In today’s world of finance, every entity with capital—from individual investors to major institutions—is constantly on the lookout for avenues to generate returns and mitigate the erosion of wealth by inflation.

Traditionally, conventional asset classes such as treasury bonds and fixed-income securities provide yield, leading to the emergence of a massive secondary market known as Interest Rate Derivatives (IRDs). In fact, the notional value of the IRD market exceeds $480 trillion globally, underscoring its significance.

Pendle Finance is positioned to unlock a similar opportunity within the decentralised finance (DeFi) space, offering crypto users a way to put their idle capital to work. By pioneering the tokenisation of yield, Pendle enables the separation and trading of future yields from the ownership of underlying assets, introducing a new layer of flexibility, liquidity, and innovative strategies for DeFi participants.

Through its groundbreaking approach to yield tokenisation, Pendle allows users to hedge, leverage, and speculate on future yields in ways previously inaccessible in crypto.

It sounds simple, but the demand is HUGE.

Let’s dive deeper!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Pendle?

Pendle Finance is a decentralised yield management protocol designed to provide users more flexibility when using the various yield-generating assets in the market. Yield is volatile; it tends to react to bull market tailwinds and bear market tailwinds. In addition, other micro-factors can influence the yield on assets.Pendle is pioneering yield tokenisation, such that users can separate and trade future yield from the ownership of an asset. This fundamental capability enables new investment strategies within the DeFi ecosystem, offering enhanced flexibility and liquidity. By tokenising both the yield and the underlying assets, Pendle gives traders and investors the ability to hedge, leverage, or speculate on future yields, thus broadening the scope of financial instruments available in the cryptocurrency market.

This innovative approach allows users to unlock the true potential of their DeFi assets, capitalising on future yields today and cultivating a more dynamic and efficient DeFi environment.

How does Pendle work?

Pendle provides the flexibility to make decisions that optimise your upside and hedge against downside risk. Until recently, this flexibility has mostly applied to ETH staking, LST derivatives and stablecoins; however, any asset that generates yield can be incorporated into Pendle’s infrastructure.Pendle delivers this flexibility in yield management by converting yield-bearing assets into distinct derivative tokens:

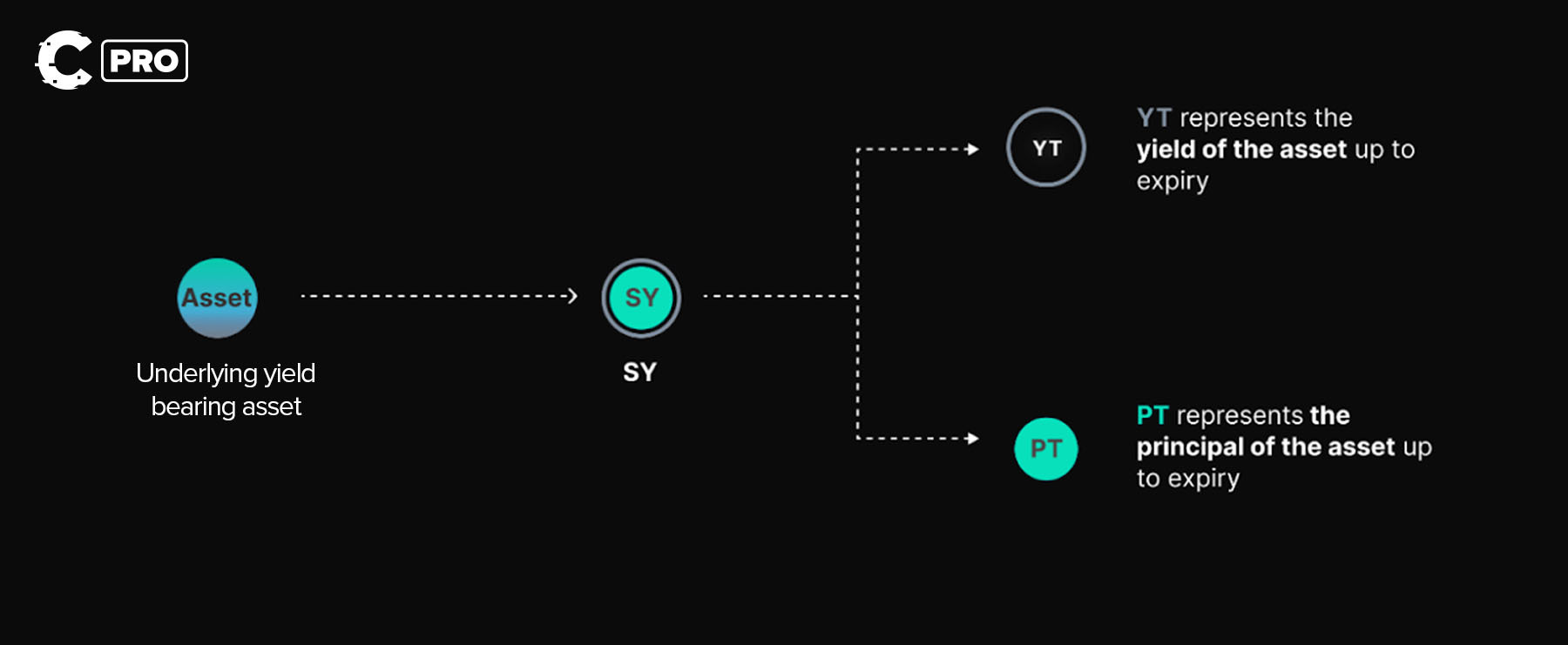

- The “Standard Yield Token” (SY) is simply the Pendle representation of the asset, identical to the underlying. This SY token is further split into the following:

- The “Principle Token” (PT) which represents the price (simplification) of the underlying asset.

