However, instead of being a festival of fortunes where people display screenshots of their 5-figure airdrops on Twitter, it is overshadowed by significant negative feedback.

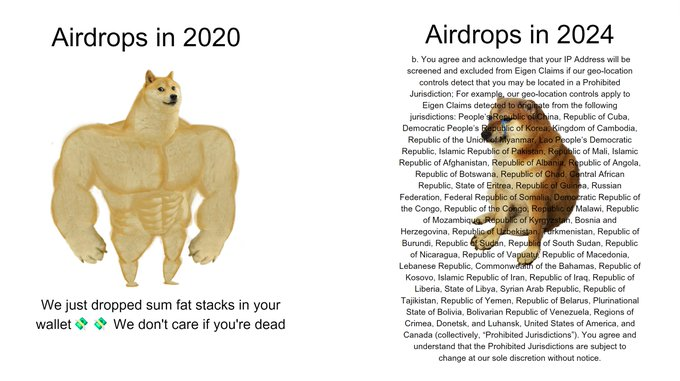

From airdrop to airdrop, the community is angry and frustrated, and fairly so; the distribution is unfair. To add insult to injury, the team also adopted some draconian restrictions to benefit insiders and VCs at the expense of everyday users.

In this report, we have looked at the drama to understand what it means to our users who followed our EigenLayer strategies.

Beyond the disappointment and anger, we present some practical solutions for overcoming hurdles related to the EigenLayer airdrop.

Don't just get mad; let's get even!

Let's dive in…

TLDR

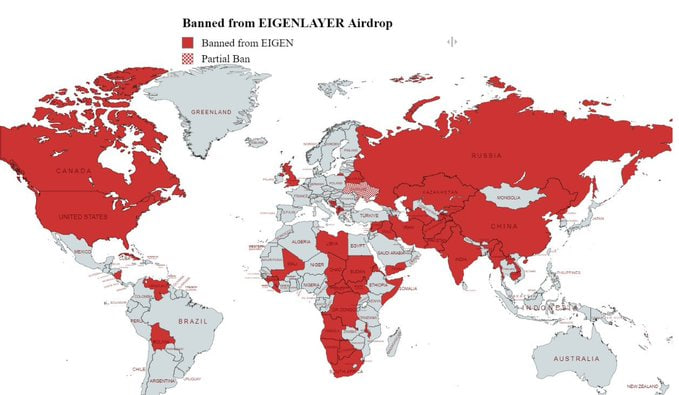

- The long-awaited EigenLayer airdrop has been plagued with controversy over unfair distribution, favouring insiders/VCs, and imposing draconian geo-restrictions.

- The airdrop contradicts the ethos of crypto by excluding over 70% of the world and being non-transferable initially.

- Despite the criticism, we think there are still potential decent returns from farming Eigenlayer with our DeFi strategies from the last report.

- We suggest a workaround to check airdrop eligibility and claim your tokens.

- The airdrop fiasco may significantly damage EigenLayer's brand image and adoption, but we still see value in continuing to farm on related platforms.

- We recommend claiming and selling at least half the airdrop if the workaround remains viable at the time of claim.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick recap

Previously, we covered EigenLayer and described it as a middleware between Ethereum and Actively Validated Services (AVSs), where new projects that need economic security can rent it from Ethereum.EigenLayer's potential valuation was massive, estimated to be around $30b—$40b. But more importantly, it didn't have a token but a points system, signalling a potential airdrop for those who committed their staked ETHs to bootstrap the platform.

Obviously, the TVL of EigenLayer rose massively amid speculation about airdrop and flourishing ecosystem.

After careful research and multiple test strategies, we have provided a smart and composable way for you to earn significant yield, earn EigenLayer points, and qualify for additional airdrops from Liquid Restaking platforms.

We have been very excited about the upcoming EigenLayer airdrop, which is finally here (the Snapshot was taken on March 15; the claim is on May 10). You can check your eligibility here.

Main criticisms

However, despite EigenLayer being the second-largest platform in DeFi, the EigenLayer airdrop has been met with significant criticism from various quarters within the crypto community. The main criticisms include:Geo-blocks

Over 70% of the world has been unfairly excluded from the airdrop. Moreover, even VPNs aren't helping, and the team behind EigenLayer deliberately put measures in place against users who try to use VPNs to access the website."You cannot claim that you are an open, permissionless and decentralised platform if you are discriminating against the majority of the world."

The ethos of crypto is to be open and inclusive for everyone. Moreover, you cannot use people's capital to bootstrap your platform, raise half a billion from VCs on the backs of your users and later unfairly exclude them from the airdrop.

If you want to ban certain territories, the project should ban these regions from the beginning, not after "milking" users for months.

