Discover the DEX Dominating an Emerging Ecosystem - A Strategic Hedge

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

In the world of decentralised finance, diversifying across ecosystems is crucial. While Ethereum mainnet and Arbitrum are popular choices, exposure to Optimism is worth considering. We've completed deep dives into several chains and we're excited to share our findings on a leading DEX on Optimism, which has been generating maximum value for its token holders.

TLDR

- Optimism and Arbitrum are neck-and-neck in adoption metrics, making exposure to Optimism potentially beneficial for portfolios.

- The DEX we're discussing has cornered the Optimism market, accounting for nearly 60% of Total Value Locked (TVL).

- The platform is now the go-to exchange for incentivizing liquidity, providing additional token rewards.

- Upcoming catalysts for the project could further strengthen its position, cementing it as the top spot on Optimism.

- Pricing the project's token relative to its ability to generate fees reveals that it is drastically undervalued.

Disclaimer: Not financial nor investment advice. Any capital-related decision you make is your full responsibility.

On Optimism

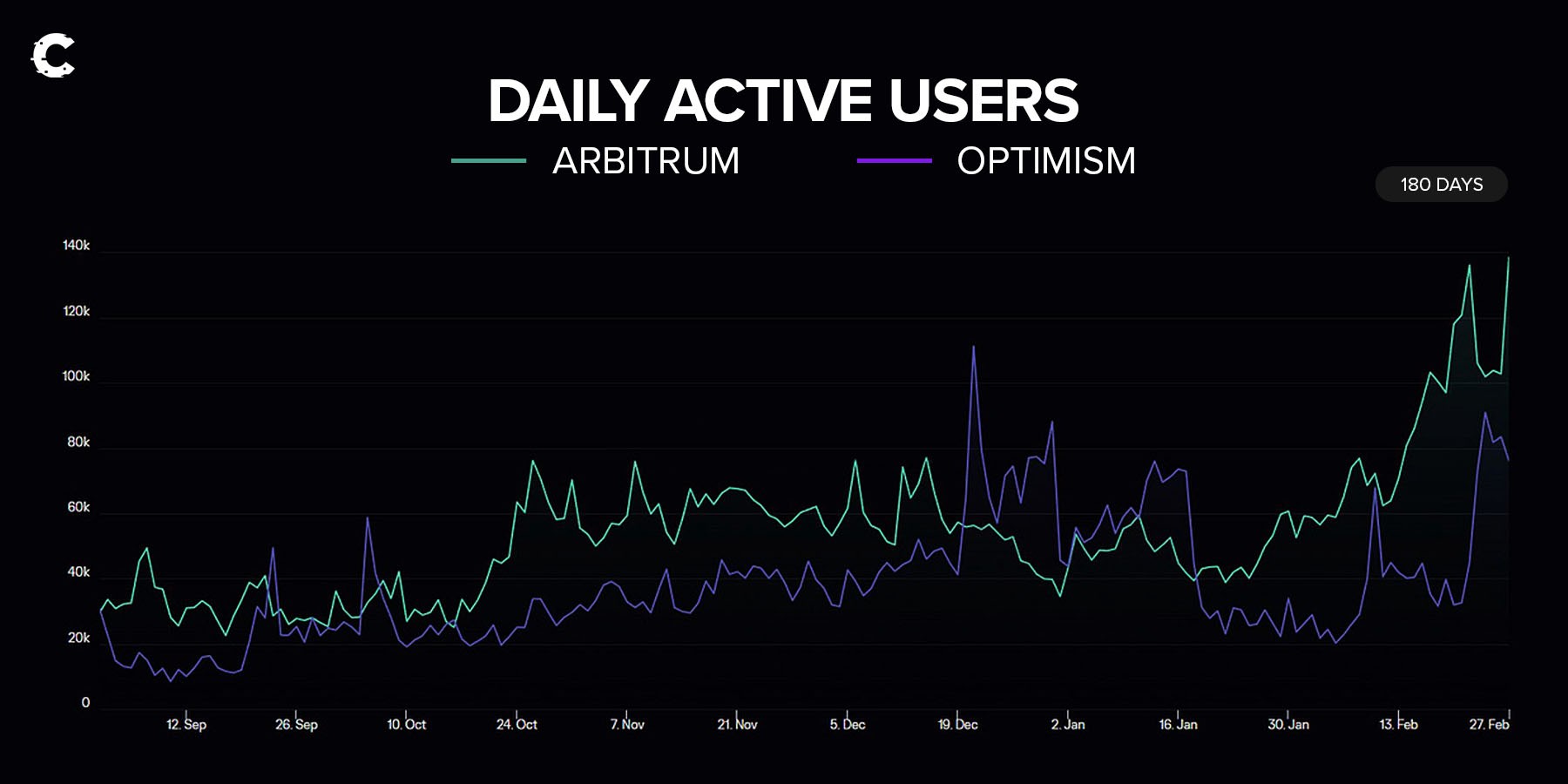

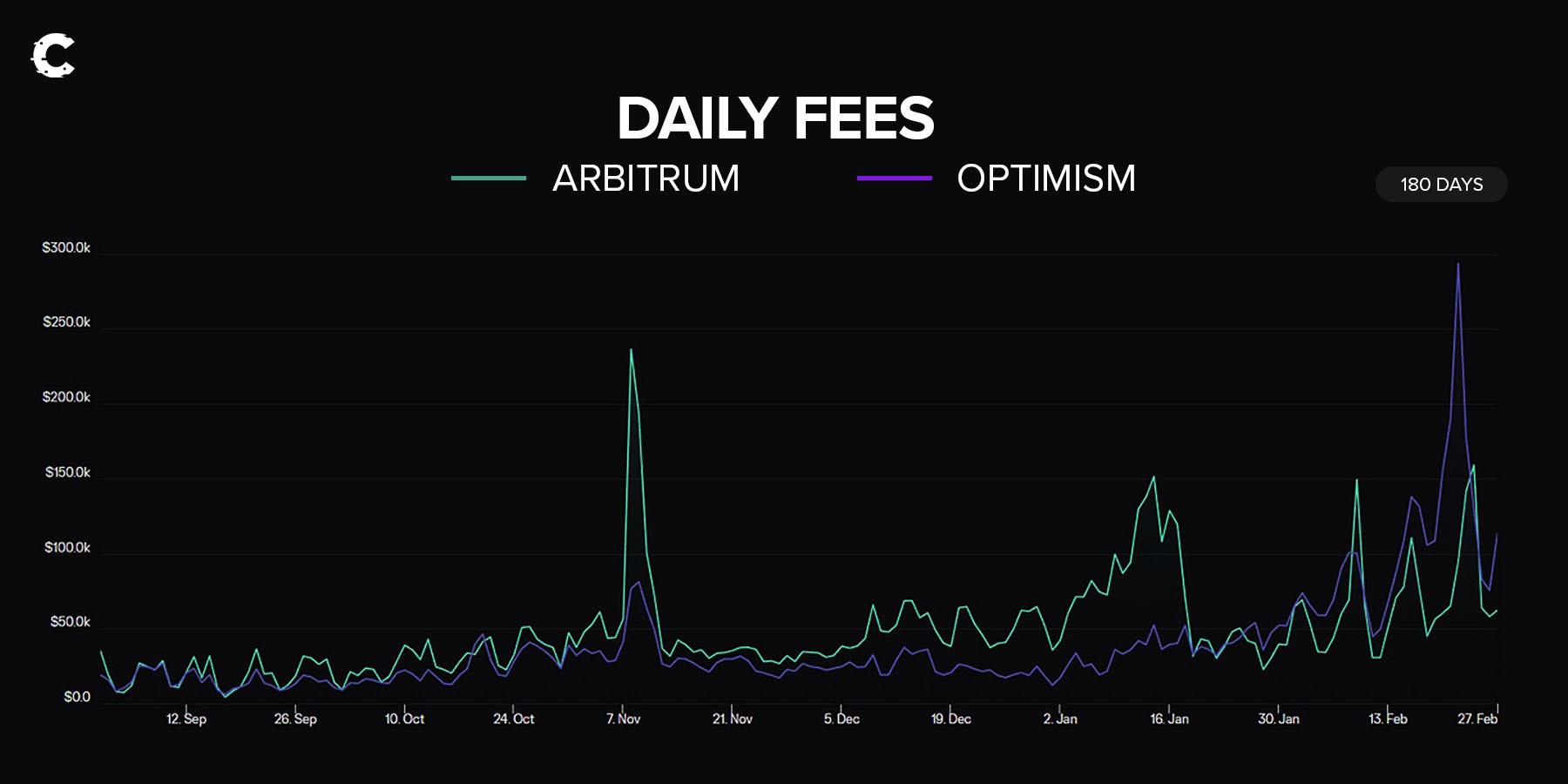

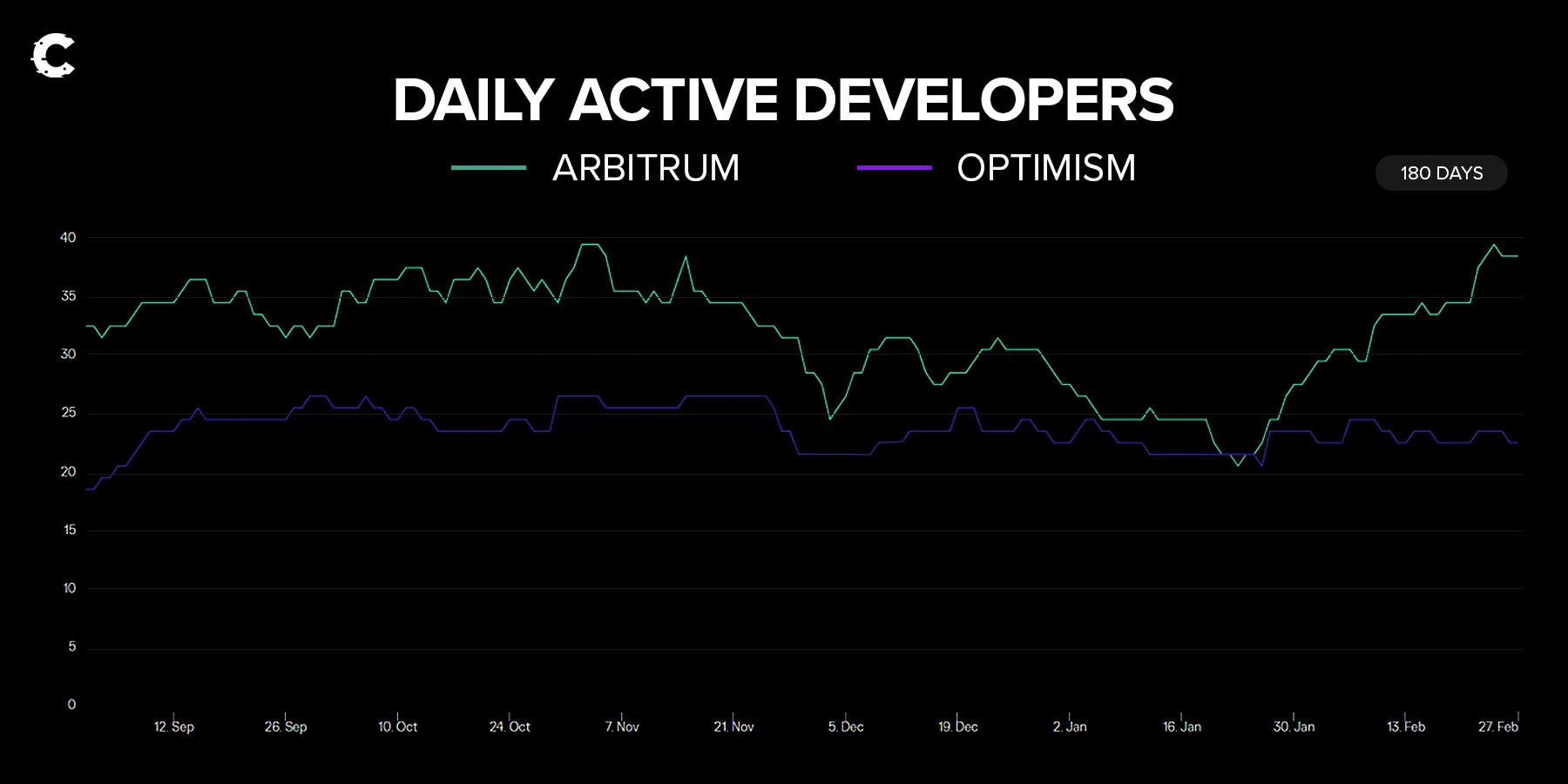

