Deep Dive: Inside the Latest Perp DEX Wars

Something interesting is happening in decentralised perps. Hyperliquid’s breakout year opened the door, and now a full ecosystem is stepping through it. New players, new models, and new opportunities are emerging all at once. In this report, we take you through the real story behind the Perp DEX Wars. LET’S GO!

In this report:

- Background Into Perp Wars

- Money-Maxi Mindset

- Hyperliquid’s strongest competitors

- Money-Maxi Mindset

- Cryptonary’s Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Background

Perpetual futures (often called perps) are crypto derivatives that let traders speculate on price movements without owning the underlying asset. Unlike traditional futures, they never expire, allowing positions to be held indefinitely as long as margin is maintained. A funding rate mechanism keeps perp prices aligned with spot markets, making them one of the most efficient tools for expressing market views.

A new cohort of competitors has emerged, including Lighter, Paradex, Aster, Backpack, Extended, and others, each pushing distinct execution models, incentive structures, and user funnels. Their coexistence has turned perps into one of the most hotly contested arenas in all of crypto. We think competition doesn’t imply replacement in this case. Multiple venues can expand the overall market, and traders benefit most when they evaluate opportunities objectively rather than attach themselves to any single protocol.

Most of crypto is still vaporware wrapped in narratives. Perps are not. They have unique product market fit, they produce real cash flow, and they are one of the few categories in DeFi that would survive even if incentives disappeared tomorrow.

Going Deeper in Perp Wars

Hyperliquid continues to define the upper tier of the decentralized perp ecosystem. Its user base, liquidity depth, and execution environment still place it ahead of every competitor, making it the most complete venue for traders operating at scale.What has changed is the landscape around it. A new wave of perp DEXs has introduced real competitive tension driven by differentiated architectures, aggressive incentive cycles, and zero-fee models that naturally attract retail and mid-size traders. Institutional flow, by contrast, concentrates on venues where depth, predictability, and execution quality have already been proven.

The result is the kind of segmentation that emerges as a sector matures: multiple high-performing venues, each capturing different user cohorts and optimizing for different trading behaviors.

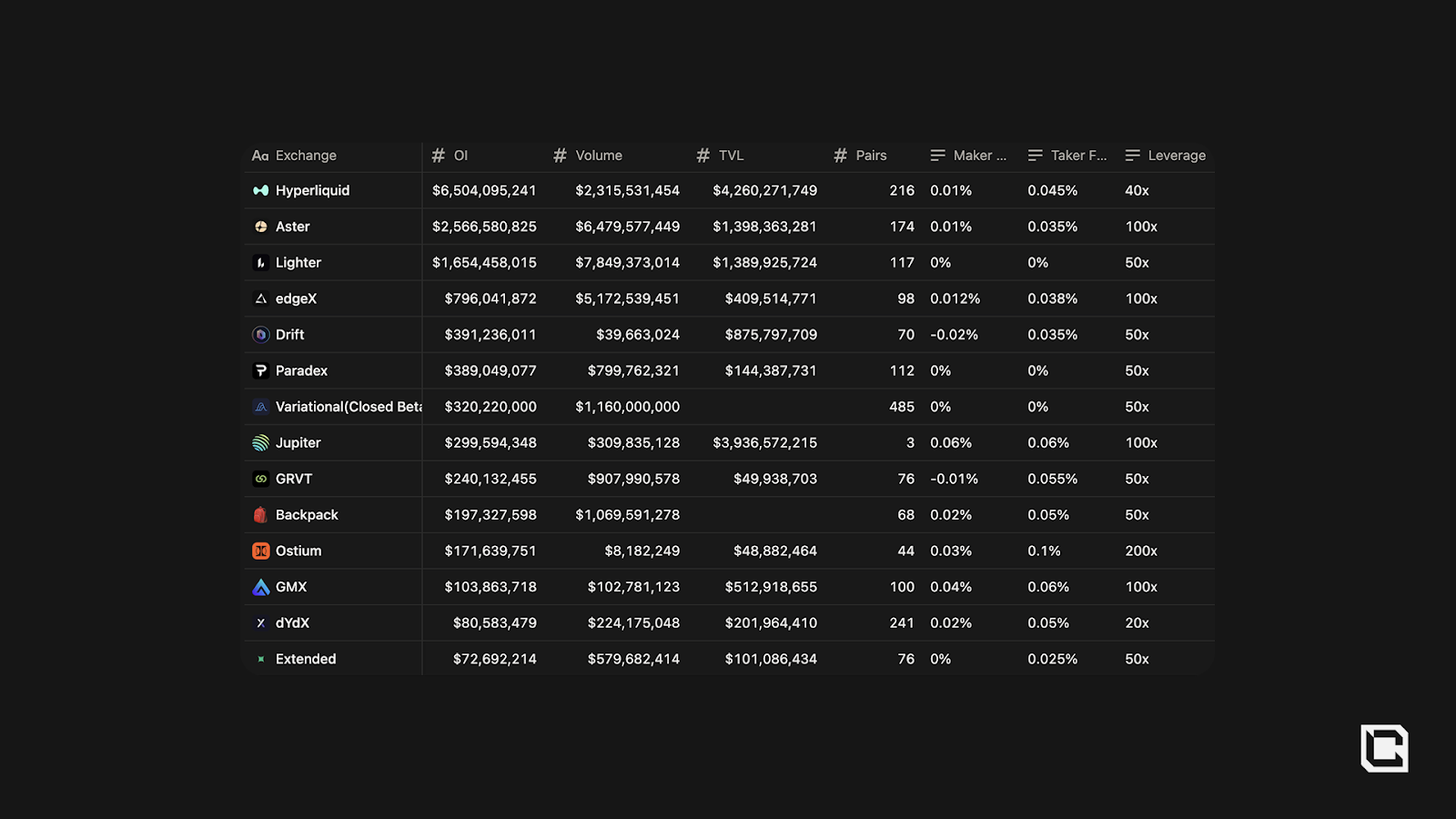

Despite the noise circulating on social media, the structural data tells a very different story. When measured by Open Interest and TVL (these metrics are far harder to distort than raw volume), Hyperliquid remains the dominant venue in decentralized perps. Zero-fee environments can inflate volume figures (e.g Lighter or Paradex), but open interest and capital commitment provide a clearer signal of where traders actually operate at scale.

