DeFi Definition

Decentralised Finance (i.e. DeFi) is inspired by the decentralisation of power introduced by Bitcoin. It consists of financial services such as lending, borrowing and exchanging, all taken on-chain. The simplest way to think about it is:DeFi: Wall Street on-chain without the corruption

Capital Blackhole

DeFi has been attracting capital at exponential rates. At the start of 2020, the Total Value Locked (TVL) in DeFi was a mere $650 million, today it sits above $43 Billion. That's a 66X! Yet, this is only the start.A survey conducted by Xangle found that 90% of US accredited investors were looking to invest into DeFi in 2021. As of 2020, US accredited investors controlled $73.3 Trillion in wealth - 90% of that number is $65.9T.

Let us assume, on average, they invest a mere 0.5% of their wealth into DeFi (conservative): that would represent $350 Billion.

DeFi Market Size

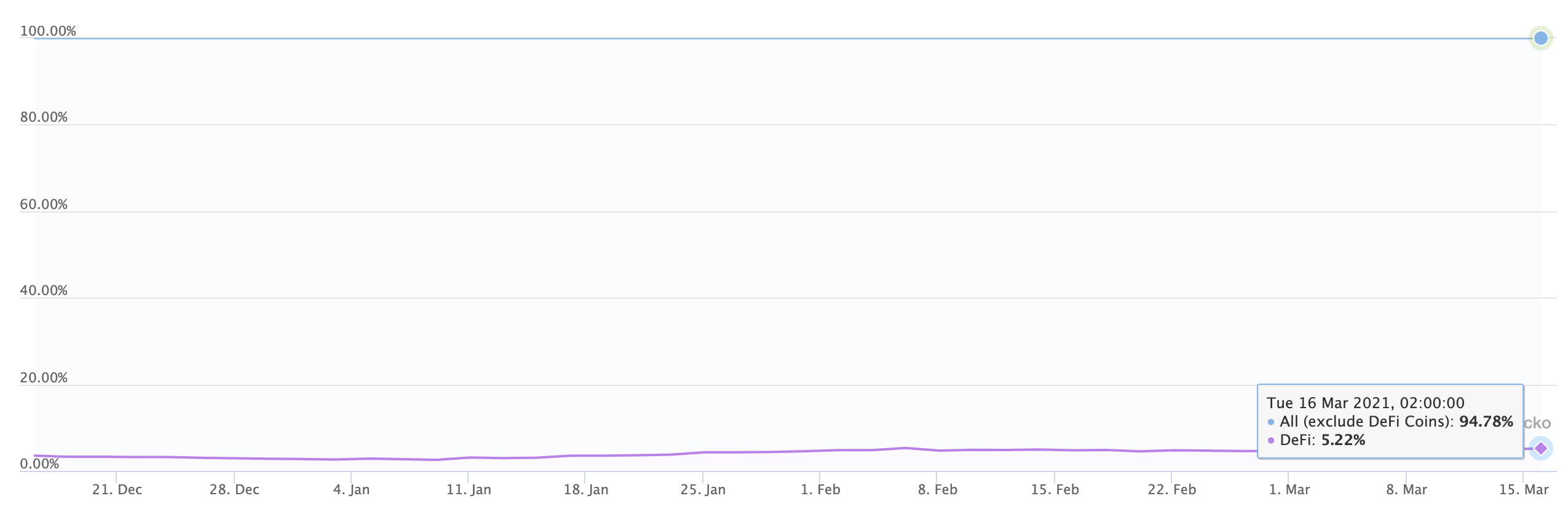

The current market capitalisation of all DeFi projects is $88.3 Billion, which means that investment from accredited investors is already four times larger than the entire DeFi market. That does not include retail investments and non-US investors.Despite being more beneficial to humanity as a whole than the majority of crypto-assets (yes, we are talking about 2017 ICO sh*tcoins), DeFi dominates less than 5% of the crypto-market in terms of market cap. This is how early it is.

[caption id="attachment_37807" align="aligncenter" width="2550"] DeFi Dominance[/caption]

DeFi Dominance[/caption]

Needless to say, we are very deeply invested into DeFi and for good/obvious reasons. However, whenever a new industry is launched and gathers attention, scams flood the place. Which is why research is crucial - which our team conducts relentlessly.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Our DeFi Investments

Our investment thesis is rather simple, we invest in protocols we will personally be users of that also have a strong value accrual mechanism for their tokens.Excluding our Layer-1 investments in networks, Ethereum & Polkadot, here are our DeFi investments:

1 - Serum (SRM)

Serum is a brand new DEX that was mainly developed by Alameda Research (creators of FTX). If there was a team that understands what an exchange requires, it’s Alameda. We bought the listing and remain “HODL”ers of the token with reasonable profits and staking rewards.

2 - Synthetix (SNX)

Synthetix is one of the older DeFi projects whose team kept their heads down and worked through the 2018 bear market. It facilitates the issuance of “synthetic” assets that can be based on a fiat currency, a cryptocurrency, a commodity, an index, a stock or anything else. All “synths” are ERC20 tokens and therefore can be traded. “Synth” is basically a new fancier DeFi name for “derivatives."

3 - ThorChain (RUNE)

As we were on our “Research Spree” looking for a DeFi protocol addressing a big empty market and a token with a robust economic model, we found RUNE (THORChain) as it addresses a market larger than what DEXes like Uniswap are addressing today. Its economic model is also the strongest one we have seen to date (full Fundamental Report here).

4 - Oxygen (OXY)

OXY is our latest DeFi bet. When we first heard about it, we were not really convinced honestly. However, as we used their wallet and saw the integrated functions as well as the economic model, we knew we had to get involved. All IEO investors already experienced a 1,200%+ increase in less than a week! (full Fundamental Report here).