Avalanche has been gaining attention for its ability to support a wide range of applications, including decentralised finance (DeFi), gaming, and real-world asset tokenisation.

It has attracted significant institutional interest, with Franklin Templeton and Grayscale Investments launching products on the platform.

This has positioned Avalanche as a key player in the tokenisation of real-world assets and the broader blockchain ecosystem.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Avalanche?

Avalanche is a high-performance, scalable Layer 1 blockchain designed to offer developers a flexible and interoperable environment for building decentralised applications (DApps) and other blockchain-based solutions.Avalanche aims to solve the "blockchain trilemma" by providing a platform that is secure, scalable, and decentralised. Avalanche is also known for its fast transaction finality and high throughput, making it an attractive option for developers and enterprises looking to leverage blockchain technology for various use cases.

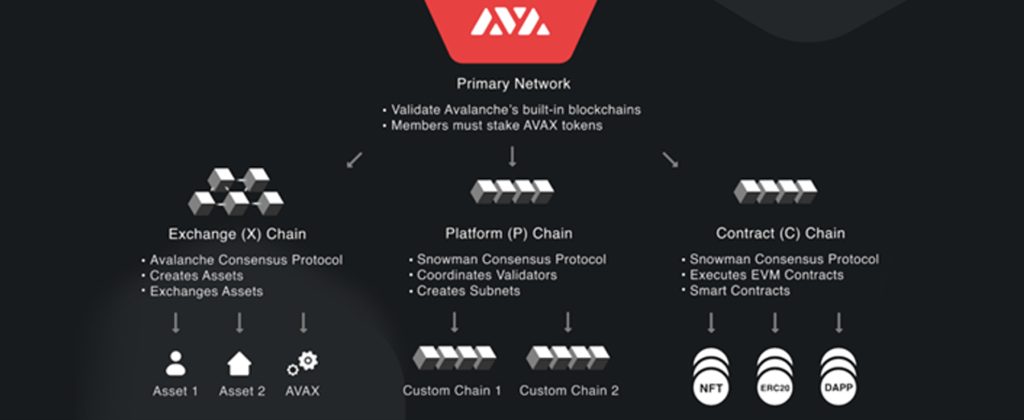

Avalanche is known for its unique tri-chain architecture, which includes the C-Chain, P-Chain, and X-Chain. This architecture allows for customisable Layer 1s, formerly known as "Subnets," which are now referred to as Avalanche L1s.

Key features:

- Consensus protocol: Avalanche uses a novel consensus protocol, the Avalanche consensus, which provides high throughput (many transactions per second), low latency, and high security. This consensus mechanism allows the network to finalise transactions quickly and efficiently.

- Avalanche's primary network validates all transactions on the sub-chains.

- The P and C chains both utilise the Snowman Consensus Protocol. Snowman is basically a more efficient, linear version of the Avalanche consensus. It's optimised for smart contract functionality as well as speed, security, and cross-compatibility with Ethereum.

- Subnets: Avalanche is built around the concept of subnets (short for "sub-networks"). These are a dynamic set of validators working together to achieve consensus on one or more blockchains. This architecture supports the creation of multiple customisable blockchains within the Avalanche platform.

- Interoperability: Avalanche enables interoperability between different blockchains within its ecosystem, allowing assets and data to be seamlessly exchanged across different subnets.

- Smart contracts: Avalanche supports the Ethereum Virtual Machine (EVM), meaning it is compatible with Ethereum-based smart contracts. This allows developers to easily port their Ethereum dApps to Avalanche, benefiting from higher performance and lower costs.

- Ecosystem and integrations: The Avalanche ecosystem is rapidly growing with multiple DeFi (Decentralised Finance) projects, NFTs (Non-Fungible Tokens), and collaborations. For instance, recent integrations include the launch of Chainlink Data Streams on Avalanche, which is used by decentralised perps exchange GMX to enhance data reliability and security.

Unique architecture

Avalanche's innovative architecture is composed of three distinct blockchains, known as the "tri-chain" structure: the Exchange Chain (X-Chain), the Platform Chain (P-Chain), and the Contract Chain (C-Chain).Each chain is designed to perform specific functions and works together to maximise the overall performance, scalability, and flexibility of the Avalanche ecosystem.