- The “Yield Token” (YT) represents the yield of the underlying asset.

By splitting the yield-bearing asset into different parts, Pendle allows users to gain exposure to the volatility of the components that make up the asset - yield or price.

These tokens can be redeemed for the price (PT), yield accrued (YT), or both price and yield accrued (SY) of the underlying asset. PT and YT tokens have expiry dates attached, meaning you can lock in a certain yield over the duration of maturity.

Pendle users know exactly how much ETH, USDC, USDT, or any other yield-bearing token they will receive at maturity.

Pendle started with LSD-Fi - comprising ETH liquid staking tokens like stETH (Lido) and rETH (RocketPool). However, they have since expanded the product to include RWAs - which we’ll get to later.

For example:

- Buying 10 PT-ETH for 9 ETH (at a discount) means after a year, the PT-ETH can be redeemed for 10 ETH at full value.

- Buying 10 YT-ETH entitles the buyer to the yield generated by 10 ETH over a year.

- Mary has $10,000 worth of USDT.

- The current USDT APY is 5%, which means theoretically, in a year, Mary will have $500 worth of yield from her original $10,000.

- Instead of waiting a year for the yield, Mary deposits the 10,000 USDT into Pendle.

- The USDT is broken down into PT-USDT and YT-USDT and given to Mary.

- Mary sells her YT-USDT for 500 USDT, retaining the PT-USDT.

- After a year, Mary’s PT-USDT matures, and she redeems her PT-USDT for the full 10,000 USDT.

But who is Mary selling her YT-USDT to?

John, who sees an opportunity:- John has 10,000 USDT and speculates that the USDT interest rate will increase to 6%.

- John buys 10,000 USDT worth of YT-USDT.

- Let’s say the price of YT-USDT is 5% of the price of USDT; with his 10,000 USDT, John can buy 200,000 YT-USDT, which entitles him to the equivalent yield of $200,000 worth of USDT.

- The yield increases to 6% the next day until maturity. This means $200,000 worth of USDT will generate $12,000 in interest over that year.

John has made a 20% return on his 10,000 USDT.

However, if the yield had decreased by1% down to 4% instead of increasing, John would have lost $2000.

This means he has overpaid for the future yield.

This ability to place trades on current and future yield opens up a huge number of potential strategies for yield generation, hedging positions, and other plays that were previously unavailable in DeFi:

This specific offer of unlocking more opportunities with yield generation is one of the key selling features of Pendle.

The bullish case for Pendle

The bullish case for Pendle hinges on its groundbreaking approach to transforming DeFi through yield tokenisation. As the DeFi space matures and becomes more sophisticated, Pendle stands poised to capitalise on the growing demand for advanced financial instruments in crypto, making it an attractive prospect for forward-thinking investors and DeFi enthusiasts alike.Pendle's value proposition is amplified by its continuous integration of new assets, incentive structures that encourage participation, and rigorous security protocols that build user trust. Coupled with a transparent and community-driven governance model.

