Cryptonary Picks Update: Mid-Year Review 2025

The crypto market is moving faster than ever. So we figured, why not do a quick check-in on how our top picks are doing? Not just price-wise, but how they're actually progressing behind the scenes fundamentally. Let's dive in...

This review analyses the performance, significant advancements, and updated metrics for our top crypto assets: from Solana's blockspace upgrades and tokenised stock integrations to Hyperliquid's increasing dominance in on-chain derivatives and Ethereum's institutional inflows.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Solana

Let's start with Solana. After tremendous success in 2024, fueled by PumpFun's meme run, Solana is now experiencing very tough competition and congestion on its network. To combat this, the developers have been heads down shipping new upgrades. For example, SIMD-0286, a network upgrade that boosts the per-block compute capacity by 66% (from 60M to 100M Computing Units), has been proposed by Solana developers.This modification helps the network handle growing demand, especially from DeFi, tokenised assets, and consumer applications, by enabling larger and more complex transactions per block. Block time doesn't change, but the hardware requirements for validators might go up a little.

Solana keeps pushing for institutional infrastructure and the tokenisation of real-world assets, here are a few fresh updates as to what the chain has achieved over the last couple of months:

- Trade US stocks on Solana: Upexi, a Nasdaq-listed company, is putting its own shares on Solana so investors can trade them 24/7 without brokers.Meanwhile, Backed Finance's xStocks let you own tokenised versions of big names like Apple (AAPLx) and Tesla (TSLAx).Users can now fully own trendy stocks like Apple and Tesla on-chain backed by real stocks(1:1) opening a multi-trillion dollar market for Solana users.

- Solana staking just went mainstream: For the first time, US investors can access Solana staking through a traditional ETF (SSK). Built by REX Shares, it brings native Solana yields to regular brokerage accounts.No wallets and no crypto onboarding needed. This could bring thousands of new investors into the Solana ecosystem.

- Robinhood makes it easier to be on Solana: Robinhood just added micro futures on SOL, meaning traders can now take leveraged positions (bullish or bearish) with smaller amounts. It's a simple way for traditional retail users to get exposure to Solana's price moves, with less capital and more flexibility.

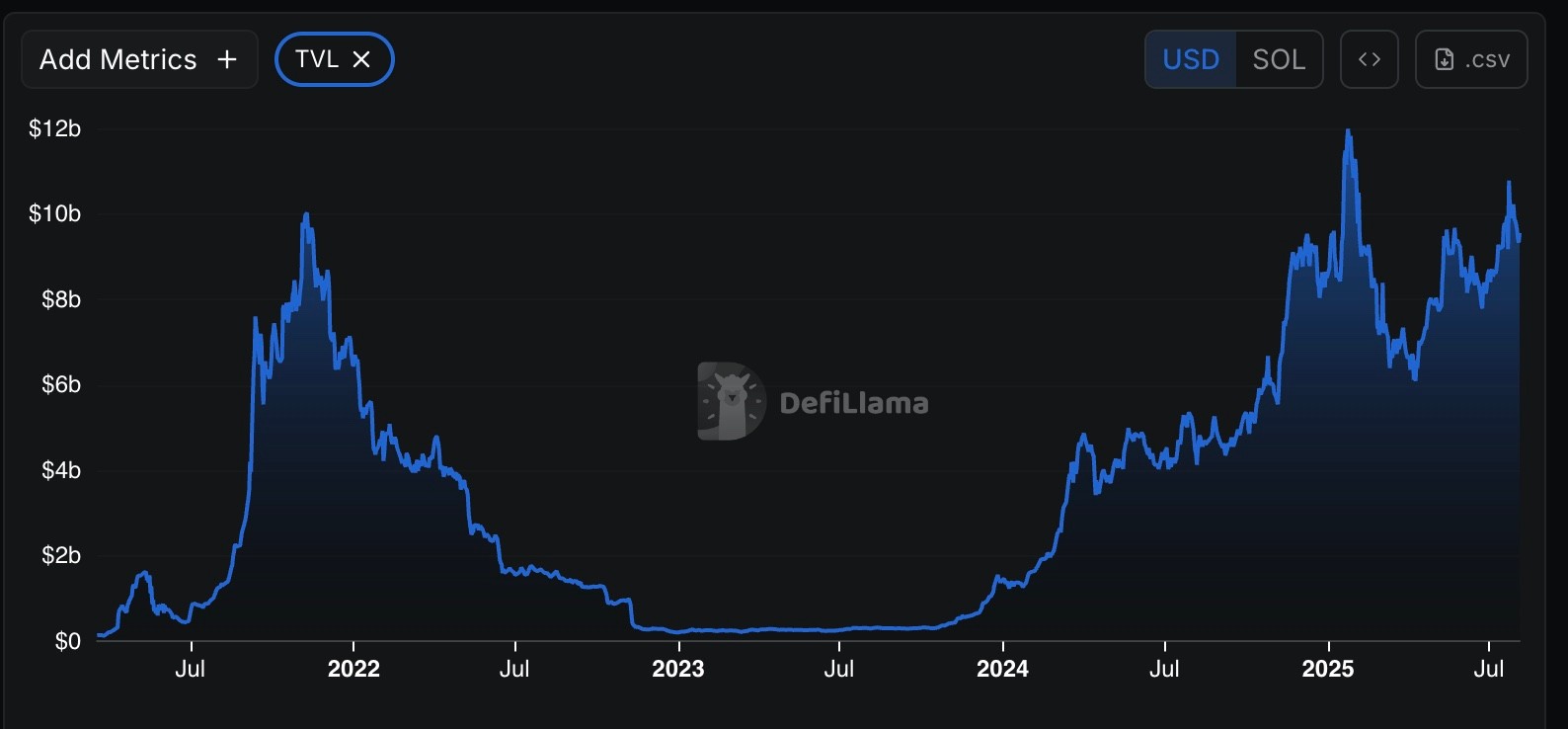

Solana's TVL

With infrastructure improvements intended to facilitate institutional and consumer adoption, Solana is establishing itself as the foundation layer for tokenised markets and the evergreen go-to chain for all things meme and degen.