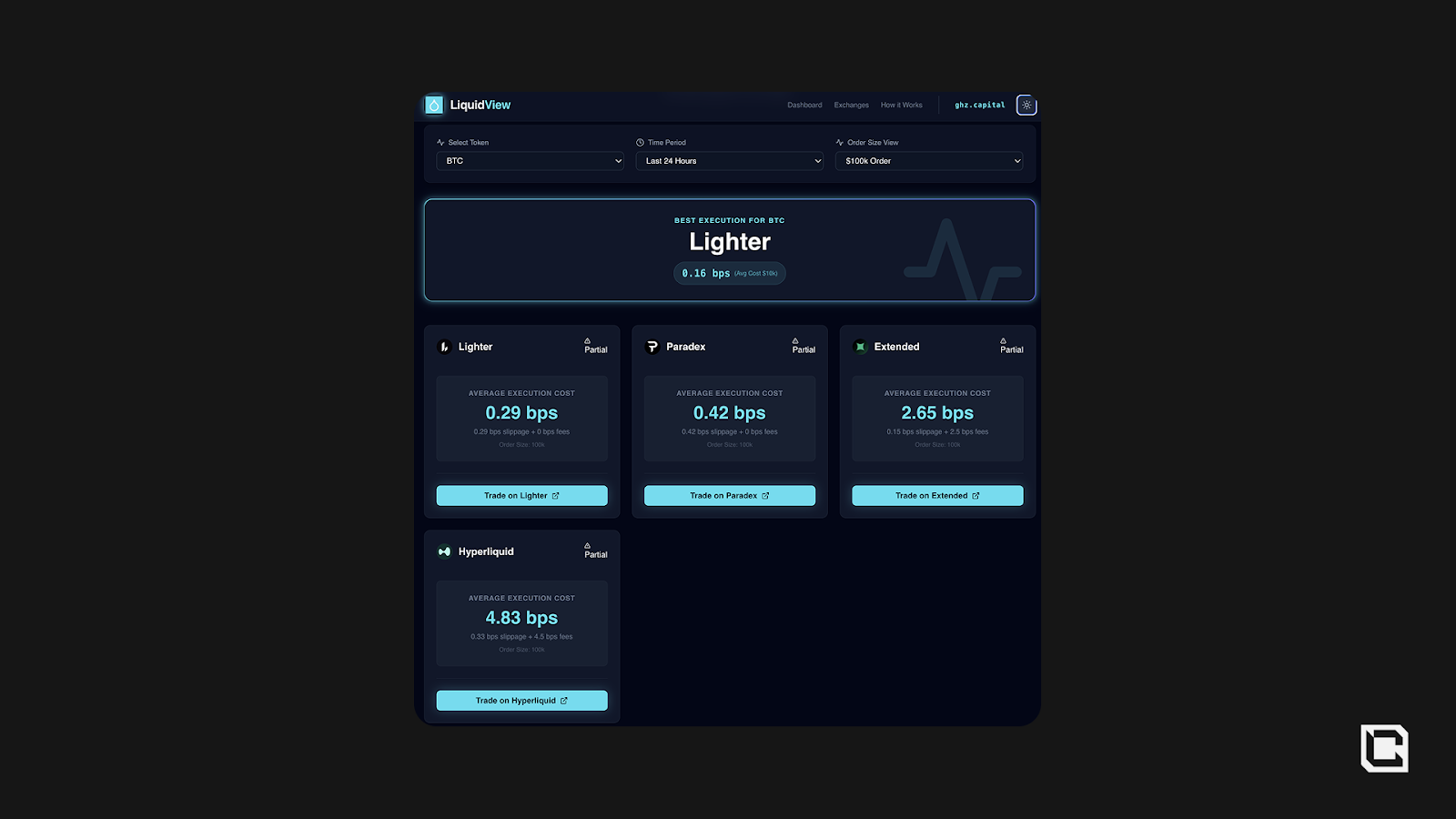

But competition is still fierce, and the differences become obvious once we compare how these platforms handle actual trades. LiquidView benchmarks show that for 100k USD BTC orders, Lighter typically costs around $2.9 to fill, while the same order on Hyperliquid is closer to $48, mainly because of taker fees. A $100k order is not small, and this cost gap naturally pulls in retail and mid-sized traders who benefit most from cheaper fills.

Paradex and Extended post equally respectable execution profiles relative to their own depth, which is why both remain legitimate farming opportunities within any growth oriented portfolio.

Our internal tooling flagged these protocols early for exactly that reason. None of this undermines Hyperliquid’s position for traders who move real size. It simply clarifies why flow is fragmenting in a way that maximizes expected value across different participant groups.

Looking at the competition at the infrastructure level, Hyperliquid’s architecture remains its strongest advantage. Its custom L1 offers one-block finality, a fully expressive EVM, and a unified environment that can support everything from advanced vault strategies to native stablecoin systems. This creates a financial stack that rollups still struggle to match in terms of composability and cohesion.

Lighter takes a very different approach. Built as a custom ZK rollup anchored to Ethereum, it delivers extremely high throughput, proof-based settlement, zero gas fees, and fast execution for retail traders. The tradeoff is that Lighter’s ecosystem is younger and has not yet been tested at the scale required by large institutional traders, even though its order books are already competitive for retail and mid-sized flow.

Both models succeed at different ends of the liquidity spectrum and together they expand the footprint of decentralized derivatives rather than cannibalizing it.

Beyond these two, other venues such as Aster, Extended, Paradex, Backpack, and several emerging rollups are pushing their own architectural variations: some leaning heavily on incentives, others experimenting with execution layers or settlement pipelines.

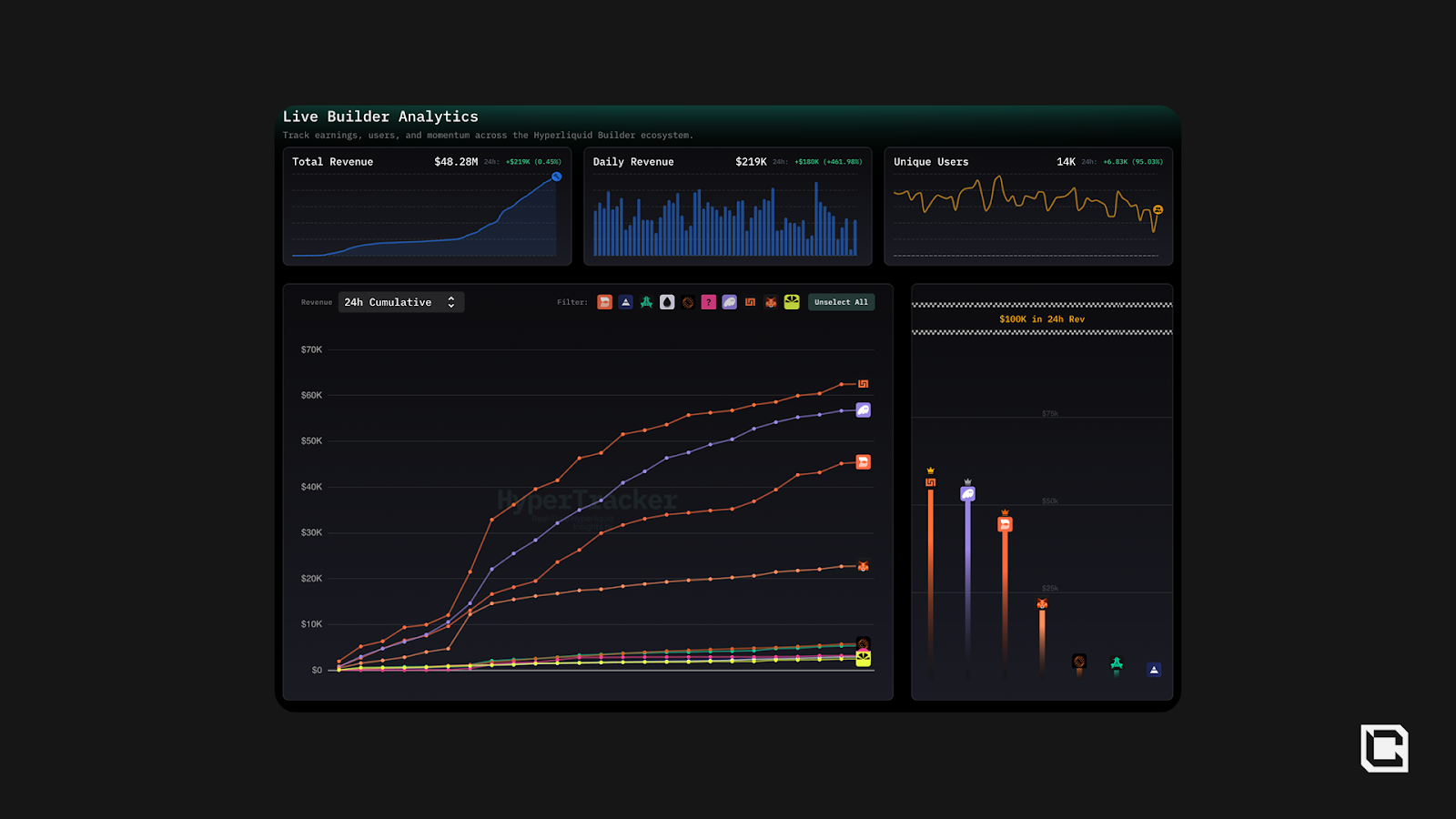

As competition intensified, Hyperliquid responded by strengthening one of its most effective structural advantages: Hyperliquid’s Builder Code system. This mechanism has quietly become one of the strongest moats in the ecosystem. Builders earn a share of the revenue generated by users who trade through their codes, creating a self-reinforcing loop where active communities, influencers, and tool creators are directly aligned with Hyperliquid’s growth.

The top codes now generate meaningful daily income, and the cumulative trajectory continues to climb. This alignment transforms external distribution into internal retention: every builder who commits to Hyperliquid becomes a long-term promoter, onboarding funnel, and liquidity magnet.

This type of creator-aligned flywheel mirrors the growth loops that powered platforms like Amazon Marketplace and YouTube, where contributors became the platform’s most powerful distribution engine. No competing venue currently offers a model of this scale in crypto, and it will take time for alternatives to replicate the depth of this flywheel.

