Essentials: Portfolio management strategies

The market’s been a wild ride lately! But as the direction of the market is becoming more clear, it’s the perfect time to revisit your portfolio strategy and make sure you’re set up for whatever comes next. Let’s dive into some essentials to level up your portfolio game!

In this article, we are going to go over:

- What a high, medium, and low-risk portfolio looks like

- Profit taking strategies

- The best place to get stable coin yield

- The best places to bet spot yield

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Portfolio risk

Let’s start with portfolio risk and the basics. Everyone has a different risk appetite and varying time horizons, which means there’s no one-size-fits-all strategy. What works for one investor might be completely unsuitable for another, depending on their financial goals, market outlook, and tolerance for volatility.As investors, understanding your own risk appetite is crucial—it’s the foundation of a portfolio that not only aligns with your goals but also keeps you confident during market swings. For instance, a risk-on portfolio might be perfect for someone young, with a steady income outside of crypto and no debt or other financial & family obligations, while a more conservative approach might suit someone looking to preserve capital or planning for near-term financial needs.

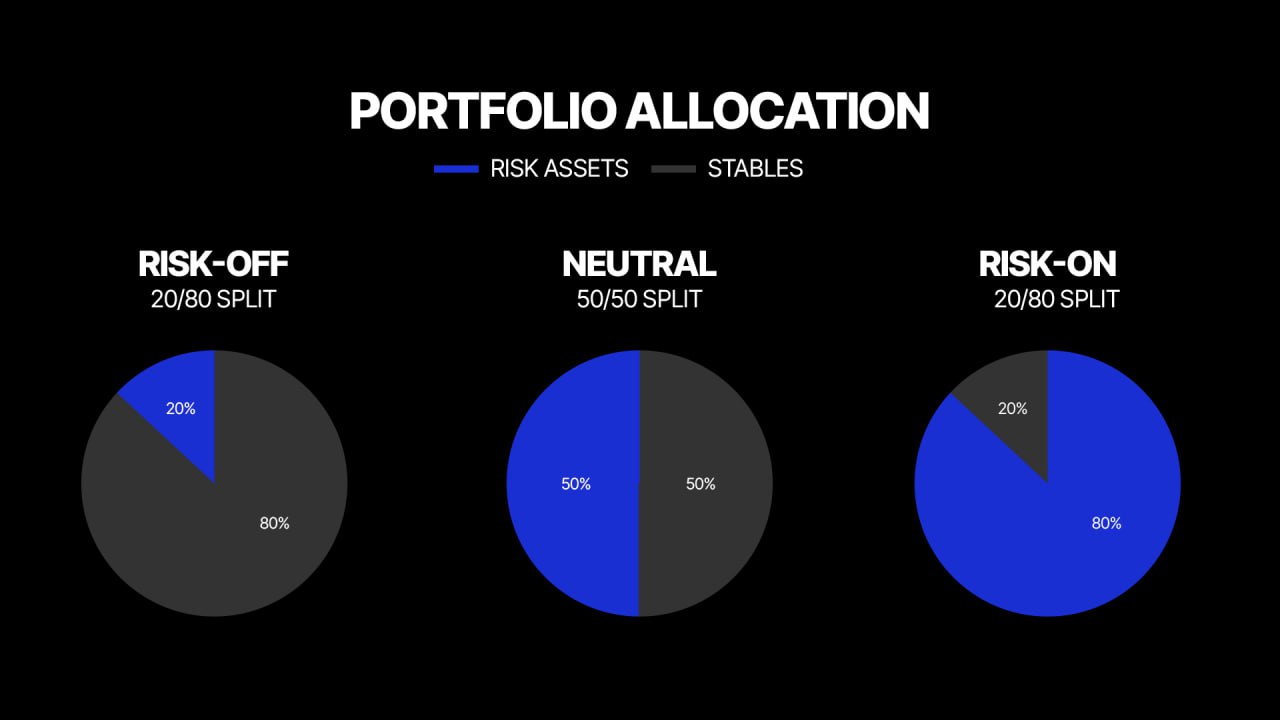

In this section, we’ll break down the three key portfolio types—risk-on, risk-off, and sitting on hands—each tailored to fit different styles and phases of the market. Starting with a risk-on portfolio.

We see a risk-on portfolio as being an 80/20 split between risk assets (combination of majors and alts) and stables. Even though, yes, this is a risk-on portfolio which optimizes for the upside, things can change in the market at the turn of a dime, so it's important to always have dry powder.

