Intro

Originally, this report was going to be about Perpetual Protocol, but things change. GMX was the prettiest lady at the dance, so we’re taking her home.But is it all it’s cracked up to be, or has it benefitted from the hype machine and echo chamber that crypto (especially crypto Twitter) can be?

Let’s find out!

Before we do, if this report is too long for you, I would highly recommend making sure to read the conclusion! Even if that’s all you read, it will be very beneficial!

TL:DR

- Innovative platform, but is it ground-breaking?

- WTF is GLP? (30% APR??)

- A piece of the DeFi money-lego’s puzzle?

- Impact of a bank-run (flight to safety/mass sale)

What is GMX?

GMX is a DeFi exchange, launched in September 2021, that allows users to trade perpetual futures (perps) with up to 50x leverage (raised from 30x through a governance vote in early May), directly from their DeFi wallet. It operates on Arbitrum and Avalanche, and supports BTC, ETH, UNI, AVAX and LINK.Rather than an order book market-making model like dYdX, or an automated market maker (AMM) like Perpetual Protocol, GMX uses a liquidity pool. This innovative approach stands out against the competition. The question is, will it be successful and sustainable, or fail and see GMX fade into the background?

GMX was previously called Gambit, a project that created the interest-bearing stablecoin, USDG. Check out the History of GMX section at the end of this report for full details!

Liquidity Pool Market-Making Model

How to make markets has plagued derivatives trading on-chain. AMMs, the original solution, whilst being hugely innovative, suffers from high slippage and costs. Order book markets work great, as long as you have sufficient liquidity to match buyers and sellers. This adds a risk factor and a cost though, as you need to incentivise market markets to provide liquidity, and if you can’t onboard liquidity, you can’t facilitate traders.

GMX uses an innovative approach, which has the potential to solve the issues mentioned above, but, does it create more problems than it solves? Let's consider.

So, how does it work?

Think about it this way, every time someone places a trade on the GMX platform, the liquidity pool is taking an equal and opposite trade. If the trader wins, the pool loses, and vice versa. This sounds risky, but historically, traders are terrible at winning.

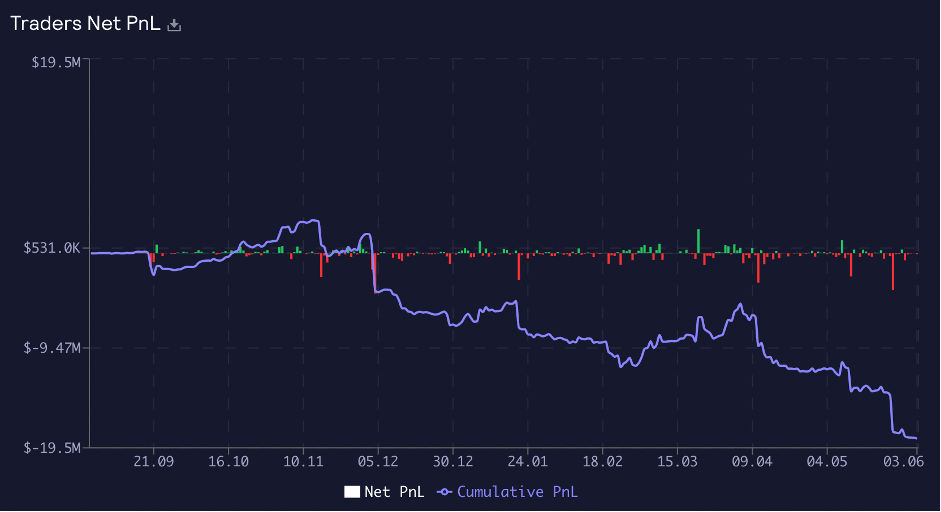

Check out the chart below to see how traders have fared on the GMX platform since its inception (the blue line is the total profit and loss (P+L), the bars are daily P+L).

Not so well… which is good for GMX liquidity providers (LPs).

To make this whole arrangement possible, GMX uses a two-token system. GMX, the governance token, and GLP, a token that represents a share of the liquidity pool.

GLP

GLP can be thought of as a kind of index fund, consisting of different weights of the assets supported by GMX (currently BTC, ETH, LINK, UNI and AVAX), and stablecoins (USDC, FRAX and DAI). This is a very loose comparison though, as there are a lot of differences between GLP and an index fund. Firstly, GLP is dynamically weighted to match traders’ liquidity needs. Secondly, GLP acts as the counterparty for trades, so when traders’ on GMX are winning, GLP holders are losing. Most importantly, GLP generates income for holders, in the form of GMX protocol fees.GLP can be minted (bought) by depositing any of the assets supported into the liquidity pool. It can’t be traded on the secondary market, meaning it can only be bought or sold on GMX directly.

GLP tokens are automatically ‘staked’ on purchase, and ‘unstaked’ when sold. The rewards can be seen in the GMX earn tab. What rewards, you ask?

GLP Pool Weights

GMX charges a variable fee when buying and selling GLP, depending on which asset you purchase with (swap from), and the current assets in the GLP pool. This allows the GLP pool to constantly rebalance to match traders’ needs (remember, the GLP pool is the liquidity that traders on GMX are trading against).Let’s take a look at how this works in practice: If there is a high percentage of ETH in the pool relative to traders' demand (and therefore the target weight), then actions that would increase the amount of ETH in the pool would have high fees, and those that reduce the amount of ETH (relative to other assets) would have lower fees. For example, if you purchase GLP with ETH, you pay a higher fee, if you buy with another asset, the fee will be reduced (as it will be reducing the amount of ETH relative to other assets).

