Over the 9 months since we adopted Barbell portfolio, the strategy has consistently outperformed the market by a huge margin, neatly balancing safe assets with speculative plays. However, in January, after careful consideration of the broader market, we decided to go risk-off and took profits, predominately moving our portfolios into stablecoins.

The strategy still works in risk-on environments and we aim to get back to it when time is right, although the picks likely to be different at that time. Therefore, whether you're a cautious investor or willing to take more chances, it offers a clear, adaptable approach to success, especially as the bull market gains momentum.

Curious to know more?

Let’s dive in...

Here’s what you’ll learn in this report:

- What the Barbell Strategy is and how it works in crypto?

- How to build your portfolio using Bitcoin, Ethereum, and Solana as core assets?

- How to tailor your investment approach to different risk profiles for optimal growth?

- Important update and rebalancing due to macro environment

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Intro to Barbell Strategy

The Barbell Strategy, coined by Nassim Nicholas Taleb, involves splitting a portfolio between low-risk assets and high-risk investments. It avoids moderate-risk options to ensure protection from market downturns while allowing for significant upside potential with speculative assets. Originally devised to hedge against “Black Swan” events in traditional markets, this strategy is particularly useful in crypto.

It balances low-risk, stable assets with high-risk, high-reward opportunities, giving you the best of both worlds. Much like Ray Dalio’s All-Weather Portfolio, this approach is designed to thrive in any market condition—especially now, as the crypto bull market is gaining momentum.

In crypto, this strategy allows you to capture potential gains from high-risk speculative tokens while keeping a strong foundation in established assets like Bitcoin, Ethereum, and Solana.

- Low-risk assets: These act as the bedrock of your portfolio, providing stability and protecting you from sharp losses.

- High-risk assets: These offer the potential for significant returns, though they carry higher volatility.

- Liquidity: Maintaining 20% of your portfolio in stablecoins (USDC/USDT) reduces volatility and ensures you’re always ready to seize lucrative opportunities when they emerge.

Why does the barbell strategy outperform?

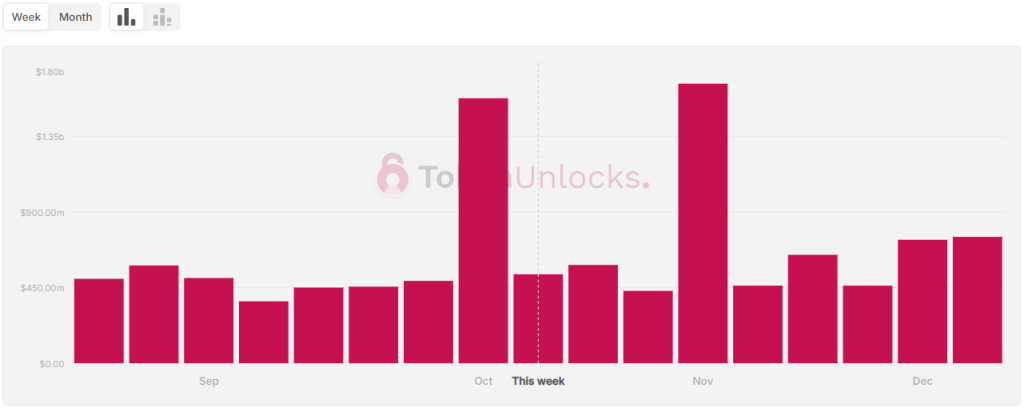

Since the beginning of this year, the Barbell strategy has been performing exceptionally well within the crypto market, primarily due to the increasing prevalence of venture capital-backed (VC) altcoins. These VC coins often come with a significant portion of their supply controlled by insiders, which has led to the underperformance of this asset class within the crypto. Most utility-driven altcoins, which could traditionally be categorised as medium-risk assets fall into this category.Most VCs and insiders are “sharks” who intend to extract as much value from retail as possible. They get into the project early and by the time their products hit the market, they are already up 100x to dump on retail. Every month, on average, there are over a billion dollar unlocks hitting the market causing selling pressure on altcoins.

Therefore, most of them are struggling to gain traction and, thus, are no longer attractive as an investment. High-risk, high-reward, pure and fair speculative assets such as memecoins are gaining in relevance over altcoins, strengthening the arguments for adopting the barbell approach.

