- Large addressable market

- Token value accrual

In this journal, we outline how this token can accrue interest (yield) in detail. We go through the available options as well as explain the risks associated with taking part in this endeavour.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

This report was exclusively created for Cryptonary Pro members and is in relation to the 30X Fundamental Research Report.Introduction

The time has come, it is finally here.The highly anticipated launch of Multi-Chain ChaosNet (MCCN) on Tuesday 13th April has come and gone, but we have seen a few people asking what this exactly means for THORChain, RUNE and the wider DeFi economy.

THORChain is the first (and currently the only) protocol that facilitates asset swaps between chains in a permission-less, trust-less and non-custodial environment. This is impressive, but even more so when you consider that to facilitate the swaps THORChain does not use a pegged or representative asset – direct Layer 1 to Layer 1 swaps via automated market-making through balanced liquidity pools.

The successful launch of MCCN combined with the funding available to developers through THORChain will no doubt attract talented individuals, and bring more applications to the protocol over the coming weeks and months.

What you need to know

Although multi-chain is now live, it has several safeguards in place to allow time for the developers to fix any bugs, test the integrity of the network and generally iron out any teething problems:- Liquidity is currently hard-capped at 450,000 RUNE combined for all liquidity providers and will gradually be increased over the coming weeks.

- Early users have been advised to use smaller amounts when interacting with the interfaces (THORSwap and ASGARDEX), providing liquidity, as well as when swapping assets to native THOR and using the wallets during this safeguard period.

- RUNE holders should be patient before upgrading their RUNE to native THOR.RUNE for the first couple of weeks.

- Incentives will be kept higher on the single-chain chaosnet (SCCN) until confidence in MCCN grows. BEPSWAP will coexist with THORSwap for a while until the limitations imposed on MCCN are gradually lifted and all funds are withdrawn from BEPSWAP.

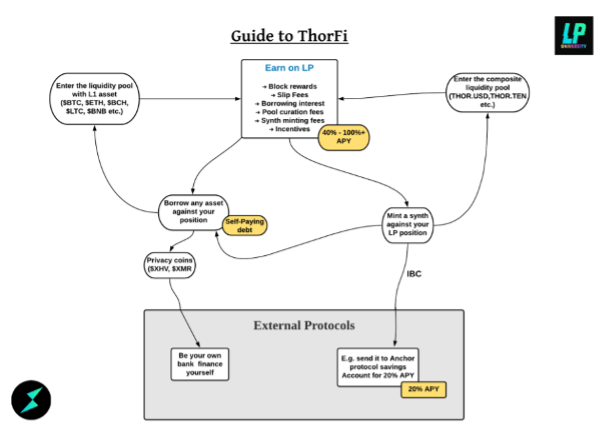

[caption id="attachment_63449" align="aligncenter" width="604"] ThorFi Ecosystem[/caption]

ThorFi Ecosystem[/caption]

Over the next few weeks/months THORChain will be adding additional features to further expand the THORChain ecosystem:

- THOR Synthetics will be added, enabling secured base layer (L1) assets. THORChain synths are unique they are 50% backed by their own asset, and 50% backed by RUNE through the use of the liquidity pools to collateralise the synth.

- Composites –THOR.USD, THOR.CRYPTO, THOR.TEN, THOR.ALTCOIN etc.

- Collateralised loans, with auto-serviced debt.

- Additional chains – currently only 5 chains are supported (BTC, ETH, LTC, BCH and BNB), however more will be added over time.

- The Mimir purge will eventually remove all safeguards such as the liquidity cap etc. as well as increase decentralisation. Mimir is a current administrative feature of THORChain that allows admins to change constants in the chain, such as minimum bond etc. When Mimir is destroyed THORChain will be uncapped and officially in main-net.

Providing Liquidity

We have seen a lot of interest from members in the Discord with respect to earning yield on their assets. Unless you have 1,000,000 RUNE to set up a node, currently the only way to earn with RUNE is through providing liquidity (LPing) into one of the pools on SCCN (BEPSWAP) or MCCN (ASGARDEX/THORSwap). This will change once ThorFi lending and synths become available, however in the meantime let’s have a look at LPing!How does it work?

With the launch of MCCN, pooling and swap functionality are now available through the THORSwap and ASGARDEX interfaces. As stated previously this is limited at the moment; however single-chain chaosnet LPing is still available through BEPSWAP and both MCCN and SCCN work in exactly the same way in terms of operation. Here is a rundown:- Liquidity Providers must have both RUNE and a second asset to stake (eg. BTC, ETH, USDT).

