Deep Dive: What is happening with BNB?

BNB just crossed the four-digit threshold, hitting an all-time high of $1080. This milestone is more than just about its price. Behind the chart are deflationary burns, surging onchain activity, ecosystem growth into AI and RWAs, and the renewed shadow of CZ. Here’s the latest with BNB…

BNB's breakout above $1000 in September 2025 marks one of the most defining moments in its eight-year history. The coin, once dismissed as a simple exchange discount token, now anchors a thriving ecosystem spanning DeFi, AI, gaming, and tokenised assets. With a market capitalisation north of $140 billion and $4 billion in daily volume, BNB is now definitely more than just an exchange by-product, it is a core piece of the crypto market itself.

What makes this move different is the mix of deflationary burns, surging onchain activity, and institutional flows. In Q3 alone, BNB Chain raked in $357M in fees, DeFi TVL pushed toward $10B, and the token supply kept shrinking.

This report will dissect the forces behind BNB's rise, its price trajectory and deflationary burns, ecosystem and onchain fundamentals, CZ's (founder of Binance) evolving role, and the emerging trends that may define its next chapter.

So let's dive in!!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Historical Context & Price Trajectory

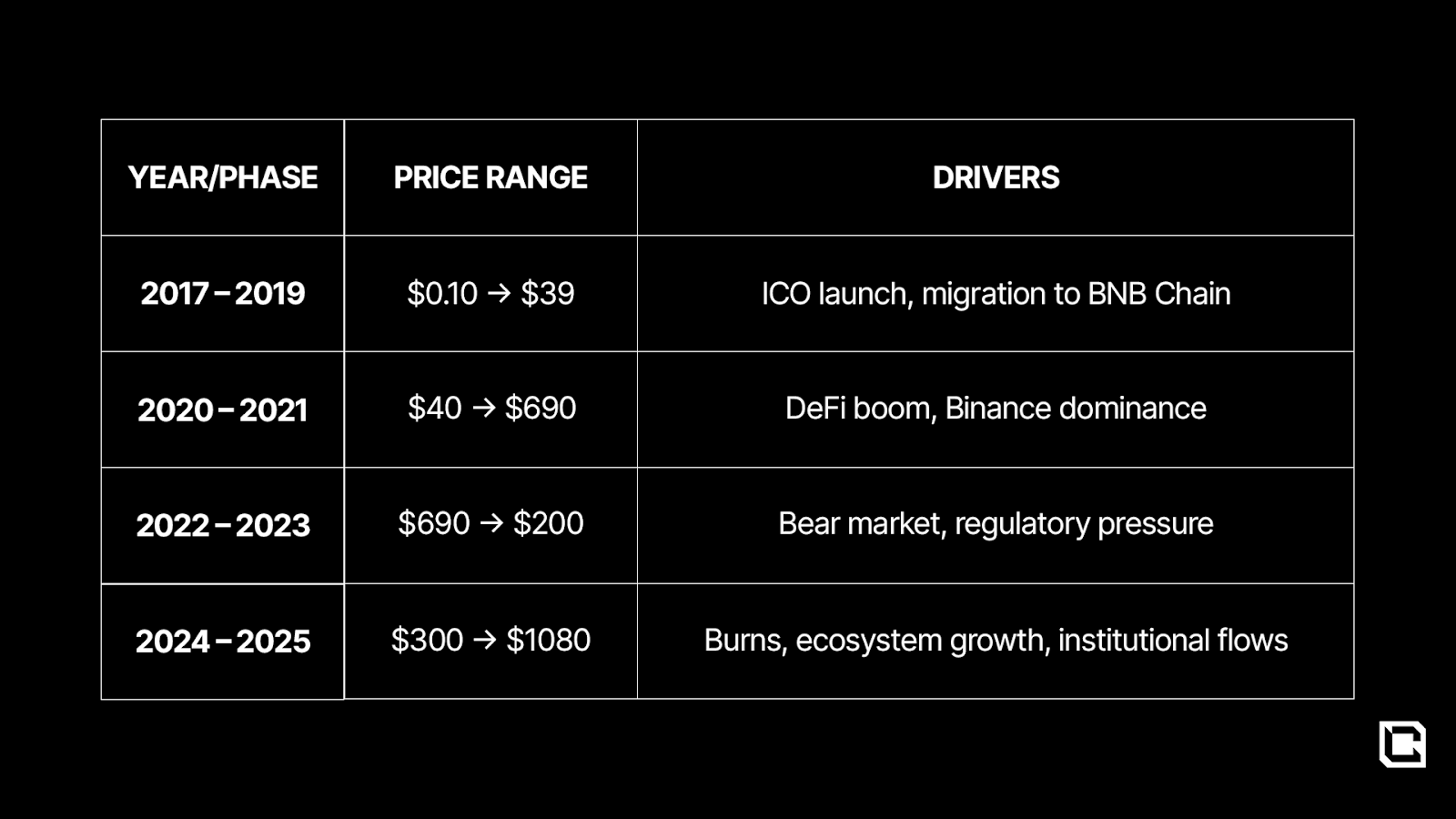

BNB's story begins in 2017 as a utility token for discounted fees on Binance. It quickly outgrew that role, migrating to its own chain in 2019 and becoming the backbone of one of crypto's largest ecosystems. The first real breakout came during the 2021 bull run, when BNB hit $690, riding the DeFi boom and Binance's dominance.The bear market of 2022–2023 