Cryptonary's thesis on Hyperliquid

Markets move, and so do our picks! Over 95% of crypto assets are vaporware tokens that trend to zero. But this asset? We've had our eyes on it for a while, waiting for the perfect entry. It's a standout in DeFi and Utility, showing a strong price action and gearing up for its next big move. Ready to dive in? Let's go!

Everyone came to Hyperliquid to farm for the airdrop rewards but rather ended up staying for the product, a technology so remarkable that it turned farmers into loyal users, growing nonstop ever since.

When we last reviewed $HYPE in early December, it was trading at $13, already showing strong potential. By December 21st, it hit an all-time high of $35, drawing significant attention from the crypto community. Right now, it is around $25 and is ready for the next massive move.

Let's dive into why we are bullish on $HYPE and decided to include it in our picks. We will cover everything from Hyperliquid's product to tokenomics and other perfect entry zones. So, let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Hyperliquid?

HyperLiquid is a custom-built layer-1 blockchain (similar to Ethereum and Solana) that combines lightning-fast transactions, unmatched scalability, and an effortless user experience that feels like using top-tier Web2 platforms like Instagram or Netflix.Its flagship product is Hyperliquid derivatives and spot exchange. Built on its proprietary L1 blockchain, it operates a fully decentralized Central Limit Order Book (CLOB) system, providing users with high-speed, gas-free, low-latency trading akin to Binance but without KYC requirements.

Unlike typical decentralized exchanges (DEXs), it exclusively lists native HIP-1 tokens (we will cover this later) for spot markets, ensuring high-quality projects and robust liquidity.

Key features

Hyperliquid L1: Built with HyperBFT, a high-performance consensus mechanism derived from LibraBFT. This tech supports up to 100k TPS, enabling seamless on-chain order book operations. For comparison, theoretically, the max Ethereum does is 119 tps while Solana does 65k tps. And with the recent congestion on Solana, it is clear that the market needs more performant chains.

Vault features: Hyperliquid has introduced a unique liquidity model that serves as a counterparty for a significant portion of trades, securing liquidity and earning a share of fees.

Users can allocate funds to Vault managers, who earn 10% of profits. This works similarly to hedge funds, except there is no paperwork, and everything is transparent. HLP, the official Vault, serves as a counterparty for a significant portion of trades, securing liquidity and earning a share of fees.

This strategy allows HLP to profit even during bear markets, leveraging net short positions to capitalize on market trends.