Moving trading TradFi assets on-chain

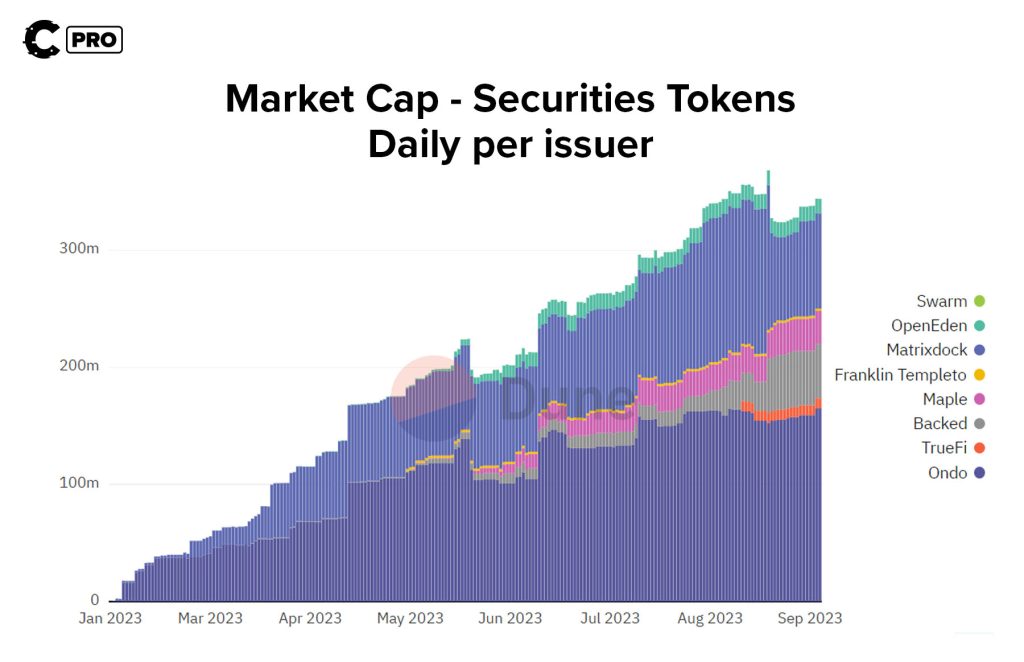

Remember the fixed-income TradFi assets we were talking about earlier? Treasury bonds and such? Well, they are gradually moving on-chain – thanks to Real World Assets (RWAs). RWAs are digital representations of tangible assets that are tradable on blockchain networks.RWAs have been a big narrative throughout 2023.

The tokenised securities market has grown from practically zero at the start of the year to well over $350 million.

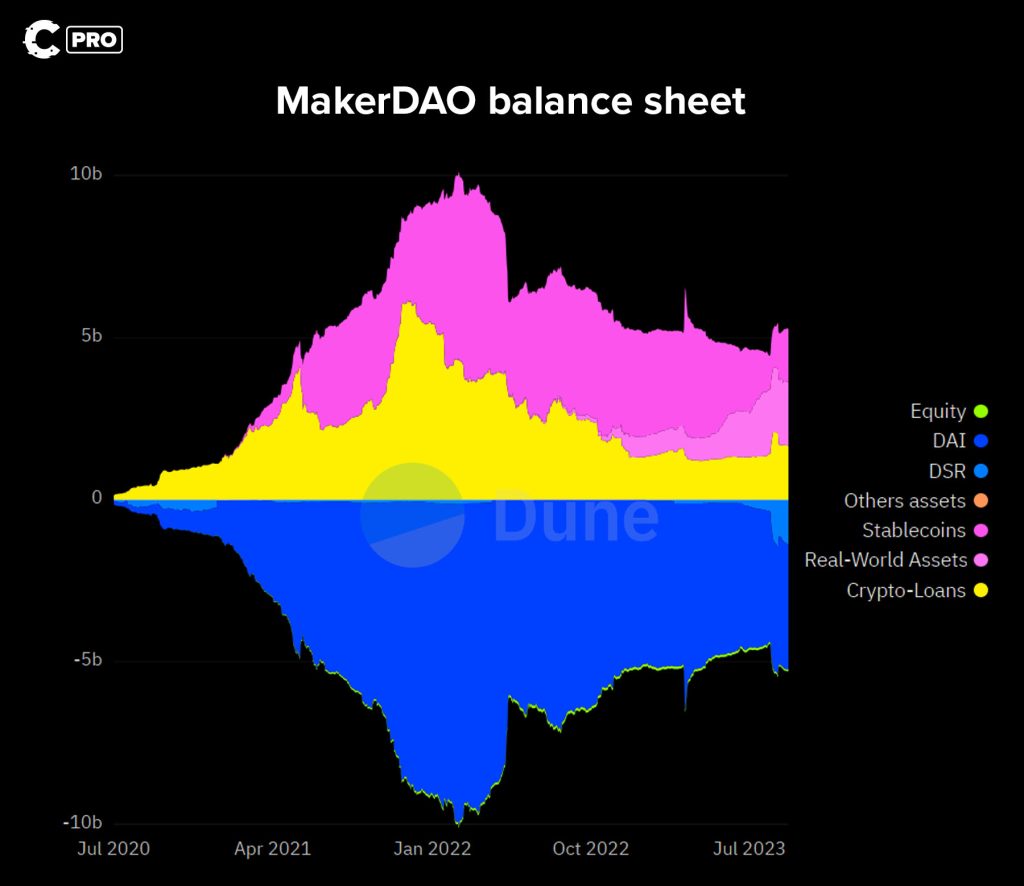

Additionally, MakerDAO, the issuer of one of the largest decentralised stablecoins, DAI, has been hard at work diversifying the assets that back DAI into RWAs.

DAI is now backed by nearly $2 billion worth of RWAs out of a total collateral pool of just over $5 billion. Most of MakerDAO's revenue now comes from RWAs like short-dated US Treasuries. Ultimately, this has allowed DAI to benefit from a base interest rate of 5%.

In essence, the demand for RWAs and tokenised RWAs is growing.