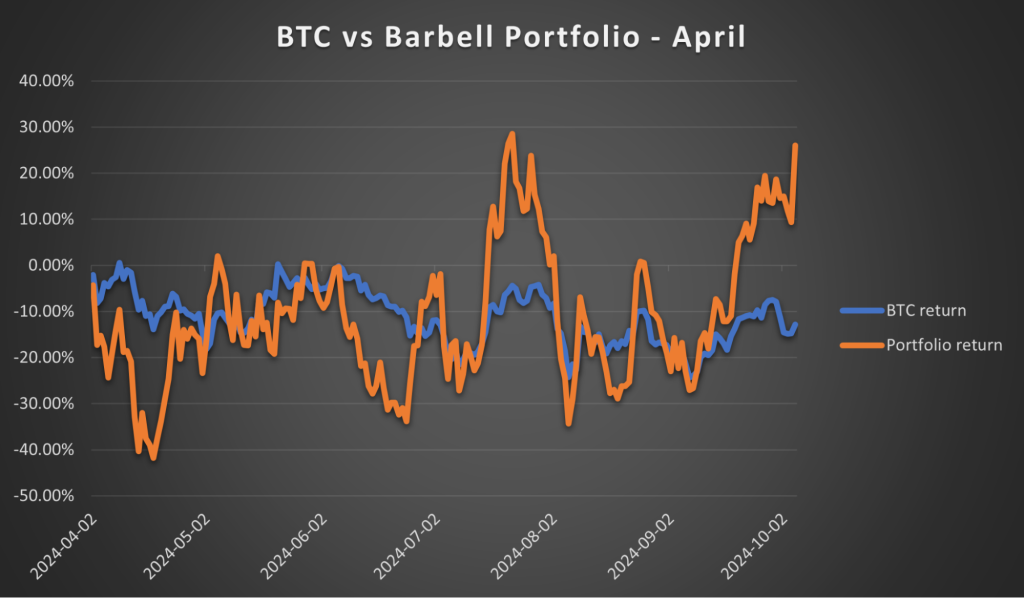

We have been advocating for a barbell portfolio with select memecoins for quite some time. Let’s take a look at the performance of the Cryptonary Barbell portfolio over the last 6 months.

The performance of the Cryptonary barbell portfolio

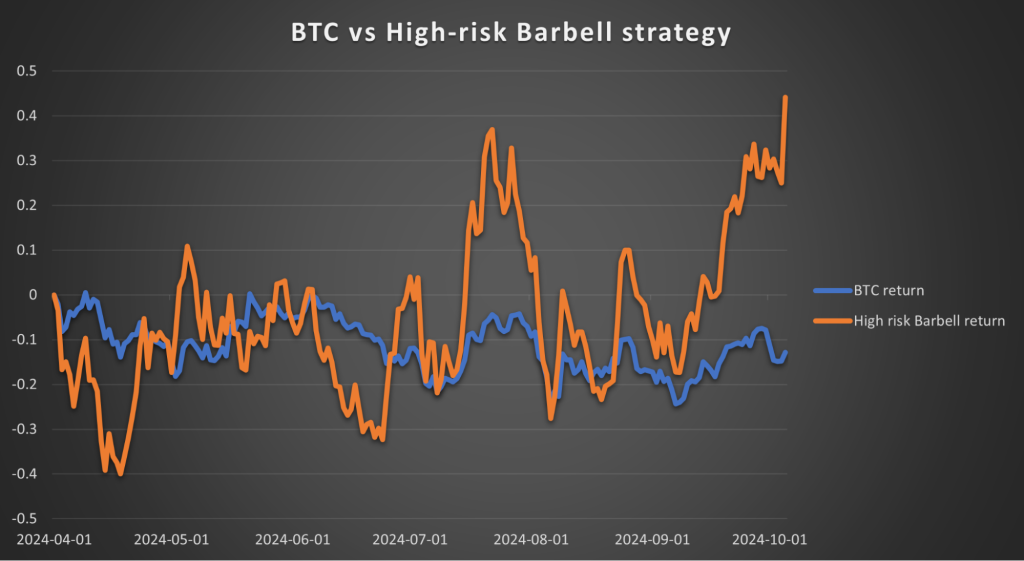

If you invested 100% of your portfolio in Cryptonary Barbell on April 1, you would have over 26% return despite BTC returning -12% and the wider market being choppy.

