DYM looks “overvalued”, but nothing is off limits in a bull market

In less than two weeks since its token launch, Dymension (DYM) has surged more than 100% – one of the few instances when a new project debuts with gains straight out of the gate and maintains the rally.

Why is DYM surging?

On the one hand, you can look at the project, the technology, tokenomics and other fundamental factors. But beyond that, timing and hype also influence how a token performs.

So which is it?

In this report, we peel back the layers to determine if this shiny new coin is well-positioned to be a winner in this bull market.

If you don’t have exposure to DYM yet, you may be experiencing strong feelings of FOMO. And if you are already in, you may also experience strong feelings of FUD.

Irrespective of what side of the divide you fall on, we strongly recommend that you don’t take any action until you’ve read this report.

Let’s dive in!

TDLR

- Dymension (DYM) is a modular blockchain infrastructure provider that has surged over 100% since its launch.

- Despite the price run-up, on-chain data shows minimal usage and activity so far. Fundamentally, DYM looks overvalued at current prices of over $7.

- However, bullish market tailwinds, airdrop hype, and speculative future growth potential could push prices higher in the short term.

- Long-term valuation depends on the ecosystem’s growth. If successful, a $3-$20 billion market cap is possible, implying a price of $10-$65 for DYM.

- For new positions, wait for a better entry point around $3-$4. For existing holders, continuing to stake DYM may be worthwhile due to uncapped airdrop potential.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Let’s start with modular blockchains

Dymension provides the decentralised infrastructure for the next generation of blockchain applications. Like an internet service provider routing data between endpoints, Dymension functions like a decentralised router connecting RollApps to the crypto economy.If you’ve DYOR into Dymension, you would have noticed Celestia coming up a lot.

Many people get lost here, but we will break it down for you.