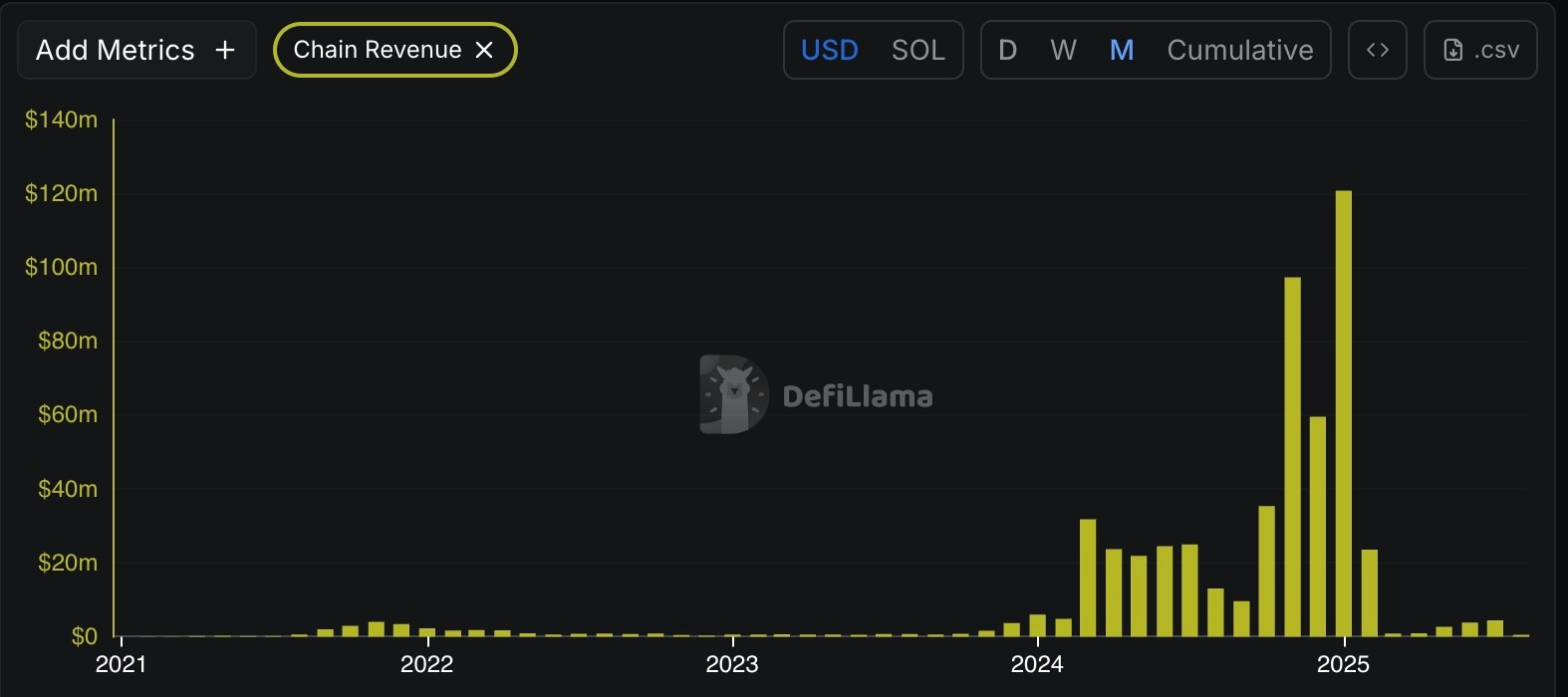

Solana's Revenue

Hyperliquid

Hyperliquid (HL) has been on an impressive run this year with a massively successful airdrop campaign, amazing tech and skyrocketing token. Hyperliquid is giving big centralised exchanges a run for their money with more than 90% dex volume being traded on HL.The only drawback in the HL ecosystem for long has been the Arbitrum bridge, which had to handle over 4 billion dollars worth HL assets, keeping it in a constant fear of being hacked, but this caveat is also resolved with Hyperliquid's recent announcement about using Circle's Cross-Chain Transfer Protocol (CCTP) V2 to directly integrate native USDC. This led to HL completely eliminating their dependency on Arbitrum bridge making it a much stronger protocol.