There are two different GLP pools, one for each network GMX operates on (Arbitrum and Avalanche). GLP tokens are not cross-chain, they represent the pool on their own network (with the different pools having different assets and weights).

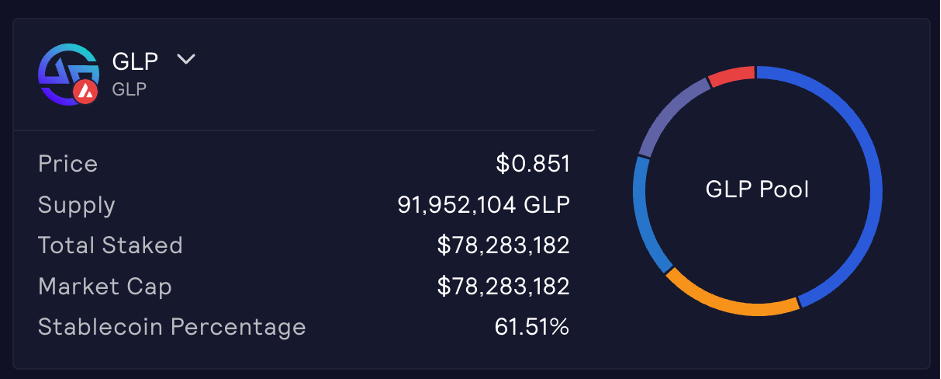

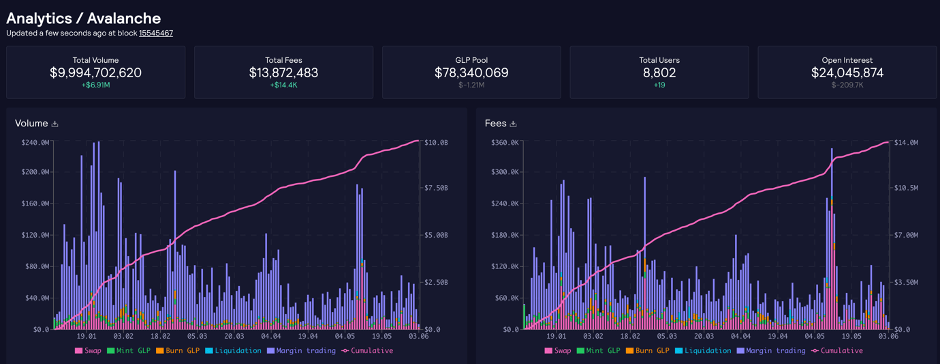

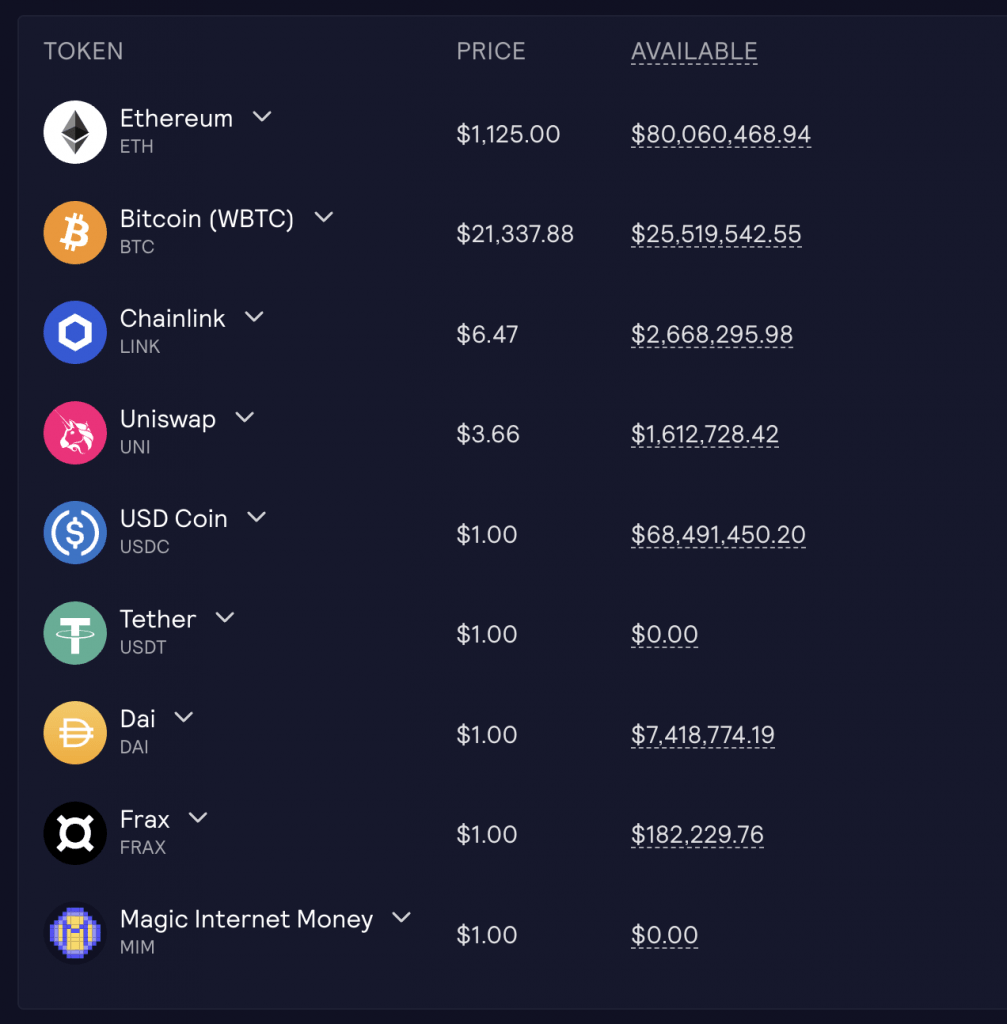

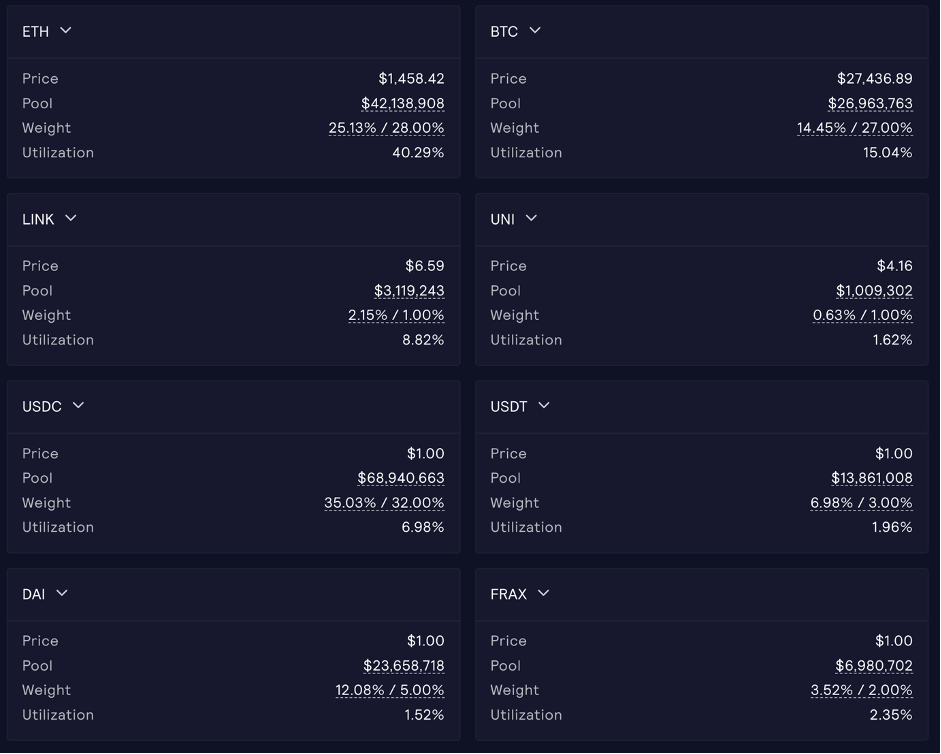

See the current composition of each below (at the time of writing):

Arbitrum – 33.85% USDC, 28.03% ETH, 12.51% DAI, 12.17% BTC, 8.29% USDT, 3.22% FRAX, 1.35% LINK, 0.55% UNI.

Avalanche – 45.33% USDC.e, 18.99% BTC, 16.17% USDC, 13.46% ETH, 6.03% AVAX.

Why Hold GLP?

There are some clear considerations here. Why hold GLP? With its asset weights set depending on what traders want, not what’s a good investment. It is highly unlikely an investor would construct a portfolio with the assets and weights seen in the GLP pool.Well, GLP holders don’t just get a share of the pool, they also get 70% of the fees generated on GMX, the upside of being the counterparty in trades (and the downside, but if the saying holds true, the house always wins) and escrowed GMX distributions (esGMX – bootstrapping, due to finish late this year or early next year).

When GLP is minted, it automatically begins accruing the rewards mentioned above, which can be claimed at any point on the GMX earn tab.

