The global sports betting market is estimated to be worth around $100 billion. In 2023, over £3.3 billion ($4.36 billion) in bets were placed in the U.K. alone.

Decentralised gambling platforms are bringing this on-chain; is there an opportunity here?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What are prediction markets?

Prediction markets (read, decentralised gambling platforms) are platforms or exchanges where participants can trade contracts based on the outcome of future events.These events can range from political elections to sports outcomes to economic indicators to any event with an uncertain but provable and knowable result. The prices of the contracts in these markets reflect the collective judgment of the participants about the probability of the event occurring.

How do prediction markets work?

- Creating contracts:

- A prediction market creates contracts for a specific event, such as "Candidate X will win the election" or "BTC will hit $100k by the end of the year."

- Each contract typically has two possible outcomes: "Yes" or "No" (sometimes represented as 1 or 0).

- Trading:

- Participants buy and sell these contracts based on their beliefs about the likelihood of the event occurring.

- If participants believe the event is likely, they might buy a "Yes" contract. Conversely, if they believe the event will not happen, they might sell a "Yes" contract or buy a "No" contract.

- Price as a probability indicator:

- The price of a contract generally represents the market's consensus on the probability of the event happening. For example, if a "Yes" contract for an event is trading at $0.70, it implies the market believes there is a 70% chance of the event occurring.

- Conversely, if a "No" contract is trading at $0.30, the market assigns a 30% chance that the event will not occur.

- Settlement:

- Once the event occurs, the market settles the contracts. If the event happens, "Yes" contracts are paid out at $1 per share, while "No" contracts become worthless. If the event does not happen, "No" contracts are paid out at $1 per share, while "Yes" contracts become worthless. So, if you bought the “Yes” contracts at $0.70 and are right, you gain $0.30 on every contract you own. Conversely, if you purchased the “No” contracts at $0.30 and are right, you gain $0.70 on every contract you own.

- Participants profit or lose based on the contracts they hold.

- Market efficiency:

- Prediction markets are considered efficient in signalling how future events might pan out because users have to put their money where their mouth is. Therefore, they have an incentive to apply their best judgment when making a prediction rather than making a blind guess. Each participant contributes their knowledge, insights, and research to the market, which is then reflected in the price.