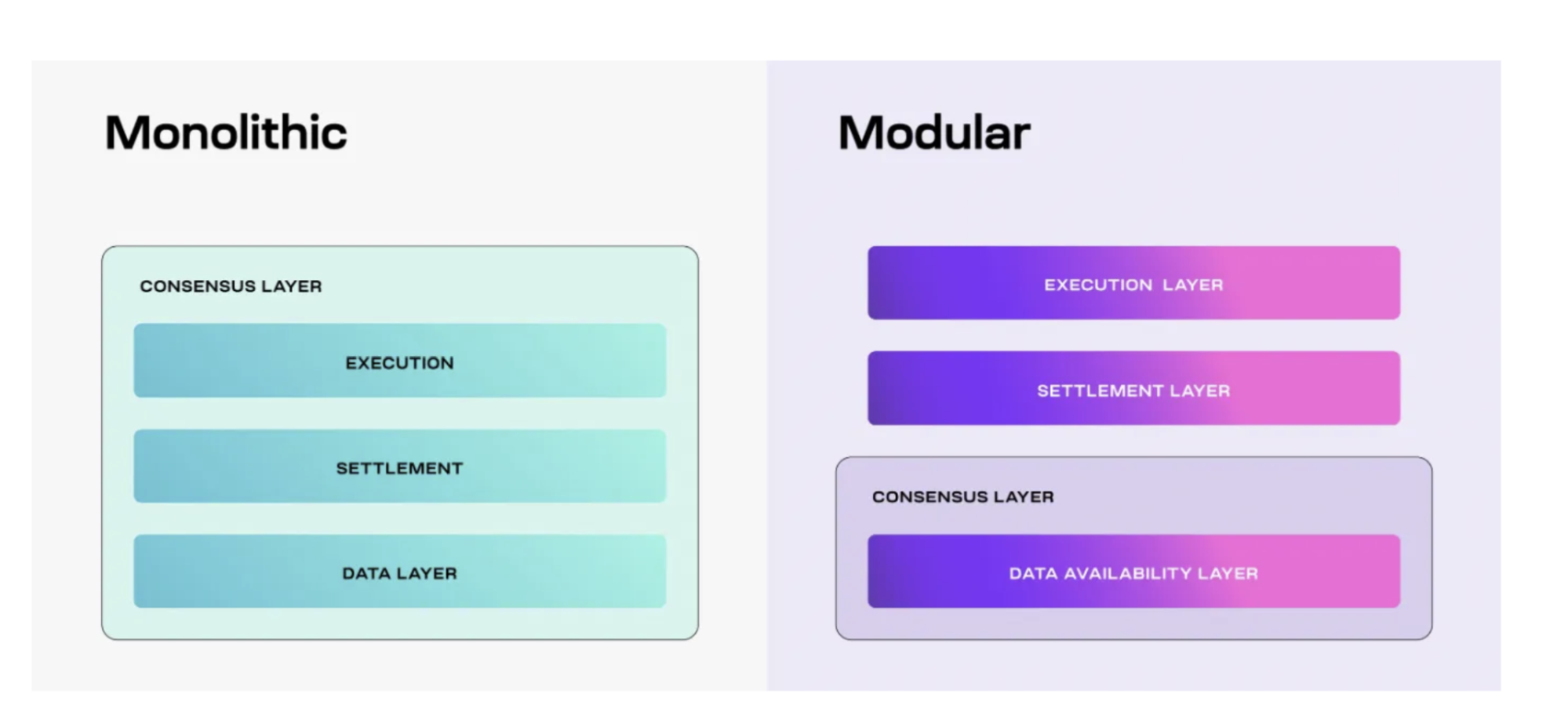

Some blockchains have a monolithic structure, and others have a modular structure.

Ethereum and Solana are great examples of monolithic architecture, where the consensus layer also manages execution, settlements, and data availability.

In a modular ecosystem, the consensus and execution layers are decoupled. In the case of Dymension, Celestia will provide the consensus layer, and Dymension will provide the settlement layer for the execution layer or L2 blockchains – all interconnected through the inter-blockchain communications (IBC) protocol.

Dymension’s working model

In Dymension’s modular infrastructure, the execution layer is formed by rollups. These rollups are blockchains that are built on top of other networks. These networks form a combination of settlement, consensus, and data availability.Roll-apps are application-specific rollups that can be built and customised according to the developers. Dymension provides an RDK (rollup deployment kit) for developers to launch roll-apps on top of Dymension.

Dymension provides roll-apps with security, interoperability, and liquidity, and DYM tokens secure the L1 blockchain. It has its own set of validators that build blocks and use DYM tokens for staking.

The final layer is about data availability. Dymension allows roll-app developers to access their own DA layers. For context, on the Ethereum ecosystem, you can only access ETH DA. With Dymension, roll-apps can use DA from Celestia, EigenDA, or others. This is where its modular architecture shines through.