1. Exchange Chain (X-Chain)

The Exchange Chain is the default chain for creating and trading Avalanche assets. It functions as a decentralised platform for digital assets, enabling users to mint, manage, and transfer assets with high throughput and minimal latency.The Exchange Chain API is used for setting the conditions and rules for the creation and trading of digital assets on the Avalanche ecosystem. Parameters such as time or location restrictions on an asset are set from this chain. The X Chain runs as an instance of the Avalanche Virtual Machine (AVM).

- Purpose: Asset creation and exchange

- Consensus protocol: Avalanche consensus protocol, which allows for high transaction throughput and low latency

- Use cases: Issuance, transfer, and trading of tokens and other digital assets

2. Platform Chain (P-Chain)

The Platform Chain is at the core of Avalanche's coordination and metadata functionalities. It is responsible for managing validators, staking, and the creation of subnets—customisable interoperable blockchains within the Avalanche ecosystem.The Platform Chain API is used to set the conditions and parameters for the creation of new blockchains/protocols to be built on Avalanche. Clients can select various options for their protocol and blockchains.

- Purpose: Coordination of the Avalanche network and management of subnets

- Consensus protocol: Snowman consensus protocol, which is optimised for high-throughput, fully-ordered, and tamper-resistant transactions

- Use cases: Validator and staking management, creation of interoperable subnets

3. Contract Chain (C-Chain)

The Contract Chain facilitates the execution of smart contracts and the creation of decentralised applications (dApps). It is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port existing Ethereum-based dApps to Avalanche.The Contract Chain runs as an instance of the Ethereum Virtual Machine (EVM). To find out more about the EVM, click here. The C Chain handles smart contract executions. It is compatible with both native Avalanche and ERC-20 contracts.

- Purpose: Execution of smart contracts and dApps

- Consensus protocol: Snowman consensus protocol

- Use cases: Deployment of Ethereum-compatible smart contracts and dApps

Key benefits of Avalanche's Tri-chain architecture

- Specialisation: By dividing responsibilities across three specialised chains, Avalanche avoids the congestion and inefficiencies seen in single-chain architectures.

- Interoperability: The chains can interoperate seamlessly, providing users with a cohesive experience while leveraging the strengths of each chain.

- Scalability: The tri-chain structure, along with the ability to create subnets, significantly enhances scalability, enabling the network to handle a large number of transactions and diverse use cases.

- Flexibility: Developers can choose the most suitable chain for their specific use cases, whether it's high-speed asset exchanges, complex smart contracts, or creating custom blockchains within subnets.

The bullish case for Avalanche

Avalanche (AVAX) is a low-risk diversification play away from BTC, ETH, and SOL. It is one of the more developed ecosystems within the crypto market. The risk/reward ratio doesn't necessarily position AVAX as an attractive investment for those looking for higher returns. However, if you want a low-risk opportunity to reduce concentration risk in the majors (BTC, ETH, and SOL), AVAX is a great candidate.Avalanche's ecosystem continues to grow, with numerous partnerships and integrations across different sectors, further enhancing its utility and adoption. Still, as one of the more established ecosystems, Avalanche-related trends and narratives are worth watching.

Avalanche solves many of the problems we have with existing blockchains.

It was designed with scaling in mind. We see the problems blockchains like Bitcoin and Ethereum are now facing as more and more users regularly interact with crypto. This means adding more traffic to already congested networks.

Avalanche tackles the scalability problems through innovations such as the Snowman Consensus Protocol, increasing transaction capacity. The affordable fees discussed above have also attracted users. We all know how daunting it can be to pay extortionate Ethereum gas fees.

Members who have been with us for a while will notice that Solana is not on the comparison table, as it would overshadow AVAX. However, a comparison between the two would be unfair, as AVAX is optimised for using CPUs as validators, whilst Solana uses high-performance computers.

The environmental implications often called out by crypto sceptics don't apply to Avalanche due to its carbon-neutral status.