The next type of portfolio is the safe, sitting-on-your-hands portfolio, which is a 50/50 split between risk assets and stablecoins. This type of portfolio is perfect for when you're not long-term/high-time frame bearish, but you feel as though the market has lost momentum, and you want dry powder for the next big thing.

The final type is the risk-off portfolio. This portfolio is the exact opposite of our risk-on-one, with a 20/80 split between risk assets and stablecoins. This type of portfolio is perfect for when we have lost high time frame momentum and it seems like the market could be sliding into a bear market. This type of portfolio is also perfect for chasing yield opportunities across the DeFi landscape, which we will talk about soon.

If you have made up your mind on what kind of portfolio type you want to adopt, check out our CPro picks and the latest reports to decide on which specific assets you want to include in your portfolio.

Okay, now, we know the essentials of portfolio construction, however, the most common mistake we see people doing is ignoring profit taking practices. So let's cover some essentials there as well.

Profit-taking strategies

When it comes to being an investor or even a trader in this market, it is as important to know when / how to exit a trade just as much as it is important to know when to enter one. From what we have seen, this is one of the biggest ways people tend to give it all back. And that is through not taking profits. Luckily, though, the story gets better from here as there are some staple ways to do this.One of the essential practices in profit-taking is Dollar-Cost Averaging (DCA) out of the position. Just like how when you want to enter a position when the market is low, you can also start to exit a position whilst the market is high. There is an old saying that you want to buy red and sell green, and while it doesn't apply to low-time-frame plays, we think it's important for big swing plays.

There are three variations of DCAing out from a position:

- Growth-based

- Price-based

- Time-based

Another profit-taking strategy is price-based. This works well for smaller tokens and requires a bit of planning so as not to get stuck at the moment. Essentially, when you enter a position, you tell yourself you will take 5-10% off every multiple or price level it reaches. For example, if you have entered an asset sub $100m market cap, you can start taking some chips off the table at $500m or $1b, etc. Each milestone, you secure some profits.

The last profit-taking strategy is time-based. This strategy primarily works if you are a believer in the classic 4-year cycle. This means you are a buyer at the beginning of it, and in the final year or so, towards the back half of it, you begin to sell until you systematically reach a risk-off portfolio. This strategy is quite popular as it takes the least amount of management, and it all comes down to what part of the 4-year cycle we are in.

All in all, having a clear profit-taking strategy for this cycle is crucial. History has shown us that those who fail to take profits often turn winning positions into long-term losses. The harsh truth is that most coins tend to thrive for only one market cycle. No matter how much you believe in a particular project—except for Bitcoin (BTC)—there’s a high chance that its valuation won’t reach the same heights in the next cycle. So, always remember to lock in those gains while the opportunity is there!

Now let's talk about some passive income and yield to make your portfolio capital efficient.

Stablecoin yield

With the introduction of DeFi almost a decade ago, crypto has become a key hub for those heavy in USD to find yield that beats the TradFi alternative yield. In TradFi, you can typically get a "risk-free" 4-5% through T-Bills. However, when we step into the crypto world, we get a lot more options and much better yields. Since there are many choices within, we decided to pick out three essential platforms to know: AAVE, Sky, and Morpho.AAVE

