In today's report, we discuss the assets in Cryptonary's List and update you on which three assets we have removed from our picks.

We review our asset list regularly, analyzing the latest research updates, technical performance, and each asset's relative strength against Bitcoin. This allows us to assess whether an asset continues to hold strong return potential.

Based on recent developments, we've decided to remove RUNE, Parcl, and SHDW from our list. Our objective is to outperform BTC, and every pick must have a strong chart against BTC unless there is a strong thesis for reversal.

These decisions aren't taken lightly but reflect our commitment to optimizing opportunity costs and focusing on assets with stronger momentum and growth potential.

Let's dive into what's happening with each of these assets and why we've made these decisions.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Jupiter:

Let's start with Jupiter. Jupiter continues to show potential with its plans and strong community backing. We're keeping this asset in our picks as the ecosystem evolves.- Jupiter's $580M January 2025 airdrop, distributing 700 million JUP tokens to over 2.3 million wallets, marks a key moment in platform evolution. Check your allocation here.

- Jupuary Vote #2 passed with 87% approval, enabling expansion plans through Jupuaries in 2025 and 2026.

- The Catstanbul event will introduce updates like token utility changes, a token audit, and a potential supply burn for long-term growth.

($JUP/BTC) analysis

On the daily BTC pair, Jupiter ($JUP) is approaching its absolute bottom at 0.00000756, currently trading at 0.00000828. This level has historically acted as a significant support zone, where $JUP previously bounced in Q1 2024, delivering a 245% rally to 0.00002613. The price action indicates that $JUP is testing this critical area once again after breaking below its longer-range consolidation.For most of 2024, $JUP traded between 0.0000104 and 0.0000175, reflecting prolonged consolidation. The recent breakdown below this range has pushed $JUP toward its previous lows, where buyers are expected to step in. The current price action suggests limited downside risk unless 0.00000756 fails to hold, which could invite further selling.

If $JUP manages to defend this key level, we could see a potential reversal and a move toward reclaiming the previous support at 0.0000104. This remains a crucial zone for buyers to establish control and shift the momentum back to the upside. For now, maintaining 0.00000756 as a base is pivotal for $JUP/BTC. We will reconsider JUP as our pick if it breaks its historical lows. So far, JUP has stayed on the list.

Pendle:

Pendle continues to impress with its innovative approach to DeFi yield optimization and ecosystem growth. With its latest developments, we remain confident in keeping Pendle on our asset list. Here's what's new:- Pendle Finance launches Boros (Pendle V3), enabling margin yield trading and targeting the $150-$200 billion daily funding rate market.

- Pendle integrates with Base and Moonwell, offering long yield, fixed yield, and LP strategies to enhance liquidity and yield utility.

- Pendle ranks as one of the top 3 DEX on Ethereum by volume, surpassing $5 billion in TVL, driven by its yield tokenization and trading innovations. Quite an achievement!

($PENDLE/BTC) analysis

On the daily BTC pair, Pendle ($PENDLE) is trading at 0.0000389, hovering just above its critical support at 0.0000377. This level has historically been a significant zone for Pendle, having acted as a springboard for two major rallies in March 2024 (200% rally) and August 2024 (100% rally). The price action suggests this area is pivotal for Pendle's continued momentum.If 0.0000377 holds, Pendle has the potential to reverse and move higher, targeting the next resistance levels at 0.0000620 and 0.0000762. A sustained bounce from this support could mark a bullish shift in structure and pave the way for a short- to medium-term rally. However, if this level fails, the next key support lies at 0.0000338, which would act as a potential accumulation zone.

Pendle must establish a base above 0.00000377 to maintain its structure and avoid further downside pressure. Reclaiming the upside resistance at 0.0000620 is crucial to confirm a bullish reversal and open the door for higher targets. For now, the focus remains on whether this strong support zone can hold.

Chainlink:

Chainlink continues to solidify its role as a critical infrastructure provider for blockchain and traditional finance integration. With its strategic collaborations and technological advancements, we're keeping Chainlink firmly on our list. Here's what's been happening:- Chainlink's integration with Coinbase's Project Diamond and SWIFT aims to drive institutional adoption, supporting asset tokenization, cross-chain interoperability, and verifiable data services, potentially bringing over 12,000 banks on-chain.

- Tokenization efforts are accelerating with projects like Coinbase and SWIFT, aiming to revolutionize asset management across blockchains and positioning 2025 as a key year for tokenization.

- Chainlink's Payment Abstraction simplifies crypto transactions by converting fees into LINK, while CCIP trials with SWIFT are set to launch fully by the end of 2025, bridging traditional finance with blockchain.