As we can see, it is a way to outperform the market without taking excessive risks. If you like this idea, here is how to start.

How to Build Your Crypto Barbell

Here’s how to set up your Barbell portfolio based on your risk tolerance. Taking action now, even with a few hundred dollars, can position you well for the opportunities ahead.Step 1: The Foundation—Low-Risk Assets

Let’s start with the low-risk side of your portfolio. These well-established cryptocurrencies are resilient and have demonstrated their growth potential. They are your security in the market.- Bitcoin: Often referred to as digital gold, Bitcoin is the biggest, most recognised and widely adopted cryptocurrency. Read our Bitcoin Thesis Report for detailed insights and future predictions.

- Ethereum: As the backbone of decentralised finance (DeFi) and smart contracts, Ethereum plays a crucial role in the crypto ecosystem. Explore the Ethereum Thesis Report to learn about its long-term potential.

- Solana: Known for its speed and scalability, Solana is emerging as a leader in decentralised applications and a preferred playground for retail players. Check out our Solana Thesis Report to understand why it’s considered a strong long-term player.

Step 2: Adding High-Risk, High-Reward Assets

For the high-risk side, speculative tokens like memecoins offer the opportunity for outsized returns. These assets are more volatile but can deliver exponential growth when they take off. These are our picks that performed exceptionally well when the risk-on environment was around. We took profits on these assets, they are here for demonstration purposes only.- DogWifHat: A speculative meme token with a viral community. Discover why it has gained attention in our DogWifHat Thesis Report.

- POPCAT: Another memecoin with explosive growth potential and a dedicated fanbase. Read the full analysis in our POPCAT Thesis Report.

- SPX: Our recent addition with potential to become the next viral sensation. Here is why we were bullish on SPX.

Suggested Allocation:

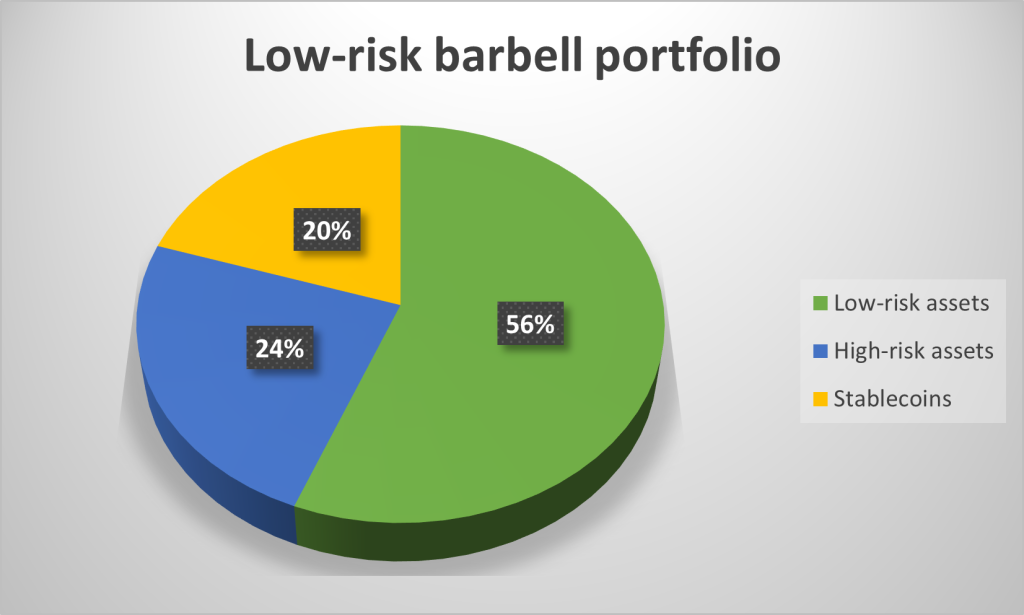

- Low-Risk Investor: Allocate 56% of your portfolio to low-risk assets (Bitcoin, Ethereum, Solana), 24% to high-risk assets, and keep 20% in USDT for liquidity.