Hyperliquid strengthened this position even further with the introduction of HIP-3 markets, which expanded the platform beyond crypto-native assets into fully on-chain equity markets. This matters because it transforms Hyperliquid into a multi-asset derivatives environment rather than a single-category venue. Traders can keep capital concentrated within one ecosystem while accessing a broader set of instruments, increasing retention and deepening liquidity across the board. Hyperliquid is becoming a solid threat to Robinhood 👀

Why Hate Each Other: The Money-Maxi Mindset

The tribalism surrounding these differences among perp platforms (especially Hyperliquid and Lighter) mirrors the same pointless rivalry seen between SOL and ETH communities. People build narratives around their bags rather than data. Hyperliquid loyalists “clown” Lighter as farm-driven and propped up by incentives. Lighter users mock HYPE unlock volatility and current price action while others mock high funding fees for trading equities.None of this reflects how professional traders operate. Retail follows incentives because that is rational. Market makers operate on any venue where spreads, rebates, and incentives create edge. When you get too attached to one protocol, you miss opportunities happening right in front of you. The money-maxi mindset beats the tribal-maxi mindset every single time.

But…Dominance Isn’t Permanent

History illustrates the danger of ideological thinking. DYDX once looked untouchable and was overtaken in under two years by protocols that iterated faster. This does not imply Hyperliquid is at risk of being replaced. It is architecturally superior, more culturally aligned with traders, and more adaptable in how its ecosystem evolves. The lesson is that dominance is not permanent unless it is actively defended. The rise of competitors is a reminder of that reality.

Another signal worth monitoring is wallet inflow data. During Hyperliquid’s own TGE run-up, Arkham tracked several million dollars bridging into the ecosystem in anticipation of bidding on HYPE.

That flow did not determine the outcome, but it reflected how aggressively capital positions when it expects a structural opportunity. The same framework applies here. There is no guarantee the pattern repeats, but it is worth watching. History does not repeat perfectly, yet it often rhymes, and early inflow behavior can offer a cleaner read on positioning than social sentiment ever will.

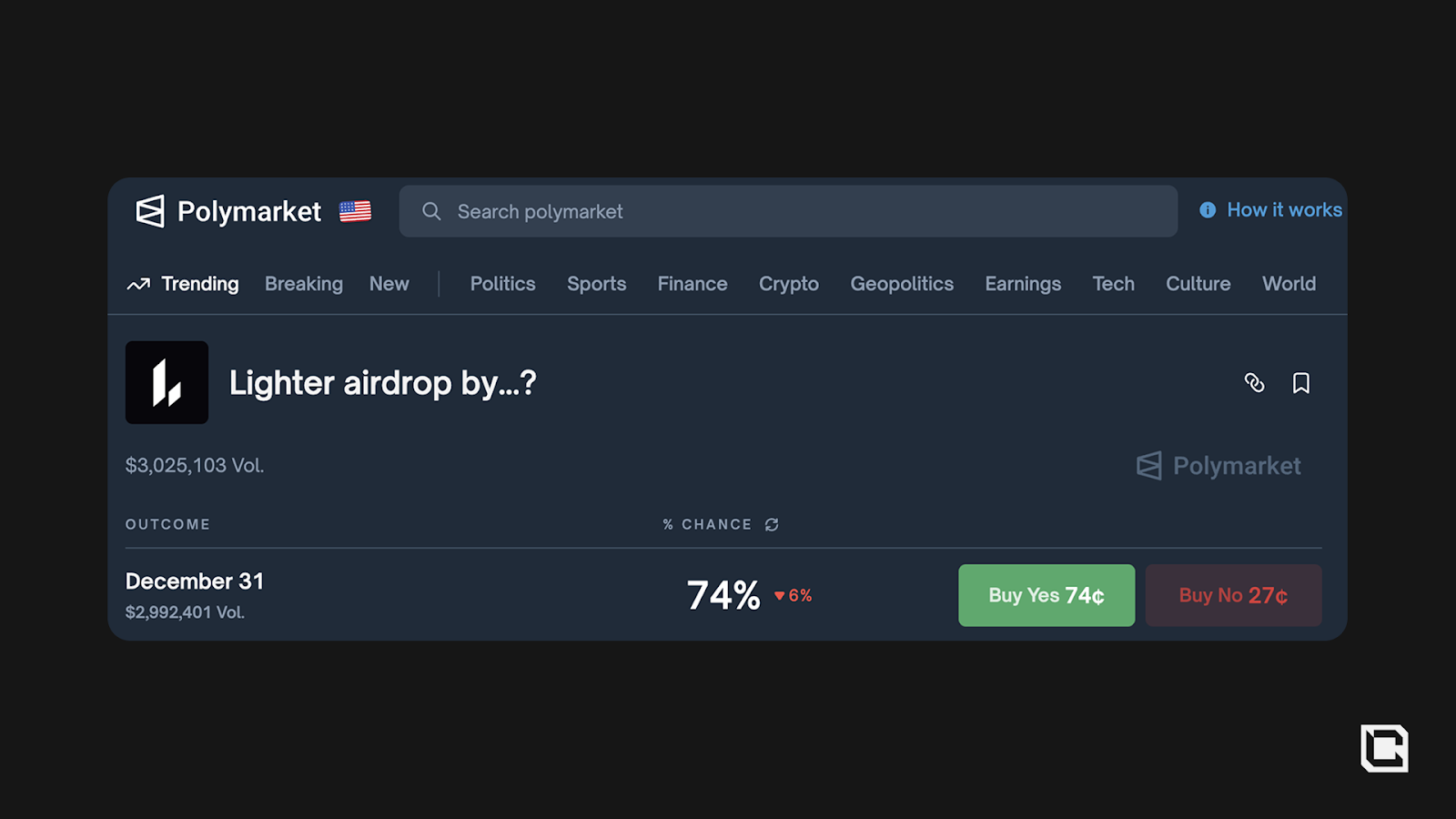

A final nuance worth noting is the emergence of an OTC market for Lighter points. Current OTC prices indicate that institutional buyers are willing to pay meaningful premiums for early allocations, with bids recently appearing near the 80 level for million dollar clips.

That does not guarantee any specific outcome at TGE, but it does signal that professional participants view the incentive cycle as materially valuable. As with all markets, prices reflect expectations. Those expectations can change, but the presence of real capital bidding for points reinforces why this cycle captured so much attention from sophisticated traders.

However, it is important to remember that Lighter raised $68 million, and VC unlocks will arrive. Post-TGE volume historically cools, and broader market pullbacks can compress valuations across all perp venues simultaneously. It will be interesting to see how all these competitors perform once they run out of incentives.

At the same time, not all VC involvement is inherently negative. Backers like Founders Fund, Haun, Ribbit, and especially Robinhood are not short-term mercenaries. Robinhood rarely invests in crypto, and when it does, it is typically with strategic intent rather than a desire to dump on retail. Their presence signals an ambition to grow the platform rather than extract from it. Hyperliquid, by contrast, carries no VC supply at all and continues to recycle real revenue directly back into the ecosystem.

The true test for Lighter is still ahead. The question is whether any significant portion of its current volume persists once the airdrop is complete. Hyperliquid passed this test. It sustained activity long after its distribution ended. Lighter must now prove that its own flow is sticky beyond incentives.

In the background, Hyperliquid received an additional structural tailwind. Hyperliquid Strategies Inc, a publicly traded DAT, authorized a $30 million stock repurchase program explicitly tied to increasing per-share exposure to HYPE.

This effectively creates persistent buy-side flow during periods where emissions or unlocks might otherwise weigh on price. Their objective is to maximise HYPE exposure for shareholders by deploying cash into accumulation. That is a rare alignment between a token ecosystem and a corporate entity acting as an on-chain liquidity sink.

