What's New With Our Giga-Brain Play (Polkadot Parachains)

Towards the end of 2021, we embarked on a journey involving Polkadot and its Parachains through our Giga-Brain play. Since then, we have covered most of our picks with journals covering the fundamentals and where each Parachain delivers value. They can be found here:

So, what’s the latest with the Polkadot ecosystem, and what can we expect going forward into Q4? Let’s find out!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Perspective

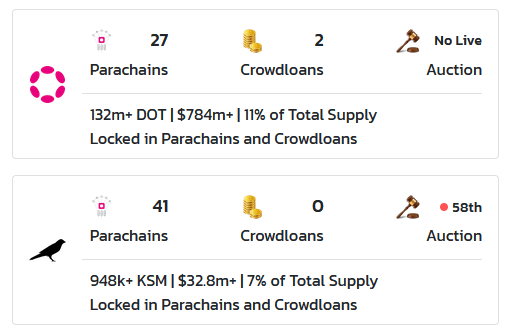

Since around Q2 2022, crypto in general has had a rough time. We’ve seen exploits, mass liquidations (looking at you, 3AC), horrendous macro conditions, a war in Europe – the list goes on. This year will no doubt be one of the most memorable for those still around in a few years. However, development has continued nonetheless, and for Polkadot specifically, there has been an explosion in development in the last few months.There are currently 41 active Parachains on the Kusama canary network, and 27 Parachains live on Polkadot itself, with 182 projects in total developing across the entire ecosystem.

Development on the Polkadot Network has been flying at a breakneck pace, with over 15,400 contributions submitted on Polkadot’s GitHub (developer repository) in September alone – an all-time high by a large margin. To put that in perspective, this is the highest of any network for September, leaving even Ethereum in the dust.

One of the key aspects preventing meaningful DeFi activity on the Polkadot ecosystem was the absence of a highly liquid stablecoin. Acala does have a stablecoin (aUSD) but was rocked by an exploit earlier this year which has left the network in maintenance mode for weeks (we’ll get into this in more detail later). However, at the end of September, Tether announced that USDT would now be supported on the Polkadot network.

The addition of this highly liquid and, most importantly, trusted stablecoin is huge news for Polkadot and provides users and protocols with a means to move in and out of the network with ease, as well as enabling swaps to stables that previously were not available.

Let’s take a look at the Parachains we selected for the auctions.

Moonbeam

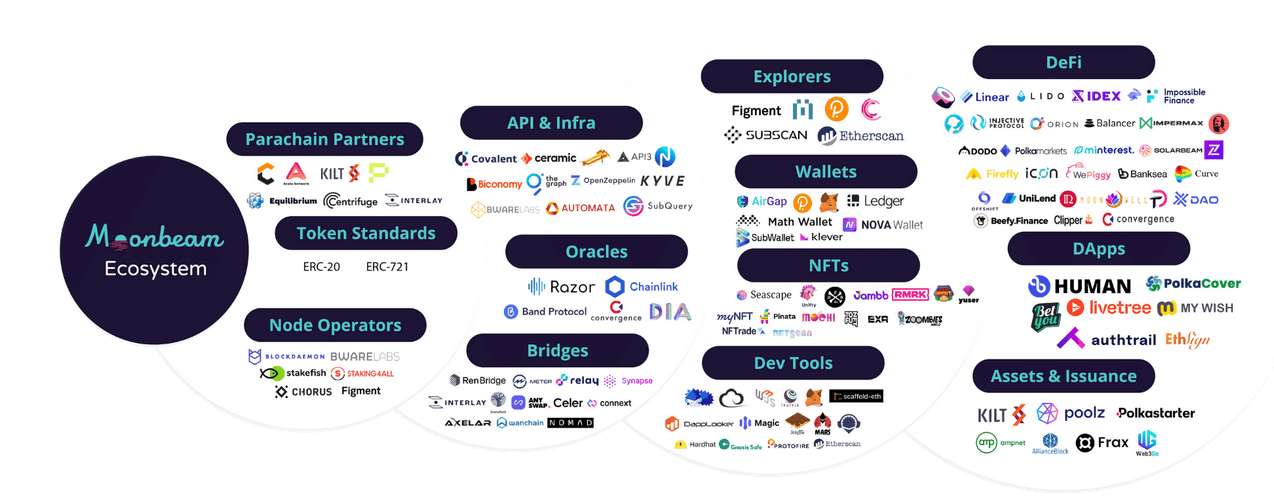

Moonbeam has seen many integrations with Ethereum-based protocols, with Curve and Lido being the biggest, as well as cross-comms protocols such as Synapse and LayerZero. Situated as the Polkadot version of Ethereum and the portal to Ethereum-based protocols, Moonbeam is well-placed for this kind of collaboration, and successful integrations with Moonbeam are a big win for the entire Polkadot ecosystem.