Simple and superior tokenomics

Avalanche's tokenomics model is designed for both simplicity and long-term sustainability. Unlike networks that require high-performance hardware, AVAX is optimised for CPUs, allowing a wider range of participants to become validators with basic modern hardware and a good internet connection. This should, in theory, encourage more decentralised validation, but currently, the network has about 1,700 active validators, which raises concerns considering the hardware requirements are relatively low.To run a validator node, one must hold 2,000 AVAX, making delegation a more feasible option for most users. Staking, which offers a highly attractive 10% APY, can be done either through direct validation or delegation, with the latter providing slightly lower returns (around 4%). As a result, 57% of the AVAX supply is currently staked, which plays a critical role in shaping the token's inflation rate.

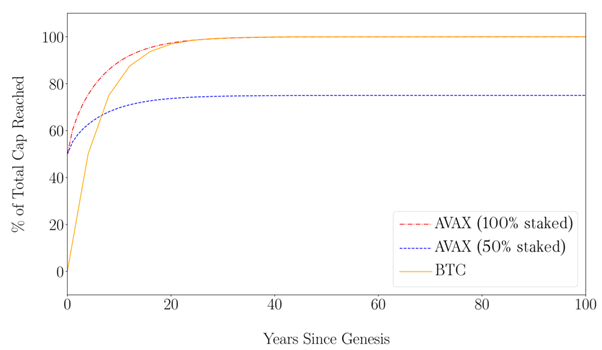

AVAX's inflation model is both simple and dynamic. The network launched with a capped supply of 720M tokens, and 360M were unlocked in the Genesis block. Emissions halve every four years, similar to Bitcoin, but the percentage of tokens staked influences the actual rate of new token issuance. If staking participation remains low, it's possible the maximum supply will never be reached, making AVAX's emissions inherently flexible.

At present, the circulating supply is around 395M AVAX, with 247M staked, and AVAX employs a deflationary mechanism by burning transaction fees. This deflationary pressure, combined with staking dynamics and capped supply, creates a strong, predictable economic model that has contributed to AVAX's growth.

The strong and simple tokenomics model, superior performance compared to most Layer-1 blockchains, sharing of core resources, and easy interoperability with other blockchains have led to its rapid growth.

Subnets

Avalanche allows developers to build other networks called subnets. In short, these subnets are designed by anyone who wishes to create a blockchain with characteristics different from that of the Avalanche Primary Network. This is done by changing the properties of validators to be specific to that Subnet. In addition to their own validators, each subnet is validated by the primary network. To create a Subnet, the creator must stake AVAX.Adoption drive

Avalanche has been actively pursuing partnerships with government agencies and private companies. The California DMV is launching its own chain on Avalanche to modernise the vehicle title transfer experience for CA's 39M+ residents.

Trusted transfers are one of the main challenges for any e-titling solution to succeed. Bringing these titles onto an Avalanche L1 brings full transparency and added security and will allow vehicle owners to track and manage their pink slip titles digitally:

"Blockchains are the most advanced tool any organisation can leverage to maximise efficiency, maintain compliance and protect consumer data – vital components for a government serving its constituents," said John Wu, President of Ava Labs. "Today's landmark announcement is a clear-cut example of how blockchain technology simultaneously benefits enterprises and consumers and Ava Labs is proud to partner with the California DMV as it transforms essential services to create a more transparent, accessible and secure user experience for citizens."

This is also an example of the utility of Avalanche Subnets, which operate in a similar fashion to Polkadot, a pseudo-Layer-0 protocol.

Avalanche's real-world adoption is exemplified by Franklin Templeton's expansion of its innovative on-chain money market fund, the Franklin OnChain U.S. Government Money Fund (FOBXX), to the Avalanche network. With $1.6 trillion in assets under management, Franklin Templeton's decision to leverage Avalanche highlights the network's growing appeal for institutional-grade financial solutions. The FOBXX fund, the first U.S.-registered mutual fund to fully utilise a public blockchain for transaction processing and record-keeping, showcases how major players are adopting Avalanche's infrastructure in traditional finance. This move reflects the broader shift toward blockchain technology to upgrade the efficiency and transparency of financial services.

The tokenisation of money market funds through Avalanche brings notable benefits to both institutional and individual investors. Franklin Templeton's Benji Investments app allows investors to convert USDC stablecoin into shares of the FOBXX fund, with the added advantage of peer-to-peer transfers on the blockchain. This level of accessibility and flexibility, powered by Avalanche's sub-second transaction finality and low transaction fees, has made the network an attractive platform for financial innovation. As institutions increasingly seek to integrate blockchain with traditional financial systems, Avalanche provides the necessary infrastructure to bridge the gap between on-chain and off-chain assets.