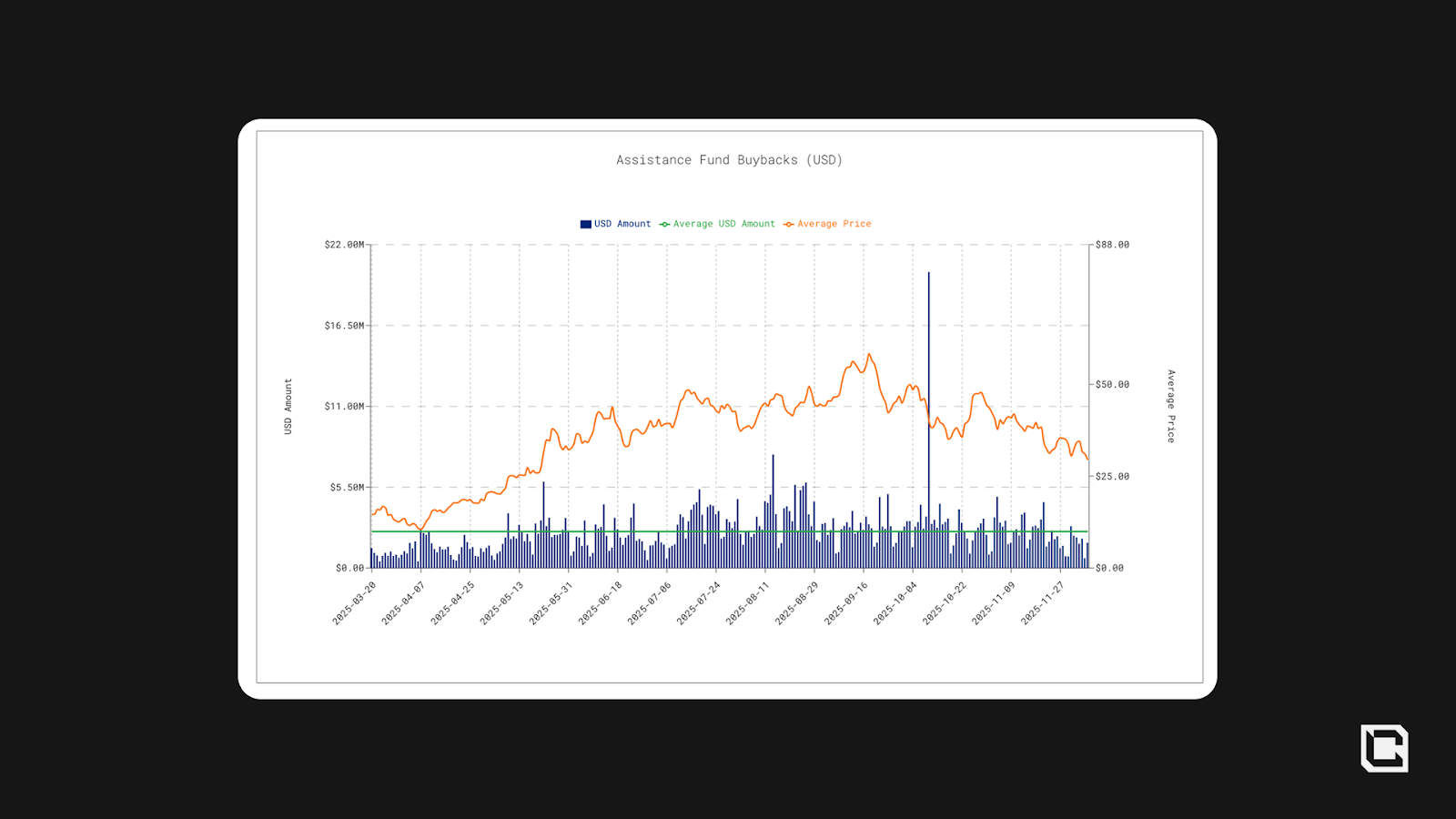

Buyback data of Hyperliquid is still strong. Even through volatility, Hyperliquid continues to recycle significant revenue into ecosystem support. It does not eliminate volatility, but it meaningfully shifts unlock periods away from one-sided sell pressure and toward a more neutralised balance.

The broader competitive frame still points to a shared enemy. Hyperliquid and Lighter are not truly competing with each other. They are collectively competing with Binance, OKX, and Bybit, which still dominate global derivatives through opaque liquidation engines, custodial exposure, and fee structures that extract from users. Every dollar of liquidity that migrates from centralized to decentralized venues strengthens the entire sector.

Hyperliquid remains the most complete, most resilient, and most institutionally aligned decentralised perps venue at the moment. The rise of Lighter and others does not weaken that. It strengthens the ecosystem by forcing innovation, increasing optionality, and proving that real competition has finally arrived. Traders who understand this dynamic will extract far more value than those who cling to tribal narratives.

Hyperliquid’s Strongest Competition: Lighter

If there is one protocol reshaping the competitive dynamics for Hyperliquid, it is Lighter. Lighter’s introduction of a true zero-fee trading environment is the centerpiece of its strategy. Retail traders immediately gravitate toward it because fee drag disappears entirely, but the deeper insight is that the model is economically coherent. The protocol routes flow through partners capable of monetising order flow on their side of the stack, allowing Lighter to operate without charging users directly.

Unlike Hyperliquid, Lighter has (for better or worse) some serious backing. Founders Fund, Ribbit, Haun, and Robinhood do not typically cluster around short-lived incentive farms. Robinhood’s involvement is especially notable. They make very few direct crypto infrastructure investments, and when they do, it is usually tied to long-term distribution strategy rather than opportunistic venture exposure.

Robinhood founder Vlad Tenev publicly congratulating the team during mainnet launch was not a casual gesture. It signaled support for a model that aligns with how Robinhood already serves its retail base. If deeper integration ever materializes, Lighter gains something the entire DEX sector has lacked: a ready-made, mainstream on-ramp.

