There's no denying that many superficial projects are out there trying to ride the hype of crypto and AI into relevance.

Yet, something revolutionary is happening at the intersection of crypto and AI.

Recently, we got our eyes on one particular project redefining what is possible on-chain.

It is creating a platform for “smart contracts 2.0” and opening up novel use cases powered by AI.

So, let’s dive in.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Crypto x AI

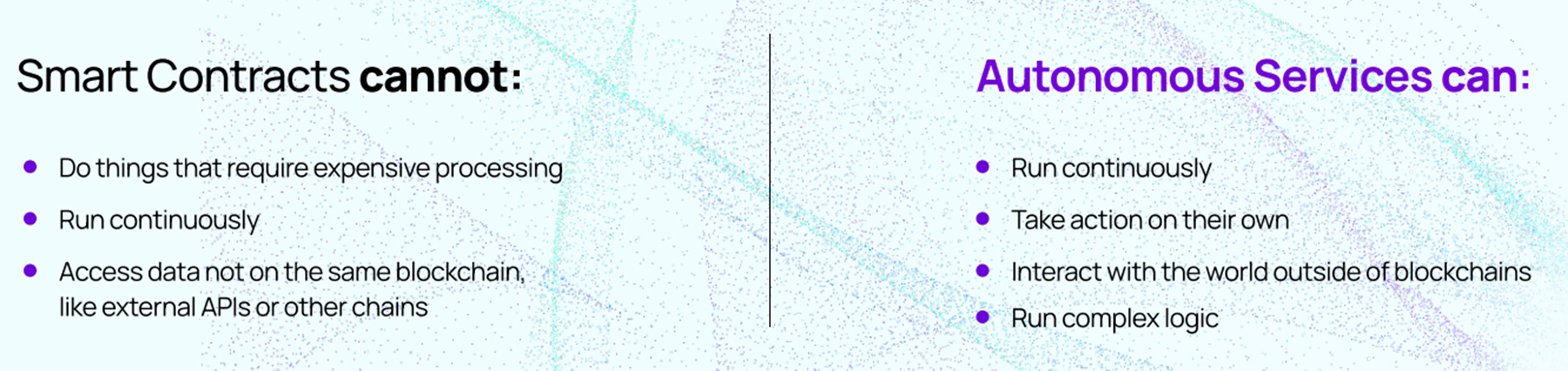

Before we start, we need to understand what is an Autonomous service (Agent) and how it is different from smart contracts.Let’s start with smart contracts. Smart contracts are digital code that defines the rules of a blockchain transaction. Let's say you want to buy a digital item from someone. You can use smart contracts instead of relying on third parties (like a bank) to make sure both of you follow through with the deal.

Autonomous services (Agents) are also a piece of code but much more complex than smart- contracts. These agents are a group of independent computer programs that interact with each other and can act on an owner's behalf, with limited or no interference, to generate economic value for its owner.

For example, you need human action when using a smart contract (e.g. signing a transaction). In contrast, agents can run continuously 24/7 without human intervention and act independently based on pre-defined logic and real-time data. They are also composable and can interact with each other to create a bigger service that achieves certain goals.

Imagine you have a specific task you want to automate, like paying rent every month. A smart contract is like setting up an automatic payment through your bank. You define the conditions (e.g., the amount and the date), and once those conditions are met (e.g., it's the first of the month), the payment is automatically made. The smart contract handles this specific task efficiently.

Now, think of autonomous services as having a personal assistant. Instead of just automating a single task, your personal assistant (autonomous service) can handle various tasks for you 24/7 without needing constant instructions. It can pay rent, manage investments, participate in governance decisions, and interact with external systems or services.

Just like we have decentralised platforms for smart contracts (Ethereum, Solana, Avalanche, etc), we need decentralised platforms for autonomous agents.

And that's where Olas enters the scene.

Olas (Previously Autonolas)

Olas is a platform for Autonomous services or applications (AI agents). Like smart contracts, any developer around the world can develop an AI agent and be rewarded in proportion to how useful her AI agent is.Service owners (those who use these AI agents) are incentivised to donate some profit generated by these AI agents mostly to developers (but, optionally, they can also direct it to Autonolas’ treasury). Additionally, if certain AI agents generate profit, “bonders” (independent users) can pair their capital with the code and make their capital work.