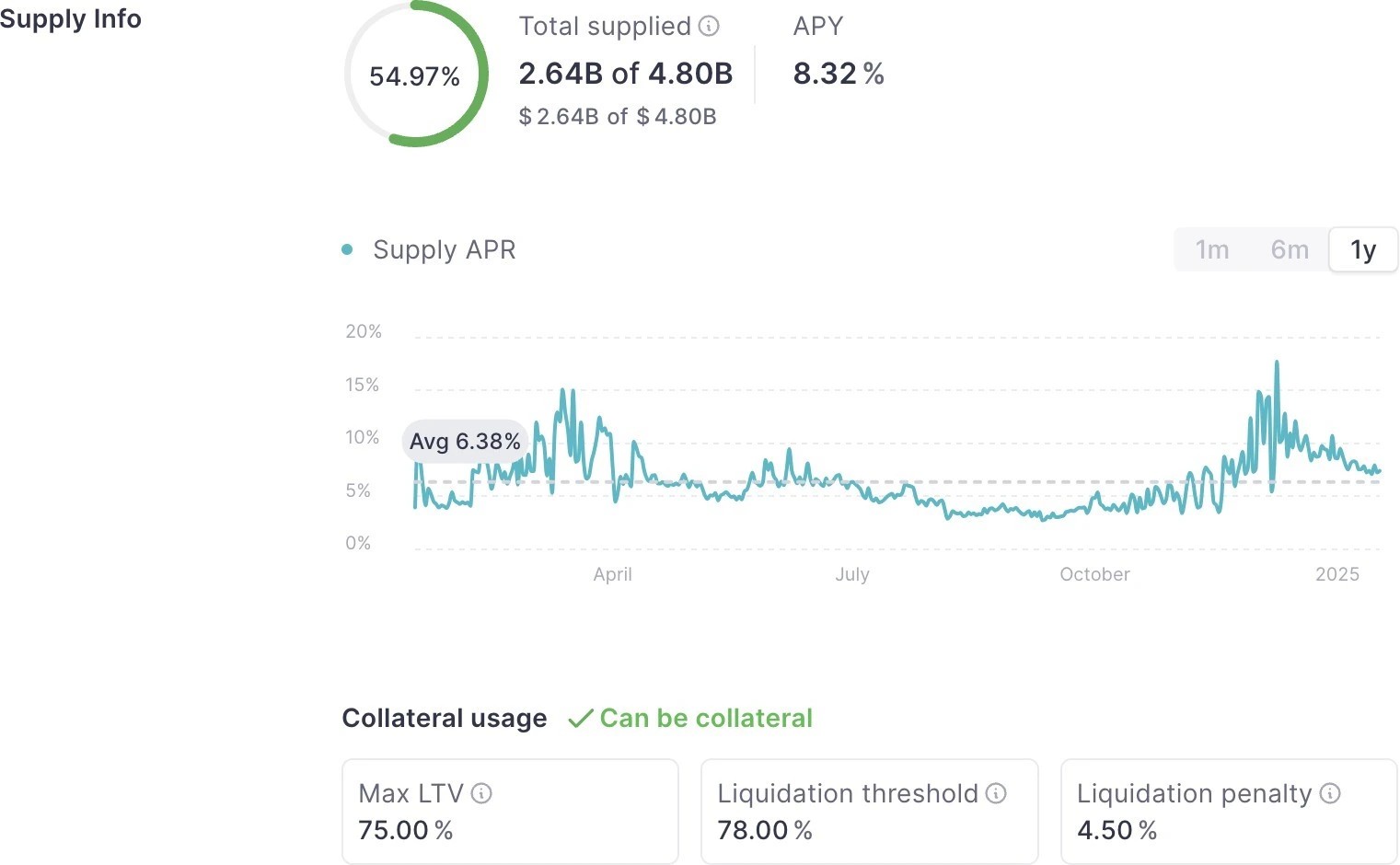

Aave is a lending platform that allows users to lend their tokens for some yield in return. It is one of the OGs that have gone through the test of time and ranks among the safest DeFi protocols. The yield comes from the interest the borrowers pay for taking the loans. When looking at the yield on stablecoins, we can see that the yield on average for the year is about 6%, which beats the TradFi benchmark of 4-5%. Moreover, unlike traditional banks, AAVE is fully transparent, and users retain self-custody.

Thus, the risk level with this is also very low because loans are overcollateralized. Borrowers can only take out less than the collateral they put up, meaning there isn't a big risk of the protocol becoming insolvent. Lastly, Aave is one of the biggest DeFi platforms in the game, with their USDC pool alone having almost $3B in TVL.

Overall, Aave is one of the biggest and most OG platforms in the crypto space and provides quite an attractive yield for both USDC and USDT while having low risk.