($LINK/BTC) analysis

Chainlink ($LINK) against Bitcoin is currently trading at 0.000206, consolidating near a significant support zone at 0.000151. This historical level has acted as a key support during previous cycles but remains a critical area to defend as $LINK continues its long-term bearish trend since peaking at 0.00169 in August 2020. Despite a temporary bounce from 0.000151, $LINK/BTC is struggling to break above the 0.000289 resistance, which indicates continued bearish pressure.On the downside, the 0.000151 level is the first crucial support. If this level fails to hold, the next strong support lies at 0.0001, which could act as a final defence for the pair. On the upside, breaking above 0.000289 would signify the first bullish shift in structure, potentially paving the way for a rally toward the next major resistance at 0.000454.

For now, $LINK/BTC remains in a consolidation phase within a bearish structure. Maintaining 0.000151 is vital for any chance of a reversal while reclaiming 0.000289 is essential to confirm a bullish breakout and initiate upward momentum. We are watching this one very closely, and potentially, it can be the next asset to leave CPro picks; however, for now, we are watching.

Nosana:

Nosana is making significant strides with its upcoming Mainnet launch and ecosystem updates. With a strong roadmap and user-focused improvements, Nosana stays on our list. Here's the latest:- Nosana Mainnet launches on January 14, 2025, with features like Nosana Console, Client SDK, and dynamic pricing.

- Explorer updates improve user experience with new pages and feedback integration.

- Mandatory staking for all nodes was introduced, with an auto-stake feature for ease of use.