was brutal. Regulatory battles, the DOJ settlement, and a shifting exchange landscape dragged prices as low as $200. Yet, the deflationary burn model and constant ecosystem upgrades kept BNB relevant. Unlike many exchange tokens that faded post-bull cycle, BNB maintained real usage and network effects.

BNB's price journey sets the stage, but its real strength lies beneath the surface. Let's dig into the fundamentals driving that engine.

Fundamentals: Utility, Burns & Deflation

The fundamentals are what keep the rally grounded for BNB's 4 digit breakthrough. Unlike most tokens that rely heavily on narrative, BNB is powered by three structural levers: utility across the ecosystem, a deflationary burn model, and institutional-grade adoption.More Than Just an Exchange Token

BNB began as a fee-discount token for Binance users in 2017, but today it functions across an entire multi-chain stack.- A gas token on BNB Smart Chain (BSC): Core hub for DeFi, NFTs, GameFi, and RWAs on Binance.

- A gas token opBNB Layer 2: High-speed rollup delivering sub-second blocks and ultra-low fees (~$0.005).

- BNB Greenfield: Decentralized data storage network, integrating directly with DeFi.

- Beyond Binance: Used in payments (merchants, cross-border remittances), staking for validators, and governance across dApps.

- Airdrops: BNB holders consistently receive airdrops from projects launching on Binance.

Deflationary Design: The Burn Engine

The single biggest driver of BNB's supply-side economics is its auto-burn program:- Since launch, 31% of supply has been permanently destroyed.

- Current circulating supply: 139M tokens (down from 200M initial).

- Burn Rate: 4.5% annually in 2025, among the most aggressive across large-cap assets.