TVL on the Moonbeam network has been grinding up despite market conditions. With the integration of new protocols and the launch of Moonbeam native protocols, such as Moonwell Artemis (think Aave on Moonbeam – decentralised lending/borrowing protocol), DeFi activity on Moonbeam has largely been outpacing other Parachains on this list.

Although TVL figures are quite small compared to other ecosystems, we believe that this is purely a case of the relatively early stage of the Polkadot ecosystem’s development, and you’ll notice these numbers are quite small across the board for the Parachains covered in this report. Up until very recently, there wasn’t much to do on the ecosystem, but we believe that momentum will pick up going into the New Year as further integrations with existing protocols increase and the user experience is improved.

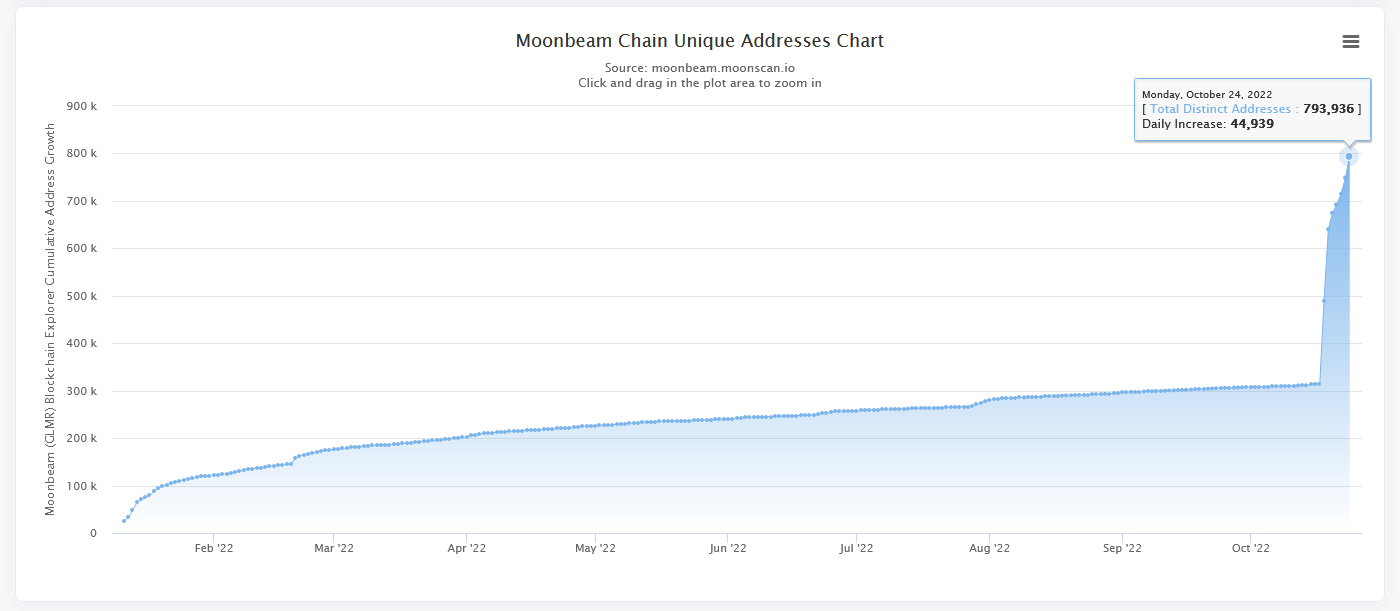

Unique Moonbeam addresses spiked in September/October, most likely coinciding with the USDT integration, further outlining the network effect that the Tether integration has had.

Moonbeam has been a top performer in terms of network activity, development progress, and integrations within the Polkadot ecosystem, and the numbers show it. Of the Parachains we selected, we’re most impressed with Moonbeam – although the token price doesn’t show it (yet).

