Cryptonary's Community Request

With the active Discord community that we have here at Cryptonary, we receive many requests to look into a vast variety of different projects or happenings. In many cases, a quick check and some brief research suffices to bring clarity. Other situations, such as the financial difficulties encountered by Evergrande in the Chinese construction market warranted a more in-depth look, and our community greatly appreciated the quick turnaround and factual approach to the scenario. In due course, many of our members have been asking for in-depth research into certain coins, and this journal covers the first of the community requested networks.

TLDR

The network in question is the Hedera Hashgraph (HBAR) network. As per their website, HBAR aims to ensure that decentralised governance is available to everyone at scale, focussing towards the enterprise sector.It seems a promising Layer 1 network with significant institutional involvement. The structuring of the network, both with the governing council and licencing agreement for their confirmation algorithm ‘Hashgraph’, raises serious concerns about the network's decentralisation. A review of the tokenomics highlighted that early investors hold the majority of tokens. Investors who have already once attempted to sell their tokens, forcing Hedera to intervene. The community allocation stands at a measly 1.2%. Their codebase is closed source and there are very few functioning applications built on their blockchain. With four years of development and the calibre of companies involved, it is logical to have expected more development. This, in turn, has led to competing Layer 1 networks offering more performant solutions with significantly more decentralisation. Effectively their competitors have managed to adequately solve the problems which Hedera itself set out to solve. With early investors and large holders of HBAR from the ICO likely aware of this development, we could see them attempting to offload their tokens when unlocked.

Although they have made some great moves recently, Hedera would need to ‘open up’ more for us to think any different.

Hedera – the network

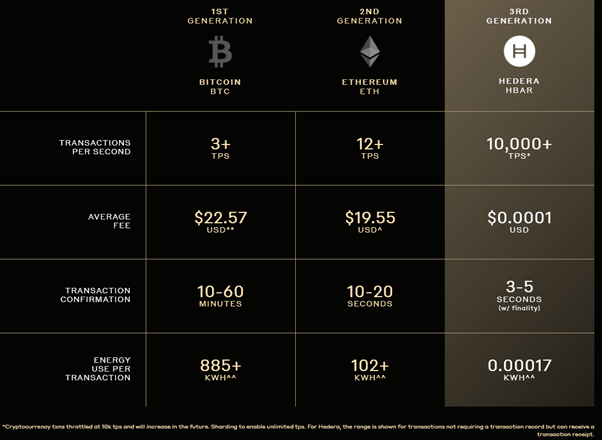

Specifically, Hedera promotes itself as a public network tailored to companies, with their native cryptocurrency HBAR powering their decentralised economy. They continue to state their network is designed for fast, fair, and secure applications to take advantage of the efficiency of Hashgraph on a decentralised public network that its users can trust. The below comparison chart is sourced directly from their website and paints HBAR in a highly positive light. Our long-term members will realise that other Layer 1 networks that boast similar, if not better performance, (AVAX, SOL) are conveniently left out.

Further statements mention that the Hashgraph consensus algorithm provides near-perfect efficiency in bandwidth usage. They claim to be able to process hundreds of thousands of transactions per second (throttled to ten thousand TPS in beta) in a single shard (a fully connected, peer-to-peer mesh of nodes in a network). Note that the above statement is theoretical, and in actual applications, we have not seen HBAR reach the 10K TPS mark that they claim.

The Governance Oxymoron

Outside of their technical specifications, Hedera's major focus is on their decentralised governance.

Hedera is governed by the Hedera Governing Council: An expert council consisting of 39 leading global enterprises and organizations, distributed across up to 11 different industries and spanning a wide range of geographies. The Governing Council makes key decisions over software upgrades, network pricing, treasury management, and more. Governing Council members are term-limited and do not receive any profits from Hedera.

The below picture is sourced directly from the Hedera website, including the caption. As you can see for yourself, the caption reflects the truly ‘decentralised’ nature of the HBAR network. And yes, this is sarcasm!

The Hedera Governing Council is structured to best fulfil the desire for a decentralized, wise, stable governance in the long-term interests of the platform. All governing council members have all taken partial ownership of Hedera Hashgraph LLC, by signing the agreement.

Somehow the words ‘decentralised’, ‘LLC’ and ‘agreement’ are all present at the same time. This alone leads us to question the integrity of the statements by Hedera. Not allowing groups of miners and developers to determine the direction of the network is apparently done in the networks best interest, even though the most successful decentralised networks have achieved their current value and status due to embracing this ethos. The network, at the moment, is not permissionless and consists of permissioned nodes run by the Hedera Governing Council. Over time the network will move to a permissionless model, to hopefully allow access to anyone who wishes to participate in the network without being approved by the Governing Council. Whilst Hedera has some big players invested, all this means is that these companies control governance. Isn’t this the exact thing that crypto should be releasing us from?

Development Progress

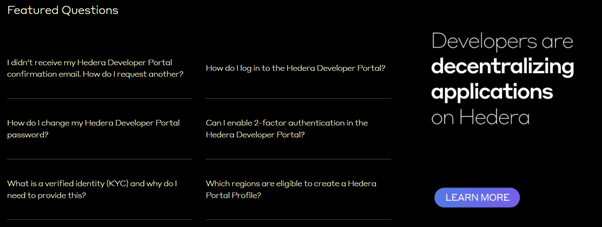

Partnering with established international companies also comes with increased expectations. Hedera has been in development since 2017, and yet developer access is still gated. Anyone wishing to develop the ecosystem goes through KYC verification and provide their personal details. In turn, this has hampered the speed of development in the ecosystem.