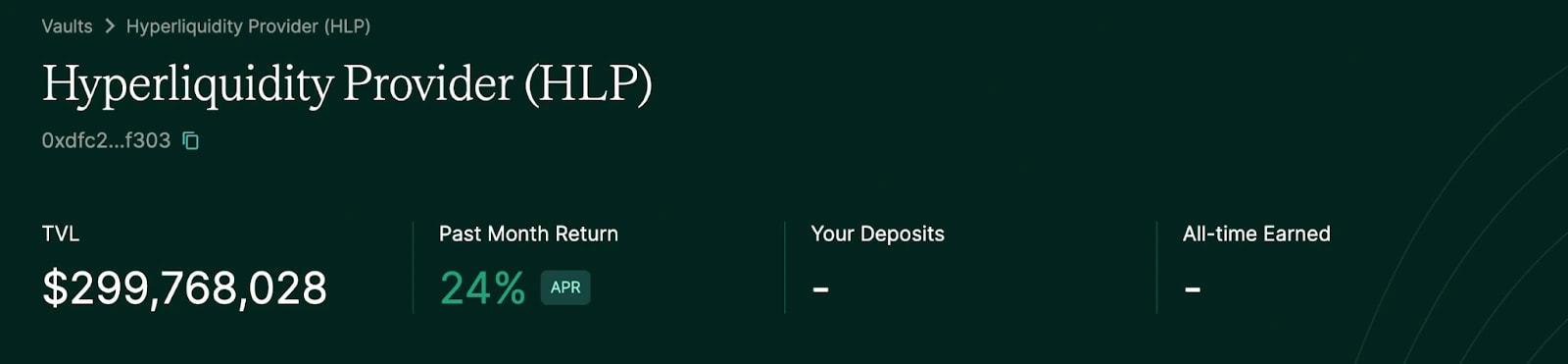

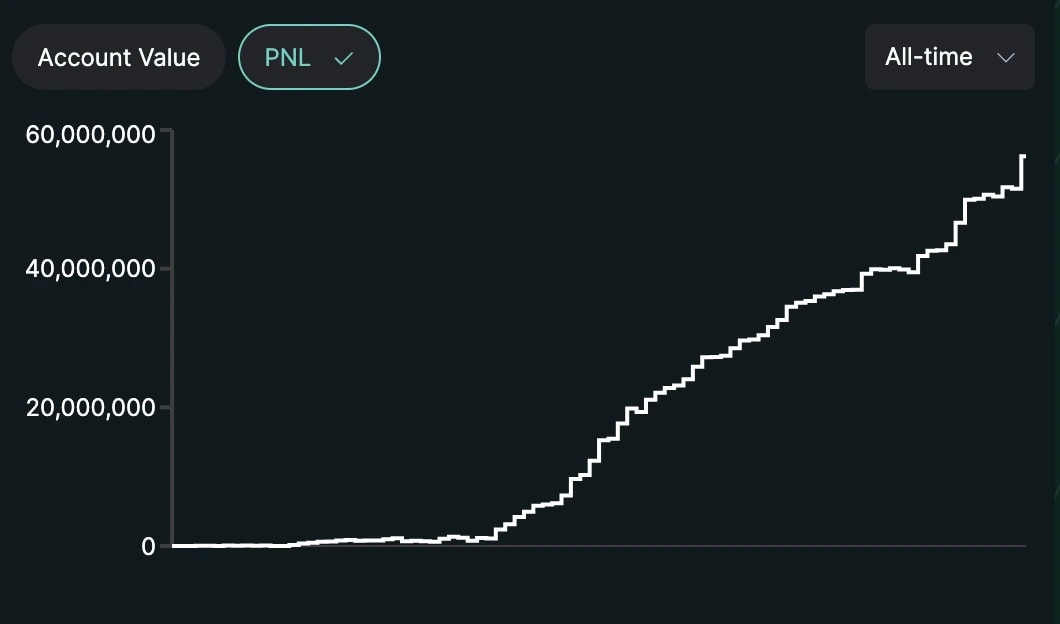

The HLP Vault has about $300M in TVL and achieved $50M in profit, consistently delivering positive APRs. Unlike passive competitors like GMX's GLP, HLP employs an active, non-transparent strategy, allowing flexibility in volatile markets.

Auction-based token listings: Probably one of the coolest features Hyperliquid has introduced. Whenever a team or community wants to get their token listed on HyperLiquid, they need to win an auction.

It has been so successful that this auction mechanism has set new benchmarks for token listings, with recent auctions fetching up to $975,000 per token. Proceeds from these auctions contribute directly to $HYPE buybacks, creating deflationary pressures.

Additionally, only 282 HIP-1 token listings are possible annually, creating significant competition among projects wanting to get listed on Hyperliquid. With such scarcity, auction prices are expected to double, with $1M+ in revenue becoming the norm per listing.

Lastly, this auction mechanism eliminates the opaque practices of centralized exchanges, fostering trust and exclusivity.

HyperEVM: Set to launch soon, this permissionless execution layer will allow developers to build applications using Ethereum-compatible tools while integrating with L1's native components. Adoption is expected to explode after this because it represents a turning point for Hyperliquid, unlocking new utility for $HYPE and expanding its ecosystem to accommodate a broader range of decentralized applications (dApps).

Unlike RustVM, which powers Hyperliquid's current trading operations, HyperEVM is fully open to external developers. This inclusivity is expected to drive a surge in ecosystem growth as new projects and builders join the network.

HyperEVM will also introduce unique opportunities for capital efficiency:

- Expanded $HYPE utility: As the gas fee token for HyperEVM, $HYPE will play a critical role in powering transactions. It will also serve as collateral for lending and liquidity protocols.

- Advanced DeFi tools: With unified on-chain order books, developers can create innovative solutions such as lending platforms, liquid staking mechanisms, and algorithmic trading strategies.