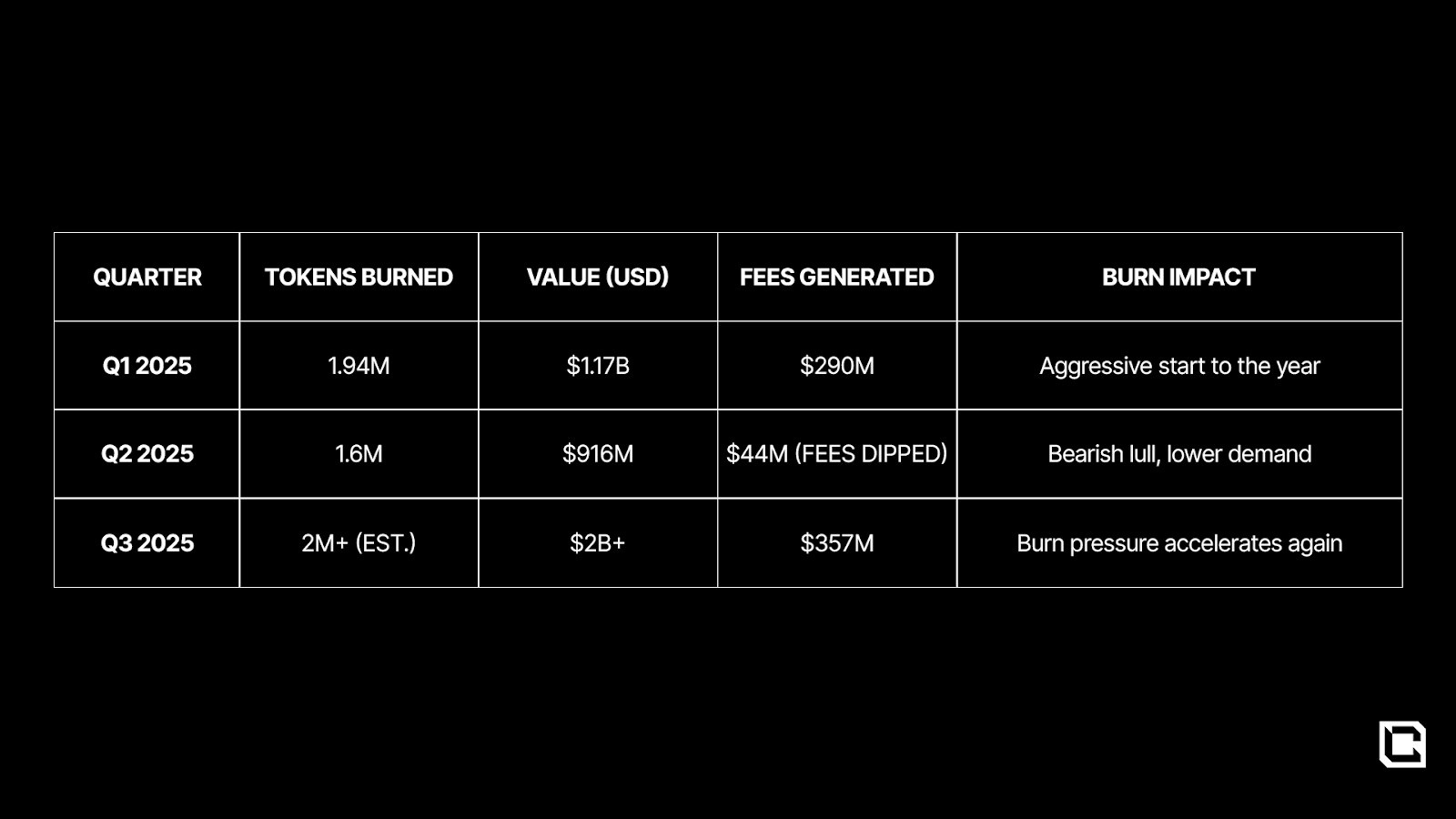

- Q1 2025: 1.94M BNB burned ($1.17B).

- Q2 2025: 1.6M BNB burned ($916M).

- Q3 ongoing: Estimates suggest >2M tokens burned, equivalent to >$2B.

The flywheel is simple: More activity → higher fees → more burns → lower supply → price support.

Institutional Confidence: Treasuries and Holdings

BNB has become a balance sheet asset for institutions, something few altcoins outside BTC/ETH can claim.- Over 30 institutions hold $1.2B+ in BNB treasuries (crypto-native firms, Asian fintechs, hedge funds, family offices).

- Q3 saw stablecoin inflows >$11B into BNB Chain, often used as collateral.

- Treasury adoption is rising because BNB's burn model makes it more predictable and supply-deflationary than most tokens.

Why This Matters

BNB has economic gravity. It burns its supply, it has a wide range of "utilities", and its institutional adoption validates it as more than a speculative play. This three-pillar structure explains why BNB, unlike many exchange tokens, has been able to sustain its march to $1000 and beyond.Price and supply tell one part of the story, but the real signal comes from the chain itself. To understand whether this momentum is sustainable, we turn to the onchain data, transactions, addresses, TVL, and fee trends.

Onchain Metrics: Activity & Growth

If fundamentals explain why BNB has value, onchain metrics reveal whether that value is being used. And in 2025, BNB Chain has gone from a high-volume, low-value network to one of the busiest and most lucrative chains in crypto.Explosive Transaction Growth

- Q2 2025: Daily transactions doubled to 9.9M (+102% QoQ).

