The market leader, Bitcoin is often dubbed ‘digital gold’ and draws similarities to the precious metal in both utility and acquisition, including the process of excavating value from its system -known in both cases as ‘mining’.

With Bitcoin though, instead of relying on heavy-duty machinery and a human workforce to scour rocks and caves in quarries and archaeological sites, it uses computing power to solve mathematical equations.

Mining is a global decentralised network of computer nodes – known as miners - competing to solve cryptographical algorithms to receive the block reward of the cryptocurrency. Transactions are immutability stored on the public ledger as a single block of data – a chain of these known as blockchain.

Due to the nature of decentralisation, a system of consensus called Proof of Work (POW) must confirm valid transactions on the Bitcoin network. In the case of Ethereum, the upcoming 2.0 launch will activate the transition from POW to a model called Proof of Stake (POS).

Costs

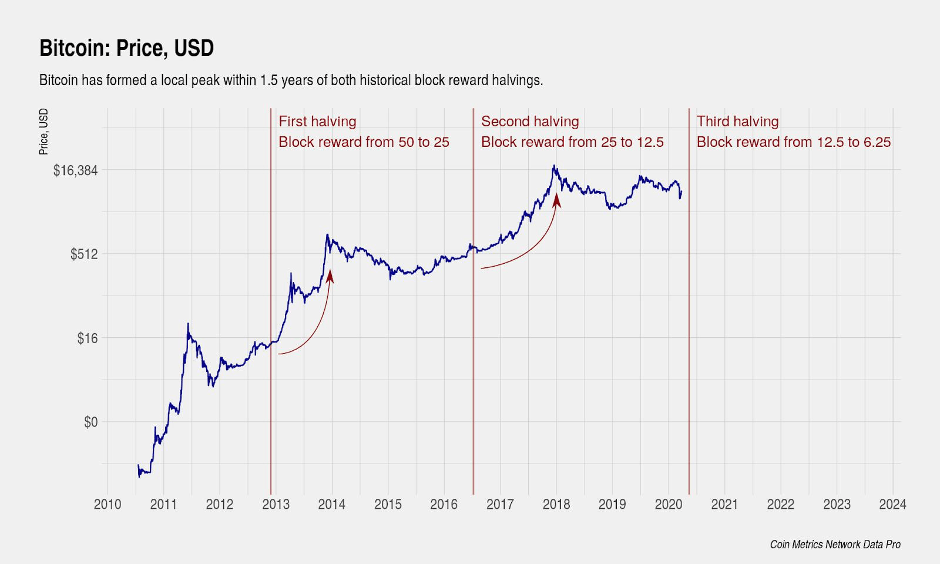

Around the time of the first halving in late-2012 – due to low competition and the relative simplicity of the cryptographical puzzles - many home-made CPU operations would have been sufficient to mine tens of Bitcoins. At that time, Bitcoin was only valued around $13 so the economic incentive for the niche industry wasn’t too enticing.

The most recent halving of Bitcoin – the 3rd in its history – actioned a scheduled decrease of the block reward by 50% from 12.5BTC to 6.25BTC. Halving’s are marked every four years and with it come both a higher cryptographic difficulty and a lower block reward for miners.

As a consequence, the entry-fees for such operations have exponentially increased meaning that miners now require more machine computation and a higher electrical output to achieve the same monetary reward.

Early mining was conducted on standard computers and laptops by utilising the internal power source: Central Processing Unit (CPU). Due to the low price of Bitcoin, miners were able to hash sequences and validate transactions with ease, turning a good profit in the meantime.

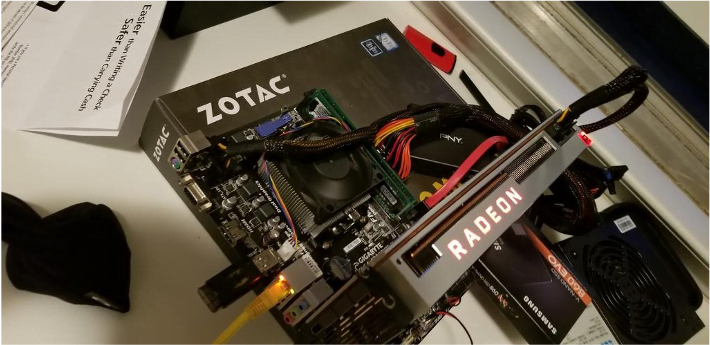

Then came the Graphical Processing Unit (GPU), otherwise known as graphics cards. Originally designed for video games, by providing more computing power, these cards enabled miners to solve equations with more efficiency and speed (50 – 100x faster than CPU) in what was becoming an emerging market.

The specificity to mining and access to customisation that came with the Field Programmable Gate Array (FPGA) was what birthed the image of modern mining - what we know of today as ‘mining farms.’

What was once an enterprise for individualism, soon became a lucrative proposition for businesses. Miners were grouped together into ‘pools’ and were afforded generous financial backing from large corporations to go about their work. In comparison to the individual miner, this method granted miners the advantage of economies of scale and as a result, a higher yield for their work.