The fees on the platform are split 70/30. With 70% going to GLP holders and 30% to GMX stakers. We will discuss returns later on, for now, let’s talk GMX and esGMX.

GMX

GMX is the governance token, holders are able to vote for proposals in the governance forum. The governance controls things such as what the maximum leverage is, which assets are supported by the platform, and therefore make it into the GLP pools, and what emissions are distributed.

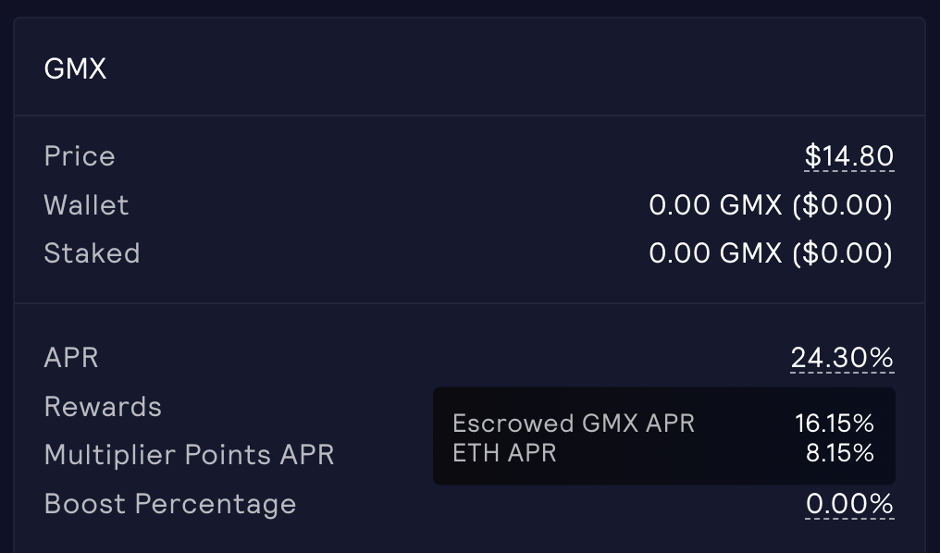

GMX stakers get 30% of fees generated on the platform, alongside the ability to vote in the governance, distributed to them in ETH or AVAX. This is boosted by esGMX rewards as mentioned above, with the current staking rewards at 8.16% ETH from trading fees, and 16.15% esGMX distributions.

esGMX

esGMX stands for escrowed GMX, a cleverly formulated bootstrapping mechanism that allows increased rewards with massively reduced sell pressure (vs just giving out GMX tokens). Distributed to GLP holders and GMX stakers to enhance rewards, esGMX is non-transferrable and non-tradable. There are two ways esGMX can be used:- Staked for rewards (you earn the same rewards staking esGMX as regular GMX)

- Vested to become actual GMX tokens over a period of one year.