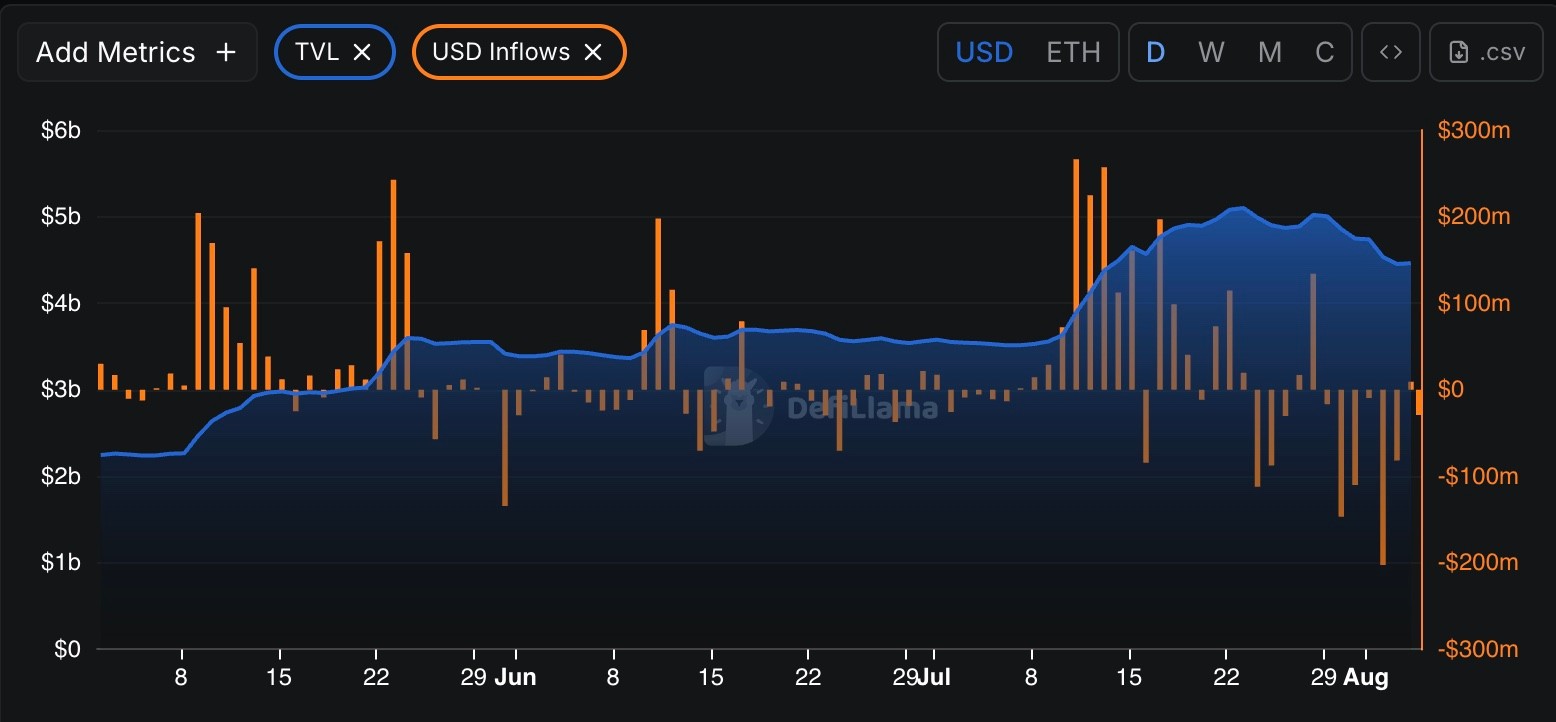

Hyperliquid's TVL and USD inflows

Here are a few fresh updates as to what the chain has achieved over the last couple of months:- Hyperliquid's Phantom mania: Millions of people can now experience advanced trading thanks to Phantom's Hyperliquid integration. More than 15 million people have already used the wallet, and now they can access Hyperliquid's quick, non-custodial transactions without ever leaving the app. This has generated $1.8 billion in trading volume, $930K in revenue, and over 17,000 new traders.

- Hyperliquid's HyperEVM & Pendle integration: Pendle is now live on Hyperliquid's HyperEVM, which means users can now tap into Pendle's fixed-yield strategies directly on the Hyperliquid ecosystem. The launch includes new pools on pendle like Hyperbeat USDT, Hyperwave, Hyperbeat Ultra Hype, and Kinetiq's kHYPE. Hyperbeat is offering 1.5 million HEART tokens across three pools as reward incentives increasing rewards for users in the Hyperliquid ecosystem through new strategies. Pendle will soon expand markets, increase liquidity, and roll out full ecosystem support on HyperEVM.

Major players like Pendle and Phantom entering are further cementing Hyperliquid's position as a chain being capable of scaling smoothly and efficiently.