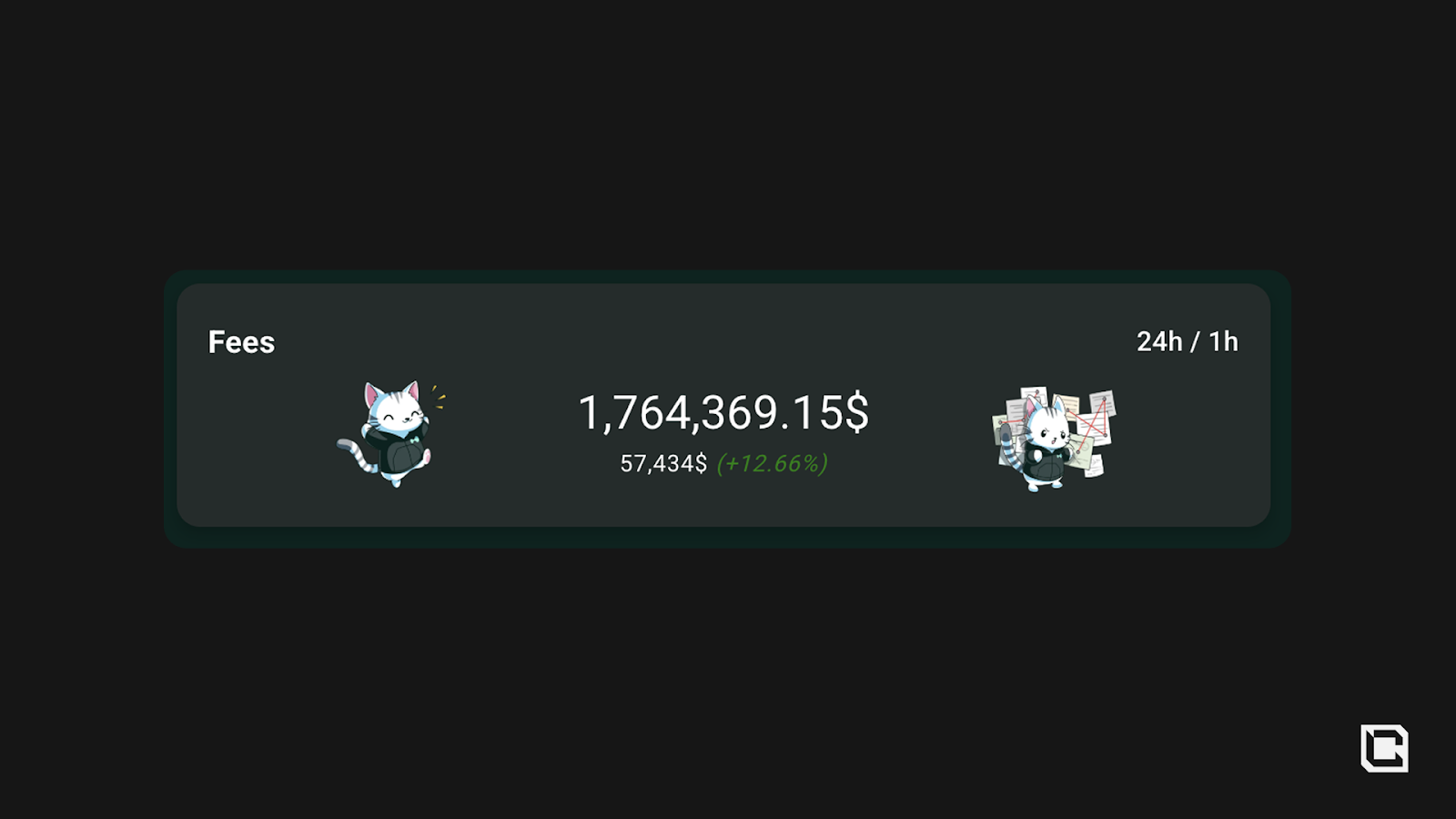

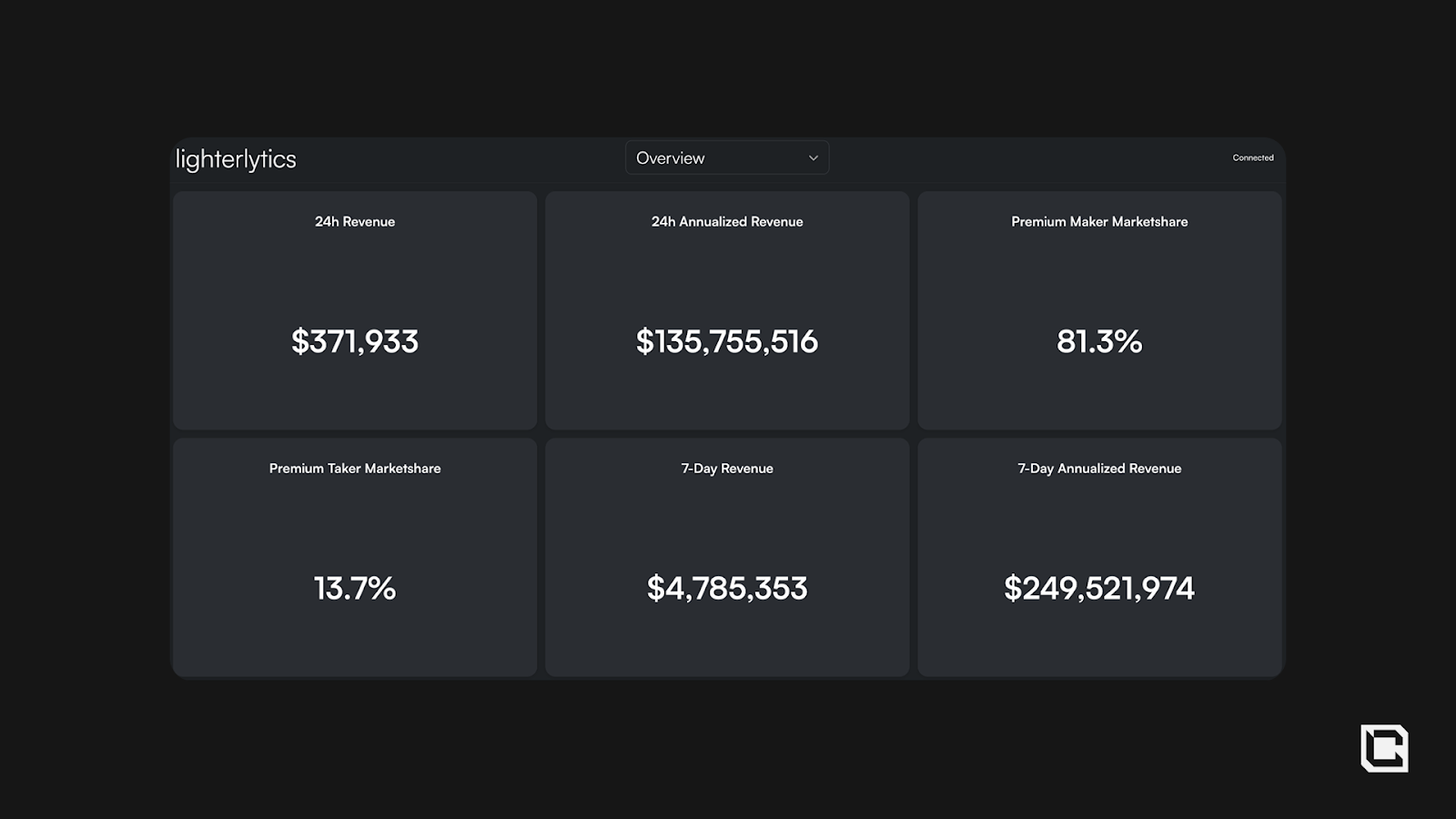

The revenue data shows that the model is already functioning at scale. Daily revenue sits in the mid-six-figure range and annualises comfortably into nine digits. Maker share north of eighty percent indicates that sophisticated liquidity partners are participating, not just incentive farmers. For a venue that only recently exited private beta, the throughput and monetisation trends are unusual in a positive way.

The next phase is the real filter. Lighter is benefiting from one of the most straightforward, high potential airdrops of the year, and participation reflects that. What remains to be seen is whether volumes hold once the airdrop is complete.

The Broader Perp DEX Arena

Despite us focusing on mostly Hyperliquid vs Lighter, the story extends far beyond Hyperliquid and Lighter. A genuinely competitive landscape is emerging, with multiple venues testing new models, new incentive structures, and new ways to capture trader attention. Perps have become the most fiercely contested arena in crypto because they are one of the few categories with real product market fit. The result is a landscape that is deeper, more experimental, and more opportunistic than anything traders saw in previous cycles.