- Funds can be deposited in one of 2 ways: a symmetrical deposit is where assets are deposited in an equal amount (eg. $1000 worth of RUNE and $1000 worth of ETH) or an asymmetrical deposit where assets are deposited in an unequal amount (eg.$2000 worth of RUNE and $0 worth of ETH).

- Asymmetrical deposits are only recommended if the pool is already unbalanced, however the vast majority of the time Liquidity Providers should deposit symmetrically.

- Providers are adding assets to a pool in order to provide the liquidity required for the automated market making and operation of the peer-to-contract system utilised by the DEX, as opposed to the peer-to-peer system and centralised market making on CEXs.

- The rewards described below are given out continuously and automatically added to the stakers funds, paid in both RUNE and the second asset.

Rewards

Liquidity Providers earn yield through swap fees and system rewards:- Fees are paid by swappers and traders.

- Every time a swap is carried out the ratio of assets in the liquidity pool diverges slightly from the market rate – this event is called ‘slip’. A portion of each slip stays in the pool and is allocated to liquidity providers, forming a part of their staking yield.

- THORChain reward emissions curve provides some rewards, as well as rewards paid out long-term from the token reserve which is filled up through network fees and allows for continuous income even when exchange volumes are low.

- Yield is affected by % ownership of a pool, volume and size of swaps, the incentive pendulum (as described in the 30x token report) and the natural variance in asset prices.

Risks

As with any asset your capital is at risk through natural price action. However, when providing liquidity through chaosnet this can also lead to something called ‘Impermanent Loss’. Impermanent Loss is a phenomenon unique to liquidity pools whereby liquidity providers can sometimes end up with less value than what could have been realised by simply HODLing the staked assets. Here’s a simplified example for the BTC/RUNE pool:- A liquidity pool has 10 BTC and 37,500 RUNE. This implies a Bitcoin price of 3,750 RUNE. For this example, we'll assume Carlo came as liquidity provider with $100,000 (1 BTC & 3,750 RUNE) which gives him a 10% share in the pool.

- After 100+ days, BTC goes up 5X while RUNE goes up 15X, the pool ratio would be out of balance and gets rebalanced by arbitrage traders. Now the price of BTC would turn to 1,250 RUNE (RUNE has 3Xd against BTC in this example 15/5=3). Since the liquidity doesn't change in the pool, arbitrage traders bring the ratio back to 50/50 by withdrawing RUNE and adding BTC. In this case, they bring the assets in the pool to 17.3 BTC and 21,650 RUNE.

- The LP funds are determined by their share in the pool, not the number of coins they provided so Carlo's 10% share is 1.73 BTC and 2,165 RUNE. They amount to a total of 1.73 * 1,250 + 2,165 = 4,327.5 RUNE

- Had Carlo simply HODLed his 1 BTC and 3,750 RUNE he would now have 1 * 1,250 + 3,750 = 5,000 RUNE

- This 672.50 RUNE (5,000-4,327.5) difference is called an Impermanent Loss.

It is important to understand this mechanism before making any decisions on allocating capital to a pool. Liquidity providers should consider the length of time they would be holding their stake, the volatility of both assets and how closely they correlate with each other in order to minimise the chance of realising Impermanent Loss.

Impermanent Loss Protection

Impermanent Loss Protection (IL Protection) aims to mitigate the risk described above by compensating liquidity providers with funds taken from the reserve pool. It is not only the LPer that benefits; THORChain benefits from providing this insurance as it is necessary at this early stage in development to incentivise and give people the peace of mind they need to invest their capital into the pools with as little risk as possible. Here’s how it works:- THORChain tracks a member’s deposit values.

- When the member goes to redeem their assets their loss is calculated against their original deposit value and the loss is subsidised in RUNE from the reserve.

- The member will only receive 100% of the loss if they have been LPing for 100 days. It is a linear system meaning that if you only hold for 50 days you will only receive 50% of the loss, 75 days for 75% and so on.

- IL Protection is only available for the portion that is not covered by protocol fee collections - in the example above if fees generated 300RUNE for Carlo then the protocol will cover 672.50-300 = 372.50 RUNE only (this assumes he provided liquidity for 100 days+)

- Subsidies are paid for both full withdrawals as well as partial withdrawals.

- If additional assets are added to the pool by the member the value of the new deposit is taken into account and will also be covered in the event of further loss.

- In the event of a single-sided withdrawal, and not in RUNE, the subsidy will be converted in price to the second asset and taken from the corresponding pool. The protection value in RUNE is then added to the pool in order to re-balance the pool.

ThorStarter

Aside from the launch of MCCN, another exciting development for THORChain this week is the announcement of ThorStarter IDO platform set to be launched in June 2021.

Few details are known at the moment as it was only announced in the last few hours, but you can guarantee will be all over this in the coming weeks so keep your eyes peeled!