Hyperliquid ecosystem and adoption

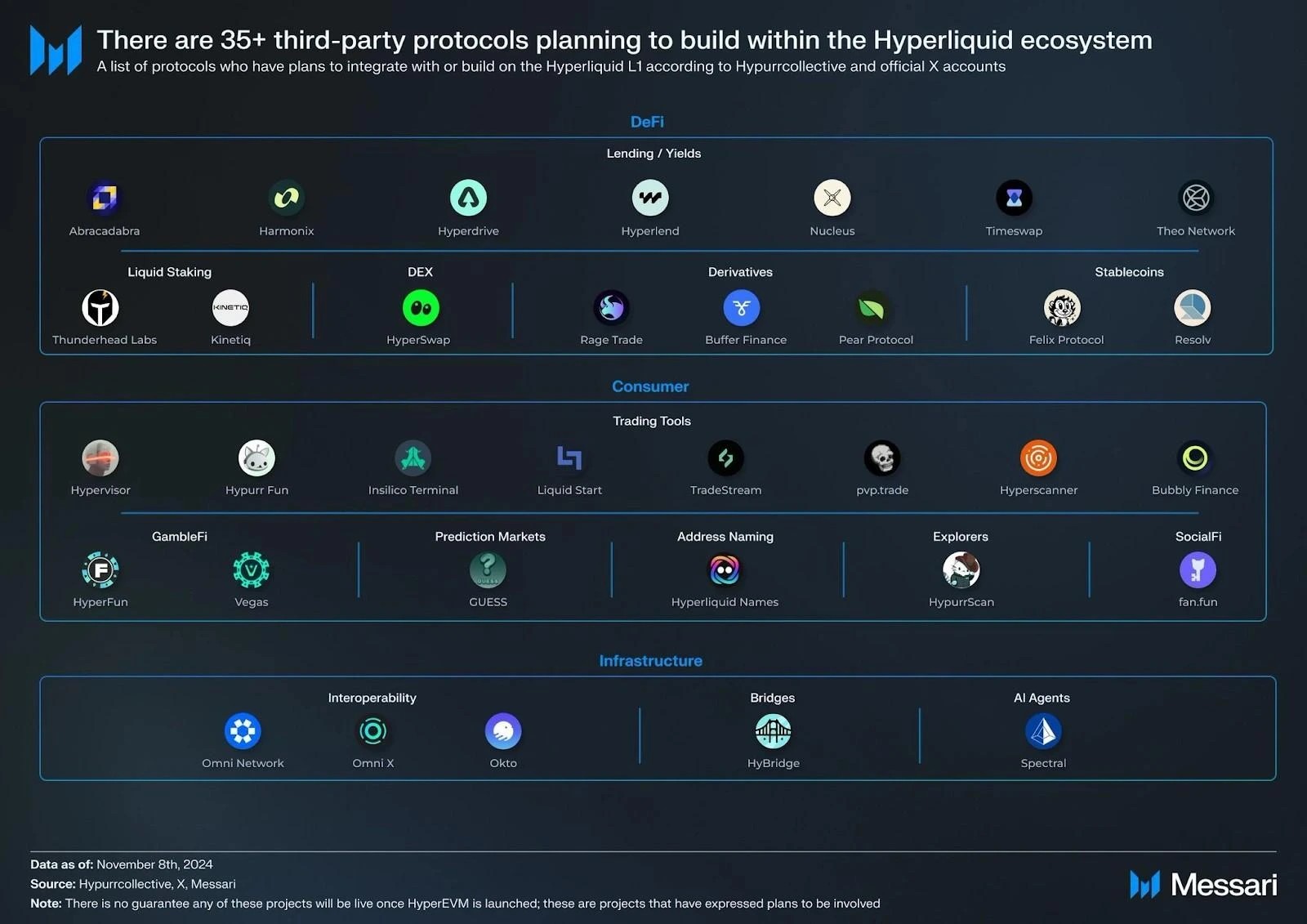

What initially started as a single app is rapidly evolving into a comprehensive decentralized financial ecosystem. The ecosystem is expected to attract a wide range of DApps such as lending protocols, Telegram bots, and gaming platforms, positioning Hyperliquid as a competitor to general-purpose Layer 1 blockchain like Solana and Ethereum.There are already over 35 projects preparing for the mainnet launch, and we believe the ecosystem will keep expanding.

At this point, the innovative features and expanding ecosystem enabled a product that has become so popular that we can boldly say it is one of the highlights of this cycle. Don't believe us? Let's go through some data.