Prediction markets are heating up

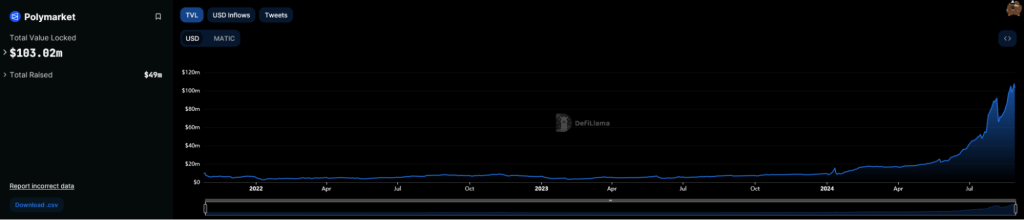

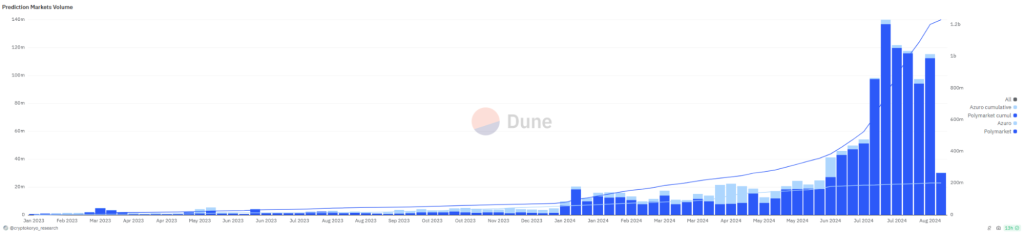

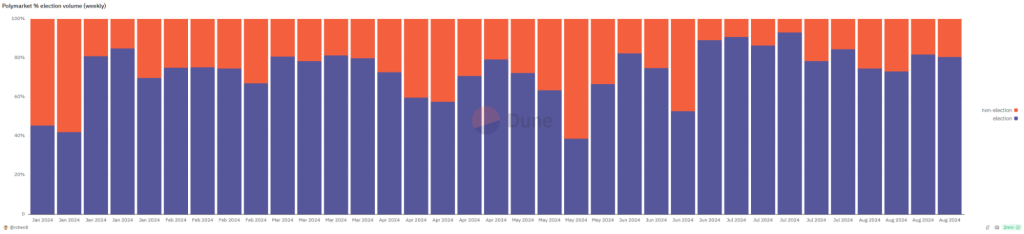

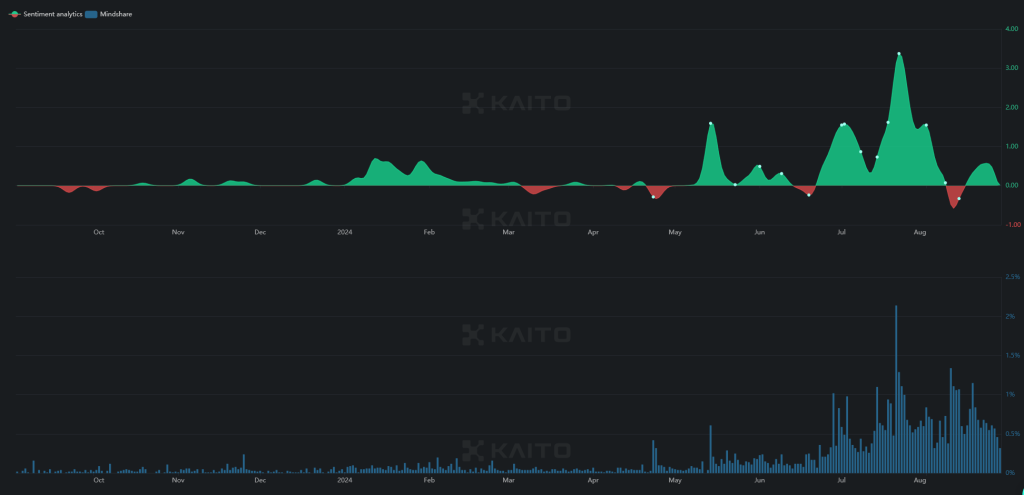

Prediction markets in crypto have been around for a while – at least, we’ve had Augur as far back as 2018. However, the sector has picked up steam in 2024 thanks partly to the global interest in the U.S. elections.Just this year, there has been a surge in activity. Volumes have been posting new all-time highs for the majority of this year:

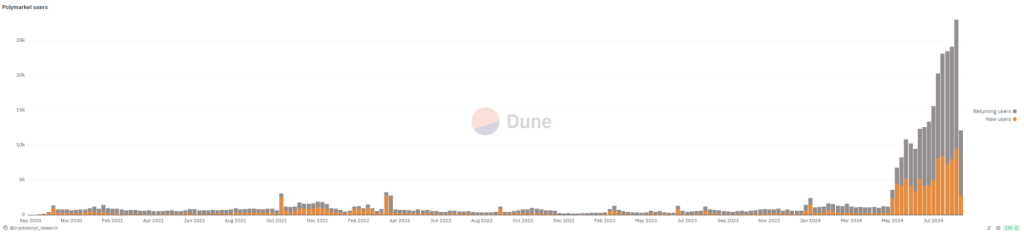

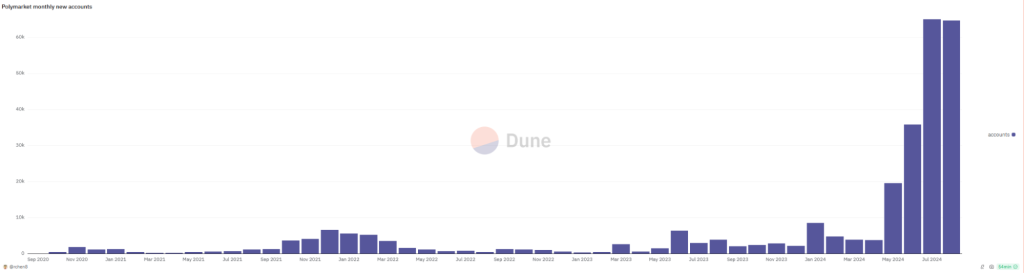

It is not just a case of people betting more—users have been piling in since mid-May. A significant inflow of new and recurring users has driven volume activity.