Currently, the number of DApps present on the hashgraph network is few compared to other ecosystems; however, they exist. A minority of DApps are operational, with most of them still being in the pre-alpha development stage. Some NFT marketplaces are functional on Hedera. However, their first collection did not fare particularly impressively. You can view the current NFT marketplace on HBAR here, and their collection of CryptoPunk copies here.

Whilst it is encouraging to see the current progress of the ecosystem, with the involvement of such established companies, it is worrying that it has taken so many years to reach this level. It is reasonable to expect more from Hedera and its development. There is also a discrepancy between the actual level of users compared to the users that the governing council companies boast.

In conjunction with past development progress issues, the 2021 Q3 roadmap is concerning, specifically as custom fees are the only thing to be implemented. Subsequently, in 2021 Q4, the deliverables simply mention something about scalable NFTs, flexible token associations, and SDK enhancement. This tooling has been present on other networks for an extended period. Additionally, with the quoted speed of 10K TPS from HBAR, scaling NFTs should not be an issue. Scheduled for 2022 is the improvement of their smart contract infrastructure. This leads to questions about whether there is a developer bottleneck on the DApp developer's side or the blockchain developers.

Tokenomics

Outside of development progress questions, significant concerns are attached to the project's tokenomics and their ownership of the Hashgraph algorithm. In the early days, initial investors appeared to be dumping their tokens, and Hedera knew this. To stop this, they proceeded to negotiate with these early investors. It resulted in an additional 3% of the overall ‘max’ supply distributed amongst them.

Hedera’s limited and exclusive license to use the Hashgraph technology platform under the MLA is perpetual, so long as certain conditions are met.

(1) Hedera will not increase the total supply of HBAR above 50 billion coins.

(2) Hedera will establish, update and comply with a published release schedule (which may be amended) for the coins from the Hedera Treasury account to ensure the security of the Hedera network.

(3) The Hedera Technical Steering and Product Committee will establish and require Council Members to comply with appropriate procedures for securing private keys and for effecting decisions of Hedera via a multi-signature account.

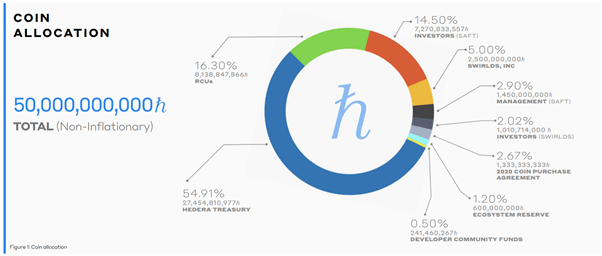

Note that the above is a 2-year-old legal agreement, and it's the same agreement as the one that was altered to accommodate for the aforementioned selling of tokens by investors. In turn, it is not inconceivable that the maximum supply also be altered in future. For all intents and purposes, Hedera is effectively a centralised blockchain. This centralisation alone personally leaves too many grey areas for us, as it is clear that early investor interests are being catered to. From their tokenomics below, the community is last on their list with only 1.2% of the tokens being set aside for an ecosystem fund. The coins held in the treasury are distributed amongst existing holders as staking rewards with a gradual inflation rate. Effectively, early investors who got a beneficial seed sale receive even more HBAR to sell on the open market.

Add in the 7% of the tokens of which 3% were effectively extorted by SWIRLDS, (SWIRLDS provide the licencing of the Hashgraph algorithm that Hedera uses for confirmations) and the distribution of tokens becomes even more suspect. The reasoning behind having the treasury control such a significant percentage of the supply is that the Hedera network reaches consensus on transactions through a coin-weighted process. Effectively a transaction becomes final when nodes with more than two-thirds of coins have contributed to consensus. This means that an attacker could disrupt the network by owning or controlling one-third of the coins. This is the reason that more than two-thirds of all coins are held by Hedera Hashgraph, LLC in its treasury account for the first several years and proxy-staked to trusted nodes so that an attacker cannot gain control of the one third needed for an attack.

This approach is understandable when the remainder of the coins are then allocated to the community and not to private investors. Additionally, the project also has licensing costs to pay to SWIRLDS from who the Hashgraph algorithm is licenced. The MLA license fees now consist of the following:

- Ten percent (10%) of the SAFT proceeds (which is already paid).

- A one-time allocation of 2.5 billion coins, or 5% of the total supply. (which is already transferred).

- A total payment of $5M.

It is important to highlight the delayed development in conjunction with the tokenomics, as they bring to light what we believe to be a fundamental flaw with HBAR.

As it stands, modern blockchains have accelerated their development, and there exists multiple Layer 1 networks that have effectively solved the short-term scalability issues encountered by Ethereum. Namely, newer Layer One networks have attained a high enough TPS with negligible transaction fees, but most importantly, have a significantly better level of decentralisation than HBAR. They also have more users and rapidly developing ecosystems. Their competitors have managed to adequately solve the problems that Hedera itself set out to solve. The fact that early investors in Hedera are probably aware of this development could see them attempting to offload their tokens when unlocked on the market. We have already seen this scenario play out once, with the organisation having to step in. It would not surprise us to see history repeated.

Hedera and their associated technology are not necessarily bad. If they successfully update their smart contracts and see DeFi via the deployed DApps, it is feasible to see increased demand for tokens as users try out the ecosystem. However, with such a large number of circulating tokens outside of the treasury holdings belonging to early investors, positive developments may be met with an offloading of tokens as they look to ‘cash in’ on their investments. Additionally, the competition between other Layer 1s has become stiffer, and every day without DeFi on Hedera, gaining market share becomes harder. In the long run, we simply believe that more performant Layer 1 blockchains with growing ecosystems (such as Avalanche and Solana) combine better decentralisation and are more community friendly. Simply put, there will be significantly better opportunities in the future.