For example, say you staked 100 GMX tokens for a year, earning 15 esGMX (alongside the ETH rewards). To vest the esGMX to normal GMX, you would need to lock that 100 GMX for 1 year. Note that the GMX/GLP you used to earn the esGMX will still earn rewards over this year, however, the esGMX you are vesting will not. The esGMX would be unlocked linearly over the year, with a tiny bit unlocking each second.

If you sell the GMX or GLP used to earn the esGMX, and would later like to vest and unlock the esGMX, you would need to purchase the appropriate amount of GMX or GLP to allow this.

This means unlocking esGMX is strongly disincentivised, as you miss out on potential staking rewards by vesting. This is a clever system to get holders to not unlock, but instead stake and earn perpetually.

Note that Escrowed GMX (esGMX) is not transferrable unless you are doing a full account transfer. The amount of GMX or GLP required to vest esGMX is unique per account and capped to the rewards received by that account. Please do not buy esGMX off the market or OTC as you will not be able to vest them.

Multiplier Points

When you stake GMX, you receive Multiplier Points at a fixed rate of 100% APR. 1000 GMX staked for one year would earn 1000 Multiplier Points.Multiplier points act as staked GMX, each multiplier point staked gives the same ETH rewards as a regular GMX token (note, they don’t accrue additional multiplier points, or esGMX, just the ETH rewards).

When GMX or Escrowed GMX tokens are unstaked, the proportional amount of Multiplier Points is burnt. For example, if 1000 GMX is staked and 500 Multiplier Points have been earned so far, then unstaking 300 GMX would burn 150 (300 / 1000 * 500) Multiplier Points.

This is designed to reward long-term stakers without token inflation. However, it does water down the rewards that new GMX stakers earn, which could disincentivise new people entering the ecosystem, and increase the chance of a few whales getting much of the staking rewards. Not something of any major concern, especially as the points are burned if the GMX is unstaked, but something worth noting.

Floor Price Fund

A unique (but pointless) aspect of GMX is their floor price fund, derived from XVIX, a previous project from the GMX team. The fund creates a minimum value for GMX tokens, by buying back and burning GMX if the value of the GMX token’s fully diluted value is less than the floor price fund.Seeded with liquidity from the GMX Olympus bonds (50% went to the floor price fund) and protocol-owned liquidity in the GMX/ETH pair (fees generated are converted to GLP and deposited into the fund).

In all honesty, this a gimmick, with the fund currently containing $3,098,545, and the fully diluted value of GMX at $238,126,095, for the floor price fund to kick in, GMX would need to have fallen in value by 98.7%.

Returns for Stakers & GLP Holders

For the purposes of demonstration and discussion, and to keep things simple, we are only looking at the fees on Arbitrum.GMX stakers are currently earning 24.30% APR, 8.15% in ETH rewards from fees on the platform, and 16.15% in esGMX. Note, staked esGMX earns the same as GMX.

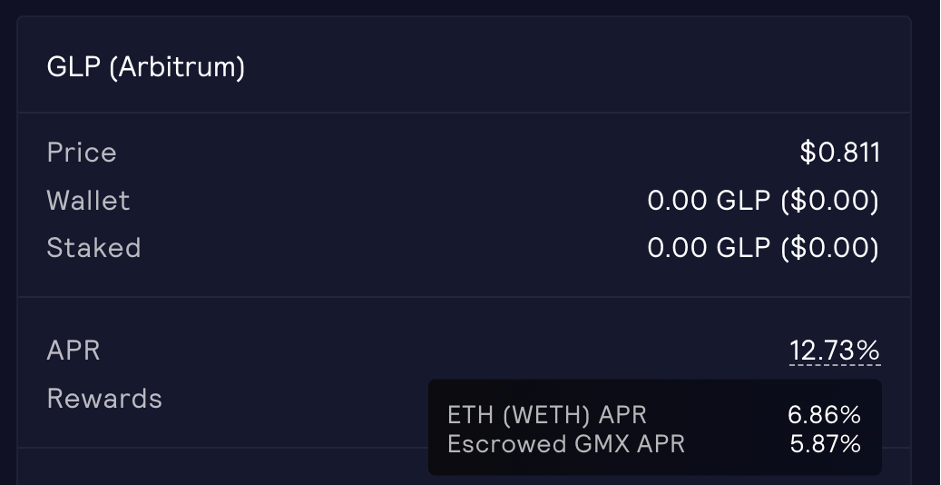

GLP holders are earning 12.67%, 6.83% in ETH rewards from trading activity, and 5.84% in esGMX.

Due to the dynamics of GLP being freely mintable with no maximum supply, the pool will always balance out to a level of APR that GLP holders are (on the whole) satisfied with. Otherwise, they would either sell or buy more, selling (burning GLP) as returns are too low or buying (minting GLP) to take advantage of high returns.