Innovative updates

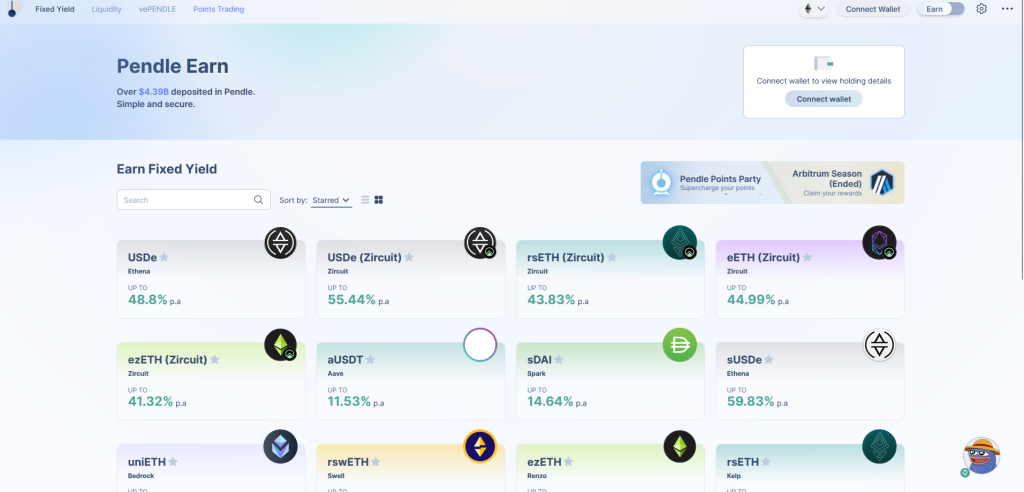

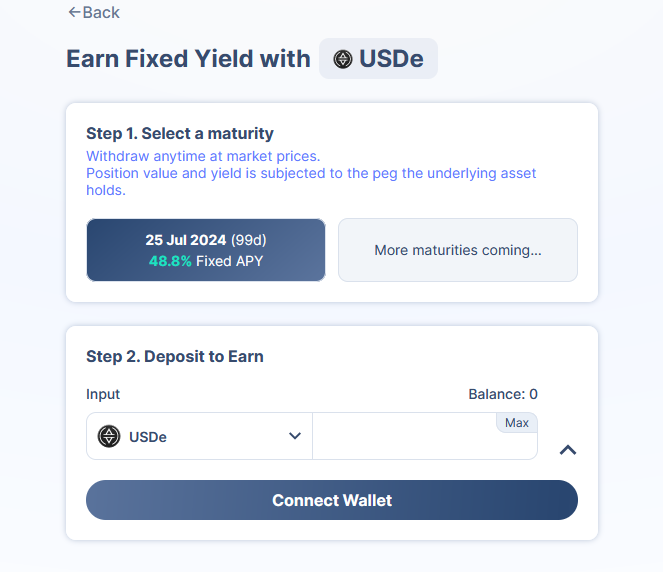

One of Pendle’s key updates in the last few weeks was the yield strategy orderbook.One of our key concerns was that Pendle was too complex for the average user to understand. Therefore, most people wouldn't use it, so it would struggle to gain mainstream adoption.

The Pendle team has completely redesigned the UI, making everything easier to navigate.

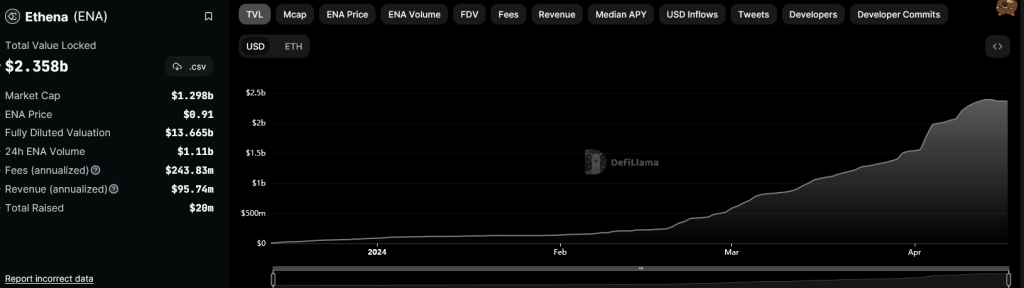

However, one of the key deployments has been the launch of USDe support, a stablecoin launched by Ethena Labs. Pendle has been partnered with Ethena and has been participating in and supporting the USDe push by Ethena.

Ethena has gone from relatively unknown to over $2.5 billion in TVL - the relationship with Pendle has been mutual.

Offering 50-60% APY on a stablecoin deposit might sound insane, and it most likely is if it goes on for too long. We all know what happened to Terra/LUNA/UST.

But Pendle is not actually exposed to the collapse of the stablecoin; they're just capitalising on the hype. If USDe went to 0, Pendle would, of course, get some bad press. Pendle is smart, though, and they likely have a contingency for that exact scenario—a depeg of the USDe.

We haven't done full due diligence on USDe, and that's not the topic of this report, but it explains the acceleration in TVL on Pendle—people love "free" yield, even if it isn't risk-free.

The USDe partnership serves Pendle well in showcasing its product - get your yield now for a given quantity of USDe.