Avalanche's role in institutional adoption extends beyond just tokenised assets. Its customisable, enterprise-grade infrastructure has positioned it as a key player in transforming financial markets. Franklin Templeton's partnership with Avalanche underscores a growing trend where traditional financial giants are turning to blockchain-enabled solutions to unlock new opportunities. As more institutions explore the tokenisation of assets and the efficiencies blockchain can offer, Avalanche's network is poised to support the next wave of financial innovation, driving real-world use cases and expanding the possibilities for both investors and developers.

Avalanche's valuation exercise + price targets

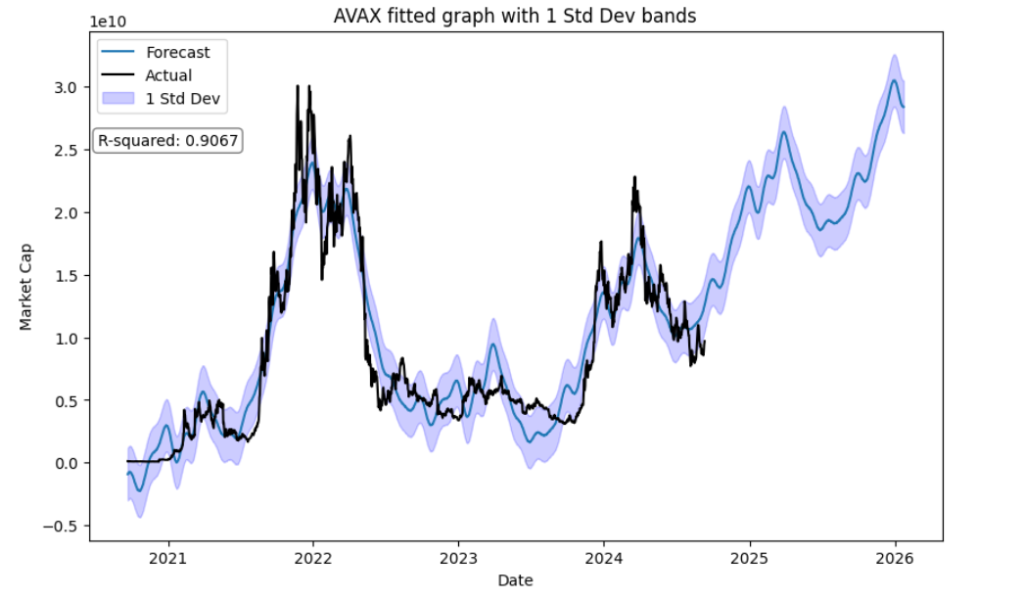

Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Avalanche's valuation. We downloaded the historical market cap of Avalanche and utilised a machine-learning model based on Prophet library to forecast future market cap, resulting in the following projections:For 24/25

The graph below illustrates a time series forecast. The black line represents the actual values, while the blue line shows the predicted values. The shaded area around the forecast line indicates the plus/minus 1 standard deviation of errors, providing a clearer visual representation of the predictions.

Based on the model above, we came up with four different scenarios.

- Bearish scenario: Historically, net earnings (emissions - fees burnt) are mostly close to 0 or insignificant for an asset with over $9b market cap. However, since this is a bearish scenario, let's assume there will be 5% inflation. Thus, by 2025, with a circulating supply of 425,539,935 tokens and an estimated market cap of $28b, we can expect $66 per AVAX per this scenario.

- Base scenario: This scenario suggests that the mcap of AVAX is expected to reach $30b ($30,483,709,770) by the end of 2025. Since historically, net earnings (are mostly close to 0 or insignificant), we can assume supply stays relatively the same (or with insignificant changes) for simplicity. The future market cap and a circulating supply of 405,276,129 will result in $75 per AVAX per our base scenario.