Dymension tokenomics

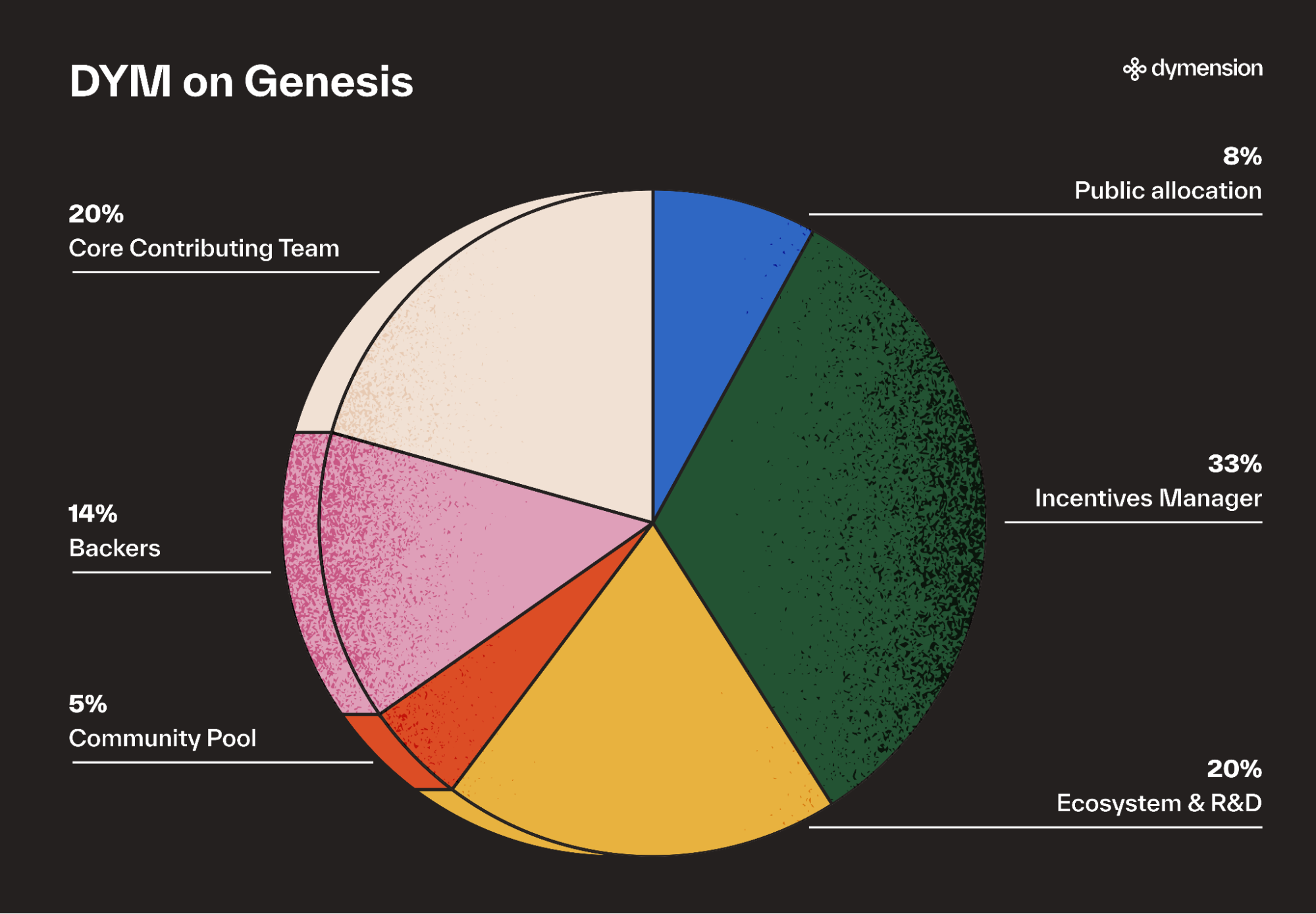

Dymension’s token generation event created a lot of buzz in the ecosystem. The network mainnet went live on February 6, serving more than $390 million worth of DYM tokens for its early users. Within a week, its market cap crossed $1 billion.The protocol dropped 146 million tokens at launch, i.e., 14.6% of the total supply. The total circulating supply breakdown is listed below.

At first glance, the tokenomics doesn’t appear to be investment-friendly, with major allocations to the core contributing team, backers, and incentives manager.

However, over the next 12 months, the allocations will have a 12-month lockup period, followed by 24-month linear vesting.