Whether you are looking at daily active users (DAUs), fees, or developer activity, Optimism (OP) has been neck-and-neck with Arbitrum for the past six months.On top of this, Coinbase announced that they’re building a layer 2 with the OP-stack and will syphon a percentage of fees over to the Optimism Foundation. So, we could see bullish sentiment continuing over the next couple years.

[caption id="attachment_265785" align="aligncenter" width="1800"] DAUs for Arbitrum (teal) and Optimism (purple) over the past six months.[/caption]

DAUs for Arbitrum (teal) and Optimism (purple) over the past six months.[/caption]

[caption id="attachment_265784" align="aligncenter" width="1800"] Daily fees for Optimism (teal) and Arbitrum (purple) over the past six months.[/caption]

Daily fees for Optimism (teal) and Arbitrum (purple) over the past six months.[/caption]

[caption id="attachment_265782" align="aligncenter" width="1800"] Daily active developers for Optimism (teal) and Arbitrum (purple) over the past 6 months.[/caption]

Daily active developers for Optimism (teal) and Arbitrum (purple) over the past 6 months.[/caption]

Because of this, we argue that it’d be foolish to have zero exposure to the Optimism ecosystem.

One Optimism-native project that’s grabbed our attention is Velodrome — a DEX with real-deal fee generation.

