As crypto use continues to develop, Layer 2s address gas fee issues, and DeFi options platforms innovate at incredible speeds.

The DeFi options boom is coming, and we don’t want to miss it!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility and only you are accountable for the results.

TLDR

- Options are an essential part of any financial market

- In crypto, they are massively underused at the moment

- DeFi options are growing at a rapid pace, both in use and protocol development

- If crypto reaches the same levels as equity markets, that would mean 500-1,000x growth

- We are early…

Hmmmm, Options?

Hopefully you read Is This Sector Going to the Moon in 2022?, but in case you didn’t, here’s a brief explanation of what options are:

Options give the holder the right, but not obligation, to purchase an underlying asset for a pre-determined price at a specific point in the future.

Say Karim is buying an option on Ethereum from Bill. He would pay Bill $200 now, for the right to buy 1 ETH, for $3,000, in 1 months’ time. He wouldn’t be forced to buy it (unlike futures), so if the price goes down, he only loses the premium. If he wants to buy it, Bill must sell it to him at the set price. If ETH goes up to $5,000, Karim has made a $1,800 profit.

Why TradFi Loves Options

I sense you asking, “But Max, what’s the big deal with these options? Why do people use them?”So let me tell you.

I would argue that no one can predict the future (predicting what you are going to eat for lunch doesn’t count!). Crystal wielding mystics may disagree, but what happens if they forget to charge their crystals in the moon, and their powers go bye-bye? Hedging, I hope.

Options are incredibly versatile instruments, and sophisticated traders can use the wide range of choices to create derivatives that suit a specific purpose. For example, if they hold a range of alt-coins and want to protect against 70% of potential downside, a basket of options can achieve this. The underlying asset, and goal of the basket, can be changed to suit any need!

On the other side, if you’re in BULL MODE 5000, and want to emphasise gains, that can be done. By putting down a small amount of capital, you guarantee the ability to buy a large amount of an asset (such as ETH), at a later date for a pre-determined price.

Options and Futures

In TradFi, options and futures hold almost equal volumes. The split is near 60/40 in favour of futures. In crypto, futures, especially perpetual futures (perps) dominate. This is a simple question of market maturity and options infrastructure. Let me say it again… The boom is coming!Types of Options

There are so many different ways to use options, there are puts and calls, with various expiry dates. Now, would you like to go long or short?Wait, isn’t that what put and call means?

Not exactly.

Put – give the buyer the right, but not obligation, to sell a set amount of an asset at a set price.

Call – give the buyer the right, but not obligation, to buy a set amount of an asset at a set price.

Now, you can buy (going long) or sell (going short) the options. Selling, however, is considerably more complicated. You have unlimited liability when you sell an option, so need to be very careful here.

Then you’ve got expiry dates, does Karim want to settle in 1 month? 2 months? 6? It’s his choice.

Oh, and would you like American or European?

American – buyer can exercise (claim the asset) any time before the expiry date.

European – buyer can only exercise on or after the expiry date.

Now that you’re caught up on options, we can move on to the good part…

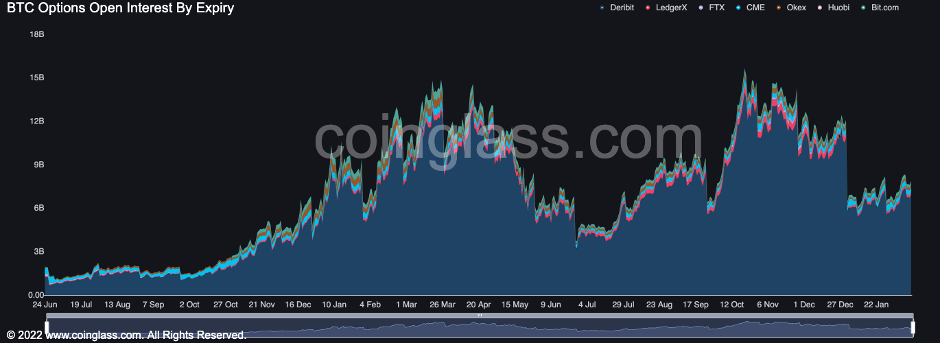

Options in Crypto

Options markets are a vital part of the TradFi ecosystem, with more volume traded than the equities (stocks) themselves. If crypto reaches the same levels as our equity markets, that is nearly $1b per day in crypto options volume. This could mean a potential 500-1000x growth multiple from here!We have already seen huge growth in crypto options, mostly concentrated in Deribit, a centralised exchange. There has been rapid growth in DeFi, but the numbers are still tiny in comparison.