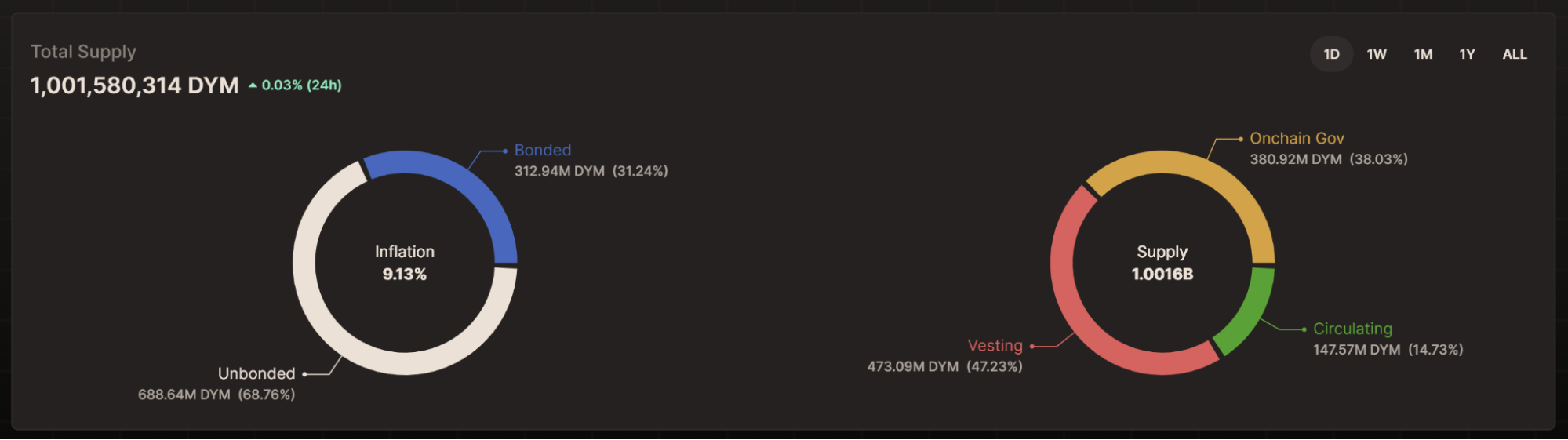

There is further evidence that indicates reduced token dilution. At the moment, 31% of the tokens are bonded. When we looked through the validators list, we observed that around 245 million DYM tokens were bonded through delegation. Subtracting that from the total bonded tokens, we get 57 million DYM tokens, i.e., potentially the number of tokens staked, from the current circulating supply of 146 million. That is a huge amount of the initial supply.

(It is important to note that the circulating supply is expected to reach 198 million by the end of February.)

