Cryptonary's 50x

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Cross-chain communications is one of the biggest issues in crypto right now – and most people are sleeping on it. But not CPRO! Solid solutions to this problem will provide the opportunity for huge growth and upside potential for successful protocols within this sector. Cross-chain protocols are already attracting a lot of institutional attention, and they have been on our radar since 2020.

We believe that with the opportunity the market has presented, and will continue to present until financial markets return to bull mode, NOW is the time to learn about these protocols.

Luckily, we have done the research already! The following CPRO exclusive journal will outline a protocol that we believe has a 50x potential in the next bull market – it’s a must-read!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- Synapse Protocol (SYN) is a cross-chain liquidity protocol utilising various solutions (bridges, liquidity pools, communications infrastructure) created to allow the transfer of assets between EVM chains.

- Synapse Chain will be a new cross-chain native Layer 1 blockchain, utilising SYN to secure the network through a Proof-of-Stake consensus mechanism.

- We expect the protocol, and this new ecosystem, to bring innovation to the crypto space.

- Our final upside target is $54 – other targets included in the report.

50x Intro

Cross-chain protocols are attracting a lot of crypto institutional attention. We cannot state enough how important cross-chain comms is to the wider crypto economy. Without these solutions the entirety of DeFi and economic activity within crypto is essentially isolated on a per chain basis.

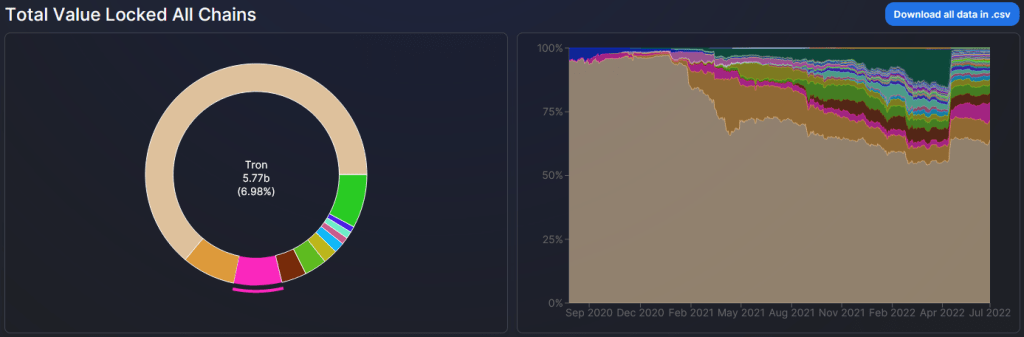

The above dataset allows us to visualise the issue – this is a breakdown of DeFi Total Value Locked across all chains. For the most part, Ethereum is still the most dominant chain in terms of DeFi TVL. However, the long-term trend is clear – Ethereum is losing its market share to other chains and ecosystems. The result? For the most part, these chains are unable to communicate with each other, so the liquidity is “fragmented”. So, where does that leave us?

A growing problem, with a huge reward for finding the solution.

We believe we have found a candidate in Synapse Protocol – a “Universal Cross-Chain Liquidity Protocol” that encompasses multiple solutions into a single protocol. Utilising liquidity pools, communications infrastructure, and bridges, with their own chain in development, we believe the upside potential on their native asset SYN is huge. But why?

Utilising a number of different cross-chain solutions for Ethereum Virtual Machine (EVM) chains, Synapse offers everything we would need when transferring assets to most of these chains. The utility is excellent and there is already a large user base due to the fact that Synapse offers a large number of chains. Be it Layer 1s, Layer 2s, sidechains – the protocol has extensive coverage. Additionally, Synapse is one of the few protocols that offers near-instant transfers between Ethereum and its Layer 2s.

In addition to the above, Synapse is also developing its own chain, Synapse Chain. This will provide even more utility and add value to the token. The purpose of Synapse Chain is to create a new ecosystem of cross-chain protocols that can leverage the already existing Synapse cross-chain infrastructure and liquidity. In this sense a new cross-chain native blockchain will be created, lowering the barrier that exists between EVM compatible chains and massively reducing the extent of liquidity fragmentation within the wider crypto space.

