Cryptonary's 35X

When corrections come around, shopping time starts. Besides that, when the market experiences corrections, fear can take over. That fear often pushes prices lower because investors begin to sell. We believe this can be seen as an opportunity.

While most market participants are focusing on their recent PnL activity (mainly L) and forgetting about fundamentals, a smart investor can enter at low prices.

We are currently investing in a new project that should help propel the crypto industry and DeFi even further. This is not a short-term bet, it is one we will be involved in for several years.

Note: This opportunity is not available to US residents.

Looking For a Fresh Idea

The truth is that we don’t like investing in repetitive copycats for two reasons:- They lack innovation

- They lack moat

On the other hand, a project offering additional layers to improve upon what Ethereum offers, is a project that peaks our interest. This project does exactly that.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Introducing The Mina Protocol

The Mina Protocol focuses on the fact that it is a light blockchain. The network leverages the power of Zero Knowledge Proofs (ZK Proofs). In fact, decentralised applications including DeFi Apps can be built on top of it. These are called Snapps.

The Mina Protocol focuses on the fact that it is a light blockchain. The network leverages the power of Zero Knowledge Proofs (ZK Proofs). In fact, decentralised applications including DeFi Apps can be built on top of it. These are called Snapps.

The economic model comes in the form of staking tokens to earn revenue which locks up supply. As well, there is no supply cap with yearly inflation.

TLDR

- Mina Protocol focuses on being a “light” blockchain as most other blockchains become victims to their own success over time.

- The network leverage the power of Zero Knowledge Proofs (zk Proofs) to achieve the former.

- Decentralised Applications (incl. DeFi Apps) can be built on top of it – they are called Snapps.

- No supply cap with yearly inflation. The economic model comes in the form of staking tokens to earn revenue which locks up supply.

- Through our realistic lens, we believe MINA can reach $250 by 2025 (we also mention an optimistic and a conservative approach).

- We expect price to “dump” after the listing for reasons stated below.

- We will be allocating 7% of our portfolio to it.

- Entering via DCA (Dollar-Cost Averaging) over 15 days.

Current Requirements Are Heavy

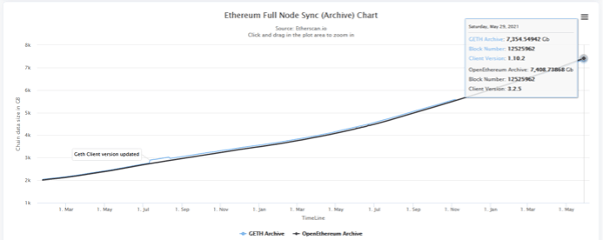

Current blockchains, such as Bitcoin and Ethereum require validators to store the entire ledger. This contains the history of all transactions and contract states and is essential to secure the network. Using Ethereum as an example, we can see from the chart below that the amount of memory required to store the full history of the Ethereum ledger in an archive node is over 7 Terabytes.

This is a monumental amount of information because not many people have 7TB or more in storage capacity. Additionally, the storage capacity equirement will only increase as more transactions and contracts are executed and added to the ledger. This can harm decentralisation and place the security of the ledger in the hands of the few. As a result, handling peer-to-peer transactions becomes unfeasible for the average user.

To put this into perspective, let's use an analogy. The process is similar to having to check how every single dollar in our possession has previously been spent before you spend an new one. Granted, with the rate that the US Government has been printing dollars, it’s likely you won’t have to go back very far. But, that’s a topic for another day.

Mina "World's Lightest Blockchain"

The Mina project seeks to address this problem. Labelling itself as “the World’s Lightest Blockchain”, the entire Mina ledger is stored in a file of around 22kb in size. With Mina, the ledger will never use more storage space than this, even as network usage grows. This means that anyone can download and sync the file very quickly, and then contribute to its security.It is the world’s first succinct Layer 1 blockchain with application support. What does this mean? A succinct blockchain allows transaction verification to be independent of the chain length. In fact, Mina does this by utilising consistently sized cryptographic proofs, called zk-SNARKs.

Zero-Knowledge

Interestingly, Mina manages to compress the entire history of the ledger into 22kb through the use of a zero-knowledge Succinct Non-Interactive Argument of Knowledge proof construct. Simply put, the zk-SNARK construct allows for a statement to be proven as true without having any other information about the statement other than it is in fact true.Here is a simple analogy to describe how verification works. We leave the office and lock the door on the way out. When we come back, someone is standing in our office. Even so, all of the windows and doors are intact. The only logical conclusion we can take from this is that the person now standing in our office had a key to get inside the locked room. We don’t know the exact details of how they got that key, only that they are now inside the office.