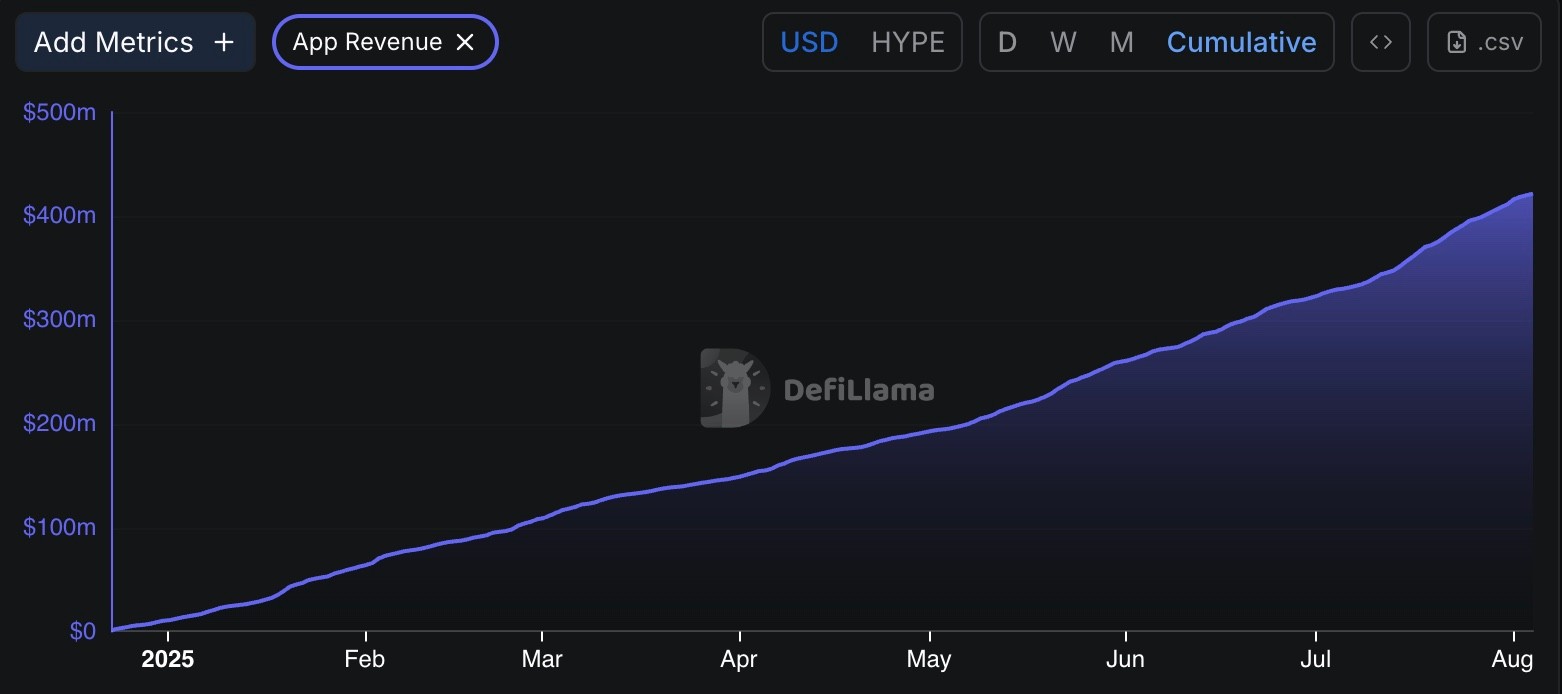

Furthermore, as we know, Hyperliquid executed one of the best tokenomics schedule which was proved with their token price skyrocketing to $46 in spite of the airdrop rewards which shows people came for the drop and stayed for the tech. And one of the reasons for this success is Hyperliquid's massive revenue consistently puts a buying pressure on the $HYPE token.

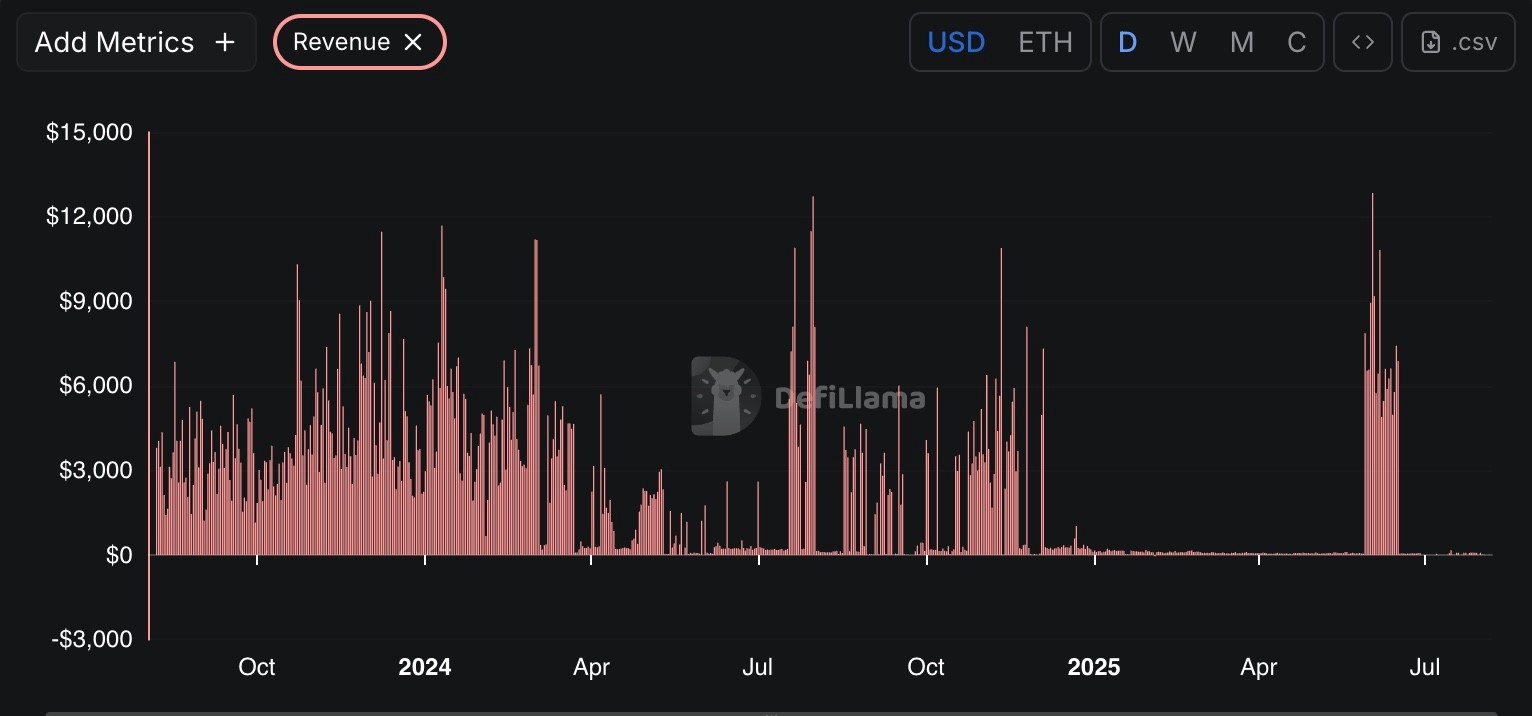

Hyperliquid revenue

Hyperliquid is demonstrating that self-custody and high performance can coexist through user-focused integrations and infrastructure optimisations, with constant upgrades and capturing other chains, Hyperliquid is ready to make a dent in Defi and Web3.Ethereum