Outlook

Obviously, we have covered the macro situation extensively in recent weeks. The current economic situation globally is one of the worst in the last 4 decades. With inflation rampant, energy concerns, quantitative tightening, and conflicts affecting food and other commodities, financial markets are not in a good place right now.Having said that, we believe that the upside potential for SYN, taking into account current usage numbers and future developments, is extremely high when the market returns to full bull mode. A cross-chain native ecosystem is something that we haven’t really seen and if Synapse is able to pull it off (and we believe they’re capable) the kind of volumes and transaction counts that this ecosystem could attract would be huge.

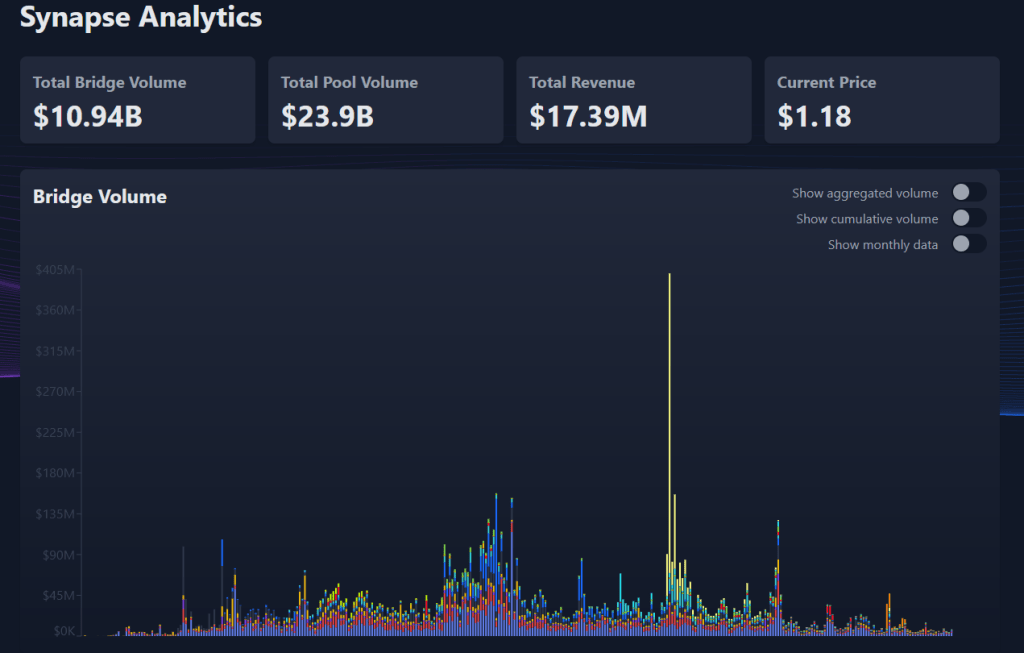

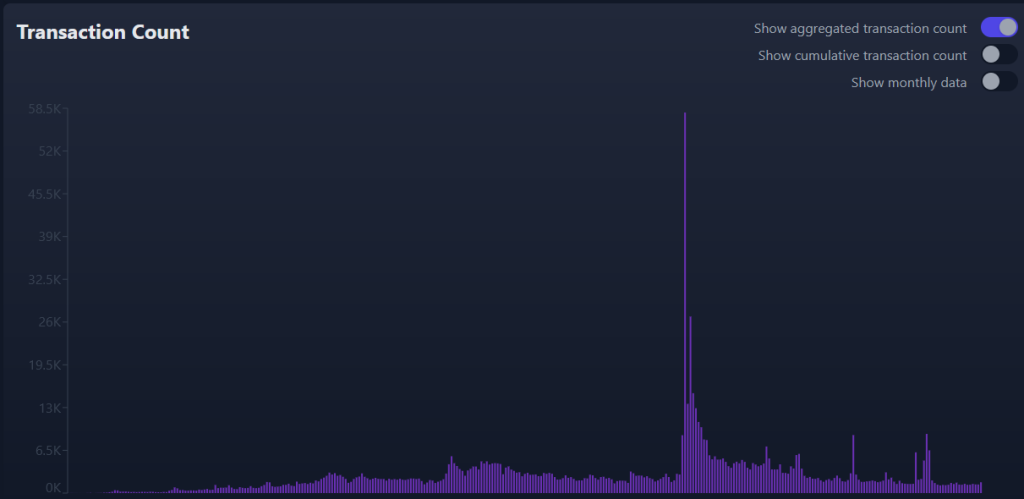

Looking at some numbers we can see that Synapse already has some impressive transactional volumes, and revenue figures. These figures go back to the launch of the chain in August 2021. Although the volumes (when denominated in dollars) have dropped off due to the bear market affecting the prices of the assets being transferred, looking at the transactional numbers we can see that there is still steady usage and demand for the product.

Overall, the figures show us that the product is well-used, and we would expect the introduction of Synapse Chain and development on that chain will rapidly accelerate the transaction count. This ultimately leads to more revenue for the SYN token, and appreciation in the token.

Valuation Theory/Calculation

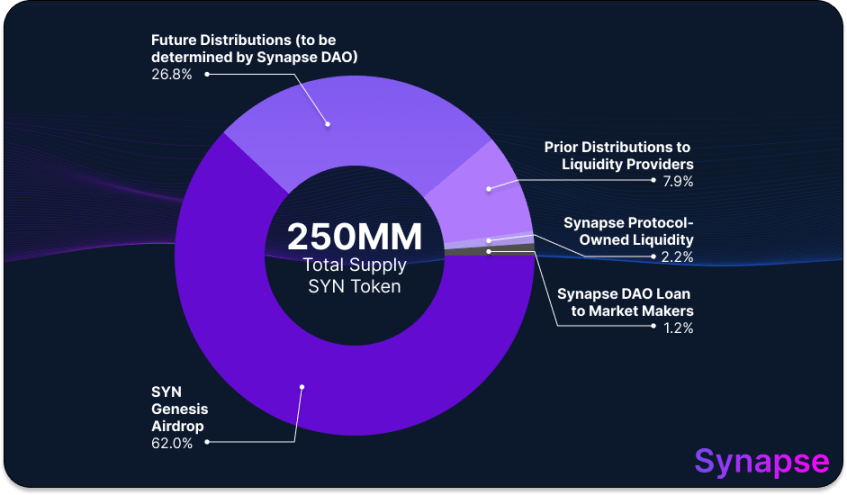

SYN is the utility and governance token of Synapse Protocol. With the launch of Synapse Chain, which will be Proof-of-Stake with SYN being used to secure the protocol, the utility will be expanded, and SYN will become a native L1 token. Let’s look at the tokenomics:

Supply:

- 186 million SYN Circulating.

- 250 million SYN Maximum.

It is unclear to what extent Synapse Chain will affect inflation, if at all, but the numbers above represent a highly undervalued protocol. The potential adoption rate of Synapse Chain is also unknown; however, we expect the introduction of a new ecosystem utilising SYN as the L1 token will add significant value that hasn’t been priced in yet. But to what extent?

Since there is not really a comparable chain with the same capabilities as Synapse, we will compare the chain to other cross-chain solutions and decentralised exchanges that offer a similar product:

- THORChain Peak MCap: ~$5 billion.

- UNISwap Peak MCap: ~$18 billion

- Serum Peak MCap: ~$4.5 billion

Price Targets

In terms of entry, the market has presented a relatively decent R:R for most assets if the goal is to hold longer term. Let's now think about best, and worst case scenarios in the near term, and what we should expect for either of these situations:

Best case scenario - SYN manages to reclaim $1.43 on the weekly timeframe, registering a higher high, after which we'll only need a higher low and another higher high to confirm a weekly market structure change. This change will provide enough confirmation for us to look for day-to-day trades, swing trades or even long-term investments.

Worst case scenario - SYN gets rejected upon a test of its $1.43 resistance level and fails to register a weekly higher high, from where its price will start to descend and range between $1.43 and its all-time low, $0.43, until either of these levels is broken.

The fact that SYN will follow the majors (Bitcoin and Ether) is not news to us, so it's best to keep an eye on them as well as the wider macro environment.

Although $54 would be the end goal, we believe that reacquiring and protecting our initial capital is an important factor, and so we will be looking at a few upside profit-taking targets:

- $1 billion valuation, token price ~$5.30 (sell 20% of holding).

- $1.5 billion valuation, token price ~$8 (sell 20% of holding).

- $6 billion valuation, token price ~$32 (sell 10% of holding).

- $10 billion valuation, token price ~$54 (sell 20% of holding).