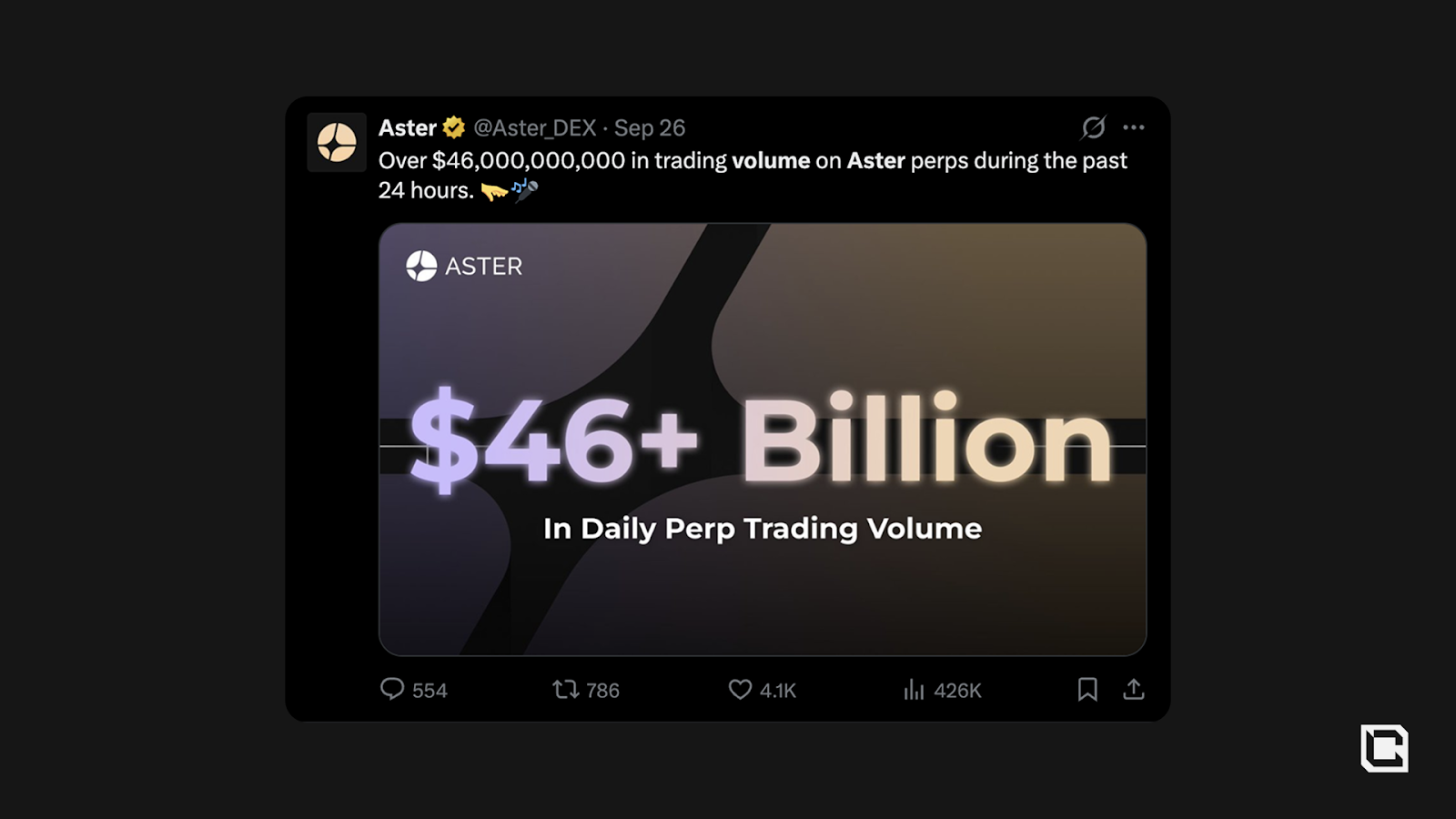

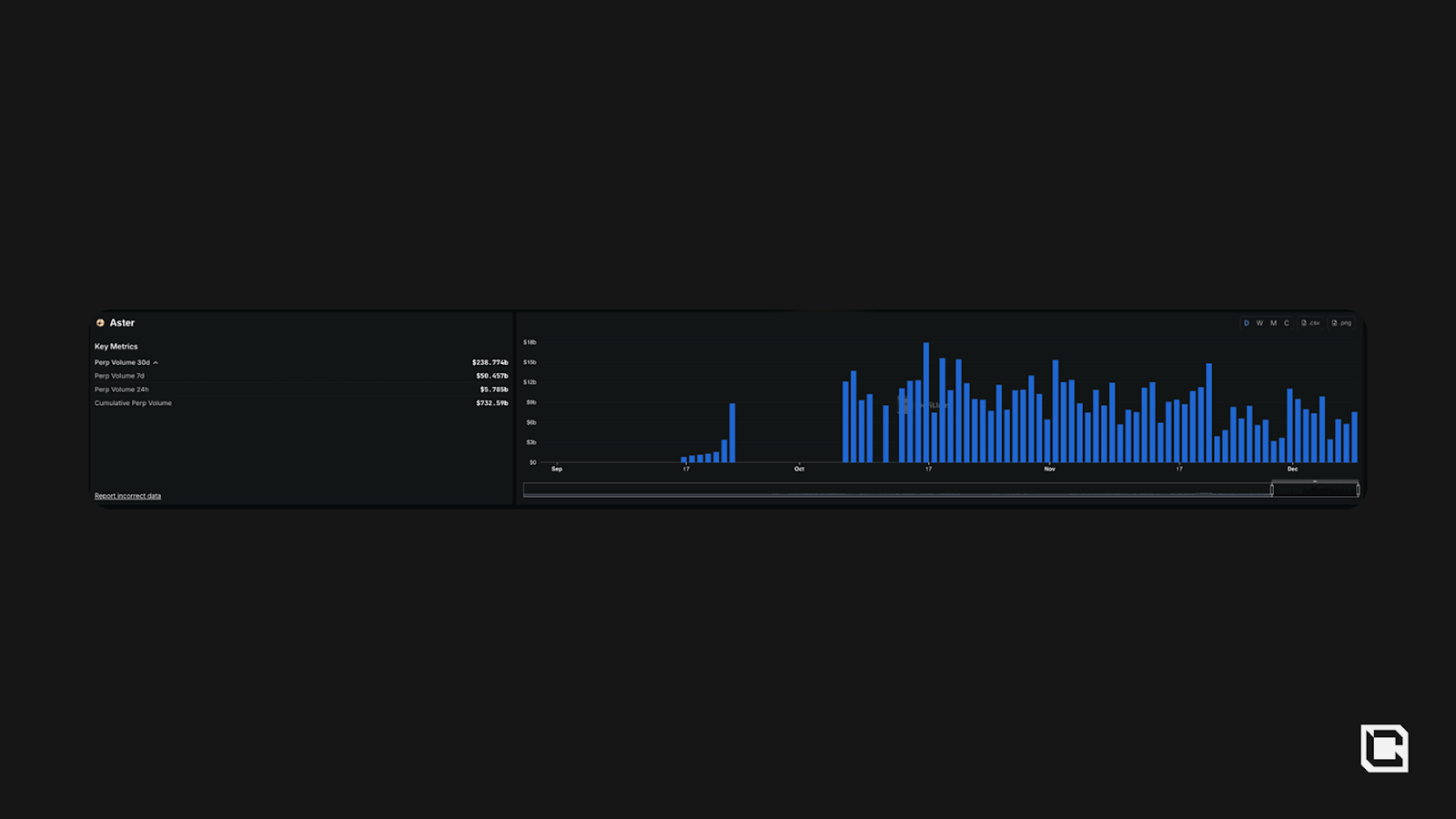

Aster showed how extreme incentive cycles can still get. The airdrop season produced massive headline volume, including days where they reported over forty billion dollars traded. The numbers sparked plenty of controversy, and skepticism around wash trading was justified. But the episode demonstrated an important truth: incentive driven flows still move fast, and once the rewards shrink, so does the activity. Aster’s arc is a case study in mercenary capital rather than sustained market share.