Significant amount to insiders

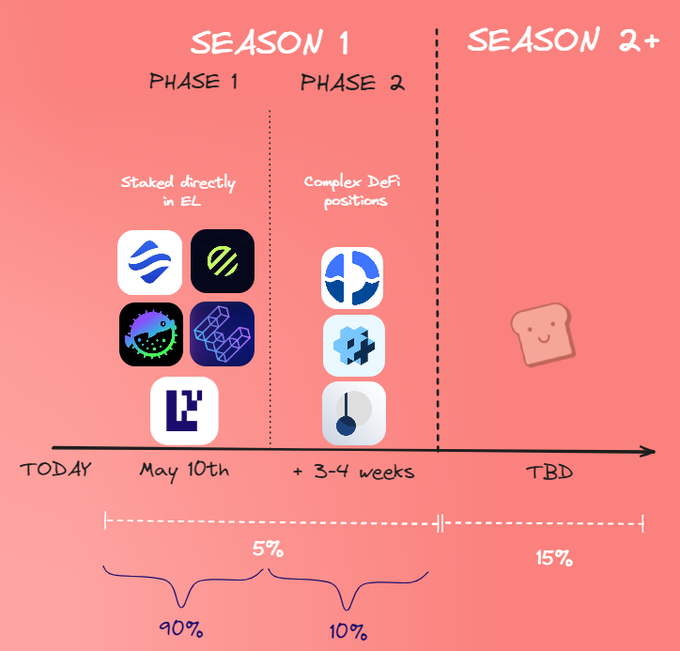

Critics have pointed out that only 15% of the airdropped tokens have been allocated to community stakers, with a mere 5% (around 70% of them further excluded from the drop due to geolocation) of the total token supply set aside for the initial airdrop.This distribution strategy has been seen as favouring the project's team and early investors, who are set to receive 55% of the tokens.

VCs and teams are getting extremely greedy, which can explain the growing popularity of memecoins during this cycle. You can check our latest memecoin report to know why and which memecoins are set to win this cycle.

Non-transferability

Another point of contention is the non-transferability of the tokens at the beginning, which has frustrated many airdrop participants.That means when you receive your EIGEN tokens, you cannot do anything with them until the team allows transferability (Hello, decentralisation!).

The team claims transferability will be turned on after certain milestones are achieved. However, the team has been very elusive about what they mean by "milestones."

These developments certainly are frustrating. However, we believe there is still some light at the end of the tunnel.

Looking deeper

First, we have structured our strategies so that even if you don't get an EigenLayer airdrop, you should still end up with a significant yield and potential airdrop from Liquid restaking platforms.If you have used complex DeFi strategies and liquid staking platforms, you probably won't qualify for phase 1 of the airdrop. However, you will be eligible for phase 2 of the airdrop—both phases are treated equally and receive the same volume of airdrops.

Since none of the airdrop tokens are transferable, DeFi users won't be disadvantaged compared to native restakers who will receive their tokens in phase 1.

ROI for farming EIGEN airdrop

Moreover, looking at the return on investment related to EigenLayer farming is also encouraging.Before going into the smart and complex strategies outlined here, we had a small test capital restaked natively on EigenLayer.

Based on pre-market prices and various estimates, we can see that we have been getting around 100%—200% ROI in 6 months (since November), which we believe is a very decent ROI on ETH.

We believe DeFi users will receive a similar airdrop for restaked strategies and will get additional yield from Pendle and Beefy. All combined, it should result in significant ROI.

If you start using our recommended strategies, you may not be eligible for the season 1 airdrop. However, you can still qualify for an airdrop from KelpDAO and season 2 of EigenLayer and Renzo.

All in all, returns are decent. However, several challenges are standing between users and their airdrops.

Main blockers and solutions

First of all, due to geo-blocks, you can't even check whether you are eligible for the airdrop.However, we found a workaround:

To check your allocation:

- Go to DeFillama

- Click "Check airdrops for address."

- Input your address

- Check your allocation

Once you have checked your allocation, you must somehow claim it on May 10 or later.

There are a couple of solutions for claiming your airdrop tokens. One way is to fly to another country without a geo-block.

However, this solution isn't feasible because most people have relatively small allocations.

Alternatively, here is what you can do

- Get a month's subscription to Proton VPN ($10). Most VPNs aren't working, but this one seems to be okay

- Change location to Brazil or Mexico. (At the time of writing it is working)

Cryptonary's take

Controversial airdrop distribution is very bad for the brand image and adoption.We believe EigenLayer has made a significant strategic mistake that can cost them a substantial portion of their TVL.

We are already seeing massive withdrawal queues exiting EigenLayer after the announcement:

However, we believe the fiasco with the airdrop will significantly damage the image and adoption of EigenLayer. Therefore, we remain cautious regarding the future of this project, and we look to sell at least half of the airdrop if the workaround is still viable at the time of the claim.

On the bright side, we still think that our EigenLayer DeFi strategies can result in decent ROI because we designed them so that even if EigenLayer drops 0 tokens, we still win.

Therefore, we will continue using Pendle and Beefy strategies to farm KelpDAO and Season 2 of EigenLayer.

Cryptonary, OUT!