What is Velodrome, and why you should care

Velodrome is a DEX that combines the best aspects of existing DeFi systems into a cohesive experience - designed to serve as Optimism’s premier ecosystem-native liquidity layer. Every ecosystem requires deep pools of assets in order for it to run smoothly, and for Optimism, that’s Velodrome.The team

Velodrome was founded by the former team of veDAO. This crew is fully KYC’d (Know Your Customer) with the Optimism Foundation (a requirement to receive grants), alleviating some of the risks carried by teams with anonymous founders.The ve(3,3) model

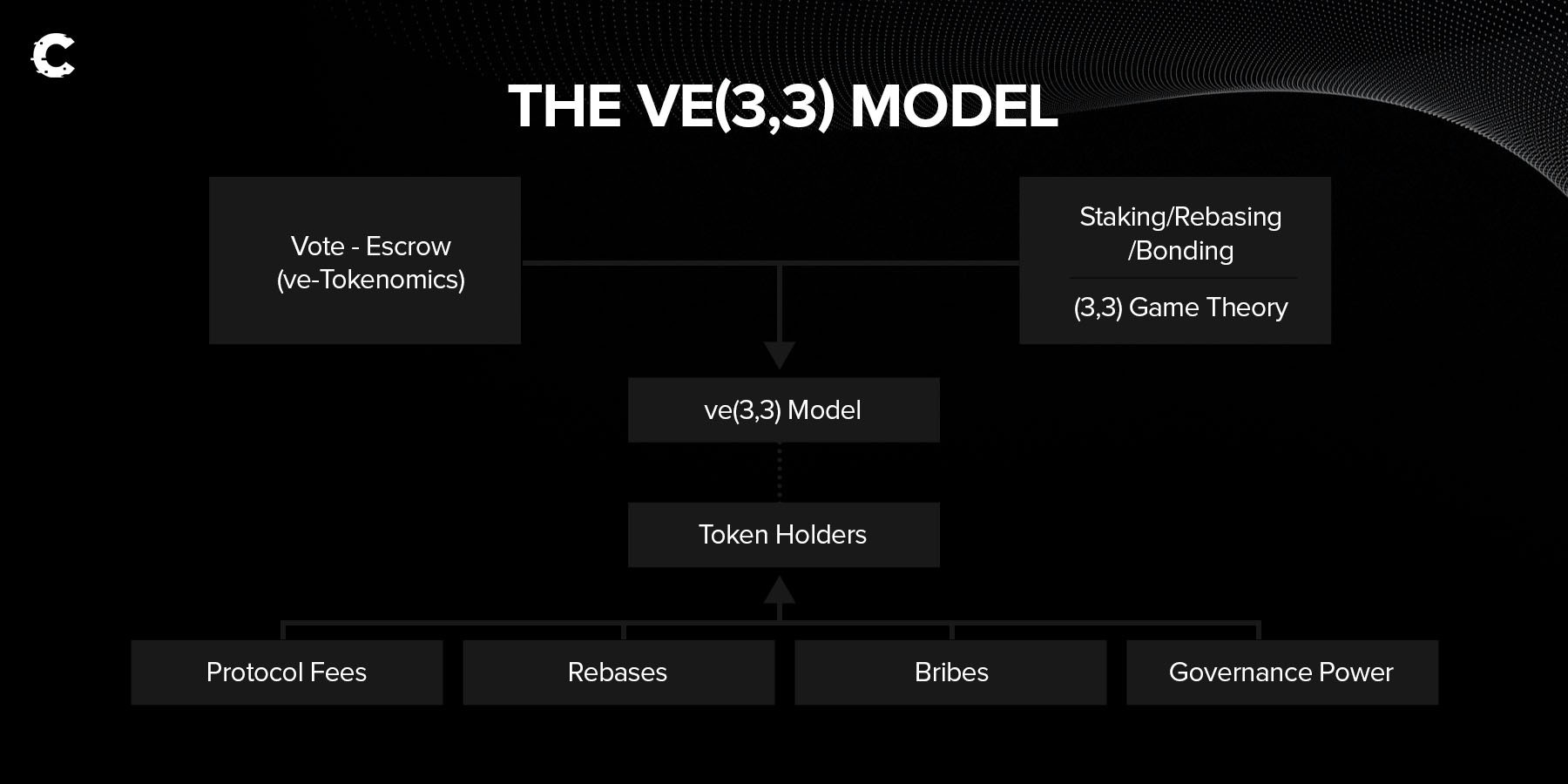

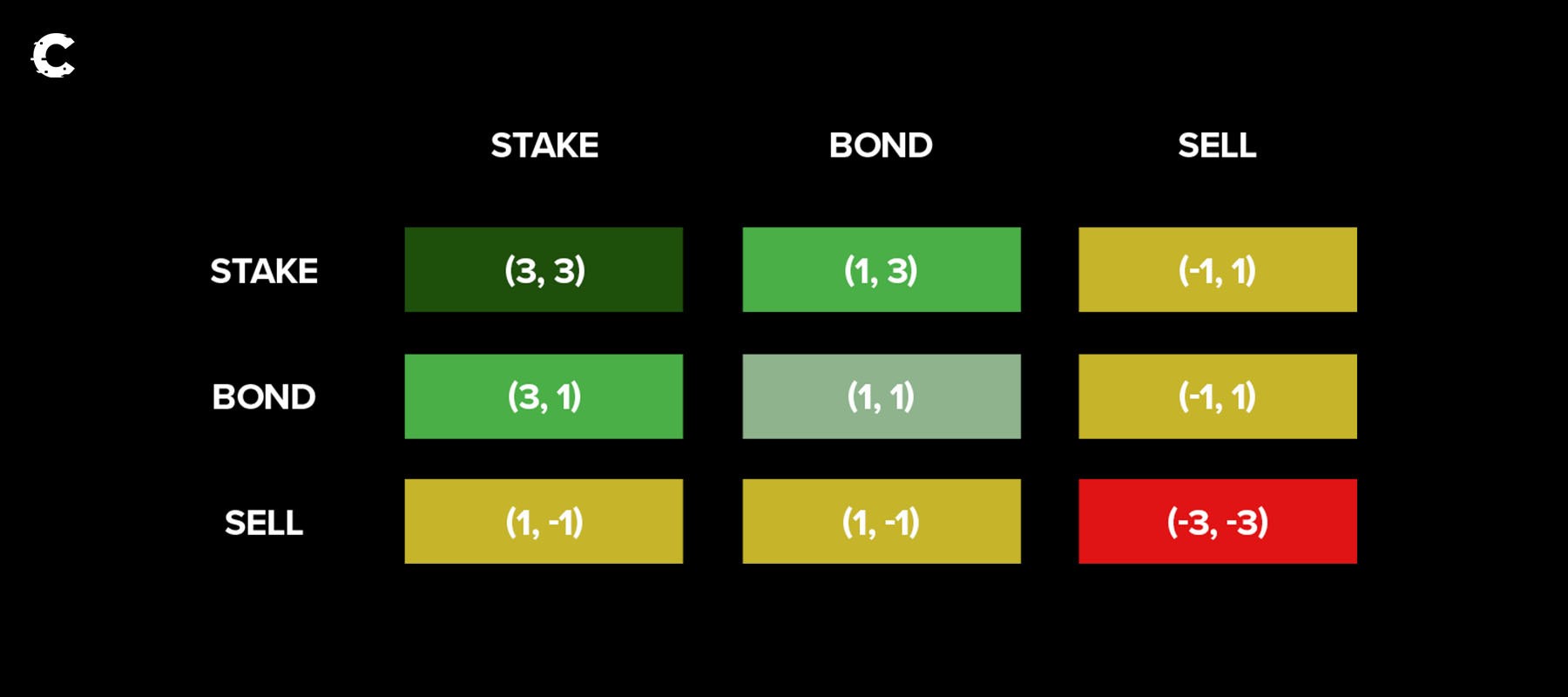

Velodrome’s tokenomic model combines Curve’s vote-escrow (ve) design with (3,3) game theory originated by OlympusDAO to align incentives between token holders and the protocol’s long-term goals. Let’s break this down…

Vote-escrow tokenomics (or “veTokens”) allow holders to stake/lock their tokens to unlock the token’s use case(s). For Velodrome, users can stake their $VELO to receive $veVELO (more on this soon).