Parallel Finance

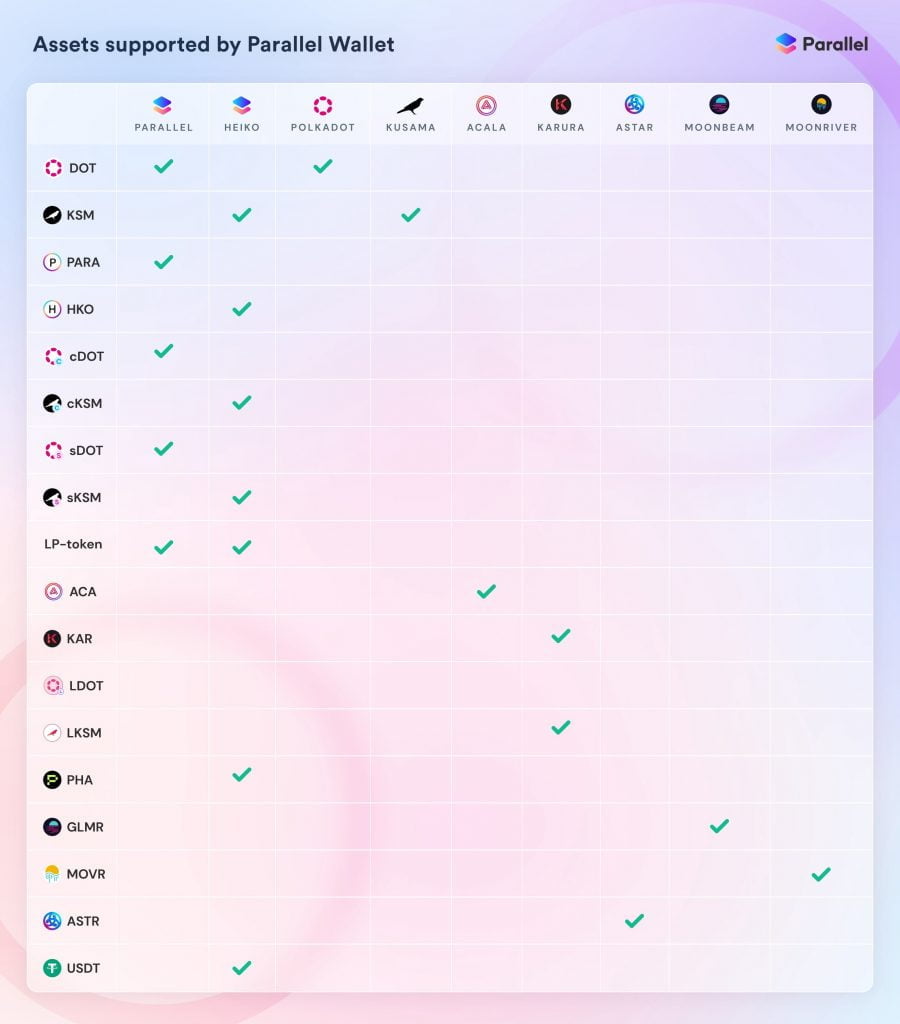

Another of our top picks, Parallel, has seen outstanding progress in development, and we expect this to continue indefinitely. We recently released an ecosystem report that outlines Parallel; however, there have been a few developments that were not included. Earlier this year, Parallel launched its own multi-chain wallet (Parallel Wallet), which supports several assets across both the Polkadot and Kusama ecosystems.