First of all, Hyperliquid dominates the narrative, commanding an impressive 77.69% market share in DEX (perpetual) trading.

Secondly, it dominates the decentralized derivatives sector, commanding over 50% of market volume. Its open interest reaches 10% of Binance's levels. This is some monster accomplishments for a protocol that launched slightly over 1 year ago.

Thirdly, Hyperliquid's spot exchange, despite being launched just around 8 months ago, is already a major player, achieving $300-350m in average daily volume and ranking among the top 10 spot DEXs globally. We believe it will eventually end up being in the top 3.

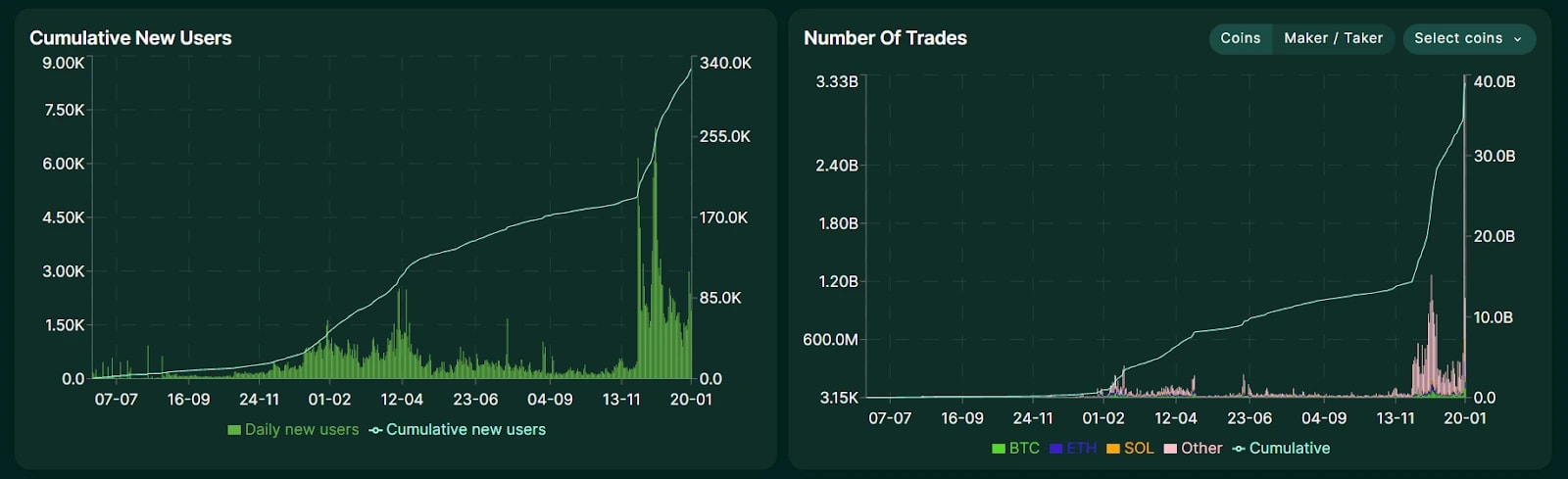

Lastly, just to showcase how the product is loved by people, the cumulative number of users and number of trades has been increasing exponentially. With the launch of HyperEVM and the expanding ecosystem, the adoption will only accelerate. It is clear that there is a new giant in the room, and it is HyperLiquid.

Now, let's look at tokenomics and see whether the token is as promising as the tech and fundamentals.