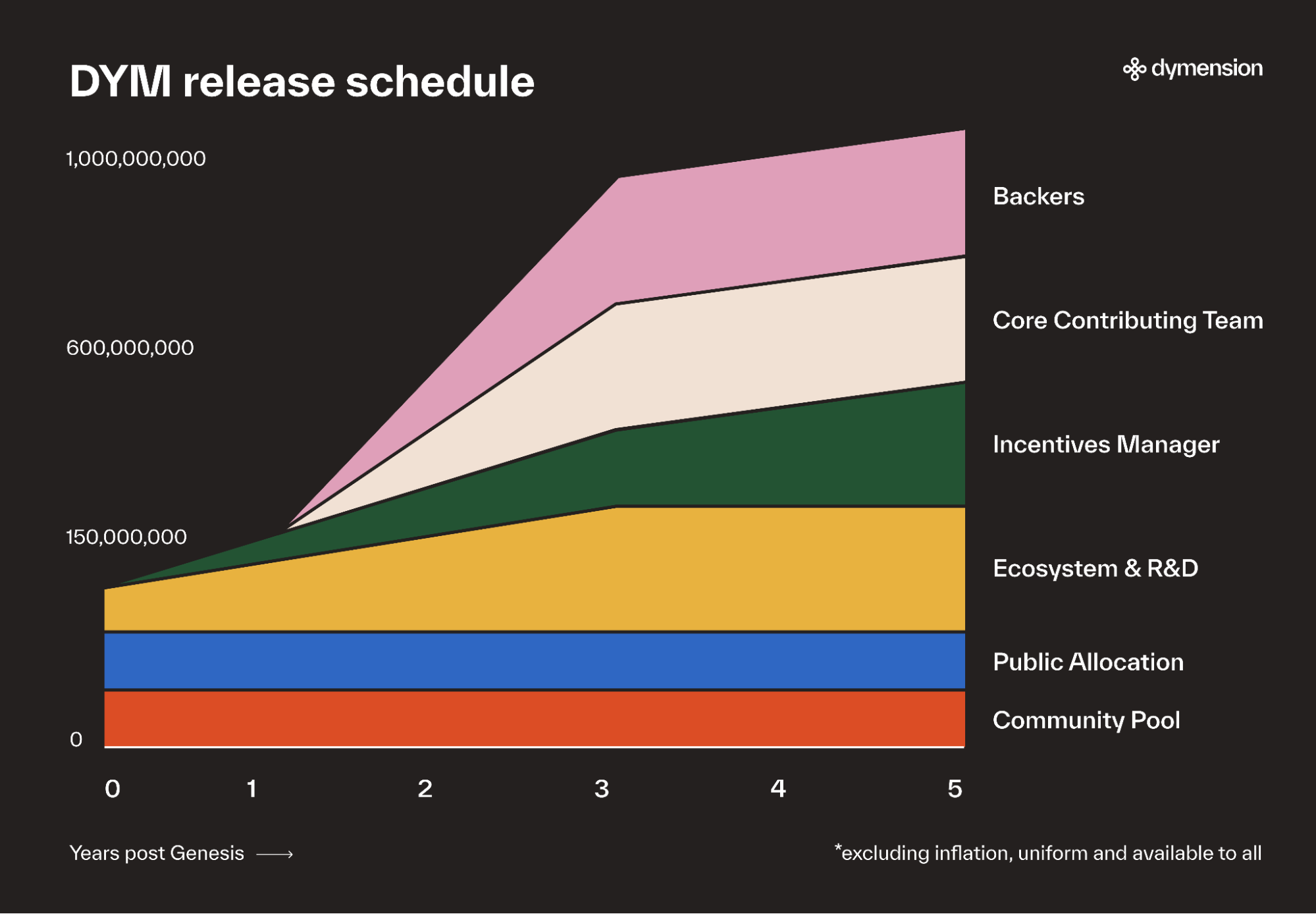

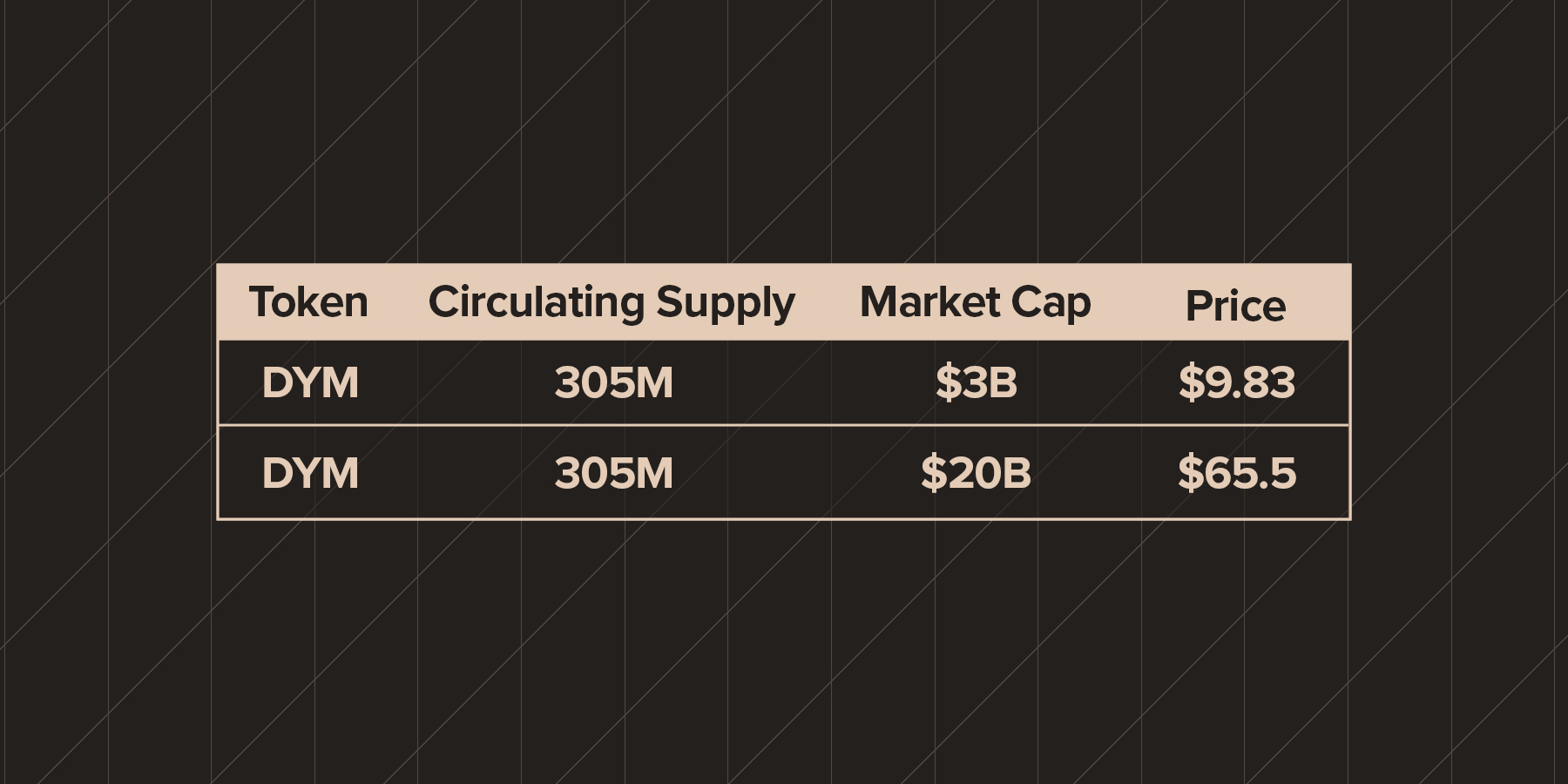

The emission schedule highlights that in February 2025, around 305 DYM tokens will be circulating, vested slowly throughout 2024. As highlighted earlier, the selling pressure from investors and the team is locked in for 12 months.