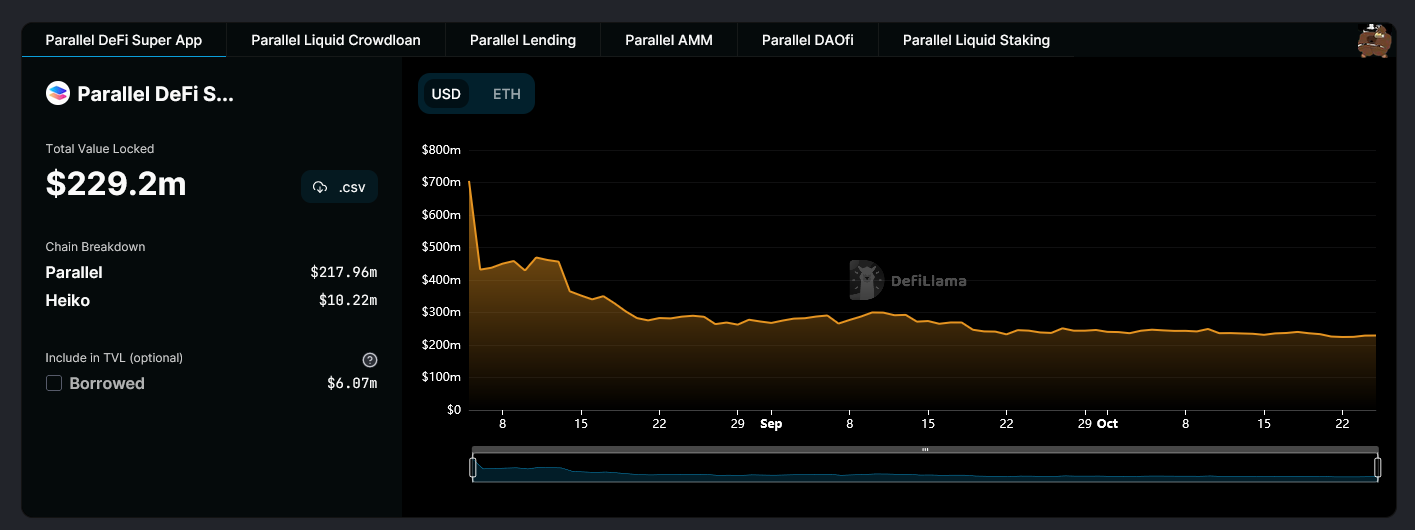

Over and above the launch of the wallet, the Parallel DEX (thanks to the USDT integration) is actually usable now. Before, there was only the ability to swap PARA to the derivative liquid DOT tokens. However, a few new assets have been added, and the Parallel DEX now has around $50 million in TVL – roughly 22% of the total for the Parallel Ecosystem.

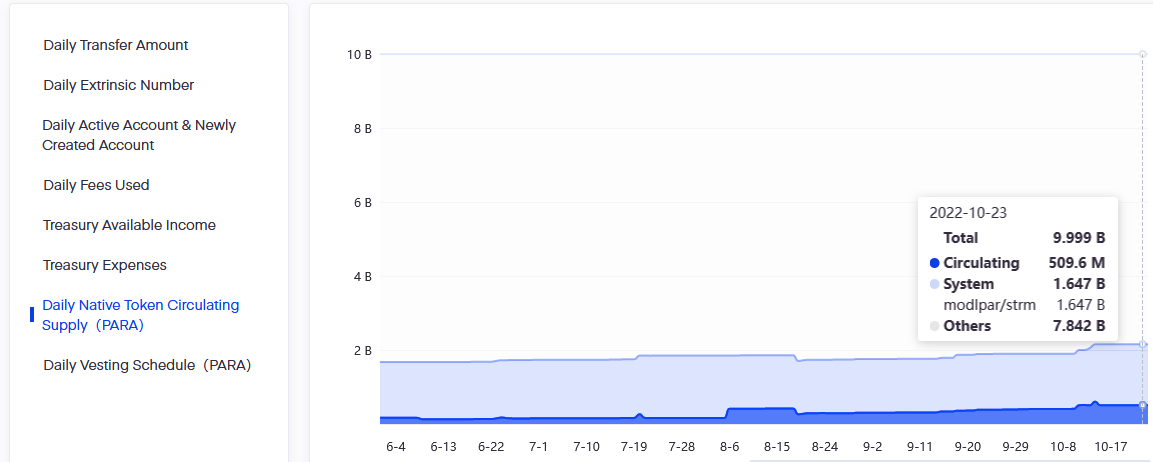

TVL has been mostly flat across the entire ecosystem, with liquid crowdloan deposits taking up most of the total. One issue that Parallel has is in its tokenomics – the emissions schedule is heavy on inflation.

Since the start of June 2022, over 350 million PARA has been added to the circulating supply, a 200%+ increase. This is largely down to incentives for using the network – liquidity providers are subsidised with additional PARA tokens on top of any natural yield accrued, as well as PARA bonuses for using the platform for liquid crowdloans.

This is not great from an investment perspective, as inflation without meaningful lockups etc., is certain to drive prices down. This is our main concern with PARA and is not likely to get any better until further token utility is rolled out in future products.

Astar Network

Astar now has 23 DApps (not including Astar itself) in its ecosystem, ranging from decentralised exchanges such as ArthSwap to more bespoke protocols like Astar Degens, a DAO that aims to incubate and assist developers with making their ideas practically and economically feasible.