Tokenomics

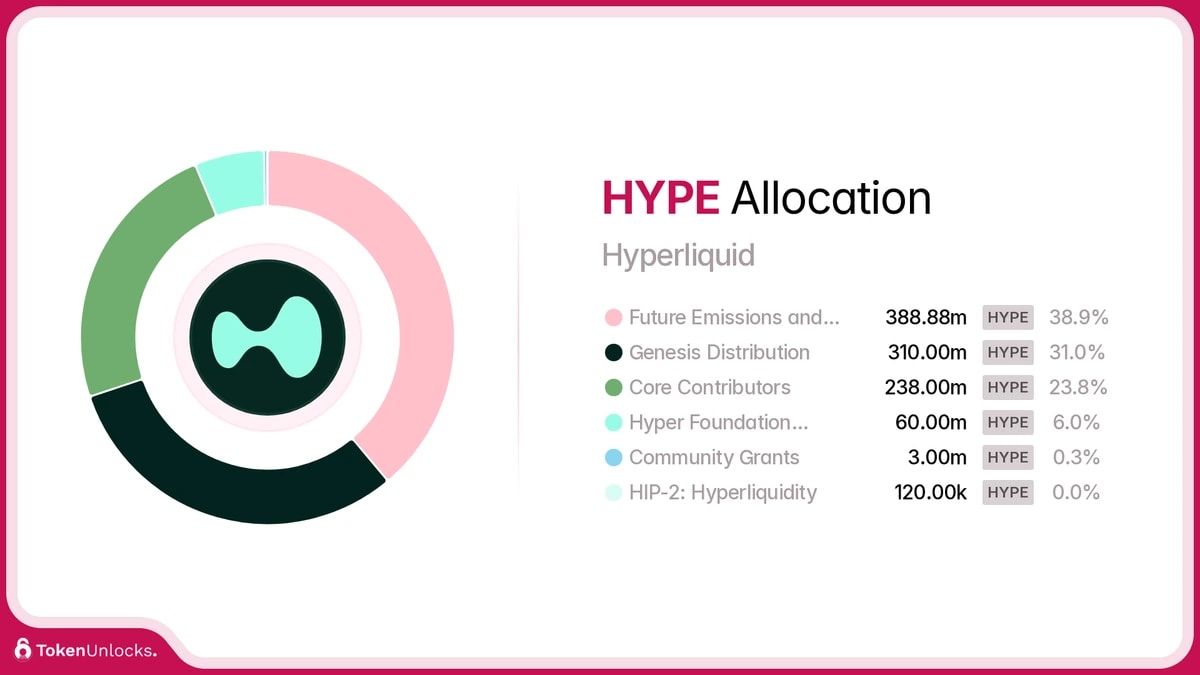

The $HYPE token lies at the core of Hyperliquid's ecosystem, driving growth, community engagement, and sustainability. It was airdropped to the community for using the platform in the early stages. We were bullish on the platform and covered the airdrop opportunity here and here. Some of our community members received 5-6 figures in free money.Supply allocation

- Total supply: 1 billion $HYPE tokens.

- Community rewards: 38.88% of tokens are reserved for emissions and incentives, ensuring ongoing user participation and platform growth.

- Genesis airdrop: 31% of the supply was airdropped, fully unlocked at the time of launch (TGE), setting a strong precedent for community-centric decentralization.

- Core contributors: 23.8% is allocated to the team, with a one-year lockup and gradual vesting through 2027-2028.

- Hyper foundation: 6% is reserved for operational and ecosystem growth initiatives.

- No VCs and exchanges are involved; it is a pure community and the team.

Value accrual

Okay, so supply distribution is fantastic and community-oriented. But what about value accrual? Value accrual is probably one of the most important things to look at after mindshare and narrative. Fortunately, Hyperliquid is ticking boxes here as well. It has a strong product and ecosystem that generates massive revenue through:- Platform fees: Trading fees from both derivatives and spot exchanges, including funding and liquidation fees.

- HIP-1 auctions: Dutch auctions for token listings have fetched prices as high as $975K per token.

- Future EVM gas fees: The HyperEVM launch will add gas fees as an additional revenue stream.

- HLP vault: 46% of trading fees go to HLP holders.

- Assistance fund (AF): 54% of trading fees fund $HYPE buybacks, creating consistent deflationary pressure on the token supply.

- Airdrops (Bonus): There are rumours that some of the 30+ projects currently building on HyperEVM will airdrop portion of their tokens to HYPE holders/stakers

Valuation analysis: Why are we bullish?

By comparing $HYPE to Binance's $BNB, we can better understand its valuation and potential:- Market Metrics: $HYPE's market cap is approximately 8.5% of BNB's, with its fully diluted valuation (FDV) at 26%.

- Trading Activity: Hyperliquid's trading volume and open interest in derivatives reach about 7.3% and 12.5% of Binance's levels, respectively, showcasing significant traction in a competitive market.

- Economic model: $HYPE allocates 54% of revenue to buybacks, significantly outpacing Binance's historic 20% allocation for token burns. Hyperliquid generates over half a billion in revenue annually.