Over the long term, the token should face inflation pressure, but until 2025, certain positive catalysts can improve incremental demand for the token, which may trigger positive price action.

Long story short, even though DYM has delivered an impressive performance since it launched, the tokenomics suggests that the token will likely face a supply glut ahead. And unless major catalysts continue to support demand for DYM, the strong token performance may not be sustainable.

How do we value DYM?

We will be taking a couple of approaches in this section.First, we will review the logical long-term route, focusing more on the cash-flow basis increment and token economics. Second, we will take on a more demand/supply dynamic path for a short-term period, incorporating a bull market narrative and positive catalysts.

1. Long-term: monetary policy to generate revenue

Dymension aims to create a sustainable ecosystem between supply and demand, where DYM will be part of utility and value accrual. Its three value accrual mechanisms are:- Burn: DYM tokens are systematically burned as part of validating bridging fees and protocol swap fees.

- Transaction Fees: All fees generated from blockspace demand are distributed amongst DYM validators and their stakers.

- Supply Lockup: RollApp bonds reduce the circulating supply of DYM, enhancing the network's security and stability.

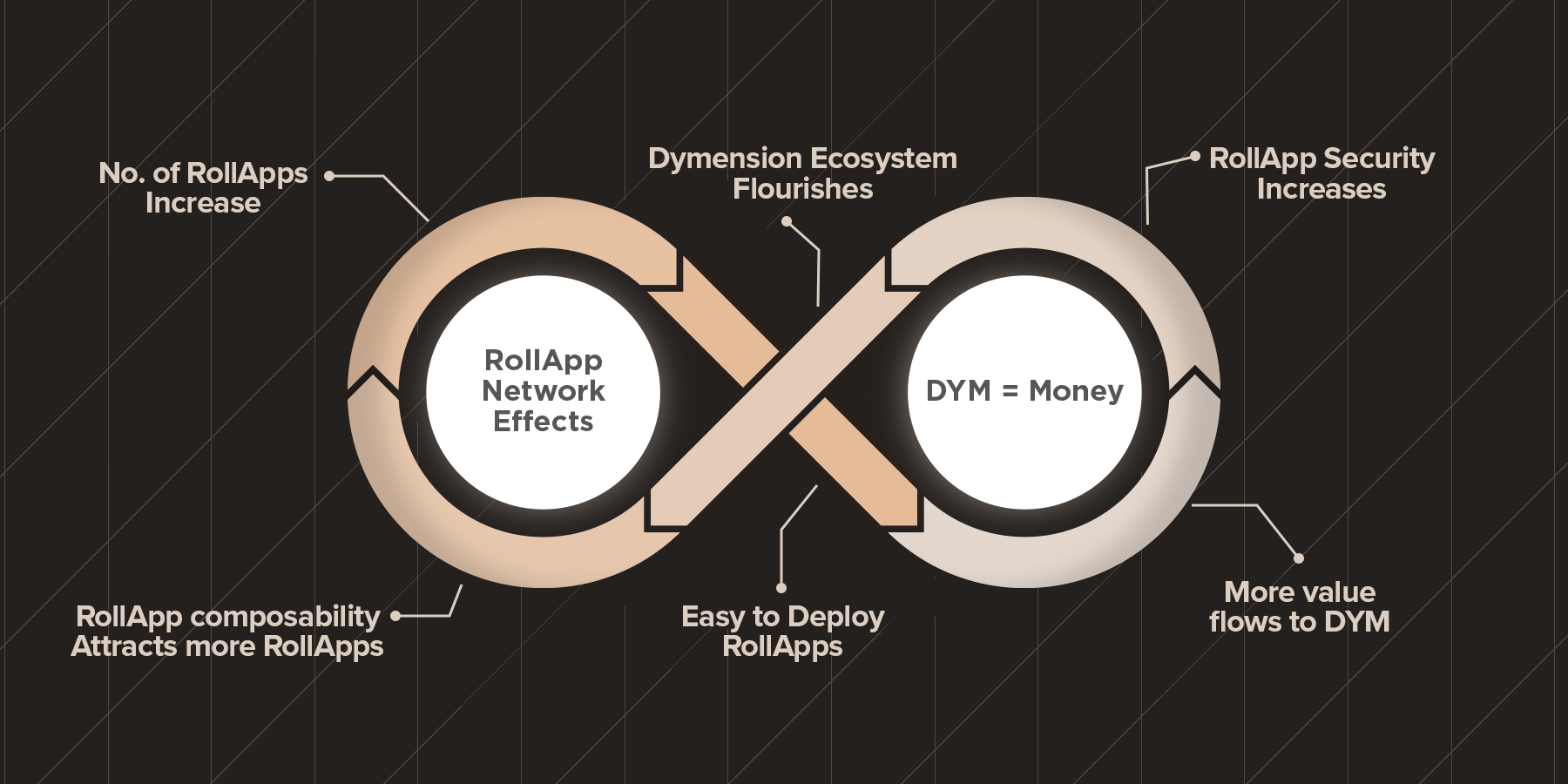

As one of the first-mover advantages in the RaaS (roll-apps as a Service) ecosystem, DYM has the upper hand, where a successful loop would look like the following:

Now, the success of the Roll-app ecosystem will lead to higher users, where participants will purchase and stake DYM for yield. Increased market valuation of DYM enhances its security, drawing in more RollApps to leverage the token.

Enhanced roll-apps will increase engagement and transaction volumes, generate higher fees, and consequently boost DYM burning and token value. Rising DYM value will convince more individuals to invest in and stake it, reinforcing better security for roll-apps.

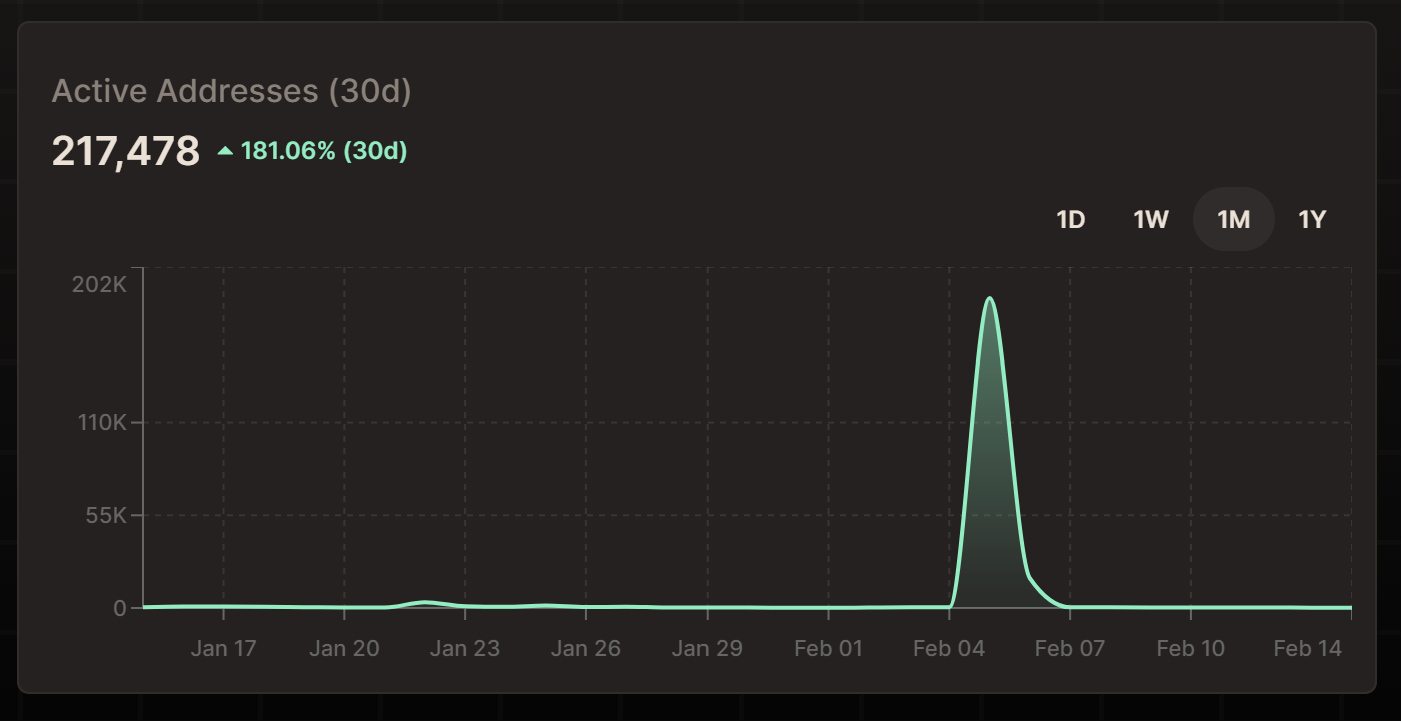

This is the ideal scenario for DYM, but in reality, the performance of its test net suggests something else. Out of 15,394 deployed roll-apps, only 1135 are currently live. The top roll-apps have less than ten active addresses, and none of the roll-apps are currently convincing.

