Crypto’s best-kept secret: DeFi’s passive income trick

The future of wealth creation is here. With just an Internet connection, anyone can tap into unparalleled yield and passive income opportunities. DeFi's asymmetric strategies offer smart market exposure, turning your capital into a relentless engine for outsized returns while protecting your downside. Ready to explore? Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Decentralized finance and passive income

Decentralised Finance (DeFi) is a transformative ecosystem of blockchain-based applications that is redefining wealth creation. By replacing banks, brokers, and gatekeepers with transparent, trustless smart contracts, DeFi empowers anyone with an internet connection to access financial services. From lending and staking to liquidity provision, DeFi's diverse yield strategies offer passive income opportunities that far surpass those of traditional finance, with returns ranging from a steady 5% to over 100% APY, compared to the modest 2% offered by a savings account.Why DeFi? It's about empowerment and opportunity. Traditional financial systems often lock out many, requiring high minimums, lengthy approval processes, or insider connections to access meaningful returns. DeFi tears down these barriers, embodying financial inclusion. With just a crypto wallet and a small amount of capital, you can participate in a global economy, earning income from your assets without handing over control to a third party. This democratisation of finance means passive income and yield opportunities aren't just for the elite - it's for anyone willing to learn and engage.

Yield strategies in DeFi are particularly compelling because of the diverse options they unlock. Unlike traditional investments like bonds or dividends, which often yield modest returns, DeFi offers dynamic ways to put your money to work. You can lend stablecoins to earn steady interest, stake tokens to secure a blockchain and earn rewards, or provide liquidity to decentralised exchanges for a share of trading fees. These strategies, powered by DeFi protocols across blockchains like Ethereum, Solana, and Hyperliquid, cater to varying risk appetites, from conservative to high-growth. The flexibility to choose your approach, coupled with the potential for compounding returns through reinvested earnings-makes DeFi a new powerhouse for building wealth passively.

The focus on passive income in DeFi also aligns with a broader shift toward financial autonomy. In a world of rising costs and stagnant wages, relying on active income alone is no longer enough. DeFi's yield strategies offer a way to generate cash flow without constant oversight, letting your assets work around the clock. Whether you're saving for the future, diversifying income streams, or seeking financial independence, DeFi provides tools to achieve those goals.

There are many yield opportunities, but in this report, we would like to focus on something we find as an asymmetric bet among many yield-generating options.

Let's talk about Concentrated liquidity provision

Mastering passive income with DeFi

Concentrated liquidity is a mechanism in DeFi where liquidity providers (LPs) can allocate their capital to a specific price range within a trading pair rather than having it spread across the entire price spectrum.Imagine you're a fisherman looking to catch fish in the vast ocean. In traditional fishing, you'd cast a wide net across the entire ocean, hoping to catch something, but your efforts are spread thin. Concentrated liquidity is like choosing a specific spot in the ocean where fish are abundant, focusing your efforts to maximize your catch. In decentralized finance (DeFi), this "ocean" is a liquidity pool, and concentrated liquidity is a game-changer for how you provide liquidity to earn rewards.

Liquidity pools: The basics

Liquidity pools are the backbone of decentralized exchanges (DEXs) like Orca or Uniswap. They're smart contracts that hold pairs of tokens, like SOL and USDC, allowing users to trade one for the other. Liquidity providers (LPs) deposit equal values of both tokens into the pool (e.g., $100 of SOL and $100 of USDC) and earn a share of the trading fees, say, 0.2% per trade. The higher the volumes and trading activity, the more fees the pool collects. In traditional pools, your liquidity is spread across all possible prices for the token pair, from $0 to infinity. This ensures trades can always happen, but often means your capital isn't working as hard as it could.