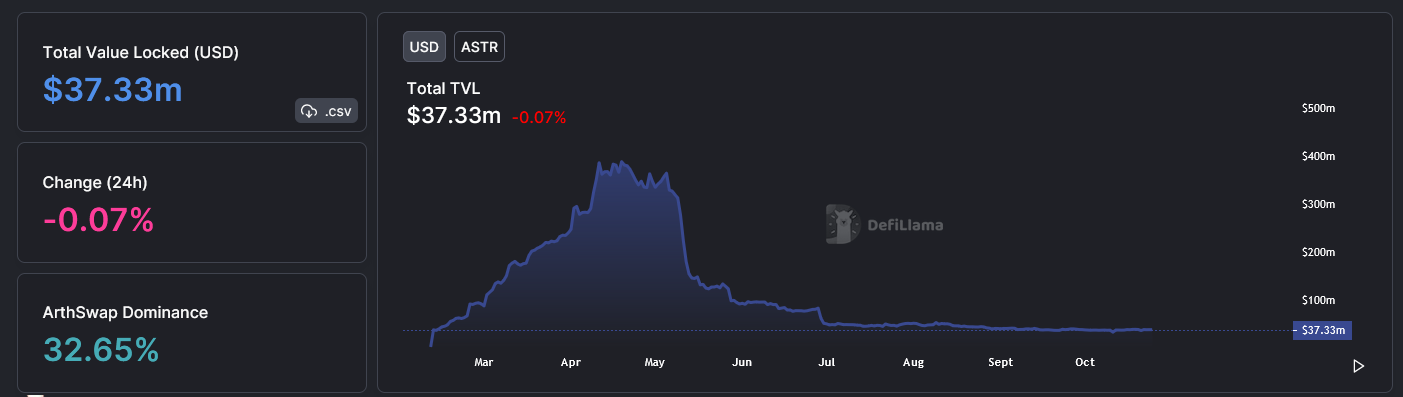

Astar took a hit on TVL, as did the ASTR token price, along with the rest of the market earlier this year. The dump was aggravated by the end of the Astar Stake2Earn festival. When this ended, there were not enough projects launched on the network to move the previously staked ASTR into, so TVL collapsed and took the token price with it. This is a recurring theme on the Polkadot network – price depreciation is not because these projects don’t work; it’s because there have been few opportunities for network participation until very recently.

Web3 Cities?!

One interesting development for Astar Labs is that the second largest port city in Japan, Fukuoka, has announced a partnership with Astar to begin working on Web3 use cases. The program aims to work with individuals and businesses to educate and provide support to those who want to integrate aspects of Web3 into their everyday operations. In addition to this, over 45 companies have now partnered with Astar Labs to drive innovation in the space – Microsoft Japan & Amazon Japan being the biggest contributors.

From day one, Astar has set out to create an all-in-one solution for developers by enabling multiple programming languages under one virtual machine. We are confident that they can fulfil this niche and, owing to the focus on the development environment and DApp staking, Astar is one of the most promising projects on Polkadot from both an investment and utility standpoint.

Is Acala Bust?