The Application-Specific Integrated Circuit (ASIC) is the top-tier hardware currently on the market. A premium brand ASIC microchip such as the Antminer S9 will set you back around $2,000. What you’ll get from that is 14 TH/s hash rate speeds, the most efficient of the series at around 1350 watts power consumption. Bitcoin’s cost of production almost equals that figure, especially as its price soars to all-time highs (ATH’s). Therefore, for most small-scale operations this option simply isn’t profitable.

Mining farms have cropped up across the world in large-scale warehouses to store the hundreds, often thousands of ASIC algorithmic rigs and thus consolidating profit into central locations. This assessment though doesn’t even factor in the costs for graphics cards, power supplies, generators and coolers. Later on, we discuss China’s dominance in this sector and the reasons behind it.

Without this mass resources of behemoth corporations behind them, many small-scale miners have been forced to shut down amid this contemporary, digital gentrification.

Investment in mining hardware can be a costly business as you’ll go onto hear from some of our community members. Those interested in learning more, or calculating their cost of setup can benefit from the many online resources available. Here’s one of them.

Pro’s & Con’s

Pro’s

- Transactions on the blockchain are irreversible, immutable and publicly accessible in their design which allows for fair competition and network trust.

- The rise of cloud mining provides miners with new opportunities earn money by purchasing GPU computing power from global locations, instead of storing machines/equipment onsite.

- Mining is as much about the individuals monetary gain, as it is the ecosystems growth. Contributing to the cause of the technology is a considerable factor in most participants passion for this market.

- Mining is designed to be an energy-exhaustive operation so to ensure fairness and integrity in competition. However, this is having negative consequences on the environment. Bitcoin ranks 39th in countries energy consumption chart and its carbon footprint on an annual basis is now comparable to the entire of New Zealand!

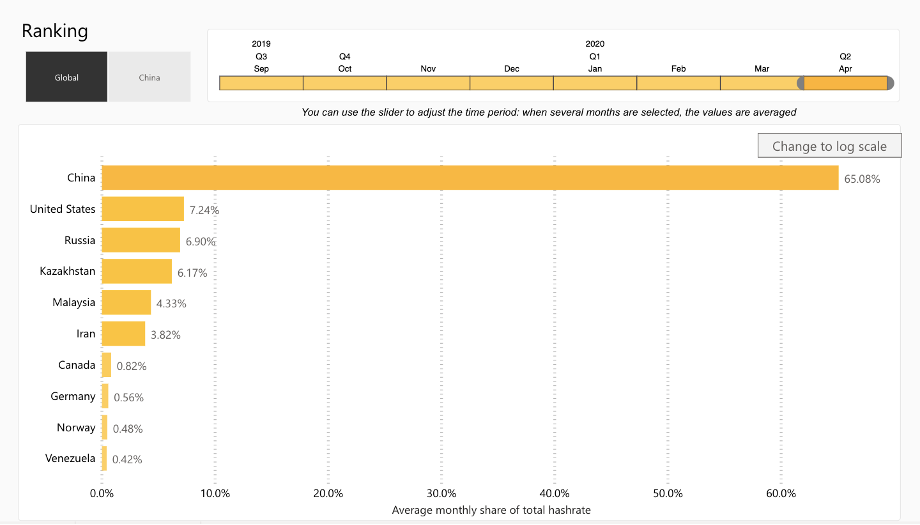

- Benefitted by low electricity costs and the ability to burn large quantities of fossil fuels including coal to little economic repercussion, China has gained control of an estimated08% of the hash power of Bitcoin, leading some to call into question the very principles of decentralisation. According to live data from the University of Cambridge, the US hash rate dwindles at a trivial 7.24% with Russia in third with 6.90%.

Interviews

A few weeks ago, we asked to hear from members of our community who have active cryptocurrency mining operations and we delighted with the response.

Any of our followers have a mining operation or set up? DM us we’d like to talk with you.

— Cryptonary (@cryptonary) November 7, 2020

Today, we have invited three miners to share their crypto mining stories in more depth. We have Tim at TKInvestments from Wyoming, Party Ferret from the UK and an Anonymous mining team from South Africa.

(Tim at TKInvestments from Wyoming)

Q1. When did you begin mining cryptocurrency and what was the initial reason?

A – We are a team of 3 people with an operation that is around 6 months old. We are essentially playing the "mining cycle" and starting when the miners overleverage and are kicked out. The market is saturated and overly populated with miners at this current juncture, so everything is overpriced.

We are looking to build from the ground up, so currently devouring information, testing rigs, building and buying test equipment, experimenting and constructing rigs to begin our $100,000 mining project in the downturn of next year.

Q2. Which country is your operation based in and how has the response from your government to this technology (either interest or hostility) impacted your growth?

A - We are located in Wyoming, one of the last wastelands in the United States. Lots of open space, lots of potential. We fought about 2 years ago to get laws and regulations regarding crypto overturned and won. It was absolutely absurd the charges you could face just dealing with exchanges like Gemini. As a result, we now have extremely low taxes.

Along with lax crypto laws and a pro-crypto local government and crypto/education and activist group located in our city. I believe that the exchange Kraken has just moved here.