(3,3) game theory was born from OlympusDAO and argues that a rational actor should stake their tokens to extract the maximum value from them. Notice how in the game theory chart below, when both users choose to stake, this results in the maximum value for both users - a win-win. This is because staking allows these users to earn a share of token emissions (periodic token rewards that are distributed to stakers).

This ve(3,3) model leverages some “ponzinomics” in order to bootstrap liquidity. Token emissions are kept at an elevated level for the first 6–18 months of operation, which directly reward early adopters with large quantities of tokens to thank them for their early support. These incentives kick off adoption, well-positioning ve(3,3) DEXs to corner decentralised markets. Learn more about Velodrome’s ve(3,3) model here.

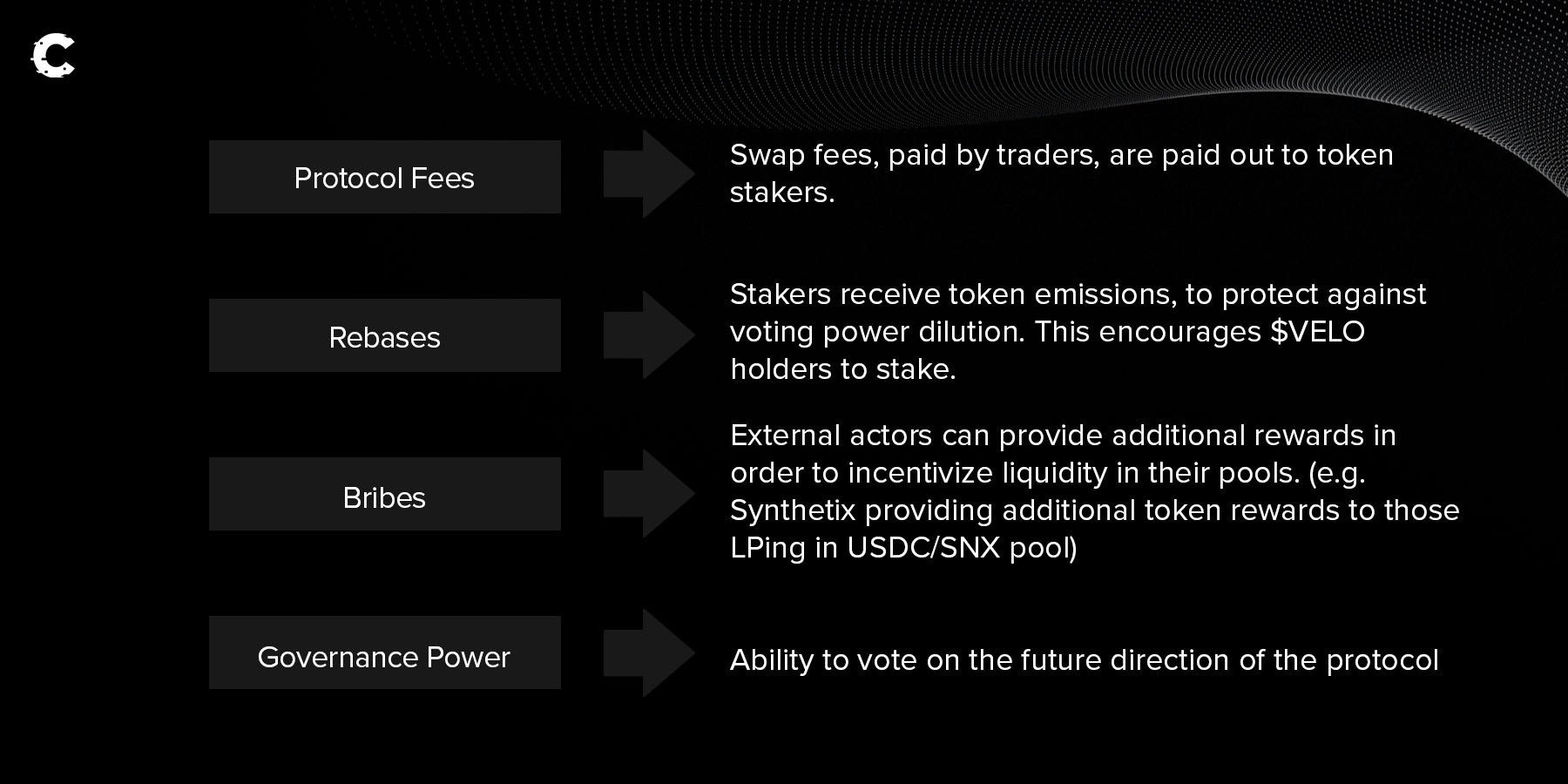

With Velodrome, users that lock/stake their $VELO (to receive $veVELO) are rewarded with protocol fees, rebase emissions, bribes (which are not what you might think they are, in the context of crypto! Read more in the following sections), and governance power (see image below).

Rebases — To protect against being diluted due to emissions, stakers are eligible for rebase rewards. These ensure that stakers maintain their proportional share of voting power.

Bribes — Other protocols can introduce additional rewards on specific liquidity pools to incentivise deeper liquidity. This process is more capital efficient than DAOs running their own liquidity pools.

The bribe marketplace and fee generation progress

Protocols have been flocking to Velodrome to incentivise liquidity via token reward “bribes” (see image below).Example: Imagine you are running Synthetix. You want users to provide liquidity to your $SNX-$USDC pool. So you offer some $SNX as rewards for users who vote for your pool to receive Velodrome emissions.

Partner protocols that are incentivizing liquidity, as of December 2022. Since then, this list has only grown.