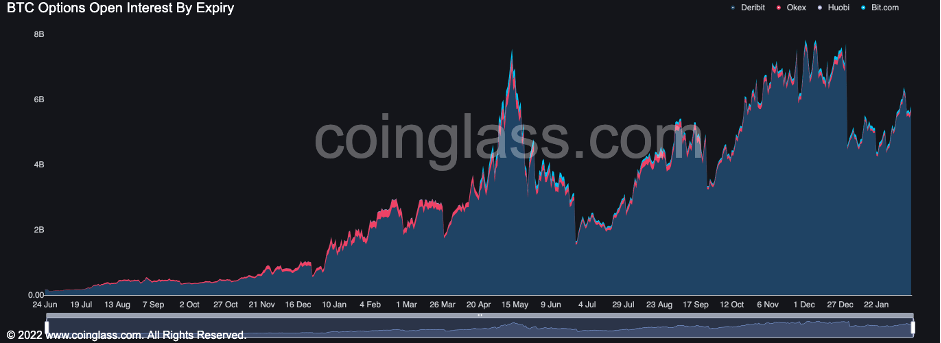

CeFi vs DeFi

Currently, Deribit accounts for around 88% of BTC options volume, and 96% of ETH (see below, dark blue = Deribit).

Honestly, the user experience on Deribit is not great. It has a confusing orderbook style that is repelling to anyone who isn’t a professional trader. However, it has a first-mover advantage in the options market, which is why it captures such a massive portion.

This leaves a gigantic opening for the right DeFi protocol. The explosion in volume seen in the charts above gives us a sneak peek of what’s coming. Let me say it again, we are early!

DeFi’ing Gravity

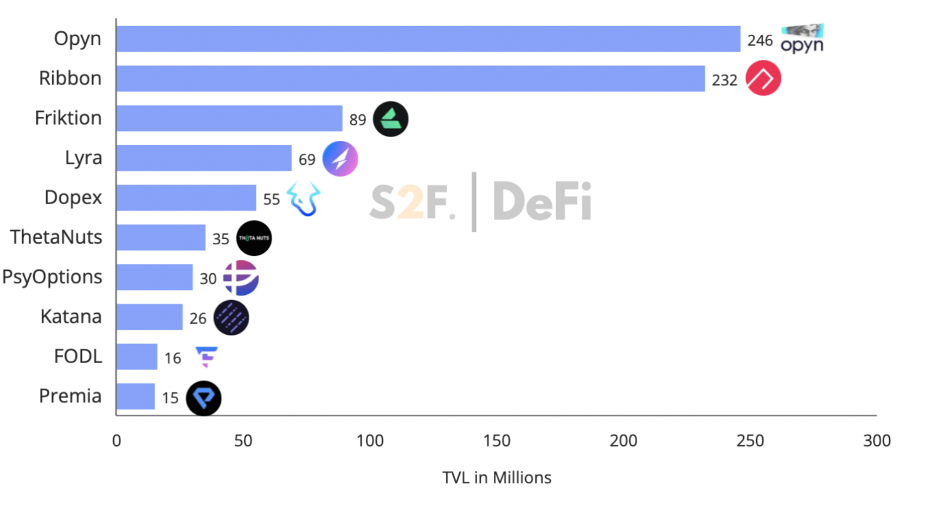

The DeFi options landscape is still in its infancy, despite meaningful infrastructure growth, and has been compared to how crypto operated in 2017. The crypto options market, especially in DeFi, will expand year over year at a parabolic rate. I don’t know about you, but to me that sounds too good to ignore!Let’s have a look at the current DeFi options landscape. Below is a chart of the top 10 platforms by TVL.

The chart includes 2 types of protocols, marketplaces and structured products.

Structured products refer to DeFi Options Vaults (DOVs). These are pools that users can deposit funds in, and supposedlyearn sustainable high APY yield (generally advertised between 10-30%).

These are complex protocols, which are vital for the DeFi options landscape, so they will be covered in their own research report next in this series. Spoiler alert, the yields aren’t as good as they first seem!

Note, many marketplaces such as Dopex and Premia offer the ability to deposit into these options vaults, as well as buying options. We are solely focusing on the options buying side for this report.

Top Picks

Now, the bit you’ve all been waiting for. Our top picks!

These are the most interesting platforms, NOT necessarily the best to invest in. This doesn’t take into account token utility, tokenomics, or many other vital factors. If we see these as an investment opportunity for ourselves, we will write a stand-alone article on them at that time (not financial advice).

The platforms that I find most interesting fall into 2 categories, live ones roaming the DeFi wild, and those in their testing phase.

Protocols on Mainnet

DopexPros:

- On Arbitrum, a layer 2 (L2), benefiting from the L2 boom and Ethereum network effects.

- Highest TVL and liquidity, especially impressive on an L2.

- Tokenised options, working on creating a secondary market.

- Great social presence and educational content.

- Constantly trying to innovate, and backed by Tetranode

- Not the best UI/UX, complicated with a focus on options vaults, rather than the options themselves.

- European style options, meaning you can’t exercise early (however they are working on a secondary market).