How OLAS works

- A developer registers the AI agent (on the OLAS protocol)

- Agents enable new functionalities that bring new value

- DAOs and individuals use these agents

- DAOs donate some profit generated by these agents to the Treasury and developers

- Donations further attract developers

- Devs from all around the world are incentivised to create new, useful AI agents

To develop such an ecosystem, OLAS provides two key components:

- Open-source software stack: A set of tools and libraries for developers to build autonomous services.

- On-chain protocol: A blockchain-agnostic protocol for coordinating and incentivising the operation of these services through their token OLAS.

What are the use cases of AI agents?

As with smart contracts, potential applications of AI agents are constrained only by the imagination of developers and end-users. Anyone can create anything as long as it is valuable.One of the use cases for AI agents is improving DAO’s operations. Most DAOs, in their current form, still have trust assumptions. Communities still rely on the goodwill of the core team to execute the decisions of the DAOs, which makes these DAOs pretty much centralised and manual.

For example, we all remember the fiasco that happened to the Arbitrum DAO. Essentially, Arbitrum Foundation sold ARB tokens without the approval of the DAO, which questions the decentralisation of this form of governance.

However, with AI agents, the treasure can be managed by transparent, decentralised and autonomous agents who will find the best ways to execute any DAO’s bidding. In this sense, AI agents can be very valuable in helping DAOs achieve their purest form and fulfil the promise of true decentralisation and autonomousness.

In summary, using cases of these AI agents can improve DAOs’ operations (treasury management, liquidity management, etc.), minimise transaction costs, automate voting processes, rebalance liquidity pools, and much more.

However, an early-stage platform hosting this kind of activity needs to achieve a network effect to grow bigger and bigger.

So, let’s now look at data to see whether OLAS is gaining traction.

Let’s talk numbers

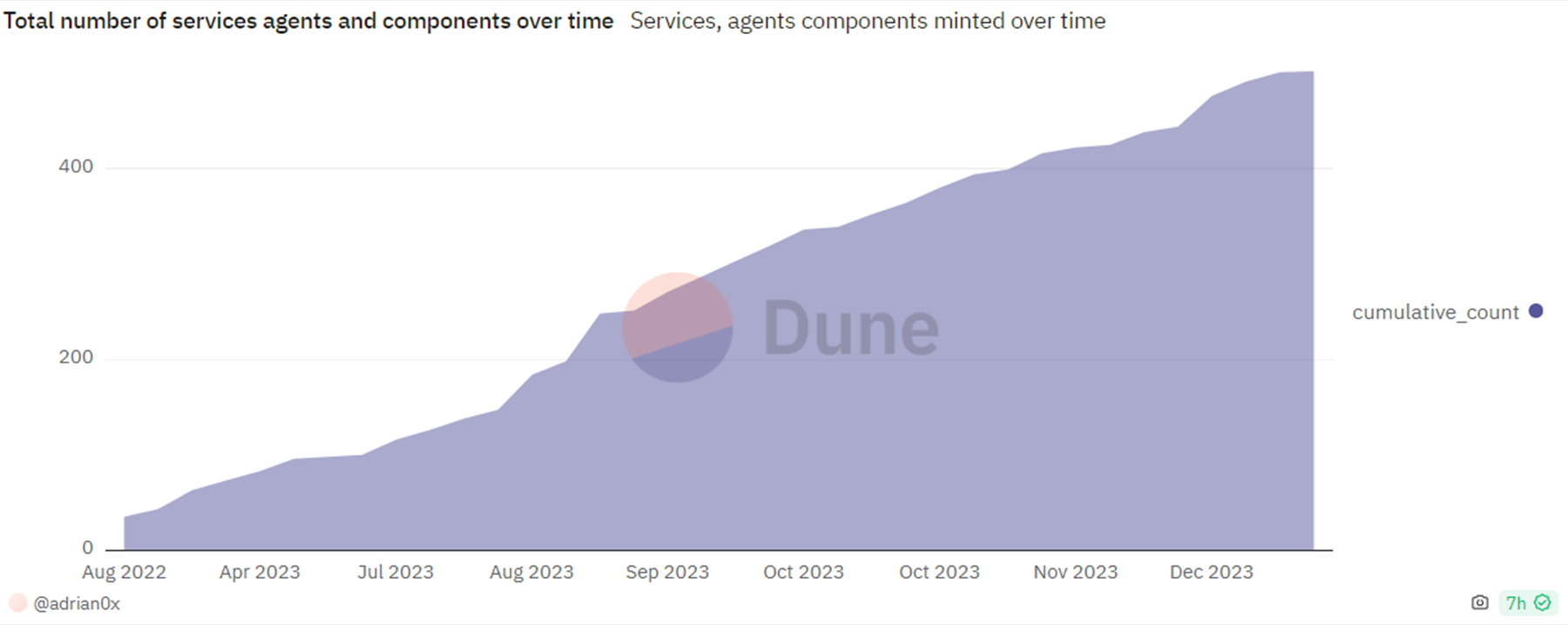

The number of AI agents and components is growing consistently. It is clear that AI agents caught developers’ attention.