After a sluggish start to the year, Ethereum over the last month has proved why it still is the Godfather L1, with it still being the go-to chain for all things Defi and with its L2 - friendly ecosystem picking up pace, with Base beating even Solana in daily transactions and AI agents leading the narrative on Base. Good old Ethereum is melting faces at the moment and is ready for new all-time highs.Notable Developments:

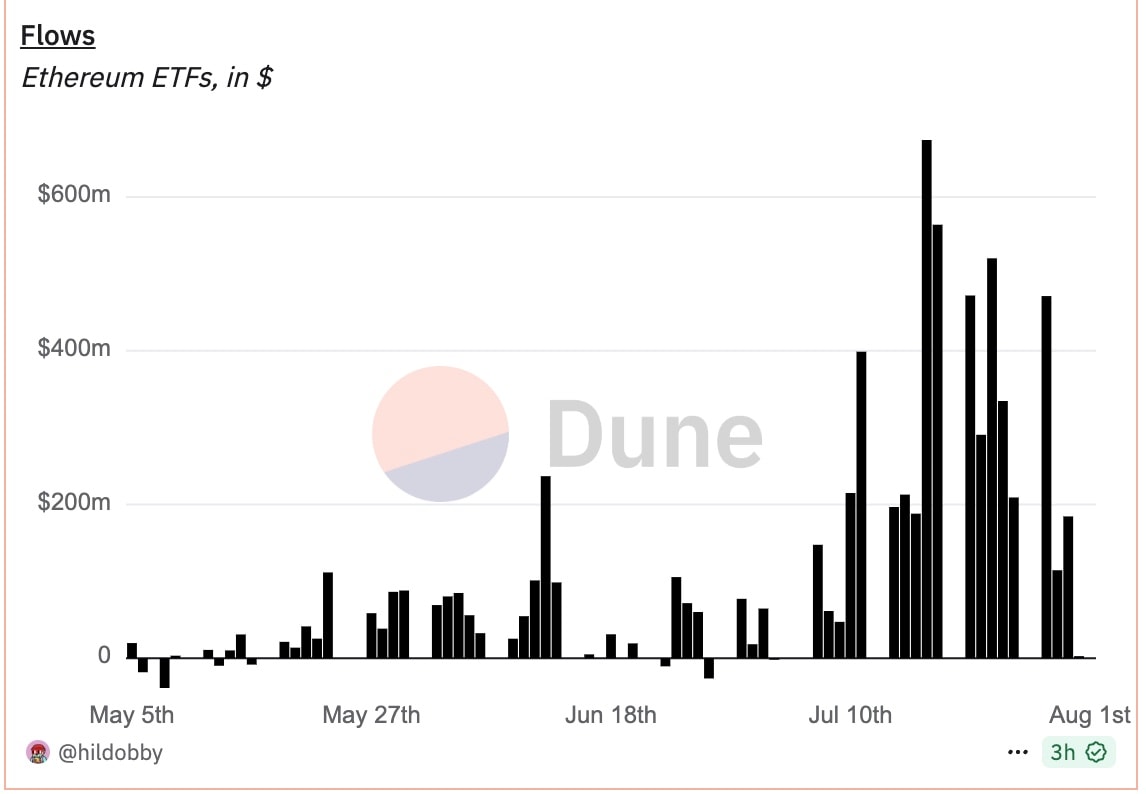

- Ethereum ETFs are on fire: Ethereum ETFs saw strong demand this year, with over 2.8 billion dollars flowing in during July alone. That brings the total net inflows for 2025 to more than $8.6b. As access becomes easier and more people look for exposure to ETH, these ETFs are quickly gaining popularity.

ETH ETF inflows

- Consistent Institutional buy-ins: Together, more than 60 corporate entities currently own over $10 billion in Ethereum. Businesses such as NASDAQ listed SharpLink Gaming have shown long-term confidence and interest in staking yields by purchasing 77,000 ETH over-the-counter from its treasury. Meanwhile, Wall Street giants like BlackRock, VanEck, and Fidelity have significantly increased their ETH exposure through Ethereum ETFs, including spot ETH ETFs like BlackRock's ETHA, VanEck's EFUT, Fidelity's FETH, and notably 21Shares' ETH Staking ETF (CBOE: AETH), which became the first to offer staking rewards in the U.S. This marks a major turning point, positioning ETH as both a yield-generating asset and an institutionally validated store of value.

- Ethereum's Social App Boom is Beating Solana: Base, the Ethereum network built by Coinbase, just passed Solana in daily token launches. The big reason is Zora, a new social app where every post turns into a tradable token. After Coinbase redesigned the Base app to make minting super easy, activity exploded. Zora's token shot up over 500 percent in a month, showing how Ethereum is now leading the way in onchain social apps.

Fundamentals and price performance:

The first half of the year, we could see no price action from ETH, staying laggard in a pumping market, with price going as low as $1400 in May, after which ETH saw a resurgence in price shooting to $3900 and staying stable in the range of $3500 to $3900.