Concentrated liquidity: Fishing where the fish are

Concentrated liquidity, pioneered by Uniswap V3 and adopted on Solana by platforms like Orca, Raydium, Lifinity, etc, flips this model on its head. Instead of spreading your capital across all prices, you choose a specific price range where you think the token pair will trade. For example, if SOL is trading at $175, you might provide liquidity for the SOL-USDC pair, for example, between the $150 and $200 range.This is like fishing in a specific reef where fish are plentiful. When the market price stays within your chosen range, your capital is hyper-focused, facilitating more trades and earning you a larger share of the fees. Platforms report eye-popping returns.SOL-USDC pools on Orca or Kamino have boasted APYs as high as 300% during volatile markets, compared to 10-20% in traditional pools.

However, there are some additional nuances/features of this yield strategy to be aware of. When the price of SOL is "in-range" (between $150 and $200), your position is active, and you will earn fees/income as people trade and pay small fees to liquidity providers. At $175 (middle of the range), your position will consist of 50% SOL and 50% USDC. As the price of SOL approaches the edges of the range, one of the following happens

- As SOL’s price approaches $150, you will gradually “sell” USDC and “buy” SOL, so that at $150 and below, 100% of your position will consist of SOL

- Conversely, as SOL’s price approaches $200, you will gradually “take profits” on SOL and “buy” USDC so that at $200 and above, 100% of your position will consist of USDC

- Once you are out of range, you stop earning fees.

Why it's a big deal

- Higher Returns, less capital: By concentrating your liquidity, you can achieve the same trading volume (and fees) with less money. It’s like catching more fish with a smaller, well-placed net. Current daily yield on the $150–$200 range on SOL is 0.369% per day (134% per year at the time of writing).

- Capital Efficiency: Your funds work harder, focusing on the price range where trading activity is heaviest.

- Great for market exposure: Concentrated liquidity gives you exposure to the market’s movements. If the price rises within your range, you earn fees and benefit from holding appreciating tokens. If it falls, you accumulate more of the depreciating token, effectively dollar-cost averaging (DCA) into it.

- Unsung edge: The market can be forgiving: the longer the price stays in your range, the more fees you collect, and time works in your favour. This dynamic puts you in a strong position, as staying in range compounds your returns while mitigating sharp losses.

- Time and volatility are your edge here, where whether prices are going up or down can still keep you in a strong position. Prices go down, you accumulate more of the token you expect to grow in the future. Prices go up, hey, you made money. And as time goes on, your downside gets smaller and smaller, and the upside gets bigger and bigger due to fees/yield accumulated.

The Trade-offs and risks

Concentrated liquidity isn't without risks. If the price moves outside your chosen range (e.g., SOL spikes to $250), your liquidity stops facilitating trades, and you miss out on fees and end up with either USDC or SOL.

Imagine if you entered the pool at $175 per SOL, and the next week, SOL shoots to $300 in a single weekly candle. You wouldn’t enjoy the upside fully because you DCAed out fully by SOL reaching $200 to USDC. This is called impermanent loss—despite being profitable in dollar terms, your position might be worth less than if you’d just held SOL in this period. Despite high APY collected in USDC and SOL, the fees collected in just 1 week won’t be enough to cover missed capital gains.

Additionally, the tighter the range, the more fees you collect (higher APY), but the higher the possibility of you going out of the range and having impermanent loss. The wider the range, the fewer fees you collect, but a lower possibility of going out of the range and having impermanent loss

Mitigation strategy: The art here is to find a perfect balance between high APY and the width of the range so that you earn maximum fees and stay in range for a prolonged enough time. This comes with the understanding of the market trends and where the asset is likely to go next or chop around. You can have a good sense of this over time if you read our Market Directions and Market Update reports.

Also, it is important to think about what levels you would be okay with 100% of your position in SOL, and at what price you would be okay selling all your SOL to USDC. If the price goes to a lower band, congrats, you have accumulated more SOL as an investment for the future. If the price goes to the upper band, congrats, you have taken profits at the level you wanted to exit.

Balancing these two things can help you choose the right range, or you can just follow us for ranges we think are the most appropriate, depending on the market.