The take away from this is that although we can’t prove how they got in, we know that there is only one way they could have entered without forcing their way in. Therefore, beyond any reasonable doubt, we can assume that they used a key to open to door. The preceding events are not important, only the outcome.

Older Copies of Ledger Deleted

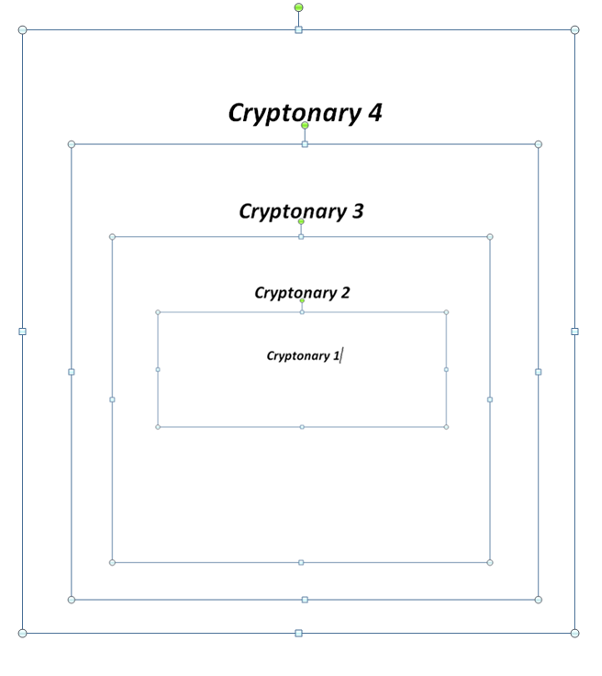

With Mina, a similar process allows previous iterations of the ledger to be deleted. At the same time, the outcome of previous blocks remains known. In addition, Mina can maintain the 22kb size of the ledger because the outcome of each consecutive block is stored in the snapshot of the next block.Take the following example:

This image represents how data is stored in the Mina protocol. The memory required to store each image individually is almost identical. Still, this image contains the same amount of information as the four individual files that make up its snapshot. For every new block, a new zero-knowledge proof is created. Its job is to prove that all balances are correct and that any transactions prior to the proof are accurate.

Notably, Mina utilises a version of the Proof-of-Stake (PoS) mechanism called Ouroboros Samasika. This differs from conventional PoS. Instead, the Mina version is adapted in order to operate within the context of a succinct blockchain.

Consensus Algorithm

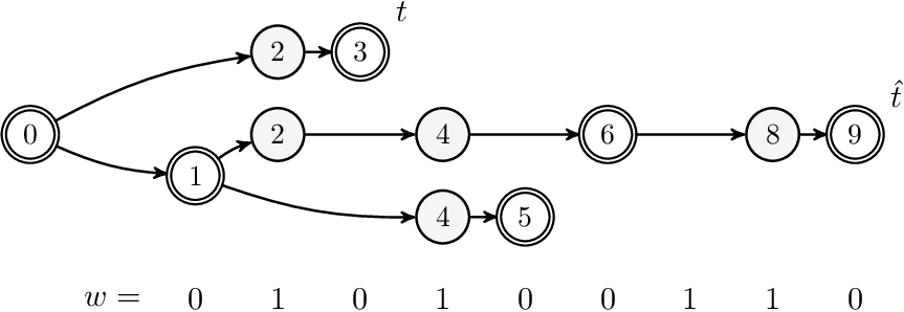

Basically, the Samasika consensus is able to segregate honest chains from dishonest ones regardless of how far back in the ledger history the fork occurred.

The longest chain from the Genesis Block is generally taken as the most accurate but there are exceptions. Honest block creators seek to add to this chain while also preventing inaccurate forks from taking over. In the figure above, the honest block producers are represented by the double-lined circles. They always have the final say. They can invalidate malicious forks and validate accurate blocks which will ensure continuity of the ledger.

Other differences that improve decentralisation include:

- Dynamic Availability – Mina has removed some of the strict rules for becoming a validator we see on other chains. This change allows anyone to participate without prejudice.

- Uncapped Participation – Most conventional PoS consensus mechanisms are limited by the amount of validators they can have active at any one time. This is due to the use of Byzantine Fault Tolerance (BFT) protocols. With BFT, more validators will increase consensus complexity. Hence, this can lead to longer block validation times. Mina doesn’t use a BFT protocol. Therefore, the number of validators is not limited which increases decentralisation.