We are a strictly private and discreet group and therefore don’t require any extra licences or permits. To couple this, there are no present laws or regulations in this country that require you hold this. I have been told of a gentleman in town operating in a similar way who mines himself and has over 1000 BTC ASIC miners.

Q3. In May, the Bitcoin’s reward for mining blocks was halved to 6.25 BTC. How has this impacted the profitability of your operation this year and what will be the impact in the years to come?

A - We don’t mine BTC, we are ETH believers and are going to do so till ETH 2.0 drops. We believe that GPU & ASIC will die in a devastatingly dumb and ideological move to staking!

BTC is a powerhouse and mining in today's age as a GPU miner is shooting yourself in the foot because ASIC's already have gained ownership over that realm. ETH and ETH Classic are still paying [$2.50/per unit] a day for us running Radeon 7’s we buy and refurbish. This is super lucrative and being paid in ETH is a bonus to us.

One of our partners runs a gold mining operation and is stunned just running the miners we could pay off our initial investment in less than a year! We believe in the HODL philosophy and have educated ourselves through mining and Cryptonary to aim to bolster our economic growth and investments into 2022.

ETH 2.0 is going to launch soon. I don’t know of any home operations with GPU's that know how the farm will float in the new age. What happens when those flood other algorithms and projects? We fear that it's going to be another miners "crypto winter".

So, we are searching for the next ETH to GPU protect so that we can hedge ourselves in and support a network of truly amazing value.

With the current presidential election, our situation in the United States is absolutely chaos. If we lose our oil, coal and energy sectors, America's mining will become null and void. Power will cease to be in excess and we will begin being rationed wattage and power during hours of the day, similar to California which is already experiencing power outages.

We as internet of value participants need energy to sustain our operations. With the change of presidential administration, we fear that our needs will be rejected and subsequently growth halted.

(Party Ferret from the UK)

Q1. When did you begin mining cryptocurrency and what was the initial reason?

A - I started mining in Nov 2017 because I wanted to get into crypto, but being risk adverse I decided to mine it to gain assets rather than buy it. My thinking was that at least I’d have assets to sell on if it didn’t work out. Initially, I began with one rig initially and then added another in December 2017.

For any new miners in the community, this is where I started.

Q2. Which country is your operation based in and how has the response from your government to this technology (either interest or hostility) impacted your growth?

A – I’m from the UK and my only concern is HMRC made a policy decision in 2019 that I can’t offset any hardware purchase or electricity costs against income which seems somewhat unfair. Other income streams can offset electric costs, hardware purchases etc.

There are no permits currently required in the UK, although solar power was the only thing that kept the operation profitable during bear season.

Q3. In May, the Bitcoin’s reward for mining blocks was halved to 6.25 BTC. How has this impacted the profitability of your operation this year and what will be the impact in the years to come?

A - I initially mined XMR, then ETH in a pool. I tried using Minergate, but eventually settled on Nicehash as the most convenient method for me. It probably took me about 4 months to get that sorted as my only advice was from Google searches. The first 6 months were pretty intense getting to where I am now in terms of effort required and convenience.

The biggest impact is going to come from ETH 2.0 and POS, we’ll have to wait and see what affect that has on profitability.

It’s been an interesting journey from knowing nothing about mining to building rigs, troubleshooting, carpentry, electrics, googling cannabis growing websites to find the best way of silencing the industrial extractor fan, amongst other things along the way.

I also use the mining rigs to heat the house during the winter so overall, it’s a win, win situation. I think in my domestic environment I’ve reached optimum setup and depending on the POS changes with Ethereum I will continue to mine for a while.

(Anonymous from South Africa)

Q1. When did you begin mining cryptocurrency and what was the initial reason?

A - We started our mining operation in 2013 with Monero (XMR) as we were curious about the crypto space.

Q2. Which country is your operation based in and how has the response from your government to this technology (either interest or hostility) impacted your growth?

A – Our team is based in South Africa and has several farms positioned in areas where cheap electricity is accessible. Our government hasn’t made any official comments about cryptocurrency yet, to be honest it’s still the wild west out here!

Q3. In May, the Bitcoin’s reward for mining blocks was halved to 6.25 BTC. How has this impacted the profitability of your operation this year and what will be the impact in the years to come?A - Due to our access to cheap electricity fees, we've been profitable during the entire bear market. Even the recent BTC halving hasn’t impacted our operation too much.

I don’t think crypto mining will be as big/profitable in the coming years. With project like ETH moving to Proof of Stake (POS), it just feels like a waste of resources and energy to have these huge mining farms running all over the world.

Our team have agreed that we won’t be in this industry for much longer. For us, it’s easier to just accumulate and hold assets to see returns over time. Right now, we are selling small portions of our mining reward to cover costs and then selling the rest to buy into other projects such as XRP.

Conclusion

If you’ve made it this far, you’ll be happy to know that this article is the first of a two-part series about the past, present and future of cryptocurrency mining.

In the next piece, we’ll be exploring more about the impact of politics on this industry, especially what the regulatory and legal implications could be for US miners and market participants following the change of presidency. We’ll also be tackling the intensifying arms race for cryptocurrency power in a decentralised world.