This influx of users and activity has been largely in line with the resurgence of the crypto market since November 23/January 24. Adding to the hype is the U.S. 2024 presidential election campaign. With many speeches, debates, and other events related to the campaign trail, gambling on these events is essentially the same as gambling on a sports match.

It has the same incentives, the same reason to watch, easy to follow, and a black-and-white outcome depending on the wager.

Additionally, the decentralised prediction markets have a vast range of outcomes you can bet on - more so than traditional betting markets.

But like we often say, we are still early!

Polymarket has a TVL of $103 million. That’s around 0.095% of the current global sports betting market—not even a drop in the bucket—it’s a rounding error.

But it won’t stay a round error for long. The simple fact of the matter is, wouldn’t you gamble on the odds of Donald Trump going to prison? By the way, that’s a live bet at the moment, but more on that in a bit.

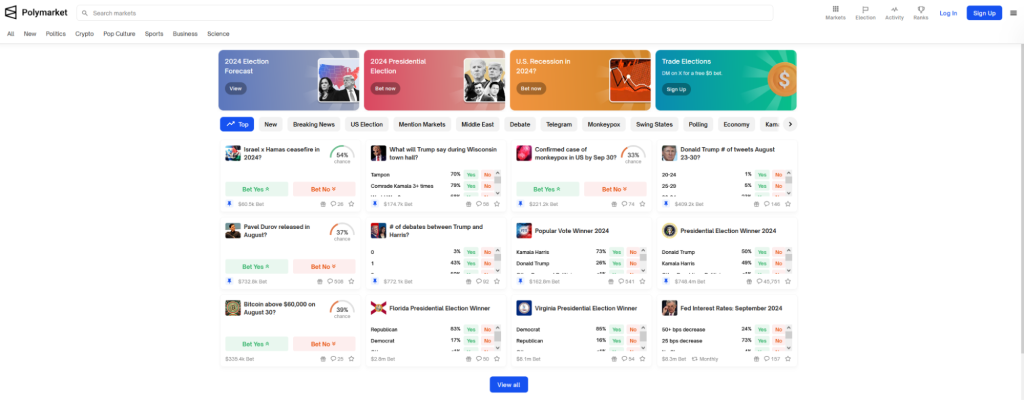

Polymarket

Polymarket is a decentralised information marketplace built on Ethereum. Users can speculate on the outcome of real-world events. Utilising blockchain technology, Polymarket offers a transparent, trustless platform where anyone can trade on various topics, from politics and economics to sports and entertainment.

Polymarket thrives on the idea that markets can aggregate information more effectively than individual experts. By allowing users to buy and sell shares based on their predictions, Polymarket turns information into a tradeable commodity.

This crowdsourced knowledge reflects collective degeneracy, with degeneracy so foul that sometimes the odds offered are actually a more accurate forecast than election polls or expert opinions.

Here’s a summary of Polymarket:

- Decentralisation: Built on Ethereum, Polymarket is a fully decentralised platform. This ensures no single entity controls the marketplace, making it censorship-resistant and globally accessible.

- Non-custodial Trading: Users maintain control of their assets at all times. Polymarket employs smart contracts to manage trades, ensuring that funds are only released based on the outcome of real-world events. For confirmation of outcome, Polymarket uses real-world data from oracles, ensuring proofs are posted and any false positives are absolutely clarified before paying out.