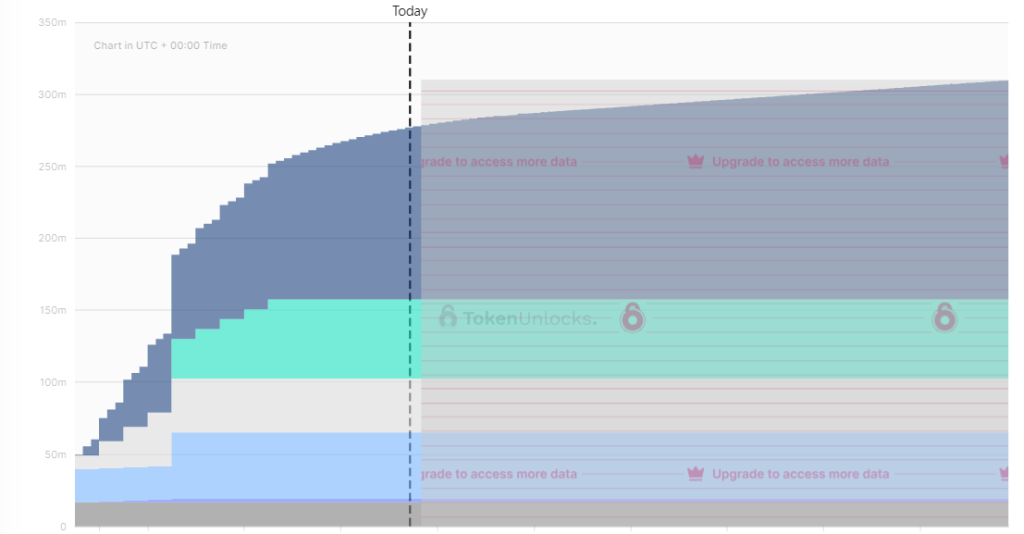

Decent tokenomics

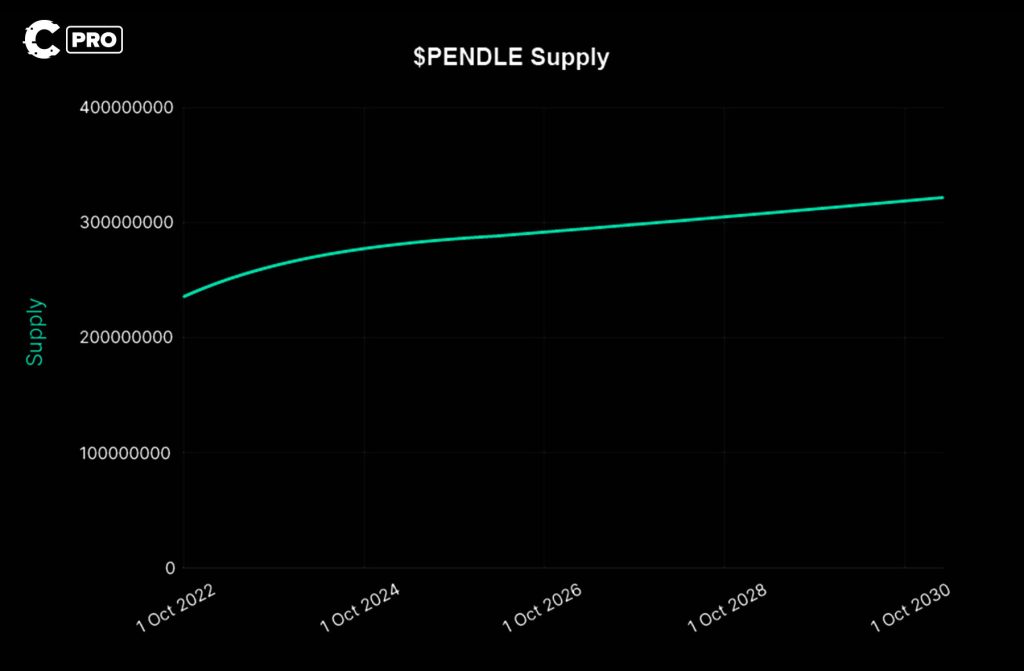

PENDLE is the utility and governance token for Pendle Finance.Supply information:

- Total Supply: ~258 million tokens

- Max Supply: Uncapped

After this date, PENDLE will inflate by 2% perpetually, with the emitted tokens being used for incentives.

The vesting schedule was complete by April 2023, so no new additional inflation will come from allocations.

PENDLE has the following utility:

- Governance: vePENDLE holders are entitled to a share of the revenue generated by the protocol, based on which pools successfully received incentives through voting.

- Protocol Fees: Over and above the governance incentives, vePENDLE holders (regardless of participation) receive a portion of overall protocol fees.

- Incentives: LPs holding vePENDLE are entitled to boosted yield from participating in liquidity pools.