Now, we need to ask whether these agents are being used.

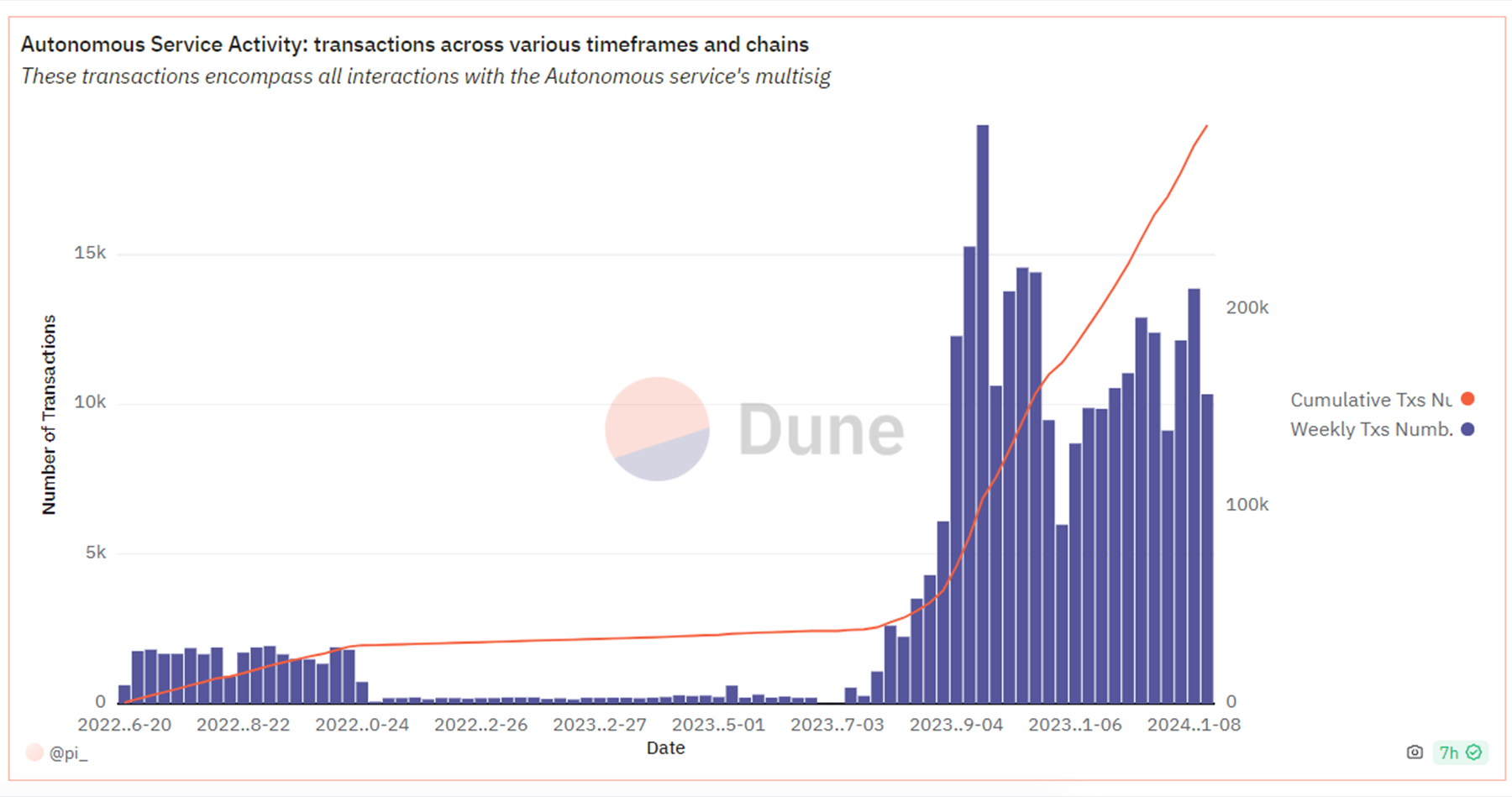

The amount of activity related to autonomous services has skyrocketed since July last year, and looks like it has established a new average.

Among notable services built on OLAS, we can note Valory, which received a grant from Balancer for their smart-managed pools based on the Fear & Greed Index. Centaurs, which helps communities manage their DAOs with the help of AI CoPilots, is another notable project.

We believe novel, innovative applications will keep emerging as OLAS matures.

However, the best crypto investments are those with innovative products, growth, and excellent tokenomics.

Therefore, let’s look at OLAS’s tokenomics.

Tokenomics

Let’s start from the basics- OLAS price: $4.30

- OLAS Market Cap (circulating): $228m

- OLAS Market cap (fully diluted): $2.32m

- Current supply of OLAS tokens: 536.26m

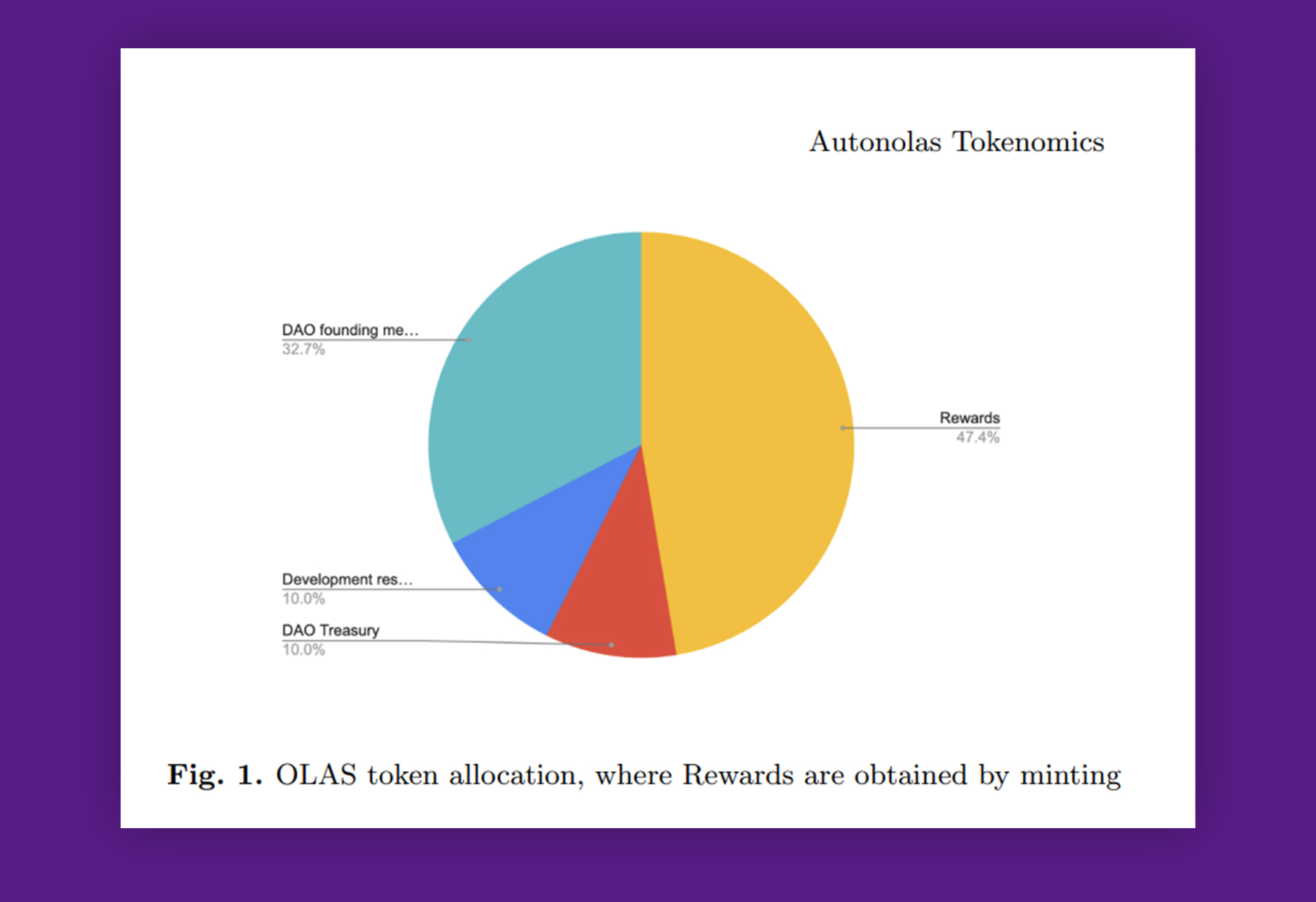

Almost half of the supply is allocated for incentives for building new agents and services on top of OLAS.

As we mentioned earlier the developer’s code is represented as NFTs. Developers stake their “useful” code as NFTs for autonomous services and receive a share of the OLAS inflation in exchange. Additionally, devs get incentives in ETH (donations) and top-ups in OLAS.

Token allocation

The token allocation chart shows that DAO’s founding members got almost ⅓ of the token supply; 10% is allocated for Treasury and 10% for Development.

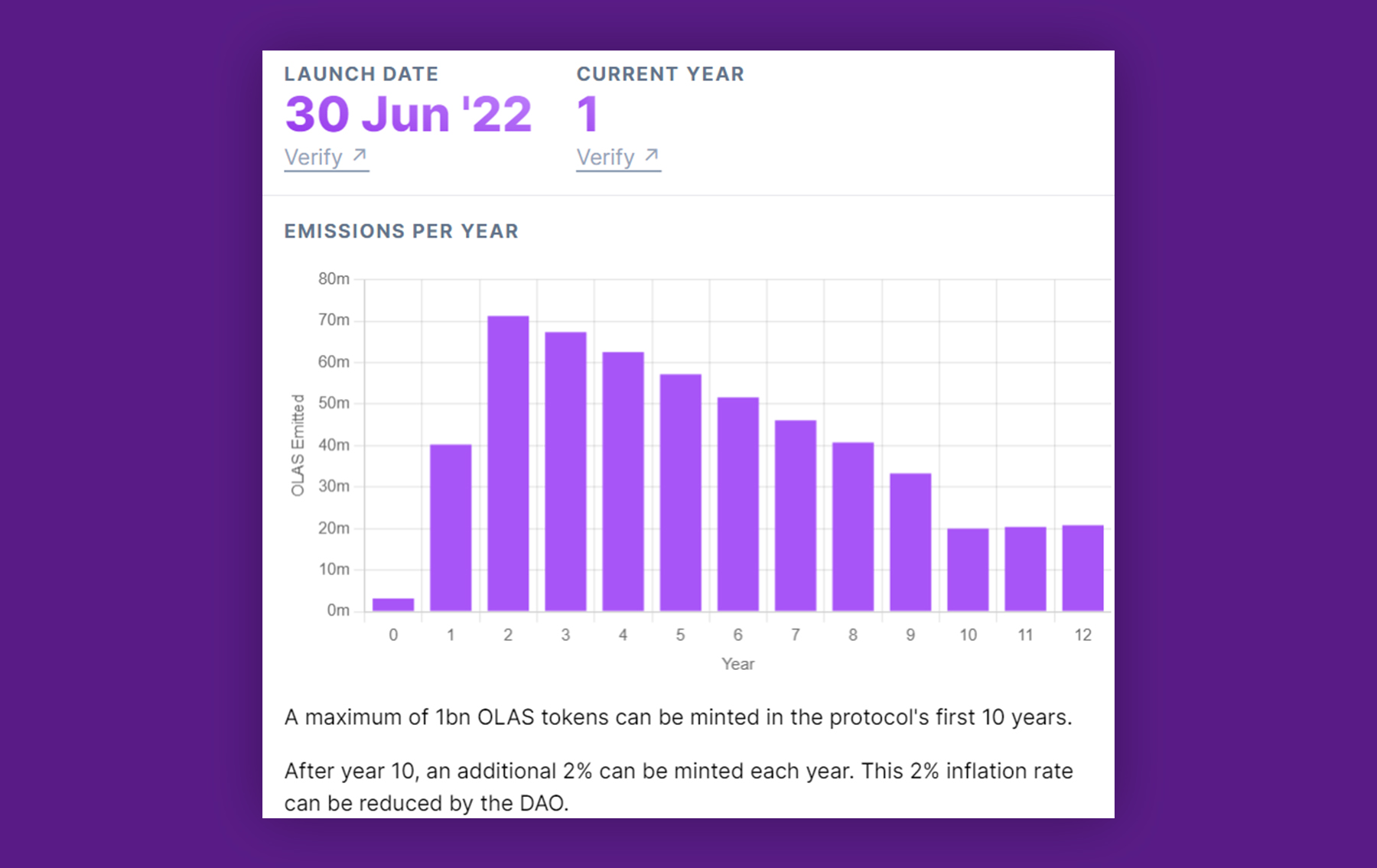

The token is inflationary, and from 2024 to 2025, the supply will increase approximately by 100m tokens, which is roughly 20% (10% per year on average).

