Cryptonary’s research methodology

Hey, we’re pulling back the curtain to reveal the meticulous methodology behind Cryptonary’s standout investment research, grounded in transparency and precision. We also have an important message for our community…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

At Cryptonary, we prioritise transparency and clarity when presenting our research and investment picks. This report serves to ensure that our community and readers understand the methodologies, potential risks, and purpose behind the insights we share. Our goal is to empower our audience with high-quality research that stands out in an industry flooded with misinformation.

We pride ourselves on delivering some of the best-quality research available, backed by a rigorous approach and an unwavering commitment to accuracy. With a market comprising over 2.4 million tokens, we have consistently demonstrated our ability to identify winning assets, providing our readers with a level of performance that surpasses market expectations.

For example, our Barbell portfolio recommended back in April outperformed BTC by over 150%. Curious to know how we achieve such performance? Keep reading...

BTC cumulative return since 2024-04-01: 38.26%; Barbell Portfolio cumulative return since 2024-04-01: 194.17%. Our portfolio outperformed BTC by 155.90%.

This disclaimer reinforces our commitment to transparency and excellence while emphasizing the thoughtful nature of our research. Further, we believe that a clear understanding of our research processes—and what qualifies as one of our carefully selected picks— is an important clarification for our community to make well-informed investment decisions.Let's dive in...

The multi-step research process

Our team of researchers and analysts spans multiple time zones, allowing us to monitor the markets 24/7. Each team member brings a robust background in capital markets, research, and analysis.We engage in continuous internal discussions on market trends, assets, and potential picks. When a team member identifies a compelling new asset, they submit a concise, one-page report outlining key information about the asset and presenting their thesis on why it merits our attention. The rest of the team then reviews the submission, requests additional information if needed, and opens the floor to team feedback. After thorough consideration, the Head of Research makes the final decision on whether the team should conduct a further analysis into the asset for publication. All published reports are supervised by the leadership of the company.

After the research process has started, we look at a number of factors depending on the nature of an asset:

Utility coin version:

- Supply distribution (mostly circulating, no huge allocation to insiders or VCs)

- Tokenomics (value accrual: burn, revenue-revenue share, utility)

- Fundamentals (Volume, Revenue, Fees, Total Value Locked, etc)

- Narrative (Must be hot and unique, for example, AI or RWA)

- Team (Track record of delivery and innovation, transparent communication)

- Price action (Strong chart against USD and BTC)

- Uniqueness (Does it have a unique value proposition? Partnerships? Tech?)

Memecoin version:

- Meme is fun and normie friendly.

- Wide distribution: community-owned with no insiders or cabals involved

- Community is a die-hard cult: active on socials, creates media and is fun to stick around.

- Thorough inspection of major holders and how much of the supply they control

- In a hot ecosystem (Solana, Ethereum, etc)

- No red flags. e.g. liquidity is locked, and ownership of the contract is renounced.

- Growing number of holders

- Pre-PumpFun era memecoins (at least 1-year-old) are preferred

Once the draft is complete and meets Cryptonary's rigorous internal standards, it is published on our website. However, it is important to clarify that the publication of a single report does not imply that the asset is officially included in Cryptonary’s Picks.

Once the report is reviewed by all team members, each of them will conduct further research to build their own individual conviction. If a majority of the team independently decides to include the asset in their personal portfolios, it is then added to the Cryptonary Picks.

The leadership team also contribute their insights to the picks list, refining price targets and enhancing the underlying thesis. As a result, assets included in Cryptonary’s Picks represent the “collective wisdom” of the Cryptonary team. This collaborative approach drives our success, and our results speak for themselves…