Pendle’s valuation exercise + price targets

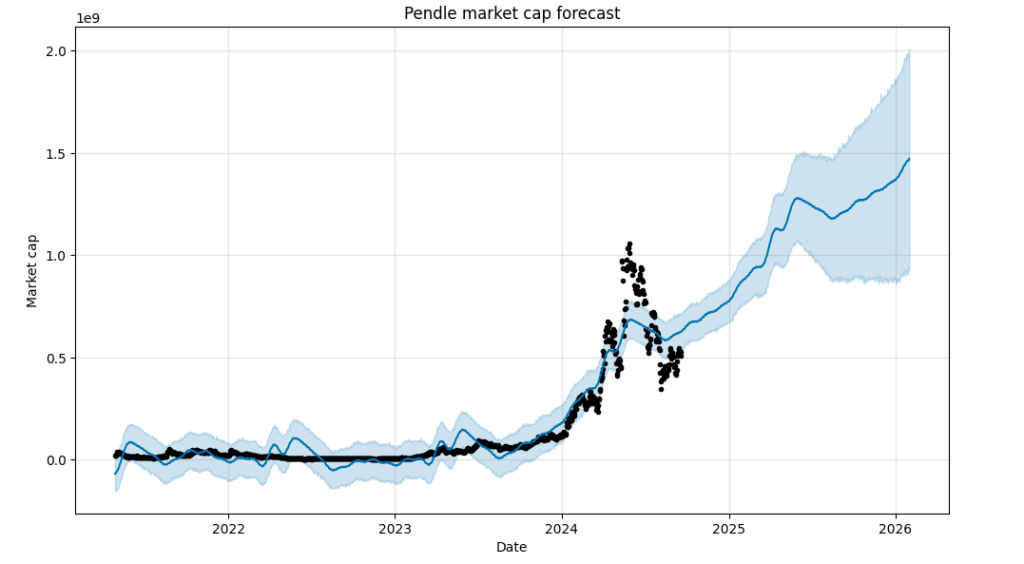

Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Pendle’s valuation.We downloaded the historical market cap of PENDLE and utilised a machine-learning model based on Prophet library to forecast future market cap, resulting in the following projections:

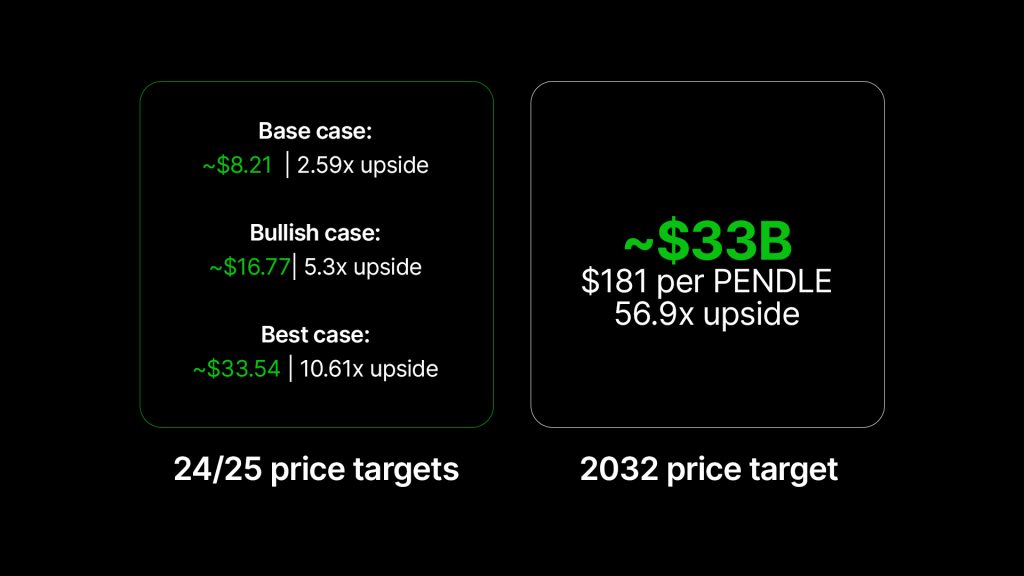

For 24/25

The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area).

- Bearish scenario: This scenario suggests that the mcap of PENDLE is expected to reach $885m ($885,916,067) by the end of 2025. The current circulating supply of Pendle is 158,415,646 tokens, while the maximum supply is unlimited. The inflation rate of Pendle is currently around 7%, and the rate is expected to decrease at an increasing speed. Since 2025 is right around the corner we will assume only a 7% net increase in the supply of Pendle. Thus, by the end of 2025, we expect a circulating supply of 166,336,428 tokens.

Considering future market cap and circulating supply, it will result in $5.32 per PENDLE per our bearish scenario.

- Base scenario This scenario suggests that the mcap of PENDLE is expected to reach $1.36b ($1,365,932,897) by the end of 2025. Assuming 166,336,428 tokens in circulation by the end of 2025, it will result in $8.21 per PENDLE per our base scenario.