GMX on the other hand does have a capped supply, at 13,250,000, however, multiplier points mean the amount of “GMX” token the platform fees are split between can theoretically increase by 13,250,000 each year (as if all GMX is staked, it will all earn 100% APR in multiplier points, which share the fees in the same way as staked GMX tokens).

Returns Dilution

Considering esGMX and multiplier points’ inflation (assuming 50% of GMX stakers continue staking), there will be an additional 2.5m GMX (in the form of esGMX and multiplier points, but these earn in the same way as staked GMX), or around 40% dilution of rewards to stakers.If trading activity remains where it is, that would mean a mere 2.88% return for any new GMX stakers, and diluted returns for older ones. The true situation is likely to be less extreme than the example given above, due to people unstaking and losing multiplier points, but the point stands true. The risk/return of holding/staking GMX and GLP at this moment in time is not where we would want it to be.

esGMX Bootstrapping

Initially, the protocol intended to give away 2 million GMX, in the form of esGMX, to bootstrap the protocol, boosting rewards and attracting more users. This amount has been used up, and with the market conditions and protocol still in a vital stage of its growth, a governance proposal has been passed to use 1m of the esGMX which was intended for the floor price fund to further bootstrap the protocol. This will be distributed via a dynamic emission schedule to target a return of 20% APR (between rewards from fees and esGMX bootstrapping rewards, the protocol will aim to return 20% APR until the esGMX runs out).As mentioned above, the floor price fund is almost completely pointless, and even with the 1.5m remaining esGMX that was intended for it, that would only increase the fund to < $40m, which is not enough to have any meaningful impact. Using the remaining floor price fund supply to further bootstrap the protocol is a great idea in my opinion.

There are concerns, though. Currently, the majority of rewards on the platform come in the form of esGMX from reserves, not from fees. Market conditions have seen the APR from fees drop from around 15% to 7-8%. When the additional esGMX is used, around December this year (2022), there is a big question mark over if the APR will be enough to keep GMX and GLP holders in.

GMX holders don’t have the same luxury of returns finding an equilibrium (aside from the burning of multiplier points, which likely won’t have that much effect). For them to get increased returns, the only way is more trading volume and fees.

If GLP holders are only earning 7% APR, I don’t see the incentive to stay involved, holding a basket of assets that, in reality, no investor would choose (in the tokens and weights of the pool), and earning only 7% interest in ETH for the risk (they would also get the upside from being the counterparty in traders, but that is minimal when considering how many GLP holders it is split between). Holders selling their GLP will bring the APR up for others, and allow the price to find an equilibrium. However, liquidity on the platform will suffer.

Tokenomics

The maximum supply for GMX is currently set at 13.25m, minting beyond this is possible, but controlled by a 28-day timelock and would require a governance vote. The split of these 13.25m tokens was due to be as follows (as discussed above, 1m of the GMX for the floor price fund will now be distributed as esGMX in rewards):- 6 million GMX from the XVIX and Gambit migration

- 2 million GMX paired with ETH for liquidity on Uniswap

- 2 million GMX reserved for vesting from Escrowed GMX rewards (this has already been distributed, there is a proposal to take 50% of the 2m for the floor price fund to bootstrap, more on this later)

- 2 million GMX tokens to be managed by the floor price fund

- 1 million GMX tokens reserved for marketing, partnerships and community developers

- 250,000 GMX tokens distributed to the team linearly over 2 years

Pricing on the Platform

Rather than using a supply and demand pricing model, GMX uses Chainlink oracles to price their perps. This is contrary to all competitors. Centralised exchanges and dYdX use orderbook pricing, which, whilst being a huge improvement on the price fluctuations seen in AMMs (like Perpetual Protocol), still prices as a function of supply and demand (and market makers tolerance).

By using Chainlink oracles, GMX will always use the ‘true’ price of the assets, pulled from a range of centralised and decentralised exchanges. Traders can place orders of any size, and the price will not move.

This leads me to ask, what if there isn’t sufficient liquidity to match demand?

If there is excess demand in an orderbook or AMM market, price increase to reflect this and ensure trading is always possible (if you’re willing to pay the price). With GMX’s model, it’s possible for users to place a trade that the platform is simply not able to handle (as it has too little liquidity).

I didn’t find any information about what would happen in this scenario in my search, and can only assume that if pool utilisation gets very high, they would be forced to halt trading.

Fees

There is a 0.1% fee on opening and closing positions (charged against the notional size). This is much higher than competitors, with dYdX and centralised exchanges charging considerably less than half that.Assets

The range of assets available is a major drawback for GMX, and one that I see no way around. Due to the design of the platform, any asset that is supported must also form part of the GLP pool.

This means GMX will likely never be able to offer a wide range of assets, and simply can’t add assets according to trader demand. There are potential routes around this, but until we see a tangible and proven answer, I don’t see how GMX can compete (outside of the structured product market) with the likes of dYdX (excluding a black-swan event of failure by dYdX).

Liquidity, Volume and Open Interest

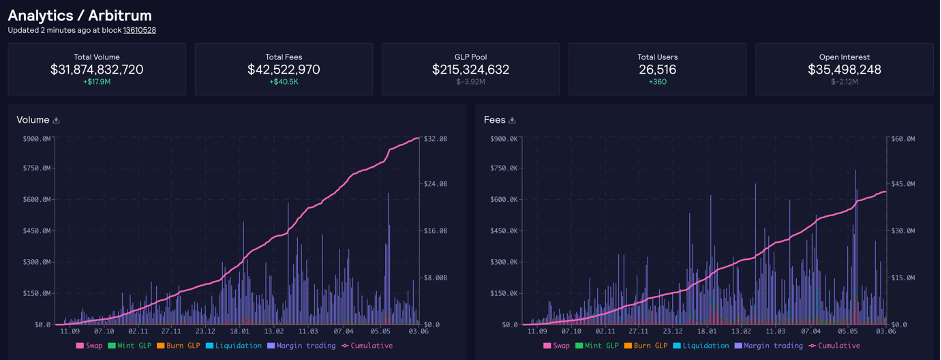

The split is about what you would expect between Arbitrum and Avalanche, as seen below.

Volume and fees on Arbitrum are slightly upward sloping, whereas for Avalanche they’re slightly downward. This is an effect of the layer 2 narrative we are seeing and is likely to get more extreme in the future.

The charts we see above are promising, with volume and fees on both (more so on Arbitrum) rising at a steady rate despite harsh market conditions.

Pool Utilisation

Below you can see the composition of each GLP pool (Arbitrum, then Avalanche, available refers to the amount in the pools):

We can see there is a high percentage of stablecoins in both pools, and a focus on them, ETH and BTC, with alts having much smaller percentages. This is a consequence of what traders want, rather than by design for GLP holders, however, it’s definitely better that way with the current market conditions.

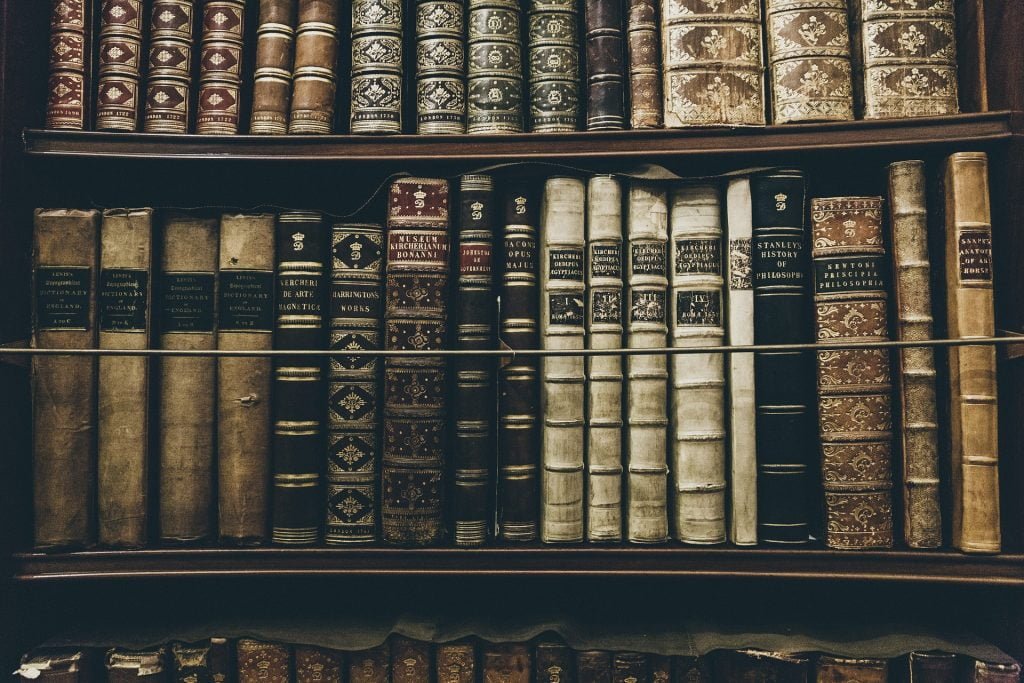

Below we have the utilisation of each asset in the pools (Arbitrum 1st, then Avalanche). The 1st number under “weight” is the current weight of the asset compared to the total of the pool, the 2nd is the target for the pool (which is used to calculate the dynamic fee):

On both Arbitrum and Avalanche, usage is relatively low. This tells us there is room for more trading activity without the need for additional liquidity, meaning returns could be higher for GLP and GMX holders.

Composability and Integrations

The fact that GMX is built on Arbitrum and Avalanche means other protocols can integrate with it easily, giving an edge over dYdX when it comes to structured products and other possible integrations (like automatic hedging engines). They have already announced partnerships with Open Ocean, Yield Yak, Jones DAO, Vovo, Vesta, InsureAce.IO and DODO. I expect many more to come.The future of DeFi, in my opinion, relies heavily on interoperability and protocols connecting through code (money-lego’s), allowing efficiencies, returns and products/services that are simply impossible without DeFi. For more information check out our Why is DeFi So Damn Impressive article.

As an example of the possiblities, consider JonesDAO. They are integrating with GMX, using perps to increase returns and hedge risk in their structured product vaults. The returns and risk reduction possible through this partnership couldn’t be done without GMX (or a suitable alternative).

Another example would be an automatic hedging engine. There aren’t any I’m aware of yet, but when one is built, as GMX is EVM compatible, it could easily integrate, allowing GMX users to choose a specific level of downside protection when they trade perps.

The other side of this argument is that StarkWare, whose StarkEx blockchain dYdX is built on, has just raised funds at a massive $8bn valuation, StarkWare's valuation was %242 billion.) (in a private VC round). It uses zero-knowledge proofs, which are widely considered the future of scaling solutions, and has the potential to be a disrupter in the space. If that does happen, dYdX will be ahead of the curve, as one of the first applications using the tech.

Smart contracts and source code are all available here.