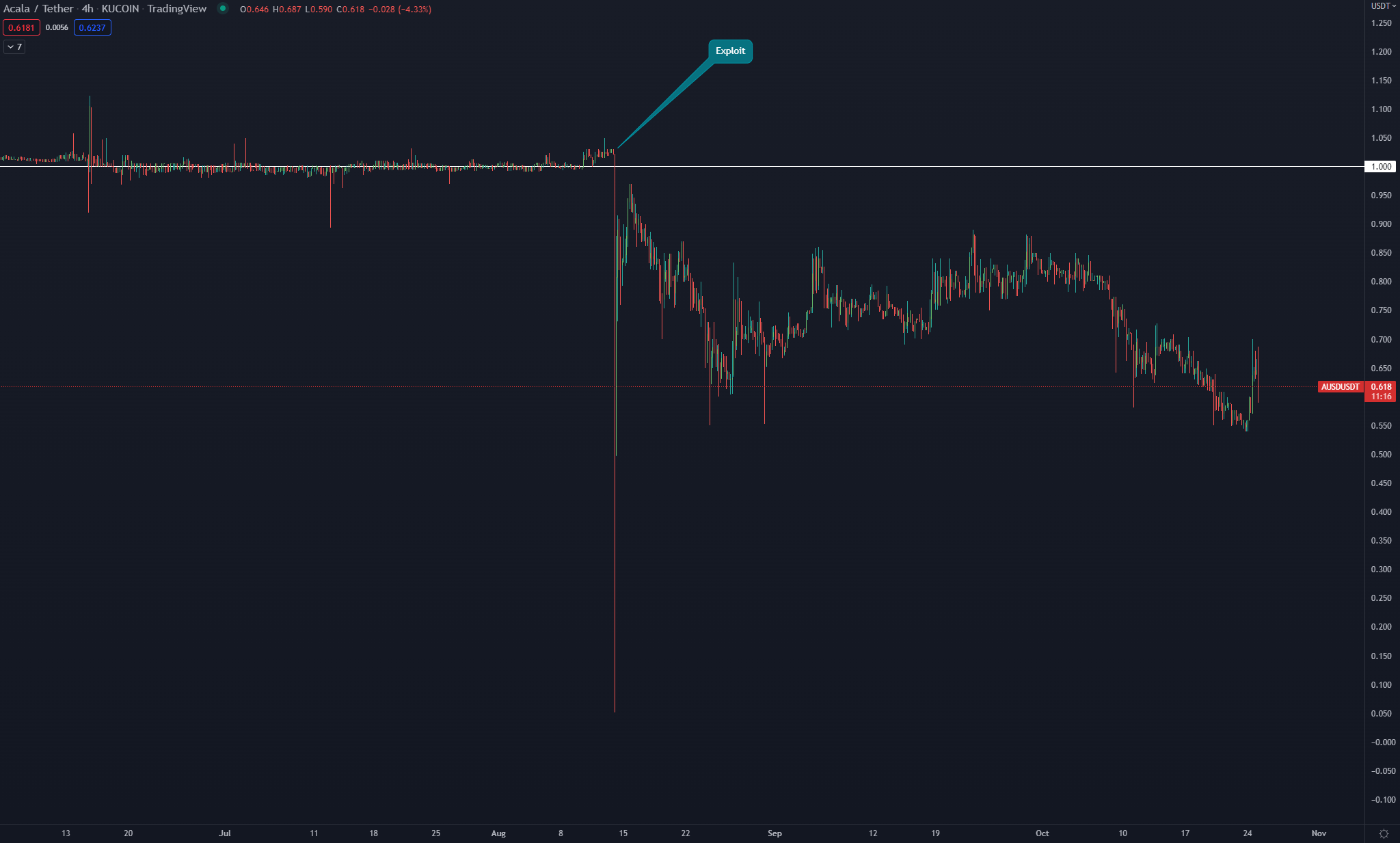

We’ve saved the elephant in the room till last – Acala. The ecosystem suffered an exploit in August where over 3 billion aUSD (Acala USD, the native stablecoin) was minted. The hacker was able to exploit a problem in the code relating to the issuing of incentive rewards, and they were able to exponentially "print" aUSD.The iBTC-aUSD pool was completely drained, and the DOT pool was also partially drained; however, ultimately, only $1.6 million in funds were taken off-chain in addition to around $4.6 million of minted aUSD before the Acala team put the network on maintenance mode, stopping transactions and halting the connection to other chains.

aUSD briefly went to zero – there could be no other outcome since the huge number of printed tokens had no collateral to back them. What happened?

- Acala was put into maintenance mode halting all internal, inbound, and outbound transactions.

- An investigation was underway almost immediately to track the wallets that managed to withdraw funds – 16 wallets in total were identified as having error-minted balances.

- Around 2.97 billion of the 3.022 billion aUSD tokens have been identified, and all of these have been burned, which has restored the aUSD peg.

- The network is now back online, and normal functions have been restored.

- Acala has updated its risk parameters and has continued audits.

Before the exploit, there was around $115 million in TVL, which is now down to around $45 million. The collapse of aUSD was a huge hit for the Polkadot ecosystem since before USDT was integrated, aUSD was the only stablecoin available on Polkadot. We believe that it will take many months for confidence in the Acala and its stablecoin to recover – if it ever does. With the USDT launch on Polkadot, there is a clear bias towards using USDT rather than aUSD for the foreseeable future.

What’s the Outlook?

For the most part, we are happy with the pace of development across our Giga-Brain picks. The main competitor for the Polkadot network is Cosmos. We have outlined that the tokenomics model for ATOM (as they are right now, see this report for updates on Cosmos) is completely inferior to DOT tokenomics. However, the Cosmos ecosystem is more expansive and has a much farther reach owing to its sharded nature.In terms of DOT, what we would look out for going forward is the relatively large unlocks that will happen once the first batch of Parachain leases expires towards the end of 2023. It is unclear to what extent DOT may be re-deployed back into the Parachain projects, but that basically depends on the market conditions at the time, along with any incentives from the Parachains themselves.

It’s important to note that we got our allocations for “free” (we’ll get our DOT back in December 2023), and so we’re quite content to ride out the downside. For more information on individual projects, the links above include further details and long-term outlooks.