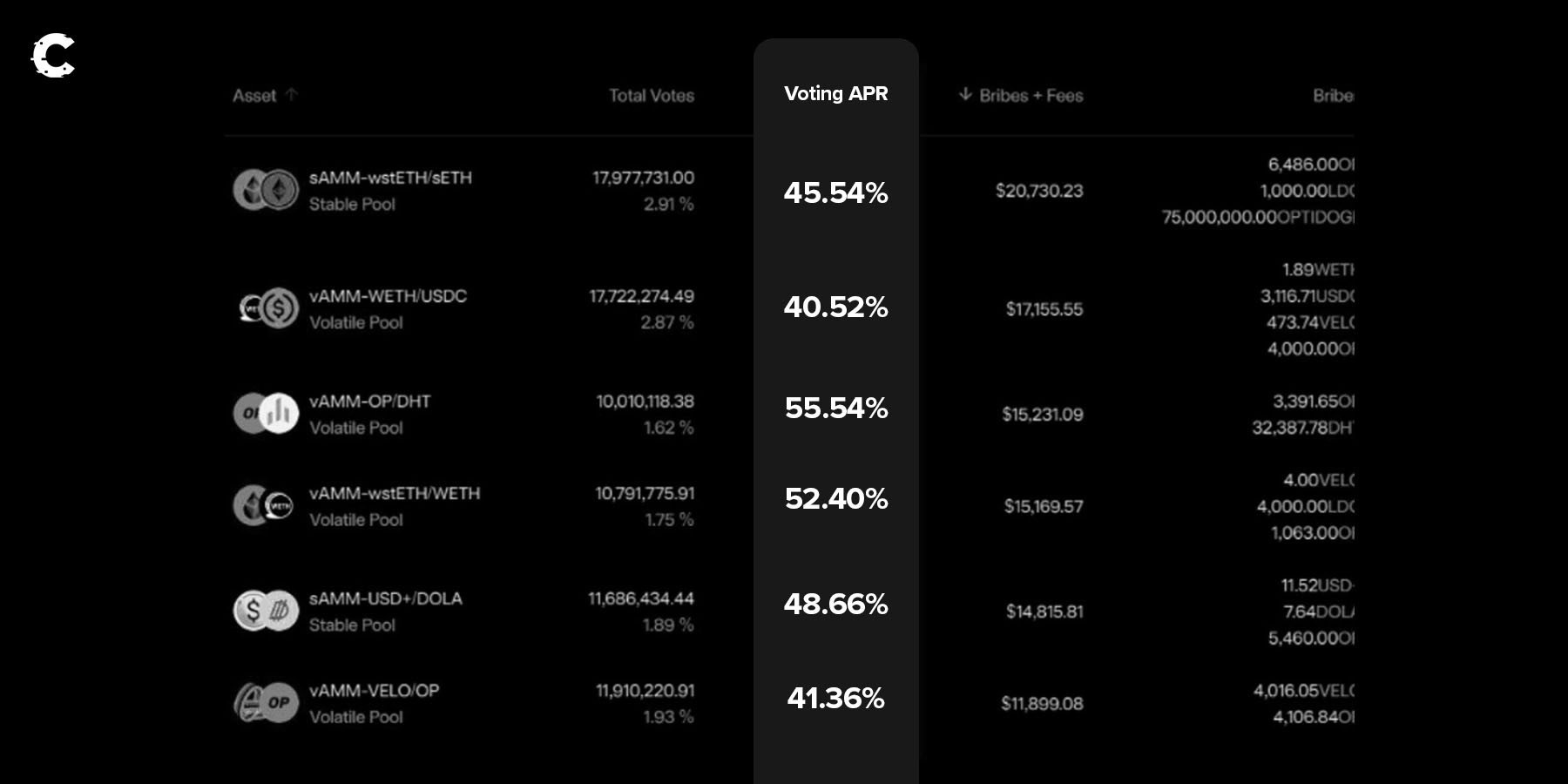

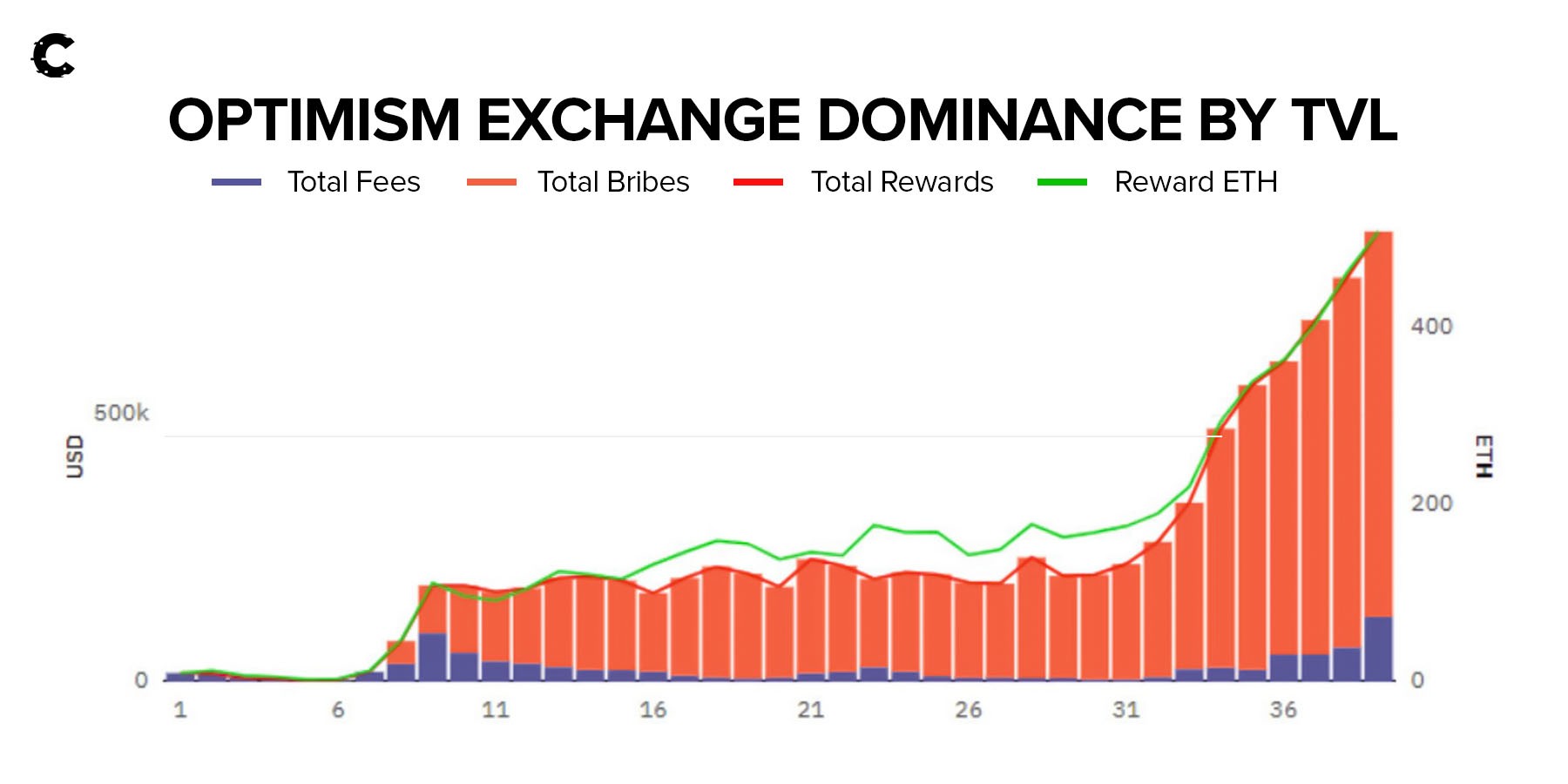

This bribe marketplace has been on a roll recently, powering fee generation to all-time highs. These bribes reward $veVELO token holders who vote for specific pools to receive standard $VELO emissions (for more advanced users: think Curve-Convex-Votium, but all neatly packaged into one).