Flight to Safety

One consideration is flights to safety, and what impact they could have. For example, if a black swan event takes place, either within the GMX ecosystem, or to an asset the GLP pool holds, and we see a rush of people selling GLP, what would happen?

A potential scenario is: Fees rise as people sell, disincentivising selling or, at worst, making it pointless (as fees would take such a large amount of the value). This would protect open positions on the platform by ensuring there is liquidity to back them. However, GLP value and trust would be eroded, likely triggering even more of a flight to safety, where holders see the value falling, and want to get out ‘whilst they still can’, at any cost.

GMX does have protection against this being an end-game scenario, such as GLP being tradable only on the GMX platform and the dynamic fee, which makes it impossible for all the liquidity to exit the platform, or GLPs price to fall due to mass dumping on the secondary market. Clearly, though, it would be a very negative situation

Conclusion

GMX has some clear flaws, the lack of assets available for trading, with no clear resolution, considerably higher fees than competitors, and the untested market-making model (and everything else that goes with it) being the main ones.

esGMX currently forms the majority of rewards going to GMX stakers and GLP holders. When these run out (end of 2022 – early 2023), if trading volume on the platform has not significantly increased, this will have a major impact on both the price of GLP and GMX, and liquidity on the platform.

esGMX will begin unlocking in September 2022, adding selling pressure to an already poor market. Alongside this, the team has around a year runway (cash available to cover expenses), if the bear market lasts longer, they will need to sell GMX (likely in the form of esGMX) to raise funds, which adds additional pressure to the token.

GMX has a unique and innovative approach to market-making with GLP, but the issues of this model are clear, and I struggle to see it sustaining long-term against competition like dYdX.

GMX could create a niche and capture the DeFi ‘money-legos’ market, integrating with a range of protocols (as discussed above). However, as the battle between layer-2’s and alt layer-1’s heats up, it is hard to choose a winner. If StarkWare manages build through this bear market and take market share from the likes of Arbitrum and Avalanche, as well as build a portal for EVM protocols (so they can move over easily), that niche would be at risk.

Falling trading volume due to market conditions, with no clear ending in sight, as well as GMX’s high valuation and speculative nature, are a big risk factor (especially if these market conditions stay long-term).

The major selling point for GMX right now is the fact that it is the only major perps exchange that shares fees with token holders. This draws in investors, but doesn’t change any of the above. If dYdX successfully decentralises and begins sharing fees, and StarkWare becomes a major player in the layer-2 wars, that could mean the end for GMX.

In summary, GMX is an extremely interesting and innovative platform, treading where no one has before. However, there are many drawbacks, unknowns and potential issues. If the protocol had a low valuation that would be acceptable, but with its fully diluted value at almost $200m, I would not feel comfortable investing in the protocol at this stage, especially not during a bear market.

Sit tight and watch developments is my advice. It’s not out, just on the bench.

History of GMX – What is Gambit?

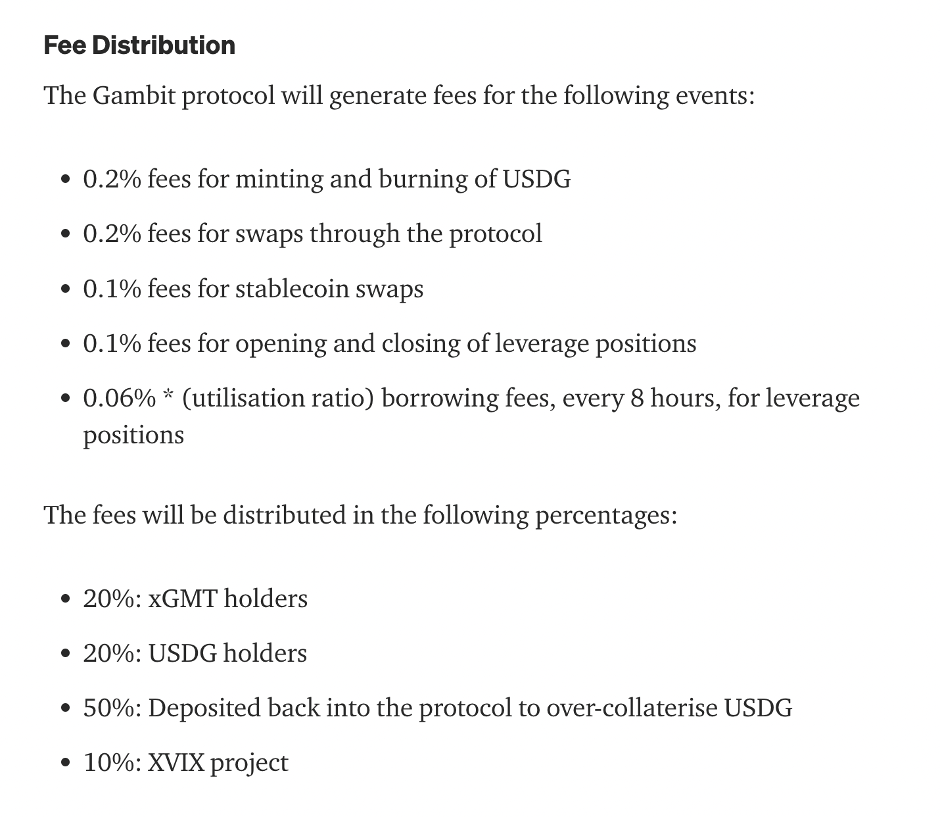

GMX was previously called Gambit and was on Binance Smart Chain. Introduced in Feb 2021 on their Medium, it was initially supposed to be a partially backed interest-bearing stablecoin, with the reserves used as liquidity for the swaps/perp platform (beginning with spot swaps, with the intention to introduce perps later on).