- September 2025: Consistently averaging 13-14M transactions per day.

- This places BNB Chain neck-and-neck with Solana and Ethereum in throughput, while maintaining near-zero downtime.

- Gas fee cuts (to $0.01, with proposals to $0.005) have made it a magnet for micro-transactions and GameFi.

Active Users Surge

- Q2: Active addresses grew 33% to 1.6M.

- By September: 10–15M weekly active addresses, a 15% weekly growth rate.

- BNB Chain now records more DAUs than Ethereum, positioning it as the go-to network for retail dApps.

- Growth driven by DeFi protocols, meme tokens, and AI-linked apps.

Fee & Revenue Acceleration

- Q2 2025: Fees dipped to $44M during market retracements.

- Q3 2025: Surged to $357M, up 710% QoQ.

- For several days in September, BNB Chain outperformed Solana in daily fees ($1.1–1.4M vs. Solana's $0.85–0.95M).

- Fee revenue is now directly tied to burns, compounding scarcity.

DeFi & TVL Expansion

- TVL (Q2 2025): $9.95B.

- By September: $9.87–14.5B, depending on aggregation method.

- Major drivers: PancakeSwap (DEX volumes), Aster (Perp DEX) Venus (lending), and liquid staking protocols.

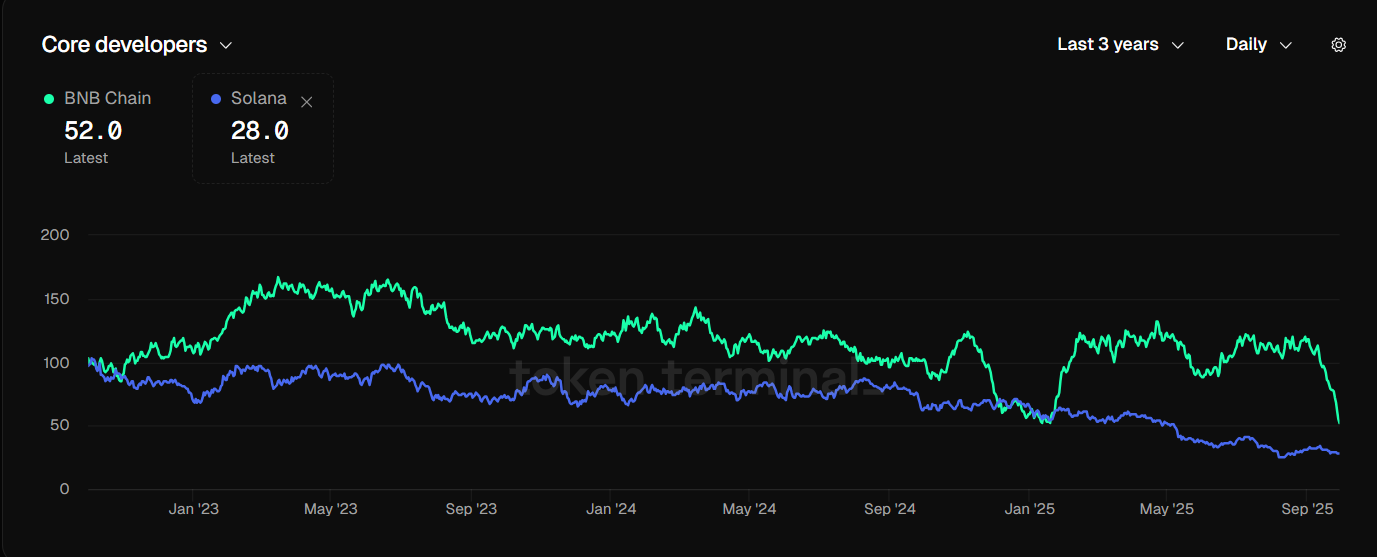

Developer & Ecosystem Momentum

- 1,471 dev events in 30 days, second only to Ethereum.

- Major upgrades (Lorenz & Maxwell forks) reduced block times to 0.75s, with proposals for 0.45s.

- Gasless payments and anti-MEV tooling gaining traction, improving UX.