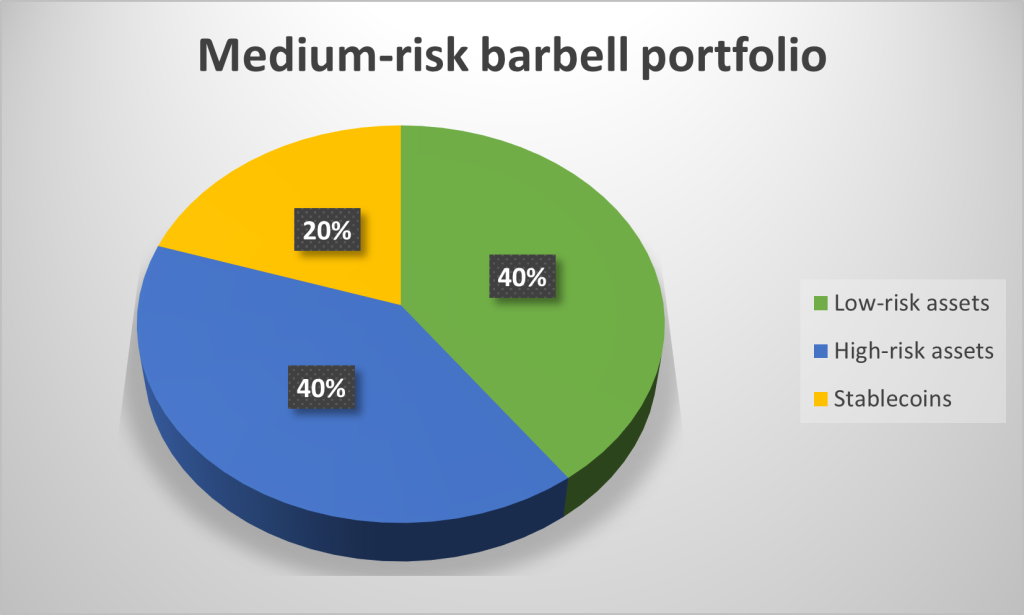

- Medium-Risk Investor: Allocate 40% to low-risk assets, 40% to high-risk assets, and 20% in USDT.

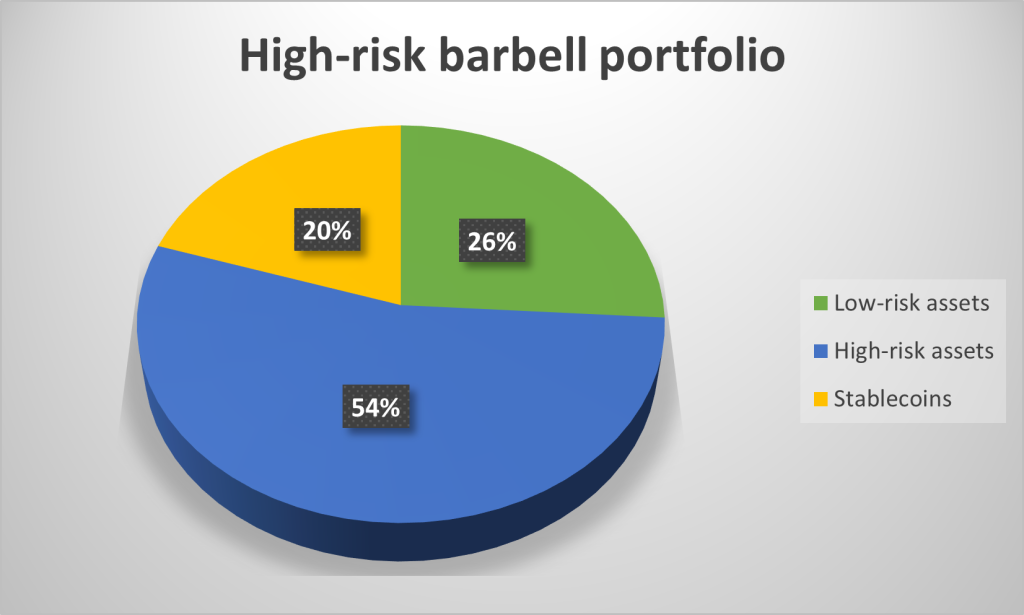

- High-Risk Investor: Allocate 24% to low-risk assets, 56% to high-risk assets, and 20% in USDT. Even if you’re just starting with a small amount, these low-risk assets can give you the security you need while you explore higher-risk opportunities.

Example: Allocating $500, $5,000, and $50,000 Using the Barbell Strategy

Let’s explore how your portfolio could be allocated depending on your risk tolerance and the amount you’re ready to invest:Low-Risk Investor:

$500 Example:

- 56% in low-risk assets: $280 split between Bitcoin, Ethereum, and Solana.