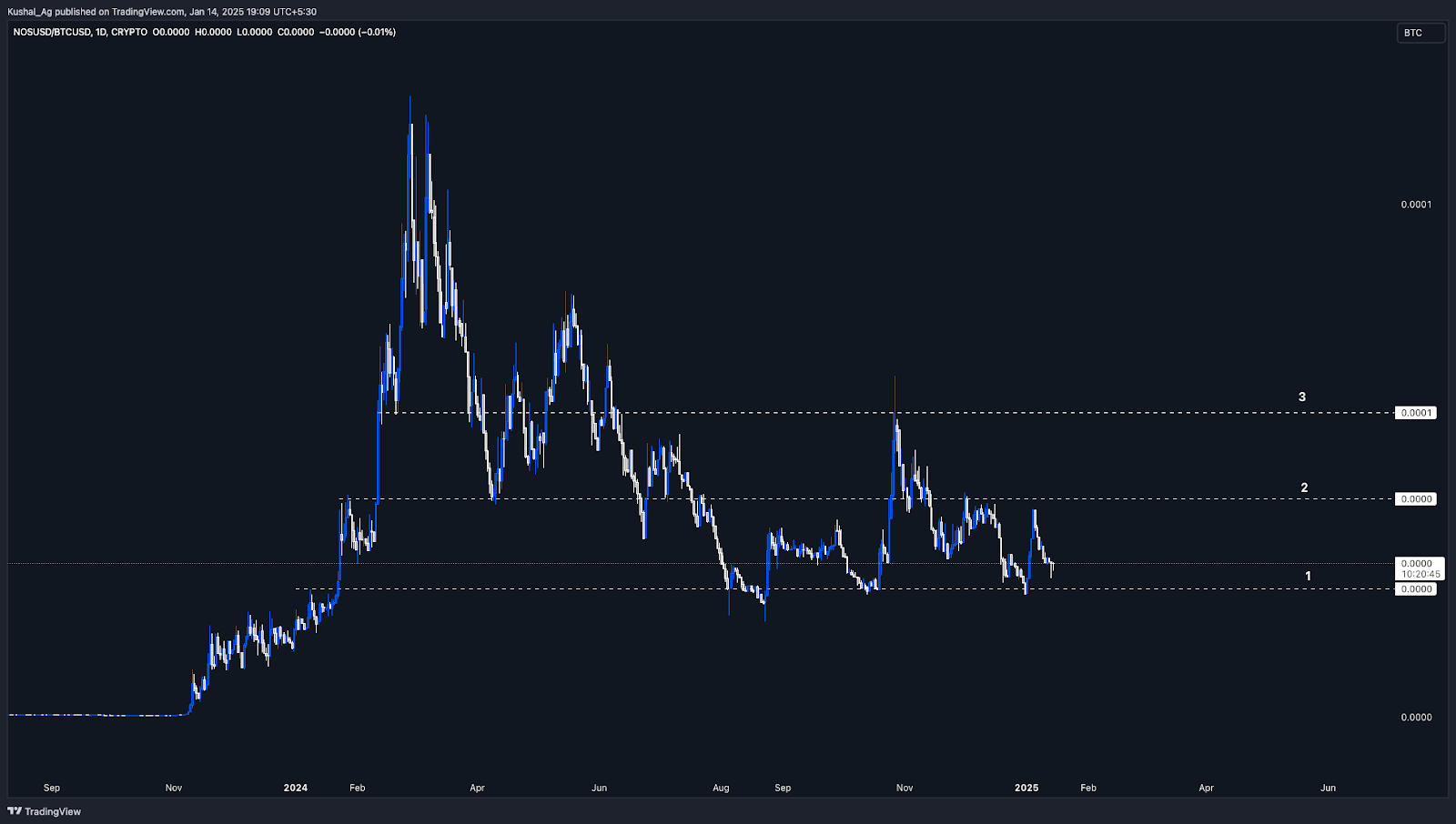

($NOS/BTC) analysis

Nosana ($NOS) is marked by three critical levels: Line 1, Line 2, and Line 3. The year began with an impressive 380% pump from Line 1, establishing a high before retracing back to its base. Following the retracement, $NOS entered a consolidation phase, trading between these key levels, with Line 2 acting as a pivot.Recently, $NOS rallied from Line 1 to Line 3 in October 2024, demonstrating bullish momentum. However, the price failed to sustain above Line 3 and retraced back to the range between Line 1 and Line 2, where it is currently consolidating. If $NOS can break above Line 2, it could retest Line 3 and potentially move higher, while holding Line 1 remains essential for a bullish structure.

A break below Line 1 would signal weakness and potential underperformance against Bitcoin. Conversely, reclaiming Line 2 would indicate strength, setting the stage for another test of Line 3. Nosana's movement within these levels will dictate its trend in the short to medium term.

Rune:

We're removing RUNE from our list due to concerns over THORChain's lending issues and potential RUNE dilution. These challenges suggest the project may struggle to deliver strong returns in the near future. Here's what's happening:- THORChain's lending service owes creditors about 1600 BTC but holds only 590+ BTC in the lending pool. This shortfall highlights a severe liquidity issue, with borrowing heavily impacted by BTC's rising price since loans were issued.

- To meet obligations, THORChain may need to mint up to 24 million RUNE, roughly 8% of the circulating supply. This would likely dilute RUNE's value, reducing its purchasing power and putting further pressure on the asset's market price.

($RUNE/BTC) analysis

Using the weekly time frame with a logarithmic scale, Rune ($RUNE) is showing signs of weakness, trading at 0.000033, nearing its crucial support at 0.0000311. This level, last tested in July 2023, acted as a significant pivot point, leading to a bullish reversal. However, Rune has been unable to sustain resistance above 0.000052, which marked a strong area of rejection.- Primary Support: 0.00003125 (July 2023 lows).

- Secondary Support: 0.0000252, a deeper support level.

For any bullish recovery, Rune must reclaim the 0.000052 resistance and establish a base above it. Until then, the focus remains on whether the upcoming support can stabilize the price and provide a foundation for a potential reversal.

THORChain's lending crisis and potential RUNE inflation pose major risks, impacting growth and investor confidence. We still love the platform overall and its unique value. However, we see better opportunities in other assets for returns and stability, and for these reasons, we must say goodbye to Rune at the moment.

Parcl:

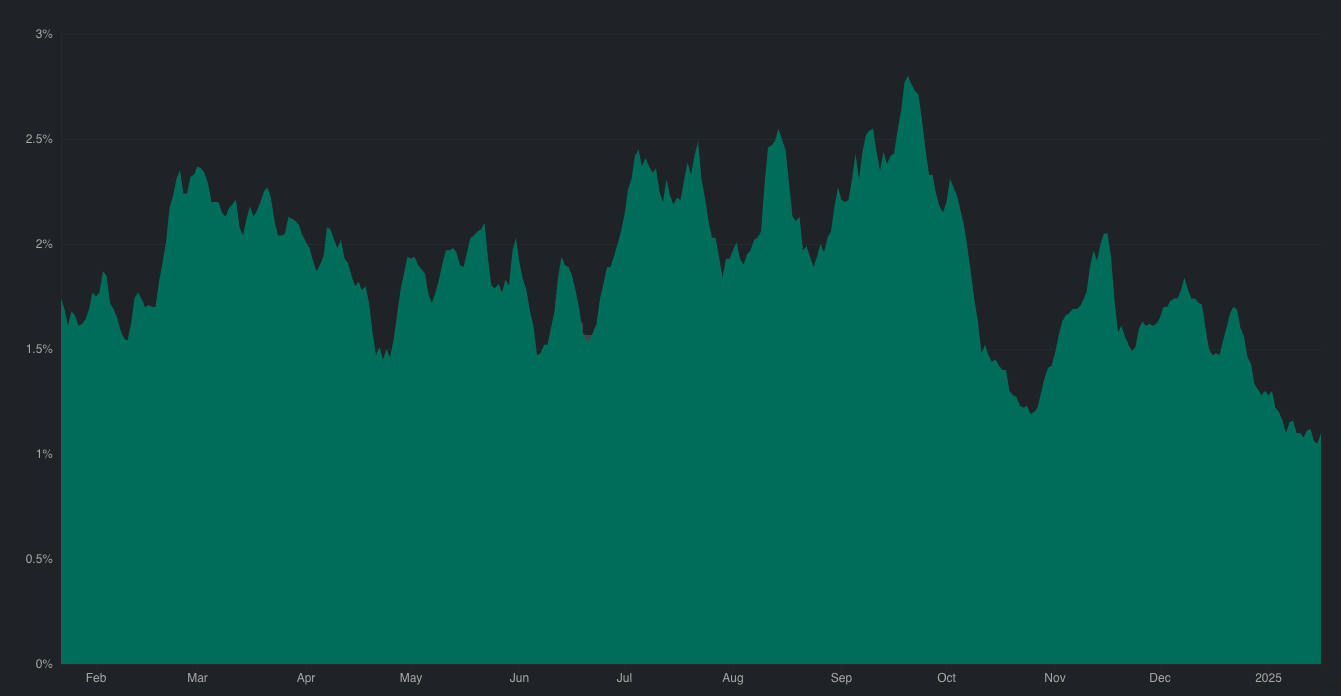

After assessing Parcl's recent performance, we've decided to remove it from our list. While the project has potential, key metrics and market sentiment indicate it may struggle to deliver meaningful returns in the near term. Here's why:- The narrative for Parcl hasn't gained traction yet, and it has received very little attention in the market. We may be too early here, as the project's visibility and momentum remain low.

- An upcoming token unlock in April 2025 will release 161.70M PRCL (16.2% of the total supply), valued at $46.92M or 72.7% of the current market cap, potentially adding significant selling pressure.

- Parcl's TVL has been declining since its all-time high in April, raising concerns about the project's ability to retain user engagement and capital.

($PRCL/BTC) analysis

Parcel ($PRCL) is marked by four key levels: Line 1, Line 2, Line 3, and Line 4.In September, $PRCL found its bottom at Line 1, from where it pumped 120% to Line 3. After retracing to Line 2, it gave another significant 140% pump to Line 4, which acted as a strong resistance. Over the next phase, $PRCL consolidated between Line 2 and Line 3, retesting Line 4 but failing to break above it.

Currently, $PRCL has broken below Line 2 and is heading toward Line 1; it's September low. If it fails to hold Line 1, the asset could enter price discovery on the downside, signalling a bearish trend against BTC. To regain strength, $PRCL needs to reclaim Line 2 and break above Line 3, but for now, the momentum is bearish.

While Parcl offers an innovative concept, the lack of market interest, technical weakness, and decreasing TVL signal challenges ahead. For now, we believe other assets provide stronger opportunities, but we'll continue monitoring Parcl for future developments. P.S. The chart against BTC doesn't look good either

Shadow token:

After evaluating SHDW's performance and market narrative, we've decided to remove it from our list. The anticipated momentum in 2024 failed to materialize, raising concerns about the project's near-term potential. Here's why:- The DePIN narrative for SHDW hasn't gained traction as expected in 2024, with a noticeable decline in mindshare during the latter part of the year.

- SHDW's relative performance against BTC has been weak, indicating a technical downside and limited strength compared to the broader market.

($SHDW/BTC) analysis

Shadow ($SHDW) is trading around key levels: Line 1, Line 2, Line 3, and Line 4.In November, $SHDW hit its low at Line 1 before rallying an impressive 400% to reach Line 4. After failing to sustain the move, it retraced back to Line 2, a historically bullish area for $SHDW, before attempting another move to Line 3, which acted as resistance. Currently, $SHDW is back at Line 2, consolidating.

If $SHDW fails to hold Line 2, it risks revisiting Line 1, which is November low. A breakdown below Line 1 would signal further downside price discovery. On the upside, reclaiming Line 3 would open the path to retesting Line 4, presenting a potential bullish scenario. For now, holding Line 2 is critical for the asset's structure.

While SHDW remains an interesting project, its lack of narrative momentum and technical weakness make it a less compelling option for now. We'll continue to monitor its progress but see better opportunities elsewhere.

Cryptonary's take

Removing assets from our list is never about labelling a project as "bad" or lacking potential. Every asset we analyze holds unique qualities and opportunities, but the crypto market is about timing and optimizing opportunity costs. At this moment, we believe RUNE, Parcl, and SHDW may not offer the best return potential compared to other opportunities in the market.These removals don't diminish the innovation or vision behind these projects. Instead, they reflect our focus on prioritizing assets that align more strongly with current market trends, technical performance, and broader adoption narratives.

We'll continue to monitor these projects closely, and if conditions improve, they could find their way back onto our list. For now, we're redirecting our attention to areas with clearer growth trajectories and stronger upside potential.

P.S. We have a few potential candidates to be brand new picks in our list. Follow us to be up-to-date.

Peace!Cryptonary, OUT!