- Versatile Market Creation: Polymarket allows users to create their own markets on virtually any topic. This flexibility has made it a hub for diverse and niche topics, with markets often covering events not addressed by traditional platforms.

- Predictive Power: The aggregated data from Polymarket’s user predictions serves as a powerful forecasting tool. These markets have proven to be accurate indicators of future outcomes, offering valuable insights for traders, researchers, and the general public.

- Transparent Pricing: Polymarket provides real-time price updates, reflecting the latest consensus on the likelihood of an event. This transparency allows traders to make informed decisions based on current information.

- Low Fees and High Speed: Leveraging Ethereum’s Layer 2 solutions, Polymarket minimises transaction fees and ensures quick settlement times, making the platform cost-effective and efficient for users.

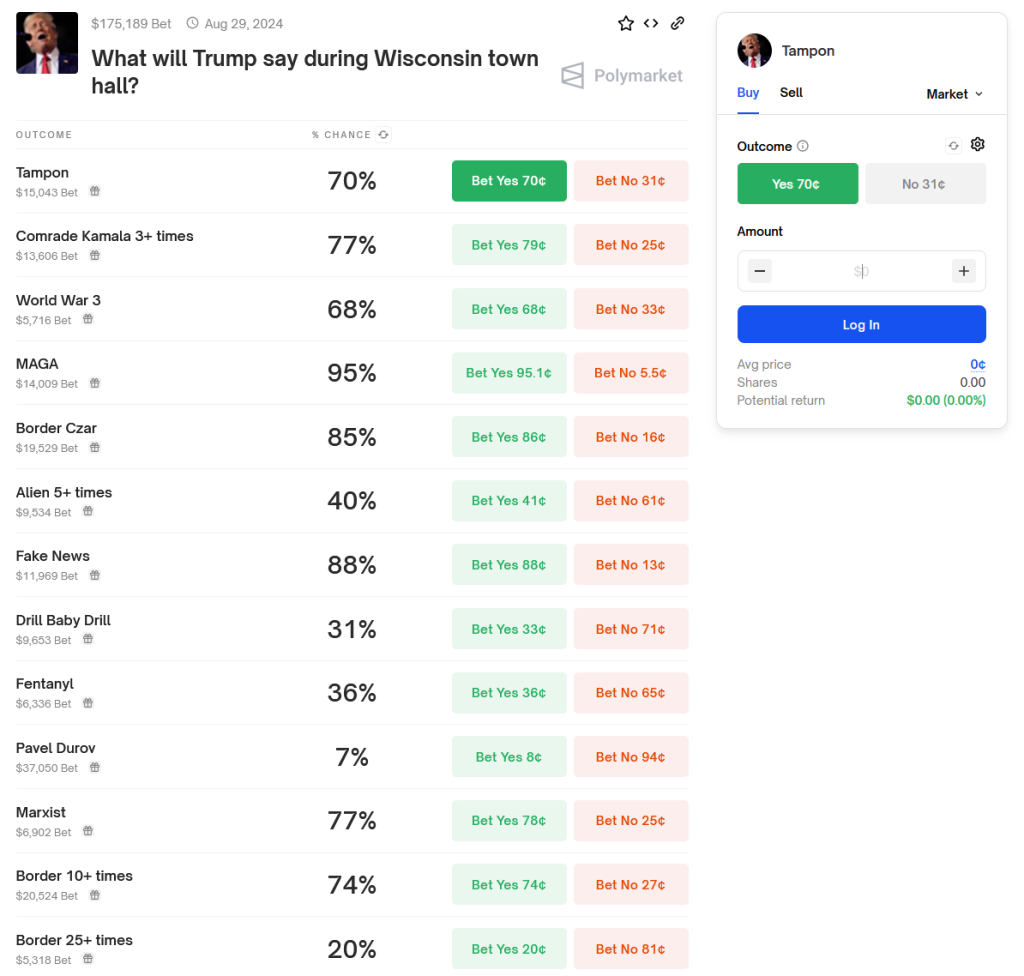

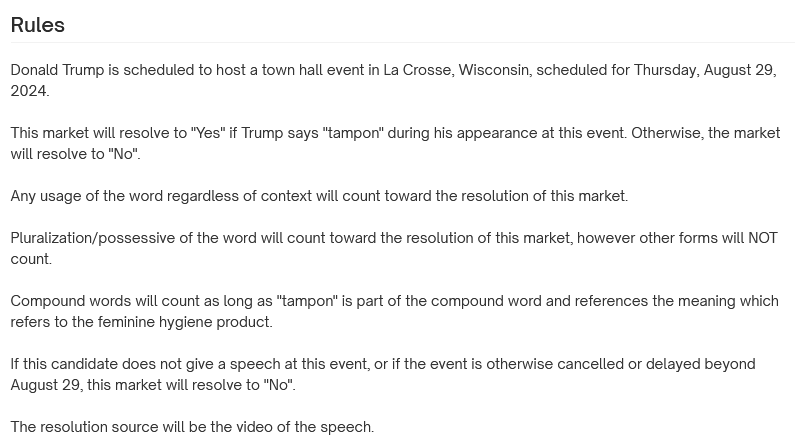

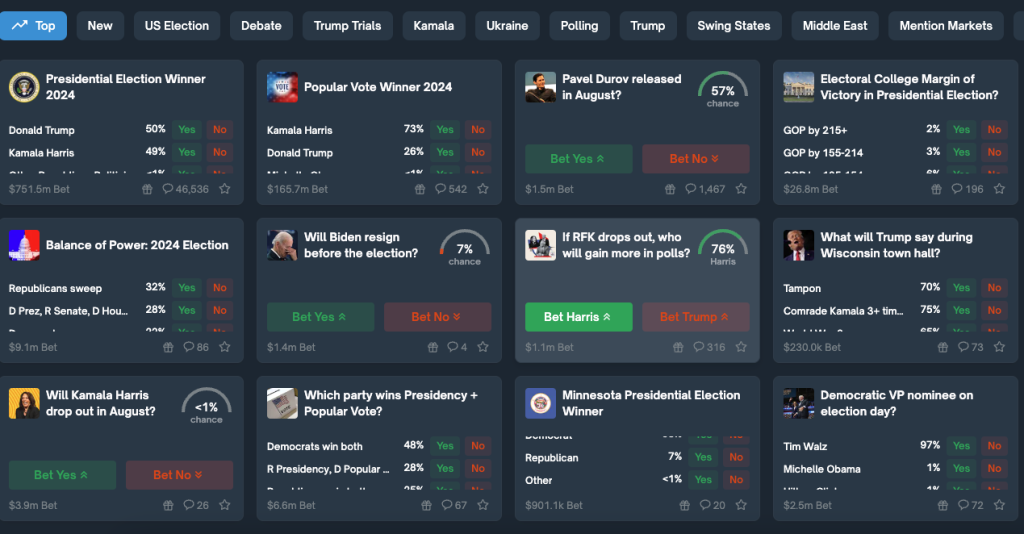

Take this as an example:

If Trump says “Comrade Kamala” three or more times, then the people who think he won’t say it three or more times will pay those who bet “yes”.