- Bullish scenario: Lastly, the bullish scenario suggests that the mcap of AVAX is expected to reach $32b ($32,570,548,760) by the end of 2025. Similarly, we will also assume the same net circulating supply for simplicity. Considering the future market cap and a circulating supply of 405,276,129 will result in $80 per AVAX in our base scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn't consider come up or believed were low-likelihood events. Potential changes might include rapid adoption of Avalanche's subnets by institutions, new innovative use cases that will bring huge capital inflows to its ecosystem or massive deflationary forces from adoption. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

For 2032

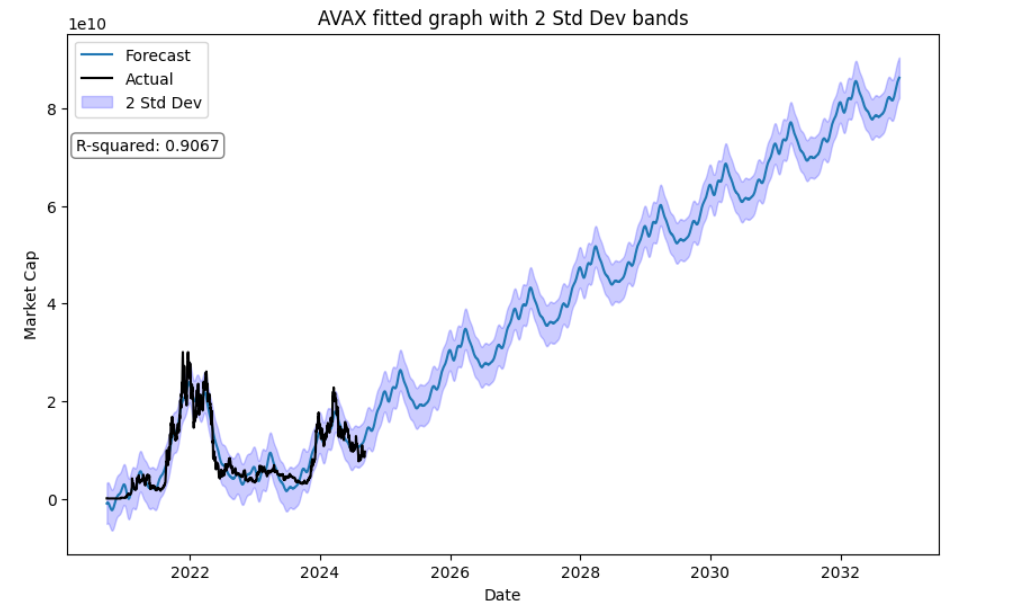

The graph below shows a time series forecast of AVAX's market capitalisation from 2020 to 2032. The x-axis represents the time period, while the y-axis shows market capitalisation in billions of USD. The black line indicates actual market cap values, and the blue line represents forecasted values.

The shaded blue area illustrates a 2 standard deviation confidence interval, providing a further margin of safety for our estimations. With an R-squared value of 0.9067, the model demonstrates a strong fit to the historical data, projecting a generally upward trend in AVAX's market cap

Based on the model above, we came up with four scenarios.

- Bearish scenario: Our machine learning model suggests that the mcap of Avalanche is expected to reach $82b ($82,144,194,754) by the end of 2025. The current supply of AVAX is 405,276,129. For the bearish scenario, we will assume 5% inflation for simplicity. Using these numbers, by 2032, the supply of AVAX is expected to reach 598,777,423 coins. Considering the future market cap and a circulating supply of 598,777,423, it will result in $140 per AVAX per our bearish scenario

- Base scenario: This scenario suggests that the mcap of Avalanche is expected to reach $86b ($86,231,033,744) by the end of 2025. Here, we will assume that the historical trend of almost 0 net inflation (or insignificant) will continue to hold until 2032. Thus, we will keep a current circulating supply of 405,276,129 for simplicity. Considering future market cap and circulating supply, it will result in $212 per AVAX per our base scenario.

- Bullish scenario: Lastly, the bullish scenario suggests that the mcap of AVAX is expected to reach $90b ($90,317,872,735) by the end of 2025. For simplicity, we will also assume the same net circulating supply here. Considering the future market cap and a circulating supply of 405,276,129, it will result in $222 per AVAX in our bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn't consider come up or believed were low-likelihood events. Potential changes might include the rapid adoption of Avalanche's subnets by institutions and new innovative use cases that will bring huge capital inflows to its ecosystem. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Cryptonary's definitive price targets on AVAX

Over the short term, we are confident about AVAX's upside potential, and we think it has a decent shot at hitting the 24/25 price targets.