Here are some other risks:

- Smart contract risks: Smart contracts powering DEXs like Orca are susceptible to bugs, vulnerabilities, or hacks, which could result in partial or total loss of funds. A single coding error or exploit, as seen in past DeFi hacks (e.g., a 2023 protocol loss of $10M), can jeopardise your deposit, even on audited platforms. While Solana's robust $9B DeFi ecosystem includes rigorous audits (e.g., Kudelski Security for Orca), no contract is entirely risk-free, requiring vigilance to safeguard your capital. However, DeFi has been battle-tested for quite some time now, which makes the likelihood of bugs less and less likely over time. However, the risk can never be zero.

- Stablecoin de-peg risk: Any stablecoin can de-peg (be worth less than $1), and USDC is not an exception. However, USDC, issued by Circle, remains one of the most reliable and audited stablecoins on the market right now

- Yield variability: The attractive APYs of concentrated liquidity depend on trading volume and market conditions, leading to fluctuating returns. Low trading activity or prolonged bear market environments can significantly reduce the yields.

Common mistakes and best practices

Here are some mistakes that users generally make when starting their journey with liquidity poolsObsessing over portfolio balance alone

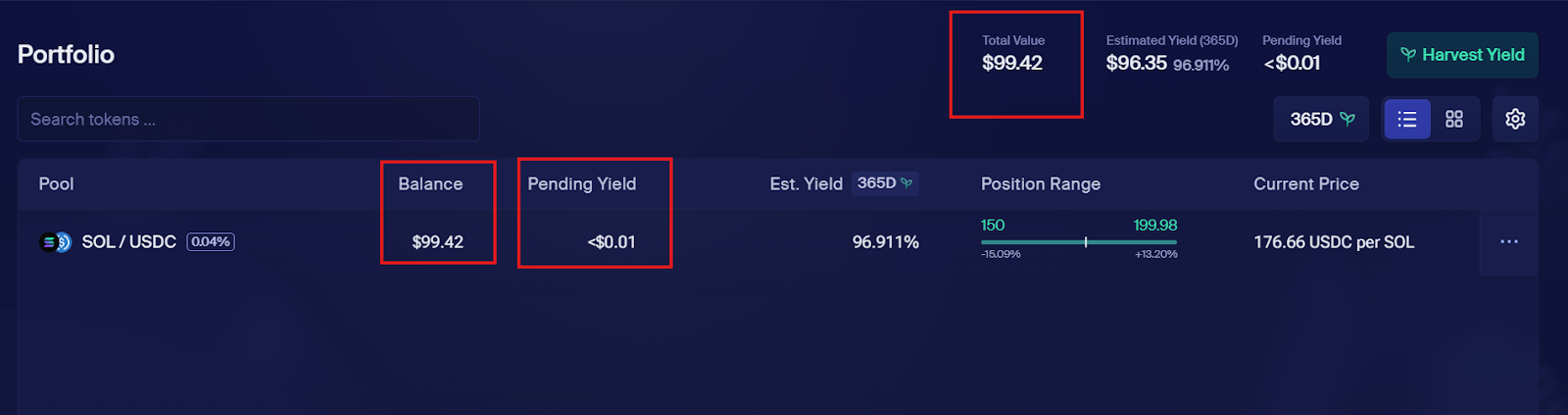

It's tempting to keep an eye on your portfolio's dollar value and stress when it fluctuates, but that's only part of the story! Concentrated liquidity is about earning those sweet trading fees over time, paid in SOL and USDC. If you focus only on the balance and ignore the yield you're racking up, you might miss the bigger picture. Those fees can add up significantly, especially in active markets.Therefore, keep track of both your portfolio balance and the fees you’re earning. On Orca’s dashboard, it is “Total Value” shows both your position balance and the yield you have already accumulated.

Think of your yield as a steady stream of passive income that’s working for you, even when prices swing. Therefore, optimise your psychology for time and volatility, imagine you own a piece of a casino.

Panicking when out of range

If SOL's price moves outside your chosen range (say, it rockets past $200 or dips below $150), your position stops earning fees for a bit. It's easy to think, "Oh no, I chose the ranges wrong, I will pull out my liquidity now!"If you stay in the pool, the price can swing back into your range, and your position will start earning those sweet fees again. For example, let’s say you set a range of $120–$180 for a SOL-USDC pool, but SOL drops to $100. At that point, your position might be 100% in SOL.