SNARK Apps (Snapps)

Up until this point, we could well have been describing ZCash. This is because the Mina Protocol shares a lot of similarities with that chain. However, what sets Mina apart is the decentralised application layer built on top of its succinct main-chain.Snapps play an important role in this. Also called Snarkified Applications, they are similar to the applications built on Ethereum such as Uniswap. Yes, Snapps differ from the DApps of Ethereum in that they leverage the inherent privacy of zero-knowledge proofs.

This is what allows verification of pretty much anything without having to disclose details about it. The only requirement is that the details be valid. Obviously, the verified information must be produced at some point. However, this can be done on-chain. The SNARK is therefore produced as a way of proving the information is accurate and valid.

MINA, More Scalable Token

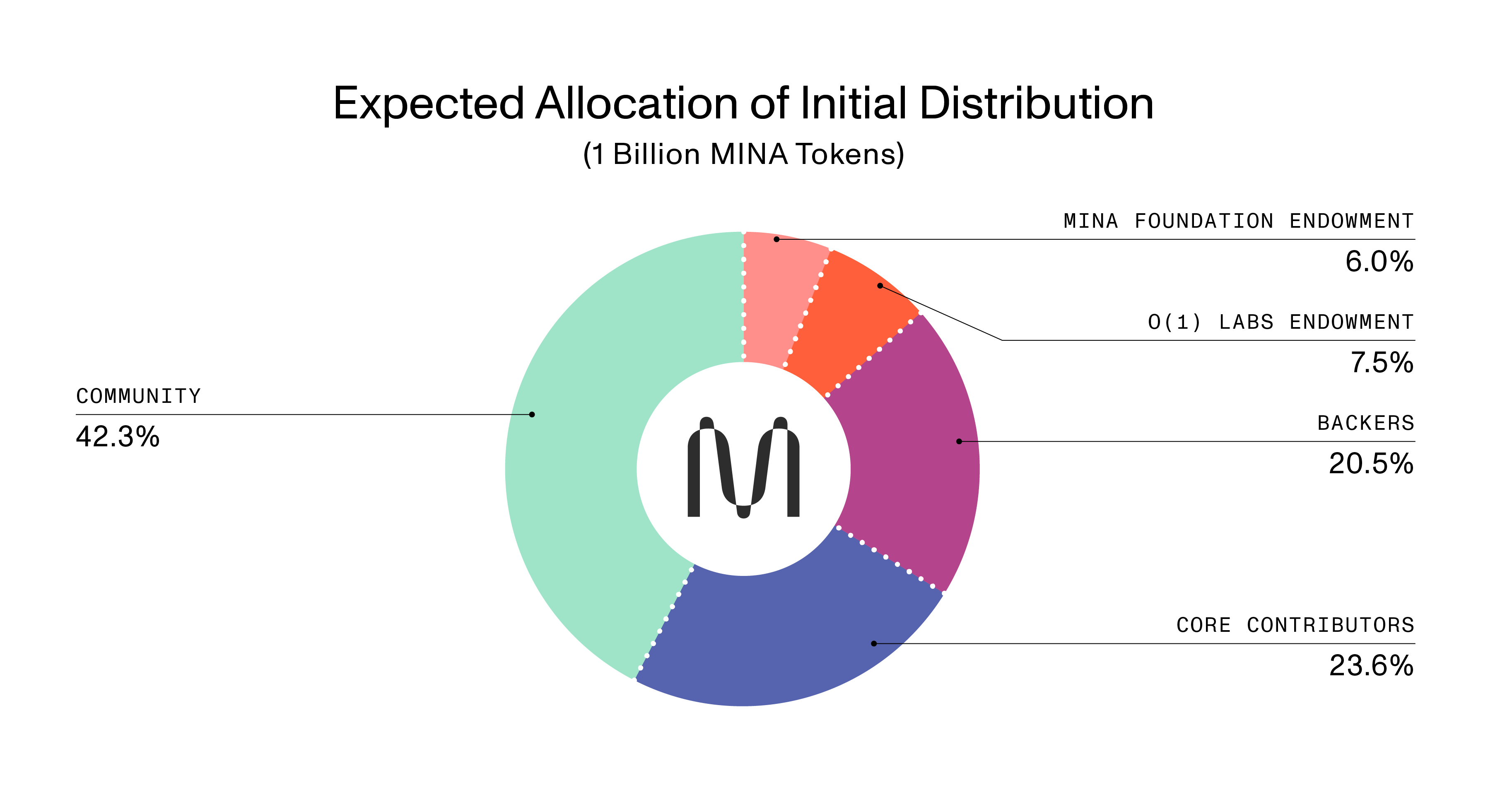

In addition to this, Mina is fundamentally more scalable than Ethereum is in its current form. This is not to say that the Mina Protocol is an “Ethereum killer”. To be clear, Mina is still largely experimental, and Ethereum’s protocol continues to dominate. That said, we believe that the future is multichain. We speculate that Mina could have an important role to play in that future.Evidently, the MINA token is the blockchain’s native asset. A key element to explore is token allocations. This is because a majorly team-owned token can be problematic. However, we do not believe this to be the case with MINA.