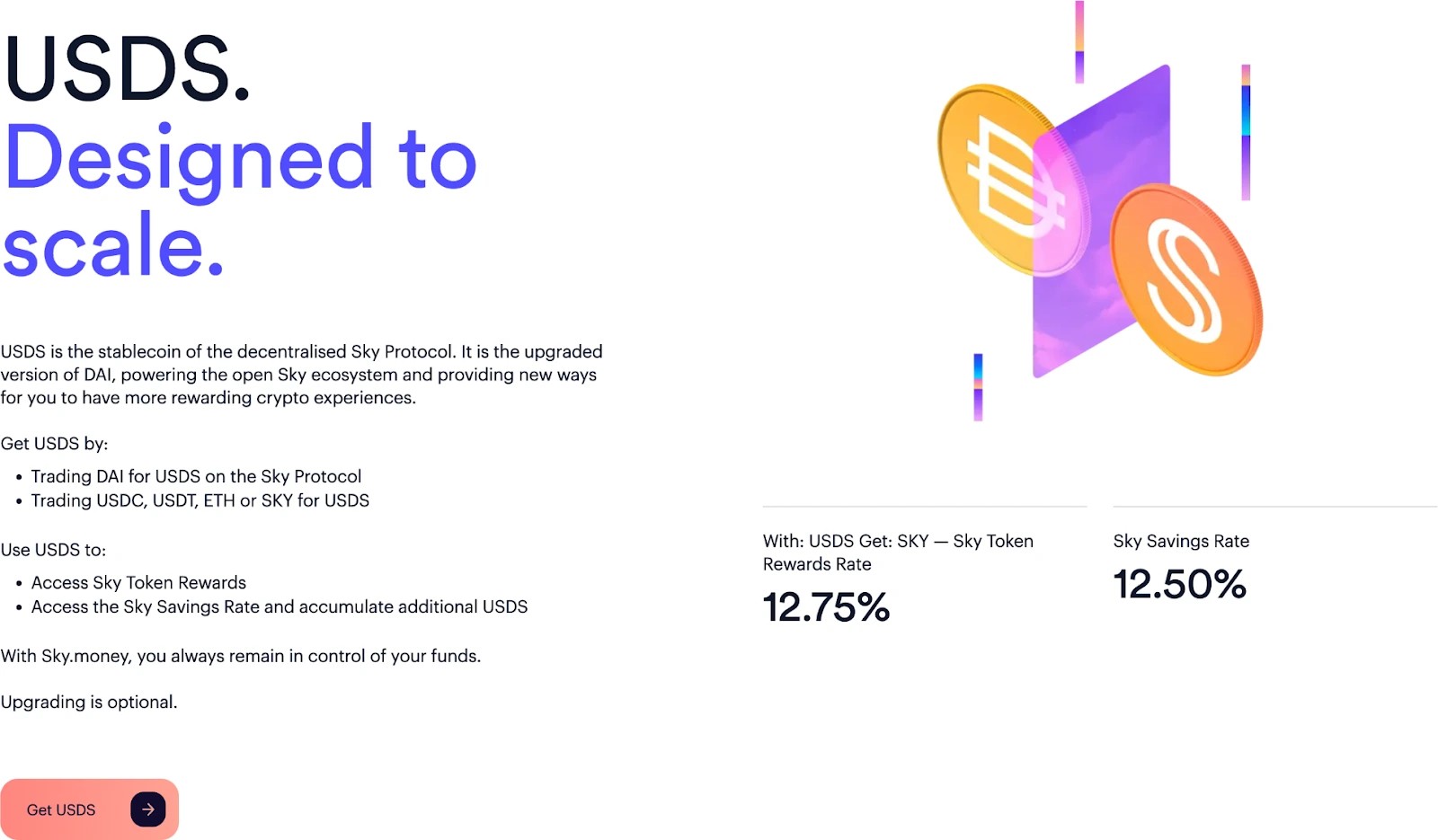

SKY(formerly makerDAO)

The next platform we want to talk about is SKY. This is the rebrand of MakerDAO. Sky boasts a whopping 12.5% return on USDS (which is 1:1 redeemable with other stables), beating the average return of the S&P 500. This yield comes from the Sky ecosystem itself; when you stake your USDS, they will then add it to a pool that earns yield on the tokens you have staked, resulting in an APR of about 10-12.5%. And as we can see below, if you opt to have the Sky tokens as a reward instead of stables, your yield can be higher. That being said, we do not exactly recommend this!

Additionally, the Sky Savings TVL is quite high, with over $1b in stables, meaning a fair amount of participants trust the Sky ecosystem.

Overall, the 12.5% annual reward from staking USDS is quite attractive, and with a high TVL, we can tell that the market trusts this system. MakerDAO has been in the space for years on years and is a staple in the DeFi community. We think that this is a very valid spot to part your stables, be it DAI, USDC, or USDT.