You will observe that in the bull and best-case scenarios for the 2024/2025 bull run, Avalanche presents a 3.48x to 6.95x upside from current prices. While this is a strong performance, it slightly underperforms compared to Solana's projected 4.02x to 8.05x gains in the same market conditions. This underperformance is noteworthy given Avalanche's smaller $9.6 billion market cap compared to Solana's $63 billion, suggesting that Avalanche has more room for growth from a market cap perspective.

The reason Avalanche might trail slightly in these scenarios is due to the nature of euphoric bull runs, where momentum and hype can overshadow fundamentals. In such market conditions, qualitative factors like market sentiment and speculative enthusiasm often drive price action more than factors like market cap or token supply. Given that some other networks currently command greater momentum, it's not unexpected for them to lead in the short term, especially at the peak of a speculative rally.

However, while momentum-driven assets might see greater upside during moments of euphoria, Avalanche's robust fundamentals position it for sustained long-term growth. Its superior tokenomics, developer-friendly ecosystem, and growing real-world adoption suggest that it remains well-positioned for consistent value appreciation over time even if it doesn't lead to speculative surges.

How to Buy AVAX

1. Buying on a centralised exchange

- Step 1: Choose a centralised exchange

- Popular centralised exchanges that list AVAX include Binance, Coinbase, and Kraken. Ensure you register on a reputable exchange that supports your country.

- Step 2: Create and verify your account

- Sign up for an account on your chosen exchange and go through the verification process (this often includes providing proof of ID and address).

- Step 3: Deposit funds

- Deposit funds into your exchange account. Common payment methods include bank transfers, credit/debit cards, or cryptocurrency transfers.

- Make sure to check the exchange’s supported payment methods if you’re depositing fiat currency (e.g., USD, EUR).

- Step 4: Buy AVAX

- Navigate to the exchange’s trading section.

- Search for the AVAX trading pair (e.g., AVAX/USD, AVAX/EUR, AVAX/BTC).

Decide on the amount of AVAX you want to purchase and choose between a market or limit order.

- Market order: Buy AVAX at the current market price.

- Limit order: Set a specific price at which you want to buy AVAX. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw AVAX to your wallet

- After purchasing AVAX, it’s a good practice to withdraw it to a secure wallet, like MetaMask or Core, for safekeeping.

2. Buying via MetaMask wallet

- Step 1: Install the MetaMask wallet

- Download and install the MetaMask wallet extension for your browser from the official MetaMask website. Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This is essential for recovering your wallet in case of loss or device failure.

- Step 3: Add the Avalanche C-Chain to MetaMask

- MetaMask doesn’t natively support Avalanche, so you’ll need to add the Avalanche C-Chain network manually.

-

-

- Open MetaMask and click on the network dropdown (where it says “Ethereum Mainnet”).

- Select “Add Network” and input the following details:

- Network Name: Avalanche Network

- New RPC URL: https://api.avax.network/ext/bc/C/rpc

- Chain ID: 43114

- Symbol: AVAX

- Block Explorer URL: https://snowtrace.io

-

-

- Click “Save” to add the Avalanche Mainnet C-Chain.

- Step 4: Buy AVAX via MetaMask

- Once you’ve added the Avalanche C-Chain, MetaMask will allow you to purchase AVAX directly.

-

-

- Click on the "Buy" button in MetaMask.

- Select a payment provider that MetaMask integrates with, follow the instructions, and use your debit/credit card or other payment methods to buy AVAX.

- Review the fees and confirm your purchase. Once the transaction is complete, your AVAX will appear in your MetaMask wallet.

-

- Step 5: Verify the transaction

- Once the purchase is complete, check that your AVAX balance has been updated in MetaMask. You can also view the transaction details on the Avalanche C-Chain explorer (Snowtrace) by clicking on the transaction link.