No

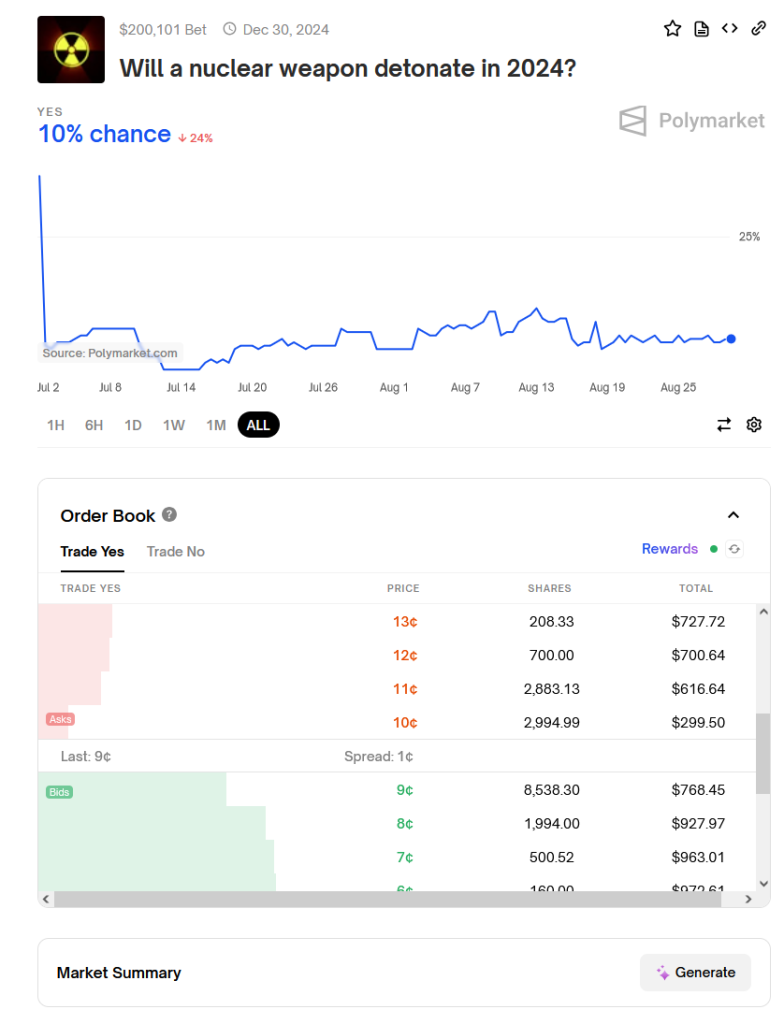

The mechanics behind Polymarket's prediction markets are straightforward yet powerful. Each “share” in a market is priced between $0.00 and $1.00, reflecting the market's perceived probability—or "odds"—of an outcome occurring.

For instance, if a share representing a candidate in an election is priced at $0.63, the market estimates the candidate has a 63% chance of winning. To participate, you’d purchase shares in the outcome you believe will occur - Trump or Kamala.

The market resolves once the event has played out, and the winning outcome’s share price adjusts to $1.00. The closer a result is to happening, the higher its share price, while less likely outcomes are more affordable to bet on.

Each bet has rules that confirm the outcome. After that, the results are released, and winners and losers are paid. The mechanism is quite simple—Polymarket matches bettors with the other side. There is no house as in traditional betting companies like William Hill or Ladbrokes, which makes fees much more attractive.

Lower fees = bigger payout; there’s also the nuance that you will generally get better odds on Polymarket than in a traditional bookmaker.

How do I use Polymarket?

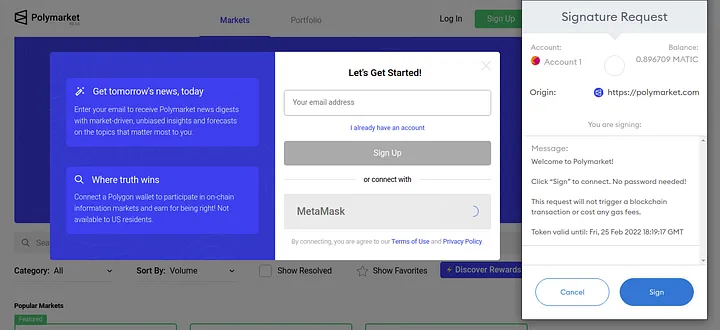

Polymarket has provided an in-depth guide with videos on how to use the platform; you can find these here.Step 1: Sign up & deposit funds

Sign up:- You can register using your email and a password, but signing up using Metamask or Phantom is highly recommended. If you're new to Metamask, you might want to learn how to set it up first.

- After clicking "Connect with Metamask," confirm the sign-up process in your wallet.