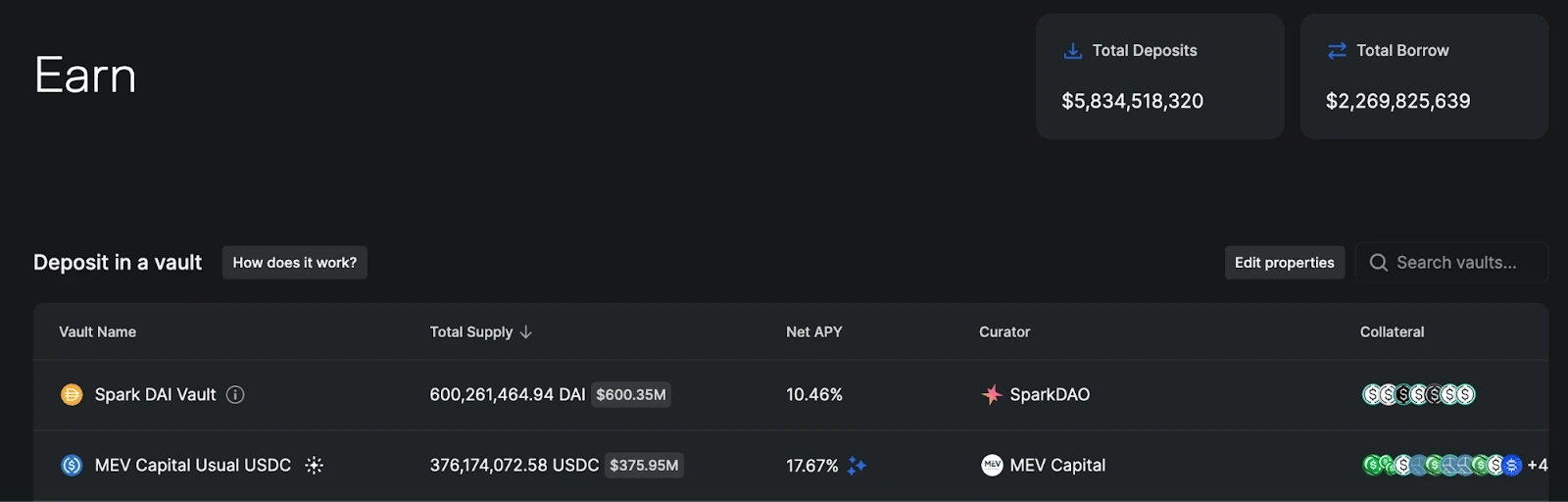

Morpho

Morpho is another DeFi lending system that has been growing in popularity this cycle. On Morpho, third-party risk market experts can run their own vaults, and users can deposit into them to attain a pre-determined, variable yield. Like the platforms before, the yield also comes from borrowers paying interest.Across the platform, there are various vaults that split depositor allocations across different tokens to achieve a higher yield. This inherently is more risky. However, that hasn't stopped over $5 billion in deposits since its inception, which is quite high.

We can see here that on stablecoins alone, the average return across a few of the vaults is between 10-13%.

We think while it is quite nice to have a higher return of a couple of percentages, it is important to remember that the risk here is higher as a third party is actively deploying the collateral where they see fit.

