Earn passive income on stablecoins: High-yield stablecoin strategies for all levels

Welcome to another week in a ranging market. As we remain stable and effectively sidelined from all the noise, it can tend to get boring. Our fingers twitch as we look for ways to engage while the markets remain uninteresting. Well, look no further because today, we have 4 interesting high-yield-bearing strategies for everyone from beginners to more advanced levels.

In this article, we will be covering stablecoins specifically, but stay tuned-over the coming weeks, we will share strategies for major cryptocurrencies and more advanced strategies as well.

Ever wondered how your stablecoins can make money for you without having to trade a single chart? That's exactly what we're about to dive into.

As a reminder, yield farming is essentially a way we can put our stables to work to get us extra returns while holding our coins. This is done through DeFi, one of the pillars of crypto space. In this article, we will cover a few different sections. First, we will look at different types of simple yield strategies- some with lockups (which we'll discuss later) and some without. Finally, we will take a look at a more advanced way to get a higher yield on your stablecoins.

Sounds interesting, right? Great, let's dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Yield strategies with lockup

The first couple of strategies we will be looking at are platforms with lockups. Lockups essentially mean that once your tokens are in the vault, pool, or LP position you cannot immediately withdraw your tokens.Sometimes you might have to lock them up for a couple of weeks or you might have to wait a couple of weeks to withdraw from them. To clarify this doesn't mean that it's unsafe to do, rather, it is just a different way things can be done in DeFi.

Pendle

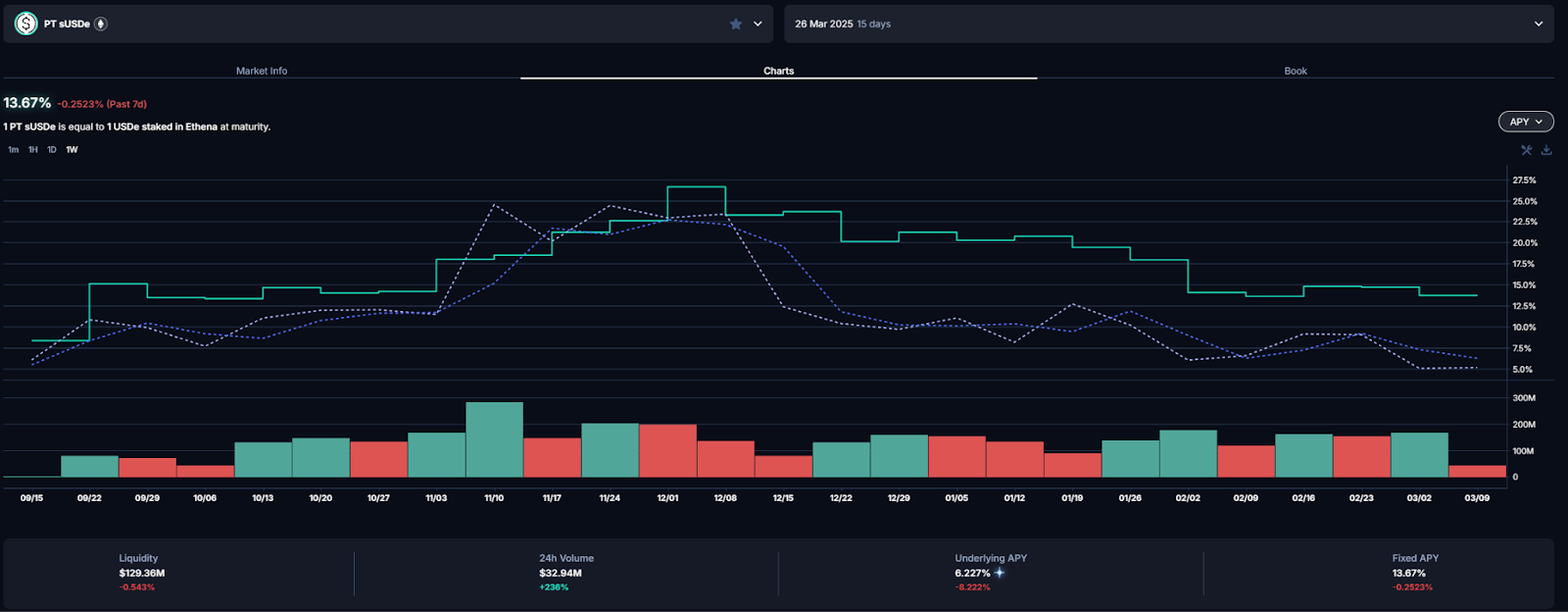

The first yield bearing platform we will look at today is Pendle. Pendle is a permissionless yield-trading protocol that allows you to manage and optimize your yields. It enables users to tokenise their yield-bearing assets, and to trade the principal and yield components separately. For a more in depth explanation feel free to check out some of the articles we've written prior.On Pendle we want to look at the following sUSDe pool which at the moment has a 13.67% fixed rate APY. Now as we said prior to this there is a lockup and as we can see in the top left of the image below it is for 15 days where after that is done you will be able to remove your tokens from the market.