- Ecosystem growth in AI, GameFi, and meme tokens driving sticky user bases.

Onchain, BNB Chain is firing on all cylinders: higher users, higher transactions, higher fee revenue, and deeper liquidity. Unlike in prior cycles where activity was inflated by bots or unsustainable yield farms, the 2025 surge reflects broader adoption, from institutions to retail gamers.

This onchain momentum is also the result of a broader ecosystem push, in DeFi, AI, GameFi, and tokenization, that's making BNB Chain one of the most versatile platforms in Web3.

Leadership & Governance: CZ and Richard Teng

BNB's rise has never been just about technology. It's equally a story of leadership, governance, and community trust. Few ecosystems in crypto are as tightly linked to their founder as Binance and BNB are to Changpeng Zhao (CZ). Yet, the baton of formal leadership now rests with Richard Teng, marking a shift from founder-driven narrative to institution-style governance.Changpeng Zhao (CZ):

- Founding Era (2017–2023): Built Binance from scratch, scaling it to the world's largest exchange by volume. BNB was initially a fee-discount token but, under CZ's "Build and Build" mantra, became the foundation of a multi-chain ecosystem.

- Legal Fallout (2023–2024): Faced U.S. DOJ and SEC actions, resigned as CEO, paid $50M fine, and served four months in a low-security facility. This shook market confidence but also removed a key overhang.

- Post-Release (2024–2025): Pivoted to philanthropy (Giggle Academy) and investments (YZi Labs, $10B AUM). His September 2025 X bio change, dropping "ex-@binance," reignited speculation of a return, boosting BNB sentiment by 5–8%.

- Influence Today: No longer CEO, but still the face of BNB. His posts on ecosystem upgrades and treasury plans move markets instantly.

Richard Teng:

Richard Teng stepped in as Binance CEO in late 2023 after CZ's resignation, bringing his background as a former MAS regulator. His arrival came at a time when Binance faced intense legal and reputational pressure. By prioritising compliance, negotiating settlements, and engaging regulators directly, Teng helped restore trust in Binance's operations and provided the institutional steadiness that the ecosystem urgently needed.Under Teng's leadership, the BNB ecosystem has not stood still. He oversaw key upgrades like halving gas fees and introducing sub-second block times, improvements designed to make the network more competitive with chains like Solana and Base. These updates reinforced BNB's long-term viability and showed that Teng was not just a figurehead for compliance, but a driver of innovation.

Market perception of Teng has been largely positive. Though he lacks CZ's charisma and cultural presence, he is widely viewed as the "professional face" Binance needed to reassure institutions and regulators. His leadership is seen as complementary rather than competitive with CZ's, Teng anchors Binance in credibility and compliance, while CZ, from outside, continues to provide cultural pull and symbolic influence over the ecosystem.

That said, centralisation risks still loom large. The top ten wallets hold nearly half the supply, and Binance continues to dominate critical infrastructure, making governance semi-decentralised at best. Even so, sentiment is overwhelmingly positive, reflecting broad confidence in both Richard Teng's regulatory steadiness and CZ's cultural influence.

Technical Analysis

BNB/USDT (Daily Timeframe)

BNB/USDT has been in a strong uptrend, with momentum building since mid-2025. From March 2024 until July 2025, the pair traded inside a broad consolidation range, bounded by resistance at $700 and support at $500. This year-long accumulation set the stage for a decisive breakout, which began to materialize between May and July 2025 as price reclaimed the 200-day EMA and sustained strength above it.By July, the rally accelerated, carrying BNB from around $600 (mid-range) to a new all-time high of $1,084, a gain of 70%. The milestone was significant not just technically but also psychologically, as BNB now trades and consolidates in four digits for the first time.

- Support Zones: Short to medium-term support sits in the $900–850 range. The 200-day EMA at $766 provides a critical structural floor if the broader market corrects.

- Upside Structure: Resistance is minimal as BNB is in price discovery. Future upside levels will be reassessed as momentum unfolds.

With strong structure above the 200-day EMA and solid accumulation behind the breakout, the bias remains constructive, though pullbacks into support cannot be ruled out.