Supposedly this system would offer a large and liquid range of assets (from the stablecoin reserve), allowing anyone to open a long position with no slippage or spread. Fees would be generated through trading on the platform, as well as minting and burning USDG (the stablecoin). A portion of these fees would go to pay the interest rate of the stablecoin, with the majority kept within the system to increase liquidity.

Gambit testnet was launched in April 2021, in the article, they discuss the fact that Gambit creates a new method of providing liquidity without impermanent loss. It was stated that the interest-bearing stablecoin may not be using the protocol to its full potential. This is where discussions about changing and furthering the protocol began, although at that time, it was only a discussion about exploring the potential of USDG further.

You can see the distribution of the token, GMT, here. At launch, GMT had a fully-diluted value of $5m. For the “sake of regulatory compliance”, tokens that earn fees from the protocol “should be given free of charge to network participants”.

It seems that this wasn’t realised at the time of the GMT sale. At the launch of GMT, it was stated that the tokens are governance tokens, which manage the distribution of protocol fees. Which seems to suggest they would have a claim on those fees.

Seemingly as a workaround, and to bootstrap liquidity, Gambit donated xGMT tokens (the fee earning token) to anyone who provides liquidity to the GMT/USDG and xGMT/USDG pairs. At this point, USDG was still a major part of the plan. The fee distribution from the protocol at that time can be seen below:

But, what is the XVIX project? The intricacies of the project are out of the scope of this report, however, it is a project from the team behind GMX, and was designed as a floor price fund, which is one of the characteristics we see in GMX (more on this later). **

USDG and Gambit mainnet went live on 28th April 2021, as per this Medium post, and between then and 5th May 2021 the protocol handled $61,448,803 of trading volume and collected $79,826.79 in fees.

On June 21st Gambit posted the Gambit Migration, announcing the merging of all XVIX, XLGE, GMT and xGMT tokens into one single GMX token, as per this governance proposal (this also goes into great detail on why they made the switch, so worth a read if you’re interested).

This was the beginning of GMX as we know it! Based on Arbitrum, the contracts launched on 7th July 2021, with GMX’s price at $2 (the conversion rate for holders of the old tokens).

USDG was still a major part of the platform at this point, as you can see in the governance proposal. On 30th June, Gambit partnered with UniDex to provide leverage markets to traders.

Soon after, on 6th July, Gambit introduced GMX Tokenomics Part I – which was the birth of GMX. Explaining that USDG was problematic, and introducing GLP – GMX’s liquidity pool asset (this will be explained later). At this time, USDG was still live on BSC. There is no announcement about the end of USDG, and it is unclear what happened, but It seems that Gambit/GMX phased out USDG, allowing 1:1 redemption on Gambit. Note, the Gambit platform does not support any swaps or activity apart from allowing holders to sell their USDG at par value.

If you’re interested in what exactly USDG was and how it worked, check out this article. If you scroll down there is a section covering the stablecoin in-depth (but not considering the extensive risks).

GMX Tokenomics Part I introduced all the aspects of the platform we know and will cover today, including GLP, esGMX, multiplier points, and the renaming of the platform, from Gambit to GMX.

July 9th saw GMX Tokenomics part II released, introducing the GMX floor price fund, and on the 14th GMX was deployed on Arbitrum.

Welcome to the world, GMX!

Update Since Deep Dive Was Published (10/08/22)

GMX x Arbitrum Odyssey

See what the Arbitrum Odyssey is, and why it’s a potential goldmine, here.Essentially, it’s a series of tasks, and after you complete each, you’re rewarded with an NFT. We, along with many others, believe this will be a deciding factor in the rumoured Arbitrum airdrop.

After another protocol dropped out, GMX is now a feature in the Arbitrum Odyssey, meaning one of the tasks will be trading on the platform.

The Odyssey has been paused until Arbitrum Nitro is live, as the excessive load on the network was causing inflated gas prices, and it wasn’t showing the network in a positive light.

This is set for the end of August, and we expect the Odyssey to resume early September.

X4

X4 is the newest update to GMX, involving a new AMM (automated market maker) that gives pool creators and projects full control over the functions of their pool. This innovative approach is something we haven’t seen before.Usually, when a pool is created, the creator has limited control over its functions. X4 will create an AMM that allows custom behaviours, such as setting fees to any percentage, easy changing of fees, and different fees for different actions (such as buying or selling). Projects can pay LPs in a single token, rather than the standard mix of tokens. Check out this article for full details.

A hugely interesting concept, and one we’ll update on once it is out in the wild.

For the time being, this has been put on the back shelf, with GMX focusing on Synthetics…

Synthetics

GMX plan on using synthetic assets alongside the PvP (person v person) market-making model created by X4. This allows any asset with a Chainlink price feed to be traded, including real-world assets such as oil, gold, currencies, stocks and anything else.Essentially, the PvP AMM would allow anyone to create a market on GMX, and the synthetic assets allow markets for anything with Chainlink price feed.

GMX Cash Runway

In the GMX deep dive, we mention the fears around GMX’s cash runway – the team have taken notice of these rumours, and answered with the below:“Since there have been some questions on the long-term sustainability of the project we feel it is appropriate to address them here. The team currently has ~1.8 million held in USDC, this is sufficient to last 18 months till March 2024. Within 2022 we aim to continue growing trading volumes, and with the PvP model we may propose directing a percentage of fees to a treasury.

For example, if the PvP AMM is launched in about three months, the product can be left to run for a while and 10% of fees can be directed to a treasury at the start of 2023.”