Fund your Metamask wallet:

- To get started, you'll need to fund your wallet with MATIC and USDC on the Polygon network. USDC is used for trading on Polymarket, while MATIC is required for transaction fees (gas fees). You won't need much MATIC—typically, 0.1 MATIC (around $0.15) will be sufficient.

- Once your Metamask wallet is funded, you’ll need to deposit USDC into your Polymarket account. Click the "Deposit" button next to your account address on Polymarket, copy the deposit wallet address, and transfer your USDC to this address via Metamask.

Step 2: Bet on the markets

With funds in your Polymarket account, you’re ready to start participating in the markets.Explore the markets:

- Navigate to the "Markets" tab at the top of the Polymarket homepage.

- Browse through the available markets and select one that interests you.

Place your bet:

- After selecting a market, choose the outcome you think will happen.

- Decide how much USDC you want to invest in this outcome. The interface will display some important information:

- Average price: This shows the cost per share. Larger orders or lower liquidity can result in a higher average price.

- Estimated shares: Indicates the number of shares you’ll receive. If your prediction is correct, each share can be redeemed for $1 USDC.

- Return on investment: This percentage reflects the potential profit if your prediction is accurate.

- Once you’ve reviewed everything, click "Buy" and confirm the transaction. The trade should be completed in about 20 seconds.

Step 3: Selling your shares

You don’t have to wait until the market closes to sell your shares. You can sell them at any time.- Navigate to the market:

- Go to the specific market page where you hold shares and click the "Sell" tab.

- Sell your shares:

- Enter the number of shares you want to sell, or click "Max" to sell all.

- Click "Sell" and then confirm the transaction.

Step 4: Redeeming shares

After a market resolves, you can redeem your winning shares for USDC.- View Your Positions:

- Click on the "Portfolio" tab to see all your active market positions.

- Redeem Winnings:

- If the market resolves, the "Trade" button next to your position will change to "Redeem."

- Click "Redeem" to claim your winnings.

Drift

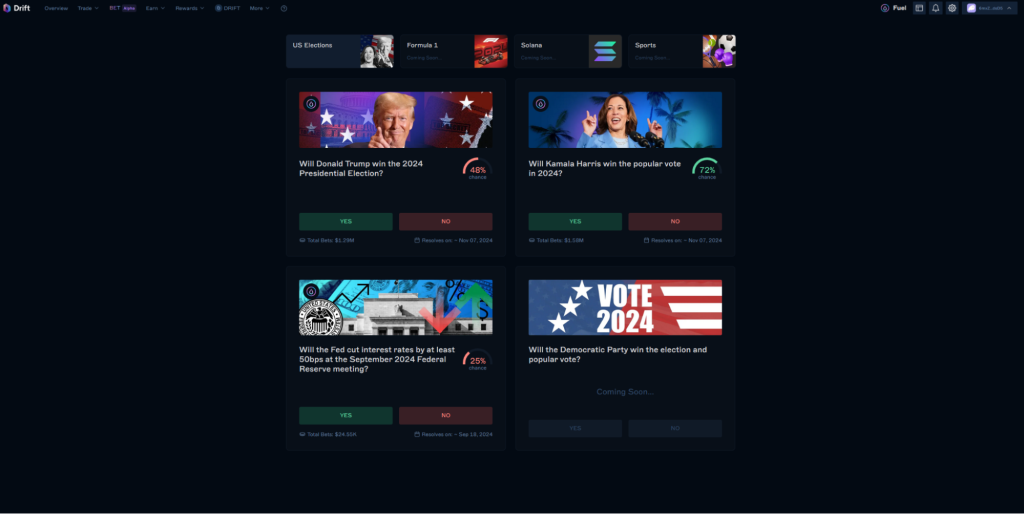

Polymarket may be the leader in the sector; however, there are other options…Just this month, a new prediction markets protocol was launched following the success of Polymarket: Drift, Solana’s answer to Polymarket.

It works like Polymarket, with the first odds being offered during the election cycle.