Benefits

- Simple process

- Deep liquidity

- High APY while having to just deposit stables

- Yield tends to drop over time

- Smart contract risk

- Unstacking period

- Temporary Depegs

- Go to Pendle website

- Click on Markets

- Click on the green fixed APY button on the sUSDe row

- Select how much you want to put in

- Click swap (~13% APY)

Drift

The next product we want to talk about is called Drift. Drift is a decentralised exchange native to Solana but, over time, has branched out to other things, such as strategy vaults, which is the product we will be looking at today.A strategy vault is a way for people to maximize their yields with trading strategies employed by teams on Solana. These strategies can vary from aggressive to delta-neutral to a mix of leverage and hedges.

Today, we will be looking at the vault called Hedged JLP.

Hedged JLP+ is a vault where the team running it (M1 allocates to the Jupiter Liquidity Pool token (JLP) while hedging the underlying JLP positions to deliver stable, market-neutral returns. The returns specifically come from a combination of the fees paid to the Jupiter Liquidity Pool by traders and the funding rate payments by shorting the underlying asset. So through owning the asset and shorting it at the same time, they remain neutral and collect fees, which in turn deliver us, the stakes, yield in return.

Looking at the informational snippet below, we can see that the APY over the past 90 days has been significantly high at 31%, and on top of that the TVL is also quite high at 28M dollars, in USDC, supplied. This shows us that people trust this vault and for now the APY remains quite lucrative

It is key to note that this vault has a lockup of 3 days and 12 hours; this means that once you move to take your position out of the vault, you must wait that long to regain access to your coins. However, this vault does not explicitly use them. It's also important to see that this vault does have the ability to draw down, and looking at the screengrab above, we can see that the max daily drawdown is 1.17%

Benefits

- Easy to understand

- High APY

- Proven Hedge Fund running it

- Lockup period of 3 days and 12 hours

- Smart contract risk

- Yields can be variable over

- Go to the Drift website

- Click on Strategy Vaults

- Click on the "View Vault" button on the Hedged JLP+ row

- Deposit into the vault (~33% APY)

Yield strategies without lockup

The next two yield strategies we are going to talk about are liquid staking options that require no extra work besides clicking into the farm/ yield opportunity, and when you are ready, you can seamlessly remove your stake within the same minute that you want, with no lockup.These options typically can come with a bit less yield but the ability to have quick access is nice especially in fast moving markets.

Beefy

The first option we have for earning yield will be on Beefy. For a quick refresher, Beefy is a multi-chain yield optimizer that allows us to get higher returns while doing the work for us, such as auto compounding.On Beefy, we want to zero in on the Seamless USDC vault which at the moment has a 7.1% APY and about 30M dollars deposited. Making it quite a high yield along with a good amount of the market backing it.

Benefits

- Roughly 8% yield passively on USDC

- Simple to use

- Automated

- Instant Unstaking

- Over time, APY tends to decrease.

- Smart contract risk

- Check slippage

- Go to the Beefy website

- Filter by stablecoins

- Click on the Seamless USDC vault

- Click deposit (~7.4% APY)