[caption id="attachment_265778" align="aligncenter" width="1800"] Daily revenue of Velodrome, mostly powered by bribes, from token terminal. See the breakdown in this Dune board.[/caption]

Daily revenue of Velodrome, mostly powered by bribes, from token terminal. See the breakdown in this Dune board.[/caption]

With Velodrome’s market control only increasing, it’s on the path to achieve complete dominance over Optimism liquidity.

Consistently-high APRs for $veVELO token voters incentivises long-term holding.

Thesis — DEX dominance, and a fee-generating machine

Why $OP is an inefficient play

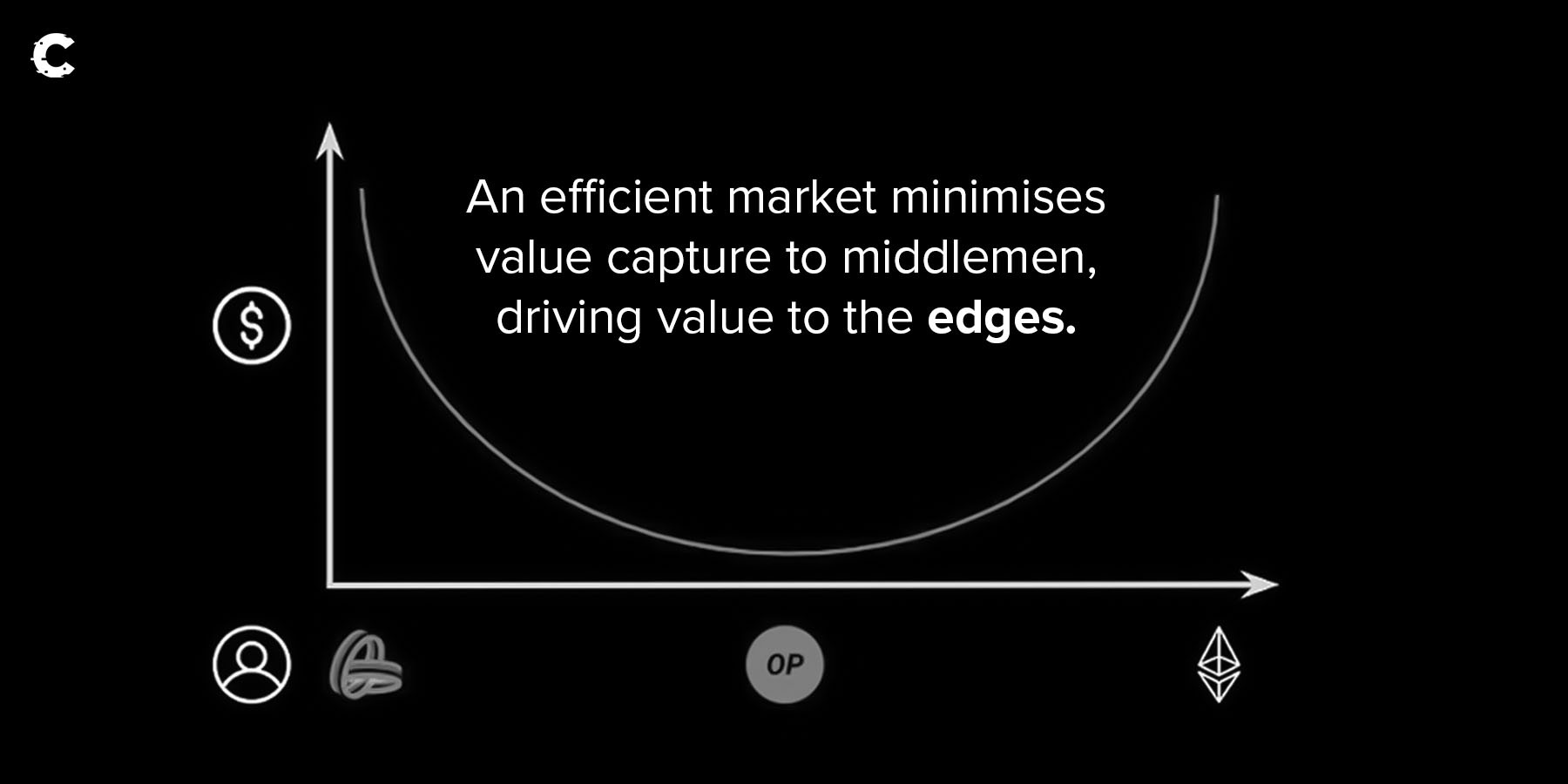

While the simplest solution to gain Optimism ecosystem exposure may be with its native token $OP, we’re not the biggest fan. Beyond $OP being a simple governance token that does not generate value to the holder and has an extreme inflation schedule, an efficient market will tend to minimise the value capture to middlemen (which is the Optimism layer 2, in this case).

Indeed, Optimism only controls a 15% margin on the transaction fees flowing through its network, with the majority of the fees going to the Ethereum mainnet for security. As Velodrome has the closest contact with the end user, it’s in the prime position to extract value.