The spike in active addresses was only evident during its TGE and airdrop; since then, there has been no relevant activity.

It is only a testnet, and we are still early, but based on current statistics, the project screams overvaluation at the moment, which brings us to its short-term value scenario.

2. Short-term: a bull market, airdrops, and memes

One of the factors that has propped up DYM so far is the triad of bull market sentiment, airdrops, and meme culture.The crypto market is in an uptrend, and fundamentals get thrown out of the window during bull markets. For context, BTC is up 20% in the last seven days. Despite bearish macro data in the broader economy, we’ve not had a meaningful pullback in three months.

Now, airdrop farming is the current bullish market trend – people can stake their tokens to be eligible for more airdrops.

TAI and DYM are related projects, and TIA stakers received 5-figure airdrops over the past few weeks. So, the DYM community expects a similar trend with Dymension. The common consensus is that current and future roll-apps will be deployed on Dymension, which makes DYM stakers eligible for incentives. Therefore, a large quantity of DYM is staked.

With DYM, the airdrop hype is even higher because there is uncapped airdrop potential from limitless roll-apps that will be deployed on the protocol.

Lastly, the present staking APR is 30%, and no one is looking to sell DYM at the current price point. Based on its limited emission schedule over the next year, the demand dynamics are favourable for DYM, regardless of the success of roll-apps in the near term.

All the factors above are keeping users in the Dymension ecosystem, and that’s the main reason the token has been on an uptrend and is likely to continue on that path in the short term.

How high can DYM go?

If you aren’t in DYM already, the risk-to-reward ratio of building a position on DYM is very high at the moment, especially because the token looks extremely overvalued based on the on-chain market activity.We will re-evaluate the token when it falls in the $3-$4 range; this might be the ideal range to consider entering a position to improve the odds of a positive performance.

That said, we are in a bull market where narrative triumphs over logic and the right conditions can cause massive hysteria-led rallies.

Keeping these factors in mind, let us calculate where DYM prices can be in 12 months if it continues to enjoy the bullish tailwinds from the broader bull market, airdrop expectations, and winning narrative.

Currently, the execution layers, or L2s, are worth $20+ billion. Data availability layers are worth around $3 billion and growing. So, it is not out of line to suggest that settlement layers can be valued in the same bracket since they form an equally important component in a modular network.

Now, we have to keep the emission rate in mind, as the circulating supply will be 305 million DYM in February 2025. We are also considering the growth for DYM from $4, where we would consider buying into the token for maximum returns.

Therefore,

- Base case scenario from $4, DYM can rise by 2.5x

- Bull case scenario from $4, DYM can rise by 16x.

Price analysis

DYM has been trading on the market for only a week. After reaching a high of $8.3 on Feb. 8, the token has slowly consolidated down to the $7 support range.

Now, at the time of publication, the token has registered a new all-time high at $8.73.

There is limited data, so a concrete analysis is not possible now.

Cryptonary’s take

It is important to understand the context behind Cryptonary’s large price target. This is based on peak market hysteria, where everything falls in line for DYM.We do believe there is huge market potential for the protocol, but a 16x return is a pure hopium target right now.

We have drawn this analysis because people who receive DYM tokens as airdrops can continue to hold the asset. They have nothing to lose financially, as they are not actively investing.

If you aren't exposed to DYM already, we want to double down on our earlier sentiment. At $8+, DYM is a risky buy because, going by pure fundamentals, DYM remains overvalued.

The lack of on-chain statistics and market growth limits a cohesive outlook, but from a fundamental point of view, modular blockchains have a future.

We will keep a close eye on Dymension and how the testnet fairs over the next couple of months, and come back with a revived investment proposition, and if it ideally matches our 16x hopium target.