It's like living through a new industrial revolution.

Time and time again, the naysayers feel ridiculous, and the same goes for every piece of technology that has ever been invented in the history of man.

But these things take time to build and for the final concept to come to fruition.

Some might even argue that there is no such thing as the final concept; did the Wright brothers ever anticipate man on the Moon?

But we digress. Web3 is constantly developing, and it's our job to keep you updated with the latest scoop.

Let's dive in!

Key questions

- Is Chainlink's latest move setting it up to become the gold standard for cross-chain communication? A major Wall Street player's involvement hints at something big.

- What's shaking up the THORChain ecosystem? A new wallet is turning heads, but what does it mean for existing players?

- How does Injective attract heavyweight partners in a bear market? The latest collaboration could open doors you didn't even know existed.

- Are these protocols really "building through the bear," or is it just hype? We dig into the data to separate substance from noise.

- What do these developments in cross-chain tech mean for the future of DeFi? The answer might surprise long-time crypto enthusiasts.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Chainlink

In April, Chainlink announced that CCIP (Cross-Chain Interoperability Protocol), a messaging service similar to LayerZero, is now open to any developer. Chainlink operates on basically every chain in some form and is the only real contender to LayerZero in terms of scope and function.

Chainlink is constantly adding to its already significant network. The latest integration with Starknet represents another chain, another source of traffic, and another ecosystem that will likely become dependent on Chainlink data feeds:

However, it is not just blockchains that Chainlink is targeting.

BlackRock has partnered with Fidelity to provide data, emphasising Chainlink's reach and the reliability of its data streams.

This connection, in particular, is huge. By garnering support from one of the largest funds anywhere on the planet, Chainlink has opened the door for further partnerships with other huge players. In Law, you have cases that set precedents or standards. Chainlink is positioning itself to become THE standard for data feeds.

THORChain & THORSwap

We're accustomed to THORChain shipping things, but we have a few updates to add to the scope of this report. Of course, if something game-changing happens within the THORChain ecosystem, it will be worthy of an individual report, so keep an eye out!But for now, let's discuss all things THORChain!

Firstly, we'll discuss price action.

As we know, the market has been relatively down over the last few months. We know that the price of RUNE is inherently tied to:

- Liquidity in the protocol.

- The value of the assets in the protocol.

In terms of recent developments, there are a couple of things we can touch on…

Vultisig

There's a new competitor to THORWallet in town.Vultisig is a cross-chain wallet that utilises THORChain's infrastructure to facilitate swaps. It will have a token, $VULT. Rather than beat around the bush, they have been relatively upfront about what the token will be used for:

- To raise capital to accelerate the product during its bootstrap phase.

- To buy users and AUM as quickly as possible using an Airdrop.

- To provide incentives to contributors to build the product.

- To allow anyone to support the adoption trajectory of the product.

Everyone does this, but most fling around terminology that makes them sound more attractive than they are to collect bank from degens, like a devious Pied Piper.

Tell me what you will use my money for, then actually use it that way - I'm much more likely to buy your token if I can't sniff ulterior motives.

That's not to say they won't just do the usual BS, but at least there's a more reasonable "don't expect huge gains" in their narrative.

To test the token contract, Vultisig launched a meme coin, $WEWE…

Buy it, don't buy it - mostly irrelevant.

The essential pointer here is the marketing angle, which lends credibility to the team - they know what they're doing.

Here is a key list of features for the wallet:

- Cross-chain swaps (obviously).

- Co-signing - manage one wallet with multiple devices.

- Spend limits, CA whitelisting, and DeFi integration.

THORSwap

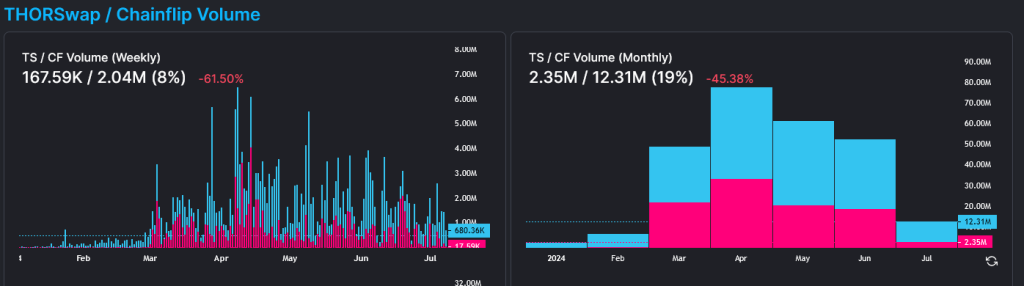

One interesting point about THORSwap is that THORYield, the equivalent of DeFiLlama for THORChain, has started tracking THORSwap/Chainflip volume. But what is Chainflip?

"We at Chainflip believe the best form of on-chain trading lies in cross-chain swaps."

Chainflip launched in Q3 2023, using THORChain infrastructure as the basis for the cross-chain swaps outlined above. The key here is that Chainflip was launched post-THORSwap, and as you can see above, from March, it is taking significant volume from THORSwap.

For THORChain, this is good; for THORSwap, not so much.

This is good for THORChain because it adds one more element to the ecosystem—another door for users and volume to enter.

It's bad for THORSwap because there must be something that Chainflip is doing better.

We will explore THORChain more in-depth next week, but there are certainly enough happenings to warrant an update…

Stay tuned!

Injective

In terms of data, most DeFi-oriented protocols are the same story, copied and pasted. Injective's TVL chart doesn't look too dissimilar to the THORChain chart or the total DeFi TVL chart.

DeFi, in general, has been flatlining since March, which does not bode well for all of the DeFi protocols we've covered over the last years, especially for purpose-built DeFi protocols like Injective.

However, the sparks are present - it is the lack of kindling holding us back.

The Galaxy Digital mentioned in this announcement is a $6.2 billion fund that manages primarily Web3 assets. INJ has been one of the top performers this year, and its relentless drive to get its foot in the door everywhere it can is one of the key reasons for that success.

The latest partnership with Galaxy, in the form of validation, provides another huge stakeholder in the success of the Injective ecosystem. Sometimes, the mere act of a large shareholder with a lot of capital becoming involved in an ecosystem is huge for the ecosystem in question.

The motive is clear—Galaxy manages funds, has announced a partnership with, and is validating for Injective. The incentives are aligned, and the partnership is symbiotic—Injective does well, gets more transactions, and Galaxy gets better returns for its shareholders.

What does Galaxy do to facilitate this? It supports Injective and helps the push.

Galaxy, in particular, has many institutional connections, and so Injective is likely to take full advantage of these, which Galaxy will be more than happy to accommodate.

Injective is not only partnering with institutional players; it is also getting some relatively smaller players on board.

Andromeda, an on-chain operating system, has ported to Injective to further enhance the aOS (Andromeda Operating System) capability.

Again, these integrations ultimately lead to more volume, more users, and enhanced user experience.

Cryptonary's take

As we've learned through experience, the protocols that continue building throughout adversity are the ones to watch. Although market conditions are not even close to the worst we've seen, it's crucial to see how the protocols you follow react.Are they trying to shore up holes in their sinking ship? Or are they unphased, building, and looking to come out stronger - no matter the conditions?

Conviction is a function of trust. And trust is built through action and past deliveries.

You'll notice that we've extensively covered cross-chain comms in the past couple of weeks. This is not by accident—if you've been following us for the last few years, we've always pushed the narrative that the future is multi-chain.

These developments, from the protocols building them to the capital holders funding them, are setting a precedent playing out every day across every ecosystem.

There's light at the end of the tunnel; keep hope alive.

Cryptonary Out!