- Only offers 1 expiry date, with no flexibility.

- No fee-sharing yet for DPX token holders.

- Trying to do A LOT at the same time, with options, vaults, synthetic assets, stablecoin issuance and more. Although in crypto everything moves at a million miles per hour, so while this may not be an issue, it is important to consider.

- As of 22/02/22 Hegic has launched Hegic HardCore, an Arbitrum out-of-the-money options trading platform. This addresses the issue of high gas fees and missing the L2 market, as well as adding adjustable strike prices (only out-of-the-money at present). However, we have discounted Hegic, see the update at the end of this article for full details.

- Smooth and enjoyable UI/UX with American style options, offers fully customisable expiry date (up to 30 days) and ability to set take profit orders.

- Clearly created for options traders, and works very well for that purpose.

- Total trading volume is rapidly increasing, going from under $100m at the end of Q3, hitting $200m on Jan 6, then $400m on Feb 13.

- No gas fees on options contracts over 10 ETH or 0.1 BTC.

- Low TVL and liquidity, and has been dropping. This is concerning as liquidity is needed to fund the options.

- Only on Ethereum, with no plans to migrate to L2s (gas fees are prohibitively expensive for retail).

- Not very active on social media relative to competitors, and offers little educational content.

- Can’t choose your own strike price. This could be a negative, however, it removes the need to check all options to see which is most profitable (good for retail investors).

Pros:

- UI/UX is very clean, easy to use and pleasing to the eye

- Flexible strike price and expiry date, offering options with longer durations than Hegic and Dopex.

- High gas costs for the same transaction when compared to Hegic.

- Options prices (on Arbitrum) higher than competitors.

- High fees, 3% on purchase and 3% on exercise of the option.

Protocols on Testnet

These do not have tokens yet, so we recommend going and trying them out. This helps the protocol develop, and could make you eligible if they decide to airdrop. If you do test them out, let us know what you think – we would love to hear your opinions!As it’s so early, it’s hard to form a proper view on these protocols. So we’ll have to keep track of them and see how they develop.

Arrow Markets

Pros:

- Highly intelligent team with a clear focus on sustainability and long-term success (focused on delta hedging their options pools, more on this in the next report covering DOVs).

- UI/UX is very smooth and pleasant (for testnet), with normal and pro modes.

- Backed by Alameda Ventures, CMS Holdings and Delphi Digital, among others.

- Launching on Avalanche, massively reducing potential target market.

Pros:

- Will operate on Ethereum and Metis L2.

- Actively looking for partnerships to build on their offerings (3 so far).

- Seems quite clickbait-y with their offering, claiming to be “building the ‘Goldman Sachs’ of the Metaverse”.

- Testnet UI/UX is not great, although the platform is early in its development.

Please note: none of the platforms mentioned are the perfect solution. As more development and iterations happen this may change, but they all currently have flaws.

Conclusion

As discussed, options are underused in crypto. It’s only a matter of time. In fact, we’re already seeing huge growth in the protocols, despite being relatively small. This is only going to speed up from here, and the market is still wide open.

We’re seeing rapid innovation, but with this comes teething problems. As the market matures, protocols continue to iterate, fine-tuning their offerings, and the winners will become clear. Right now we’re in the early stages of this market and the potential for growth is enormous (remember the 500-1000x I mentioned earlier!), and by researching and getting to know the market, we will benefit from its parabolic growth.

We’ll be taking a deep dive into some of the projects mentioned today later in the series. Be sure to check out the next report on DeFi Options Vaults (DOVs), as it will cover the vital liquidity providing side of protocols such as Dopex, Hegic and Premia.

Thanks for reading!

Update:

Since then, Hegic has addressed the main issue we had with them, by launching on Arbitrum (a layer 2 solution). There remains an even bigger issue though. Liquidity.

As you know from 80% Yield!? Is it Sustainable (if you missed it, be sure to read it before carrying on), DeFi Options Vaults (DOVs) are an ingenious, DeFi native solution to the liquidity dilemma.

The liquidity dilemma – Options are relatively simple to buy, but complex to sell. As they get increasingly popular, there are significantly more buyers than sellers, stunting the growth of the market.

On a side note, DOVs are a solution to a problem that has plagued CeFi forever. It would be impossible for the same solution to be used in CeFi, and this is only the first of many innovations and ingenious solutions we are seeing routinely come up in DeFi. DeFi is a sandbox, where the impossible is constantly being done.

Hegic

Having looked into Hegic further, we have discounted it. It cannot be a long-term winner in its current form. Liquidity on the platform has consistently fallen, with no incentive for liquidity providers (LPs) to choose Hegic over other protocols, and no clear way for DOVs to integrate and build on top of Hegic.

Should Hegic find a way to address this issue before it's too late, we will reconsider. But it is not clear that this will happen, or how.