Yield on ETH+SOL

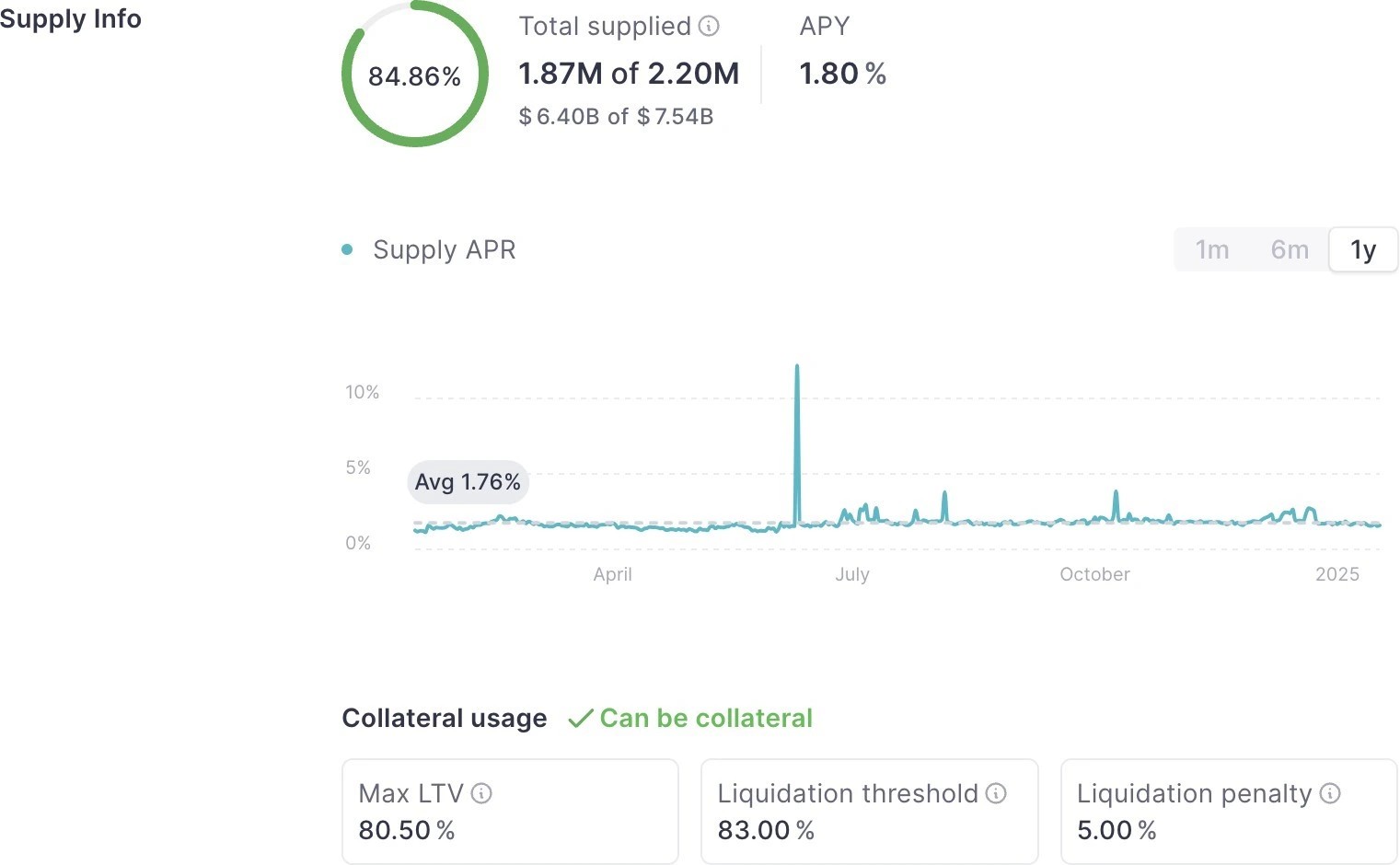

Now, when it comes to your spot coins, it's easy to just let them stay in your wallet, but when we put in a bit of effort, we can see that there are ways we can earn more on the assets we haven't turned into stables. For this section, we want to look at two major protocols for staking and getting yield on ETH.Again in the conversation, Aave comes up. As we can see, the APY on ETH is quite shockingly low in respect to stablecoins. However, Aave remains one of the best choices, with a solid 1Y average of about 1.75% on your ETH.

Again, the risk level for this protocol is quite low and we would recommend parking some of your idle stables here.