- Bullish scenario: The model suggests that the mcap of PENDLE is expected to reach $1.86b ($1,860,707,099) by the end of 2025. Sticking to our assumption of 166,336,428 tokens in circulation by the end of 2025, it should result in $11.18 per Pendle. However, if you look at the model, there is around a 50% deviation in price from the upper band of the model. Therefore, since it is a bullish scenario, we add 50% for a potential deviation. Thus, considering future market cap, circulating supply and potential deviation, it will result in $16.77 per PENDLE per our bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn’t consider come up or believed were low-likelihood events. For example, one such event that pushed Pendle to new highs was Points Meta (airdrop farming). Pendle could successfully adjust to the market by offering Points Market, where users could speculate on the potential value of airdrops. However, not many expected such a meta to emerge. In the future, the same low-likelihood event can emerge, whether it is related to RWA or DeFi, that can push Pendle to exceed our expectations. To account for this potential scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Summary

For 2032

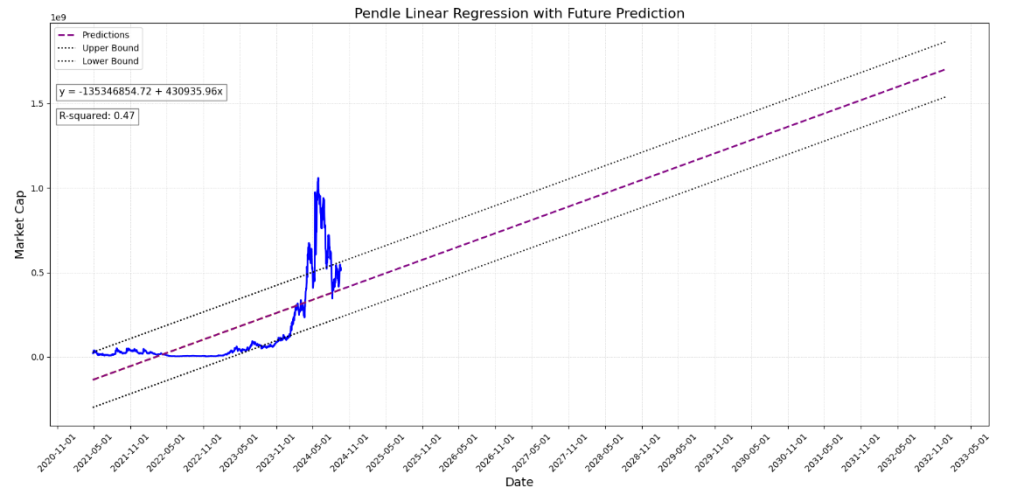

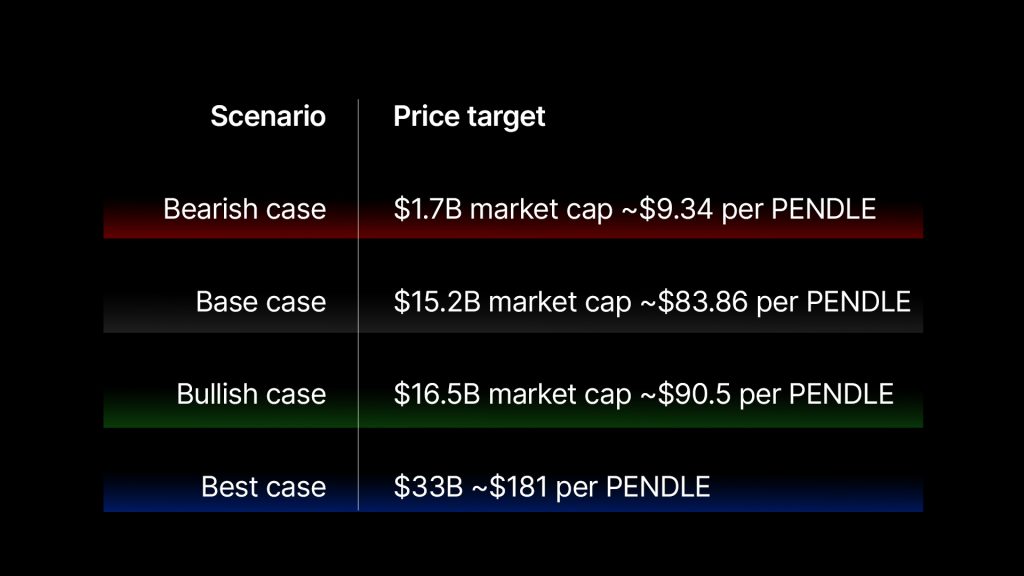

For our long-term predictions, we used a mix of quantitative methods depending on various scenarios:- Bearish scenario:

- The Y-axis represents the market capitalisation of PENDLE, while the X-axis represents time. The fitted line (rising purple line) shows a steady upward trend. The shaded area represents 1 standard deviation of error both to the upside and downside.

Based on this model, we can expect PENDLE to reach $1.7b ($1,702,595,024) by the end of 2032. The inflation rate of Pendle is currently around 7%, and the rate is expected to decrease at an increasing speed. For simplicity, we will assume Pendle will inflate 15% by 2032 from the current supply. This will result in 182,177,992 tokens

Thus, considering both the expected future market cap and circulating supply, it will result in roughly $9.34 per PENDLE per our bearish scenario.

Based on this model, we can expect PENDLE to reach $1.7b ($1,702,595,024) by the end of 2032. The inflation rate of Pendle is currently around 7%, and the rate is expected to decrease at an increasing speed. For simplicity, we will assume Pendle will inflate 15% by 2032 from the current supply. This will result in 182,177,992 tokens

Thus, considering both the expected future market cap and circulating supply, it will result in roughly $9.34 per PENDLE per our bearish scenario.