Price targets

OLAS token is used for governance and managing the Treasury.Additionally, OLAS token holders can collectively own Protocol Owned Services (POSe) that consist of AI agents and require external operators to stake OLAS to run the services.

External DAOs can use these services and are encouraged to donate to OLAS’s Treasury. However, we believe that relying on voluntary donations to treasure for value accrual for the token is a weak value proposition.

Therefore, despite being bullish on the protocol and sector overall, we have conservative price targets for OLAS for the time being due to its poor tokenomics.

For the sake of valuation, we will assume that OLAS’s supply will increase by 20% in the next two years and circulating supply will be equal to 57.12m

- Bullish scenario: In our bullish scenario, Olas becomes the main hub for AI agents. The agents will start becoming day-to-day users of blockchains, and the speculative demand will push the mCap of OLAS to $2-$3 billion in the next two years. So, based on the 57.12m circulating token assumption, the price of OLAS would be between $35 - $52 (8X-13X).

- Base scenario: In our base scenario, bull market vibes and AI narrative alone will push the mCap of OLAS to $1-$2 billion. In this scenario, the price of each OLAS token would be $17.5 - $35 (around 4x-8x).

- Bearish scenario: OLAS fails to attract developers. We are wrong about the importance of AI agents, and they can’t find product market fit. Despite being a legitimate project, the token can suffer 30% to 60% loss.

Technical analysis

Let's be honest: charting this token is hard, almost pointless, because of how fresh and light the volumes are.

Anything below $4.50 looks cheap on the chart, but we'll need more months of price action to see how this plays out liquidity-wise, etc.

It doesn't quite look like the team is market-making OLAS. There are no wicks or anything, and that’s because they’re not market-making it. The order book will, therefore, just be super thin.

If we were in a bad bear market, it would drain and turn into one of those L-shaped charts - starts high, goes close to 0, and then does nothing or rises again two years later.

When launching a new token, market-making it on exchanges is often essential. Market making and general liquidity are everything; without them, the token can drain away even with really good tokenomics.

So, while this is a great project, the tokenomics aren't exactly great, and the chart isn't encouraging as well.

Buying into OLAS would be a wildcard move - it would either ride on the crypto x AI momentum or go bust - unless the DAO fixes the tokenomics.

How to buy OLAS

If we wanted to invest in OLAS, this is how we would do it.OLAS is available on Ethereum, Polygon and Gnosis chains. The best liquidity is on Gnosis. If we wanted the best execution, we would trade OLAS on Gnosis.

Here are the steps.

- Go to Jumper exchange

- Transfer from any supported chain and asset to Gnosis. (For the destination token, choose xDAI; It is the gas token on Gnosis chain)

- Go to Balancer

- Swap from xDAI to OLAS (Make sure you leave some xDAI in your wallet for gas)

You can lock OLAS to participate in governance. However, locking is only available on Ethereum Mainnet.

Cryptonary’s take

Will AI agents become a core part of the crypto economy?We think there's a decent chance that AI agents will evolve to become active crypto users. This is bullish.

OLAS's approach is promising because their tokenomics heavily favour developers, which can result in a thriving ecosystem of AI agents in a couple of years.

That said, we don’t see compelling tokenomics that benefits investors, yet.

The token is inflationary, especially in the coming 1-2 years. There is no direct value accrual of the OLAS token that would benefit investors.

However, despite poor tokenomics, the potential of the protocol is enormous.

It is not another DEX or lending protocol.

It is a brand-new market sector. Plus, we cannot rule out potential changes by the DAO to tokenomics in the future.

Since new developers are incentivised with OLAS tokens, token value can decrease, potentially making developer incentives less and less valuable.

Therefore, we believe it is in OLAS DAO’s best interest to find robust value accrual for the token to continue incentivising development within their ecosystem, which we believe they eventually will.

Therefore, we will be closely watching OLAS and inform our community if there are significant changes.

Cryptonary OUT!