ETH price action

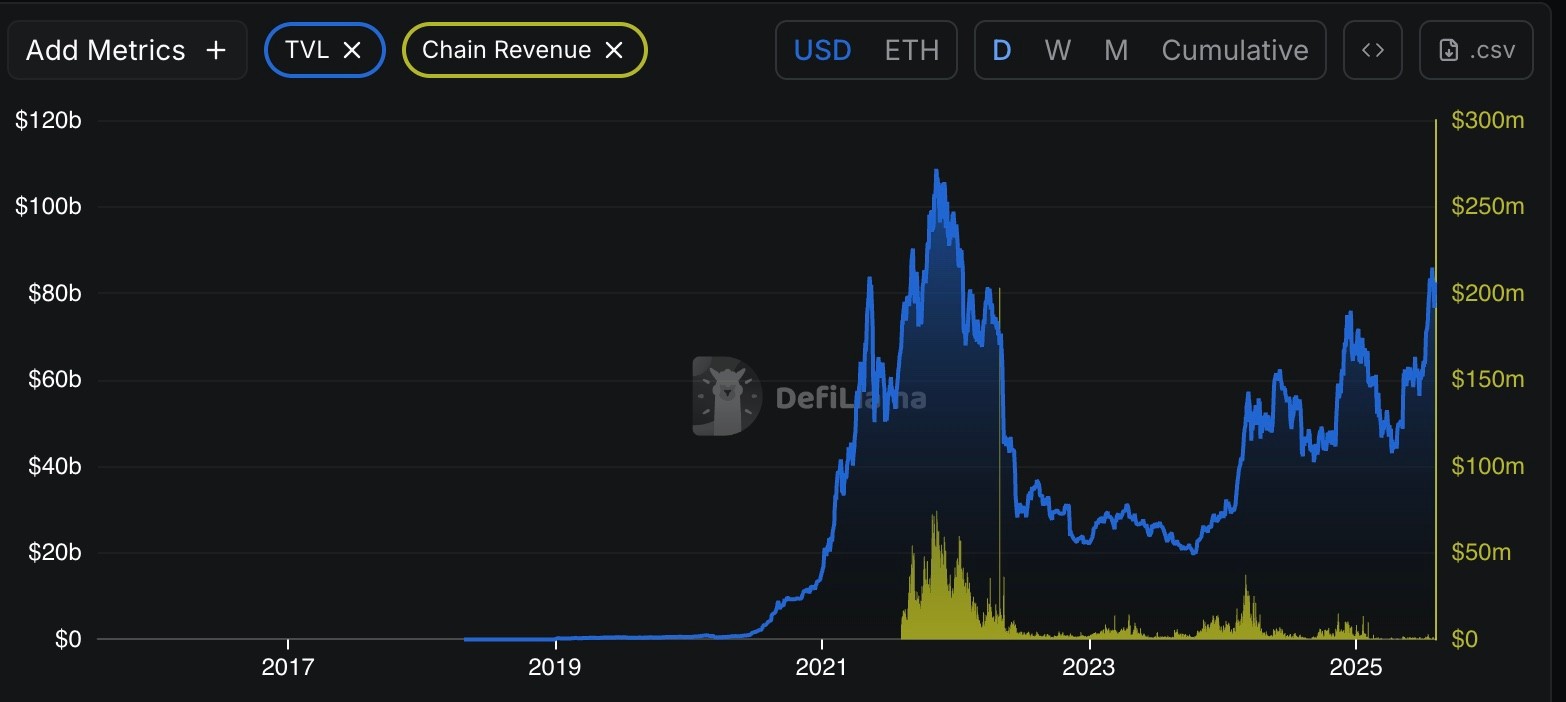

Ethereum is advantageous from two perspectives: as the scalability foundation for DeFi and consumer-facing rollups, and as a high-yield treasury asset for institutions, which has considerably increased the total value locked onchain (mainly DeFi) to a mammoth figure of $84 billion, adding to this the revenue on-chain has consistently been net positive indicating that ethereum infrastructure and its use cases are continuously expanding and consolidating which cements Ethereum's status as the ‘Father of Layer-1s'.