Lido

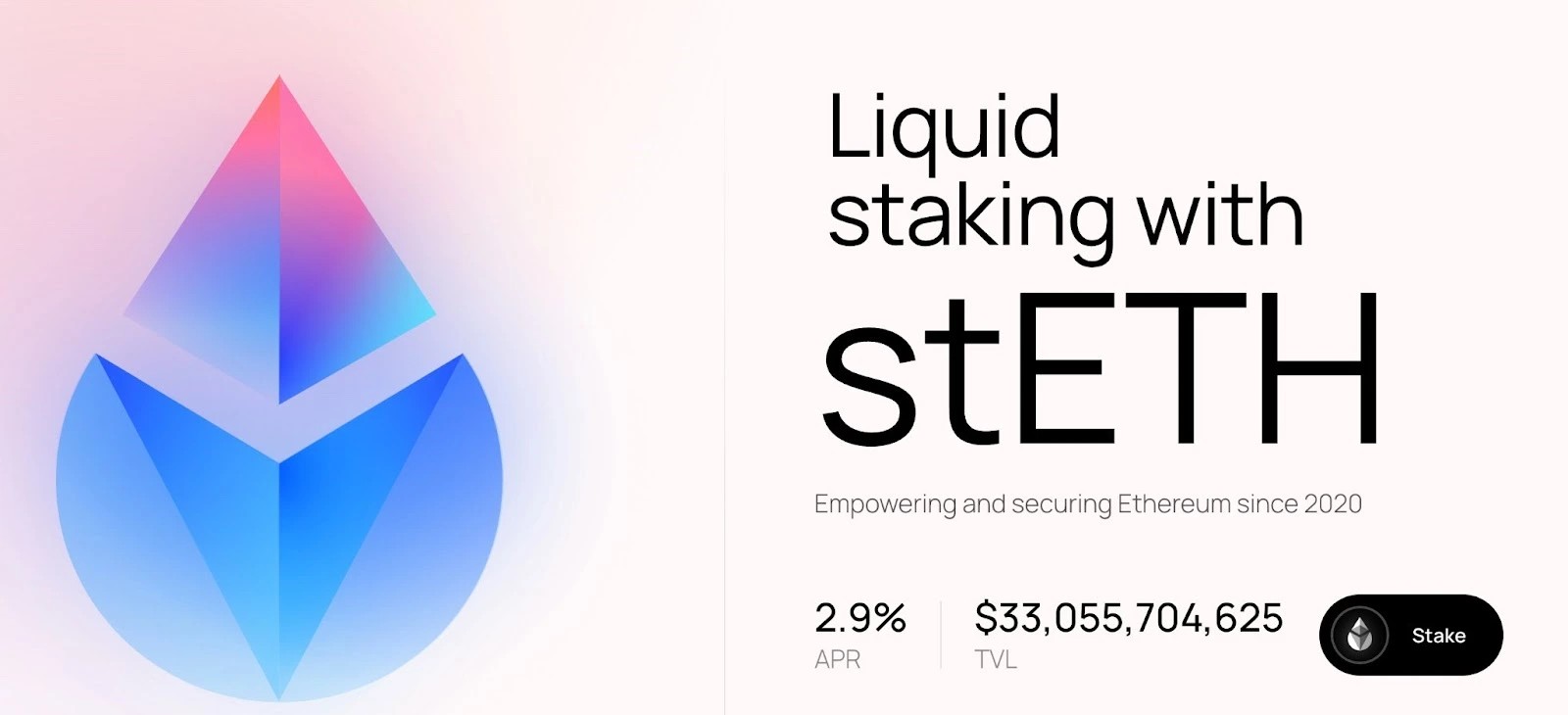

LDO is a liquid staking platform, which essentially means users can stake their ETH and, in return, get stETH, which allows them to still use the currency across different DeFi platforms for lending, borrowing, or even staking again. Because of this additional feature, we can see the APY is quite a bit higher at 2.9%. Additionally, we can see that the TVL is ginormous at $33B worth of ETH.

We can also see that this platform has been in the game for quite a long time, almost 5 years, and have half a million unique stakers on the platform.

Overall, Lido is an OG in the ETH staking space and offers the most consistent and safest yield for your liquid ETH. We 100% recommend it as a place to put your idle Ethereum to work in the downtime.