Morpho

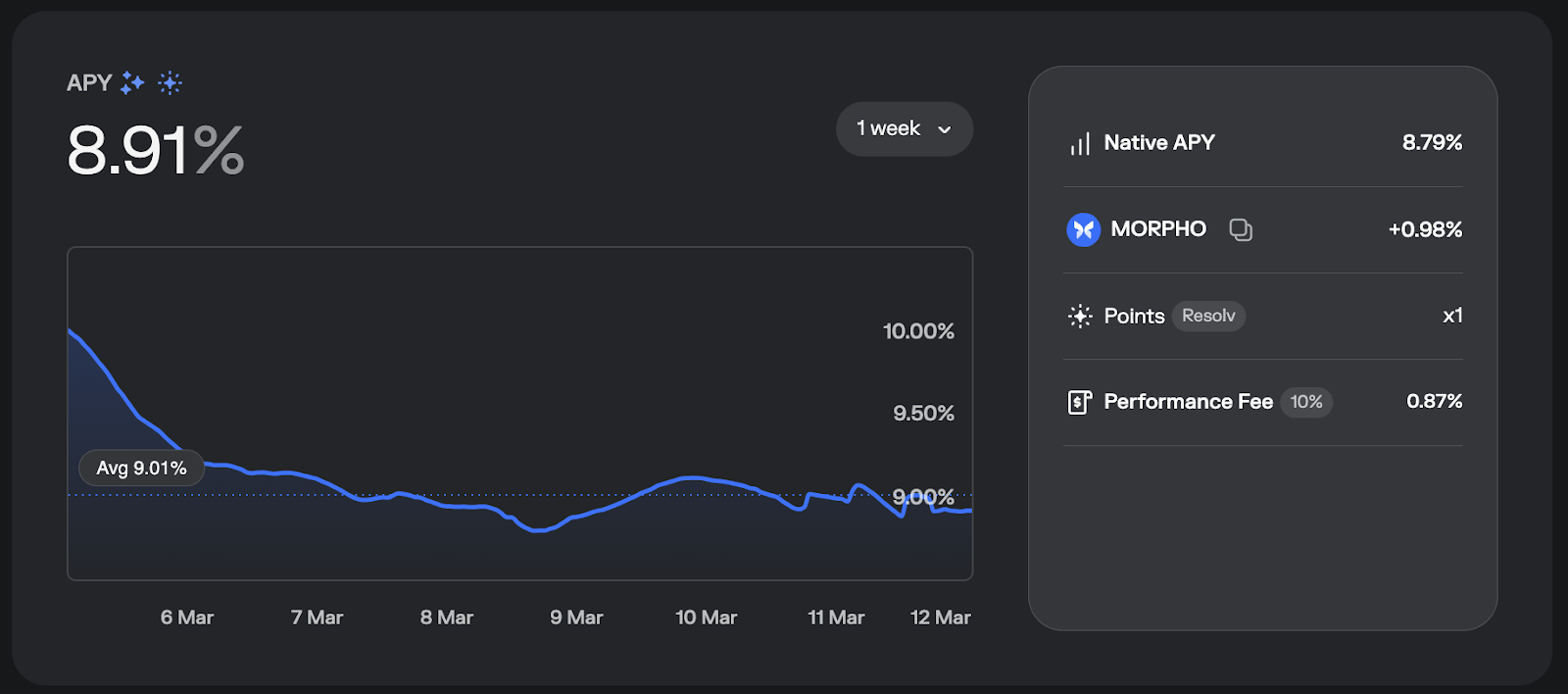

The second non-lockup option will be through a platform called Morpho. Morpho is an open infrastructurefor on-chain loans and is self-proclaimed as the most secure, efficient, and flexible lending platform. Morpho is EVM-based and has a whopping $4.8B deposited into vaults on the platform.

On Morpho, we will be looking to use the MEV Capital Usual USDC vault. This vault works through the team (MEV Capital) using USUAL-boosted USDC and then providing it to a set of liquid collateral markets. But it's mostly comprised of USD0++ and USDC.

As we can see below, the deposits are over a quarter of a billion dollars, and the APY is at almost 9%.

As we continue looking, we can also see that natively, the APY is 8.79%, and an additional 1% is given through the Morpho platform.

Benefits

- Deep liquidity

- Low risk of liquidation

- Simple to use

- APY does tend to drop slightly over time

- Smart contract risk

- Temporary Depegs

- Go to the Morpho website

- Click on the MEV Capital Usual USDC vault

- Click deposit (~8.91% APY)

- You can use the vault both on Ethereum and on Base

Best practices for yield farming

While all this yield can seem quite amazing there are two quick reminders we want to leave you with before you go clicking buttons.The first thing is to remember to stay diversified. This means that at any time, you should never keep all your eggs in one basket. This is because while these platforms are safe and do have millions, and sometimes billions of dollars worth of capital, behind them, they still all carry inherent smart contract risk. Even the biggest companies have been hacked, and just recently, Bybit got drained of 1.5 billion dollars instantly. So, always remember that no matter how good the yield sounds, there are no insurances in web3, and because of that, we must always act with longevity in mind first.

The second and final thing to remember is to make sure to monitor your positions. While APY remains good now, these numbers are subject to change over time. This is especially true with active high APY farms and liquidity pools, which should have constant reassessment to ensure there are no impermanent loss issues, APY falling, or anything else. In DeFi, it is paramount that we keep up to date with all our positions regularly.

Cryptonarys take

Overall, we can see that there are still many ways for us to look to actively make a return in the market. From sit and relax strategies to more active ones, there is something for everyone. That being said, we urge you not to get too complacent as with anything, it is necessary to keep tabs on your positions. At the end of the day, yield farming is a great opportunity to get returns while the markets are slow, and we believe it is worthwhile for you to look into.The market may be slow, but your money doesn't have to be. Yield farming is an easy way to earn while you wait, and we'll be back soon with even more advanced strategies.

That's it for us.

Cryptonary OUT!!