The Mina protocol has been in development since 2018. Usually, this means money has been raised from multiple parties. These parties have likely tried to secure as much of the supply as possible. Indeed, this is the case with Mina and preferably, we would like to see Community allocation to be closer to 60%.

Essentially, the MINA token is used for two primary purposes:

- To pay block producers.

- To pay SNARK producers.

High Number Produced

The other aspect to consider is the number of tokens produced. The initial distribution is at 1 Billion MINA tokens. Most of these are time-locked. Thus, the maximum supply is simply not available enough since there is no supply cap. Instead, similar to ETH, MINA has shown yearly inflation, starting at 12% per year and dropping down to a stable 7% rate.The question than becomes: Which mechanism gives MINA a good economic model? The obvious answer: Staking.

Staking achieves two simultaneous goals: network security, and out-of-circulation supply. Through the process of staking, MINA token holders can take their tokens off the market. This reduces the supply and adds upside pressure on the price.

As we know, the Mina Protocol makes staking accessible. It allows anyone to validate transactions and earn their pro-rata share of the inflation. This low barrier to entry encourages token holders to stake. On that same note, the Mina Foundation is offering what they call supercharged rewards for unlocked token holders. This will be done over the first 15-months to further encourage staking early on.

Usage

In the novel world of crypto, we like seeing products released before a token. Mina has done this but its developers went a step further. Beyond being functional, there is already interest in building Snapps on the Mina network.For example, the decentralised finance application Teller allows individuals to upload their real credit score privately onto the blockchain. They can then take on uncollateralised loans, which is rather interesting since most lending on DeFi tends to be over-collateralised.

The market is in fear, meaning investors in MINA want to realise their profit by selling. For one thing, the listing price is unknown. This fear may be accentuated if price starts high because most of retail has been given a wake up call by this correction.

Listing Price Action

Even though the exact listing day may see an increase at first, we speculate this pump may ultimately be sold and drive down the price. To where will depend on price lists. Accordingly, we’ve taken that variable out of the equation. We will be Dollar-Cost-Averaging MINA from June 1 to 15 2021.You may be asking yourself: Cryptonary, CoinMarketCap is showing that MINA is already priced at ~$50 with a $187 all-time high. How is that possible and what sort of upside does that leave?

This is a fair question and here is the answer. We believe what CoinMarketCap failed to show is that the price is based on one single exchange called BitZ which is trading an IOU. An IOU stands for “I owe you”, meaning the exchange is selling its users contracts at high prices. Additionally, once MINA tokens become publicly available, they will be redeemable for much lower prices and allow them to pocket the change. We saw this with Flamingo Finance (FLM) where the IOU was trading near $20. It was then listed sub-$1 after it became publicly available. This is a cheap move that only scam exchanges make.

Currently, only CoinList and Kraken have expressed that they will list MINA. Even though we have accounts on both, we are in no rush to buy. We will be waiting to see if other exchanges share the listing. FTX or Binance will be our venues of choice by order of preference. If they don’t list, we intent to focus on what’s available.

2025 Price Prediction

Price predictions are generally based off the thesis that crypto is a multi-trillion dollar market. Cryptonary ranges its predictions based off of three scenarios for 2025 when it comes to the Total Crypto MCap ranking. Here they are:- Conservative: $20 Trillion

- Realistic: $50 Trillion

- Optimistic: $100 Trillion

From these assumptions, we can project a price for MINA. While not all the supply will be unlocked by 2025, we take the conservative route of assuming this will be the case. The total supply is projected to be around 1.3 Billion MINA tokens. This amount factors in inflation for 2025 and gives us the following price targets (rounded down):

- Conservative: $100

- Realistic: $250

- Optimistic: $500

Our Allocation

Given MINA’s recent technological innovation, we will be using the 3% cash we have sitting in our portfolios. This is in addition to using the 1% profit taken from XRP. However, may not ben enough. Hence, we will be cutting dead weight and allocating those funds to MINA. This weight will come from OXY (all 2%) and XPR (another 1%), leaving 3% in XRP and 0% in OXY.This move will allow us to dedicate 7% of our portfolio to MINA.