BNB/BTC (Weekly Timeframe)

The BNB/BTC pair reinforces the bullish narrative, showing relative strength against Bitcoin. From 2022, BNB/BTC was locked in a downtrend. That trend persisted until July 2025, when price finally broke the long-standing descending trendline, coinciding with the breakout on the BNB/USDT chart.Since then, BNB has flipped the 200-week EMA to the upside and is now ranging between Level 2 and Level 3 (defined resistance and support zones on the chart). This breakout indicates a shift in momentum, with BNB beginning to outperform BTC after two years of underperformance.

- Support Zones: The 200-week EMA, sitting between Level 2 and Level 3, now acts as a key pivot. Holding this level will confirm strength.

- Upside Potential: A sustained flip of Level 2 into support would open the path toward Level 3 and Level 4, signaling continuation of BNB's outperformance.

Weekly RSI sits in the overheated zone (71) versus its long-term average of 57. This suggests the pair may need a cooling-off period or consolidation before another leg higher. Still, the structural break of the downtrend and reclaim of the 200-week EMA mark a significant long-term inflection for BNB relative to BTC.

Combined Takeaway

Both BNB/USDT and BNB/BTC charts point to a decisive shift in market structure. On USD, BNB is consolidating above $1,000 in price discovery after breaking a year-long range, with supports clearly defined at $900–850 and the 200-day EMA around $766.On BTC, the breakout from a multi-year downtrend and reclaim of the 200-week EMA mark the start of a new phase of outperformance, even if RSI suggests some cooling may be due. Together, the setups confirm BNB's technical strength in both absolute and relative terms, reinforcing the broader bullish thesis.

Risks & Constraints

BNB's push past 4 digits is impressive, but sustaining momentum means navigating the risks that still hang over its story. Fundamentals are strong, yet external pressures and internal vulnerabilities remain.Regulatory Overhang

The $4.3B DOJ settlement in 2023 didn't end scrutiny. Compliance, AML, and retail protections are still under the microscope, especially in the U.S. and Europe. Richard Teng's leadership gives Binance credibility, but fresh regulatory actions could restrict BNB's access to ETFs, institutions, or mainstream finance. Headlines alone have historically sparked volatility, leaving sentiment exposed until regulators give clearer acceptance.Centralisation Concerns

BNB Chain has made strides toward community-driven governance, with validators leading 2025 proposals like fee cuts and privacy tools. Still, the top 10 wallets hold ~50% of supply, and Binance controls core infrastructure. This concentration enables fast decisions but undermines decentralization narratives, leaving BNB discounted versus peers like ETH or SOL.The influence of CZ is still quite huge. He is one the richest men on the planet with an estimated networth of $79 billion. Betting on BNB is essentially betting on CZ.

Ecosystem Competition

BNB faces pressure from Solana's memecoin momentum, Ethereum's institutional dominance, and fast-moving L2s like Arbitrum and Base. Its edge, low fees, scalability, and exchange utility is real, but sustaining leadership requires constant upgrades and partnerships. Without them, BNB risks becoming a "fast follower" rather than a driver of innovation.The UIUX of the BNB ecosystem is not the best as well. Solana or Base are faster and dApps building on those chains have better user experiences. This is tough competition. However, the utility of BNB is so broad that even if BNB completely loses an L1 race, it is likely to still be alright, though underperforming.

Cryptonary's Take

BNB crossing $1,000 is proof that deflationary design, ecosystem expansion, and cultural confidence can coexist in one asset. The chain is producing real fees, the burns are working, and institutional capital is no longer ignoring it.Risks remain, from regulation to competition, but the story here is of a token that has matured from an exchange discount voucher into a deflationary engine powering one of crypto's most active ecosystems. Every cycle has its leaders, and in 2025, BNB has forced itself back into that conversation.

We'll keep tracking this closely in our Market Direction tool coverage.

For now, the message is simple, BNB is building a foundation that could carry it far beyond. The momentum is alive, and the energy in this ecosystem is electric. We are carefully evaluating whether we should include BNB into our picks, but we are still waiting for broader clarity on the market. Most importantly, we want to be confident that BNB will outperform BTC from here.

Therefore, stay tuned!

Cryptonary OUT!