Market dominance

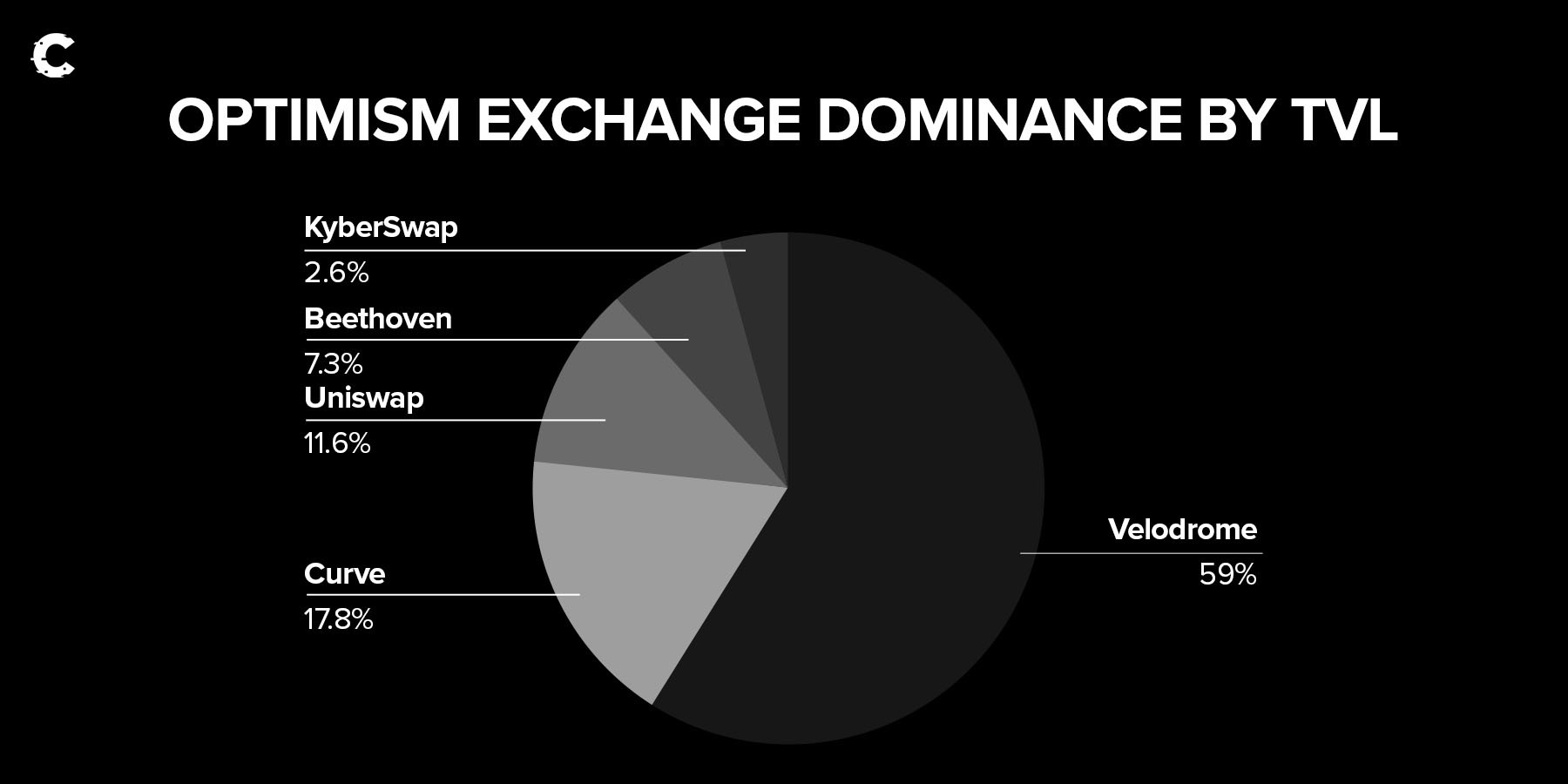

[caption id="attachment_265774" align="aligncenter" width="1800"] Dominance of the top 10 Optimism decentralised exchanges, showing the monopoly of Velodrome[/caption]

Dominance of the top 10 Optimism decentralised exchanges, showing the monopoly of Velodrome[/caption]

If we take a look at the TVL within DEXs on Optimism, Velodrome’s dominance is clear. At 59%, Velodrome has more than 3x more liquidity than Optimistic Curve and 8x that of Beethoven X, the next-largest Optimism-native DEX.

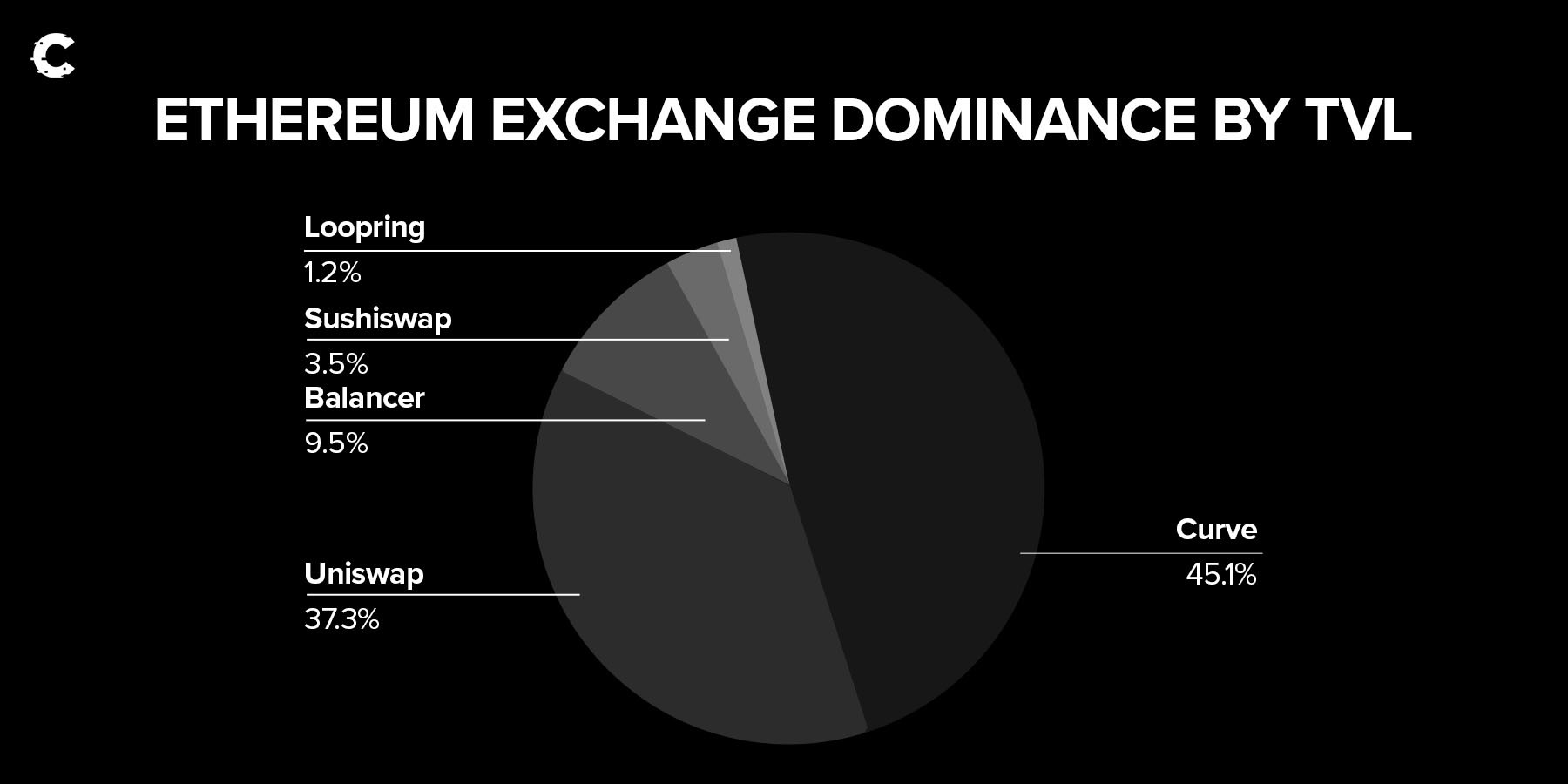

[caption id="attachment_265773" align="aligncenter" width="1800"] Dominance of the top ten Optimism decentralised exchanges, showing the duopoly of Curve and Uniswap[/caption]

Dominance of the top ten Optimism decentralised exchanges, showing the duopoly of Curve and Uniswap[/caption]

Velodrome is in a unique position to corner the liquidity market on Optimism.