- 24% in high-risk assets: $40 in DogWifHat, $40 in POPCAT, $40 in SPX.

- 20% in USDT: $100 kept in reserve for liquidity.

- 56% in low-risk assets: $2,800 split between Bitcoin, Ethereum, and Solana.

- 24% in high-risk assets: $400 in DogWifHat, $400 in POPCAT, $400 in SPX

- 20% in USDT: $1,000 kept in reserve for liquidity.

- 56% in low-risk assets: $28,000 split between Bitcoin, Ethereum, and Solana.

- 24% in high-risk assets: $4,000 in DogWifHat, $4,000 in POPCAT, $4,000 in SPX

- 20% in USDT: $10,000 kept in reserve for liquidity.

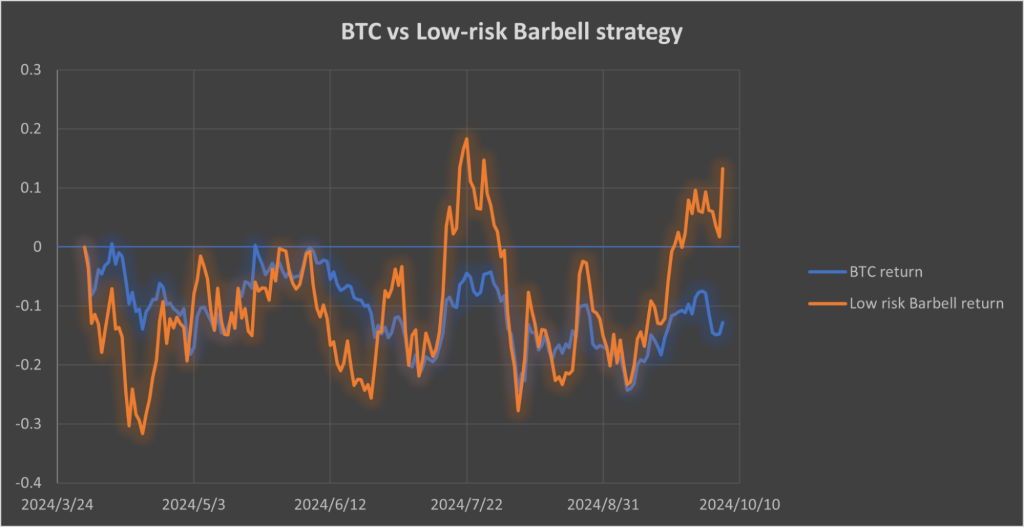

Performance of low-risk Barbell strategy

This portfolio has resulted in 13.3% over the last 6 months after accounting for stablecoin allocation. Meanwhile, in the same period, BTC returned -12%, the majority of altcoins reached new all-time lows and the wider market has been choppy. *excludes SPX since it is a recent addition

*excludes SPX since it is a recent addition

Medium-Risk Investor:

$500 Example:

- 40% in low-risk assets: $200 split between Bitcoin, Ethereum, and Solana.

- 40% in high-risk assets: $67 in DogWifHat, $66 in POPCAT, $66 in SPX.

- 20% in USDT: $100 kept in reserve for liquidity.

- 40% in low-risk assets: $2,000 split between Bitcoin, Ethereum, and Solana.

- 40% in high-risk assets: $670 in DogWifHat, $660 in POPCAT, $660 in SPX.

- 20% in USDT: $1,000 kept in reserve for liquidity.

- 40% in low-risk assets: $20,000 split between Bitcoin, Ethereum, and Solana.