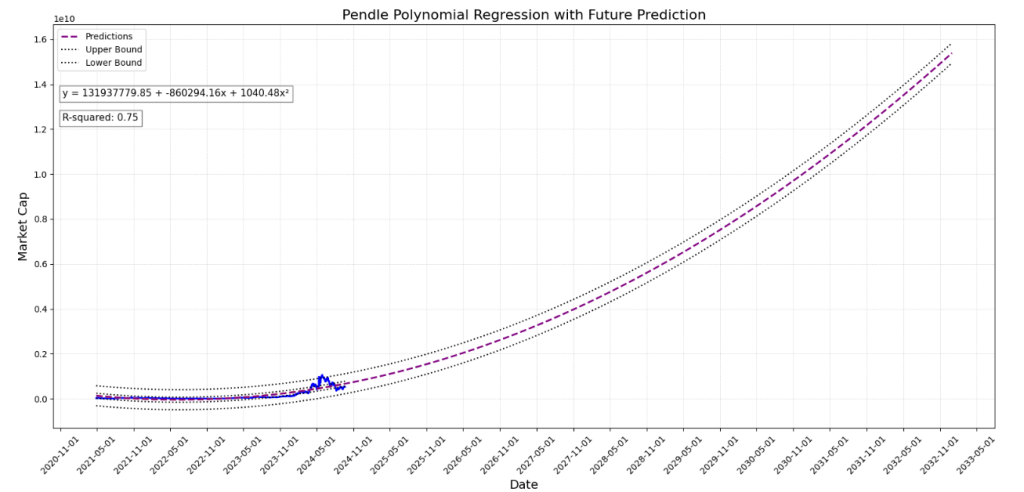

- Base scenario: For our base and bullish scenarios, we employed a different model. For these scenarios, we opted for the best-fit exponential model to come up with the long-term valuation for Injective instead of linear models. Our analysis resulted in the following model:

- This model suggests that the mcap of PENDLE is expected to reach $15.2b ($15,277,770,987) by the end of 2032. Assuming 182,177,992 tokens circulating by the end of 2032, it will result in roughly $83.86 per PENDLE per our base scenario.

- Bullish scenario: The model suggests that the mcap of PENDLE is expected to reach $16.5b ($16,500,763,002) by the end of 2032. Assuming 182,177,992 tokens circulating by the end of 2032, it will result in roughly $90.5 per PENDLE per our base scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn’t consider come up or believed were low-likelihood events. For example, one such event that pushed Pendle to new highs was Points Meta (airdrop farming).

To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Summary

Cryptonary's definitive price targets on Pendle

Over the short term, we are confident about Pendle's upside potential, and PENDLE has a decent shot at hitting the 24/25 price targets.We are even much more confident about the 2032 targets because it gives plenty of time for DeFi to go mainstream and for LSD-Fi to become a core part of DeFi.

Risks to consider before buying PENDLE

While the report thus far has consistently supported our bullish stance on Injective, we must address potential risks and considerations crucial for making informed investment decisions.Loss in market share

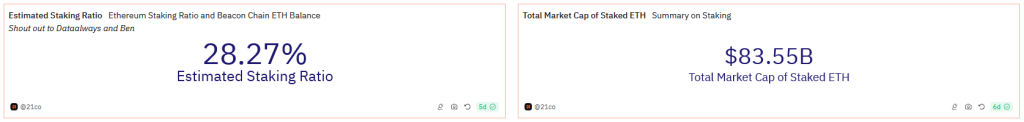

Pendle loses significant market share to other LSD-Fi protocols, dropping below 10%. This would signify very low demand for the product and would invalidate the above thesis.Drop in ETH staking participation

Since LSTs are crucial to Pendle’s product, a significant drop in ETH staking participation (below 16%) would invalidate the above valuation, which depends on stability/continued growth.However, it is unlikely that the ETH staking ratio will drop that low.

With the current figures, we’re confident this should be a non-issue.

Note: this risk likely be mitigated by expanding the RWA product and launching more diversified pools.

Cryptonary’s take

Despite market conditions and corrections, Pendle's performance has been exemplary, with little sign of weakness. PENDLE is a prime example if we're looking for assets showing strength for investment in dips. It is up almost 200% in the YTD period despite the general weakness in DeFi and it is up more than 2,200% since we recommended the asset.As stated in the previous report, the interest rate swap market is huge in TradFi, and Pendle is well on its way to monopolising that sector in crypto. Really, the only thing that could knock Pendle down a peg or two is some exploit or controversy.

However, barring such black swan events, we are confident that Pendle's trajectory is sustainable, even in the beginning stages. The longer it goes without any major exploit or controversy, the more confidence it will instil, facilitating further investment by more users (simpler UI) and larger quantities of capital. Pendle's success from here has what it takes to be a self-fulfilling prophecy.

Cryptonary, OUT!