Jito and Marinade

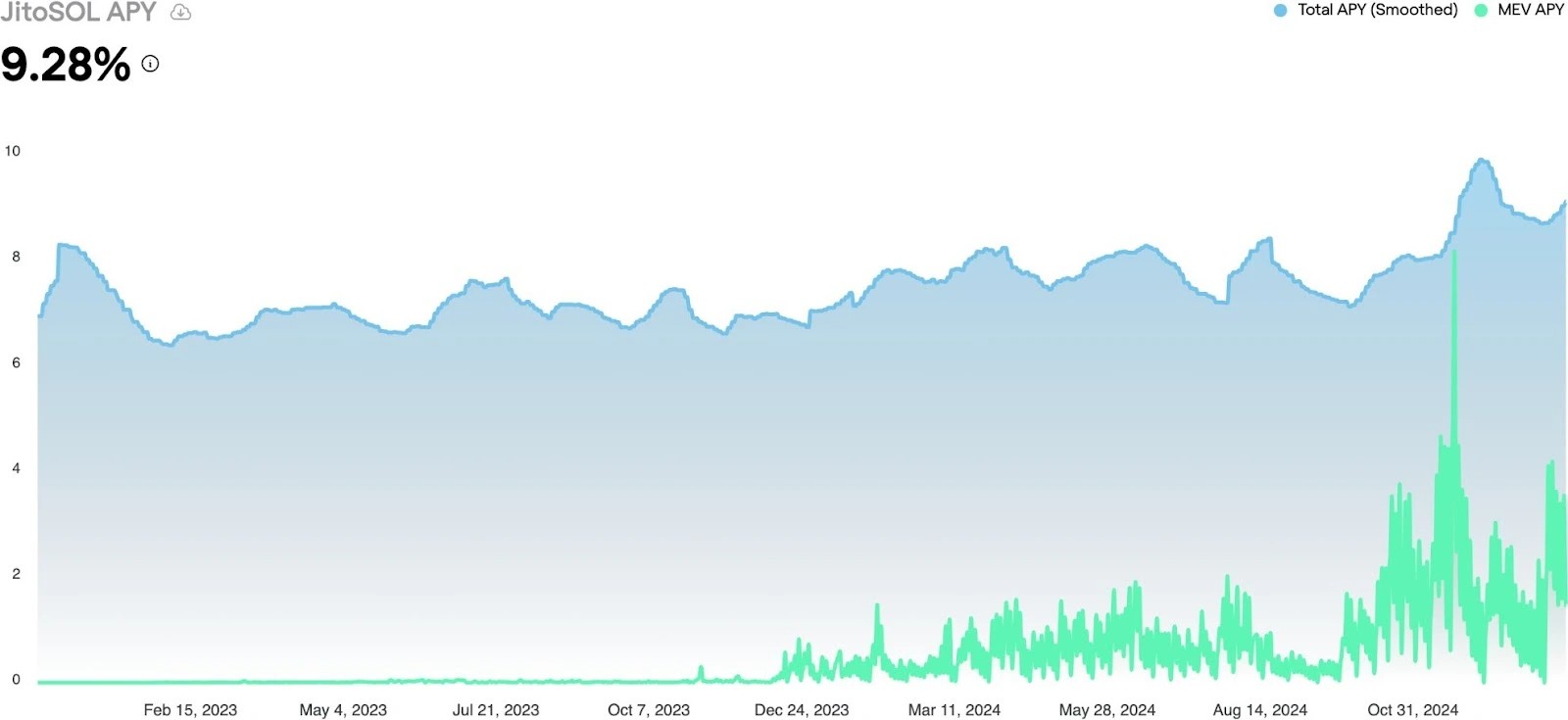

Finally, we will talk about a couple of protocols for earning yield on Solana. Solana, out of all the majors, has the largest number of places to earn a yield on it, so it is important to be selective. Here, we have chosen JTO and Marinade.JTO is a liquid staking platform that awards users with staking rewards and MEV rewards. In return for staking SOL, the user gets JitoSol, which can also be used to do various things on the Solana DeFi landscape, just like stETH through Lido. As we can see on this page, the yield Jito offers is a 9,35% APY on Solana, which beats out almost every other staking/lending rate you can find on the Solana blockchain.

On top of this, Jito also has 14M Solana in TVL, which is equal to almost $3b. This puts it as a giant in the space that clearly, as the capital shows, is trusted by the community.

Overall, Jito is an OG in the staking + MEV rewards game and is a low-risk place to park your liquid Solana tokens. That, plus the added benefit of getting JitoSOL in return, which can then be used to do other activities, makes this platform a solid contender for a place to store your SOL.

Lastly, we want to talk about the next liquid-staking protocol: Marinade. As we can see below, they offer an additional 1.5% through block rewards that put it above Jito's APY. As far as we can see, this is the highest APY available that has quite a lot of capital backing, over $2b. Additionally, Marinade offers instant unstaking, making it very retail-friendly.

Cryptonary's take

Portfolio management is the cornerstone of success for any investor or trader. Whether you're new to the game or a seasoned pro, knowing the essentials and best practices is non-negotiable. This report is intended to serve as a gentle reminder of the fundamentals—those timeless principles that guide us through both bull and bear markets.We believe it’s crucial to continually educate ourselves and refine our strategies. As investors, we should always seek ways to optimize our portfolios and increase returns, especially through low-risk essentials such as lending, staking, and yield farming. Platforms like AAVE, Lido, and Jito offer excellent avenues to make your assets work harder while maintaining a focus on safety and transparency.

Remember, staying informed and adaptable is what separates good investors from great ones. And we are here to provide the alpha, macro research and the best-curated content to help you to stay ahead of the curve and make an informed decision.

Cryptonary OUT!!