Risks to consider before buying AVAX

While the report thus far has consistently supported our bullish stance on Avalanche, we must address potential risks and considerations crucial for making informed investment decisions.General market risks

The risks of regulation that apply to Ethereum also apply to Avalanche. For a full breakdown, please follow this link to our Ethereum report, which examines the regulatory landscape in depth.Competition

Avalanche's primary competition includes Ethereum, Solana, Cosmos and Polkadot ecosystems. Solana, in particular, has dominated altcoin performance this year, which is likely a contributing factor to the decline of Avalanche activity.L0 sector underperformance

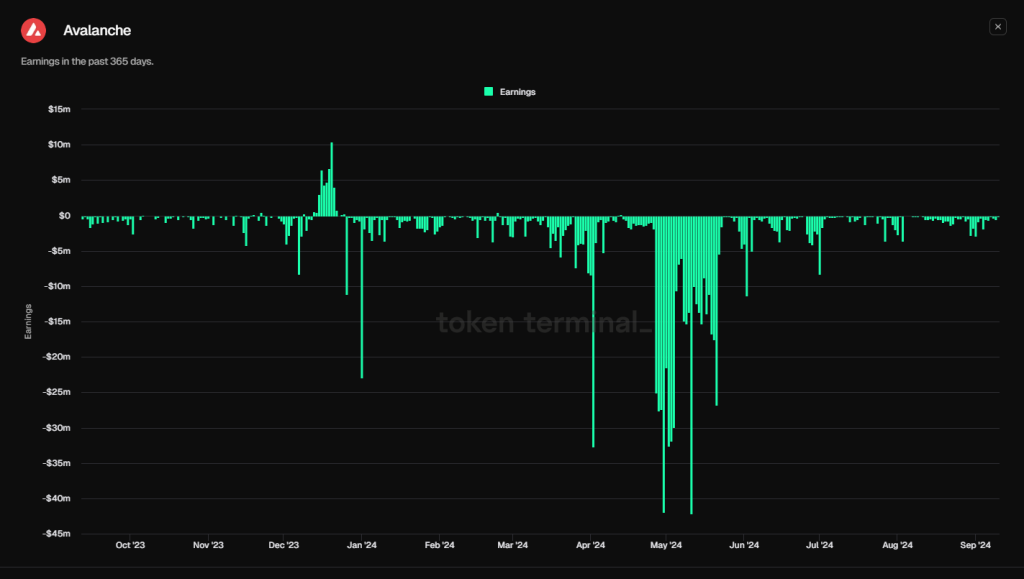

Cosmos and Polkadot, in particular, are the most similar to Avalanche. Cosmos has the IBC, Polkadot has Parachains, and Avalanche has subnets. Generally, Layer-0 protocols have not been standout performers to date. Polkadot has really struggled to get Parachains off the ground. However, the demand for this type of blockchain infrastructure is generally relatively low. This sentiment is another contributing factor to Avalanche's underperformance against its peers.Continued downtrend in activity

The drop-off in activity and fee generation outlined above appears to have started a detrimental trend for Avalanche. If the initiatives and drive for adoption fail to generate actual users and on-chain activity, then the underperformance of AVAX will continue. There is not necessarily a "terminal" stage for this; it can recover, but it is something to watch. Conversely, the break of this downtrend and reversion to activity levels seen before April 2024 will be a strong precursor to a recovery in token price performance.Cryptonary's take

Avalanche stands out as one of the more mature and developed ecosystems in the blockchain space. It offers robust scalability and real-world use cases, especially in sectors like finance and asset tokenisation. Its unique tri-chain architecture and subnets provide a solid foundation for flexibility and performance, allowing developers to build custom Layer-1 chains tailored to specific use cases. This has attracted institutional interest, including partnerships with Franklin Templeton and the California DMV.From an investment standpoint, Avalanche presents a relatively lower-risk option for diversification away from major assets like BTC, ETH, and SOL. Avalanche's more conservative upside projection reflects its focus on sustainability, real-world utility, and strong tokenomics, which will likely drive long-term value.

Despite the network's solid fundamentals, it faces significant competition from other Layer-1s like Ethereum and Solana, and its growth has been overshadowed by Solana's success in 2023. Additionally, the underperformance of Layer-0 ecosystems such as Cosmos and Polkadot highlights the broader challenge of driving demand for more complex blockchain architectures like subnets.

Avalanche remains well-positioned for continued real-world adoption and long-term value appreciation. Still, its immediate upside may be more limited in speculative bull markets compared to more momentum-driven assets. If you are looking for a low-risk asset with solid, long-term potential, consider AVAX a strong candidate.

Cryptonary OUT!