There’s not a whole lot to it at the moment, but for Solana lovers who want to bet on the election - here’s your spot.

The election cycle is the running theme for success across the whole sector, so there’s a massive elephant in the room.

What happens to prediction markets after it’s all over?

Will it all come crashing down after the elections?

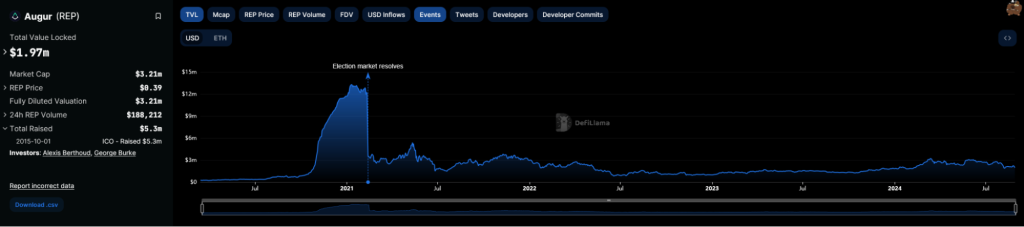

The rise in bets and the accumulation of TVL looks excellent on paper. But we have seen a similar story before.Augur, after the 2020 elections

Augur, an Ethereum prediction market, had around $10 million in bets on the 2020 election. This was up from practically $0 six months before.

When that bet was resolved, after a period of indecision due to the January 6 events and Trump’s challenge of the results, TVL dropped as those bets were paid out. Augur’s TVL failed to recover, and it seems that Polymarket became the new “place to be” for betting. This is likely due to the lower transaction costs using Polymarket (built on Polygon) compared to Augur (built on Ethereum).

Why is it different for Polymarket?

The Polymarket TVL figure at the beginning of this article gives you a general idea of how small the market is (and how early we are). For perspective, Polymarket had a $9.64 million TVL in January, a ~1200% TVL growth in 5 months.

Around 80.4% of bets on Polymarket are based on election bets. If the election were to conclude tomorrow and all bets were paid out, Polymarket’s TVL could drop anywhere from $75-85 million. This is a similar drop percentage to Augur’s TVL in 2021.

Data from socials shows a positive outlook for Polymarket across all platforms, as well as healthy growth in mindshare that is confluent with the spike in new users.

Undeniably, though, most of these people are here to bet on the election, with the resulting TVL inflated due to an election year.

It is doubtful that TVL will remain at these levels after Jan/Feb 2025 when the new President (whoever that may be) is sworn in and any issues/challenges are resolved.

However, Polymarket has the advantage over Augur in that fees are cheaper. This means it is more accessible, so Polymarket is more likely to get return business from new users whenever some other popular event becomes worth betting on.

Prediction markets are here to stay

Short of total nuclear annihilation (which you can bet on as well, by the way), the beauty of it all is that there will always be something to give odds on. And some degen on the other side is always willing to pay you, no matter how outlandish the bet.

Cryptonary’s take

Prediction markets are a natural progression to satiate the basic human need to gamble. Although the numbers this year have been inflated significantly by the 2024 election cycle, it is undeniable that the number of new users indicates that the sector is grabbing attention.With all the new users, Polymarket is unlikely to share the same fate as Augur after this election cycle. Yes, TVL may drop, but the exposure and subsequent familiarity that these new users will have with the platform (and the concept) will benchmark future growth in the sector.

We would like to see the launch of a native token for both Polymarket and Drift BET (Drift has a token as it’s also a derivatives exchange), with some form of fee-share structure that drives value to the token. But honestly, purely through sentiment and the nature of the sector, a Polymarket token would attract a huge number of degens purely from hype.

But for now, we wouldn’t recommend buying into any prediction market tokens. The inevitable collapse in TVL in the next 4-5 months will absolutely affect any token price (and ruin any profits made). But if you have strong opinions about the election, you should put your money where your mouth is.

The indomitable human spirit and our unmatched capacity to throw money away can never be beaten; prediction markets are here to stay.

Cryptonary, Out!