Don’t stress! SOL is a blue-chip asset in the crypto world, and prices often bounce back after some market chop. When SOL climbs back into your $120–$180 range, your position reactivates, and you’re back to collecting yield like a pro. By staying patient, you’re not only holding a solid asset but also setting yourself up for more passive income when the market moves in your favour.

Setting Ranges Without a Plan

Choosing a price range is like picking the perfect spot to fish - you want to be where the action is! Setting a range that's too tight (+-5% from the current price) might boost your APY, but it increases the chance of slipping out of range quickly. On the flip side, a super-wide range might keep you in the game longer, but could mean lower fees. Finding the sweet spot takes a bit of thought.Less is more. Optimise your range for longevity and align it with your comfort zone. Ask yourself: "At what price would I be happy holding 100% SOL for future growth? At what price would I feel great locking in profits with 100% USDC?" For example, if you're cool with owning SOL at $150 and taking profits at $200, set your range around those levels. If you keep getting in and out of the ranges, that will incur additional liquidity, trading fees that hurt your profitability. That is why enter with an aim to be in a pool as long as possible.

Pro tip: Keep an eye on market trends (or check out our market update reports) to get a sense of where SOL might trade next, or follow our ranges that we share. These help you pick a range that maximises fees while staying active for as long as possible.

How to earn passive income with SOL - USDC concentrated pool

- Step 1: Set Up a Solana Wallet

- Download non-custodial wallets like Phantom

- Fund the wallet with SOL and USDC via exchanges (e.g., Coinbase, Binance, etc).

- Step 2: Go to a DEX

- Go to ORCA and connect your wallet

- Step 3: Provide Liquidity

- Select the SOL-USDC pool, and choose a price range (e.g., We will provide ranges below, but ).

- Deposit SOL and USDC depending on the range

- Confirm transaction (low Solana fees ensure affordability).

- 3 ranges:

- $150 - $200, daily yield of 0.172% at the time of writing

- This is a tight, high-yield range for those who want to capitalise on SOL's current trading action and accumulate as much SOL and USDC via yield in a short period of time

- $120 - $250, daily yield of 0.071% at the time of writing

- This is a balanced range for those seeking solid returns with a bit more breathing room than the $150-$200 range. If SOL and the broader market pull back, that is okay, you will DCA in. At the same time, there is enough room for the upside if the market goes up. The yield is still high to compensate for potential impermanent loss.

- $100 - $300: daily yield of 0.054% at the time of writing

- Set and forget type of range, it is possible that SOL revisits the 2-digit price, but the probability of that is relatively low, and it will take time. Also, it is likely that SOL will reach $300, but that also will take time (Q4 - Q1 2026). Very low risk range.

- $150 - $200, daily yield of 0.172% at the time of writing

- Step 4: Earn and Monitor

- Earn trading fees paid in USDC and SOL

- Enjoy passive income and yield

Step-by-step video tutorial

Cryptonary's take

Sometimes crypto can be the wild west with vicious price action. Providing liquidity into solid assets with huge volumes is your ticket to owning the casino. Unlike traditional investments that demand constant attention or lock you into modest returns, concentrated liquidity on platforms like Orca, Raydium, and Kamino lets your money work smarter, not harder, harnessing the power of Solana's booming $9B DeFi ecosystem.What sets liquidity provision apart is its unique edge: time and volatility are your allies. In a SOL-USDC pool, you earn trading fees every time traders swap tokens. The longer prices stay within your chosen range, the more fees you stack, compounding your returns effortlessly. Volatility, often a foe in crypto, becomes your friend here. Swings in SOL's price fuel trading activity, boosting your fee income, whether the market surges or dips. This dynamic makes concentrated liquidity an asymmetric bet: your capital thrives in the chaos of Solana's 70% DEX volume dominance, turning market energy into your profit.

It's financial empowerment. By providing liquidity, you're not just betting on SOL's price - you're running the table, collecting a piece of every trade. Own the casino, and let the game come to you.

Peace!

Cryptonary, OUT!