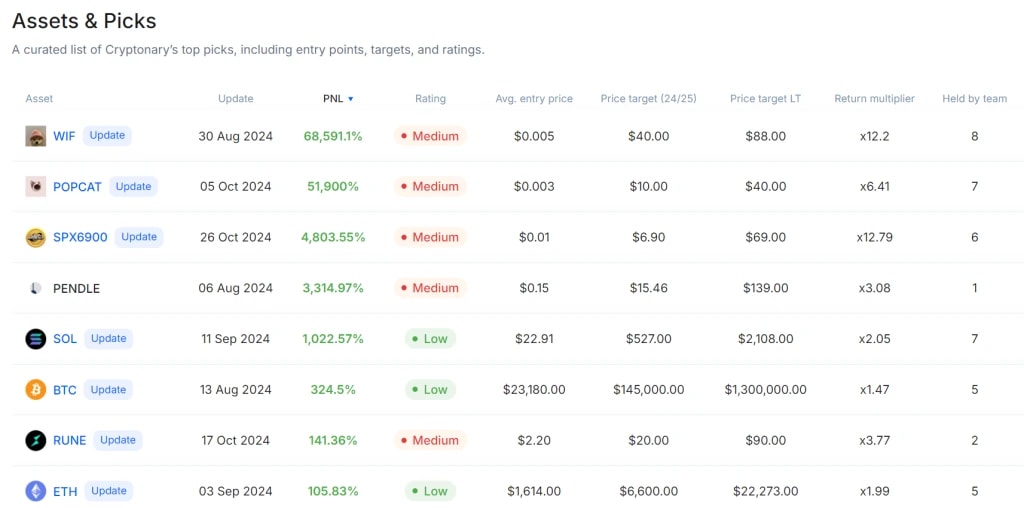

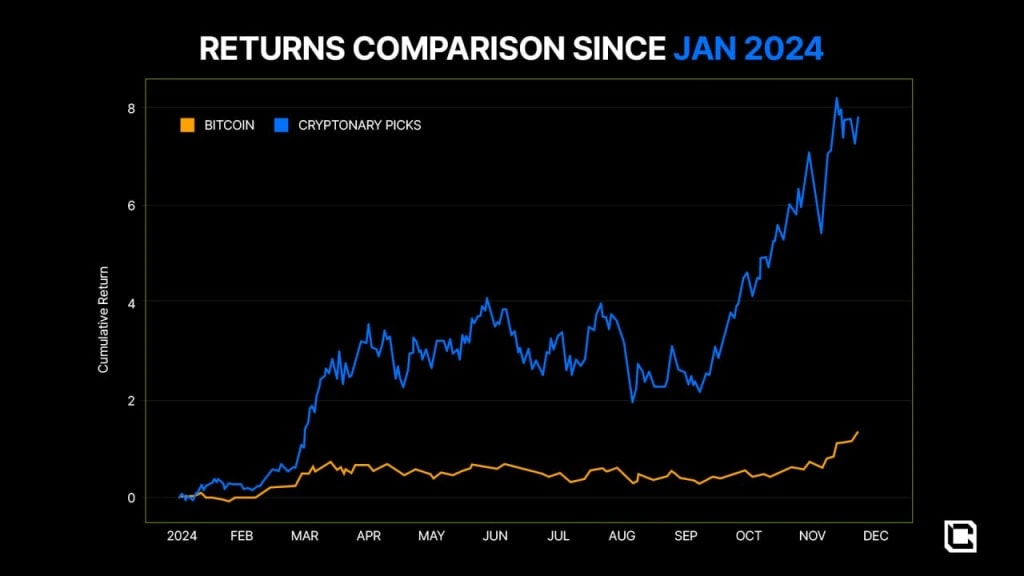

Here is the performance of our Cryptonary picks since the beginning of the year:

BTC cumulative return YTD: 133.39%; CPro picks cumulative return YTD: 778.75%; current CPro picks outperformed BTC by 645.36%.

BTC cumulative return YTD: 133.39%; CPro picks cumulative return YTD: 778.75%; current CPro picks outperformed BTC by 645.36%.

Official picks vs. individual opinions

Another important message for our community is the distinction between Cryptonary's official position and the personal opinions of individual team members. While team members may share assets on social media or through community channels like Discord, these views are not reflective of Cryptonary’s official stance by default.Cryptonary picks are the result of a collective research effort, reflecting the combined expertise and rigorous scrutiny of the team. In contrast, individual statements are personal viewpoints that do not carry the endorsement of Cryptonary, even though we do understand the importance of every statement coming from a team member branding-wise. Therefore, we regularly communicate with each other and share thoughts with the rest of the team to be aligned. This distinction is crucial for maintaining accountability, having a common vision and preventing misinformation, especially when it comes to memecoins.

As we mentioned earlier, while we publish in-depth research on various assets, ecosystems, and sectors, these analyses do not automatically constitute Cryptonary’s picks. Such pieces are often meant to explore the broader market or highlight short-term opportunities. An asset only becomes an official Cryptonary pick when it is formally listed in the “Assets & Picks” section on our website.

However, this does not mean non-CPro pick pieces lack value as investment opportunities or insightful information. Every analysis undergoes a rigorous research process and has the potential to benefit readers through avenues such as airdrops, yield generation, trading strategies, psychology, portfolio management or short-term investment opportunities. These analyses are crafted to help readers navigate the market and capitalise on opportunities, even if the assets discussed are not listed as official Cryptonary picks.

That said, it is crucial to differentiate between the individual pieces or opinions of team members and Cryptonary’s official picks. While individual researchers and analysts may share their personal views or portfolio strategies, these are based on each researcher/analyst’s own convictions and do not represent the collective pick. By clearly separating personal insights from official company positions, Cryptonary reinforces its dedication to transparency, ensuring the community has access to reliable and thoroughly vetted information today and in the future.

Cryptonary’s take

At Cryptonary, we’re all about empowering you with the best research in a space full of noise. Our picks aren’t random—they’re the result of deep dives, team debates, and rigorous checks to ensure they stand out. This approach has consistently delivered standout performance, such as our Barbell portfolio outperforming BTC by over 150% since we recommended it and our picks surpassing BTC’s returns by 645% this year.Transparency is key, which is why we separate official picks from personal opinions. We hope this piece provides clarity on our research methods as we strive to deliver the best research, analysis, and education in the industry. Our goal? We aim to help you make informed decisions and navigate this ever-changing market confidently.

Peace!

Cryptonary, OUT!