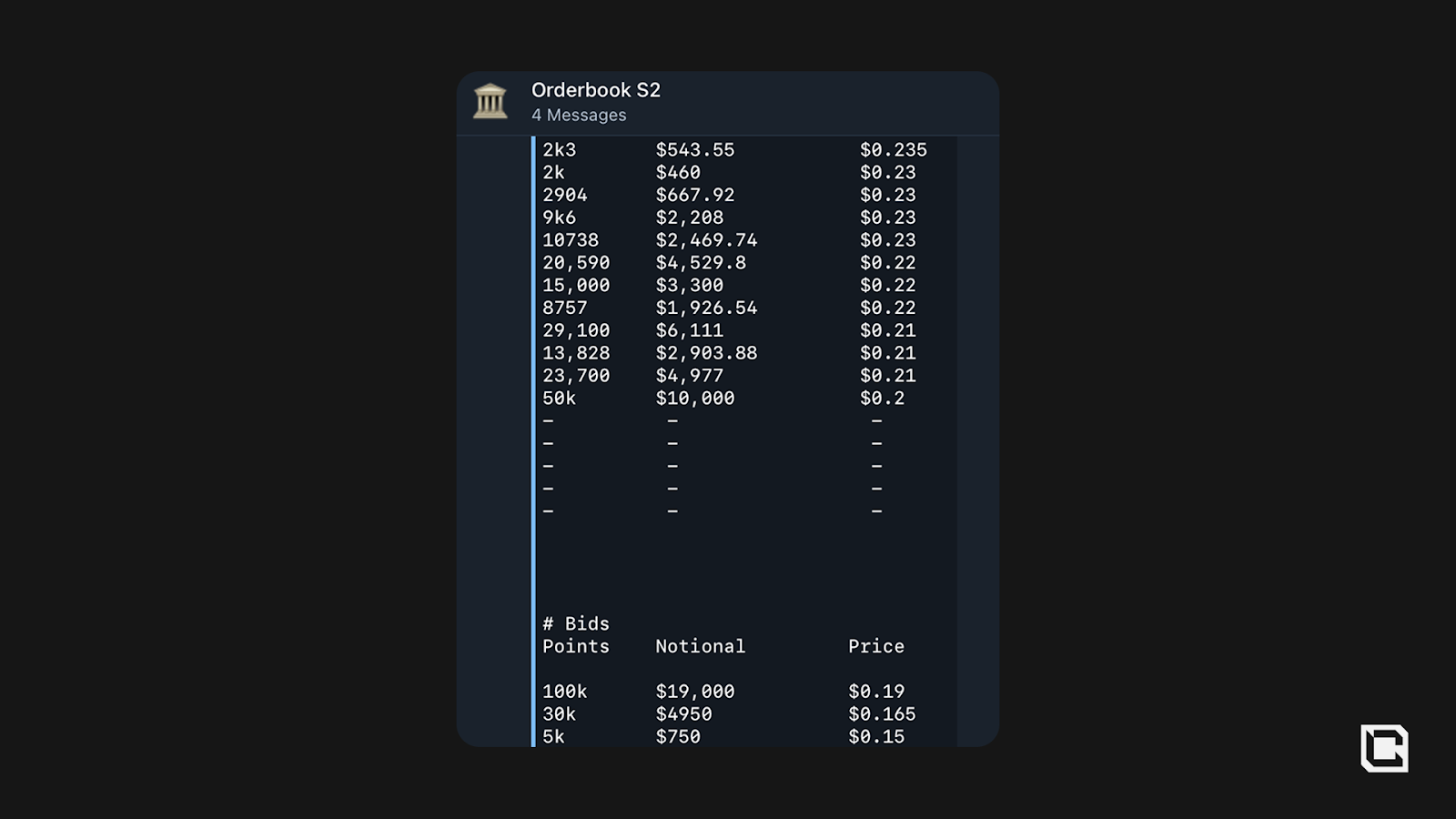

Paradex offers a much cleaner example of opportunity. Their zero fee model mirrors Lighter’s and has quietly created one of the most efficient environments for farming. Paradex XP is transferable and currently sells OTC for around 0.20 dollars.

In practice, a trader generating $7 million in volume last week earned roughly 10 thousand XP, which could be offloaded for about 2 thousand dollars while also accumulating points from Lighter. With both venues charging zero fees, the cost basis for delta neutral trades is negligible. This is one of the most efficient EV loops available right now, and it remains underutilized by anyone still glued to a single platform.