Additionally, Hyperliquid's automated listing and auction mechanisms drastically reduce operational costs compared to Binance's manual processes.

- Community-centric model: $HYPE holders benefit directly from Hyperliquid's growth, unlike many tokens with less direct revenue sharing, including Binance's BNB

Long-Term growth drivers

- EVM launch: The introduction of HyperEVM is expected to unlock new use cases, including gas fee revenue, further driving $HYPE's utility.

- Higher auction Prices: As demand for HIP-1 token listings grows, auction revenues are projected to increase substantially.

- Platform fees: Scaling trading volumes, particularly during a bull market, will amplify fee-based revenues, bolstering Hyperliquid's growth trajectory.

- EVM gas fees: If HyperEVM activity aligns with platforms like Base, it could generate $15M or more in monthly fees.

- Ecosystem growth: High-quality dApps on HyperEVM will amplify trading activity and increase $HYPE utility.

Price targets

Here are some basics related to the $HYPE:- Current circulating market cap: $4b

- Fully diluted market cap: $12b

All things considered, we believe our first target should be half of Solana's FDV, which is roughly $70b-80$b mcap. This will result in $70-$80 per HYPE or around 5.8x-6.6x from current prices.

Bull case: For the bull case, we think Hyperliquid can reach the current FDV of BNB (Binance). BNB is currently worth around $100b, and Hyperliquid is a superior product, in our opinion. However, Binance has a stronger ecosystem and backers. We believe as Hyperliquid matures, HYPE will close the gap and reach $100b mcap.

We believe these targets are more than attainable, and to be frank, we are being slightly conservative, considering how deep we are into the bull market. The downside here is relatively minor; anything below $20 is very cheap and will likely be bought very quickly.

However, the upside is still massive relative to risk. Therefore, we believe it is a very attractive asset in the market, and we are confidently adding it to our list.

Risk factors

Let's talk about some risks, too. Every groundbreaking project faces challenges, and Hyperliquid is no exception. Here are the primary risks that could impact its trajectory, along with their potential implications.Centralisation risks

Validator setup: Hyperliquid's mainnet currently relies on a centralized validator setup with only four validators operated by the team in Tokyo. While the testnet features a decentralized validator set of over 60 participants, transitioning this model to the mainnet could pose challenges. Failure to decentralize validators may raise concerns about censorship resistance, security, and the protocol's credibility as a decentralized platform.Regulatory scrutiny: Hyperliquid's permissionless model and lack of KYC requirements appeal to many users, but they also expose the platform to regulatory scrutiny, especially in jurisdictions with strict anti-money laundering (AML) rules. Regulatory pressure may force Hyperliquid to implement KYC or geofencing measures, potentially reducing its competitive edge. This risk is especially relevant considering how centralized Hyperliquid is at the moment.

Competing with centralized giants: Hyperliquid faces stiff competition from centralized exchanges like Binance, Bybit, and Bitget, which dominate the market in terms of liquidity, user base, user security, and regulatory standing. If Hyperliquid fails to scale its user base and liquidity rapidly, it may struggle to maintain its competitive edge.

Reliance on Oracles: As with most derivatives platforms, Hyperliquid depends on Oracles to provide accurate pricing data. Any disruption, manipulation, or delays in Oracle's performance could lead to significant issues, such as incorrect liquidations or financial losses. Oracle failures during high-volatility periods could trigger cascading platform-wide issues.

How Hyperliquid can address these risks

- Validator decentralization: Prioritize a seamless transition to a decentralized validator network without compromising performance.

- Security measures: Regular audits, bug bounty programs, and a focus on securing HyperEVM's architecture.

- Ecosystem development: Attract high-quality projects through grants and ecosystem incentives to foster innovation.

- Regulatory strategy: Balance compliance with privacy by implementing region-specific measures while preserving the platform's ethos.

How to buy

Step 1: Set Up an EVM wallet

To interact with Hyperliquid, you'll need an EVM-compatible wallet to log in. Here are some great options:- Rabby

- MetaMask

- Zerion

Step 2: Prepare your funds

You'll need funds to bridge into the Hyperliquid ecosystem. These include:- ETH for gas fees: ETH on the Arbitrum network to cover transaction fees.

- USDC for collateral: USDC will serve as the capital you deposit into Hyperliquid.