Ethereum's TVL and Revenue

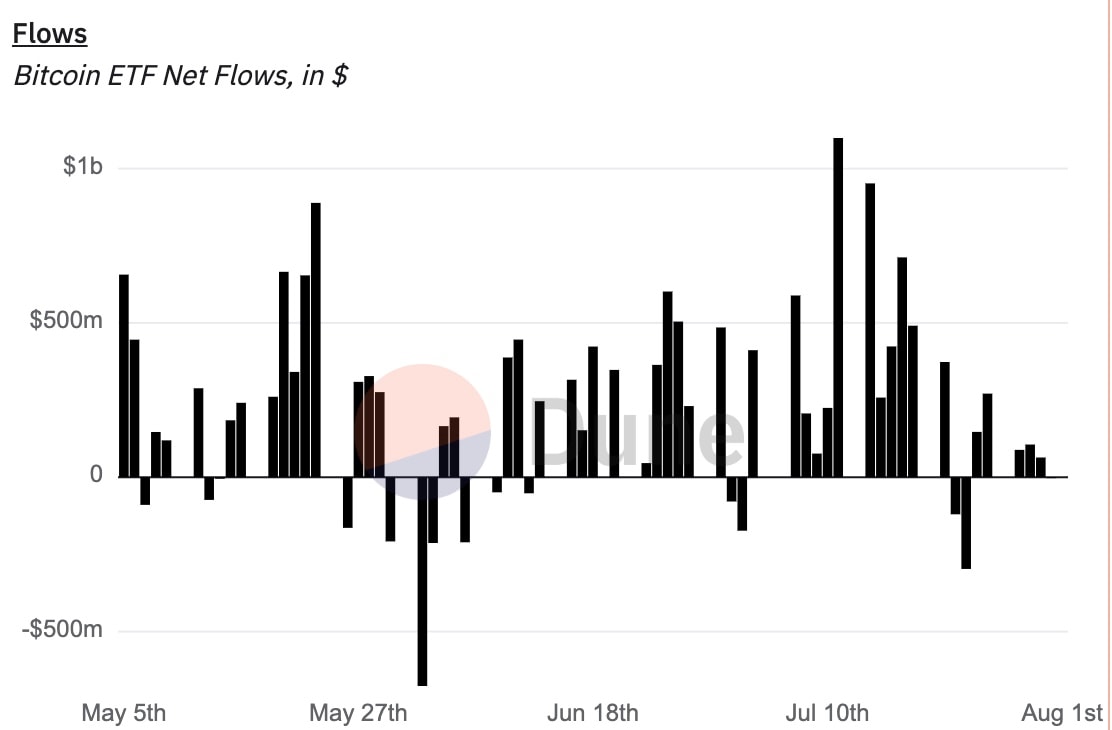

Bitcoin

The institutional era of Bitcoin is gaining strength: Bitcoin is well into its institutionalisation stage, propelled by maturing infrastructure, macro tailwinds, and capital flows:- With more than $14 billion in Bitcoin, MicroStrategy, now known as Strategy, reported its first profit in six quarters.

- Galaxy Digital demonstrated strong market liquidity by handling a historic $9 billion over-the-counter Bitcoin transaction.

- Leading brokers like FalconX and Standard Chartered are growing their institutional Bitcoin desks.

On the infrastructure front:

- To facilitate tokenisation and escrow without sacrificing base layer security, Blockstream is creating "Simplicity", a Bitcoin-native smart contract language.

- Because of its two-year-low volatility, Bitcoin is positioned as more than just digital gold; it is a programmable reserve asset.

Bitcoin trying to break into DeFi?

With initiatives like Babylon spearheading a new wave of experimentation, Bitcoin L2s are finally progressing beyond bridges and sidechains. Babylon allows native, self-custodial BTC staking to secure other chains with no bridges, no custodians as an alternative to wrapping BTC or sacrificing decentralisation. It's a technically sophisticated solution that attempts to capitalise on Ethereum's dominance in the staking economy while maintaining the spirit of Bitcoin.However, there is still no actual yield despite the hype; there are only points, test phases, and promises for the future. By December 2024, Babylon's TVL had grown to $5 billion, but it has since stalled, reflecting the more general fact that capital is parked rather than active.

Babylon's TVL

Jupiter

Pivoting from a DEX aggregator to building a full-blown vertically integrated DeFi platform. With $80 billion volume in Q2 2025 swaps alone, it currently manages more than 90% of the chain's swap volume.Current product advancements:

- Solana's superapp: Jupiter began as a token exchange, but it has since evolved into a comprehensive DeFi super app on Solana.Jupiter Lend - In collaboration with fluid protocol Jupiter started Jupiter lend, enabling users to borrow with up to 90% loan-to-value (LTV), much higher than the usual 75% offered on most crypto platforms.Jupiter Studio - Additionally the newly launched Jupiter Studio allows you to launch your own token without knowing any code and even includes useful features like fee sharing (50% to developers) and anti-bot protection giving the community access to a custom launchpad.

- Jupiter is rapidly emerging as the entry point for transferring TradFi to DeFi as tokenised assets gain popularity on-chain. Users can now access over 60 real-world stocks, including Tesla, Meta, Nvidia, and Apple, as tradable tokens on Solana through xStocks.With support for popular Solana dApps like Jupiter, Kamino, Raydium, and Phantom Wallet, these assets are available around-the-clock, freely transferable, and 1:1 backed by real shares. Fast, international finance without brokers or trading hours.One trade at a time, Jupiter is closing the gap between Web3 and Wall Street by fully integrating tokenised stocks into DeFi.

JUP's price action

Pendle

From the time of its launch if there's any protocol that's jolted and left a dent in the DeFi space, it has to be Pendle. With more than $7 billion in total value locked and extensive ecosystem integrations across Ethereum and emerging chains, Pendle has solidified its position as DeFi's top fixed income protocol.Important points to note:

- Composability and expansion into other ecosystems as a crucial advantage: Pendle is rapidly expanding its ecosystem thanks to strong composability. Platforms like Silo, Morpho, and Stargate now support its SY token standard, upgraded AMMs, and Principal Tokens (PTs).

- At the same time, Pendle's multi-chain strategy continues to gain momentum with new deployments on HyperEVM and Berachain, accelerating adoption and deepening integrations across DeFi.

Pendle is quickly becoming the primary yield layer for both DeFi and TradFi by creating scalable, modular fixed-income primitives that connect institutional structure and retail innovation.

When all is said and done, the most significant crypto protocols are not only developing technically but also structurally matching institutional requirements.

Pendle Performance:

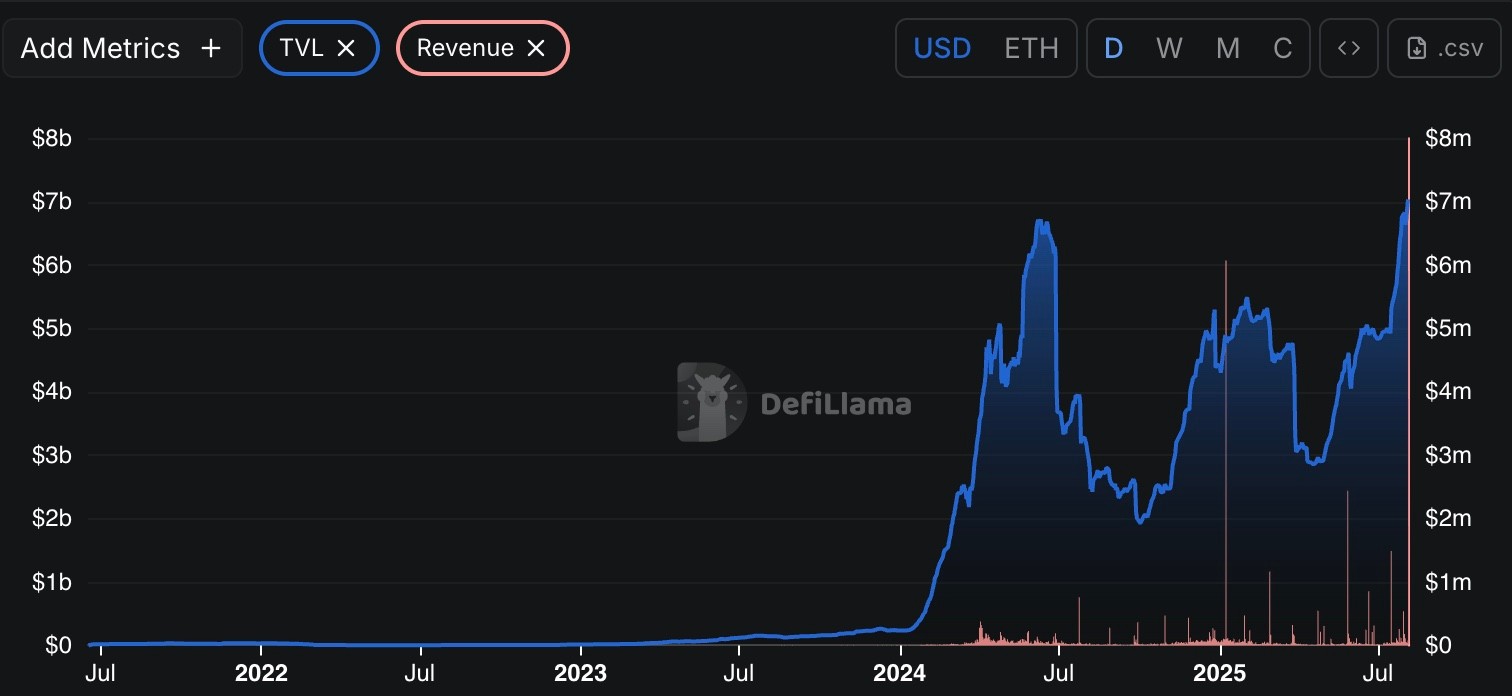

Pendle's price action is a testament to "price follows innovation", with Pendle users benefitting from its robust infrastructure and pools alongside the solid price action of its native token $PENDLE which has 100x'd and has still plenty gas left in the tank, the current price of $PENDLE is $3.6 which is short of its ATH of nearly $6.Revenue and the value locked are two metrics which show how a DeFi protocol is performing, with Pendle's TVL at a mammoth 7 billion dollars and consistent revenue generation showing continued investor optimism and support to pendle's ever-evolving ecosystem.

Pendle's TVL and Revenue

Chainlink

After facing some rising competition from Pyth and other decentralised oracles, Chainlink is showing that innovation and diligence will prevail, with the White House and Trump citing LINK as a key infrastructure provider for the advancements of blockchain technology.Key Advancements:

-

Chainlink launches real-time data for U.S. equities & ETFs to power tokenised RWA markets: Chainlink is bridging TradFi and DeFi with real-time, on-chain pricing(offering datastreams) for U.S. equities and ETFs. This enables 24/7 trading of tokenised assets like synthetic stocks and perpetuals, bringing reliability and compliance to tokenised DeFi markets across 37 blockchains.

-

Chainlink deepens institutional integration with compliance & payment infrastructure: Chainlink is expanding its role as foundational infrastructure for tokenised finance by enabling compliant asset issuance with partners like Apex Group, GLEIF, and the ERC-3643 Association.Through its integration with Mastercard, Chainlink also unlocks onchain crypto access for billions of users, bridging institutional capital and global payment networks with decentralised finance.

Price and Fundamental performance

Unlike other alt's Chainlink needs heavy liquidity at the buy side to show massive runs, given the recent advances and partnerships, it is a matter of time before we see chainlink's meteoric rose to its ATH. Currently LINK trades at $16 with a 4% daily increase after the announcement of datastreams being used by institutions.With Institutional adoption and RWA ecosystem leaning on Chainlink's infra for their price feeds and the onboarding of trillion dollar TradFi conglomerates on Chainlink.

Chainlink's Revenue

With consistent tech upgrades and revolutionary partnership, Chainlink is set to gain more ground in the decentralised oracle industry and reign as the most important oracle provider in the industry.Cryptonary's take

Solana is scaling for real-world asset tokenisation and equity trading, leveraging its high-throughput blockchain, with Jupiter emerging as its primary DeFi interface to streamline user access.Hyperliquid is carving a niche as a mobile-native hub for high-performance onchain derivatives, catering to sophisticated traders. Ethereum remains the foundation for Layer 2 innovation and institutional capital, supporting scalable, enterprise-grade DeFi solutions.

Bitcoin is evolving into treasury-grade, programmable collateral, bolstered by its unmatched security and new smart contract capabilities. Meanwhile, Pendle's detachable DeFi rails are institutionalising fixed-income products, redefining yield strategies in decentralised finance while ChainLink is powering most of the DeFi with its oracle services and being cited by the White House as a key player in crypto.

In short, every asset in our CPRO picks is cooking something. Fundamentals are constantly improving. However, the narrative of each asset oftentimes impacts shorter term price action. All our picks are great assets that will perform well, however, the most optimal portfolio remains a Barbell portfolio (BTC, ETH, SOL, HYPE and AURA). However, our DeFi picks (PENDLE, JUP, LINK) will perform great as well and fit best for DeFi lovers.

Peace!

Cryptonary's OUT!