Fee generation compared to market cap — spoiler alert: Currently undervalued

When we compare the rewards generated by Velodrome to its competition, we can see that Velodrome has been on a roll.[caption id="attachment_265772" align="aligncenter" width="1800"] Total rewards for Velodrome have been “up only” for the past several weeks due to its growing bribe market (source)[/caption]

Total rewards for Velodrome have been “up only” for the past several weeks due to its growing bribe market (source)[/caption]

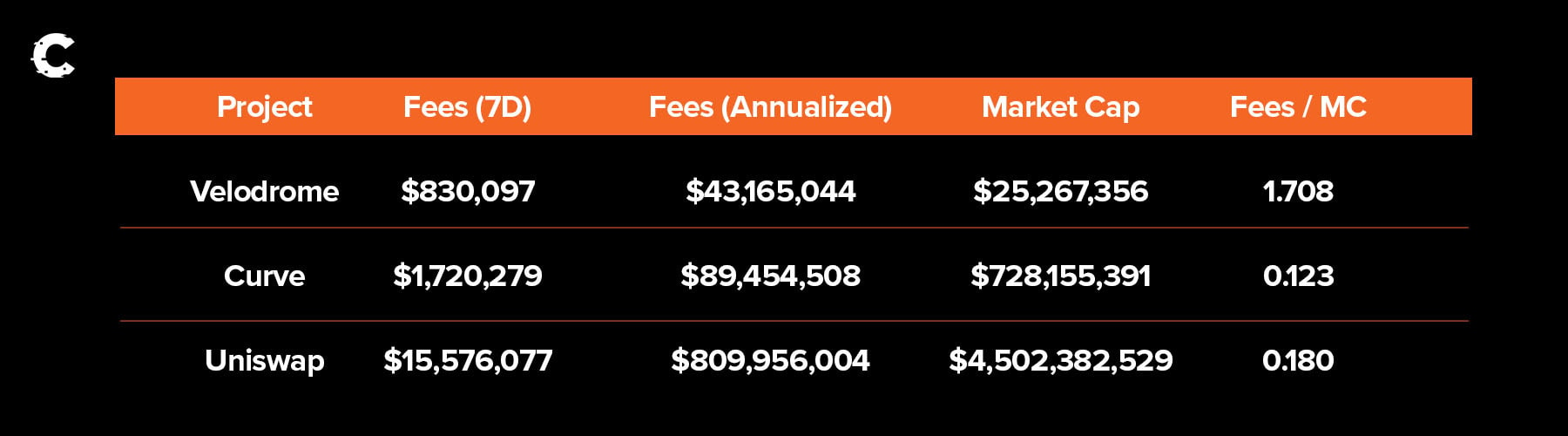

Below, we compare the rewards generated by Velodrome with those from Curve and Uniswap (on Ethereum mainnet).

Note that Velodrome’s fees/market cap is significantly larger than that of either Curve or Uniswap — showing that it’s outperforming the market’s expectations. Using these benchmarks, Velodrome is currently undervalued by about 90%, showing a roughly 10x potential if the market values it fairly.

Furthermore, Curve and Uniswap are fierce competitors in the world of mainnet DEX activity. As discussed previously, Velodrome faces no such competition on Optimism, suggesting that a higher multiple in the future is likely.

Upcoming catalysts

On top of the innovation already in place, Velodrome is set to introduce some exciting new features throughout 2023:- Relay — a tool that optimises voting power for maximal rewards, auto-claims, and compounds rewards without any user interaction. For those familiar with the Curve ecosystem, think of this as an automated Hidden Hand.

- Custom pair support — users will be able to create their own custom pools (similar to 80–20 Balancer pools or pools with 3–4 tokens like Curve).

- Gasless swaps — by using its in-house liquidity, Velodrome can offer a CEX-like (Centralised Exchange) user experience.

- Concentrated liquidity abilities, similar to Uniswap v3 — to offer advanced users higher APRs (annual percentage rates) when they specify how they’d like to offer liquidity.

$VELO price targets

At current market conditions, assuming no change in Market Cap of $OP or change in TVL in Optimism, we would use the above multiple (10x) as the target for $VELO. This would bring our price target (per token) to $2.00.In the long-term, (hopefully) Ethereum commands roughly 10x more TVL in its DeFi applications. If we assume Optimism holds on to half of its layer 2 dominance (with the rising dominance of Arbitrum and the launch of various zero-knowledge layer 2s like zkSync and Starkware), this would add an additional 5x to our previous target. With a long-term goal of 50x, this brings the price target to $10 per $VELO.

Velodrome risks

As always, it is important to manage risks. Outside of standard smart contract vulnerabilities, here are the minefields we’ll be watching out for:#1 — Competition

While Velodrome maintains a strong TVL lead, we’ll be looking for competitors that have the potential to suck up Velodrome’s liquidity. This includes Uniswap, especially considering the addition of their bribe marketplace. While the two trailing Optimistic DEXs (Curve and Uniswap) are big players, they've dedicated most of their attention to their Ethereum mainnet products.

#2 — Reduction in Optimism adoption

Naturally, Velodrome’s overall success is tied to that of Optimism. If Optimism’s popularity declines, Velodrome will be forced to pivot or perish.

#3 — Inflation schedule outpacing demand

While $VELO’s emissions are not as aggressive as $OP’s, they're still quite high at >100% for year 1 and ~50% for year 2. This early inflation is quite common for ve(3,3) models, but Velodrome will have to continue to drive improvement to stay ahead of this.

Invalidation criteria

If one or more of the following occur, we would consider our thesis invalidated. In that case, we would reduce our $VELO position or exit entirely.#1 — If we see a large shift in market share to other layer 2s. This would be a worrying sign that Optimism users are jumping ship. A marked decrease in DAUs and/or transaction fee counts for multiple months would be cause for concern.

#2 — If there is a large drop in bribe values on Velodrome for several epochs (weeks) in a row, this would be a reason to reduce or exit.

#3 — If we see a competitor gaining market share in the world of Optimistic DEXs, this would be a sign that we need to reduce our allocation. If we see another competitor’s TVL rise to 25% of the total, we will decrease our allocation. Similarly, if Velodrome’s dominance falls under 40%, we will reduce exposure.

Cryptonary’s take

While Optimism (deservedly) receives criticism for their large incentive program, the Optimism Foundation is well-capitalised to continue this marketing tactic for years to come.When it comes to hedging your investments, betting on a market leader in TVL is a great starting point. Every ecosystem needs a DEX, and Velodrome has already established itself as the go-to hub of liquidity on Optimism.

Their team seems determined to succeed— whether through additional partnerships and/or with innovative updates to their protocol.

Action points

Below are the actions we will personally take over the next few months:- $VELO’s price has been doing very well lately, but we'll stand by our price targets and DCA monthly, as long as $VELO sits below $0.50.

- At $2.00, we will sell a percentage of our $VELO to obtain the dollar amount we originally invested. For example, if we invested $100 at a price of $0.50 to get 200 $VELO, we would be selling 50 of our $VELO at $2.00 to take our original $100 off of the table.

- Of the remaining amount, we'll scale out at each dollar level, with heavier percentages towards $10. In practice, scaling out 5% at $3 and $4, 10% at $5 and $6, 15% at $7 and $8, and 20% at $9 and $10.