- 40% in high-risk assets: $6,700 in DogWifHat, $6,600 in POPCAT, $6,600 in SPX

- 20% in USDT: $10,000 kept in reserve for liquidity

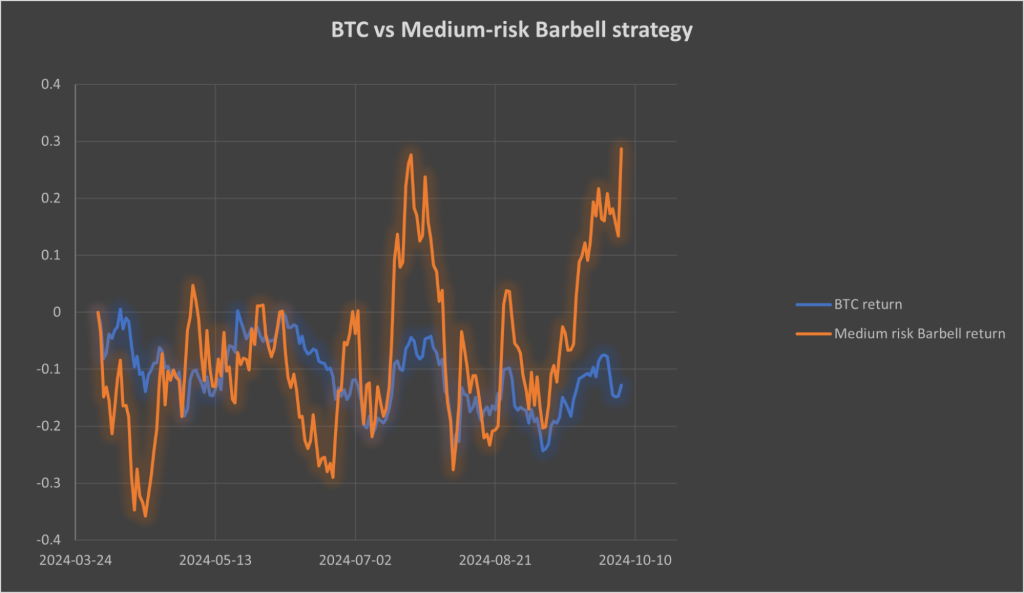

Performance of the medium-risk Barbell strategy

This portfolio has resulted in 28.7% over the last 6 months after accounting for stablecoin allocation. Meanwhile, in the same period, BTC returned -12%, the majority of altcoins reached new all-time lows and the wider market has been choppy. *excludes SPX since it is a recent addition

*excludes SPX since it is a recent addition

High-Risk Investor:

$500 Example:

- 24% in low-risk assets: $120 split between Bitcoin, Ethereum, and Solana.

- 56% in high-risk assets: $94 in DogWifHat, $93 in POPCAT, $93 in SPX.

- 20% in USDT: $100 kept in reserve for liquidity.

- 24% in low-risk assets: $1,200 split between Bitcoin, Ethereum, and Solana.

- 56% in high-risk assets: $940 in DogWifHat, $930 in POPCAT, $930 in SPX.

- 20% in USDT: $1,000 kept in reserve for liquidity.

- 24% in low-risk assets: $12,000 split between Bitcoin, Ethereum, and Solana.

- 56% in high-risk assets: $9,400 in DogWifHat, $9,300 in POPCAT, $9,300.

- 20% in USDT: $10,000 kept in reserve for liquidity.

Performance of the high-risk Barbell strategy

This portfolio has resulted in 44.13% over the last 6 months after accounting for stablecoin allocation. Meanwhile, in the same period, BTC returned -12%, the majority of altcoins reached new all-time lows and the wider market has been choppy. *excludes SPX since it is a recent addition

*excludes SPX since it is a recent addition

Strategic exit: An update

Despite strong performance of our barbell portfolio, by January 2025 we decided to exit most of our positions to cash. Why? The euphoria was kicking in, and dispersion was setting in. The broader trend showed liquidity thinning out, weaker projects failing to keep up, and market sentiment shifting. We had already ridden the strongest wave—holding longer would have meant exposing our gains to unnecessary risk.

Rather than panic selling, we made clear and strategic call. By locking in profits in Jan-Feb, we avoided the inevitable downturn that followed after, reinforcing the key principle behind our strategy: know when to enter, but more importantly, know when to get out.

Cryptonary’s take

Our Barbell Strategy offers a balanced yet aggressive approach to growing your portfolio in a rapidly evolving market. By combining solid, low-risk assets with high-potential, speculative investments, you can position yourself for growth while protecting your downside.However, it is important to remember that if the whole market goes down, no other strategy than holding cash can protect your downside. Therefore, despite the strategy working as intended, we have moved to stablecoins as of Jan/Feb 2025.

However, we still intend to go back to the barbell approach when the risk-on environment returns, probably in Q3-Q4 this year, although the picks are likely to be different.

This strategy works, and the track record of its performance confirms it. For now, we remain patient and are doing research on the next picks for the Barbell.

Peace!

Cryptonary, OUT