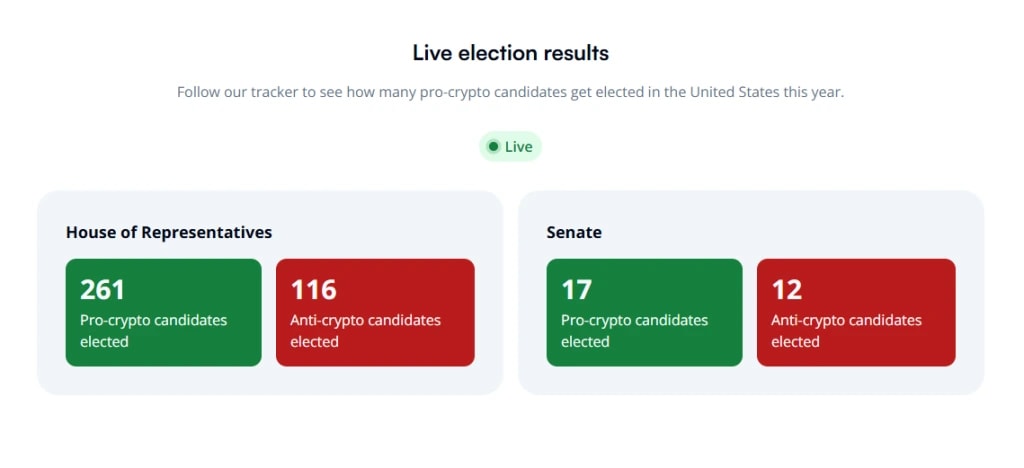

It is no secret that politics influence various industries including crypto, and guess what? Majority in the House and Senate are pro-crypto candidates. With 278 pro-crypto candidates in Congress now, lawmakers are poised to advance bills fostering clarity and freedom to innovate, which the crypto industry has been struggling with under the previous administration.

To summarise, now we have:

- The most crypto-friendly President in U.S. history now holds office.

- The most pro-crypto Congress to date, with a majority in both chambers.

- Politicians now recognize that an anti-crypto stance is no longer viable or politically advantageous.

- A significant number of crypto-related bills that were previously blocked or stalled are now likely to pass under this pro-crypto Congress.

What should we expect from Trump?

Last week we wrote about both candidates’ stance on crypto and now we have a clear winner. As we turn our attention to President Trump’s upcoming term, one of the most intriguing aspects of his upcoming presidency is his clear and unyielding stance on crypto industry. Let’s dive deeper into the specific policies President Trump has promised and their potential impact.Key policies: Crypto-friendly agenda

Trump’s rhetoric during the campaign laid the foundation for his future policies. Here are some of the standout commitments he made:- End the Anti-Crypto Movement: Trump promised to halt the anti-crypto stance that had characterized the Biden and Harris administrations.

- Fire SEC Chair Gary Gensler: One of Trump’s headline promises is the removal of current SEC Chair Gary Gensler. This action was positioned as a priority, with Trump stating that Gensler’s removal would mark a new era for crypto oversight—one that supports innovation rather than hinders it.

- Market Cap of Bitcoin to Surpass Gold: Trump’s vision for Bitcoin is ambitious—he foresees the market capitalisation of Bitcoin flipping that of gold. This speaks volumes about his belief in the future potential of digital assets as a cornerstone of economic value.

- Bitcoin Strategic Reserve: Under his administration, the U.S. is expected to build and maintain a strategic reserve of Bitcoin, reinforcing the notion that digital currency is viewed as an asset of strategic importance.

- No CBDC: Trump’s aversion to a U.S. CBDC is rooted in his concern for financial freedom and the decentralization of economic control. By opposing a state-backed digital dollar, he aims to protect citizens from excessive oversight and potential economic manipulation.

- The U.S. Won’t Sell Any BTC: Finally, Trump’s commitment to maintaining U.S. Bitcoin holdings aligns with a long-term strategy of positioning the nation as a global leader in digital asset accumulation.

Regulatory and legal shifts

With the new pro-crypto Congress, several developments are expected to happen. Under new leadership, these bodies could adopt more balanced regulatory approaches.- More innovation: There is less fear for possible entrepreneurs wanting to start up in crypto, meaning more innovation.

- Lawsuits: Pending lawsuits might be dropped or reconsidered, resulting in fairer treatment for crypto companies.

- Regulatory clarity: Potential clarity on Initial Coin Offerings (ICOs), freer token launches, clarity on what is a security and what constitutes an investment contract.

- ETFs floodgates are now open: There is now strong possibility that other than BTC and ETH ETFs there will be others. Ethereum ETFs with staking rewards (dividends) and Solana ETFs are now on the table as well. This is super bullish for the industry.

Banking and payments

The administration’s stance may enable banks to engage more seamlessly with crypto assets.- Banks will be able to interact with crypto more easily. No more “Operation Chokepoint”.

- Banks might be able to custody digital assets for their clients. Bill was presented however, didn’t pass under the previous administration.

- Stablecoins gain wider adoption: transfers, payments, and stores of wealth in stables will become more popular.

- As a result, more legit stablecoin providers can emerge, including banks-backed stablecoins.

Implications for Defi

New administration is incredibly bullish on DeFi for the following reasons:- Fee-switch: Deregulation and clarity with regard to digital assets are good for the value accrual of DeFi tokens. Most of them are likely to turn on fee switches either through token buybacks or revenue shares, which is incredibly bullish for DeFi overall.

- Airdrops: Last 6-8 months have been tough on airdrops. Many were afraid to launch their tokens.. However, with upcoming deregulation and clarity in the crypto industry, many will be launching their tokens.

- RWA: The adoption of RWA accelerates: trading/investing in stocks, bonds, real estate will become possible.

Cryptonary’s take

For the first time in history, the U.S. has a pro-crypto president and vice president, with Congress also showing strong support for digital assets. Their ambitious plan includes making Bitcoin a part of the nation’s strategic reserve and positioning the U.S. as a global hub for crypto innovation. This shift in policy has fueled an unprecedented surge in the market.Bitcoin has shattered its previous record highs, igniting a rally that signals we’re only at the beginning. The Federal Reserve is cutting interest rates while the economy remains robust, providing even more momentum to the market. Meanwhile, prominent Bitcoin advocate Michael Saylor is raising $42 billion to acquire additional Bitcoin, underscoring the growing confidence in the space.

We are at the start of the euphoric stage of the market cycle; most of the gains will be made here. Don’t fade momentum. If something has already gone up 10x, it could go up another 10x. We’re in a market where new highs become the new normal.

The takeaway: don’t miss this chance. The excitement is here. Be part of it, stay on track, and remember: there has never been a more bullish time to be in crypto.

Don’t fable the bags!

Cryptonary, OUT!