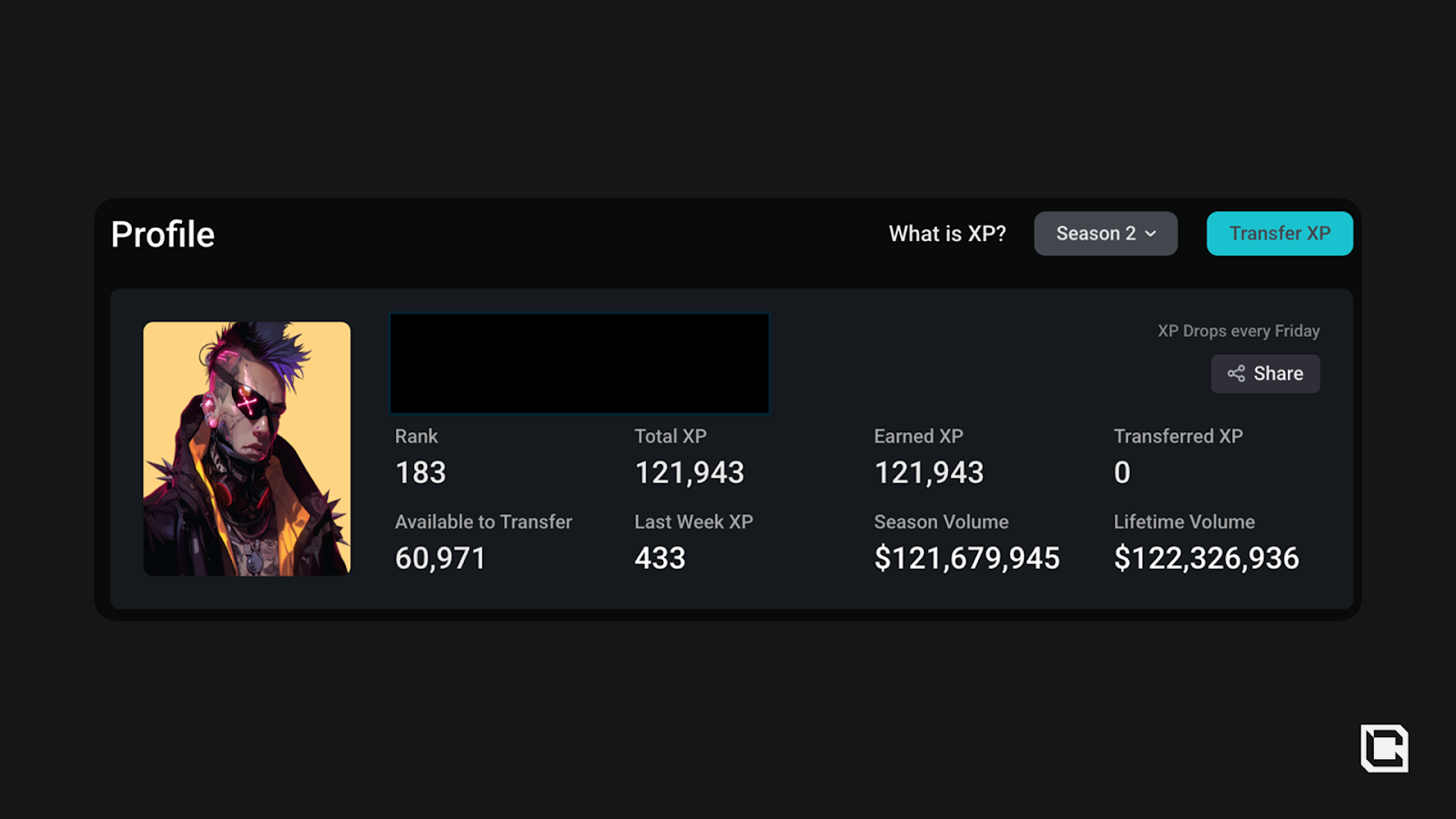

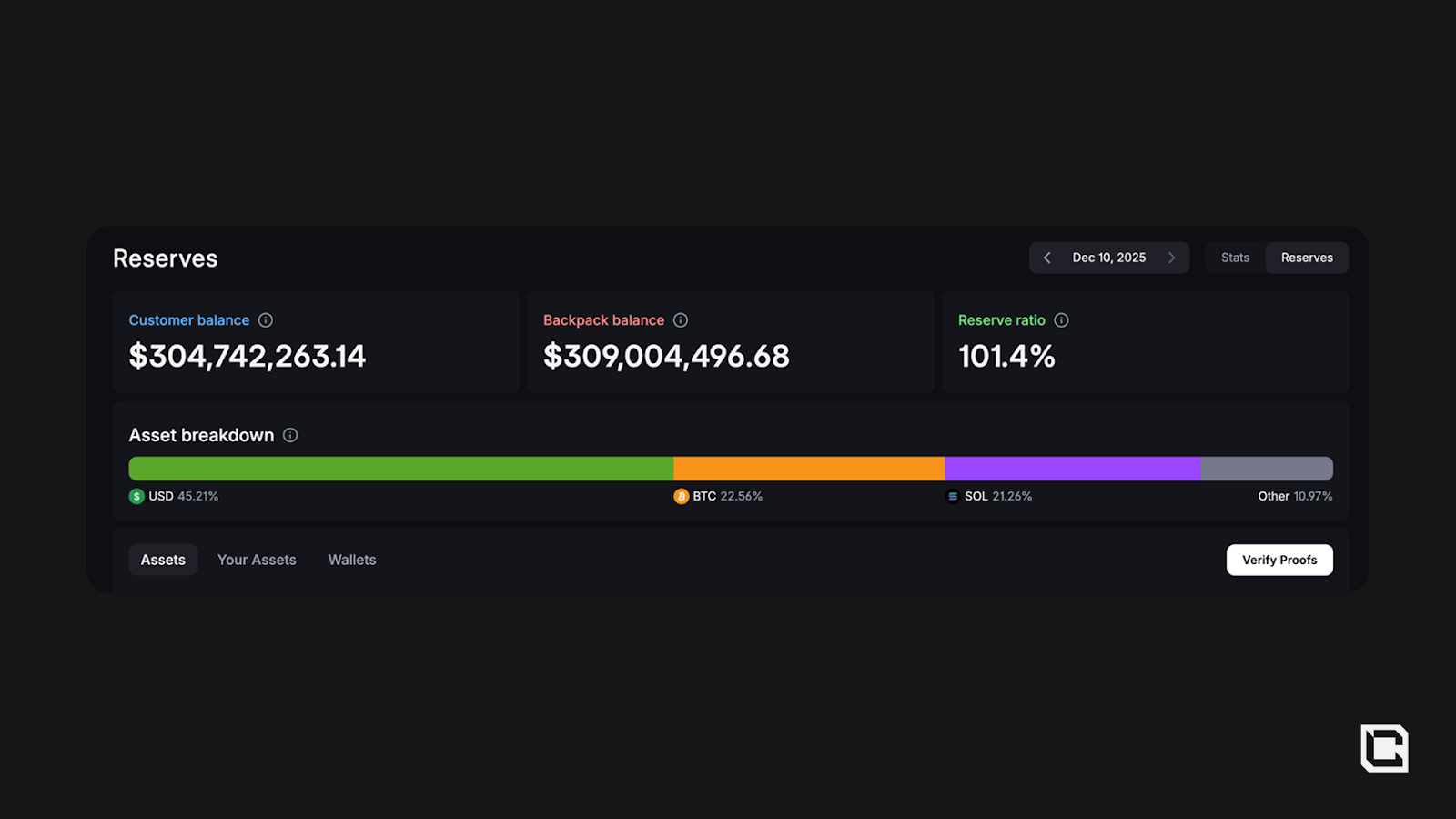

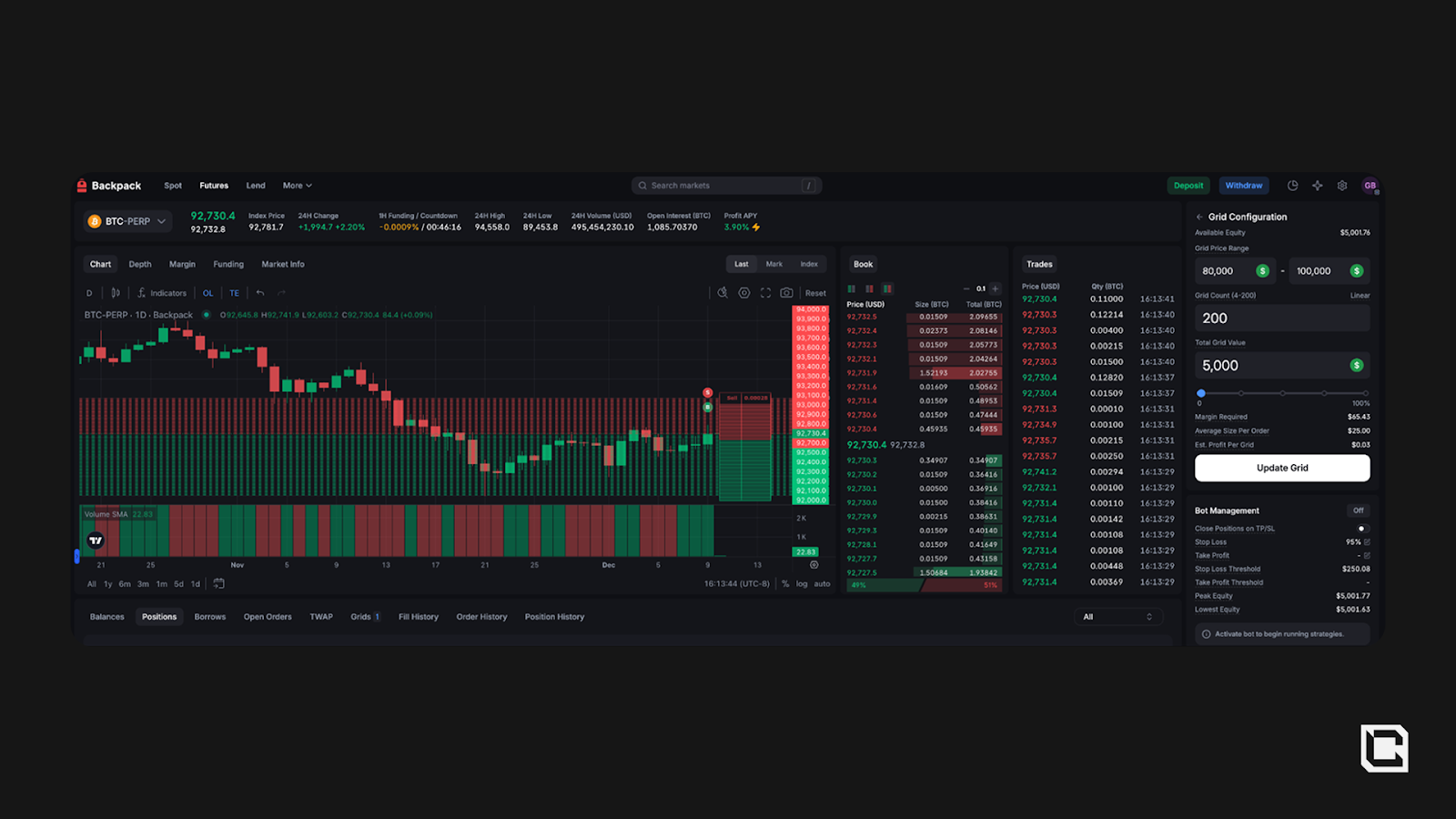

Backpack is pushing differentiation in a completely different direction. Rather than competing purely on emissions, they are building a CEX-quality experience on top of crypto native rails. They require KYC, which pushes them closer to a regulated exchange model, but they offset that tradeoff with one of the only true onchain proof of reserves systems in the industry.

Their integration of automated grid bots directly into the trading interface is another real edge. It gives everyday users access to quant-style tools that historically lived inside prop desks and systematic funds. With Backpack approaching their own TGE in a few weeks, these are the kinds of features that give users a reason to stay after the airdrop is over instead of rotating out the second rewards slow down.

There are plenty of other examples if you know where to look. Extended, Based App, Variational, GRVT and others have all created pockets of asymmetric opportunity around points, XP, and early liquidity. Most of them are probably better suited for a separate deep dive, but the pattern is the same. Incentives pull in flow, execution quality decides who stays, and the gap between those 2 phases is where serious traders extract most of their edge.

To conclude, among all these perp platforms we think Hyperliquid can remain the structural leader and still coexist with an expanding field of competitors. Lighter, Paradex, Backpack, and the rest are not threats to that position so much as they are additional sources of additional value in a market.

As a reminder, the job is not to pick a tribe. The job is to understand where capital is moving, which incentives are still mispriced, and how to convert that rotation into PnL without tying your identity to any single venue.

Cryptonary’s Take

Our long term stance on Hyperliquid has not changed, nor should it. The protocol still sits at the center of decentralised derivatives with the deepest liquidity, most reliable execution, strongest cultural base, and clearest economic alignment between users and builders. Nothing in recent market activity alters that structural reality.The emergence of new venues and incentive cycles is good for the whole space. It does not challenge Hyperliquid’s position but expands the opportunity set. Some incentive programs were strong enough to justify meaningful participation, and the additional value was undeniable. But engaging with those cycles is not a referendum on long term conviction. Hyperliquid remains the structurally superior venue.

The real test for new entrants begins after the incentives fade. Hyperliquid has already proven that activity can remain elevated even without a public points program. If newer venues can maintain meaningful volume once rewards decay, they earn a lasting place in the competitive landscape. If not, they fall into the category of incentive driven experiments. The data will decide.

The Perp DEX Wars may look like a battle for dominance, but they are not a zero-sum game. For example, Hyperliquid and Lighter can grow stronger together by expanding the sector, attracting new liquidity, and forcing each other to innovate faster. Lighter is not the only example either. Paradex, Extended, and other emerging venues all created pockets of opportunity. And in a market this directionless, where price action grinds sideways or bleeds slowly downward, opportunities like these matter even more. Competition sharpens execution, widens user choice, and accelerates the migration away from centralized venues. In perps, competition is the rising tide that lifts all ships.

Peace!

Cryptonary, OUT!