Step 3: Bridge ETH to Arbitrum

- Load ETH in your EVM wallet: Ensure your wallet has enough ETH to bridge fees and future transactions.

- Bridge ETH to Arbitrum: Use a bridging service like DeBridge to transfer assets from your source network to ETH on the Arbitrum network. This ETH will act as gas for Hyperliquid transactions.

Step 4: Bridge capital to Arbitrum as USDC

- Select DeBridge: Access DeBridge to transfer USDC from your source account to the Arbitrum network.

- Confirm the transaction: Ensure the correct wallet address and network (Arbitrum) are selected before confirming the transfer.

- Check USDC balance: Once the transaction is completed, your USDC will appear in your EVM wallet on the Arbitrum network.

Step 5: Connect to Hyperliquid

- Launch the Hyperliquid app: Visit the official Hyperliquid platform and click on Launch App.

- Connect your wallet: Use your EVM wallet (e.g., MetaMask or Rabby) to log in. Ensure it's set to the Arbitrum network.

- Deposit USDC:

- Navigate to the Deposits section on Hyperliquid.

- Approve the connection with your EVM wallet.

- Deposit your USDC into Hyperliquid's ecosystem.

Step 6: Trade $HYPE

With your funds successfully deposited, you can now start trading $HYPE on the spot tab in the coins list section on Hyperliquid without any restrictions or complications.Here is a video tutorial on how to bridge and buy HYPE tokens:

Technical analysis

HYPE has played out both sides of the range in these past few weeks. After bouncing from the $12 support in mid-March, it rallied to $17.3 but faced rejection at the downtrend resistance line, confirming continued bearish structure. It has now broken back below $12 and tapped into the lower support zone between $9.8 and $7.2, bottoming out (so far) at $9.32.Key Levels to Watch:

- Resistance Zone ($15 – $12): What once was support is now acting as resistance. Price is currently trading at $11.89, retesting this region from below. Rejection here would further confirm the shift in market structure.

- Downtrend Resistance Line: HYPE continues to trade under the descending trendline from February highs. This trendline remains a dynamic resistance, price has failed to close above it.

- Lower Demand Zone ($9.8 – $7.2): This zone previously marked a potential downside target. The recent bounce from $9.28 shows initial interest, but if the retest at $12 fails, a deeper mitigation into the $8.5 area becomes likely.

Closing remarks

HYPE has had a really good run here off the lows at $9.40, and not far off seeing a 100% move higher from those lows. Price is now starting to reach a level where it's beginning to look slightly exhausted to the upside. We're expecting this to look like a trend of lower highs and lower lows on a really zoomed out basis, with our plan to fill our long-term HYPE bags into single digit HYPE over the coming month or two. For now, we remain patient for that, and we expect HYPE's price to rollover over the next week say.Cryptonary's take

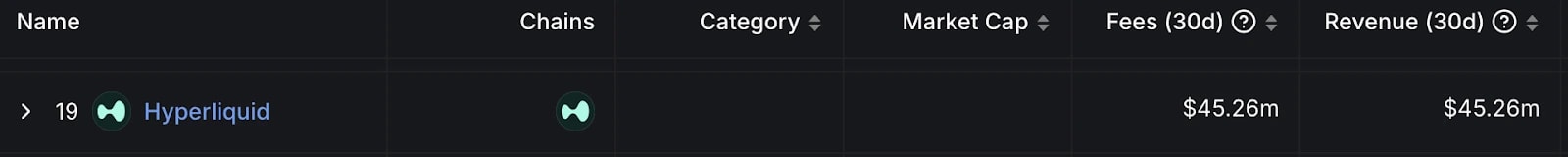

In short, HYPE checks every box: No backdoor deals, no overhyped KOLs, no VC influence, a rock-solid product, deflationary tokenomics and a fiercely loyal user base that doesn't feel the need to look elsewhere.The numbers speak volumes: with $45.26m in revenue for just the last 30 days, Hyperliquid has already established itself as a leader in decentralized derivatives, commanding significant market share and approaching trading metrics seen in top centralized platforms like Binance.

With the chart showing strength, the market is showing its hand. We likely to see HYPE outperforming the broader market in the next 3/6/12 months, meaning it one of the asset we will happily add to our portfolios. For precise entries follow our Market Direction tool and reports.

Peace!

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms